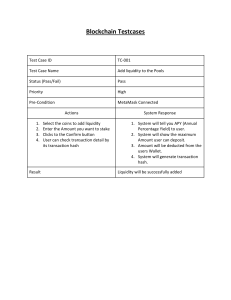

THE ULTIMATE GUIDE ALL THERE IS TO KNOW ABOUT NFTS NFT POWERCLASS™ HOW TO GET RICH WITH A REVOLUTIONARY BLOCKCHAIN-BASED TECHNOLOGY THAT'S TAKING THE WEB BY STORM: THE NFTS NFT POWERCLASS™ IS A COMPREHENSIVE GUIDE THAT WILL TEACH YOU EVERYTHING YOU NEED TO KNOW TO TAKE YOUR FIRST STEPS INTO THIS NEW WORLD FULL OF OPPORTUNITIES AND GIVE YOU A STEP-BYSTEP METHOD THAT YOU CAN FOLLOW TO EARN YOUR FIRST $20,000 WELCOME TO WEB 3.0 ALL RIGHTS RESERVED HOW DOES AN NFT WORK CONTENTS TABLE OF 6 8 10 11 12 13 15 WHAT IS AN NFT WHAT DOES IT MEAN TO "MINT" AN NFT HOW DO NFT ROYALTIES WORK WHAT IS AN NFT COLLECTION WHAT IS OPENSEA WHAT ARE THE 8 NFT CATEGORIES 23 24 27 38 41 42 44 46 50 51 54 WHAT ARE NFTS USED FOR WHAT MAKES AN NFT VALUABLE HOW TO BUY AN NFT WHAT IS A FIXED PRICE OR AUCTION WHAT NFT BLOCKCHAINS ARE THERE HOW TO AVOID NFT SCAMS WHO BUYS NFTS WHAT ARE THE "GAS" FEES HOW TO STORE AN NFT THAT I OWN WHAT IS AN NFT WALLET AND WHY USE IT HOW TO PROTECT MY NFT WITH A COLD WALLET 55 61 65 69 RESELL NFTS AT A PROFIT: 5 RULES FOR FINDING A HIGH POTENTIAL PROJECT FINDING YOUR FIRST NFT UNDERSTANDING AND USING THE POWER OF TIMING WHAT IS THE "FLOOR PRICE" OF AN NFT COLLECTION BONUS 71 73 74 75 76 77 CREATE AN NFT PROJECT FROM SCRATCH! HOW TO PUT YOUR NFT PROJECT FOR SALE HOW TO DISPLAY YOUR NFT COLLECTION HOW DO YOU ADD YOUR NFT COLLECTION TO A SECURE LIST? HOW TO VERIFY YOUR OPENSEA ACCOUNT? HOW TO GENERATE THOUSANDS OF UNIQUE NFTS AUTOMATICALLY 4 KEYS TO A SUCCESSFUL NFT PROJECT LAUNCH 78 HOW TO MAKE PEOPLE 81 DISCOVER YOUR PROJECT WHAT IT TAKES TO EARN $100K+ 82 WITH NFTS GENERATING PASSIVE INCOME 85 WITH NFTS ARE THERE OTHER NFT NETWORKS 86 THAT ARE GAS-FREE? 9 NFT PROJECTS THAT WENT VIRAL 87 AND GENERATED $1M+ IN SALES! 9 EXAMPLES OF SUCCESSFUL NFT 97 FLIPS (BUY-SELLS) GOLDEN NUGGET: STEP100 BY-STEP GUIDE ON HOW TO MAKE $500-$100 PER DAY INTRODUCTION If you are reading this Guide, it is probably because you have already heard about the famous images presented under the name of "NFT" which sell every day for several thousands, even several millions of dollars online... You may even be wondering what could be so special about these images that have to be so special to be sold at this price? Why would anyone be willing to pay so much for such simple images? And why couldn't I just take a screenshot of that image, own it myself, and then resell it? At a slightly more advanced stage, you might be wondering if you too can buy NTFs and resell it for more money. In that case, how do you invest in the right projects? Maybe you would even like to create NFTs yourself and become a millionaire by selling those "images" online? In any case, whether you are already an NFTs fan or a complete beginner, you are in the right place to understand everything from A to Z and launch yourself in this industry which, despite its young age, is already shaking up the biggest industries of the world and is evolving in giant steps. What is an NFT? N-F-T: It stands for Non-Fungible Token. And to understand what it means, let's quickly break down each of these words together. First of all, the Token. An NFT is first and foremost a Token A Token is used to represent many things, including art, video, music, and even physical objects. In practical terms, there are many things that can be turned into Tokens. These Tokens are mostly PNG images, but also animated images (GIF), MP4 audio tracks, or videos. What is the difference between an Image and an NFT? For a simple image to become an NFT, it must be stored on an online network called the Blockchain. A unique "serial number" is then created each time a Token is placed on the blockchain. Each NFT will have its own serial number, which makes it unique. This is also what makes each Token non-fungible. What does it mean when we say that something is fungible? We say that an object is fungible when it can be replaced by another identical object. Example: A $10 bill can be replaced by another $10 bill. Its value will be strictly the same. It is therefore a fungible object. On the other hand, your cell phone, your watch, your clothes and anything else you own that you could go and sell on eBay falls into the category of non-fungible objects, because each of these objects is unique and can have a completely different value. Barack Obama's laptop will probably be worth more than someone else's, even if it's the same model and brand. Likewise, one NFT cannot be exchanged for another NFT. Because even if it is the same image, each copy of this image has its own serial number and therefore has its own value, thus making it unique. A Non-Fungible Token (NFT) can therefore be simply described as a unique digital object, stored on the Blockchain. How do NFTs work? NFTs are bought and sold with crypto-currencies. You've probably already heard of Bitcoin? It’s the most famous and widely used cryptocurrency today. The second most popular cryptocurrency is called Ethereum. It is with this currency (Ethereum) that it is possible to buy the majority of NFTs. The Ethereum cryptocurrency has its own Blockchain: a sort of decentralized public ledger that stores and verifies the details of all transactions made on its network. When you buy or sell an NFT using Ethereum, the blockchain keeps track of its current owner, as well as all previous owners. Anyone can find out who owns a particular NFT, who has owned it in the past, at what price each transaction was made, on what date, etc. By being decentralized, NFTs on the blockchain are not stored on a single server. The ownership record of all NFTs is stored on many servers and computers around the world, called "nodes". This makes counterfeiting virtually impossible. How are NFTs different from cryptocurrencies? NFTs and crypto-currencies go hand in hand, but they are not the same thing. The difference is that cryptocurrencies are fungible: you can exchange one Bitcoin for another Bitcoin and the value will be the same. NFTs are different because each NFT has a unique serial number on the blockchain. Therefore, each NFT is one of a kind and can have a completely different value. What is an NFT collection? An NFT collection is simply a group of NFTs in a particular project. You can view the top-ranked NFT collections on Opensea and CoinMarketCap using the links below: NFT rankings on OpenSea NFT collections on CoinMarketCap What is Opensea? OpenSea.io is the first and largest peer-to-peer selling platform for crypto goods (imagine it like eBay for cryptoassets), which includes collectibles, gaming items, and other virtual goods backed by the blockchain. On OpenSea, anyone can buy or sell these items using smart contracts. OpenSea.io does a great job of providing consumers with a wealth of information and data about NFT collections. They provide information such as trust scores, creation date, offers, and sales volume. This helps consumers make informed decisions when purchasing NFTs. Below is an example of an NFT listing on OpenSea The price history is displayed under the current highest bid, as well as a list of previous bids and their timestamps. The 8 Categories of NFT On the exchange platforms, the main categories of NFT are the following: 1 - Visual Art An online community of creators, developers, and merchants is pushing the art world into new territory. It all started with CryptoPunks, a set of 10,000 randomly generated pixelated images that proved the demand for digital ownership of non-physical objects and collectibles in 2017, and the market has been evolving rapidly ever since: more than 1 billion dollars have been invested in this collection to date. But Visual Art is far from being the only category of NFTs. 2 - Music Many artists are taking advantage of the NFT opportunity by offering their audiences limited edition unreleased tracks. Tory Lanez, the American rapper, used this technology to sell 1+ Million NFT albums... in 57 seconds! On the French side, Booba was a pioneer by offering a title in the form of NFT which was a huge success with $600.000+ generated the week of its release. From these examples, it is the whole industry of the music labels which is threatened by the appearance of a viable way for an Artist to finance himself by selling digital products NFT directly to their audience while getting closer to their community. 