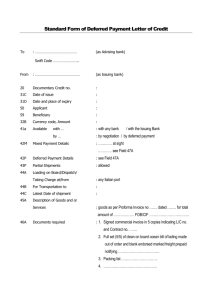

Export regulation and documentation PREPARED AND PRESENTED BY COMMERCIAL BANK OF ETHIOPIA TRADE SERVICE ADVISORY AND TRAINING December 2015 1 TRAINING OBJECTIVES The objective of this training is to refresh association members regarding international and local regulations in international trade. At the end of the training participants are expected to implement what they have learnt on their day to day export transactions. To share knowledge on documents to be presented to the banks before and after shipment of goods in accordance with Ethiopian context . This will make to have smooth banking operation to provide quality services and increase exporters’ satisfaction. 2 CONTENT Export regulation and documentation International Trade What is Export? Modes of Payment in Export Governing Rules in Export International rules Local regulations Documents in Export Pre & post shipment documents Other banking practices to facilitate export Guarantee Foreign transfer Small items export 3 Current Ethiopian Export Practice Eligibility criteria How to proceed Letter of credit and amendment Required documents for permit issuance Negotiation and settlement Handling of Document under Documentary Collection Exercise on sample L/C International Rules ICC Rules /UCP600 and URC522 Annex 4 INTRODUCTION This training is launched upon request of Ethiopian Pulses, Oilseeds and Spices Processors Exporters Association/ EPOSPEA / in collaboration with Commercial Bank of Ethiopia to update its members knowledge on international trade and current banking practices. Commercial bank of Ethiopian is currently a leading bank with more than 960 branches all over the country As you all know, export is the major Foreign Currency earning mechanism, and you exporters are the major role players in this regard We hope you will gain more from this training . Thank you 5 INTERNATIONAL TRADE Exchange of goods and services cross-frontier (between several political economics) and flow of goods from seller to buyer in accordance with the contract of sale and the consequential flow of payment from buyer to seller. Payment Buyer Sales Contract Seller Shipment 6 What is export? Export Element of international trade, Sending goods or rendering services in return of payment . Sending goods or rendering services to the global market in competitive price with standard quality. Export helps to fill the demand of goods or services of importing courtiers and enhance exporting countries to have positive balance of payment. Modes of payments in Export • • • • • Advance payment/ Cash in Advance Consignment sales Documentary Collection Documentary Credit/ Letter of Credit Open Account 7 ADVANCE PAYMENT The method of payment where the exporter receives payment from the buyer prior to shipment or rendering of service • Advantage to Seller – Use of funds/no liquidity problem , no fear of none payment – Goods to be shipped at seller’s convenience. • Disadvantage to seller – Price change may affect the transaction if contract is signed without holding stock • Advantage to Buyer – Avoid price increase (specially for fast changing items) • Disadvantage to Buyer – Loss of use of funds – Lack of control over the goods – Fear of Seller’s refusal/ unable to ship the goods – Political/country risk 8 CONSIGNMENT SALES The supplier ships the goods to the importer (known as theconsignee) whilst retaining ownership. The consignee is theagent responsible for paying the supplier if and only when thegoods are sold. • Advantage to Seller – Enter market • Disadvantage to Seller – Lack of control over the goods – Fear of nonpayment /Delay payment – Political/country risk • Advantage to Agent – Pays only when sales is made • Disadvantage to Agent None 9 DOCUMENTARY COLLECTION • A mode of payment where exporter ships the goods prior to receiving payment and give instruction for handling of documents (financial and/or commercial) to his bank. • Exporter can give instruction to deliver document against payment /against Acceptance as per the contract agreement • Advantage to seller - Enter market • Disadvantage to seller - Delay payment/fear of non payment - Non acceptance of the documents • Advantage to buyer - May refuse to pay or accept the documents - Gives him time to sell goods before payment if it is CAD acceptance - Less costly • Disadvantage to buyer - Goods may not be as represented on the documentation 10 LETTER OF CREDIT • Undertaking issued by a bank in favor of a beneficiary by which the bank substitutes its creditworthiness for that of the applicant by promising to honor (pay) if the document specified in the letter of credit (complied) are timely presented As per UCP 600 definition : • Documentary credit means any arrangement, however named or described, that is irrevocable and there by constitutes a definite undertaking of the issuing bank to honor compiling presentation 11 Advantages &disadvantages of Documentary/Letter of Credit • Advantages to the seller • Risk of none payment by buyer is covered by the issuing bank • Elimination of country risk (if L/C is confirmed) • Disadvantages to the seller • Country risk • • Advantage to the buyer • Payment is based only on documents compliance with terms and conditions of the L/C • Disadvantage to the buyer • Expensive • Goods may not be as represented in the documentation. • 12 OPEN ACCOUNT A mode of payment where supplier/Seller ships goods or renders service and sends documents to the buyer prior to receipt of payment and withoutany form of security. Payment will be made by the transfer to the supplier’s account as per their agreed time for payment. – This mode of payment is not allowed in Ethiopia 13 Governing Rules in Export 1. International rules 2. Local regulations 1 International Regulations There are many regulatory bodies but the most widely accepted is the International Chambers of Commerce (ICC) Documentary Credit UCP 600 - Uniform Customs and Practices for Documentary Credits Documentary Collection URC 522 - Uniform Rules for Collections Guarantee URDG 758 - Demand Guarantees ISP98 - International Standby Practices Others INCOTERMS 14 2. Local regulation It Varies from country to country depending on the monetary policies of government The basics of the regulations would include: Exchange Control regulations Documentation requirements Foreign exchange funds flow Local rules over rule in case of conflict between local and International rules Documents in Export There are two