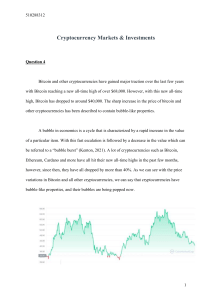

Introduction I think many of us have heard at least once about blockchain, various cryptocurrencies and NFTs. But still, what are these unusual tokens really like? I just read an article written by Julie Bang with headline Non-Fungible Token (NFT): What It Means and How It Works from Investopedia source What is a non-fungible token? (NFT) Non-fungible tokens (NFTs) are cryptographic assets on a blockchain with unique identification codes and metadata that distinguish them from each other. Yet at the same time many people wonder how tokens on the internet worth money at all could be — especially when many of them just represent “ownership” of an online image or animation that you could, in principle, download a copy of for free. It’s easy to see why NFTs inspire both excitement and deep skepticism: They’re a completely novel asset class, and we don’t see new asset classes appear that often. But what drives the value of an asset that’s just a digital token people can pass around? To appreciate NFTs properly, we first must think through what they are and the types of market opportunities they enable. legitimate question How it works? Essentially, NFTs are like physical collector’s items, only digital. So instead of getting an actual oil painting to hang on the wall, the buyer gets a digital file instead. NFTs are created through a process called minting in which the information of the NFT is published on a blockchain. NFTs can be used in many areas, for example, the author gives an example of a contract between two real estate buyers. As a result, this reduces transaction costs for both the buyer and the seller. The most famous use case for NFTs is that of cryptokitties. Like digital kitties, real imaging Non-fungible tokens, which use blockchain technology just like cryptocurrency, are generally secure. The distributed nature of blockchains makes NFTs difficult (although not impossible) to hack. One security risk for NFTs is that you could lose access to your non-fungible token if the platform hosting the NFT goes out of business.