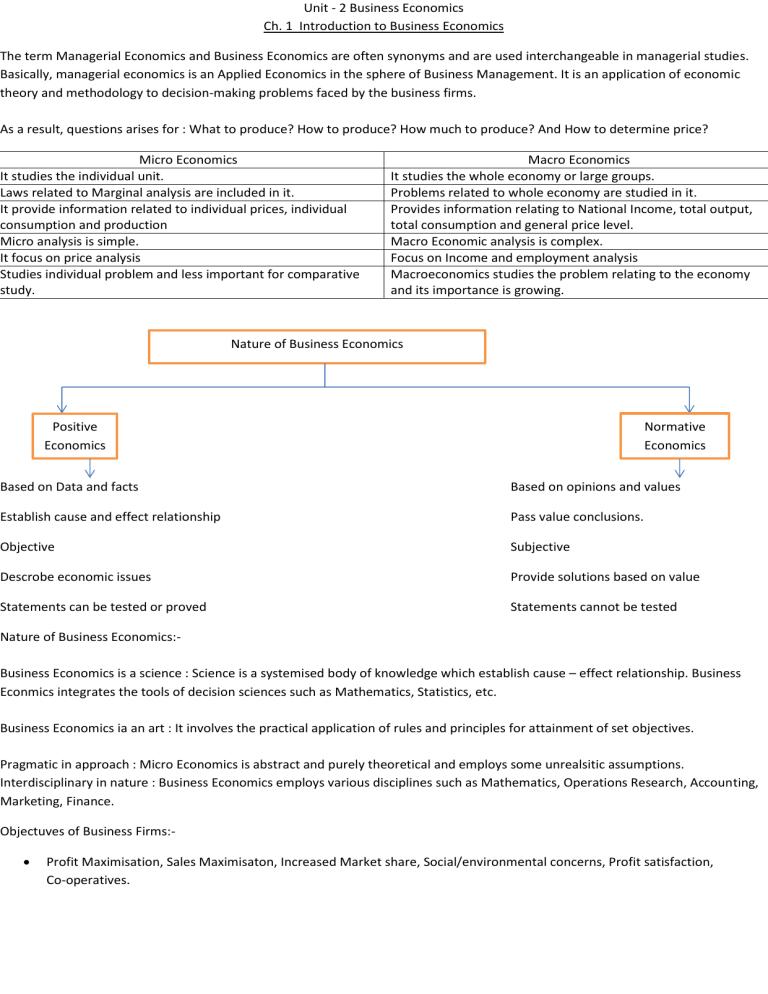

Unit - 2 Business Economics Ch. 1 Introduction to Business Economics The term Managerial Economics and Business Economics are often synonyms and are used interchangeable in managerial studies. Basically, managerial economics is an Applied Economics in the sphere of Business Management. It is an application of economic theory and methodology to decision-making problems faced by the business firms. As a result, questions arises for : What to produce? How to produce? How much to produce? And How to determine price? Micro Economics It studies the individual unit. Laws related to Marginal analysis are included in it. It provide information related to individual prices, individual consumption and production Micro analysis is simple. It focus on price analysis Studies individual problem and less important for comparative study. Macro Economics It studies the whole economy or large groups. Problems related to whole economy are studied in it. Provides information relating to National Income, total output, total consumption and general price level. Macro Economic analysis is complex. Focus on Income and employment analysis Macroeconomics studies the problem relating to the economy and its importance is growing. Nature of Business Economics Positive Economics Normative Economics Based on Data and facts Based on opinions and values Establish cause and effect relationship Pass value conclusions. Objective Subjective Descrobe economic issues Provide solutions based on value Statements can be tested or proved Statements cannot be tested Nature of Business Economics:Business Economics is a science : Science is a systemised body of knowledge which establish cause – effect relationship. Business Econmics integrates the tools of decision sciences such as Mathematics, Statistics, etc. Business Economics ia an art : It involves the practical application of rules and principles for attainment of set objectives. Pragmatic in approach : Micro Economics is abstract and purely theoretical and employs some unrealsitic assumptions. Interdisciplinary in nature : Business Economics employs various disciplines such as Mathematics, Operations Research, Accounting, Marketing, Finance. Objectuves of Business Firms: Profit Maximisation, Sales Maximisaton, Increased Market share, Social/environmental concerns, Profit satisfaction, Co-operatives. Theories of Firm Baumol’s theory of Sales Maximisation :- Baumol theory advocates for Sales maximisation, rather than profit maximisation. He argues that there is no reason to believe that all firms seek to maximise their profits, Business has large number of objectives, and it is difficult to determine them. So, Baumol finds that most manager seek to maximise sales revenue rather than profits. Williamson’s model of Managerial Utility :- This model advocates that management is separated from ownership in large number of ways and manager have discretionary powers but entrepreneurs have capital. So, proper match need to establish. Cyert-March model of Firms :- Cyert and march looked at large multiproduct cooperations, but not as ordinary firms, but as a coalition of different but interest group including owners, managers, workers, input, suppliers, customers, and tax authorities. All these group have their own interest in corporations but top management should focus on : (i) Production Goal (ii)Inventory goal (iii) Sales Goal (iv)Market share (v) Profit Goal Marris Model of Managerial Enterprise :- Robin Marris theory advocates for Balanced growth between Managerial Constraints and Financial Constraints. Limit Price theory :- Limit price is defined as the maximum price that existing firm can charge with the objectives of limiting the number of firms and preventing the entry of new firms to the industry. Limit price is practice of charging a price lower than the profit maximising one. Generally, oligopoly firms practice this. Theories of Rent Richardian theory of rent:- As per the Classical theory of rent, the Rent is the price paid for indestructible and original value of the land by tenant to the landlord. Ricardian theory of rent is the earliest theory of rent as is generally known as the classical theory. Point of distinction between Ricardian and modern theory of rent is that while Ricardo