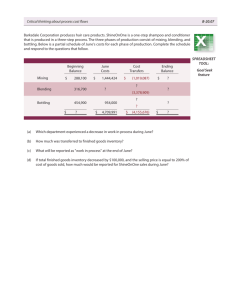

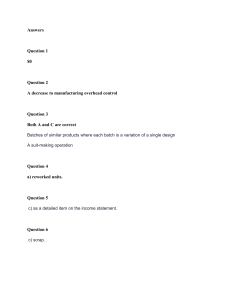

Accounting 226- Final Exam—due by Saturday, 12/10 at 11:59pm. Instructions: This exam is individual work only. No other individual may be consulted. The exam should be uploaded to Blackboard by 11:59 pm on Saturday, December 10th OR emailed to me at both johnsonra1@wofford.edu and JOHN2942@uscupstate.edu. Use of textbooks, notes, and other sources, other than people, are ok. Late work will be penalized, and given the deadline for grading turnaround, could result in an incomplete. Save your file exactly as it is here. Edit the answer sheet pages to include answers below. Add your name. Save any work and add to your exam file so you may receive partial credit on problems. Good luck, treat as a challenge, do your best! To the extent possible, try to do your work on this exam, and save as a single file! Answer sections are provided for problem II and III if you choose to complete those! NAME: Darrell Jones Part I. Multiple Choice: Place answers here. (55 pts total). 1)C 2)D 3)A 4)B 5)D 6)A 7)A 8)D 9)A 10)B 11)A 12)B 13)B 14)B 15)C 16)D 17)A 18)C 19) A 20)B 21)B 22)D 23)A 24)C Problems: Choose any (4) of the (6) listed later in the exam. Some problems have answer sections provided. Others do not. Answers are under each problem I solved Problem II. Equivalent Units. List all answers on each line, marking them clearly. 1. 2. 3. 4. Problem III. Journal Entries. No General Journal Debit Credit 1 2 3 Version 1 1 4 5 6 7 8 Version 1 2 Problem I. Multiple Choice items. Mark your selections on the answer sheet at the front of the exam! 1. A $2.00 increase in a product's variable expense per unit accompanied by a $2.00 increase in its selling price per unit will: a) decrease the degree of operating leverage. b) decrease the contribution margin. c) have no effect on the break-even volume. d) have no effect on the contribution margin ratio. 2. Goodman Corporation has sales volumes of 3,000 units at $80 per unit. Variable costs are 35% of the sales price. If total fixed costs are $66,000, the degree of operating leverage is: a) 0.79 b) 0.93 c) 2.67 d) 1.73 3. Moyas Corporation sells a single product for $20 per unit. Last year, the company's sales revenue was $300,000 and its net operating income was $24,000. If fixed expenses totaled $96,000 for the year, the break-even point in unit sales was: a) 12,000 units b) 9,900 units c) 15,000 units d) 14,100 units 4. Last year Easton Corporation reported sales of $480,000, a contribution margin ratio of 25% and a net loss of $16,000. Based on this information, the break-even point was: a) $435,000 b) $544,000 c) $506,000 d) $600,000 5. Hopi Corporation expects the following operating results for next year: Sales Margin of safety Contribution margin ratio Degree of operating leverage $ 400,000 $ 100,000 75% 4 What is Hopi expecting total fixed expenses to be next year? a) $75,000 b) $100,000 c) $200,000 d) $225,000 6. Iverson Corporation's variable expenses are 60% of sales. At a $400,000 sales level, the degree of operating leverage is 5. If sales increase by $40,000, the new degree of operating leverage will be (rounded): a) 3.67 b) 2.86 c) 5.25 d) 5.00 7. Sufra Corporation is planning to sell 100,000 units for $8.00 per unit and will break even at this level of sales. Fixed expenses will be $300,000. What are the company's variable expenses per unit? a) $5.00 b) $4.00 c) $3.00 d) $4.50 8. Ferkil Corporation manufacturers a single product that has a selling price of $100 per unit. Fixed expenses total $225,000 per year, and the company must sell 5,000 units to break even. If the company has a target profit of $67,500, sales in units must be: a) 6,000 units Version 1 3 b) 5,750 units c) 7,925 units d) 6,500 units 9. Sales at East Corporation declined from $100,000 to $80,000, while net operating income declined by 300%. Given these data, the company must have had an operating leverage of: a) 15 b) 2.7 c) 30 