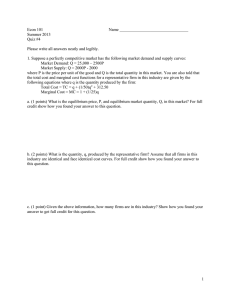

In Chapter 8, we saw how cost curves can be derived from production functions and input prices. Once a firm has a clear picture of its short-run costs, the price at which it sells its output determines the quantity of output that will maximize profit. Specifically, a profit-maximizing perfectly competitive firm will supply output up to the point that price (marginal revenue) equals marginal cost. The marginal cost curve of such a firm is thus the same as its supply curve. In this chapter, we turn from the short run to the long run. The condition in which firms find themselves in the short run (Are they making profits? Are they incurring losses?) determines what is likely to happen in the long run. Remember that output (supply) decisions in the long run are less constrained than in the short run, for two reasons. First, in the long run, the firm can increase any or all of its inputs and thus has no fixed factor of production that confines its production to a given scale. Second, firms are free to enter industries to seek profits and to leave industries to avoid losses. In making decisions or understanding industry structure, the shape of the long-run cost curve is important. As we saw in the short run, a fixed factor of production eventually causes marginal cost to increase along with output. In the long run, all factors can be varied. In the earlier sandwich shop example, in the long run, we can add floor space and grills along with more people to make the sandwiches. Under these circumstances, it is no longer inevitable that increased volume comes with higher costs. In fact, as we will see, long-run cost curves need not slope up at all. You might have wondered why there are only a few automobile and steel companies in the United States but dozens of firms producing books and furniture. Differences in the shapes of the long-run cost curves in those industries do a good job of explaining these differences in the industry structures. We begin our discussion of the long run by looking at firms in three shortrun circumstances: (1) firms that earn economic profits, (2) firms that suffer economic losses but continue to operate to reduce or minimize those losses, and (3) firms that decide to shut down and bear losses just equal to fixed costs. We then examine how these firms make their long-run decisions in response to conditions in their markets. Although we continue to focus on perfectly competitive firms, all firms are subject to the spectrum of short-run profit or loss situations regardless of market structure. Assuming perfect competition allows us to simplify our analysis and provides us with a strong background for understanding the discussions of imperfectly competitive behavior in later chapters. Short Run Conditions and Long Run Cost Before beginning our examination of firm behavior, let us review the concept of profit. Recall that a normal rate of return is included in the definition of total cost (Chapter 7). A normal rate of return is a rate that is just sufficient to keep current investors interested in the industry. Because we define profit as total revenue minus total cost and because total cost includes a normal rate of return, our concept of profit takes into account the opportunity cost of capital. When a firm is earning an above-normal rate of return, it has a positive profit level; otherwise, it does not. When there are positive profits in an industry, new investors are likely to be attracted to the industry. When we say that a firm is suffering a loss, we mean that it is earning a rate of return that is below normal. Such a firm may be suffering a loss as an accountant would measure it, or it may be earning at a very low—that is, below normal—rate. Investors are not going to be attracted to an industry in which there are losses. A firm that is breaking even, or earning a zero level of profit, is one that is earning exactly a normal rate of return. New investors are not attracted, but current ones are not running away either. With these distinctions in mind, we can say that for any firm, one of three conditions holds at any given moment: (1) The firm is making positive profits, (2) the firm is suffering losses, or (3) the firm is just breaking even. Profitable firms will want to maximize their profits in the short run, while firms suffering losses will want to minimize those losses in the short run. Maximizing Profits The best way to understand the behavior of a firm that is currently earning profits is by way of example. Example: The Blue Velvet Car Wash When a firm earns revenues in excess of costs (including a normal rate of return), we say it is earning positive or excess profits. Let us consider as an example the Blue Velvet Car Wash. Looking at a few numbers will help you see how the specifics of a business operation translate into economic graphs. Car washes require a facility. In the case of Blue Velvet, suppose investors have put up $500,000 to construct a building and purchase all the equipment required to wash cars. If the car wash closes, the building and equipment can be sold for its original purchase price, but as long as the firm is in business, that capital is tied up. If the investors could get 10 percent return on their investment in another business, then for them to keep their money in this business, they will also expect 10 percent from Blue Velvet. Thus, the annual cost of the capital needed for the business is $50,000 (10 percent of $500,000). The car wash is currently servicing 800 cars a week and can be open 50 weeks a year (2 weeks are needed for maintenance). The cost of the basic maintenance contract on the equipment is $50,000 per year, and Blue Velvet has a contract to pay for those services for a year whether it opens the car wash or not. The fixed costs then for the car wash are $100,000 per year: $50,000 for the capital costs and $50,000 for the equipment contract. On a weekly basis, these