considered rent as “Surplus produce” attributable solely to land as factor of production, his theory was based on the principle of demand and supply. If in a country fixed supply of land exceeds the total demand for land, no rent will be paid. Modern economists considered rent as “Economic Surplus” Quasi Rent (Given by Alfred Marshall), refers to short – term earnings of factors which are in fixed supply in the short run. The equilibrium price of a factor of service can be divided into two components : (i) Transfer Earning – Opportunity cost and (ii) Economic Rent – excess of actual earning over its transfer earning. Economic rent may thus be denied as factor’s actual earning minus its transfer earning. Theories of Profit Pure Profit = Economic Profit/ just profit / return over opportunity cost. It is residual left over all contractual cost have been met. In other word, pure profit equals net profit less opportunity cost of management, insurable risk, depreciation, necessary min. to shareholders. Walker’s theory of Profit : Profit as a rent of ability :- Sir F.A. Walker believes that profit is the rent of exceptional ability that an entrepreneur may possess over the least efficient entrepreneur. Pure profit is the difference between least efficient entrepreneur and that of those with greater efficiency. Clark’s theory of profit : Profit as a reward for Dynamic Entrepreneurship :- According to J B Clark, Profit accrue in dynamic world, not in static world. Static world is one whre there is absolute freedom of competiton; but population and capital are stationary; thre are no investments, no inventions; production process does not change; good s continue to remain homogeneous. In dynamic world; there is increase in population, capital, improvements in production techniques, change in form of business organisation. In Clark’s view, major functions of an entrepreneur in a dynamic environmnent is related to these changes. The typical changes that emerge out of special efforts of some entrepreneur are inventions and improvements in the methpds pf production. Hawley’s Risk theory of profit : Profit as a reward for risk bearing :- F B Hawley regarded risk-taking as the inevitable accompaniment of dynamic production and those who take risk have a sound claim to a separate reward, known as profit. Knight’s theory of profit : Profit as a return to uncertainty bearing :- Frank Knight treated proft as a residual return to uncertainty bearing, not to risk bearing. Obviously, Knight made a distinction between risk and uncertainty. He divided risk into calculable and non-calculable risk. Calculable risk are insurable e.g. fie, theft accident. The area of incalculable risk is thus marked by Uncertainty. If the decisions of entrepreneur proved right by subsequent event, he makes profit and vice –versa. Schumpeter’s Innovation theory of rent : Profit as reward for innovations : He assumes a closed, commercially organised, capitalist economy in which private property, division of labour and free competition prevail, along with constant population level. In stationary equilibrium, total receipts are equal to total outlay, there is no profit. Profit can be made by introducing innovations in manufacturing and methods of supplying the goods. The innovations include, introduction of new good, introduction of an new method of production, creating or finding a new market, finding new source of raw material ,etc. Chapter 2 Demand Analysis Demand refers to quantity of a good or service that consumers are willing and able to purchase at various prices during a given period of time. Unless desire is backed by purchasing power or ability to pay, and willingness to pay, it does not constitute demand. Effective demand = Money + willingness to pay + desire to buy Types of Demand Direct and derived demand :- Direct demand refers to demand for goods meant for final consumption. Whereas, Derived demand refers to demand for those goods which are needed to further production. Autonomous and induced demand:- Goods whose demand is independent of the demand of any other goods is autonomous demand. Ex – demands for food, shelter, cloth. Goods whose demand depends on demand of some other goods is induced demand. Cross Demand :- When the demand for a commodity depends not on its