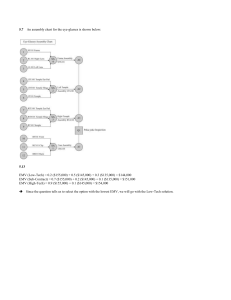

Instructor’s Manual Chapter 1 1 Chapter 1 I Chapter Outline 1.1 A Decision Tree Model and Its Analysis • The following concepts are introduced through the use of a simple decision tree example (the Bill Sampras' summer job decision): Decision tree Decision node Event node Mutually exclusive and collectively exhaustive set of events Branches and final values Expected Monetary Value (EMV) Optimal decision strategy • Introduction of the folding back or backward induction procedure for solving a decision tree. • Discussion on sensitivity analysis in a decision tree. 1.2 Summary of the General Method of Decision Analysis. 1.3 Another Decision Tree Model and Its Analysis • Detailed formulation, discussion, and solution of the Bio-Imagining example, which is a problem with more alternatives and event nodes than the Bill Sampras example. • Discussion on sensitivity analysis and analysis of other alternatives faced by Bio-Imaging and Medtech (a related company). 1.4 The Need for a Systematic Theory of Probability • Discussion on the "Suds-Away" dishwashing detergent example, which introduces the need for probability theory to properly assign probabilities to branches at event nodes (conditional probabilities). • The solution to this example is postponed to Chapter 2. 1.5 Further Issues and Concluding Remarks On Decision Analysis • Discussion on the following subjects: • Risk analysis when using the EMV procedure. • Non-quantifiable consequences not necessarily considered by a decision tree analysis. • Benefits of using decision analysis: Clarity of decision problem Insight into decision process Importance of key data Suggestion of other ways to look at the problem Manual to accompany Data, Models & Decisions: The Fundamentals of Management Science by Bertsimas and Freund. Copyright 2000, South-Western College Publishing. Prepared by Manuel Nunez, Chapman University. Instructor’s Manual Chapter 1 2 II Teaching Tips 1. Generally, students find more difficult the formulation of a problem as a decision tree than following the procedure for solving it. Finding the right logical sequence of events and identifying decision and event nodes is hard to do for many students. It is recommendable to present a few decision tree examples emphasizing the design and structure of the trees without necessarily solving them in class. 2. A detailed presentation of the Bio-Imagining decision tree example from the textbook may take a long time. This example is very good for the students to read on their own. If the goal is to reinforce in class the concepts introduced in the Bill Sampras example, it is a good idea to ask the students to prepare the BioImagining example in advance or, alternatively, to present a less detailed example, perhaps from the exercise list. 3. The discussion on the EMV criterion and risk can be enhanced by showing a simple payoff matrix decision example where different decisions are optimal depending on other criteria such as a greedy strategy (highly risky) or a mini-max strategy (highly conservative). A matrix decision example can be also used to introduce the general subject of decision analysis. 4. In presenting a decision tree case in class, it is recommendable to ask the students (cold-calls) the following: (a) What are the decisions in the case? (b) What are the uncertainties involved in the case? (c) What are the branch-probability values and the endpoint evaluation of the tree? (d) Ask for volunteers to play the role of the main characters in the case. (e) If you were the person making the decision, what would you do? III Answers to Chapter Exercises 1.1 (a) Mary’s optimal strategy is to continue with the show. The EMV of this strategy is $5,550. Manual to accompany Data, Models & Decisions: The Fundamentals of Management Science by Bertsimas and Freund. Copyright 2000, South-Western College Publishing. Prepared by Manuel Nunez, Chapman University. Instructor’s Manual Chapter 1 3 (b) Mary’s optimal strategy is to wait until August 14 to listen to the weather forecast for the next day. If