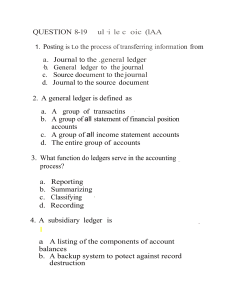

CONTROL ACCOUNTS AND SUBSIDIARY LEDGER The general ledger becomes unreasonably large when hundred of customers’ accounts are involved. With thousands of customers, it becomes unworkable. This problem can be best addressed using an accounts receivable control account in the general ledger; and individual customer accounts in a subsidiary ledger. General ledger is a controlling account in the sense that its balance should equal to the total of the individual account balances in the subsidiary ledger. 2. Purchases Journal is a journal specially designed to record all purchase transactions on account. This includes purchase on merchandise inventory, office and store supplies, and other assets. The primary source of document used as the basis for the entries in the journal is the receiving report. The accounts payable column is posted to the accounts payable subsidiary ledger on a daily basis. A check mark in the posting reference indicates this has been done. Subsidiary ledger is the individual customer accounts. It is controlled by the accounts receivable account in the general ledger. Are often used for accounts payable, inventory, and property and equipment. Supporting ledgers for the general ledger. Subsidiary Ledger Accounts Receivable Customer A Customer B 3000 7000 Customer C 8000 General Ledger Accounts Receivable Control Account 28000 Customer D 10000 SPECIAL JOURNALS These are journals of original entry other than the general journal that are designed for recording specific types of transactions of a similar nature. Most entities use the following special journals: 1. Sales Journal is a journal especially design to record all sales transactions on account. This means that we will only record the amount once, a debit to accounts receivable and credit to sales. Amount recorded in the sales journal are posted daily to the subsidiary ledger to keep a current record of the accounts receivable from each customer. A check mark ( / ) is placed in the posting reference column of the sales journal to signify that the amount has been posted to the customer’s account in the subsidiary ledger. Updating the subsidiary ledger daily also allows the credit department to review and monitor a customers’ account balance at times other than a billing date. At the end of the month, when all sales have been recorded and the sales journal has been totaled and ruled, the total sales figure is posted to the general ledger as a debit to the accounts receivable and as a credit to the sales account. 3. Cash Receipts Journal is a journal specially designed to record all transactions related to receipt of cash, or simple speaking, all “debit cash” transactions. This includes cash sales, collection of accounts receivable, and recognition of sales discounts. We also have the sundry accounts column for accounts not given in tabular headings. Cash receipts are evidenced by source documents like prenumbered official receipts, cash register tapes or cash slips, and bank credit memorandum. Amount recorded are posted daily to the subsidiary ledger to keep a current record of the accounts receivable from each customer. A schedule of accounts balances in the subsidiary ledger is usually prepared at the end of each accounting period to verify that the subsidiary ledger agrees with the related control account. Nazario Sea Products Schedule of Accounts Receivable June 30, 2020 Dapitan Retailers Pagadian Grocers Butuan Company Total 40,000 50,000 10,000 100,000 4. Cash Disbursement Journal is a journal specially designed to record all transactions related to disbursements of cash, or simply speaking, all “credit cash” transactions. This includes cash purchases, clearing of accounts payable, and recognition of purchase discounts. This journal has columns for the date and the number of check issued for each cash payment. In short, special journals should be designed to suit transactions commonly encountered by an entity. VOUCHER SYSTEM Most enti ADVANTAGE OF USING SPECIAL JOURNALS Their use permits division of labor. When special journals are used, the recording step can be divided among several persons, each whom is responsible for particular types of transactions. It often reduces recording time. Special journal transactions need no routine explanations for each entry. Saves time in posting from the journals to the GENERAL JOURNAL ledger. When special journals are used, the general journal is maintained for adjusting, closing, and reversing entries; and for recording that do not fit in other special journals. Example includes merchandise returns; write-offs of uncollectible accounts; and certain non-cash transactions involving notes receivable and notes payable. PROVING THE LEDGERS At the end of the period, after all postings have been made, equality should exist between the following: The total debits and total credit balances of the accounts in the general ledger. These amounts are used to prepare the trial balance. The balance of A/R control account in the general ledger and the sum of the individual customer accounts in the A/R subsidiary ledger. The balnce of the A/P control account in the general ledger and the sum of the individual creditor accounts in the A/pP subsidiary ledger. This control procedure is important because thhis helps ensure the accuracy of the accounting records. FLEXIBILTY OF SPECIAL-PURPOSE JOURNALS If certain transactions appear repeatedly in the general journal, it may be advisable to set up a new special journal for that purpose.