3 - Domain names nike.crypto nike.blockchain nike.nft Crypto domains are Blockchain addresses that allow, among other things, to receive payments in cryptocurrencies. This is big business for speculators, NFT traders and metaverse natives who buy and sell these NFTs at a profit. How much do you think Nike would be willing to pay you to buy back their domain name to collect cryptocurrency payments? The sale of "sex.crypto" for 230 ETH (+$70,000 as of the time of writing) on OpenSea recently put the spotlight on this category of NFTs and could explode as adoption increases over the coming months and years. 4 - The Metaverse Metaverses are virtual worlds powered by the blockchain where users can create and trade digital assets, play games, buy plots of land, display art in galleries, and a host of other uses where only the imagination seems to be the real limit. Many popular projects such as Decentraland, Cryptovoxels, and Somnium Space already have millions of users. Virtual plots of land from the game TheSandbox have been sold for more than 50 million dollars. Recently, it is Facebook that has affirmed its ambitions to become a major player in this category by presenting its Metaverse project, even renaming their company "Meta". 5 - Collector's cards With the democratization of NFTs classic games are taking on a whole new dimension and giving new life to trading cards. Gamers and collectors can now own the cards they buy on their favorite games and trade them on secondary marketplaces like OpenSea. The ability to purchase unique assets traded and stored on the blockchain is fundamentally changing the way online ownership is perceived in the digital age. Of note, the soccer game Sorare, where players can buy cards featuring their favorite players, just closed a record-breaking $600 million fundraising round. 6 - Sport Sports brands have some of the most valuable intellectual property on the planet. Coupled with the tremendous media exposure of top athletes, it's no wonder that sports teams and other companies seek to symbolize and sell items to their millions of fans. The Lille Football Club (LOSC) has released an NFT collection that represents their 4 French Championship titles. On the NBA Top Shot platform, video excerpts of basketball games, although accessible to all on YouTube, are traded at a premium. The secret? They are sold with a certificate of authenticity, thanks to NFTs. With the adoption of NFTs in the event industry (Concert, Theater, Cinema, Museum...), it seems obvious that tickets to access stadiums could be sold via NFTs in the near future. 7 - Utilities Whether it's rewards, avatars to use in games or to unlock special features, a growing number of creators and developers are taking advantage of NFTs to create and support their communities. This is an opportunity to build on the development of certain projects and the interest of their community at the same time. 8 - Collectible works Currently, some of the most viral NFT collections fall into the collectible category. Some of the examples you've probably already heard of include the Bored Ape Yacht Club, Cool Cats, CryptoPunks, Doodles and CyberKongz collections. "Bored Ape Yacht Club" is a collection of digitally drawn monkeys. The majority of them share the same basic characteristics, but attributes such as background color, clothing, facial expressions, style, text, etc. vary to create a complete collection whose NFTs have sold for nearly a billion dollars. What is the purpose of NFT? All artists and creators can now easily display and monetize their work. Artists can sell their work directly as an NFT to a consumer and make a profit; This leads to less dependence on traditional art galleries and auctions Royalties can be included, which means that each time their NFT is sold, the artist can receive a certain percentage of the price at which the consumer decides to resell it. Royalties are paid to the original artist each time the NFT moves from consumer to consumer. If their art were sold in the traditional way, the revenue from secondary sales would not occur, making NFTs particularly beneficial to creators NFTs ensure ownership of a digital object, thanks to the blockchain What are NFT Royalties and how do they benefit the artist or creator? NFT royalties are automatic revenues that the author will receive from all future resales of his or her NFT on the secondary market. Each time a NFT transaction is made, a smart contract ensures that a predetermined share of the profits goes to the original artist or creator. A percentage of 5-10% is considered the norm for royalties, although the creator is entirely free to choose this percentage. Example: Mike creates an NFT and sells it to Vanessa for $100. Mike gets $100. Then Vanessa decides to sell the NFT to Vincent. Mike will get a percentage of the sale Vanessa made to Vincent, as well as on all subsequent resales, ad infinitum. This new way of distributing royalties in an equitable and automatic way is very advantageous for artists and creators, who usually only benefit from the first sale of their work. What makes an NFT valuable? There are a ton of reasons to buy an NFT... Let's look at 8 of them: 1. Uniqueness - Each NFT is unique, the only one of its kind. It is impossible to create another NFT with the same serial number on the same smart contract. Everything is verified by the blockchain and can be seen by everyone. 2. Copyright - Your NFT may come with a copyright if you use Mintable.app. If the seller chooses to do so - it means that the owner of that Token on the Blockchain will have full commercial copyright to use that image and asset. What makes an NFT valuable? 3. Scarcity - Because they are unique and cannot be copied, they are scarce. Most of the time, there are very few NFTs from an artist or seller. Therefore, you can safely assume that you will be one of the few people in the world to own a collectible that can then be resold. 4. Collectible - Many people see NFTs as a way to collect digital goods. You can keep them and their value will only increase since there are few ways to dilute the collection. Buying them for resale can make you thousands of dollars. Many people manage to make a living from this activity. 5. Downloadable - If it is on Mintable.app, only the current owner of the NFT can download the file attached to it. This makes it unlockable for the owner. If your NFT contains something like game resources, music, a PDF, or more, you might want to purchase the NFT just to download its content (song/ PDF/ etc). 6. Immutable - No one can change the metadata of the token, no one can delete your image or the name of the token. This means that it will never change, it will never be deleted, it cannot be removed from the blockchain. This is what makes it so valuable and attractive to collectors. What makes an NFT valuable? 7. Permanent - Unlike a collectible Pokémon Card, for example, which might deteriorate, NFTs are eternal. Because the data does not change, and because the blockchain is permanent, you will always have this Token if you buy it. You will always be able to resell that Token if you want to. It's like buying a gold bar - you own it and can do whatever you want with it. 8. Resaleable - You can make a lot of money by buying high potential collectible NFTs to resell at auction later on. Thousands of NFTs sell every day for more than $20,000 when the original buyer bought it for only a few hundred or thousands of dollars. Their owners earn more than $15,000 after a few days or weeks, in ONE transaction! In short... NFTs certainly have value! What does it mean to "mint" an NFT? Minting refers to the process of publishing a Token on the blockchain for the first time, which makes it purchasable. This process requires paying a minting fee. Once this fee is paid, future sales of the NFT can be made without having to go through this minting process again. Technically, there is a way to offer an NFT for sale for the first time without having to mint it. Due to the expense of minting, artists often use a process called "Lazy Minting". When an NFT is offered for sale using this method, it is not actually minted until it is purchased. The buyer then pays the "GAS" fees associated with minting the NFT in his own wallet. How to buy NFTs? You can buy NFTs on any existing NFT marketplace such as Opensea.io. Most NFTs are sold via the Ethereum blockchain, so you will usually need Ethereum to buy an NFT. So the first thing to do is to buy Ethereum on any crypto-currency exchange like Coinbase, Binance or Gemini and send it to a crypto-currency wallet (we recommend MetaMask). All of this may seem complex if you're just starting out, but it's actually quite simple. Just follow our steps and you will be able to make your first purchase in no time. Once created, connect your MetaMask wallet to OpenSea or any other NFT marketplace. Once you have funded your account, you can start searching for your nugget. Once you have picked the NFT you wish to purchase, click on "Buy Now" and follow the instructions in your wallet. When the transaction is complete, the NFT will be transferred to your wallet. Step 1: Create your Metamask wallet 1. Go to the Metamask website using your Chrome browser and click on "Install Metamask for Chrome". 