the forecast indicates a rainy day, she should cancel the show. If the forecast indicates a sunny day, she should continue with the show. The EMV of this strategy is $6,200. Manual to accompany Data, Models & Decisions: The Fundamentals of Management Science by Bertsimas and Freund. Copyright 2000, South-Western College Publishing. Prepared by Manuel Nunez, Chapman University. Instructor’s Manual Chapter 1 4 1.2 (a) See decision tree above. (b) Once Monday's bid is made, Newtone's optimal strategy is to accept the bid if it is a $3,000,000 bid and reject it if the bid is for $2,000,000. If Monday's bid is rejected, then accept Tuesday's bid, regardless of the amount offered. The EMV of this strategy is $2,600,000. Manual to accompany Data, Models & Decisions: The Fundamentals of Management Science by Bertsimas and Freund. Copyright 2000, South-Western College Publishing. Prepared by Manuel Nunez, Chapman University. Instructor’s Manual Chapter 1 5 1.3 (a) As shown in the table below, as p decreases James' optimal decision changes as to take Meditech's offer. A break-even analysis where we solve the equation 440p - 200(1-p) = 150 reveals that the break-even probability is p=0.55. In other words, if the probability of successful 3D software is below 0.55, then it is better for James to accept Meditech's offer, otherwise continue with the project. Probability of Successful 3D Development p EMV Optimal Strategy 0.00 0.10 0.20 0.30 0.40 0.50 0.60 0.70 0.80 0.90 1.00 $150 $150 $150 $150 $150 $150 $184 $248 $312 $376 $440 Accept Medtech's offer Accept Medtech's offer Accept Medtech's offer Accept Medtech's offer Accept Medtech's offer Accept Medtech's offer Continue with project Continue with project Continue with project Continue with project Continue with project (b) In this case, the EMV at nodes E and H is $2,040,000, so that James' optimal decision is to continue the project and if the 3D software is successful, then he should either apply for SBIR or accept Nugrowth's offer. (c) We assume that we only change the high-profit probability under successful 3D software, the probability of medium-profit remains the same as the probability of low-profit, and all other probabilities, revenues, and costs remain the same. As shown in the table below, under these assumptions, we have that James' optimal strategy is to accept Meditech's offer if probability of high-profit is 10% or less. He should continue with the project, and then accept Nugrowth's offer is 3D software is successful, whenever the probability of high-profit is more than or equal to 20%, but less than or equal to 50%. Finally, he should continue with the project, and then apply for SBIR if the 3D software is successful, whenever the probability of high-profit is 60% or more. Manual to accompany Data, Models & Decisions: The Fundamentals of Management Science by Bertsimas and Freund. Copyright 2000, South-Western College Publishing. Prepared by Manuel Nunez, Chapman University. Instructor’s Manual Chapter 1 6 Probability of High-Profit Scenario for Successful 3D Software High Medium Low 0.00 0.10 0.20 0.30 0.40 0.50 0.60 0.70 0.80 0.90 1.00 0.50 0.45 0.40 0.35 0.30 0.25 0.20 0.15 0.10 0.05 0.00 EMV 0.50 $150 0.45 $150 0.40 $184 0.35 $286 0.30 $388 0.25 $490 0.20 $598 0.15 $714 0.10 $829 0.05 $945 0.00 $1,060 Optimal Strategy Accept Medtech's offer Accept Medtech's offer Continue with project, then accept Nugrowth if successful 3D Continue with project, then accept Nugrowth if successful 3D Continue with project, then accept Nugrowth if successful 3D Continue with project, then accept Nugrowth if successful 3D Continue with project, then apply for SBIR if successful 3D Continue with project, then apply for SBIR if successful 3D Continue with project, then apply for SBIR if successful 3D Continue with project, then apply for SBIR if successful 3D Continue with project, then apply for SBIR if successful 3D Manual to accompany Data, Models & Decisions: The Fundamentals of Management Science by Bertsimas and Freund. Copyright 2000, South-Western College Publishing. Prepared by