types of documents :1.Pre-shipment Pro forma Invoice Contract 2. Post shipment documents Financial Commercial 15 Pro forma Invoice – an invoice sent by a seller to a buyer in advance of shipment / delivery of goods. It is an indication of price and presented in a form of quotation. Sales Contract a document concluded prior to engaging oneself in one of the international trade products. it is a legal undertaking between buyer & seller on its own and may be sued outside of any trade instrument associated with exchange of goods, services or property for an agreed upon value in money paid or promise to pay. Post shipment documentsBill of Exchange/ Beneficiary Draft An unconditional order written from one person (the drawer), to another person (the drawee). It directs the drawee to pay a certain sum at “sight” or at a fixed or future determinable date, to the order of the party who is to receive payment (payee). There are two types of drafts:16 Demand /sight - where payment is expected to be done the moment document is handled to the drawee Time draft – the sum is payable at some fixed date given on draft, like, 30,45, 60,… Promissory note a written promise committing the signer to pay to another at a future date (usually with interest) Commercial Invoice an accounting document where the beneficiary claims payment from applicant . (as per UCP 600 art.18 a ) i. must appear to have been issued by the beneficiary ii. must made out in the name of the applicant iii. must be made out in the same currency in the credit iv. need not be signed Art. 18.c The description of the goods, services or performance in a commercial invoice must correspond with that appearing in the credit 17 Packing/ weight list Are part of commercial document Give information how goods are packed and quantity/number in each pack should show same quantity as shown on the commercial invoice and other documents Official documents Documents issued by other independent officials rather than the business partners. They are different certificates issued by specific organs like. inspection, origin, quality, weight certificates…etc They should be issued in original, signed and stamped by the issuer, Insurance document A document issued by a named insurance company showing the risk covered, issued in original, signed and stamped by the issuer. The risk cover date shown on the insurance document should be prior from the date of shipment. 18 Transport documents Way bills like Bill of Lading (B/L), Air way Bill (AWB), Truck way Bill (TWB)/Road or Railway consignment notes and Courier/postal receipts Bill of Lading (B/L) as a transport document serves a threefold purposes:1. a receipt for the goods delivered to the carrier for shipment; 2. a contract of carriage of the goods from the place of receipt to the place of delivery listed in the bill of lading; and 3. It is an evidence of title to the goods. it should be • Presented in full set • Date as indicated in the credit /as agreed • Issued /Endorsed as required by credit/as agreed • Notations should be marked as required 19 Other banking practices to facilitate export GUARANTEE A letter of guarantee issued by a bank is a written pomise by the bank to compensate (pay a sum of money) to the beneficiary in the event that the obligor fails to honor his obligations in accordance with the terms and conditions of the guarantee. Currently it is governed by the rules known as URDG758, ISPB98 Upon the trade partners agreement, either payment or shipment of goods Come first in international trade. If the Ethiopian exporter agrees : to be paid in advance, needs to participate a foreign bid needs to give assurance in relation to quality and timely delivery of goods, he may be required to give a bank guarantee to his partner after NBE approval 20 Types of Bank Guarantees:Bid Bond, Performance Bond, Advance Payment Guarantee, Loan Guarantee, Retention Guarantee, and Customs Duty Guarantee Foreign transfers •Incoming money transfer :- transfer of money from abroad to Ethiopia. CBE is currently using SWIFT for customers using Advance Payment as mode of payment for export. ▪Outgoing money transfer:- transfer of money from Ethiopia to abroad. CBE is using mainly SWIFT to transfer payment to settle weight and/or quality loss, demurrage… etc. regarding export 21 Small items export •The permit issued for export of small items by tourists, foreign residents of Ethiopian Nationals who wish to take souvenirs. • Also this permit is given for items to be sent abroad for sample, gift, repair, replacement, exhibition and trade fair and personal effects and belongings etc. Current Ethiopian Export Practice Eligibility Criteria Customer should have the following to enter in to international trade /Export/ under any modes of payment approved by NBE. Valid trade license Should have Tax Identification Number (TIN). Should have NBE account number Should open current account with the bank Should not be reported as delinquent by NBE 22 As per the NBE’s Directives Export is allowed under the following Modes of payments Letter of credit Sight/acceptance Documentary collection CAD sight/acceptance Advance Payment Consignment How to proceed Indicative price- try to get price information Search for market - web site, chamber of commerce… Know your customer- try to know your customer, get as much information as possible Conclude a detailed contract - Indicating a mode of payment, item to be exported, expected shipment period, delivery terms, unit and total price …etc 23 INCOTERMS /International Commercial Terms/ like FOB,CFR, CIF, CPT… are contract of sales between buyer & seller Classify which parties must do in respect of:1. Carriage of goods from seller to buyer 2. Export & import clearance 3. Also explain division of costs and risk between parties (buyer & seller) INCOTERMS… The 11 terms have been categorized under two categories 1. RULES FOR ANY MODE OR MODES OF TRANSPORT EXW EX WORKS FCA FREE CARRIER CPT CARRIAGE PAID TO CIP CARRIAGE AND INSURANCE PAID TO DAT DELIVERED AT TERMINAL DAP DELIVERED AT PLACE DDP DELIVERED DUTY PAID 24 2. RULES FOR SEA AND INLAND WATERWAY TRANSPORT FAS FREE ALONGSIDE SHIP FOB FREE ON BOARD CFR COST AND FREIGHT CIF COST INSURANCE AND FREIGHT Contract should be… Unambiguous Clearly state the duties and liabilities of each party Clearly state the place of arbitration/ settlement in case of dispute Clearly state an agreed product or service Clearly state shipping and delivery details Required documentation Insurance