costs amount to $2,000 per week. If the car wash operates at the level of 800 cars per week, fixed costs are $2.50 per car ($2,000/800). There are also variable costs associated with the business. To run a car wash, one needs workers and soap and water. Workers can be hired by the hour for $10.00 an hour, and at a customer level of 800 cars per week, each worker can wash 8 cars an hour. At this service level, then, Blue Velvet hires workers for 100 hours and has a wage bill of $1,000. The labor cost of each car wash, when Blue Velvet serves 800 customers, is $1.25 ($10/8). The number of cars each worker can service depends on the number of cars being worked on. When there is too little business and few workers, no specialization is possible and cars washed per worker fall. With many cars to service, workers start getting in one another’s way. We saw that at 800 cars per week, workers could wash 8 each per hour. Later when we graph the operation, we will assume that the number of cars washed per worker rises and then falls, reaching a maximum at a volume less than the current 800 cars. Every car that is washed costs $0.75 in soap, adding $600 to the weekly bill if 800 car washes are done. Table 9.1 summarizes the costs of Blue Velvet at the 800 washes per week level. The industry price is $5.00, and we have assumed that the total number of car washes done in the market area in a week is 8,000; there are 10 firms like Blue Velvet in this competitive marketplace all earning economic profits. There are three key cost curves shown in the graph that represents Blue Velvet. The average variable cost (AVC) curve shows what happens to the per unit costs of workers and the other variable factor, soap, as we change output. Initially as output increases workers can service more cars per hour as they work together, thus causing the AVC to decline, but eventually diminishing returns set in and AVC begins to rise. Now look at the average total cost (ATC) curve. The average total cost curve falls at first in response to the spreading of the fixed costs over more and more units and eventually begins to rise as the inefficiencies in labor take their toll. At the output of 800 washes, the ATC has a value of $4.50. Look back at Table 9.1. The total cost of Blue Velvet at a service level of 800 cars is $3,600. The $4.50 comes from dividing $3,600 by 800 cars. Finally, we see the marginal cost (MC) curve, which rises after a certain point because of the fixed factor of the building and equipment. With a price of $5.00, Blue Velvet is producing 800 units and making a profit (the gray box). Blue Velvet is a perfectly competitive firm, and it maximizes profits by producing up to the point where price equals marginal cost, here 800 car washes. Any units produced beyond 800 would add more to cost than they would bring in revenue. Notice Blue Velvet is producing at a level that is larger than the output that minimizes average costs. The high price in the marketplace has induced Blue Velvet to increase its service level even though the result is slightly less labor productivity and thus higher per unit costs. Both revenues and costs are shown graphically. Total revenue (TR) is simply the product of price and quantity: P* q* = $5 800 = $4,000. On the diagram, total revenue is equal to the area of the rectangle P*Aq*0. (The area of a rectangle is equal to its length times its width.) At output q*, average total cost is $4.50 (point B). Numerically, it is equal to the length of line segment q*B. Because average total cost is derived by dividing total cost by q, we can get back to total cost by multiplying average total cost by q. That is, ATC = tc/q and so TC = ATC x q Total cost (TC), then, is $4.50 800 = $3,600, the area shaded blue in the diagram. Profit is simply the difference between total revenue (TR) and total cost (TC), or $400. This is the area that is shaded gray in the diagram. This firm is earning positive profits. A firm, like Blue Velvet, that is earning a positive profit in the short run and expects to continue doing so has an incentive to expand its scale of operation in the long run. Managers in these firms will likely be planning to expand even as they concentrate on producing 800 units. We expect greater output to be produced in the long run as firms react to profits earned. Minimizing Losses A firm that is not earning a positive profit or breaking even is suffering a loss. Firms suffering losses fall into two categories: (1) those that find it advantageous to shut down operations immediately and bear losses equal to total fixed costs and (2) those that continue to operate in the short run to minimize their losses. The most important thing to remember here is that firms cannot exit the industry in the short run. The firm can shut down, but it cannot get rid of its fixed costs by going out of business. Fixed costs must be paid in the short run no matter what the firm does. Whether a firm suffering loss decides to produce or not to produce in the short run depends on the advantages and disadvantages of continuing production. If a firm shuts down, it earns no revenue and has no variable costs to bear. If it continues to produce, it both earns revenue and incurs variable costs. Because a firm must bear fixed costs whether or not it shuts down, its decision depends solely on whether total revenue from operating is sufficient to cover total variable cost. ATC = TC q. Producing at a Loss to Offset Fixed Costs: Blue Velvet Revisited Suppose consumers suddenly decide that car washing is a waste of money and demand falls. The price begins to fall, and Blue Velvet is no longer so profitable. We can see what Blue Velvet’s management will decide to do by looking back at Figure 9.1. With an upward-sloping marginal cost curve, as price begins to fall, the Blue Velvet management team first will choose to reduce the number of cars it services. As long as the price is greater than ATC (which is minimized at