price but on the price of other related commodities, it is called cross demand. Joint Demand :- In finished goods, as in case of bread, there is need for so many things – the services of the flour mill, oven, fuel, etc. The demand for them is called Joint Demand. Composite Demand :- A commodity is said to have a composite demand when its use us made in more than one purpose. Determinants of Demand :- Price of related goods, price of related commodities,`Income of the consumer, tastes and preference of the consumer, consumer’s expectations, other factors like future expectations, composition of population, consumer credit facilities, promotional effect on demand Demand Function : Dx = f (Px, Py, Y, Pc, T, F) Law of Demand :- The law of demand states that there is an inverse relationship between the price of a commodity and its quantity demanded, if other things remaining constant. Assumptions of the law :- Ceteris Paribus, Money income of consumer remain the same, no change in scale of preference, no change in price of substitutes, no expectation of price change of commodity in near future, commodity is not prestigious. Demand Schedule is a tabular representation of a commodity and its quantity demanded per unit of time. Demand curve is the graphical representation of demand schedule. Market demand = Sum of individual demand for a commodity or product. Factors behind the Law of Demand Substitution Effect Income Effect When price of commodity falls its substitutes become relatively costlier. When price of commodity falls, real income of that consumer in the terms of that Increases. His purchasing power also increases. Utility Maximising behaviour MUm=Pc=Mux Consumer will buy more to satisfy him Exceptations to law of demand :- Giffen goods, Status goods, Expectations of further price rise in future. Movements and shifts in Demand Curve Movement in demand curve :- Other factors remaining constant the quantity demanded changes, due to change in price. Also known as ‘Changes in quantity demanded’. Curve moves upward or downward. Movements are change in quantity demanded. In Movements, Price then Demand = Expansion( represented by Downward arrow in figure) Price then Demand = Contraction (represented by upward arrow in figure) Shifts in demand curve ( Change in DEMAND) When the price remain same, and quantity demanded changes due to change in other factors, it is known as change in demand. Because curve shift either leftward or forward. Law of Supply Law of suppy can be stated as; other things remain constant,thq quantity of a good produced and ffered for salewill increaseas the price of goods rises and decreases as the price falls. Law of suppl is based on law of diminishing marginal returns or dimnising marginal product. Movements and shifts in supply curve Movements along the supply curve:If price increases, supply also increases and vice versa. Shifts in supply curve :Factors other than price affect the supply curve. Ex- Input price, technology, taxes and subsidies, price of related goods, price expectation, no of firms in the industry. Equilibrium Price :- Equilibrium refers to market situation where quantity demanded is equal to quantity supplied. Price ceiling :- A price ceiling occurs when the price is artificially held below the equilibrium price and is not allowes to rise. It has two adverse effect, one is ‘queuing’ and other is ‘black market’. Price Floor :- Price is artificially held above the equilibrium price and is not allowed to fall. It is also called ‘ Fair trade’. Allocating function of prices:- Process by which productive resources are allocated between and among production processes in repose to change in prices of goods and services. It is a long run phenomenon. Chapter 3 : Consumer Behaviour Utility is the want satisfying power of a commodity. It is the anticipated satisfaction by the consumer. Consumer behaviour Cardinal One Commodity Ordinal Two commodity Slope of IC = Budget line Cardinal Utitlity Measurement (Alfred Marshall) In this, economists are of the view that utility is cardinally or quantitavely measured. They assumed (i) One utils equal one unit of money; and (ii) Utility of money remains constant. Assumptions of Cardinal utility aproach are :(A) Rationality (B) imited Money Income (C) Maximisation of