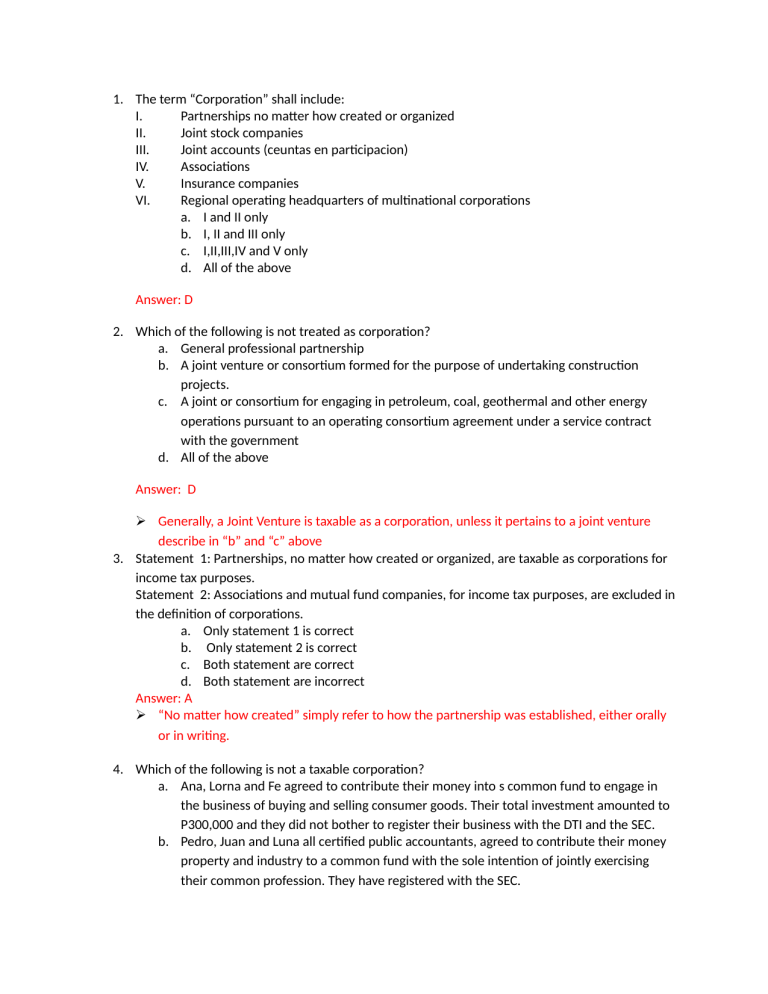

1. The term “Corporation” shall include: I. Partnerships no matter how created or organized II. Joint stock companies III. Joint accounts (ceuntas en participacion) IV. Associations V. Insurance companies VI. Regional operating headquarters of multinational corporations a. I and II only b. I, II and III only c. I,II,III,IV and V only d. All of the above Answer: D 2. Which of the following is not treated as corporation? a. General professional partnership b. A joint venture or consortium formed for the purpose of undertaking construction projects. c. A joint or consortium for engaging in petroleum, coal, geothermal and other energy operations pursuant to an operating consortium agreement under a service contract with the government d. All of the above Answer: D Generally, a Joint Venture is taxable as a corporation, unless it pertains to a joint venture describe in “b” and “c” above 3. Statement 1: Partnerships, no matter how created or organized, are taxable as corporations for income tax purposes. Statement 2: Associations and mutual fund companies, for income tax purposes, are excluded in the definition of corporations. a. Only statement 1 is correct b. Only statement 2 is correct c. Both statement are correct d. Both statement are incorrect Answer: A “No matter how created” simply refer to how the partnership was established, either orally or in writing. 4. Which of the following is not a taxable corporation? a. Ana, Lorna and Fe agreed to contribute their money into s common fund to engage in the business of buying and selling consumer goods. Their total investment amounted to P300,000 and they did not bother to register their business with the DTI and the SEC. b. Pedro, Juan and Luna all certified public accountants, agreed to contribute their money property and industry to a common fund with the sole intention of jointly exercising their common profession. They have registered with the SEC. c. Victorious Bus Company and California Bus Company owns separate franchise to operate a public utulity covering the area of Northern Luzon. To achieve maximum efficiency of utilizing their assets and to avoid the negative effects of competition, the two companies agreed to pool their resources together and operate as a single company. d. Rody and Allan, lawyer and certified public accountants, respectively. agreed to contribute their money, property and industry to a common fund to render service of business process outsourcing. Answer: B The partnership organized in “b” is a GPP, hence, non-taxable 5. Which is not Characteristic of corporate income tax. a. Progressive tax b. Direct tax c. General tax d. National tax Answer: A 6. Which of the following is subject to income tax? a. SSS and GSIS b. Philippine Health Insurance Corporation (PHIC) c. Local Water Districts d. Philippine Amusement and Gaming Corporation (PAGCOR) Answer: D 7. One of the following is exempt from income tax a. Proprietary educational institutions b. Private cemeteries c. Government educational institutions d. Mutual savings bank Answer: C 8. Statement 1: Corporations exempt from income tax are not subject to income tax on incomes received which are incidental or necessarily connected with the purposes for which they were organized and operating. Statement 2: Corporations exempt from income tax are subject to income tax on income of whatever kind and character from any of their properties(real or personal) or from any other activity conducted for profit, regardless of the disposition of such income. a. Only statement 1 is correct b. Only statement 2 is correct c. Both statement are correct d. Both statement are incorrect Answer: C 9. Which of the following statements is incorrect? “Joint Stock Companies” are constituted when a group of individuals, acting jointly, establish and operate business enterprise a. Under an artificial name b. With an invested capital divided into transferable shares c. An elected board of directors, and other corporate characterisrics d. Operating with formal government authority Answer: D 10. A “Joint Account” is constituted when one interests himself in the business of another by/and I. Contributing capital thereto. II. Sharing in the profits or losses in the proportion agreed