about $4.35 on the graph), Blue Velvet continues to make a profit. What happens if the price falls below this level, say to $3 per car? Now Blue Velvet has to decide not only how many cars to wash but whether to be open at all. If the car wash closes, there are no labor and soap costs. But Blue Velvet still has to pay for its unbreakable year-long contract, and it still owns its building, which will take some time to sell. So, the fixed costs of $2,000 per week remain. For Blue Velvet, the key question is can it do better than losing $2,000? The answer depends on whether the market price is greater or less than average variable costs— the costs per unit for the variable factors. If the price is greater than the average variable cost, then Blue Velvet can pay for its workers and the soap and have something left for the investors. It will still lose money, but it will be less than $2,000. If price is less than average variable cost, the firm will not only lose its $2,000 but also have added losses on every car it washes. So, the simple answer for Blue Velvet is that it should stay open and wash cars as long as it covers its variable costs. Economists call this the shutdown point. At all prices above this shutdown point, the marginal cost curve shows the profit-maximizing level of output. At all points below this point, optimal short-run output is zero. We can now refine our earlier statement, from Chapter 8, that a perfectly competitive firm’s marginal cost curve is its short-run supply curve. As we have just seen, a firm will shut down when the market price is less than the minimum point on the AVC curve. Also recall (or notice from the graph) that the marginal cost curve intersects the AVC at AVC’s lowest point. It therefore follows that the short-run supply curve of a competitive firm is that portion of its marginal cost curve that lies above its average variable cost curve. For Blue Velvet, the firm will shut down at a price of about $1.50 (reading off the graph). Figure 9.2 shows the short-run supply curve for the general case of a perfectly competitive firm like Blue Velvet. The Short-Run Industry Supply Curve Supply in a competitive industry is the sum of the quantity supplied by the individual firms in the industry at each price level. The short-run industry supply curve is the sum of the individual firm supply curves—that is, the marginal cost curves (above AVC) of all the firms in the industry. Because quantities are being added—that is, because we are finding the total quantity supplied in the industry at each price level—the curves are added horizontally. Figure 9.3 shows the supply curve for an industry with three identical firms.1 At a price of $6, each firm produces 150 units, which is the output where P = MC. The total amount supplied on the market at a price of $6 is thus 450. At a price of $5, each firm produces 120 units, for an industry supply of 360. Below $4.50, all firms shut down; P is less than AVC. Two things can cause the industry supply curve to shift. In the short run, the industry supply curve shifts if something—a decrease in the price of some input, for instance—shifts the marginal cost curves of all the individual firms simultaneously. For example, when the cost of producing components of home computers decreased, the marginal cost curves of all computer manufacturers shifted downward. Such a shift amounted to the same thing as an outward shift in their supply curves. Each firm was willing to supply more computers at each price level because computers were now cheaper to produce. In the long run, an increase or decrease in the number of firms—and, therefore, in the number of individual firm supply curves—shifts the total industry supply curve. If new firms enter the industry, the industry supply curve moves to the right; if firms exit the industry, the industry supply curve moves to the left. We return to shifts in industry supply curves and discuss them further when we take up long-run adjustments later in this chapter. Long-Run Directions: A Review Table 9.2 summarizes the different circumstances that perfectly competitive firms may face as they plan for the long run. Profit-making firms will produce up to the point where price and marginal cost are equal in the short run. If there are positive profits, in the long run, there is an incentive for firms to expand their scales of plant and for new firms to enter the industry. A firm suffering loss will produce if and only if revenue is sufficient to cover total variable cost. Such firms, like profitable firms, will also produce up to the point where P = MC. If a firm suffering loss cannot cover total variable cost by operating, it will shut down and bear losses equal to total fixed cost. Whether a firm that is suffering losses decides to shut down in the short run or not, the losses create an incentive to contract in the long run. When firms are suffering losses, they generally exit the industry in the long run. Thus, the short-run profits of firms cause them to expand or contract when opportunities exist to change their scale of plant. If expansion is desired because economic profits are positive, firms must consider what their costs are likely to be at different scales or operation. (When we use the term “scale of operation,” you may find it helpful to picture factories of varying sizes.) Just as firms have to analyze different technologies to arrive at a cost structure in the short run, they must also compare their costs at different scales of plant to arrive at long-run costs. Perhaps a larger scale of operations will reduce average production costs and provide an even greater incentive for a profit-making firm to expand, or perhaps large firms will run into problems that constrain growth. The analysis of long-run possibilities is even more complex than the short-run analysis because more things are variable—scale of plant is not fixed, for example, and there are no fixed costs because firms can