satisfaction (D) Cardinal Measurement (E) Dimnishing MU (F) Constant Marginal Utility of Money (G) Utility is addictive Law of Dimnishing Marginal Utlity :- It os one of the fundamnetal law of economics. This law states that as the quantity consumed of a commodity goes on increasing, the utility derived from each successive unit goes on dimnishing, consumption of all other commodities remains the same. Its assumptions are:(i) Homogeneous units (ii) Standard units ofconsumption (iii) Continuous Consumption (iv)Cost of related goods (v)Law fails in case of prestigious goods (vi)Based on unrealistic assumption Law of Equi-Marginal Utility :- It is an extension to law of Dimnishing Marginal Utility. This law explains the behaviour of a consumer in distributing his limited income among various goods and services. This law states how a consumer allocates his money income between various goods and services so as to pbtain maximum satisfaction. Assumptions of Equi-Marginal Utility:(i) Consumer wants remain unchanged (ii) cosumer has fix income (iii) price of ALL GOODS are known to consumer (iv) buyer cannot influence market (v)he can spend money in small amounts (vi) rationality (vii)Utility is cardinal measurable Utility maximising behaviour Single Commodity :- Px = Mux = Mum Two Commoditites :Indifference Curve Analysis This approach is bsed on consumer preferences. It believes that human satisafaction cannot be measured quantitatively in monetary terms. In this approach, it is felt that it is much easier and scientifically more sound to order preferences to measure them in terms of money.Ordinal approach is based on ordering of preferences. Assumption of Indifference Curve Approach :(i) Rationality (ii) Ordinal Utility (iii)Transitivity (iv) consistency in choice (v)Non-satiety,i.e. consumer always prefer large quantities (v) Dimnishing MRS Indifference Curve :- It is defined as locus of points each representing a different combinations o f two gooods, which yield the same utility or level of satisfaction to the consumer. It is also called Iso-utility curve or equal utility curve. Space between X and Y axes is known as Indifference plane or commodity space. Indifference Map represents set of IC. Higher IC denotes Higher satisfaction. In Indiffernce map, IC are ranked in order of consumer’s preferences. Marginal Rate of Substitution :- MRS is the rate at which one commodity can be substituted for one another, the level of satisfaction remaining the same. MRS is the slope of IC. MRS y,x = -ΔY or, MUx ΔX MUy If goods are perfect substitutes, IC will be straight line which have negative slope showing constant MRS, MRS xy = 1 As we go on MRS goes on Dimnishing :- It menas that quantity of a commodity that a consumer is willing to sacrifice for an additional unit of another goes on decreasing when he goes on substituing one commodity for another. Properties of Indifference Curve:1. IC cannot intersect or tangent to one another 3. IC are downward sloping ,i.e. MRS Decline 5. IC may or may not beparallel too each other. 2. Higher ICs are preferred to lower ones 4. IC are convex, i.e. Law of Dimnishing MRS Exceptions to Convex shape of IC Perfect Substitutes :- IC is stratight line with negative slope. MRSxy = 1. Perfect Complements :- IC is right angleed or L shaped. MRSxy = 0. Convexity of IC impliestwo propoerties : (i) goods are imperfect substitutes (ii)MRS goes on decreasing Budget Line :- It shows all those combinatiojs of two goods which the consumer can buy spending his money income on rwo goods at given prices. All those combination which are in the each of consumer will lie on budget line. Budget line equation : Y = PxQx + PyQy Budget Set :- Also known as opportunty set which includes all possible sonsumption budles that someone can afford given the prices of goods and person’s income level. Slpe of budget line = Px/Py. A new budget line is drawn if (i) Income of consumer changes (ii) Price of commodity changes Income Consumption Curve – It is graph of combinations of two goods that maximise a consumer’s satisfaction at different income lievels. It is plotted by conecting the points at which budget line correspond to each income level touches relevant highest indifference curve. ICC is thus locus of equilibrium points at various levels of