2. Add MetaMask as a Chrome extension 3. After MetaMask is installed. Click on "Start" to create your wallet. 4. If this is your first time using MetaMask, click on "Create Wallet". 5. Follow the instructions and create a password 6. Memorize and keep safe the wallet seed. Be sure to keep it secure. The "backup" or "bootstrap" seeds can be used to restore access to your wallet. No one but you should have access to this backup phrase. Even MetaMask cannot recover it for you if it is lost, so be sure to keep it written down somewhere so you don't lose it. Very Important Note: Your seed can give you access to all the funds in your portfolio. No platform will ever ask you for your seed. No matter what the circumstances, DO NOT share your seed with anyone! Step 2: Buy or transfer Ethereum Now that you've created your MetaMask Wallet, it's time to deposit crypto. Open the MetaMask extension in your extensions toolbar, and click on "Buy". 2. A 'Deposit Ether' popup window will appear. To top up the balance using a credit card, click "Continue to Wyre". 3. You will then be directed to the Wyre payment page. Here you can convert any currency to Ethereum. Choose the desired amount, enter your credit card, and click "Next". Important Note: Make sure NOT to change the wallet address field, as it will automatically be filled with your MetaMask wallet address. Step 3: Create an OpenSea account 1. Go to Opensea.io 2. Choose MetaMask to connect Step 4: Buy your 1st NFT 1. Go to Opensea.io and search for an NFT collection 2. Click on the NFT you wish to purchase. 3. Once you have found the NFT you wish to purchase, click on "Buy Now". 4. Check the total, then click on "Confirm Order". 5. Verify gas charges and confirm the transaction 7. And that's it, you're done! You can now click on "In Wallet" to see the NFT you just purchased. If the NFT is not visible, keep in mind that there may be a slight delay due to processing time. What is a fixed price sale and an auction? When looking for an NFT, keep in mind that there are two ways to buy. The first is the fixed price sale, which means that the creator sets a price that cannot be negotiated. The second way to sell NFTs is through an auction. Once a creator has put their NFT up for auction, the consumer can then make a bid. Then, there are two ways for a creator to sell their NFT at auction. The first is to sell to the highest bidder; the seller offers a price and whoever offers the highest amount will be able to buy the NFT. Under this approach, an automatic transaction will occur if the price exceeds the ETH price set by the seller. If the price ends up below the set amount, it is up to the seller to accept the highest bid. The seller is not obliged to close the deal. You can also set a reserve price for the NFT in case the seller does not receive an offer equal to or higher than this price. It is not possible to set a price lower than one ETH because OpenSea covers the gas costs. The seller may choose to accept a bid below the reserve price at any time, but will be responsible for the associated gas charges. Once the auction has begun, the reserve price cannot be changed. NFTs offered at auction are only available for a certain period of time.If a consumer makes a bid in the last ten minutes of the auction, the auction will automatically be extended for an additional ten minutes. Cancellation of the best bid also results in an extension. In most cases there is also a minimum bid requirement, on OpenSea bids must be at least 5% higher than the previous bid and they must also be in the same cryptocurrency. The second way to sell an auctioned NFT is through a declining price sale, meaning that the price of the NFT decreases until a consumer buys it. The consumer can buy the NFT at any time in the specified currency or make a bid If the NFT is part of an "unverified collection," that is, an NFT that has not been reviewed by the platform's user safety team then the buyer will be asked to review the details of the collection before purchasing. What are the different blockchains for NFTs? NFTS are usually on the Ethereum blockchain but can also be on other networks, such as Solana, Polkadot and Avalanche. OpenSea specifically supports the Ethereum blockchain where Ethereum is used to pay transaction fees. Polygon is another blockchain that provides secure and instant transactions with various Ethereum currencies (ETH, USDC and DAI). You can think of Ethereum and Polygon as twin blockchains, as the currencies are similar with some slight differences. With Polygon, a user can create and sell NFTs without transaction fees. (There are many different blockchains for NFTs and each network has different transaction fees, market caps, account transition rates, etc.) There are alternatives to Opensea such as Rarible, Nifty Gateway, Axie Marketplace and many other platforms. How to avoid scams when buying NFT? When you go to a marketplace like OpenSea, it is essential that you know how to navigate safely. Here are some tips: 1. Get help through official channels. If you have any questions or requests, only use the official channels and if you ask questions to the community at large, be careful of malicious users. 2. Never share your seed phrase with anyone! It is provided to you when you create your OpenSea account. It is the only data that is used to generate your account. 3. When downloading a wallet, make sure it is an official wallet. Get the link from the vendor's official website. 4. Never click on unknown links and avoid emails or files from unknown sources, stay alert when browsing and interacting with others on social media. 5. Never use the same password on multiple accounts. 6. Enable two-factor authentication and avoid two-factor authentication via SMS, as it is vulnerable to attacks. 7. To protect your wallet, use a physical wallet (Cold Wallet), which adds an extra layer of security for your NFTs and funds. 8. Limit smart contract approvals, if you use MetaMask, check your spending limit regularly when approving transactions. 9. Before purchasing an NFT, do some preliminary research to ensure the viability of the NFT collection (including making sure the project has a large following on their social networks). Who buys NFTs? The popularity of NFTs continues to grow. Especially with artists, gamers and brands in all areas of culture. Snoop Dog, Jay-Z, Odell Beckham Junior, Serena Williams, Jimmy Fallon, Steve Aoki, Reece Whiterspoon, Jordan Belfort, Stephen Curry, Jason Derulo, Paul Logan, Saquil O'neal are some of the names that are among the buyers of the CryptoPunks collection with Nfts between €100,000 and €1 million. Some celebrities, like Jake Paul for example, have created their own NFT collection. Jake Paul’s one is called "The Future Of Boxing". There is an opportunity for you to invest in these digital assets that will increase in value and be resold at a profit. Major companies are starting to integrate NFTs into their businesses. For example, Coca-Cola, Asics, NBA, Taco Bell, Nike and even Louis Vuitton recently launched a unique video game incorporating NFTs. Major brands like Disney+ are launching their own Metaverses in partnership with Epic Games and plan to incorporate many NFT characters, from Stars Wars to Fortnite. NFTs are an interesting source of revenue for brands, as evidenced by all the major brands that are joining the NFT community. Luxury brands like Louis Vuitton are joining the NFT world. They are using the opportunity to expand their catalog and get closer to their customers beyond physical products. What are gas fees? Gas fees are