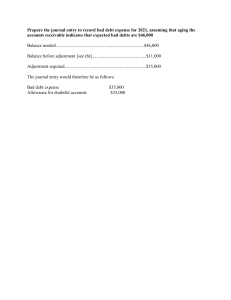

Short Problem Topics ● Present value ● Operating Activities section of the Statement of Cash Flows ● Journal entries ● Adjusting entries ● The pros and cons of (changes in) an accounting standard (e.g., expensing stock options). ● Calculating financial statement numbers given an adjusted trial balance Topics that will likely come up in True/False and Multiple Choice Questions Midterm 1 Topics ● 3 types of business activities and examples of each 1. Financing: comp needs to acquire $ in order to support its operations a. 2 main sources: i. Debt financing: borrowing $ from creditors (bank) ii. Equity financing: selling stock to investors 2. Investing: company needs to purchase resources in order to run day-to-day operations a. involve acquisition or disposal of items (land, buildings, equipment) 3. Operating: most important category; day-to-day activities of producing and selling a product of providing a service; reason company exists ● The fundamentals of GAAP accounting… - what is it - Actg standards that guide the measurement and disclosure of busn activities - why we do it - Determines financial stmt content by guiding the measurement and disclosure of busn activities - how do we do it 1. Identify relevant economic activity 2. Quantify these activities 3. Record the results - who determines it - SEC regulates interstate sale of stocks and bonds; give FASB authority to set actg standards - FASB reports to SEC; sets gaap actg standards - PCAOB sets auditing standards ● The accounting process/cycle (understand the steps and the purpose of the steps; each step is there for a reason, not just for fun!) - Analyze using A = L + SE Journal Entries Post to general ledger (T accounts) Unadjusted trial balance Adjusting entries Adjusted trial balance Prepare financial statements: 1. Income statement (bc u need net income for stmt of stockholders equity in retained earnings) 2. Stmt of Stockholders Equity (ending retained earnings and common stock and additional paid in capital -- all ending balances -- are on balance sheet in stockholders equity section) 3. Balance sheet (cash shows up as ending balance on statement of cashflows) 4. Statement of cashflows ● What is reported on each of the main 4 financial statements, and what do they tell us 1. Balance Sheet a. Main components: i. Assets: resources ii. Liabilities: obligations iii. Equity: stockholders’ claim on firms assets b. Actg eq: assets = liabilities + stockholders’ equity c. Only financial stmt reported at point in time d. Tells you financial position of company 2. Income Statement a. Main components: i. Revenue: goods that increase company’s resources from providing goods/services ii. Expenses: everything that decreases company’s resources from providing revenue b. Net income = rev - expenses i. Aka ‘net loss’ c. Period of time d. Tells you results of operations for a given period of time 3. Stmt of stockholders equity a. Components: i. Contributed capital: from stockholders ii. Earned capital b. Beginning of retained earnings + net income - dividends ending retained earnings c. Period of time d. Reports events causing increase/decrease in comps stockholders’ equity 4. Stmt of cashflows a. Components: i. Financing: issuance and repurchase of comp stock and cash borrowed from and repaid to creditors ii. Operating: cash spent on OPEX and received from sale of goods/services iii. Investing: cash payments and receipts when a comp buys and sells long-term assets that it uses in its operations b. Reports comp’s cash inflows and outflows c. Period of time ● Connections between the financial statements A. Net inc from inc stmt is used to compute ending retained earnings on statement of stockholders equity B. Ending common stock, retained earnings, and total equity from the statement of stockholders’ equity is shown on the balance sheet C. Ending cash balance on the statement of cash flows is shown on the balance sheet ● ● ● ● D. Beginning-of-period balance sheet shows comps financial position at earlier point in time E. Inc stmt, stmt of stockholders’ equity, and stmt of cash flows report activity for a period of time F. End-of-period balance sheet reports the comp’s financial position at this later point in time The role of external auditors - Review internal reports then gives opinion on whether financial statements are fair representation of comp and in accordance to GAAP Sources of additional information (i.e., not the actual financial statements) in