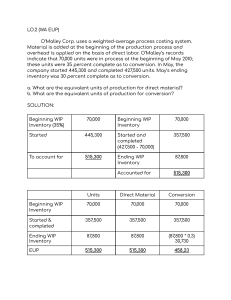

CHAPTER 4 Process costing systems 1. Features of Process Costing: The objective of process costing is to find out the cost of each process by identifying the direct costs with the particular process and apportioning the indirect costs i.e. overheads to each process on some suitable basis. The important features of process costing are: i. The production is continuous and mass production and the final product is the result of a sequence of processes or departments. ii. Costs are accumulated by processes or operations or department. iii. The products are standardized and homogeneous. iv. The cost per unit produced is the average cost which is calculated by dividing the total process cost by the number of units produced v. The finished product of each but last process becomes the row material for the next process. 2. Similarities and Difference between Process and Job order Costing As discussed in the previous section, the production process influences the choices of cost accounting system. Firms producing distinct and unique products use job order costing system where as firms producing similar or identical units use process-costing system. Process costing system accumulate costs by departments for a period of time, just as a job order costing system accumulate costs by jobs, and the total cost will be assigned to the units produced in that period. Process costing system is product costing system which is applied when identical units are produced in mass. Identical units are assumed to take the same amount of direct material, direct labor & manufacturing overhead. These costs are accumulated over a period of time and the total cost is assigned to units produced in the period the cost is accumulated. In process costing system, each unit is assumed to take equal amount of direct material, direct labor and manufacturing overhead. The difference between job order and process costing system is, thus, the extent of the averaging used to compute unit cost. In job order costing each job differs in terms of material used, labor incurred, and manufacturing overhead. Hence, it is impossible to assign the same cost for different jobs. On the contrary, identical units produced in mass take equal amount of direct material, direct labor, and manufacturing overhead. Thus, the unit cost can be found by dividing total cost by the number of units produced. When a firm produces identical lots of goods repetitively, maintaining a separate job cost sheet would be unnecessarily expensive. The aggregate cost and the unit cost can be computed without a job cost sheet, thus saving the cost associated with producing such records. Costs are accumulated by departments over a certain period and the unit cost can be found by dividing the total cost to the units produced during that period. Process costing system fit among others to, paint manufacturers; oil refineries, sugar refineries, and salt producers. The difference between job order and process costing arise from two factors. The first is that, the flow of units in process costing system is more or less continuous, and the second is that these units are indistinguishable from one another. Under process costing, it makes no sense to try to identify material, labor and overhead costs with a particular order from customers as we did in job order costing system, since each order is just one of the many that are filled from a continuous flow of virtually identical units from the production line. Under process costing, we accumulate costs by department, rather than by order, and assign these costs equally to all units that pass through the department during the period. A further difference between the two costing system is that the job order cost sheet has no use in process costing, since the focal point of that method is on department. Instead of using job order cost sheets, a document known as cost of production report is prepared for each department in which work is done on products. The production report serves several functions. It provides a summary of the number of units moving through a department during a period, and it also provides a computation of unit costs. In addition, it shows what costs were charged to the department and what disposition was made of these costs. The department production report is a key document in process costing system. The major difference between job order and process costing systems is summarized in the table below. Base comparison of Job order costing Process costing Type of Diversified, heterogeneous and Homogeneous products produced product unique products continuously Cost By job for a specified number of By department or cost center for a accumulation units specified period of time Work in One for each job One for each department process Basic Job cost sheet for each job document Cost of production report for each department or cost centers Cost per unit Cost accumulated by job divided Cost accumulated by cost centers divided by units in job by equivalent unit of production during a period of time Reporting Nature By job By cost center or department of Each job may use different Each units produced uses the same costs for each amount of material, labor and standard amount of materials, labor and