similar to "transaction fees" in the Ethereum blockchain. When you perform a transaction, such as transferring cryptocurrency to another wallet or purchasing an NFT, you must have enough ETH in your wallet to account for the gas fee associated with the transaction (e.g. An NFT may show a price of 0.5ETH and rise to 0.6ETH with the gas fee). Keep in mind that gas prices fluctuate due to network congestion. Before confirming a transaction, it is recommended to consult websites like https://ethgasstation.info You can take advantage of price fluctuations to benefit from lower transaction fees. On OpenSea, there are three different types of gas fees: one-time, recurring and no fee. One Time Fee: To be paid only once The first time you sell an NFT on OpenSea, you will be required to pay a registration or account initialization fee before you can begin your journey on their platform. After paying this fee, you will be allowed to trade between your wallet and OpenSea, as well as transfer NFTs when a sale takes place. The first time you use a crypto-currency, you will be charged a transaction approval fee. The first time you make an auction, you will also have to pay a one-time fee to approve the WETH for trading. Contract Approval: If the NFT you are reaching has been minted by a custom NFT contract, you will have to pay an approval fee to authorize the trades. Recurring fees: To be paid with each transaction This fee occurs every time you: - Accept an offer - Transfer an NFT - Buy an NFT - Delete a listed NFT - Cancel an offer - Convert cryptocurrencies - Freeze your metadata. This means that your item will be stored safely forever. It is during this automatically performed process that you lock and store your object permanently on a decentralized file storage system, which allows data such as object name, media, description, properties, levels, and statistics to be visible to others. No Gas Charges - you can perform these actions without paying any charges: Create NFTs with the "Collection Manager"! In this case, the 1st buyer will pay the mining fees. Create a collection of several NFTs List an NFT at a fixed price and at auction, and reduce the price of an NFT you have listed How to lower the gas costs when buying an NFT On Opensea, it is possible to manually change the gas charges when purchasing NFT. By opting for a lower gas fee, you also agree to extend the processing time of your transaction by a few extra minutes. So it's a simple option that we recommend you use if you're not in a hurry to purchase. Another simple tip is to shop on the weekends as fees are generally lower. Currently the hours to avoid are 11pm to 4am and the least busy hours are between 3pm and 7pm Pacific Time. How do I store an NFT I own? On OpenSea, whether you are a creator or a collector, the platform allows you to customize your profile as you wish. When you buy an NFT, it is immediately transferred to your Opensea account. People can then click on your profile and see the NFTs you have collected. What is an NFT wallet and why do I need one? An online wallet like MetaMask allows you to store all your cryptocurrencies and all your assets on the blockchain, including your NFTs. MetaMask also acts as a gateway to blockchain applications as it provides you with the necessary tools to make payments when buying NFTs, to collect payments when selling NFTs, but also to store NFTs and exchange them from one wallet to another as well as for every transaction on the Ethereum blockchain. OpenSea is a platform whose sole purpose is to interact with the blockchain, it does not store your NFTs or take possession of your assets. OpenSea is where most of the peer-to-peer NFT exchanges take place, so you will need a wallet as it is a mandatory tool to “translate” your actions into transactions on the blockchain. All crypto wallets have different features, so here are some tips to help you find the perfect NFT wallet. User experience: NFTs are already a complicated concept, so it is recommended to choose a wallet that does not have a complicated user interface. So choose wallets that offer ease of configuration and use. Cross-blockchain compatibility: since the main blockchain for NFTs is Ethereum, most wallets are likely to be compatible with the Ethereum blockchain. However, if you want to buy or sell NFTs on other networks, you will need a wallet that is compatible with other blockchains. Multiple device support: it will be helpful if your wallet supports multiple devices. (Mobile, tablet, computer...) Some good wallets that will help you get started: - MetaMask (recommended) - Coinbase Wallet - AlphaWallet - Enjin - Trust Wallet Can I protect my NFTs with a physical wallet? Yes. If you plan to keep your NFTs for a long period of time, it may be wise to protect them with a physical wallet, also called Cold Wallets. Cold wallets are also recommended if you are going to be very active or cash out large amounts of money to secure your investments. Physical wallets are much more secure than standard crypto wallets because a hacker would need to have physical access to the device to get at your crypto assets. The Ledger Nano is a great example of a physical wallet to protect your NFTs and all of your assets on the blockchain. How do you resell an NFT for profit? Many people make money with NFTs by "flipping" them. This simply means that they buy a project at a low price and then sell it at a higher price later on. While it's impossible to 100% guarantee that the price of a particular project will go up, there are a few things to consider before you make your first NFT purchase. There are 5 main things to consider before bidding on NFT projects. 1 - The community When choosing an NFT project, you need to make sure it has an active community. Always make sure to check the project's engagement on social networks. A good NFT project will have an active community and will not be flooded with fake comments or spam. We recommend selecting projects with more than 10,000 members on Discord and Twitter (the leading platforms in the NFT world). Without a large enough community, the project will have a hard time attracting enough firsttime buyers in a short enough period of time to create some buzz around the project. Example: We found that the Cryptoon Goonz NFT Project had hyper-active members on Twitter and particularly on Discord, with a community that is growing very quickly. It is partly this growth that pushed us to invest very early in this project. 2 - The brand When you invest in NFTs, you are first investing in the success of the collection as a whole and therefore in the brand behind it. Unlike cryptocurrencies, NFTs cannot be sold instantly. There is less liquidity because you have to find a buyer for your NFT. Liquidity can become an issue if the creator or the team behind the project does not have long-term plans to develop the brand. We systematically look at the history of the founders and the artists behind the project to gauge the viability of the collection. Example: The Doodles NFTs project is led by a famous 2D artist called Burn Toast, with exceptional skills and a remarkable palette. We recommended this project to our Private NFT Club members when it was available for $2000. Each NFT is worth at least $10.000 on resale with peak sales of over $200.000. 3 - The vision When looking to invest in an NFT project, it is important to focus on a project that you think has a medium to long term future. It is important to know that the team is committed to the project for the long term, and is not just looking to make a quick buck. To know this, look for a project roadmap (available on the website). The vision should be unique and span several years, not a few months. Collections that include long-term projections with real benefits to the purchase of an NFT are generally the safest investments. Example: NFTs from the CyberKong VX project may be used in games and in The Sandbox (Top 3 NFT games currently). We recommended this project to our Private NFT Club members when it was available for $5000. Each NFT is worth at least $30.000 on resale with peak sales of more than $400.000. 