d) 12 10. A company sells two products--J and K. Product J has a contribution margin ratio of 40% whereas Product K has a contribution margin ratio of 50%. Annual fixed expenses are expected to be $120,000, of which $80,000 belong to product J and the rest product K. Product J will generate $2 million in sales. Product K will generate $1.8 million in sales. Which product line is the most efficient to sell? a) J b) K 11. Highjinks, Incorporated, has provided the following budgeted data: Sales Selling price Variable expense Fixed expense 20,000 units $ 100 per unit $ 70 per unit $50,000 How many units would the company have to sell in order to have a net operating income equal to 5% of total sales dollars? a) 18,000 units b) 20,000 units c) 15,333 units d) 14,286 units 12. The Tse Manufacturing Corporation uses a job-order costing system and applies overhead to jobs using a predetermined overhead rate. The company closes any balance in the Manufacturing Overhead account to Cost of Goods Sold. During the year the company's Finished Goods inventory account was debited for $125,000 and credited for $110,000. The ending balance in the Finished Goods inventory account was $28,000. At the end of the year, manufacturing overhead was overapplied by $4,500. The balance in the Finished Goods inventory account at the beginning of the year was: $28,000 $13,000 $17,500 $8,500 13. The Tse Manufacturing Corporation uses a job-order costing system and applies overhead to jobs using a predetermined overhead rate. The company closes any balance in the Manufacturing Overhead account to Cost of Goods Sold. During the year the company's Finished Goods inventory account was debited for $125,000 and credited for $110,000. The ending balance in the Finished Goods inventory account was $28,000. At the end of the year, manufacturing overhead was overapplied by $4,500. If the estimated manufacturing overhead for the year was $24,000, and the applied overhead was $26,500, the actual manufacturing overhead cost for the year was: a) $19,500 b) $22,000 Version 1 4 c) $28,500 d) $31,000 14. Which of the following would most likely NOT be included as manufacturing overhead in a furniture factory? a) The cost of the glue in a chair. b) The amount paid to the individual who stains a chair. c) The workman’s compensation insurance of the supervisor who oversees production. d) The factory utilities of the department in which production takes place. 15. Rotonga Manufacturing Company leases a vehicle to deliver its finished products to customers. Which of the following terms correctly describes the monthly lease payments made on the delivery vehicle? Direct Cost Yes Yes No No A) B) C) D) a) b) c) d) Fixed Cost Yes No Yes No Choice A Choice B Choice C Choice D 16. The costs of direct materials are classified as: Conversion cost Yes No Yes No A) B) C) D) a) b) c) d) Manufacturing cost Yes No Yes Yes Prime cost Yes No No Yes Choice A Choice B Choice C Choice D 17. The cost of electricity for running production equipment is classified as: A) B) C) D) a) b) c) d) Conversion cost Yes Yes No No Period cost No Yes Yes No Choice A Choice B Choice C Choice D 18. The fixed portion of the cost of electricity for a manufacturing facility is classified as a: A) B) C) D) a) b) c) d) Version 1 Period cost Yes No No Yes Product Cost Yes No Yes No Choice A Choice B Choice C Choice D 5 19. For the past 8 months, Jinan Corporation has experienced a steady increase in its cost per unit even though total costs have remained stable. This cost per unit increase may be due to _____________ costs if the level of activity at Jinan is _______________. a) b) c) d) fixed, decreasing fixed, increasing variable, decreasing variable, increasing 20. When the level of activity decreases within the relevant range, the fixed cost per unit will: a) decrease. b) increase. c) remain the same. d) the effect cannot be predicted. 