a 10K - Management Discussion and Analysis (MD&A) - Managers give their opinion/interpretation of comps performance for given period as well as their expectation moving forwards - Notes to Financial Statements - Contains info about how manager’s got to the numbers they got - Auditor’s Report FASB’s conceptual framework - Financial reporting objectives - Financial stmt elements - Qualitative characteristics of actg info - Recognition and measurement criteria for financial stmt items The impact of transaction of the accounting equation and the financial statements - Issued stock: “Mike invested $30,000 cash in exchange for comp’s common stock - Paid Rent in Advance: “prepaid a year’s rent at $500 per month; meaning it paid $6,000” - Purchased Merchandise Inventory on Account: “purchased $3,000 of merch inv on acct” - Signed Bank note for cash: “obtained two-year bank loan for $20,000. Annual interest charged on the note amount to 6% and are due each Nov 30” - Purchased Equipment: “purchased equipment used for bike maintenance and assembly. Mike used $15,000 cash from bank loan” - Hired a Part-Time Emp - No impact when you hire employee Asset = liabilities + owners equity a. Cash +30,000 (debit) = notes payable +30,000 (credits) b. Cash -10,000 (credit b/c decreasing) and notes receivable +10,000 (debit) c. Cash +500 (debit) = common stock +10 (credit) and additional paid in capital +490 (credit) i. Stockholders 1. Contributed capital, common stock 2. Retained capital, retained earnings d. Equipment +15,000 (debit) and cash -5,000 (credit) = notes payable +10,000 (credit) e. Cash -2,000 (credit) = retained earnings -2000 (debit) ● Revenue Recognition and Expense Matching Principles - Rev rec principle: rec recognized when ‘earned’ - When the company transfers promised goods or services to customers - In the amount the comp expects to receive - Does not depend on when cash is exchanged - Revenue Transactions -- Cash received before Revenue Earned: ● when cash is received before company delivers good/service, the liability account unearned rev is recorded ○ ● When comp delivers goods/services unearned rev is reduced and rev is recorded ○ - Cash received when rev earned: ● When cash is received on date revenue is earned ○ - Cash received after rev earned: ● Cash received after comp delivers goods/services, an asset accounts receivable is recorded ○ ● Cash is received and the accounts receivable is reduced ○ - Expense matching principle: - Expenses incurred to generate rev are recognized (matched) in same period - Cash pmt may occur at same time, before, or after - Expense Transactions - Cash paid before expense incurred: ○ Cash is paid before the comp receives goods/services, an asset account, such as prepaid insurance expense is recorded ■ ○ When the expense is incurred prepaid insurance expense is reduced and insurance expense is recorded ■ ● Cash paid when expense incurred ○ Cash is paid on date expense is incurred, (ex:rent) ■ ● Cash paid after expense is incurred ○ Cash is paid after comp receives goods/services (rent), a liability accounts payable is recorded ■ ● When cash is paid the payable is reduced ○ Midterm 2 Topics Chapter 6 ● Record credit sales (i.e., sales on account) - - Sale on account - Ex: assume company sells 30 cameras for $500 each on account. Journal entry is: Sales rev recorded w/ credit and a debit to either cash or AR - checks/debit cards: recorded as cash sale ● The accounting treatment of contra revenues (credit card sales, sales discounts, and sales returns & allowances) - Credit Card Sales - Credit card discount: fee issuer of credit card will charge the seller each time a card is used - Recorded as contra revenue account: reduction of gross revs in arriving at net sales - Or as selling expense - Ex: assume Company sells 30 cameras for 500 each, but this time customer purchases w/ a credit card. Credit card company charges a 3% fee. Journal entry is: - - 15,000 (gross rev) - 450 (credit card fees) - 14,550 (net sales on income statement) Ex 6-2: total gross sales for period include: - CC sales (discount 3%) $9,400 - Sales on acct (2/15,n/60) $12,000 - Sales related to sales on acct were $650. All returns were made before payment. One-half of remaining sales on account were paid within discount period. The company treats all discounts and returns as contra-revs. What amount will be reported on inc statement as net sales? - - Effect of credit policy changes on receivables turnover ratio - Ex M6-5: indicate