4 - The minting limit If a project has a limited number of NTFs that can be minted, there will be fewer of them on the market, which creates scarcity and increases the value of each NFT in the collection. We encourage you to pay particular attention to projects that start out with a collection of NFTs that will be reduced in size over time. These types of projects can be very profitable, because if they are successful with 10,000 NFTs, it is likely that each of the remaining 5,000 NFTs (for example) will be very valuable. Example: The characters of the CoolCats project are only available in 9999 copies. This gives us some stability regarding the price of an NFT purchased from their collection. Avoid at all costs collections that do not offer a limited number of characters, because a future addition of a few hundred or even a few thousand more NFTs could drastically decrease the value of an NFT. 5 - The utility of the Token When you buy an NFT, it is important to consider it in terms of the value it brings as a commodity. This value can take two forms, tangible or intangible. An example of tangible value is exclusive access to events or future product or service variations. Intangible value can take the form of the art itself or the association with the community or brand. Example: Imagine online horse racing, where bettors bet on horses running in Metaverses. Incredible, isn't it? This could be the future of horse betting. Now imagine you can buy the horse that thousands of people will bet on and build a real stable that wins races. This is what led us to invest early in the ZedRun project. Choose your first NFT! NFTs are to be considered as assets and can be accumulated. Their value will fluctuate as it is based on the forces of supply and demand. But if the value of the NFT increases, you will be able to sell the NFT and make a profit in the process. There is no analytical model or rule to determine which NFTs will increase in value; however, looking at the trading history, the creator of the NFT, the price history, previous sales, transfers and identifying trends can all be helpful in choosing which NFT to invest in. Choosing which NFT to invest in is crucial and accounts for 80% of your success. The remaining 20% is about finding the NFT with the most potential from this collection, based on the budget you can allocate. The best platform to use right now to help you choose the right NFT to invest in within a collection is "rarity.tools". rarity.tools ranks NFTs according to their rarity to help you determine their value. This will help you make buying decisions and comparisons between different NFTs and even different projects. A rarity score is assigned based on the characteristics of the NFT. These vary between different NFTs as they refer to aspects such as clothing, style, utility, facial expression, background, text, etc. Rarity.tools has a ranking system that allows you to compare NFTs according to the volume of Ethereum exchanged and the community votes. The filtering system provided allows you to choose the characteristics or the type of NFT you are looking for with ease. Keep in mind that the rarity of an NFT should not be the only factor you consider when deciding which NFT to invest in! Different NFTs have unique aesthetics or combinations of features that cannot be accounted for by a rarity score. It is therefore recommended that you take into account other factors such as a potential buyer's demand, or the intrinsic utility of the NFT in question. When you enter the rarity.tools website, click on "upcoming", in order to get a sneak preview of the NFTs projects that will be launched soon. This will be a great help when you are looking for NFTs to buy, as you will be able to buy them at their lowest price, while having the possibility to get in touch with their community on social networks. The best investments are often made by buying NFTs in pre-sale between 0.01ETH and 0.1ETH (classic mining rate), before their public launch on Opensea. Icy.tools is another great tool we recommend you use to search for upcoming NFT projects. Icy.tools allows you to find new trending NFT collections and filter them by time, floor price, volume and sales. If you click on the "Discover" tab, you will also be able to see the "Top Projects in the Mining Stage" that are being purchased in real time. This allows you to see exactly what is trending right now, as well as the percentage of "unique minters". If the percentage of unique minters is high, it means that a lot of people are buying NFTs from these collections. This is usually a better sign than having a small group of large investors buying NFTs from the same collection. A tip: Before investing in a project, take the time to check their Discord! If their community is growing quickly, it's a good sign that the collection has potential. Discord is an incredibly popular voice, video, and text chat platform that originated in the video game community, but has since spread to many other areas. Discord servers have become extremely important to the NFT communities that gather and grow here. This is where the NFT community lives and this is where you will find the most important information about any collection. That's why you should ALWAYS join the Discord server of any NFT project you plan to participate in. After joining the project's Discord server, look in the sidebar for a #General chat and enter it. The general chat is simply where members of the Discord server go for general discussions about the project. If the group has a large number of members and a very active chat, this is a very good sign for the potential success of the project. Caution: NEVER agree to trade after being solicited by private message on Discord. Many scams take place via private message. Focus ONLY on the official project server channels. Timing is a crucial element when purchasing an NFT We recommend that you pay particular attention to the following two elements: 1 - The "floor price" of the collection When you click on a collection, metric information, such as the floor price, is displayed. The floor price is the lowest price at which an NFT from that collection is sold. It is updated in real time. Comparing the floor price with the selling price changes of the NFTs in the collection is an effective way to determine if you should invest in an NFT. If the floor price increases over time, it means that the demand for that collection/project is increasing. In our opinion, it is better to buy several NFTs at the lowest price from different collections, rather than putting everything on one NFT from a specific collection. Remember that at the end of the day, you are banking on the success of a collection. 2 - Frequency of transactions When you click on a collection, you can access the volume of transactions. By clicking on this data, you will be able to see the history of the last sales and the amount of each transaction. Make sure you invest in a collection that as many people as possible are investing in! The more buyers there are in a short period of time, the more growth potential the project has. We recommend selecting projects with a transaction frequency that is measured in minutes, not hours or days. BONUS CONTENT: Creating an NFT project from scratch! To get rich with NFTs, there are two major solutions: Buy underpriced NFTs and resell them at a higher price, or... Sell your own collection of NFTs. By choosing the second option, not only do you earn money on the initial sales of each NFT in your collection ($100 x 10,000 NFTs for example), but you can also decide to earn 10% royalties on all sales that are made on the secondary market. A real Jackpot if your project is successful! How to create your own collection? Don't worry, we've got you covered! You just need to follow the guide below. There are so many different ways to create your own NFT projects! You can draw your NFT by hand or combine images using software such as - Photoshop - Illustrator - Ibis paint x - Sketchbook - Any drawing or design application If you are using Photoshop or Illustrator, you can start by drawing the base, for example a cat, and then use the same cat design combined with different overlays of clothing, background colors, bubbles, etc. This allows you to have a variety of NFTs with different features. Like a mustache or a monkey tail. Each feature could have different colors. Be creative! How do I put my NFT project for sale on OpenSea? Once you have a file you want to upload as an NFT, click on create and add a new item: - Drag the digital file into "drop file". On OpenSea, the maximum size is 40 MB. - Configure your logos, social