21. Budgeting processes, regardless of the type, should generally begin with a a. Production budget. b. Master budget. c. Cash budget. d. None of these are correct. 22. Budgeting has many purposes, and in general, all of the items below are positive results of a good budgeting process EXCEPT: a. Budgeted and actual results have always been very close. b. The organization began its processes by creating a budget for anticipated sales. c. The organization came in well under budget last year. d. The organization receives input on the budget from a variety of sources. e. The budget is presented clearly to all relevant stakeholders. 23. The schedule of Cost of Goods Manufactured is used for what purpose? a. For manufacturers to approximate the “Purchases” account as would be used by retailer in calculating COGS. b. For creating additional gainful employment for cost accountants. c. It equals COGS- BI so it is a convenient plug figure. d. To motivate management to be efficient. e. None of these is true. 24. Barney Corporation uses job-order costing. They make an entry to record the transfer of inventoried materials from work in process A to work in process B. This could be a. debit to inventory expense. b. a debit to manufacturing overhead. c. a debit to WIP-B d. a potential error. Version 1 6 Free response section. 45 points total. Choose any (4) of the problems below. Answers are under each problem I solved Problem II. Equivalent Units. Transfer your answers to the answer sheet. Show all work when you turn in so you may receive partial credit. Selzik Company makes super-premium cake mixes that go through two processing departments—Blending and Packaging. The following activity was recorded in the Blending Department during July: Production data: Units in process, July 1 (materials 100% complete; conversion 30% complete) Units started into production Units in process, July 31 (materials 100% complete; conversion 40% complete) Cost data: Work in process inventory, July 1: Materials cost Conversion cost Cost added during the month: Materials cost Conversion cost 10,000 170,000 20,000 $ $ 8,500 4,900 $139,400 $244,200 All materials are added at the beginning of work in the Blending Department. The company uses the FIFO method in its process costing system. Required: 1. Calculate the Blending Department's equivalent units of production for materials and conversion for July. 2. Calculate the Blending Department's cost per equivalent unit for materials and conversion for July. 3. Calculate the Blending Department's cost of ending work in process inventory for materials, conversion, and in total for July. 4. Calculate the Blending Department's cost of units transferred out to the next department for materials, conversion, and in Reconciliation of Units % already % completed this completed period Units Conver Conver Material Material sion sion Beginnin g WIP Units introduc ed Total units to be account ed for Complet ed and Transfer red unit Ending total for July. WIP Version 1 10,000 100% 30% 0% 70% 160,000 0% 0% 100% 100% 20,000 0% 0% 100% 40% 170,000 180,000 7 Equivalent Units Material UnitsTr ansferr ed: From WIP From units started/I ntroduce d Total Total Units 10,000 Total Version 1 % Equival complet ent ed this Units period Equival ent Units 0% - 70% 7,000 150,000 100% 150,000 100% 150,000 160,000 150,000 157,000 Total Units Ending WIP Conversion Material Conversion % % Equival Equival complet complet ent ent ed this ed this Units Units period period 20,000 100% 20,000 40% 8,000 8 Cost per Equivalent Units Material Conversion Cost incurred in Current Period Total Equivale nt Units Cost per Equival ent Units $139,400 $244,200 170,000 165,000 $0.82 $1.48 Material Equivale nt Units of Producti on 170,000 Material Cost per equivale nt Unit TOTAL $383,600 $2.30 Conversi on 165,000 Conversi on $0.82 $1.48 Cost per Equivalent Units AND Cost to be accounted for Material Conversion TOTAL $ 139,400 $ 244,200 $ 383,600 170,000 165,000 $ 0.82 $ 1.48 $ 2.30 $ 8,500 $ 4,900 $ 13,400 $ 397,000 Cost incurred in