exit their industry in the long run. In theory, firms may choose any scale of operation; so, they must analyze many possible options. Now let us turn to an analysis of cost curves in the long run. Long Run Costs: Economies and Diseconomies of Scale The shapes of short-run cost curves follow directly from the assumption of a fixed factor of production. As output increases beyond a certain point, the fixed factor (which we usually think of as fixed scale of plant) causes diminishing returns to other factors and thus increasing marginal costs. In the long run, however, there is no fixed factor of production. Firms can choose any scale of production. They can build small or large factories, double or triple output, or go out of business completely. The shape of a firm’s long-run average cost curve shows how costs vary with scale of operations. In some firms, production technology is such that increased scale, or size, reduces costs. For others, increased scale leads to higher per-unit costs. When an increase in a firm’s scale of production leads to lower average costs, we say that there are increasing returns to scale, or economies of scale. When average costs do not change with the scale of production, we say that there are constant returns to scale. Finally, when an increase in a firm’s scale of production leads to higher average costs, we say that there are decreasing returns to scale, or diseconomies of scale. Because these economies of scale are a property of production characteristics of the individual firm, they are considered internal economies of scale. In the Appendix to this chapter, we talk about external economies of scale, which describe economies or diseconomies of scale on an industry-wide basis. Increasing Returns to Scale Technically, the phrase increasing returns to scale refers to the relationship between inputs and outputs. When we say that a production function exhibits increasing returns, we mean that a given percentage of increase in inputs leads to a larger percentage of increase in the production of output. For example, if a firm doubled or tripled inputs, it would more than double or triple output. When firms can count on fixed input prices—that is, when the prices of inputs do not change with output levels—increasing returns to scale also means that as output rises, average cost of production falls. The term economies of scale refer directly to this reduction in cost per unit of output that follows from larger-scale production. The Sources of Economies of Scale Most of the economies of scale that immediately come to mind are technological in nature. Automobile production, for example, would be more costly per unit if a firm were to produce 100 cars per year by hand. In the early 1900s, Henry Ford introduced standardized production techniques that increased output volume, reduced costs per car, and made the automobile available to almost everyone. The new technology is not very cost-effective at small volumes of cars, but at larger volumes costs are greatly reduced. Ford’s innovation provided a source of scale economics at the plant level of the auto firm. Some economies of scale result not from technology but from firm-level efficiencies and bargaining power that can come with size. Very large companies, for instance, can buy inputs in volume at discounted prices. Large firms may also produce some of their own inputs at considerable savings, and they can certainly save in transport costs when they ship items in bulk. Wal-Mart has become the largest retailer in the United States in part because of scale economies of this type. Economics of scale have come from advantages of larger firm size rather than gains from plant size. Economies of scale can be seen all around us. A bus that carries 50 people between Vancouver and Seattle uses less labor, capital, and gasoline than 50 people driving 50 different automobiles. The cost per passenger (average cost) is lower on the bus. Roommates who share an apartment are taking advantage of economies of scale. Costs per person for heat, electricity, and space are lower when an apartment is shared than if each person rents a separate apartment. Example: Economies of Scale in Egg Production Nowhere are economies of scale more visible than in agriculture. Consider the following example. A few years ago, a major agribusiness moved to a small Ohio town and set up a huge egg-producing operation. The new firm, Chicken Little Egg Farms Inc., is completely mechanized. Complex machines feed the chickens and collect and box the eggs. Large refrigerated trucks transport the eggs all over the state daily. In the same town, some small farmers still own fewer than 200 chickens. These farmers collect the eggs, feed the chickens, clean the coops by hand, and deliver the eggs to county markets. Table 9.3 presents some hypothetical cost data for Homer Jones’s small operation and for Chicken Little Inc. Jones has his operation working well. He has several hundred chickens and You have now seen what lies behind the demand curves and supply curves in competitive output markets. The next two chapters take up competitive input markets and complete the picture. ACTIVITY 1. Ajax is a competitive firm operating under the following conditions: Price of output is $5, the profit-maximizing level of output is 20,000 units of output, and the total cost (full economic cost) of producing 20,000 units is $120,000. The firm’s only fixed factor of production is a $300,000 stock of capital (a building). If the interest rate available on comparable risks is 10 percent, should this firm shut down immediately in the short run? Explain your answer. 2. For cases A through F in the following table, would you (1) operate or shut down in the short run and (2) expand your plant or exit the industry in the long run? Total Revenue Total Cost Total Fixed Cost A B C D E F 150 0 150 0 500 200 0 150 0 500 200 0 250 0 200 500 0 600 0 150 0 500 0 700 0 150 0 500 0 400 0 150 0