cover Method of payment once the contract is signed the parties should be abide by it and act accordingly, if they default, may not be good for:25 ▪ themselves ▪ their partner ▪ image of a country so try to discuss the content thoroughly before signing of a contract Contract Content Contract No……. Date………………. Names of importer and exporter Item to be imported/exported Quantity Price on greed measurement Terms of delivery Means of conveyance Port of loading/discharge/destination Expected shipment period Mode of payment Arbitration….. Required documents Invoice, transport document, certificate of origin… ----------------------Buyer’s signature Seller’s signature Seal of both parties 26 • Appear at a bank counter for Trade Service • For collection of credit advice (in case A/P) original L/C and/or amendment (in case of L/C) • Permit Issuance (for all modes of payments) • Document presentation (L/C and CAD) Letter Credit Exporter should thoroughly check the L/C he receives from his bank. Try to check the details of the L/C given under the Fields. Field 49 Confirmation Is the L/C confirmed? (if it is acceptance L/C) Field 31D Date and place of expiry Is the expiry date convenient for you ? Field 50 Applicant name Check the spelling of the applicant name and address Field 59 Beneficiary name Check the spelling of the beneficiary name and address Field 32B Currency code, amount Is the currency and the amount of the L/C is what you agreed on your contract? 27 Field 41A Available with… By… bank On which bank L/C is available? How does the payment is to be treated? … by sight, negotiation, acceptance, or deferred payment? Field 42C Draft at … sight Does the L/C require a draft/bill of exchange Field 42A Drawee ….name of a bank On which specific bank the draft required to be drawn Field 43P Partial shipment Are you allowed to ship partially or not? Field 43T Trans shipment Are you allowed to change vessel if yours does not destine where you needed to arrive? Field 44E Port of Loading Which port is selected for loading? Field 44F Port of Discharge (final destination ) Where is the final destination? Field 44C Latest date of shipment When is last date for shipment? Field 44F Description of goods Does the item to be shipped is fully described as per your contract and shows unit and total price? 28 Field 46A Required documents Can you prepare and avail all the documents needed for this specific shipment? Field 47A Additional conditions Are there any additional conditions to be fulfilled? Field 71 Charges Who is going to pay the charge, you or the buyer or both) Field 48 Period for presentation of document When is the last date for document presentation to the (bank) here/to issuing bank)? Amendment ● A process to change terms and conditions of letter of credit, which can be initiated by the beneficiary or the applicant and all parties (beneficiary, applicant and banks) should agree on the changes. ▪ The importer submits an application to his bank/issuing bank to make the requested changes on the L/C ▪ Amendment can be made right after issuance of the L/C or after shipment is done. Some common types of amendments are : Increase L/C amount Extend expiry and/or shipment date Change trade term 29 Correct misspellings, Change in description of goods, …etc. Required document for permit issuance • Valid foreign trade license for export TIN Certificate Completed signed & sealed export application form (BANK PERMIT FOR EXPORT OF GOODS) A copy of sales contract Three copies of invoices duly completed, signed & stamped Credit advice – Advance payment Letter of undertaking–Consignment & Documentary collection /CAD/ modes of payments Authenticated L/C instruments – L/C mode of payment Negotiation After permit issuance exporter ship the goods, prepare and submit the shipping documents to his bank for negotiation and further dispatch to the importer The bank will check the presented documents as per the L/C and negotiate (pay/purchase the document) if it is complying with L/C instrument, if not return for correction to the exporter, if it is still not corrected, dispatch the documents without payment/ on collection 30 basis at the exporter’s risk upon receiving his/her consent. According to UCP 600 Article 5 “banks deal with documents and not with goods, services or performances to which the documents may refer “ so we check the document received from our customers against the Letter of credit (L/C) terms and conditions, according to UCP 600, NBE Rules and directives, and per the bank’s procedures. While checking the documents, we may come across some irregularities, and the frequent ones are listed below: L/C has expired. Late Shipment . Partial shipment is effected, which is not allowed by L/C On board notation on bill of lading is missing, not consigned as per the L/C, notify party is not as per the L/C, status of the signatory not mentioned, alteration not approved Marks and numbers differ between documents. Not enough copies of documents are presented. Typing errors or misspellings Not approved alteration by the issuer Required signatures have been omitted specially on certificates. 31 Description of goods on invoice and other documents differs from credit. Lack of consistency between documents Stale document (presentation of document after 21 days from the B/L date) • Late presentation (Presentation Period) • Insurance cover is insufficient. • Presentation of acceptance letter from the buyer for any discrepancy instead of amendment • Presentation of Fumigation certificate without valid license and letter from Min. of Agriculture issued to a fumigation company Handling of Document under Documentary Collection Document presentation - After permit issuance exporter ship the goods, prepare documents and presents to his bank for further dispatch to the buyer adding clear instruction for the repatriation of the amount. Dispatch and follow-up of documents - Bank will dispatch the documents to the buyer bank as per the address and instruction of the exporter and follow the repatriation of payment to credit the exporter’s account 32 SAMPLE OF LETTER OF CREDIT (IN SWIFT FORMAT) Date: 20-12-14 Issuing Bank: Mizuho Corporate Bank Ltd. Tokyo Japan Advising Bank: Commercial Bank of Ethiopia Addis Ababa, Ethiopia :27:SEQUANCE OF TOTAL 1/1 40A:FORM OF DOCUMENTARY CREDIT IRREVOCABLE 20: DOCUMENTARY CREDIT NUMBER ILC 11100540200 31C: DATE OF ISSUE 141220 40E: APPLICABLE RULES UCP Latest Version 31D: DATE AND PLACE OF EXPIRY 150225 at negotiating bank counter 50: APPLICANT Tokaye K. Jonson’s Enterprise P.O. BOX 12700 33 5-1, Kita-Aoyama 2 –Chome, Minato-Ku Tokyo, Japan 59: BENEFICIARY ` Kebede Getachew oil seeds Export Plc ADDIS ABABA, ETHIOPIA PHONE CODE 1000 2008 32B: CURRENCY CODE, AMOUNT USD 442500.41D: AVAILABE WITH.. .BY... CBETETAAXXXX Commercial Bank of Ethiopia By Negotiation 42C: Draft …. At sight 42A: DRAWEE - FI BIC Mizuho Corporate Bank Ltd. Tokyo JP 43P: PARTIAL SHIPMENT Allowed 34 43T TRANSHIPMENT Not allowed 44E: SHIPMENT FROM Djibouti Sea Port 44F: SHIPMENT TO Yokohama, Japan 44C: DATE SHIPMENT 150127 45A: DESCRIPTION OF GOODS 300 MTS (5% MORE OR LESS) of Ethiopian whitish sesame seed Humera type current crop at USD1475.