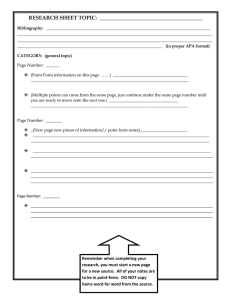

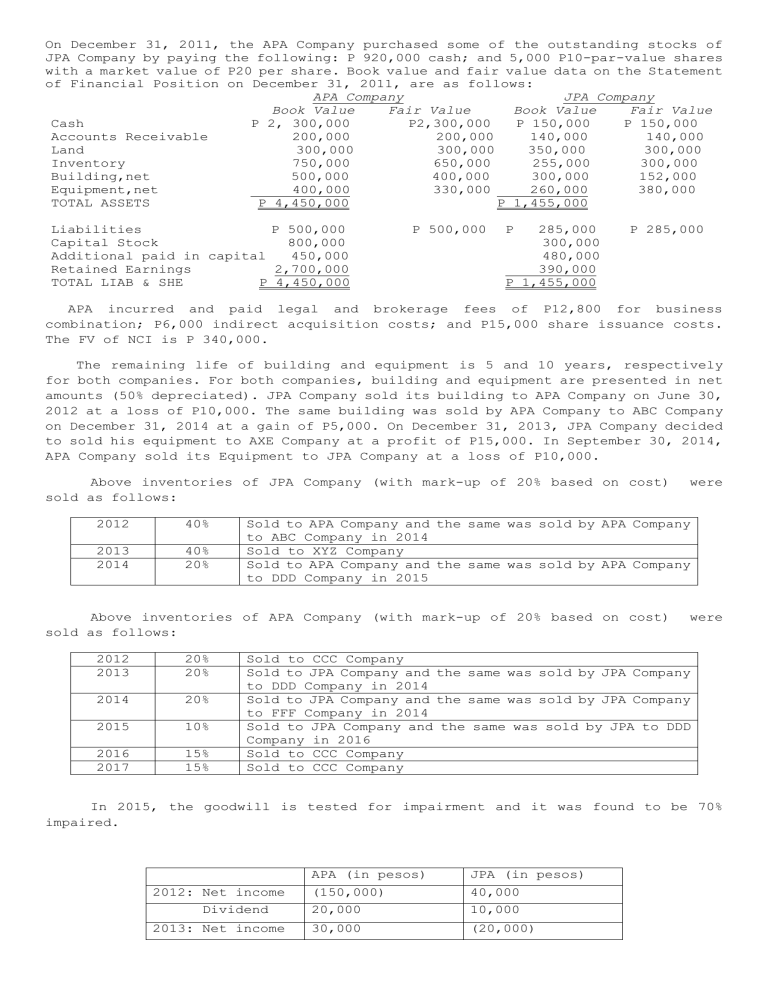

On December 31, 2011, the APA Company purchased some of the outstanding stocks of JPA Company by paying the following: P 920,000 cash; and 5,000 P10-par-value shares with a market value of P20 per share. Book value and fair value data on the Statement of Financial Position on December 31, 2011, are as follows: APA Company JPA Company Book Value Fair Value Book Value Fair Value Cash P 2, 300,000 P2,300,000 P 150,000 P 150,000 Accounts Receivable 200,000 200,000 140,000 140,000 Land 300,000 300,000 350,000 300,000 Inventory 750,000 650,000 255,000 300,000 Building,net 500,000 400,000 300,000 152,000 Equipment,net 400,000 330,000 260,000 380,000 TOTAL ASSETS P 4,450,000 P 1,455,000 Liabilities P 500,000 Capital Stock 800,000 Additional paid in capital 450,000 Retained Earnings 2,700,000 TOTAL LIAB & SHE P 4,450,000 P 500,000 P 285,000 300,000 480,000 390,000 P 1,455,000 P 285,000 APA incurred and paid legal and brokerage fees of P12,800 for business combination; P6,000 indirect acquisition costs; and P15,000 share issuance costs. The FV of NCI is P 340,000. The remaining life of building and equipment is 5 and 10 years, respectively for both companies. For both companies, building and equipment are presented in net amounts (50% depreciated). JPA Company sold its building to APA Company on June 30, 2012 at a loss of P10,000. The same building was sold by APA Company to ABC Company on December 31, 2014 at a gain of P5,000. On December 31, 2013, JPA Company decided to sold his equipment to AXE Company at a profit of P15,000. In September 30, 2014, APA Company sold its Equipment to JPA Company at a loss of P10,000. Above inventories of JPA Company (with mark-up of 20% based on cost) sold as follows: 2012 40% 2013 2014 40% 20% Sold to APA Company and the same was sold by APA Company to ABC Company in 2014 Sold to XYZ Company Sold to APA Company and the same was sold by APA Company to DDD Company in 2015 Above inventories of APA Company (with mark-up of 20% based on cost) sold as follows: 2012 2013 20% 20% 2014 20% 2015 10% 2016 2017 15% 15% were were Sold to CCC Company Sold to JPA Company and the same was sold by JPA Company to DDD Company in 2014 Sold to JPA Company and the same was sold by JPA Company to FFF Company in 2014 Sold to JPA Company and the same was sold by JPA to DDD Company in 2016 Sold to CCC Company Sold to CCC Company In 2015, the goodwill is tested for impairment and it was found to be 70% impaired. 2012: Net income Dividend 2013: Net income APA (in pesos) JPA (in pesos) (150,000) 40,000 20,000 10,000 30,000 (20,000) Dividend 2014: Net Income Dividend 2015: Net Income Dividend 20,000 None 50,000 30,000 - 10,000 40,000 20,000 20,000 10,000 ASSUMED: 75% ownership; NCI is measured at FV. REQUIRED: COMPLETE THE TABLE 12/31/2011 Goodwill or Gain on Acquisition Net Amount of Amortization based on schedule NCI in CI JPA APA Share in prior years adjusted and undistributed increase in JPA-RE NCI Conso. Income Conso. RE Conso. Building (net) Conso. Equipment (net) Conso. Depreciation- E 2013 2014 2 3 4 5 8 6 11 16 21 26 29 32 2012 1 12 17 22 27 30 33 13 18 23 28 31 34 2015 9 7 10 14 19 24 15 20 25