media links and display settings. Once you've uploaded your file, named it and added your social networks, all that's left is to set an initial selling price (preferably in ETH). Click on Create and you will have created your NFT! How to create a collection that includes several NFTs? Click on Create (top right of your screen) and create a collection. After clicking "Create Collection", OpenSea will prompt you to name the collection, insert a logo image, featured image, banner image, description, category, royalty percentage, the blockchain you want the collection to be on and the display theme. Once you have opened your collection, you can start adding your NFTs! How do I list my NFT collection on a whitelist? Listing your NFT collections on a whitelist can make a huge difference to your account as it builds consumer confidence. Collections on OpenSea can achieve "secure" status after making their first sale. Many collections use Washtrading to try and get this status quickly. If you are not sure what washtrading is, it is essentially a form of market manipulation where an investor or consumer buys and sells their NFTs themselves in order to create deceptive activity. These attempts to artificially manufacture trading volume can be easily detected and will not result in safelisting. When analyzing the sales volume of a collection in its early stages, consider checking that the buyer and seller are not identical. A tip to speed up the whitelisting process would be to include any links to your social networks, logos or any other useful information in your collections! How do I get my account verified? (Blue check mark) An account or collection is considered verified if a blue check mark is present. A check mark cannot be explicitly requested, however, OpenSea regularly scans and verifies accounts and collections to grant them a verified status. As on any other social networking platform, a blue check mark is assigned to public figures, brands, associations... To get your account verified, you must have at least 50,000 followers on Instagram or Twitter. Collection verifications are for collections created by high-profile public figures or organizations. Otherwise, the collection must reach a trading volume of 100 ETH or more, as well as have all assets revealed to be eligible for verification. To prevent consumers from misinterpreting collections, OpenSea does not verify collections that appear to be duplicates of existing collections, tributes or remixes. How do you mass-produce thousands of unique NFTs automatically? Usually, to generate NFTs, designers use software to run a script that automatically generates and compiles thousands of unique variations of art, based on multiple graphic layers that can be made with the tools mentioned above. Fortunately, there is a powerful tool available online at https://nft-generator.art/ Using this tool allows you to bypass all the complex scripts and software that developers use to generate NFT projects from a few variations. So, ready to create your first NFT collection? The 4 keys to a successful NFT project launch 1 - Plan, plan, plan! Before launching your NFT project, it is essential to plan it thoroughly. The questions you need to ask yourself are the following: What is the project about? Are they collectible cards/characters, unique artworks? What do they provide access to? Try to give it real value. When will the project be available for Minting? Timing is everything when it comes to NFT. You need to tease your audience as much as possible and make sure they are excited and ready to buy when your project launches. Where is the project launched? Opensea is recommended as it is the easiest and most user-friendly platform to launch a project. It is also an extremely reliable platform in the community 2 - Create an impactful story There are a lot of projects flooding the market that are just images or videos. To stand out, it's important to create a unique story for your project that will excite collectors. 3. Make it exclusive The most successful projects cap the maximum number of NFTs created. By having a fixed quantity available for sale, NFTs are much more likely to retain their value. Here are some examples: CryptoPunks - 10,000 unique characters. Meebits - 20,000 unique 3D characters. Bored Apes Club - 10,000 characters. VeeFriends - 10,255 unique utility tokens. 4. Become a Marketing Pro Marketing is by far the most important part of getting your NFT project off the ground. The best way to market your NFT project is through social networks and influencers. Here, you'll want to make sure that you create profiles on Discord, Twitter and on Instagram and keep on posting content regularly. Contact qualified influencers Most influencers have a loyal community that follows them and trusts their recommendations and opinions. Ideally, the audience should already be exposed to crypto and understand how to buy NFTs. We believe that influencers on YouTube or even on gaming-oriented platforms like Twitch can become powerful communications weapons for your project. Organize a giveaway Running a contest involving a giveaway of an NFT from an upcoming collection is a very popular practice in the NFT space. By hosting a giveaway, you can quickly expand your social networks and build a community around your project. For example, you can state that "anyone who wants to participate should follow the project on Instagram & Twitter, and join the Discord server." Create demand up front Most NFT projects make sure to create excitement at least 15 days before launch. By actively promoting your NFT project and disclosing the details of your project bit by bit, you can build a very active and enthusiastic community. How can I improve the chances of my project being discovered? Regardless of their verification status, all projects have the potential to succeed. Here are some simple but effective tips to improve your chances of being discovered: Original content: try not to use google images, filtered remixes, or work you didn't create. Adopt an Ecommerce sales strategy via social networks to market your NFTs before relying on the community present on platforms like Opensea. Set reasonable prices (below $200) to encourage buyer volume. Reinforce FOMO (fear of missing out) by offering a bonus to the first 100 buyers. What does it take to earn $100,000 from selling NFTs? We've taken the time to analyze data from 100 NFT collection designers who have generated between $100.000 and $199.000. The purpose of this analysis is to give you an overview of the commonalities of projects that reach this goal for you to use as inspiration. Here are our top 5 findings: 1. The most popular art medium among the $100.000 club is animated 2D, with 31.2% of creators using this format. Non-animated 2D art is a close second with 28.6%, followed by animated 3D with 24.7% and static 3D with 15.6%. 2. More than half of the artists in the $100,000 club sell on more than one platform, the average being two. SuperRare is the most popular among the sample group, followed closely by MakersPlace. 3. The median selling price of NFTs by artists in the $100,000 club is 1.033 ETH (This does not mean that they started out by setting these prices, just that their NFTs reached this average later). 33.6% were less than or equal to $100. 20.0% were between $100 and $200. 11.1% were between $200 and $300. 7.7% were $300-$400 3.9% were $400-$500. 3.3% were $500-$600. 2.5% were $600-$700... So it is interesting to start with rates less than or equal to $100 4. The average number of works sold by the artists in the sample group is 114. 