the most likely effect of the following changes in credit policy on receivables turnover ratio - Granted credit with shorter payment deadlines - increase - Increased effectiveness of collection methods - increase - Granted credit to less creditworthy customers - decrease Sales discounts - Sellers provide buyers with credit to increase sales; cost to seller is the time it takes before receiving cash - Sales discounts: separate contra-rev acct for discounts given to customer to encourage faster payment - 2/10: if you pay us in 10 days, you can take a 2% discount n/30: there’s 30 days in the full credit period - Ex: company sells 30 cameras for $500 each on account w/ terms 2/10, n/30, and the payment is made within the discount period. Journal entries are: - Ex net sales wksheet: “on jan 12, 2018 Apple sold 100 iphones to Best Buy on acct, the price of each phone was $500, and the terms with 3/15 n/30. On Jan 24,2018 BB returned half of the iphones to amazon and paid the remainder owed to Apple. During the month of Jan apple also sold 400 iphones at $800 each to customers who purchased with credit cards, there is a 2% credit card fee - What journal entries will apple use to record above entries - - What is net sales as reported on the income statement by Apple - Net sales = (50,000 - 25,000 - 750) = (320,000 - 6,400) = 337,850 - Compute the annual interest rate implicit in the sales discount - Annual implicit interest rate = (3/97)*(365/15) = 75.26% Sales returns & allowances - - Sales returns and allowances: separate contra rev account for return of merchandise not wanted by the buyer Ex: assume company sells 30 cameras for $500 each on account. Before paying for the cameras, the customer returns 10 of them. The journal entries are: Net sales: 10,000 b/c 15,000-5,000 - Financial statement notes has all the additional info for this ● Including the reporting of net sales, and the implicit interest rate associated with sales discounts - Reporting of net sales - Net sales is reported on the income statement ● The allowance method of accounting for doubtful accounts/bad debt expense - Bad debt expense: - credit losses considered operating expense and debited here - GAAP requires estimate be made of bad debt expenses at time of revenue recognition even though the actual accounts to be written off are unknown at this time - This is because of expense matching principle - Process is executed using the allowance method - Allowance for doubtful accounts - Estimate results in an adjusting entry to contra-asset account (which means it goes up with a credit) - Ex: Company estimates its bad debts expense for its first year of operations to be $5,000 - Reporting allowance for DA - Allowance for doubtful accounts is a contra-asset account w/ a normal credit balance - Allowance account is subtracted from gross accounts receivable to yield a net amount - Ex: Comp has gross accounts receivable of $14,000 ● Two methods used for estimating a company’s bad debt expense (i.e., percentage of credit sales and aging of accounts receivable) - Percentage of (credit) sales - Estimates bad debt expense as a percentage of credit sales for a given period - Percentage used is usually based on historical past credit losses - Ex: Assume Scripps Company has 2016 credit sales of $700,000 and past experience is that three percent of these sales will not be ultimately collected.Bad debts expense is calculated as $700,000 x 0.03 = $21,000 - Ex E6-7: During current year, company recorded credit sales of $1,300,000. Based on prior experience, it estimates a 1% bad debt rate on credit sales. - Journal entries: - On Sept 29 of current year, an AR for $4,000 from March of current year was determined to be uncollectible and was written off - - The appropriate bad debt expense adjustment was recorded for current year Aging of accounts receivable - Estimates allowance for doubtful accounts as percentage of the outstanding AR - Bad debts expense is then determined as the amount necessary to achieve the proper balance in the allowance account - Allowance for DA balance is computed by computing an aging sched on outstanding AR partitioned by age of the receivable - Will have beginning balance almost always - Ex: Scripps 2016 accounts receivable total $30,000 as follows: current $10,000; 0-30 days $8,000; 31- 60 days $5,000;61-90 days $3,000; over 90 days $4,000. The following schedule computes the required balance for the allowance for doubtful accounts using historical probabilities