consumer’s income. ICC curve traces out the income effect on the quantity consumed of the goods. Income effect can be positive or negative Income effectis positive when increase with income also lead to increase in consumption of goods. It is the case of norma goods. It is negative in case of inferior goods. In case of inferior good, ICC will either slope backward or downward to the right. Engel Curve :- The Engel Curve tracks the consumption of a goods as an individual income changes. Engle curve of an individual consumer can be obtained from his ICC. Engel curve for normal goods is postive whereas for inferior goods it was bleding towards Xaxis or horizintal axis. Every point on ICC shows:- (i) Money Income (ii) Demand x (iii)Demand y Consumer Equilibrium :- A Consumer is in eqilibrium when heis deriving maximum possible satisfaction from the goods and therfore is in no position to rearrange his purchase of goods. Equilibrium Point= Slope of IC = Budget line MRSxy = Mux = Px MUy = Py Consumer is in equilibrium position when the price line is angent to IC or where MRSxy is equal to ratio between price of two goods. Consumer Surplus:- Satisfaction that a consumer obtains from a good over and above the price paid. Chapter 4 : Producion Theory Production is the orgainsied activity of transforming resources into finished products in theform of goods and service. Input and output :- Input os a good or service that goes into the process of production. They are land, labour , capital, raw material and time. Output is any good or service that comes out of production process. Fixed and Variable inputs:- A fixed input is one whose supply in short run in inelastic. Fixed factors remains fixed for a certain level of output. Variable input is defined as one whose supply in the short-run is elastic. Short run and long run period :- In short run supply of certain inputs is inelastic or fixed. In Long run supply of all inputs is elastic, but do not enough to permit a change in technology. Production Function :- Quantitative relationship between Onput and output. In Long term production function, both K and L are included and production function takes the form of Q = f(K,L) Short run production function also known as Single Variable production function q=f(L) Laws of production function Short run Long run Law of Variable proportion/ Diminishing returns Law of return to scale -----------------------------------------------------------Short run law of production :- In short run firms enjoy unlimited quanity of variable factors. The law which brings out the relationship between varying factor proportion and output are Law of return to variable proportion / Law of dimnishing returns. Law of returns to a variable input :- The law of dimnishing returns that when more and more units of variable input are applied to a given quantity of fixed inputs, the total output may initially increase at an increasing rate and then at constant rate but it will eventually increase at diminishing rates. That is ,the marginal increase in the total output eventually decreases when additional units of variable factors are applied to a given quantity of fixed factors. Its assumptions are :(i) Labour is the only variable (ii) Technology remains constant (iii)Labour is homogeneous (iv) Input prices are constant Stage I(MP>AP) TP has positive slope Stage II (AP=MP) Stage III Total Product Increases, at increasing rate Marinal Product Increases and reaches its maximum Average Product Increases, but slower than MP Addt. Information Fix input are underutilised. Increases at dimnishing rate, reaches maximum Starts dimnishing and become equal to zero Starts Dimnishing Reaches its maximum, where MP=0. Keeps on declining, becomes negative Continue to diminish but always remain positive Speciailisation and teamwork continue. Fix factor are utilised fully. Fixed inputs capacity is reached, additional input cause output to fall. Output elasticity of variable input :- It shows the relationship between MP and AP of a productive input(L). formula It is simply the ratio of the MP and AP of labour Long term law of production Isoquant curve :- Also known as Equal Product curve or production indifference curve. Isoquant curve is a locus of points representing various combinations of two inputs – capita