Manuel Nunez, Chapman University. Instructor’s Manual Chapter 1 7 1.4 (a) See decision tree above. Manual to accompany Data, Models & Decisions: The Fundamentals of Management Science by Bertsimas and Freund. Copyright 2000, South-Western College Publishing. Prepared by Manuel Nunez, Chapman University. Instructor’s Manual Chapter 1 8 (b) ITNET's optimal decision strategy is to wait for the result of their patent application, and then, sue Singular regardless of whether the patent is approved or not. Manual to accompany Data, Models & Decisions: The Fundamentals of Management Science by Bertsimas and Freund. Copyright 2000, South-Western College Publishing. Prepared by Manuel Nunez, Chapman University. Instructor’s Manual Chapter 1 9 1.5 (a) See decision tree on previous page. (b) The missing probabilities are: • Avant-garde line will be a “hit” given that it is a “hit” in the San Francisco pre-test. • Avant-garde line will be a “hit” given that it is a “miss” in the San Francisco pre-test. • Business-attire line will be a “hit” given that it is a “hit” in the San Francisco pre-test. • Business-attire line will be a “hit” given that it is a “miss” in the San Francisco pre-test. • Avant-garde line will be a “hit” in the San Francisco pre-test. • Business-attire line will be a “hit” in the San Francisco pre-test. (c) The resulting probabilities are found in the table below. Javier’s optimal decision strategy is to finance the avant-garde fashion line in the fall, without pre-testing in San Francisco. The EMV of this strategy is $440,000. Joint Probabilities Conditional Probabilities S.F. Hit S.F. Miss Total Vera Hit 0.16 0.04 0.20 Vera Miss 0.32 0.48 0.80 Total 0.48 0.52 1 S.F. Hit S.F. Miss Total Ricci Hit Ricci Miss 0.27 0.42 0.03 0.28 0.30 0.70 Total 0.69 0.31 1 S.F. Hit S.F. Miss Vera Hit 0.33 0.08 Vera Miss 0.67 0.92 Total 1 1 S.F. Hit S.F. Miss Ricci Hit Ricci Miss 0.39 0.61 0.10 0.90 Total 1 1 1.6 (a) See decision tree on next page. (b) The missing probabilities are: • The tumor is benign given that the exploratory surgery indicated a benign tumor. • The tumor is benign given that the exploratory surgery indicated a malignant tumor. • The exploratory surgery will indicate a benign tumor. Manual to accompany Data, Models & Decisions: The Fundamentals of Management Science by Bertsimas and Freund. Copyright 2000, South-Western College Publishing. Prepared by Manuel Nunez, Chapman University. Instructor’s Manual Chapter 1 10 (c) The corresponding probabilities are shown in the table below. James’ optimal decision strategy is to undergo exploratory surgery. If he survives and the surgery indicates a benign tumor, he should choose to leave the tumor. If he survives and the surgery indicates a malignant tumor, he should choose to remove the tumor. The EMV of this strategy is 5.15 years. Joint Probabilities Test Benign Test Malignant Total Benign 0.375 0.125 0.50 Malignant 0.175 0.325 0.50 Total 0.55 0.45 1 Conditional Probabilities Test Benign Test Malignant Benign 0.68 0.28 Malignant 0.32 0.72 Total 1 1 (d) In this case we replace the remaining lifetime years at the leaves in the tree by zeros and ones. If the tumor is left and is indeed malignant (1 year to live), we assign a value of 0 to the corresponding leaf node, and for all the other leaves, Manual to accompany Data, Models & Decisions: The Fundamentals of Management Science by Bertsimas and Freund. Copyright 2000, South-Western College Publishing. Prepared by Manuel Nunez, Chapman University. Instructor’s Manual Chapter 1 11 we assign a value of 1. By doing this, we find that James’ optimal decision strategy is to remove the tumor without undergoing exploratory surgery. (e) This problem poses the ethical question of how valid is to make life or death decisions based on a decision tree numerical analysis and in particular, based on the EMV. After all, it is necessary to remember that the EMV is a number that should be interpreted in a long run sense. For instance, suppose that you buy a $1 lottery ticket with a probability of 1:10000000 of winning 100 million dollars, then