cost object overhead cost overhead cost It is important to recognize that much of what was learned in the preceding section about costing and about cost flows equally applies well to process costing in this section. That is, we are not throwing out all that we have learned about costing and starting from scratch with a whole new system. The similarities that exist between job orders costing and process costing can be summarized as follows: The same basic purposes exist in both systems, which are to assign material, Labor, and overhead cost to products and to provide a mechanism for computing unit cost. Both systems maintain and use the same basic manufacturing account including manufacturing overhead, raw material, work in process and finished goods. The flow of costs through the manufacturing accounts is basically the same in both systems. As can be seen from these comparisons, much of the knowledge that we have already acquired about costing is applicable to process costing system. our task is simply to refine and extend this knowledge to process costing In process costing system, direct material, labor, and manufacturing overhead costs are accumulated in the same way as job order costing system. However, the costs are accumulated by department over some period of time than by individual jobs. The time period over which the cost is to be accumulated depends on the information needs of the company. It can be a week, two weeks, but no longer than a month most often. aCost accumulation is much simpler in process costing system than in job order costing. Process-Costing Assumptions Direct Materials are added at the beginning of the production process, or at the start of work. Conversion Costs are added equally along the production process The total units to account for must be equal to the total units accounted for. 3. Preparing cost of production report The cost of production report is an analysis of the activity of a department for a given period. The cost of production report for each department may be prepared following the five-step approach. Each step presents a separate schedule. These schedules are: Step 1: Summarize the flow of physical units of output. Step 2: Compute output in terms of equivalent units. Step 3: Summarize total costs to account for. Step 4: Compute cost per equivalent unit. Step 5: Assign total costs to units completed and to units in ending work in process. A. Flow of physical units (quantity schedule) This schedule shows the physical flow of units into and out of departments. The total units to account for must be equal to the total units accounted for. B. Equivalent units (EU) schedule Equivalent Units A derived amount of output units that: Equals the total units completed plus incomplete units (WIP) restated/or expressed in terms of completed units. Are calculated separately for each input (direct materials and conversion cost) Labor + overhead Materials + Labor + Overhead Conversion Costs C. Cost to account for schedule This schedule shows the costs which are charged to or accumulated by the department. Costs to be account for in each processing department consist of: 1. Costs of the beginning work in process inventory in the department. 2. Costs added during the period. a. Costs of units transferred in from a preceding department. b. Costs added in the department itself. D. Cost per equivalent unit schedule This schedule shows us cost per equivalent unit for each cost categories i.e. cost for direct material and conversion cost. E. Assignment of costs to units completed and to ending WIP inventories. This schedule shows the distribution of accumulated costs to units completed and transferred and to units still in process. The total cost to account for must be equal to the total costs accounted for. These total cost accounted for will assign to: 1. Ending work in process inventory in the department. 2. Units completed and transferred out to the next department (or to finished goods). Illustrating Process Costing Case one: process costing with no beginning or ending WIP inventory. This means all units are started and fully completed by the end of the accounting period. This case illustrates the basic averaging of costs- a key feature of process costing system. Case two: process costing with no beginning WIP inventory but with ending WIP inventory. This is some units started during the accounting period are incomplete at the end of the period. This case introduces the concept of equivalent units. Case three: process costing with both beginning and ending WIP inventory. This case describes the effect of weighted average and first-in-first-out (FIFO) cost flow assumptions on cost of units completed and cost of WIP inventory. Case one: process costing with no beginning or ending WIP inventory. The simplest case for assigning costs using a process costing approach assumes all products are started and completed within a single accounting period. This assumption makes it easier to see how materials and conversion costs are used and applied to units of product. If all units of products are completed in one month, there is no WIP inventory. It is the presence of WIP inventory that makes process costing complex. Example 1 XYZ Company manufactures its products in two departments: Dep’t A and Dep’t B. the company started operation at the beginning of January, 2004 E.C. the following information belongs to Dep’t A for January 2004 is: Physical units for January 2004 WIP beginning inventory (January 1)………………..