and labour – yielding the same output. It is made up of two producer goods, i.e. Labour and capital. Assumptions:(i)two inputs viz labour and capital (ii)both L and K are perfectly divisible (iii) two inputs - L and K can substitute each other, but at diminishing rate (iv)technology remains constant Marginal Rate of Technical Substitution (MRTS) = ΔK ΔL MRTS is slope of Iso product curve. Types of Isoquants Linear Isoquants Input-Output Isoquants Kinked Isoquants Smooth, Convex Isoquants Description This assumes perfect substituablity of factors of production. It is case of substitutes, where MRTS =1 Also called ‘Leontief Isoquant’. Case of Complements. Shaped of curve will be right angled. MRTS=0 Activity/ Linear programming Isoquant. This assumes limited substituability of K and L. Assumes Continuous substituability of K and L over a certain range beyond it cannot go. Isoquant Map and Economic Region Isoquant map is a set of isoquants presented on a two-dimensional plane. Whole Isoquant map or production plane is not technically efficient. MRTS decreases along the Isoquant. The limit to which MRTS can decrease, is zero. Zero MRTS implies that there is a limit ti which one input can be substituted for another. Beyond this point, an additional employment of labour will necessiate employing additional units of other input. Rigid Line :- They are the locus of points on the isoquants where the MP of inuts are zero. Economic Region :- Economic region is technically efficient. Isocost line:- It may be defined as different possible combinations of two factorsthat producer can afford to buy given his total expenditure to be incurred in these factors and prices of the factors. Producer’s Equilibrium :- It implies to that situatuion in which producer maximizes his profit. In short, the producer is producing given output with least combination of factors. For Producer equilibrium, it must fulfill to conditions :(i)Iso-cost line must be tangent to isoquant curve. (ii)At the point of tangency, i.e. iso-quant curve must be convex to the origin or MRTS must be falling. Expansion Path :- It is the line which reflects least cost method of producing different level of output. Its condition Elasticity of Factor Substitution :- It is defined as percentage change in capital-labour ratio (K/L) divided by the percentage change in marginal rate of technical substitution. Formula Since along the isoquant, K/L and MRTs move in same direction, the value of EFS is always positive. Law of returns to scale :- The law states the behaviour of output in response to a proportioal and simultaneous change in inputs. It refers to that time in the fututre whenchanges in output are brought about by increasing all inputs at same time and in same proportion. Increasing Returns to scale:- If output increases more than proportionate to increase in all inputs; h>k. Constant returns to scale :- If all inputs are increased by same proportion, output will also by same proportion; h=k. Decreasing returns to scale:- If increse in output is less than proportionate to increase in all inputs; h<k. Increasing returns to scale arise because as the scale of operations increases, a greater division of labour and specialisation take place and more productive machinery can be used. Decreasing returns to scale arise due to as scale of operation increases, it becomes difficuult to manage the larger firm. The primary cause behind Increasing returns to scale is called : Economies of Scale and for Decreasing returns to scale it is Diseconomies of Scale. Economies of Scale :- It refers to reduced cost per unit that arise from increased total output of a product. Internal Economies of Scale are the one which are unique to the firm whereas External Economies of scale are the one faced by entire industry. Diseconomies of Scale :- It happens when a company or business grows so large that the cost per unit increase. It take pace when economies of scale no longer functions. In this, a firm sees an icrease in marginal costs when an output is incurred. Important Poduction Function Cobb-Douglas production function:- In 1928, Cob and Douglas introduced a famous two factor function,called Cobb-Douglas production function,in order to describe the distribution of national income by help of production functions. where