your EMV is $9. This means that if you play this game many times, in the long run your average number of earnings is $9. Nevertheless, it is very likely that you will play for a lifetime and never win this lottery. Therefore, you should be very careful when making one-shot or life-death decisions based on decision trees and the EMV. IV Answers to Case Modules KENDALL CRAB AND LOBSTER, INC. (a) There are two main decisions that Jeff has to make. First, at noon he has three options: • Send lobsters by truck using EPD. • Pack lobsters and wait until 5 p.m. • Do not pack lobsters and send coupons. Second, if he decides to wait, the storm hits Boston, and Logan closes, then he will have to choose from: • Send lobsters through MAF. • Cancel orders and send coupons. The uncertainties involved in this problem are: • The incremental delivery cost per lobster if EPD is chosen. • The incremental delivery cost per lobster if MAF is chosen. • Whether or not the storm will hit Boston. • Whether or not Logan will close if the storm hits Boston. • The percentage of coupons that would generate incremental demand for lobster. To determine the revenues and costs in the tree, consider the following: • The unit variable contribution to earnings is $30 - $20 = $10. • With MAF, this is $10 - $13 = -$3 or $10 - $19 = -$9. • With EPD, this is $10 - $2 = $8, $10 - $3 = $7, or $10 - $4 = $6. • A coupon used by a recipient might create incremental demand. If that happens, the downstream effect on earnings will be $10 (extra contribution) $20 (coupon cost) = -$10. If the coupon does not create incremental demand, then the downstream effect on earnings is simply -$20. Manual to accompany Data, Models & Decisions: The Fundamentals of Management Science by Bertsimas and Freund. Copyright 2000, South-Western College Publishing. Prepared by Manuel Nunez, Chapman University. Instructor’s Manual • Chapter 1 12 Let p be the probability that the coupon is used by a recipient and creates incremental demand, and q the probability that the coupon is used by a recipient and does not create incremental demand, then p + q = 0.70. The unit cost for a canceled lobster order is -$1 - $10p - $20q for lobsters not already packed and -$1.25 - $10p - $20q for lobsters already packed. Since p + q = 0.70, the total cost of canceling unpacked lobsters ranges between -$24,000 and -$45,000. The total cost of canceling packed lobsters ranges from $24,750 and -$45,750. To create a more realistic analysis of this case you may want to consider: • More detail if the orders are canceled. For instance, you may consider several uncertain scenarios for the number of coupons redeemed, ranging from 0 to 3000 or any other reasonable interval. • Model demand uncertainty. For instance, assigning a probability distribution to the several uncertain demand scenarios: Probability Demand 0.1 0.2 0.5 0.2 2800 2900 3000 3200 To perform some sensitivity analysis, you may want to consider changing the probability that the storm would hit Boston or the probability that Logan would close if the storm hits Boston. (b) The optimal decision strategy for Jeff is to pack the lobsters and wait until 5 p.m. If the storm hits Boston and Logan Airport closes, then he should choose to transport the lobster by using MAF. The EMV for this strategy is $25,500. Manual to accompany Data, Models & Decisions: The Fundamentals of Management Science by Bertsimas and Freund. Copyright 2000, South-Western College Publishing. Prepared by Manuel Nunez, Chapman University. Instructor’s Manual Chapter 1 13 Manual to accompany Data, Models & Decisions: The Fundamentals of Management Science by Bertsimas and Freund. Copyright 2000, South-Western College Publishing. Prepared by Manuel Nunez, Chapman University. Instructor’s Manual Chapter 1 14 BUYING A HOUSE (a) See decision tree above. (b) The optimal decision strategy for Debbie and George is to bid $390,000 initially. If there are other bidders and the seller ask them to submit a final offer the following day, then they should increase their offer by $5,000 the next day, that is, make