upon. III. They are not subject to any formality. IV. It may be privately contracted orally or in writing. a. I and II only b. I, II and III only c. I, II, III and IV d. None of the above Answer: C 11. Statement 1: Joint ventures, regardless of the purpose by they were created, are generally exempt from corporate income tax. Statement 2: The share of a co-venturer corporation in the net income of tax exempt joint venture or consortium is sibjected to corporate income tax. a. Only statement 1 is correct b. Only statement 2 is correct c. Both statement are correct d. Both statement are incorrect Answer: B 12. Which of the following statements is correct? I. The term “ domestic “. When applied to a corporation, means created or organized in the philippines or under the laws of a foreign country as long as it maintains a Philippine branch. II. A corporation which is not domestic may be a resident ( engaged in business in the Philippines) or nonresident corporation (not engaged in business in the philippines) III. Resident foreign corporations are subject to income tax based on net income from sources within the philippines. a. I only b. II only c. II and III only d. I, II and III Answer: C 13. Statement 1: Non-resident foreign corporation applies to a foreign corporation engaged in trade or business within the philippines. Statement 2: Resident foreign corporation applies to a foreign corporation not engaged in trade or business in the Philippines. a. Statements 1 & 2 are false b. Statement 1 is true but statement 2 is false c. Statement 1 is false but statement 2 is true d. Statements 1 & 2 are true Answer: A 14. Which of the following is taxable based on income from all sources, within and without? a. Domestic Corporations b. Resident Foreign Corporations c. Non-resident Foreign Corporations d. All of the choices Answer: A 15. The term applies to a foreign corporation engaged in trade or business in the Philippines. a. Resident foreign corporation b. Nonresident foreign corporation c. Multinational corporation d. Petroleum contractor Answer: A 1 . A domestic corporation had the following data on income and expenses during the year 2018: Gross income, Philippines 10,000,000 Business expenses, Philippines 2,000,000 Gross income, China 5,000,000 Business expenses, China 1,500,000 Interest income, Metrobank, Philippines 300,000 Interest income, Shanghai Banking Corporation, China 100,000 Rent income, net of 5%withholding tax 190,000 How much was the income tax payable? a. P3,540,000 b. P3,530,000 c. P3,440,000 d. P2,480,000 Answer: B Solution: Gross income, Philippines Gross income, China Business expenses, Philippines Business expenses, China Interest income, Shanghai Banking Corporation, China Rent income, net of 5%withholding tax (190,000/95%) Taxable net income X RCIT % Income Tax Due Less. CWT on rental income INCOME TAX PAYABLE 10,000,000 5,000,000 (2,000,000) (1,500,000) 100,000 200,000 ___________ 11,800,000 30% ___________ 3,540,000 (10,000) ___________ 3,530,000 2. Hananiah Corporation, a corporation engaged in business in the Philippines and abroad has the following data for the current year: Gross Income, Philippines 975,000 Expenses, Philippines 750,000 Gross Income, Malaysia 770,000 Expenses, Malaysia 630,000 Interest on bank deposit 25,000 Determine the income tax due if the corporation is Domestic Resident Foreign Corp. a. 116,800 72,000 b. 109,500 67,500 c. 312,000 515,850 d. 109,500 72,000 Answer: B Solution: Non-resident Foreign Corp. 320,000 300,000 116,800 300,000 Gross Income, Phil. Expenses, Phil. Gross Income, Malaysia Expenses, Malaysia Interest on bank deposit Taxable Income Tax rate Tax Due Domestic 975,000 (750,000) 770,000 (630,000) 365,000 30% 109,500 RFC 975,000 (750,000) NRFC 975,000 25,000 1,000,000 225,000 30% 30% 67,500 300,000 3. Ace, Inc., Philippines is engaged in research and development services and product development related to computer and aircraft parts. During the year, Ace reported the following income and expenses: Sales 10,000,000 Cost of sales 4,000,000 Operating expenses 2,500,000 Interest income, net of final tax 200,000 Dividend income, tax-exempt 800,000 The income tax of Ace. Inc., Philippines would be Sales Less. COS Gross income Less. Operating Expenses Net taxable income X by: applicable tax rate Income tax due 10,000,000 4,000,000 6,000,000 2,500,000 3,500,000 10% 350,000 4. The following data were provided by Air Jordan, an international air carrier doing business in the Philippines. Gross ticket sales in the Philippines P10,000,000 (Manila. – Macau flight) Gross ticket sales in China (Manila. – Beijing flight) 5,000,000 Gross ticket sales in China (Beijing – Manila flight) 5,000,000 Gross ticket sales in japan (Tokyo- Manila flight) 3,000,000 Gross ticket sales in the Philippines (Manila _ L.A.) Passengers were transshipped in Tokyo to L.A. by another airline 8,000,000 Estimated hours during the flight Manila to Tokyo-5 hrs; Tokyo to L.A.-15 hrs.) Gross ticket sales in L.A., USA(Manila – L.,A.) Passeengers were transshipped in Tokyo to L.A. by a different Plane of same airline company Estimated hours during the flight Manila to Tokyo-5 hrs; Tokyo to L.A,-15 hrs Expenses, Philippines 8,000,000 5,000,000 Question: How much is the income tax due of Air Jordan? Answer: P625,000 computed as follows: Gross ticket sales in the Philippines (Manila. –Macau flight) Gross ticket sales in China (Manila. – Beijing flight) Gross tickets sales in the Philippines (Manila – L.A. flight); Manila to Tokyo only (P8M x 5/20) Gross tickets sales in USA (Manila – L.A. flight) Total Gross “Philippine” Billings P10,000,000 5,000,000 2,000,000 8,000,000 P25,000,000 Income Tax Rate 2.5% Income Tax Due P625,000 Gross ticket sales in China were excluded because the flight did not originate in the Philippines Gross ticket sales in the Philippines for Manila to L.A. flight were apportioned or allocated by 5/2 because the flight is considered interrupted in Tokyo. Thus, only the amount proportionate to Philippine to Tokyo flight should be included in the determination of GPB. 5. Case A (Related income > Unrelated income): Infotech College is a private educational institution. It owns a six (6) storey building where the first 3 floors are being used for its operations and the other 3 floors are being rented by other entities. During the taxable year, its icome and expenses are as follows: Gross income from Tuition fees Rent income Operating expenses Determine the income tax due of infotech Answer: P350,000 (5M-1.5M) x 10% Case B (Related income < Unrelated income): P4,000,000 1,000,000 1,500,000 Using the same data in Case A except that the income for the year amounted to P7,500,000. Determine the income tax due of Infotech. Answer: P3,000,000 > (4M + 7.5-1.5M) x 30% > The related income < unrelated income. Consequently, the educational institution is subject to normal corporate tax of 30% based on net income. 6. Maikli Corporation has the following data: 2015 P1,700,000 1,050,000 615,000 Sales Cost of sales Operating expenses 2016 P2,300,000 1,425,000 480,000 The income tax payable in 2015 is – A. B. Answer: P 13,000 12,250 C. D. P 35,000 10,500 A Gross income (1,700,000 – 1,050,000) Less: Operating expenses Taxable income Rate of tax Normal income tax MCIT (650,000 x 2%) Tax payable (higher) 650,000 615,000 35,000 30% 10,500 13,000 13,000 7. In Number 162, the income tax payable by Maikli Corporation in 2016 is – Answer: A. P 118,500 C. P 116,000 B. 17,500 D. 137,500 C Gross income (2,300,000 – 1,425,000) Less: Operating expenses Taxable income Rate of tax Normal income tax MCIT (875,000 x 2%) Income tax (higher) Less: Carry forward of excess MCIT (13,000 – 10,500) Income tax payable 875,000 480,000 395,000 30% 118,500 17,500 118,500 2,500 116,000 8. Na Dhale Corporation, a domestic corporation, had the following selected data: YEAR GROSS INCOME EXPENSES 2014 P1,000,000 P1,200,000 2015 2,000,000 1,900,000 2016 3,000,000 2,950,000 2017 1,000,000 1,100,000 2018 980,000 500,000 The taxable income in 2018 was: a. P380,000 c. P100,000 b. P0 d. P50,000 Answer: A Solution: Gross Income Expenses NOLCO: 2014 2017 Income(loss) 2014 P1,000,000 (1,200,000) 2015 P2,000,000 (1,200,000) 2016 2017 P3,000,000 P1,000,000 (2,950,000) (P1,100,000) (100,000) (50,000) 2018 P980,000 (500,000) (100,000) (200,000) P0 P0 (P100,000) P380,000 NOLCO may be deductible from gross income for the next three succeeding years only. The remaining NOLCO of P50,000 from 2014 is already beyond the allowable 3-year period in 2018, hence, no longer deductible.