- PER MT FOB Djibouti packed in 50 Kgs net in new PP bags to be shipped in the months of January SPECIFICATIONS: MOISTURME 7 PCT.MAX FFA 2 PCT MAX OIL CONTENT 52 PCT MIN. IMPURITY 1 PCT MAX 46A: DOCUMENTS REQUIRED Beneficiary’s signed commercial invoice in two originals and 3 copies indicating contract No. TKJE012/14 Full set 3/3 clean “on board” marine bill of lading issued or endorsed to the order of 35 Issuing Bank, notify applicant and marked ‘’ Freight Payable at destination ”. Indicate carrier’s name and agent’s address at port of discharge Certificate of Origin in one original and one copy Packing list in duplicate. Certificate of weight issued by Afro Star in one original and two copies Fumigation Certificate of in 1 original and 2 copies issued by competent authority in country of origin or loading port Phytosanitary certificate in 1 original and 2 copies issued by competent authority certifying that the commodity is free from live insects, objectionable odor and fit for human consumption Beneficiary certificate stating that copy documents have been sent to the applicant within 8 working days after shipment attach courier receipt 7A: ADDITIONAL CONDITION 1. Bill of Lading should indicate that the carrier is the member of International Conference Line 2. All documents are to be made out in English 3. All document should bear our letter of credit number 4. Insurance is to be covered by the applicant 71B: CHARGES All bank charges outside Tokyo are for the account of the beneficiary. 36 48: PERIOD FOR PRESENTATION Not later than 14 days after shipment but within the expiry of the credit 49: CONFIRMATION INSTRUCTION WITHOUT 53A: REIMBUERSING BANK IRVTUS3NRMB Bank of New York, New York 78:INSTRUCTION TO THE PAYING/ACCEPTING/NEGOTIATING BANK All documents including beneficiary’s draft should be send to Mizuho Corporate Bank Ltd. 4-1613, Tuskishima Chuo-ku Tokyo 104-0052 Japan Reimbursement is to be claimed value seven (7) banking days after the dispatch of the required documents to us. Advice us under authenticated telex/SWIFT and send mt754 to IRVTUS3NRMB quoting the following details 1. L/C Number, 2.Amount of drawings, 3.Value date, 4. B/L number and date 72: SENDER TO RECEIVER INFORMATION PLEASE ACKNOWLEDGE RECIEPT OF THIS L/C. 37 Tokaye K. Jonson’s Enterprise P.O. BOX 12700 Tel. 81 00124356 Fax 81 00124359 Tokyo, Japan Sales Contract TO:- Kebede Getachew Oilseeds Exporter Addis Ababa Ethiopia Contract No TKJE012/14 Date: December 10,2014 Dear Sirs: We here by confirmed the following Contract concluded today Item to be exported : Ethiopian whitish sesame seed Humera type current crop at USD1475.- PERMT as per approved pre shipment sample Quantity 6000 bags (packed in 50kgs net)),300MT Price: USD1475/MT FOB per net weight (Total USD442500) Terms of delivery: FOB Means of conveyance: PIL Line Port of loading : Djibouti Port of destination: Japanese Sea Port Expected shipment period : in the month of January Mode of payment : Irrevocable L/C Arbitration….. Arbitration Rules GAFTA arbitration rules Required documents -Invoice, transport documents, certificate of origin… Tokaye K. Jonson’s Enterprise Kebede Getachew Oilseeds exporters Buyer’s signature Seller’s Signature Seal of both parties 38 Kebede Getachew Oilseeds Exporter P.O.BOX 1000 20088 Tel 251 115525557 Fax 251 1155525456 Addis Ababa Ethiopia Commercial Invoice No : KG/012/15 Date: 15/02/15 L/C No: JLC 54020 To:- Tokaye K. Jonson’s Enterprise P.O. BOX 12700 5-1, Kita-Aoyama 2 –Chome, Minato-Ku Tokyo, Japan Buyer’s bank - Mizihu Corporate Bank Ltd, Tokyo Japan under Irrevocable L/C No .-ILC 11100540200 300 MTS (5% MORE OR LESS) of Ethiopian whitish sesame seed Humera type current crop at USD1475.- PER MT FOB Djibouti packed in 50 Kgs net in new PP SPECIFICATIONS: MOISTURME 7 PC FFA 2 PCT MAX OIL CONTENT 52 PCT MIN. IMPURITY 1 PCT MAX Total price USD442500 (United states dollars Four hundred forty two thousand five hundred only) Shipped from Djibouti to Yokohama By PIL Line- Kota Jati B/L No. 00025 , dated 25/01/15 Signature seal 39 INTERNATIONAL RULES UCP600 Article 2 Definitions For the purpose of these rules: Advising bank means the bank that advises the credit at the request of the issuing bank. Applicant means the party on whose request the credit is issued. Banking day means a day on which a bank is regularly open at the place at which an act subject to these rules is to be performed. Beneficiary means the party in whose favour a credit is issued. Complying presentation means a presentation that is in accordance with the terms and conditions of the credit, the applicable provisions of these rules and international standard banking practice. Confirmation means a definite undertaking of the confirming bank, in addition to that of the issuing bank, to honour or negotiate a complying presentation. Confirming bank means the bank that adds its confirmation to a credit upon the issuing bank's authorization or request. Credit means any arrangement, however named or described, that is irrevocable and thereby constitutes a definite undertaking of the issuing bank to honour a complying presentation. 