a final offer of $395,000. The EMV for this strategy is $5,600. Manual to accompany Data, Models & Decisions: The Fundamentals of Management Science by Bertsimas and Freund. Copyright 2000, South-Western College Publishing. Prepared by Manuel Nunez, Chapman University. Instructor’s Manual Chapter 1 15 THE ACQUISITION OF DSOFT (a) Observe that the EMV of the net worth from buying DSOFT is $600x0.5 +$450x0.3 + $300x0.2 = $495 million. Therefore, the decision tree endpoint evaluations are the result of subtracting the final offer of Polar from $495 if such offer is accepted by DSOFT. (b) The optimal decision strategy for Polar is to offer $320 million initially. If ILEN’s counter-offer is Polar’s offer increased by 10%, then Polar should make a final offer at 10% above ILEN’s counter-offer. If ILEN’s counter-offer is Polar’s offer Manual to accompany Data, Models & Decisions: The Fundamentals of Management Science by Bertsimas and Freund. Copyright 2000, South-Western College Publishing. Prepared by Manuel Nunez, Chapman University. Instructor’s Manual Chapter 1 16 increased by 20% or 30%, then Polar should make a final offer matching ILEN’s counter-offer. The EMV for this strategy is $47 million. NATIONAL REALTY INVESTMENTS CORPORATION (a) The optimal decision strategy for Carlos is to make an offer to purchase the hospital, and regardless of whether the LIH application is delayed or not, approved or not, buy the hospital. The EMV for this strategy is $235,000. Notice that all of the parameters in the decision tree are given in the case except for the unconditional probability of LIH plan approval. This probability can be computed by using simple probability rules: P(Approval) = P(Approval | Favorable election) x P(Favorable Election) + P(Approval | Unfavorable election) x P(Unfavorable election) = 0.7 x 0.6 + 0.2 x 0.4 = 0.5. Manual to accompany Data, Models & Decisions: The Fundamentals of Management Science by Bertsimas and Freund. Copyright 2000, South-Western College Publishing. Prepared by Manuel Nunez, Chapman University. Instructor’s Manual Chapter 1 17 (b) The results from the sensitivity analysis are shown in the table below (in $ thousands). According to these results, the optimal decision strategy, as described in part (a), continues to be the same for each value of p in the given range. p 0.60 0.65 0.70 0.75 0.80 Wait EMV Offer EMV Best Strategy $170 $212 Offer $179 $224 Offer $188 $235 Offer $197 $247 Offer $207 $258 Offer (c) The results are shown in the tables below. The first table contains the NPV under the LIH plan and under regular income housing (RIH) for each discount rate (in $ thousands). The second table shows the EMV for each pair of discount rate and probability p (in $ thousands). If the discount rates are 6%, 6.5%, or 7%, the optimal decision strategy is to offer, and buy the property. If the rate is 8.5%, both NPV are negative, so that it makes sense to not offer to buy the property at all. For a 7.5% rate, the offer strategy dominates, but not by much. Finally, for the 8% rate, if Carlos offer to buy and the approval decision is delayed, then he faces the possibility of losing $254,000. If the decision is not delayed, National can take the sunk cost of$200,000 if LIH is not approved. Net Present Value (NPV) Discount Rate LIH RIH 6.00% $749 $391 6.50% $603 $210 7.00% $428 $42 7.50% $266 -$112 8.00% $117 -$254 8.50% -$21 -$386 Value of p Discount Rate 6.0% 6.5% 7.0% 7.5% 8.0% 8.5% Offer $581 $395 $224 $66 -$60 <-21 0.65 Wait $465 $316 $179 $64 $0 $0 Offer $593 $406 $235 $77 -$50 <-21 0.70 Wait $474 $325 $188 $73 $8 $0 Offer $605 $418 $247 $89 -$40 <-21 0.75 Wait $484 $334 $198 $82 $16 $0 Offer $617 $430 $258 $100 -$30 <-21 (d) The overall recommendation is to offer and buy the hospital, keeping in mind the risk of losing money for discount rates such as 8% or 8.5%. Manual to accompany Data, Models & Decisions: The Fundamentals of Management Science by Bertsimas and Freund. Copyright 2000, South-Western College Publishing. Prepared by Manuel Nunez, Chapman University. 0.80 Wait $494 $344 $206 $92 $24 $0