of non-collection. - - Is the total allowance required the number that goes into our journal entry? - Yes Ex: Assume Scripps had a beginning credit balance in the allowance for doubtful accounts of $400. The required entry would be as follows - Ex E6-11: Lin’s Dairy uses aging approach to estimate bad debt expense. The ending balance of each AR is aged on the basis of three time periods as follows: 1) not yet due, $22,000; 2) up to 120 days past due, $6,500; and 3) more than 120 days past due, $2,800. Experience has shown that for each age group, the average loss rate on the amount of the receivables at year-end due to uncollectibility is 1) 3%, 2) 14%, and 3) 34%. At end of current year, the Allowance for DA balance is $1,200 (credit) before the end-of-period adjusting entry is made - What amount should be recorded as Bad Debt Expense for current year? ● Writing off specific accounts receivable - Write off - write off receivable when it is determined the amount will not be collected - Write-off will not affect either expense or total assets, rather the entry simply cleans up the AR - Expense occurred at time of estimate, not at time of write-off - Ex: $200 of outstanding receivables is determined to be uncollected - Recovery of written off accts - Ex: assume $400 account that was written off is later collected Chapter 7 ● How FOB Shipping Point and FOB Destination affect inventory ownership (consider scenarios from the customer’s and seller’s perspective). - FOB (free on board) shipping point - Buyer assumes ownership at the time the carrier accepts the item from the seller FOB destination - Seller maintains ownership until buyer takes possession Ex E7-1: Based on its physical count of inv on dec 31 of current year, Madison company planned to report inv of $34,500. During audit, the independent CPA developed following additional info: - Goods from supplier costing $700 are in transit w/ UPS on December 31 of current year. The terms are FOB shipping point. Because these goods had not yet arrived, they were excluded from physical inventory count - Madison delivered samples costing $1,800 to a customer on Dec 27 of current year, w/ the understanding that they would be returned to madison on Jan 15 of next year. Because these goods were not on hand, they were excluded from inventory count - On dec 31 of current yr, goods in transit to customers w terms FOB shipping point, amounted to $6,500 (expected delivery date Jan 10 of next year). Because the goods had been shipped, they were excluded from physical inv count. - On dec 31 of current year, goods in transit to customers w terms FOB destination. Amounted to $1,500 (expected delivery date Jan 10 of next year). Because the goods had been shipped they were excluded from the physical inv count. - Required: madisons accounting policy requires including in inv all goods for which it has a title. Note that the point where title (ownership) changes hands is determined by shipping terms in sales contract. When goods are shipped FOB shipping point, title changes hands at shipment and the buyer normally pays for shipping. When they are shipped FOB destination, title changes hands on delivery, and the seller normally pays for shopping. Begin with $34,500 inventory amount and compute the correct amount for the ending inv. ● Inventory cost flows (including the equation for COGS) - Beginning inv: comp begins year w certain amount of inv - Equals ending inv for previous year COG purchased: added to this ^ These two together are COG available for sale From this amount, some of inv is sold (COGS) Remaining amount is ending inv Beginning inv + purchases - ending inv = COGS ● Record/value inventory and COGS using the 4 inventory costing methods - Value ex: comp sells collars - FIFO - LIFO - Weighted-Avg ● Compare the cost flow methods and analyze the impact of each - Specific identification - Closely identifies the actual COGS and ending inv - FIFO - Approximates the physical goods flow for most firms - Gross profit is larger when prices are rising - Looks better for reporting to shareholders - LIFO - Gross profit is smaller when prices are rising - Many comps prefer LIFO bc results in lower pre-tax income → lower expense when prices are rising - Also results in lower income, so do not want this for financial reporting for external users - LIFO conformity rule: if they want to use LIFO for tax reporting, must use for GAAP reporting - Weighted-Avg Cost - B/t FIFO and LIFO ● Apply the lower-of-cost-or-market (LCM) method to write-down inventory - Recorded cost of ending inv (cost) does not exceed current replacement cost (mkt) - Ex: Comp had 22 collars in inv w recorded cost of $14 each. Cost to replace each collar dropped to $12 each Chapter 8 ● Determine the acquisition cost of long-lived assets (and understand what historical cost means) - Long-lived assets initially recorded at acquisition (historical) cost - Includes cash/equivalents given up to acquire the assets and get it ready for intended use ● Understand depreciation and apply the three methods for calculating depreciation expense - Other than land, plant asset cost must be allocated to the periods of the plant asset use - This is because of expense matching principle - The period of depreciation is the asset’s useful life, which may differ from its physical life - Comp must also estimate the asset’s salvage value (also called residual value), which represents the asset’s value at the end of its useful life - Straight-line - Annual depreciation = (acquisition cost - salvage value) / estimated useful life Ex: equipment costs $5,000 w/ 3 year useful live, and $500 salvage value - Depreciation expense stays the same every year - Contra-asset account is credited which means it increases Journal entry: - - Declining-balance - An accelerated depreciation method that calculates depreciation expense as a constant percentage of an assets beginning-of-year book value Since book value declines each year as accumulated depreciation increases, annual depreciation expense declines each year There are many version of declining-balance depreciation, double-declining is common Ex: equipment costs $5,000 w/ 3 year useful life, $500 salvage value, and is depreciated using a double declining balance Book value at beginning of year = Costs - accumulated depreciation at beg of year Annual depreciation = book value at beginning of year x 2/estimated useful life - ⅔ bc double declining and 3 years Says 55 in year 3 because cant depreciate asset past salvage value - Units-of-production - - Allocate assets cost based on an asset’s use rather than based on time Depreciation per unit = (acquisition cost - salvage value)/total estimated units of production Annual depreciation is then computed based on how many units are used - Units may be miles for a vehicle, hours used, or units produced for a machine Ex: assume piece of equipment is estimated to last 9,000 hours. The acquisition cost of the equipment is $5,000 and the salvage value is estimated to be $500. ● Impairment loss on plant assets - If value of plant asset suddenly falls so severely its future cash flows are estimated to be less than its current book value, the asset is deemed to be impaired and an impairment loss is then recorded - Impairment loss = net book value - fair values - Ex: equipment cost $100,000 and acc dep of $60,000 is estimated to have current fair value of only $10,000 - Missing piece of info is expected future cash flows - 100,000-60,000=40,000 ● Capitalizing vs. expensing expenditures - - - Two types of expenditures: - Ordinary repairs and maintenance - Betterments Expenditures on ordinary repairs and maintenance are debited to an expense acct - Maintenance and repairs Capital expenditures (betterments) are debited to the asset - Extend the useful life of the asset - Improve quality/quantity of asset’s output - Reduce asset’s operating costs ● Record the disposal of plant assets - Remove asset’s cost Remove acc dep Record proceeds (cash or receivable) Record gain/loss - Difference b/t proceeds received and book value removed Ex: assume vehicle w/ acquisition cost of $20,000 and acc dep of $18,000 is sold for $3,500 - - To figure out gain/loss on sale, take acquisition cost-accumulated depreciation. This gives you net book value. Take difference between net book value and cash and you get gain/loss on sale If vehicle sold for $1500 instead, cash would be 1,500, acc dep and vehicle stays same, then debit loss on sale for $500 New Stuff (post-midterm 2) ● Cash inflows and outflows from the 3 types of business activities ● 3 sources of financing (2 are external, 1 is internal) ● Capital structure, and comparing debt vs. equity ● Payroll accounting ● The 4 types of (definite) liabilities and how to record them ● Bonds ● Contingent liabilities ● The role of the Board of Directors ● Equity issuance ● The division of capital stock (authorized, issued, unissued…) ● Treasury stock ● Stock splits ● Dividends ● Retained earnings equation