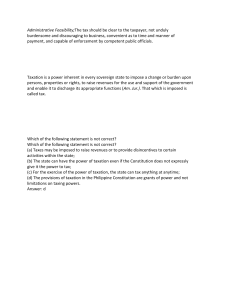

MODULE 1 PRINCIPLES OF TAXATION Civilized society is a nation that has been well organized and formed by laws and government. Where the economy generally is very strong and functions well, infrastructure is constantly being improved, and the society itself continues to grow and accomplish new things. ELEMENTS OF CIVILIZED SOCIETY the government which is the center of power its sovereignty its people its territory Inherent Powers of the Government in achieving a civilized society: Power of Eminent Domain - Eminent domain is the right or power of a sovereign state to expropriate private property to particular uses to promote public welfare. Police Power – is the power of the government to regulate behaviors and enforce order within its territory, often framed in terms of public welfare, security, health, and safety. The exercise of police power can be in the form of making laws, compelling obedience to those laws through physical means with the aim of removing liberty, legal sanctions, or other forms of coercion and inducements. Power of Taxation – the power to impose and collect taxes and charges on individuals, goods, services, and other to support the operation of the government. PHILIPPINE FISCAL SYSTEM AND TAX ADMINISTRATION SYSTEM STRUCTURE Legislated Appropriation Basic Similarities among the inherent powers of the state: •all are inherent to the existence of the government •all are for public purposes •all requires legislation of rules and regulations Primary Distinctions among the inherent powers of the state: •Taxation power is the strongest, because much of the needed government revenue are raised through taxation. •Police power is broad in scope, taxation is governed by special law, while police power is governed by the general law. •In exercise of police power the amount imposed depends on whether the activity is useful or not •Taxation and police power are applied to the community as a whole, eminent domain affects only the particular owner of real property. •eminent domain is affecting only the particular person whose real property is needed by the government in its priority projects. •Exercise of eminent domain is restricted by Constitutional “ just compensation” clause •Police and eminent domain are superior to the “non-impairment” clause of the Constitution, while in the exercise of taxation power, this Constitutional provision must be strictly observed. DOCTRINES OF TAXATION a. Lifeblood Doctrine – Without revenue raised from taxation, the government will not survive, resulting in detriment to society. Without taxes, the government would be paralyzed for lack of motive power to activate and operate it. (CIR v. Algue, Inc., G.R. No. L-28896, February 17, 1988, 158 SCRA 9) b. Necessity Theory – The exercise of the power to tax emanates from necessity, because without taxes, government cannot fulfill its mandate of promoting the general welfare and well being of the people. (CIR v. Bank of Philippine Islads, G.R. No. 134062, April 17, 2007, 521 SCRA 373) c. Benefits received principle – Taxpayers receive benefits from taxes through the protection the State affords to them. For the protection they get arises their obligation to support the government through payment of taxes. (CIR v. Algue, Inc., G.R. No. L-28896, February 17, 1988, 158 SCRA 9) d. Doctrine of symbiotic relationship - Taxation arises because of reciprocal relation of protection and support between the State and taxpayers. The State gives protection and for it to continue giving protection, it must be supported by the taxpayers in the form of taxes. (CIR v. Algue, Inc., G.R. No. L-28896, February 17, 1988,158 SCRA 9 e. DOCTRINE OF EQUITABLE RECOUPMENT -This doctrine of laws states that a tax claim for refund, which is prevented by prescription, may be allowed to be used as payment for unsettled tax liabilities if both taxes arise from the same transaction in which overpayment is made and underpayment is due. SCOPE OF TAXATION Comprehensive, covering everything (people, his property, rights and privileges Plenary, complete in every respect Supreme, with highest degree of authority OBJECTS OF TAXATION person property privileges (excise) ASPECTS OF TAXATION Legislative (fiscal policy) - levy or imposition Executive (Administration) - assessment and collection TAXATION POWER PROCESS IMPOSITION (Enactment of Tax Law) TAX ADMINISTRATION Assessment Appropriation committee of House of Representatives Finance Committee of Senate Bicameral Conference Signing by the President Collection PURPOSES OF TAXATION fiscal ( Revenue) , Primary purpose regulatory (control), Secondary purpose - Sumptuary Purpose, if the imposition of tax is to discourage extravagance. - compensatory purpose of taxation to reduce excessive inequalities of distribution of wealth. NATURE OF TAXATION necessary attribute of the state = (lifeblood of the government) essentially legislative = (requires passing of law