Current Period Total Equivalent Units Cost per Equivalent Units Cost of Beginning WIP Total cost to be accounted for . Cost report [Including Reconciliation] Cost of From Beginning WIP: Material Conversion Version 1 Units Transferred 160,000.00 Equivalent Cost per Equivalent Units Units units Cost of Units Transferred TOTAL 7,000 $0 $ 10,360 $ 10,360 $ 0.82 $ 1.48 9 From units started & completed Material 150,000 $ 0.82 $ 123,000 Conversion 150,000 $ 1.48 $ 222,000 Total Cost of Beginning WIP Total Cost of Units transferred Cost of Material Conversion Total Cost of Ending WIP $ 13,400 $ 368,760 Ending WIP Equivalent Units 20,000 8,000 20,000.00 Cost per Equivalent Units $ 0.82 $ 1.48 $ 28,240 units Cost of Ending WIP $ 16,400 $ 11,840 Total Cost accounted for $ 397,000 Rounding Off Differences $0 Total cost to be accounted for $ 397,000 Version 1 $ 345,000 $ 355,360 10 TOTAL Problem III. Journal Entries/Process Costing. Transfer your answers to the journal entry grid on the front of the exam. Show all work when you turn in so you may receive partial credit. Lubricants, Inc., produces a special kind of grease that is widely used by race car drivers. The grease is produced in two processing departments—Refining and Blending. Raw materials are introduced at various points in the Refining Department. The following incomplete Work in Process account is available for the Refining Department for March: Work in Process—Refining Department March 1 balance Materials Direct labor Overhead March 31 balance 38,000 Completed and transferred to Blending ? 495,000 72,000 181,000 ? The March 1 work in process inventory in the Refining Department consists of the following elements: materials, $25,000; direct labor, $4,000; and overhead, $9,000. Costs incurred during March in the Blending Department were: materials used, $115,000; direct labor, $18,000; and overhead cost applied to production, $42,000. Required: 1. Prepare journal entries to record the costs incurred in both the Refining Department and Blending Department during March. Key your entries to the items (a) through (g) below. a. b. c. d. e. Raw materials used in production. Direct labor costs incurred. Manufacturing overhead costs incurred for the entire factory, $225,000. (Credit Accounts Payable.) Manufacturing overhead was applied to production using a predetermined overhead rate. Units that were complete with respect to processing in the Refining Department were transferred to the Blending Department, $740,000. f. Units that were complete with respect to processing in the Blending Department were transferred to Finished Goods, $950,000. g. Completed units were sold on account, $1,500,000. The Cost of Goods Sold was $900,000. 2. Post the journal entries from (1) above to T-accounts. The following account balances existed at the beginning of March. (The beginning balance in the Refining Department’s Work in Process is given in the T-account shown above.) Raw materials $ 618,000 Work in process—Blending Department$ 65,000 Finished goods $ 20,000 Journal Entry No. Account Titles and Explanation a. Work in process-Refining department Work in process-Blending department Raw Materials inventory (To record direct materials used in production) Version 1 Debit $156,000.00 $45,000.00 Credit $201,000.00 11 b. Work in process-Refining department Work in process-Blending department Salary and Wages Payable (To record direct labor costs incurred) $68,200.00 $16,700.00 c. Manufacturing overhead Accounts Payable (To record manufacturing overhead incurred) $656,000.00 d. Work in process-Refining department Work in process-Blending department Manufacturing overhead (To record manufacturing overhead applied) $488,000.00 $104,000.00 e. Work in process-Blending department Work in process-Refining department (To record transfers from Refining to Blending department) $682,000.00 f. $700,000.00 Finished goods inventory Work in process-Blending department (To record goods completed and transferred