5. How big does your audience have to be to earn $100,000 as an NFT creator? The answer is not as important as you might think. As the graph above shows, having a significantly larger audience did not have a proportional effect on the sale price. Artists in the $100.000 club who use Twitter have a median audience of 2,032. Furthermore, having a larger audience does not necessarily mean that artists can achieve a higher sales price per NFT. Artists with smaller and perhaps more engaged audiences earned as much, if not more, for each NFT than their more popular counterparts. Generate passive income by buying NFTs Most NFTs on the market get their value from the value from their art or rarity. On the other hand, some NFTs can provide their holders with passive income in the form of dividends. The best example is the CyberKongz Genesis NFT collection. Owning one of the first thousand Genesis Kongz gives users 10 BANA$ tokens per day for the next 10 years. These tokens can then be used to interact with CyberKongz channels, or sold on the exchanges for a considerable profit. More and more collections are associating their NFTs with potential huge financial gains. Many people are taking advantage of the lack of public awareness of NFTs to accumulate real digital assets. Are there any other blockchain networks that are gasfree? OpenSea allows consumers to trade NFTs on multiple blockchains. The Polygon marketplace is a blockchain that allows you to create and sell NFTs without associated gas fees. To post on the Polygon marketplace, simply change the blockchain from Ethereum to Polygon. Polygon supports ETH, DAI and USDC. Once you set up your collection under the Polygon blockchain, you're all set and can start cashing out with no gas charges! Conversely, you can also buy NFTs without gas fees sold under Polygon. Another advantage of Polygon is that you can create semi-fungible items. This increases the supply of your NFT and therefore the number of copies minted. It also suggests that your NFT can be held by multiple wallets (useful in some cases). Discover 9 NFT projects that went viral and generated millions in sales Something to boost your motivation level! 9. Axie Infinity "Genesis" Virtual Game - $1,500,000 Axie Infinity is a game on the Ethereum platform that involves buying and breeding fantasy creatures called Axies, and it may not be that different from other popular fantasy video games. Earlier in February, a virtual asset seller ended up selling a plot of the game for $1.5 million. The seller, known simply as "Danny," announced the transaction on Twitter as follows: "This is the largest digital land sale ever recorded on the blockchain," while congratulating the new owner Flying Falcon. 8. CryptoPunk #6965 - 800 ETH - $1,540,000 Each CryptoPunk character has its own visual aesthetic. Interestingly, #6965 is one of the CryptoPunks monkeys, as is #4156. While monkeys are not exactly common, there are rarer CryptoPunk collections and this one sold for over a million dollars. This particular CryptoPunk wears a grayish fedora instead of a blue bandana. Otherwise, the facial features are quite similar to all the other CryptoPunks in the Ape collection. 7. The best I can do - $1,650,000 Another NFT created by a fairly well-known person, The Best I Could Do was developed by Rick and Morty's cocreator Justin Roiland and sold for well over a million dollars. Rick and Morty is one of the most beloved and often quoted modern cartoon series, and the creator's influence was bound to have an impact on his NFT list. A strange, almost alien riff on the popular animated series The Simpsons, The Best I Could Do is a doodle that depicts characters from the show all wearing what appear to be nipples on their bellies. It's esoteric, to be sure, but it's sure to appeal to fans of Roiland's other works. 6. The first Twitter on Tweet - $2,900,000 Twitter founder and CEO Jack Dorsey also tweeted the first tweet on the microblogging platform in 2006, a short text that said "just setting up my twttr." While the tweet will continue to exist on Twitter, it has been sold as an NFT to Sina Estav, CEO of Bridge Oracle, for $2.9 million, according to NFTS Street. Estav would get the NFT as "signed and verified by the creator." The $2.9 million raised was then donated in charity to the GiveDirectly organization, which specializes in providing financial resources to the poor and its COVID19 relief programs in Africa. 5. Doge - 1696.9 ETH - $4,000,000 For newcomers and those unfamiliar with the everchanging crypto industry, the concept of an NFT often seems strange, and it doesn't help that buyers are allegedly paying up to $4 million for a meme. There's a lot most don't know about crypto-currencies, but given their growing prevalence, it can be helpful to learn the ins and outs of crypto. Sold in early June 2021 and reported by NBCNews, the winner of the auction, pleaserdao, placed a bid of 1,696.9 ETH, which is an incredible amount of cryptocurrency to spend on anything, let alone a photo of one of the internet's most famous memes. 4. Crossroads - $6,600,000 Digital artist Mike Winkelmann, aka Beeple, has created several dystopian artworks mocking U.S. presidential candidates such as Donald Trump, Hillary Clinton and Bernie Sanders, though his work Crossroads is perhaps the best known. Crossroads features a giant baby that appears to resemble Trump, its body graffitied with remarks such as "Loser." A blue bird, symbolizing Twitter, perches on the character's shoulder while a clown emoji fills the speech bubble above. Depicting the outcome of the 2020 presidential election, Crossroads was recently sold via Nifty Gateway. 3. CryptoPunk #7804: 4,200 ETH - $7,570,000 The rarity of CryptoPunk #7804 comes from the fact that it is one of only 9 Alien CryptoPunks from Larva Labs. Besides the usual CryptoPunks, the rarest ones are Aliens, Monkeys and Zombies. The Alien wears three accessories: a pair of small sunglasses, a pipe from which a few clouds of smoke come out and a front cap. The sale took place around the same time as CryptoPunk #3100, which sold for $10,000 more than #7804 2. CryptoPunk #3100 4.200 ETH - $7,580.00 In the same vein as CryptoPunk #7804, the most expensive CryptoPunk, is also one of the 9 Alien Punks. He has a greenish-blue complexion that looks a bit like Bob's the Squidward cephalopod from SpongeBob SquarePants. The Alien also wears a blue and white headband, although nearly 406 of the 10,000 characters have one. Sold on March 11, 2021, the Punk began its journey starting at $76 at a 2017 auction, continuing to be bid at $2 million and finally at its current price of $7.58 million. 1. Everydays - The first 5 000 days - $69 000 000 In its first-ever digital art auction, Christie's auction house sold a massive compilation of art by Beeple for a record $69 million. Beeple has been making art every day since May 2007, without missing a single day. According to Artnet, Beeple is the "third most expensive living artist" in terms of auction price, after Jeff Koons and David Hockney. But make no mistake… The biggest opportunity for everyday people who don't have international fame, millionaire friends, artistic talent or millions of subscribers, is to buy undervalued NFTs and then resell them at a profit to wealthy buyers. Here are some examples with 5 different NFT collections: Golden Nugget: Step-by-step guide on how to make $500-$100 per day Getting Started Before you get started in being involved in successful NFT projects, you need to have the following things: 1. Discord account - To join any NFT project you will need to join their Discord channel where they list everything about the project including the whitelist criteria. 2. Wallets - We covered the MetaMask creation process in the previous chapter. You will need it for Ethereum based NFTs, sold on OpenSea. Additionally, you want to have a Phantom Wallet for Solana-based NFT projects on marketplaces like Solanart or DigitalEyes. The advantage of the NFT projects based on the Solana network is the incredibly low gas fee (below $1 per transaction). 3. Marketplace Accounts - You will need to create accounts in marketplaces like OpenSea and Solanart. We covered the OpenSea account creation process in a previous chapter. 4. Crypto-currencies - For starters, you will need ETH in MetaMask or SOL in Phantom depending on the project you are getting into. Market Research Finding Profitable Projects To Mint This is perhaps the most important thing when it comes to finding profitable NFT projects. Don't forget the ultimate formula that will lead you to success: timing + research = money All NFT projects either have art or utility. Ideally, you want to get into projects that have both as long as they fall into the KPIs (Key Performance Indicators) that we will cover below. However, there are times when you will go under or above the KPIs in specific situations which we will cover in examples below. The two best places to find and research NFTs are: 1. https://rarity.tools/upcoming/ 2. https://nftcalendar.io/ Keep in mind that on top of these sites you always wanna look out for NFT projects mentioned on Twitter, Instagram, Reddit, TikTok... If any project catches your eye and you see the KPIs being met you should definitely jump in and get on that whitelist. KPIs To Follow 1. Art - Is the project artistically appealing 2. Utility - Does the project have some utility value 3. Discord users - Between 2.000 and 5.000 members. Below 2.000 it means the project is too small, above 5.000 it means you are late to the party. 