40 Honour means: a. to pay at sight if the credit is available by sight payment. b. to incur a deferred payment undertaking and pay at maturity if the credit is available by deferred payment. c. to accept a bill of exchange ("draft") drawn by the beneficiary and pay at maturity if the credit is available by acceptance. Issuing bank means the bank that issues a credit at the request of an applicant or on its own behal Negotiation means the purchase by the nominated bank of drafts (drawn on a bank other than the nominated bank) and/or documents under a complying presentation, by advancing or agreeing to advance funds to the beneficiary on or before the banking day on which reimbursement is due to the nominated bank. Nominated bank means the bank with which the credit is available or any bank in the case of a credit available with any bank. Presentation means either the delivery of documents under a credit to the issuing bank or nominated bank or the documents so delivered . Presenter means a beneficiary bank or other party that makes a presentation. Article 4 Credits v. Contracts a. A credit by its nature is a separate transaction from the sale or other contract on which it may be based. Banks are in no way concerned with or bound by such contract, even if any 41 reference whatsoever to it is included in the credit. Consequently, the undertaking of a bank to honour, to negotiate or to fulfill any other obligation under the credit is not subject to claims or defenses by the applicant resulting from its relationships with the issuing bank or the beneficiary. Article 5 Documents v. Goods, Services or Performance Banks deal with documents and not with goods, services or performance to which the documents may relate. Article 6 Availability, Expiry Date and Place for Presentation a. A credit must state the bank with which it is available or whether it is available with any bank. A credit available with a nominated bank is also available with the issuing bank. b. A credit must state whether it is "available by sight payment, deferred payment, acceptance or negotiation. c. A credit must not be issued available by a draft drawn on the applicant. d ii. The place of the bank with which the credit is available is the place for presentation. The place for presentation under a credit available with any bank is that of any bank. A place for presentation other than that of the issuing bank is in addition to the place of the issuing bank. a. A credit and any amendment may be advised to a beneficiary through an advising bank. An advising bank that is not a confirming bank advises the credit and any amendment without any undertaking to honour or negotiate. 42 b. By advising the credit or amendment, the advising bank signifies that it has satisfied itself as to the apparent authenticity of the credit or amendment and that the advice accurately reflects the terms and conditions of the credit or amendment received. Article 10 Amendments a. Except as otherwise provided by article 38, a credit can neither be amended nor cancelled without the agreement of the issuing bank, the confirming bank, if any, and the beneficiary. b. An issuing bank is irrevocably bound by an amendment as of the time it issues the amendment. A confirming bank may extend its confirmation to an amendment and will be irrevocably bound as of the time it advises the amendment. A confirming bank may, however, choose to advise an amendment without extending its confirmation and, if so, it must inform the issuing bank without delay and inform the beneficiary in its advice. c. The terms and conditions of the original credit (or a credit incorporating previously accepted amendments) will remain in force for the beneficiary until the beneficiary communicates its acceptance of the amendment to the bank that advised such amendment. The beneficiary should give notification of acceptance or rejection of an amendment. If the beneficiary fails to give such notification, a presentation that complies with the credit and to any not yet accepted amendment will be deemed to be notification of acceptance by the beneficiary of such amendment. As of that moment the credit will be amended. d. A bank that advises an amendment should inform the bank from which it received the amendment of any notification of acceptance or rejection. 43 e. Partial acceptance of an amendment is not allowed and will be deemed to be notification of rejection of the amendment. f. A provision in an amendment to the effect that the amendment shall enter into force unless rejected by the beneficiary within a certain time shall be disregarded. Article 14 standard for examination of documents a. A nominated bank acting on its nomination, a confirming bank, if any, and the issuing bank must examine a presentation to determine, on the basis of the documents alone, whether or not the documents appear on their face to constitute a complying presentation b. A nominated bank acting on its nomination, a confirming bank, if any, and the issuing bank shall each have a maximum of five banking days following the day of presentation to determine if a presentation is complying. This period is not curtailed or otherwise affected by the occurrence on or after the date of presentation of any expiry date or last day for presentation. Article 15 Complying Presentation a. When an issuing bank determines that a presentation is complying, it must honour. b. When a confirming bank determines that a presentation is complying, it must honour or negotiate and forward the documents to the issuing bank. c. When a nominated bank determines that a presentation is complying and honours or negotiates, it must forward the documents to the confirming bank or issuing bank. 44 Article 16 Discrepant Documents, Waiver and Notice a. When a nominated bank acting on its nomination, a confirming bank, if any, or the issuing bank determines that a presentation does not comply, it may refuse to honour or negotiate. b. When an issuing bank determines that a presentation does not comply, it may in its sole judgment approach the applicant for a waiver of the discrepancies. This does not, however, extend the period mentioned in sub-article 14 (b). c. When a nominated bank acting on its nomination, a confirming bank, if any, or the issuing bank decides to refuse to honour or negotiate, it must give a single notice to that effect to the presenter. The notice must state: i. that the bank is refusing to honour or negotiate; and ii. each discrepancy in respect of which the bank refuses to honour or negotiate; and iii. a) that the bank is holding the documents pending further instructions from the presenter; or b) that the issuing bank is holding the documents until it receives a waiver from the applicant and agrees to accept it, or receives further instructions from the presenter prior to agreeing to accept a waiver; or c) that the bank is returning the documents; or d) that the bank is acting in accordance with instructions previously received from the 45 presenter. Article 18 Commercial Invoice a. A commercial invoice: i. must appear to have been issued by the beneficiary (except as provided in article 38); ii. must