Q=A.Kα.Lβ Q= Output, A= Efficiency, K= Capital, L = Labour Degree of return to scale 1. Constant returns to Scale – α+β = 1 2. Increasing returns to Scale – α+β > 1 3. Decreasing returns to Scale – α+β < 1 Linear Production function Q= aL + bK; a is productivity of L units of labour and b is productivity of K units of Capital. CES Production function is expressed as Q= A[αK-β+(1-α)L-β) -1/β Important propoert of CES is that it is homogeneous of degree 1. If β is assumed to be a variable, then the above function may be called the Variable Elasticity of substitution, VES function. Leontief Production function is useful when labour and capital must be furnished in a fixed proportion is as follows Q= min(aK,bL) Chapter 5 Theory of Cost Different cost concepts Incremental Cost :- It is defined as change in overall costs that results from particular decisions being made. In shorrt period, incremental cost will consist of variable cost – costs of addditional labour, additional raw materials, power, fuel,etc. – which is the result of a new decision being taken by the firm. These costs can be avoided, they are also known as differential cost, escapable cost. Opportunity Cost :- Cost of the next best alternative opportunity. Actual costs are those which are actually incurred by the firm in payment of labour, material, plant, etc. Explicit Cost:- It refers to all payments made to outsiders, by the firm for hiring or buyin the resources. Implicit Cost:- It refers to the cost of self-owned resources. Economic Cost = Accounting Cost + Implicit Cost Out-of-pocket Costs are those that involve immediate payments to outsiders as opposed to book costs that do not require current cash expenditure. Salary of self owner manager is book cost. The interest cost of owner’s own fund and depreciation cost are example of book cost. Book cost can be converted into pocket costs by selling assets and leasing them back from buyer. Historical Costs are those cost of an asset acquired in the past whereas replacement cost refers to the outlay which has to be made for replacing an old asset. Stable prices over time, other things given, keep historical and replacement costs on par with each other. Direct Costs:- Costs which can be directly attributed to production of a unit of a given product. Such costscan be ascertained, separated and imputed to a unit of output. Indirect Costs :- Costs which cannot be separated and clearly attributed to individual units of production. Business Cost:- Include all the expenses which are incurred to carry our business. Full Cost :- It includes business cost, opportunity cost and normal cost. Normal profit is necessary minimum earning in addition to the opportunity cost, which a firm must get to remain in its present occupation. Shut Down Costs are required to be incurred when the production operations are suspended and will not bbe necessary if production operations continue. When the plant is to be permanently closed down, some costs are to be incurred for disposing off the fixed asset. Fixed Cost :- These are fixed in volume for a certain given output. It do not vary with variation in output between zero and certain level of output.Ex.:- Cost of Managerial staff, Depreciation of machinery, Maintenance of land, etc. Variable Cost :- They do not with the variation in the total output. TC = TVC + TFC AC = TC/Q MC = TCn-TCn-1 or ΔTC/ΔQ or ΔTVC/ΔQ Short-Run and Long-Run Costs Short Run Cost :- If the firm wants to increase output in the short run, it can only do so by using more labour and raw materials, i.e. by variable inputs only. Long Run Cost :- It is defined as the period of time in which the quantities of all factors may be varied. Relationship between MC and AC: When AC is minimum, MC= AC. When AVC is minimum, MC = AVC. When MC intersects AC, AC is constant. When AC rises, MC rises greater than AC. When AC falls, MC falls greater than AC. This happen due to “Law of Dimnishing Marginal productivity” Long Run Average Cost Curve :- Long run is a period of time in which firm can vary all of its inputs. Short run average cost curve are ‘Plant Curves’ whereas LAC are known as Envelope Curve or Planning Curve. Optimal size of the firm is one that minimises the LAC. LMC intersects LAC when LAC is on the lowest. At the point of inflexion