AIS Test 1 Questions: Financial Transactions & Accounting Systems

advertisement

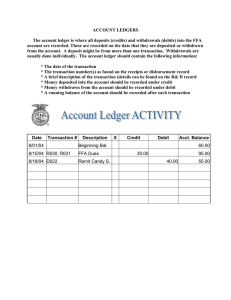

AIS test 1 questions 1. A Financial Transaction is... an economic event that affects the assets and equities of the firm, is reflected in its accounts, and is measured in monetary terms. similar types of transactions are grouped together into three transaction cycles: the expenditure cycle the conversion cycle the revenue cycle Each Cycle has Two Primary Subsystems Expenditure Cycle: time lag between the two due to credit relations with suppliers: physical component (acquisition of goods) financial component (cash disbursements to the supplier) Conversion Cycle : the production system (planning, scheduling, and control of the physical product through the manufacturing process) the cost accounting system (monitors the flow of cost information related to production) Revenue Cycle: time lag between the two due to credit relations with customers : physical component (sales order processing) financial component (cash receipts) 2. Manual System Accounting Records Source Documents - used to capture and formalize transaction data needed for transaction processing Product Documents - the result of transaction processing Turnaround Documents - a product document of one system that becomes a source document for another system Journals - a record of chronological entry special journals - specific classes of transactions that occur in high frequency general journal - nonrecurring, infrequent, and dissimilar transactions Ledger - a book of financial accounts general ledger - shows activity for each account listed on the chart of accounts subsidiary ledger - shows activity by detail for each account type 3. Computer Files ( list 4 of them and explain 3) Master File - generally contains account data (e.g., general ledger and subsidiary file) Transaction File - a temporary file containing transactions since the last update Reference File - contains relatively constant information used in processing (e.g., tax tables, customer addresses) Archive File - contains past transactions for reference purposes 4. Differentiate between batch and real time processing 5. Group Codes Represent complex items or events involving two or more pieces of data using fields with specific meaning 6. Business Ethics Business ethics involves finding the answers to two questions: How do managers decide on what is right in conducting their business? Once managers have recognized what is right, how do they achieve it? 7. Legal Definition of Fraud False representation - false statement or disclosure Material fact - a fact must be substantial in inducing someone to act Intent to deceive must exist The misrepresentation must have resulted in justifiable reliance upon information, which caused someone to act The misrepresentation must have caused injury or loss 8. Sarbanes-Oxley Act of 2002 ( Study any 2)…Explain any 2 and give you opinion Its principal reforms pertain to: Creation of the Public Company Accounting Oversight Board (PCAOB) Auditor independence—more separation between a firm’s attestation and non-auditing activities Corporate governance and responsibility—audit committee members must be independent and the audit committee must oversee the external auditors Disclosure requirements—increase issuer and management disclosure New federal crimes for the destruction of or tampering with documents, securities fraud, and actions against whistleblowers 9. Asset Misappropriation (give 2 examples for asset misappropriation) Examples: a. making charges to expense accounts to cover theft of asset (especially cash) b. lapping: using customer’s check from one account to cover theft from a different account c. transaction fraud: deleting, altering, or adding false transactions to steal assets 10. Two Types of IT Controls General controls—pertain to the entitywide computer environment Examples: controls over the data center, organization databases, systems development, and program maintenance Application controls—ensure the integrity of specific systems Examples: controls over sales order processing, accounts payable, and payroll applications