be made out in the name of the applicant (except as provided in sub-article 38 (g)); iii. must be made out in the same currency as the credit; and iv. need not be signed. b. A nominated bank acting on its nomination, a confirming bank, if any, or the issuing bank may accept a commercial invoice issued for an amount in excess of the amount permitted by the credit, and its decision will be binding upon all parties, provided the bank in question has not honored or negotiated for an amount in excess of that permitted by the credit. c. The description of the goods, services or performance in a commercial invoice must correspond with that appearing in the credit. Article 20 Bill of Lading a. A bill of lading, however named, must appear to: i. indicate the name of the carrier and be signed by: ii. the carrier or a named agent for or on behalf of the carrier, or Iii. the master or a named agent for or on behalf of the master. Any signature by the carrier, master or agent must be identified as that of the carrier, 46 master or agent. Any signature by an agent must indicate whether the agent has signed for or on behalf of the carrier or for or on behalf of the master. ii. indicate that the goods have been shipped on board a named vessel at the port of loading stated in the credit iii. indicate shipment from the port of loading to the port of discharge stated in the credit. iv. be the sole original bill of lading or, if issued in more than one original, be the full set as indicated on the bill of lading. vi. contain no indication that it is subject to a charter party. Article 23 Air Transport Document a. An air transport document, however named, must appear to: i. indicate the name of the carrier and be signed by: the carrier, or Ii. a named agent for or on behalf of the carrier. Any signature by the carrier or agent must be identified as that of the carrier or agent. • Any signature by an agent must indicate that the agent has signed for or on behalf of the carrier. ii. indicate that the goods have been accepted for carriage. iii. indicate the date of issuance. This date will be deemed to be the date of shipment unless the air transport document contains a specific notation of the actual date of shipment, in which case the date stated in the notation will be deemed to be the date of shipment. 47 Any other information appearing on the air transport document relative to the flight number and date will not be considered in determining the date of shipment. iv. indicate the airport of departure and the airport of destination stated in the credit. Article 33 Hours of Presentation A bank has no obligation to accept a presentation outside of its banking hours. Article 34 Disclaimer on Effectiveness of Documents A bank assumes no liability or responsibility for the form, sufficiency, accuracy, genuineness, falsification or legal effect of any document, or for the general or particular conditions stipulated in a document or superimposed thereon; nor does it assume any liability or responsibility for the description, quantity, weight, quality, condition, packing, delivery, value or existence of the goods, services or other performance represented by any document, or for the good faith or acts or omissions, solvency, performance or standing of the consignor, the carrier, the forwarder, the consignee or the insurer of the goods or any other person. Article 38 Transferable Credits a. A bank is under no obligation to transfer a credit except to the extent and in the manner expressly consented to by that bank. b. For the purpose of this article: Transferable credit means a credit that specifically states it is "transferable". A transferable credit may be made available in whole or in part to another beneficiary ("second beneficiary") 48 at the request of the beneficiary ("first beneficiary"). Transferring bank means a nominated bank that transfers the credit or, in a credit available with any bank, a bank that is specifically authorized by the issuing bank to transfer and that transfers the credit. An issuing bank may be a transferring bank. Transferred credit means a credit that has been made available by the transferring bank to a second beneficiary. c. Unless otherwise agreed at the time of transfer, all charges (such as commissions, fees, costs or expenses) incurred in respect of a transfer must be paid by the first beneficiary. d. A credit may be transferred in part to more than one second beneficiary provided partial drawings or shipments are allowed. A transferred credit cannot be transferred at the request of a second beneficiary to any subsequent beneficiary. The first beneficiary is not considered to be a subsequent beneficiary. e. Any request for transfer must indicate if and under what conditions amendments may be advised to the second beneficiary. The transferred credit must clearly indicate those conditions. f. If a credit is transferred to more than one second beneficiary, rejection of an amendment by one or more second beneficiary does not invalidate the acceptance by any other second beneficiary, with respect to which the transferred credit will be amended accordingly. For any second beneficiary that rejected the amendment, the transferred credit will remain unamended. 49 g. The transferred credit must accurately reflect the terms and conditions of the credit, including confirmation, if any, with the exception of: the amount of the credit, any unit price stated therein, the expiry date, the period for presentation, or the latest shipment date or given period for shipment, any or all of which may be reduced or curtailed. The percentage for which insurance cover must be effected may be increased to provide the amount of cover stipulated in the credit or these articles. The name of the first beneficiary may be substituted for that of the applicant in the credit. If the name of the applicant is specifically required by the credit to appear in any document other than the invoice, such requirement must be reflected in the transferred credit. h. The first beneficiary has the right to substitute its own invoice and draft, if any, for those of a second beneficiary for an amount not in excess of that stipulated in the credit, and upon such substitution the first beneficiary can draw under the credit for the difference, if any, between its invoice and the invoice of a second beneficiary. i. If the first beneficiary is to present its own invoice and draft, if any, but fails to do so on first demand, or if the invoices