on LTC curve, LMC takes the minimum value. LAC is least when LMC = LAC. Economies of Scope :- It is based on the assumption that if the same plant can prouce multiple products, there is a scope for a lot of cost saving because of joint ise of inputs. It is also known as scale of output. Ch 6 : Market Structure and Price Determination The function of market is to enable an exchange of goods and services to take place. Market structure refers to the environment within which buyers and sellers interact. Market has four basic components :(i) Consumers, (ii)Sellers, (iii)Commodity, (iv)Price Perfect Competition :- In a perfectly competitive market structure, there is a large number of buyers and sellers of the product and each seller and buyer is too small in relation to the market to be able to affect the price of the product by his or her own actions. Model of perfect competition is based on following assumptions :(i)Large number of buyers and seller (ii)Product Homogenity (iii)Free entry and exit (iv)Profit Maximisation (v) No government regulations (vi)Perfect knowledge and perfecr mobility of production factors In case of perfect competition, the industry is the price maker, firms are the price taker. TR = P*Q AR = TR/Q = P MR = ΔTR/ΔQ In Perfect Competition, P= AR = MR Demand curve of individual firm is horizontal straight line showing that firm can sell infinte volume of output but at the same price. Firm is the price taker and market is the price maker. Profit Maximisation:- Goal of the frm is to maximise the profit. This means the firm want to produce the quantity that maximizes the difference between TR and TC. There are two necessary conditions for profit maximisation (i) MR =MC (ii)Slope of MR< Slope of MC There can be 3 scenarios:If MR > MC, for profit maximisation, the firm should increase Quantity (Q) becuae per unit increase in revenue is more than per unit increase in cost. If MR<MC, for profit maximisation, the firm should decrease Quantity because per unit increase in revenue is less than per unit increase in cost If MR = MC, profit is maximised. Shut Down Point:- When the firm is incurring losses in the short run, it hasto deide whether to continue production or shut down. A firm will continue to produce when AR(Price) > AVC A firm will shut down when AR (Price) < AVC. When a fim shuts down itss operations, it continues to beat the fixed cost. Long Run analysis – Perfect Competition :- In the long run ,perfect competition only earns normal profit. At the point of equilibrium; P = SMC=SAC=LAC=MR=AR Types of Monopoly Natural Local/regional Economic Monopolization Legal Monopoly:- Monopoly is a formof market where a single seller sells a product which has no close substitutes. Its features are as follows :- (i) Single Seller (ii)No close substitutes (iii)No difference between firm and industry (iv)Independent decision making (v) Restricted entry due to input barriers, government restrictions, economies of scale, brand loyalty, customer lock-in and Network externalities. In Monopoly market, slope of MR is twice as that of AR. Profit Maximiation occurs in (i) MR-MC (ii)MC curve cuts MR from below. Monopsony :- It is a market where only one buyer exists and that single buyer dominates the market. Therefore, monopsony is also called as ‘Buyer’s Monopoly’. Ex.- Defence Industry is a monopsony. Monopsony mainly involved in input pricing by the buyer. Bilateral Monopoly:- A market where there is monopoly on both side, i.e. from seller viewpoint and buywe’s viewpoint. In this, both cannot maximise their profits simultaneously because the income of the seller is the cost to the buyer, and they are forced to bargain and negotiate the price of goods. Monopolistic Competition :- It refers to those market structure that fall between perfect competitio and moonopoly. It is a type of Imperfect Competition. If perfectly competitive market lacks homogenity of product, it will become Monopolistic Competition. Features of Monopolistic Competition are:(i) Large no of firms (ii)Products are close (not perfect) substitutes (iii) Differentiated product (iv)Competitve market (v) Free entry and exit (vi) firms ake deccisions independently (vii) Selling cost Conditions for profit maximisation :- (I) MR=MC (II) MC curve must cuts M Curve from below