4. Discord activity - High activity relative to the number of users in the channel 5. Total NFTs available - Less than 10.000. Anything above this inflates the value of the projects. 6. Secondary market price - Higher than mint, i.e. the floor price on OpenSea or Solanart should be higher than the original mint price of the project. 7. Previous pattern - Compare the project to other successful projects in the past. Experience really kicks in here, and after a couple of projects you will have the hang of it. The reason you want to be within these parameters is that this will almost always ensure that you are getting in the best projects early and have a guaranteed shot at the whitelist. Let's analyze 2 profitable projects with potential at the time of writing of this guide. Project 1: Knights Of Chain - www.knightsofchain.com This is one project on the Ethereum blockchain that matches all the criteria above and that should ideally be your sweet spot. Let's go over the KPIs. They have amazing artwork backed by the utility which is a community launchpad. As of the time of writing, they have around 3.000 members in their Discord channel in under a week of announcing their project. This ensures you get a guaranteed shot at the whitelist and also tells you they are growing. They have a very active community in Discord. You will sometimes see Discord channels of other NFT projects with 10.000 members with next to no activity. You want to avoid them, because that means they have purchased fake users. They also just announced that they are getting a billboard in Times Square which is also something you wanna look out for as, after any type of big PR activity, projects tend to blow up really quickly. The total supply is 9,999 NFTs, which is within the KPIs that we established. Next, the mint price will be the same as the public sale price. That's very important because if the mint price is below the public sale price you will get a lot of penny flippers who will try to undercut the market in the secondary markets like OpenSea. They have similar art to ON1 Force which is a project we were personally involved in. We got in the project for around $500 at the mint and sold our NFTs for almost $20.000 between the pre-sale and the public sale. Once you get involved in a few projects you should always aim to find projects that are similar to previously successful ones and definitely get into them as that's another factor that ensures that one will also do well. This is one reason you will see so many ape projects who are trying to be the next Bored Ape Yacht Club and almost all of them are doing great. Project 2: Catch King - https://www.catchking.io/ We wanted to present you with multiple examples of the two most popular blockchains, so you can get an idea for both because there are times when you can make an exception to the KPIs. Catch King is a project on the Solana blockchain which has pixelated art. They already have a working game so the utility is definitely there. You would be getting into this project solely for the utility. On top of that, as of the time of writing, they are a couple of weeks old and have around 400 members on their Discord channel, so if you would be getting on the project now, you would've had a guaranteed shot at the whitelist. The supply is 5.555 so it's under the KPI cap of 10.000. We have been in 2 similar projects on the Solana blockchain that had games ready to go. The NFTs were playable characters in the game and we saw incredible results with both of the projects. So, ideally, we are buying this project because of a pattern we saw before. We emphasize this as it is very important to recognize these patterns, so you can repeat your success. This kind of experience can also help you to make an exception to the KPIs. You should always aim to find projects that match the KPIs but there are times when you can go above and below the parameters and that would be when you see a pattern so you would get in a project and get whitelisted and see where the project goes. Another project that we did really well on was MekaVerse which only had the art and it still blew up. So exceptions can definitely be made once you get used to understanding these patterns. The way we broke down Knights Of Chain is exactly how you should break down every project you aim to get in and if they match definitely get in. Finding Profitable Projects On The Secondary Market To make a killing in this business, you ideally want to mint profitable projects with the parameters we mentioned above. However, you should always be looking on secondary markets like OpenSea to do quick flips which can bring you some juicy profits fairly quickly. To get started on the secondary market go here https://opensea.io/activity What you wanna look for is a pattern of multiple NFTs from one particular project that's being sold multiple times in a matter of minutes. Usually, that's determined by external factors like PR or shoutouts by an influencer. You can go find out what is happening by joining their Discord or Twitter, and confirm whether there has been a high level marketing activity. When you click on the collection of the project that you are interested in, you will see a floor price listed at the top. That is the lowest price someone has listed an NFT from that project. Next, you will sort by "Low to High" and filter the NFTs by "Buy Now" on the left sidebar, which basically shows you every NFT in that collection that has been listed for sale. What you want to look for is the difference between the lowest to the next few ones (as shown on the example on the previous page). If you see an NFT that has the lowest price at 0.269 ETH (as shown in the example) and then the next one is at 0.27 ETH and the third one is at 0.275 ETH you would buy the cheapest one right then and there and list it for 0.274. By doing that, the second one (priced at 0.27) becomes the cheapest, and once that is sold, your new NFT will have the cheapest price. If the trade activity of the project is high (which we already mentioned is crucial for the project), you should be able to sell your NFT within minutes. Now you just made a nice profit of around 0.05 ETH (almost $200 as of the time of writing) by flipping NFTs. Scaling Up and Conclusion Now you know exactly how to find promising NFT projects like Knights of Chain or Catch King at mint. You also learned how you can find profitable projects on the secondary market that you can easily flip. You should now try to get involved in as many projects as you can while keeping within the KPIs that we covered. You will be making the most money from the flips that you get from mint like the ones above and then you should funnel the profits into secondary markets like OpenSea and Solanart and do quick flips on a daily basis. If your budget allows it, try to aim for 5-10 quick flips a day and get on as many mints as you can on projects with high potential. Finally, when you are getting into a project early and you mint, try to aim for 2-3 NFTs at mint. This will allow you to sell 2 (if you bought 3) of them right away, which most of the time will get you at Break-even from your initial investment. You then keep the final one for the chance of price increase on which you can earn some serious profits. And that's it! Congratulations! You have just finished reading the entire NFT PowerClass Guide! Thank you for your attention, we hope you enjoyed the guide. Be sure to always apply the strategies described when looking for new NFT projects. Remember, there is no magic formula for choosing winning NFT projects. Always do your own research and never spend more than you can afford to lose. Patience is a virtue when it comes to investing. Invest in solid NFT projects, take measured risks and enjoy the rewards! We sincerely hope this guide has provided you with valuable knowledge on how to get started in this incredible and growing industry. Remember, only action can bring you results. Best wishes for success. NFT PowerClass. All rights reserved.