presented by the first beneficiary create discrepancies that did not exist in the presentation made by the second beneficiary and the first beneficiary fails to 50 correct them on first demand, the transferring bank has the right to present the documents as received from the second beneficiary to the issuing bank, without further responsibility to the first beneficiary. j. The first beneficiary may, in its request for transfer, indicate that honour or negotiation is to be effected to a second beneficiary at the place to which the credit has been transferred, up to and including the expiry date of the credit. This is without prejudice to the right of the first beneficiary in accordance with sub-article 38 (h). k. Presentation of documents by or on behalf of a second beneficiary must be made to the transferring bank. URC 522 Article 2 DEFINITION OF COLLECTION For the purposes of these Articles: a) "Collection" means the handling by banks of documents as defined in sub-Article 2(b), in accordance with instructions received, in order to: 1) obtain payment and/or acceptance, or 2) deliver documents against payment and/or against acceptance, or 3) deliver documents on other terms and conditions. b) "Documents" means financial documents and/or commercial documents: 1) "Financial documents" means bills of exchange, promissory notes, cheques, or other 51 similar instruments used for obtaining the payment of money; 2) "Commercial documents" means invoices, transport documents, documents of title or other similar documents, or any other documents whatsoever, not being financial documents. c) "Clean collection" means collection of financial documents not companied by commercial documents. d) "Documentary collection" means collection of: 1) Financial documents accompanied by commercial documents; 2) Commercial documents not accompanied by financial documents. Article 3 -PARTIES TO A COLLECTION a) For the purposes of these Articles the "parties thereto" are: 1- the "principal" who is the party entrusting the handling of a collection to a bank; 2-the "remitting bank" which is the bank to which the principal has entrusted the handling of a collection; 3- the "collecting bank" which is any bank, other than the remitting bank, involved in processing the collection; 4- the "presenting bank" which is the collecting bank making presentation to the drawee. 4- the "presenting bank" which is the collecting bank making presentation to the drawee. b) The "drawee" is the one to whom presentation is to be made in accordance with the 52 collection instruction. Article 4 -COLLECTION INSTRUCTION a) 1-All documents sent for collection must be accompanied by a collection instruction indicating that the collection is subject to URC 522 and giving complete and precise instructions. Banks are only permitted to act upon the instructions given in such collection instruction, and in accordance with these Rules. 2- Banks will not examine documents in order to obtain instructions. 3- Unless otherwise authorised in the collection instruction, banks will disregard any instructions from any party/bank other than the party/bank from whom they received the b) A collection instruction should contain the following items of information, as appropriate. 1- Details of the bank from which the collection was received including full name, postal and SWIFT addresses, telex, telephone, facsimile numbers and reference. 2- Details of the principal including full name, postal address, and if applicable telex, telephone and facsimile numbers. 3- Details of the drawee including full name, postal address, or the domicile at which presentation is to be made and if applicable telex, telephone and facsimile numbers. 4- Details of the presenting bank, if any, including full name, postal address, and if applicable telex, telephone and facsimile numbers. 5- Amount(s) and currency(ies) to be collected. 6- List of documents enclosed and the numerical count of each document. 53 7- a. Terms and conditions upon which payment and/or acceptance is to be obtained. b. Terms of delivery of documents against: 1) payment and/or acceptance 2) other terms and conditions It is the responsibility of the party preparing the collection instruction to ensure that the terms for the delivery of documents are clearly and unambiguously stated, otherwise banks will not be responsible for any consequences arising there from. 8- Charges to be collected, indicating whether they may be waived or not. 9- Interest to be collected, if applicable, indicating whether it may be waived or not, including: a. rate of interest b. interest period c. basis of calculation (for example 360 or 365 days in a year) as applicable. 10- Method of payment and form of payment advice. 1 •11- Instructions in case of non-payment, non-acceptance and/ or noncompliance with other instructions. c) 1- Collection instructions should bear the complete address of the drawee or of the domicile at which the presentation is to be made. If the address is incomplete or incorrect, the collecting bank may, without any liability and responsibility on its part, endeavour to ascertain the proper address. 54 2- The collecting bank will not be liable or responsible for any ensuing delay as a result of an incomplete/incorrect address being provided. Article 5 -PRESENTATION a) For the purposes of these Articles, presentation is the procedure whereby the presenting bank makes the documents available to the drawee as instructed. b) The collection instruction should state the exact period of time within which any action is to be taken by the drawee. Expressions such as "first", "prompt", "immediate", and the like should not be used in connection with presentation or with reference to any period of time within which documents have to be taken up or for any other action that is to be taken by the drawee. If such terms are used banks will disregard them. c) Documents are to be presented to the drawee in the form in which they are received, except that banks are authorised to affix any necessary stamps, at the expense of the party from whom they received the collection unless otherwise instructed, and to make any necessary endorsements or place any rubber stamps or other identifying marks or symbols customary to or required for the collection operation. d) For the purpose of giving effect to the instructions of the principal, the remitting bank will utilise the bank nominated by the principal as the collecting bank. In the absence of such