to finished goods) g. Accounts receivable Sales revenue (To record sales on account) $656,000.00 $592,000.00 $682,000.00 $700,000.00 $1,340,000.00 $1,340,000.00 Cost of goods sold Finished goods inventory (To record cost of sales) Raw Materials Inventory Debit Credit Beg. Bal. 209600 201000 $84,900.00 $660,000.00 $660,000.00 a. End. Bal. 8600 Work in Process-Refining Department Debit Credit Beg. Bal. 34300 156000 682000 e. 68200 488000 End. Bal. 64500 Version 1 12 Work in Process-Blending Department Debit Credit Beg. Bal. 53,000.00 45,000.00 70,000.00 f. 16,700.00 104,000.00 682,000.00 End. Bal. 830,700.00 Wages Payable Debit End. Bal. Credit 84900 b. 84900 Manufacturing Overhead Debit Credit 656000 592000 d. End. Bal. 64000 Accounts Payable Debit End. Bal. Credit 656000 656000 Finished Goods Inventory Debit Credit Beg. Bal. 11000 700000 640000 End. Bal. 71000 c. g. Cost of Goods Sold (COGS) Debit Credit 660000 End. Bal. 660000 Sales Revenue Debit End. Bal. Credit 1340000 1340000 Accounts Receivable Version 1 13 Debit 1340000 End. Bal. 1340000 Credit Problem IV: Flexible Budgets. Re-create the schedule below, completing any missing values. For the month ended August 31 Revenue and Actual Res Flexible Budg Actual Varian Planning Budg Spending vari ults et ces et ances Car washed (q) 8,800 Revenue ($4.90q) $ 43,080 8,800 9,000 $ 40 U $43,120 $ 980 U $ 44,100 Cleaning supplies ($0 $ 7,560 .80) $ 520 U $ 7,040 $ 160 F $ 7,200 Electricity ($1,200 + $ $ 2,670 0.15q) $ 150 U $ 2,520 $ 30 F $ 2,550 Maintenance ($0.20q $ 2,260 ) $ 500 U $ 1,760 $ 40 F $ 1,800 Wages and salaries ( $ 8,500 $5,000 + $ 0.30q) $ 860 U $ 7,640 $ 60 F $ 7,700 Depreciation ($6,000) $ 6,000 $0 $ 6,000 $0 $ 6,000 Rent ($8,000) $0 $ 8,000 $0 $ 8,000 Administrative expen ses ($4,000 + $0.10q $ 4,950 ) $ 70 U $ 4,880 $ 20 F $ 4,900 Total expenses $ 2,100 U $ 37,840 $ 310 F $ 38,150 $ 2,140 U $ 5,280 $ 670 U $ 5,950 Expenses: $ 8,000 $ 39,940 Net operating income $ 3,140 Version 1 14 Problem V: Quantitative Free Response Required: Identify any concept from the term that you find most valuable or interesting to you. This can be a qualitative concept, or a quantitative concept. For the concept: 1) Name and describe its purpose or use and the context in which you’d use it. 2) Demonstrate (or calculate) the concept using either real or hypothetical data. 3) Briefly analyze the results you compiled. 4) Comment on the significance or importance of the concept or finding. Version 1 15 Problem VI: Performance variances Version 1 16 Version 1 17 a. Materials price variance: Standard rate Actual rate Actual Quantity Materials price Variance (spap)*actual qty $5.00 $4.95 60000 $3000 favorable Materials quantity/efficiency variance Standard quantity 45000 15000*3.0 Actual quantity 49200 Standard price $5.00 $21000 unfavorable b. Labor price variances Standard $16.00 rate Actual $17.00 rate Actual 11800 hours Labor $11800 price variances (sr-ar)* actual hours unfavorable Labor quantity/efficiency variance Standard hours 12000 15000*0.80 Actual hours 11800 Version 1 18 Standard rate Labor efficiency variance SHAH*standard rate $16.00 $3200 favorable Problem VII: Balanced Scorecard. Using any business or enterprise you choose, select 2-3 organizational goals or measures. Using the 4 levels in the Balanced Scorecard hierarchy, indicate how (using + and – notation as usual) these measures might work in your chosen enterprise. (for example: Learning and Growth might suggest USC Upstate would want (+) higher retention rates for highlyeffective professors. Internal Processes might indicate that this would lead to (+) student enrollment in classes with these professors. Customer (or constituent) effects might be (+) greater learning for those students, and for Financial results (or outcomes) this could lead to (+) retention rates for all four years for these students- a financial benefit to the institution.) Show your chart as a graphic (lucidchart recommended!). Version 1 19