to make it enforceable) for public purposes = ( for the benefit of the majority of the population) territorial in operation = ( affecting those within the sovereign jurisdiction of the imposing authority) strongest inherent power of the government ( source of significant part of the required government revenue) subject to inherent and Constitutional limitations ( not an absolute power, restricted by its nature and by provisions of the Constitution) Power of Taxation – the power by which the sovereign, through its lawmaking body, raises revenue to defray the necessary expenses of government. It is a way of apportioning the costs of government among those who in some measure are privileged to enjoy its benefits and must bear its burdens Taxes – are the enforced proportional contributions from persons and property, levied by the State by virtue of its sovereignty, for the support of government and for all the public needs. The most basic function of taxation is to fund government expenditures. GOVT BUDGET REVENUE (80% Taxes) = EXPENDITURES: Operating Expenditures Capital Expenditures CONSTITUTIONAL LIMITATION ON POWER OF TAXATION Observance of due process of law Observance of equal protection of the laws Prohibition against imprisonment for non-payment of poll tax Prohibition against impairment of obligation of contracts Requirement of uniformity and equity in taxation Prohibition against taxation appropriation for religious purposes Prohibition against taxation of religious, charitable and educational entities(Religious and charitable institutions exempt from property taxes) Prohibition against taxation of non-stock , non-profit educational institutions and proprietary educational institutions (exempt from property and income taxes as well as customs duties except income derived from business activity not related to its educational purpose) Inherent limitations on Power of Taxation: A. Non Delegation of the power to Tax – the power to tax is purely legislative and it cannot be delegated by the legislature to the executive or judicial department of the government. Separation of the three branches of government. B. Exemption from taxation of government entities. Government agencies performing essential government functions are exempt from tax unless expressly taxed while those performing proprietary functions are subject to tax unless expressly exempted. Government cannot tax itself. C. Public Purpose – purpose affecting the inhabitants of the state as a community and not merely as individuals. Financing educational activities, promotion of science, maintenance of roads and bridges, aid for victims of calamities, etc. etc. D. Territorial Jurisdiction – the tax laws of the state are enforceable only within it’s territorial limits. Tax laws do not operate beyond the country’s territorial limits. E. International comity – the property of a foreign State or government may not be taxed by another. Courteous and friendly agreement and interaction between nations. LAWS Governing Taxation Power: The Constitution National Internal Revenue Code Tariff and Custom Code Local Government Taxation Special Laws Treaties Revenue Regulations Revenue Memorandum Circulars Revenue Memorandum Orders Revenue Memorandum Rulings BASIC PRINCIPLES OF EFFECTIVE TAX SYSTEM fiscal adequacy, the tax system must be flexible to response to prevailing economic condition. Taxes to be imposed should be just-enough to generate revenue required for provision of essential public services. theoretical justice, the burden of taxation must be equitable to the ability of the tax payer to pay. Taxes should equally burden all individuals or entities in similar economic circumstances Horizontal Equity: (flat rate) People in equal positions should be made to pay the same amount of taxes. Vertical Equity: (progressive rate) A tax system should distribute the burden of paying taxes fairly across people with different abilities to pay. Thus, people who earn more should pay more than those people who make less than them. administrative feasibility, the system must be simple to administer to enable the taxpayer to assess his own tax liability. Taxes should be enforced in a manner that facilitates voluntary compliance to the maximum extent possible. Tax assessment and determination should be easy to understand by an average taxpayer. There are four general requirements for the efficient administration of tax laws: clarity, stability (or continuity), cost-effectiveness, and convenience. LEGISLATION OF TAX LAWS Revenue bill must originate from the House of Representative Senate can amend or concur the House Bill Differences of two version of bills are resolved in a joint conference committee (Bicam) Tax bill to be signed by the President to become a law Veto power of the President is overcome by 2/3 votes of all members of Congress CHARACTERISTICS OF TAX LAWS A special law Civil in nature Prospective in application General Rules: On Tax Exemption •Tax exemptions are to be construed strictly against the taxpayer . •The burden of proof as to exemptions/deductions must be on the taxpayer, meaning, he is taxable, unless he could prove otherwise. On Imposition •The doubt should be resolved liberally in favor of the taxpayer, and strictly against the taxing authority, since tax laws impose special burden upon the taxpayer. On Criminal Liability if the taxpayer refused to pay his tax, he could be prosecuted for criminal liability, (exempt those involving poll tax). On Conflict in Taxation between Civil Law and Tax Law •The tax law, being a special law shall prevail. On Conflict between the Tax Law and GAAP, what should prevail? •The tax law, with respect to preparation of tax return shall prevail. DIRECT VS INDIRECT TAXES DIRECT TAX A tax is said to be direct tax when impact and Incidence of a tax are on one and same person, i.e., when a person on whom tax is levied is the same who finally bears the! burden of tax. For Instance, income tax is a direct tax because impact and incidence falls on the same person. INDIRECT TAX If impact of tax falls on one persons and incidence is on the another, the tax is called indirect. For example, Value Added tax on saleable articles is usually an indirect tax because it can be shifted on to the consumers. SYSTEM OF TAXATION Progressive – give emphasis on direct taxes (more direct taxes are collected in the system) Regressive – more indirect taxes than direct taxes are collected in the system. Situs of taxation Literally means place of taxation. The general rule is that the taxing power cannot go beyond the territorial limits of the taxing authority. Basically, the state where the subject to be taxed has a situs may rightfully levy and collect the tax. Determinant factors of situs of taxation –Protection extended –nature of tax –lex rei sitae - location of property –mobilia sequuntor personam – the place where the owner is found –citizenship of taxpayer Philippine Internal Revenue Taxes, Situs Taxation: NATURE OF TAX TAXPAYER Resident Citizen Resident Alien LOCATION / SOURCE OF TAXABLE AMOUNT W/I PHILIPPINES OUTSIDE PHILIPPINES SALES/RECEIPTS: SALES/RECEIPTS: Subject to Phil Tax Exempt Subject to Phil Tax Exempt Resident Citizen Other Individual Domestic Corporation Other Corporations INCOME: Subject to Phil Tax Subject to Phil Tax Subject to Phil Tax Subject to Phil Tax INCOME: Subject to Phil Tax Exempt Subject to Phil Tax Exempt TRANSFERS: Subject to Phil Tax Subject to Phil Tax TRANSFERS: Exempt Subject to Phil Tax BUSINESS TAX: INCOME TAX: TRANSFER TAXES: NON-RESIDENT ALIEN OTHER Taxpayers Double Taxation Our Constitution does not prohibit double taxation,, however, while it is not forbidden, it is something not favored. Double Taxation, when two or more taxes are imposed on the same Taxpayer for the same purpose for the same period by the same authority Direct Double Taxation (Illegal), When all the four elements of double taxation are present (same taxpayer, same purpose, same period, same authority). Indirect Double Taxation (Legal), When one of the elements of direct double taxation is lacking. Remedies to lessen the impact of indirect double taxation: a. deductions b. tax credits c. exemption d. reciprocity clause Characteristics of Taxes It is an enforced contribution. It is generally payable in money. It is proportionate in character. It is levied on persons, property, or the exercise of a right or privilege. It is levied by the State which has jurisdiction over the subject or object of taxation. It is levied by the law-making body of the State. It is levied for public purpose or purposes. CLASSIFICATION OF TAXES As to Purpose: –Revenue or fiscal –Regulatory or sumptuary As to object: –Personal –Property - Excise or rights As to determination of Amount –Ad valorem (taxable amount is in Peso) –Specific (taxable item is in other measurement other than peso) As to who is carrying the burden of taxation –Direct –Indirect Taxes as to rate –Proportionate - Under this classification, the individuals are required to pay tax in proportion to their income, i.e., the rate of tax remains same as the base changes. –Progressive - Under this classification, the rate of tax increases as the tax base increase. Using the progressive tax rate, taxes are seen as reducing inequalities in income distribution Taxes as to collecting government unit National taxes: –Income tax –Business tax; •Excise tax on production/importation •VAT •Other Percentage Tax –Transfer taxes: •Donor’s tax •Estate tax –documentary stamp tax –Custom duties –Energy tax –Travel tax –Motor vehicle tax Local taxes: –Community tax –Privilege/occupational tax –Real property tax –Local business taxes Other government impositions which are not considered as taxes: –License fee ( authorization) –Special assessment ( on real property for recovery of tax money) –Toll fee ( demand of proprietorship) –Surcharges ( financial penalty for tax violations)