nomination, the remitting bank will utilise any bank of its own, or another bank's choice in the country of payment or acceptance or in the country where other terms and conditions have to be complied with. 55 e) The documents and collection instruction may be sent directly by the remitting bank to the collecting bank or through another bank as intermediary. f) If the remitting bank does not nominate a specific presenting bank, the collecting bank may utilize a presenting bank of its choice. Article 6 -SIGHT/ACCEPTANCE In the case of documents payable at sight the presenting bank must make presentation for payment without delay. In the case of documents payable at a tenor other than sight the presenting bank must, where acceptance is called for, make presentation for acceptance without delay, and where payment is called for, make presentation for payment not later than the appropriate maturity date. Article 7 - RELEASE OF COMMERCIAL DOCUMENTS Documents Against Acceptance (D/A) vs. Documents Against Payment (D/P) a) Collections should not contain bills of exchange payable at a future date with instructions that commercial documents are to be delivered against payment. b) If a collection contains a bill of exchange payable at a future date, the collection instruction should state whether the commercial documents are to be released to the drawee against acceptance (D/A) or against payment (D/P). In the absence of such statement commercial documents will be released only against payment and the collecting bank will not be responsible for any consequences arising out of any delay in the delivery of documents. c) If a collection contains a bill of exchange payable at a future date and the collection 56 instruction indicates that commercial documents are to be released against payment, documents will be released only against such payment and the collecting bank will not be responsible for any consequences arising out of any delay in the delivery of documents. ANNEX 57 58 Message from presenter 1. KYC: Know your customer, use any means and search for information on web site, contact of agent. .. 2. Don’t sign a contract having ambiguous words 3 Never ship the item if there is a need for amendment on the original L/C 4. Don’t think that your bank has a right to effect payment because you choose L/C as the mode of payment. Banks deals with document alone. Only complying presentation (clean document) is a means for payment 5. There is no major or minor discrepancy. Any deviation can disqualify document and be cause for the rejection of payment 6. Presentation of acceptance letter from the buyer for any discrepancy is not acceptable instead should get amendment 7. Fumigation certificate need to be issued by licensed and those who have letter from Min. of Agriculture 59 INCOTERMS 60 DEFINITIONS OF INCOTERMS • EXW – Ex Works The buyer bears all costs and risks involved in taking the goods from the seller's premises to the desired destination. The seller's obligation is to make the goods available at his premises (works, factory, warehouse).. • FCA – Free Carrier The seller's obligation is to hand over the goods, cleared for export, into the charge of the carrier named by the buyer at the named place or point This term can be used across all modes of transport. • CPT – Carriage Paid To The seller pays the freight for the carriage of goods to the named destination. The risk of loss or damage to the goods occurring after the delivery has been made to the carrier is transferred from the seller to the buyer. • CIP – Carriage and Insurance Paid To The seller has the same obligations as under CPT but has the responsibility of obtaining insurance against the buyer's risk of loss or damage of goods during the carriage. The seller is 61 required to clear the goods for export however is only required to obtain insurance on minimum coverage. • DAT - Delivered At Terminal (New Term) Seller delivers when the goods, once unloaded from the arriving means of transport, are placed at the disposal of the buyer at a named terminal at the named port or place of destination. "Terminal" includes quay, warehouse, container yard or road, rail or air terminal. Both parties should agree the terminal and if possible a point within the terminal at which point the risks will transfer from the seller to the buyer of the goods. If it is intended that the seller is to bear all the costs and responsibilities from the terminal to another point, DAP or DDP may apply • DAP- Delivered At Place (New Term) Seller delivers the goods when they are placed at the disposal of the buyer on the arriving means of transport ready for unloading at the named place of destination. Parties are advised to specify as clearly as possible the point within the agreed place of destination, because risks transfer at this point from seller to buyer. If the seller is responsible for clearing the goods, paying duties etc., consideration should be given to using the DDP term. 62 • DDP – Delivered Duty Paid The seller is responsible for delivering the goods to the named place in the country of importation, including all costs and risks in bringing the goods to import destination. This includes duties, taxes and customs formalities. This term may be used irrespective of the mode of transport. • FAS – Free Alongside Ship The seller must place the goods alongside the ship at the named port. The seller must clear the goods for export • FOB – Free On Board The sellers must load themselves the goods on board the vessel nominated by the buyers. Cost and risk are divided when the goods are actually on board of the vessel. The seller must clear the goods for export. The term is applicable for maritime and inland waterway transport only. The buyer must instruct the seller the details of the vessel and the port where the goods are to be loaded, and there is no reference to, or provision for, the use of a carrier or forwarder. • CFR – Cost and Freight - The seller must pay the costs and freight required in bringing the goods to the named port of destination. The risk of loss or 63 damage is transferred from seller to buyer when the goods pass over the ship's rail in the port of shipment. The seller is required to clear the goods for export. • CIF – Cost Insurance and Freight - The seller has the same obligations as under CFR however he is also required to provide insurance against the buyer's risk of loss or damage to the goods during transit. The seller is required to clear the goods for export. 64