….. 0 units Started during January ………………………………….. 60,000 units Completed and transfer out during January ……..………. 60,000 units WIP ending inventory (January 31) ………………….…… 0 units Total cost for January Direct material cost added during January …………… Birr 30,000 Conversion costs added during January ……………... birr 60,000 Required: prepare a cost of production report to department A of XYZ Company for January and necessary journal entries. XYZ Company records direct material costs and conversion costs in the Dep’t A as these costs are incurred. By averaging, Dep’t A cost of products is Birr 90,000 ÷ 60,000 units= Birr 1.5 per unit, itemized as follows: Direct material cost per unit (Birr 30,000 ÷ 60,000 units) ………………….. 0.5 Conversion cost per unit (Birr 60,000 ÷ 60,000 units) ……………………… Birr 1 Department A cost per unit………………………………………………….. Birr 1.5 Journal entries 1. Work-in-process-Dep’t A ………………….Birr 30,000 Raw materials inventory ……………………….. Birr 30,000 (To record direct materials purchase and used in production during January) 2. Work-in-process-Dep’t A ………………… Birr 60,000 Various accounts…………………………………. Birr 60,000 (To record conversion costs for January; example includes energy, manufacturing supplies, all manufacturing labor, and plant depreciation.) 3. Work-in-process-Dep’t B………………….. Birr 90,000 Work-in-process-Dep’t A ……………………………… Birr 90,000 (To record cost of goods completed and transferred from Dep’t A to Dep’t B during Jan) Case-1 shows that in a process costing system, average unit costs are calculated by dividing total costs in a given accounting period by total units produced in the period. Because each unit is identical, we assume all units receive the same amount of direct material costs and conversion costs. Case-1 applies whenever a company produces a homogeneous product or service but has no incomplete units when each accounting period ends, which is a common situation in service organizations. Case two: process costing with no beginning WIP inventory but with ending WIP inventory. A slightly more complex case for process costing occurs when there is production that is not completed at the end of accounting period. In another word, there is no beginning WIP inventory, but there is some ending WIP inventory. Example 2 In February, 2004 E.C. XYZ Company places 60,000 units of products in to production. Because all units placed in to production in January were completely finished, there is no beginning inventory of partially completed units in Dep’t A on February 1. Prepare cost of production report for Dep’t A for February based on the following information that pertains to Dep’t A for February. Units of data for the month of February: WIP at the beginning …………………………………………. 0 units Started during February ……………………………………… 60,000 units Completed and transfer out during February ………….…….. 40,000 units Units still in process at the end ………………………….…... 20,000units Degree of completion of ending WIP inventory, DM 100%, CC 40% Total costs added during February Direct material ………………………….. Birr 42,000 Conversion cost ………………………… Birr 43,200 XYZ Company Cost of production report- Dep’t A For the month ended February 28, 2004 Step-1 Step-2 Equivalent Units (EU) Physical units Materials Conversion Flow of production WIP inventory beginning 0 Started during current period 60,000 To account for 60,000 Completed and transferred out 40,000 40,000 40,000 WIP ending (20,000*100%, 20,000*40%) 20,000 20,000 8,000 Account for 60,000 60,000 48,000 Total Direct Conversion Step-3 production cost materials cost Cost added during February 85,200 42,000 43,200 Total cost to account for 85,200 42,000 43,200 85,200 42,000 43,200 current period 60,000 48,000 Cost per equivalent unit 0.7 0.9 Work done in current period only Step-4 Cost added in current period Divided by equivalent units of work done in Step-5 : assignment of costs Completed and transfer out(40,000 units) Birr 64,000 40,000*0.7 40,000*0.9 Work-in-process ending (20,000 units) Birr 21,200 20,000*0.7 8,000*0.9 Total cost accounted for Birr 85,200 Journal entries i. Work-in-process-Dep’t A ………………….Birr 42,000 Raw materials inventory ……………………….. Birr 42,000 (To record direct materials purchase and used in production during February) Work-in-process-Dep’t A ………………… Birr 43,200 ii. Various accounts …………………………………. Birr 43,200 (To record conversion costs for January; example includes energy, manufacturing supplies, all manufacturing labor, and plant depreciation.) iii. Work-in-process-Dep’t B………………….. Birr 64,000 Work-in-process-Dep’t A ………..………………………… Birr 64,000 (To record cost of goods completed and transferred from Dep’t A to Dep’t B during Feb) Case three: process costing with both beginning and ending WIP inventory. Since production is usually continuous and some units still being in process at the end of a period, ending WIP inventory of the last period becomes beginning inventory of WIP in this period. The existence of beginning WIP inventory creates a problem in process costing because the following questions must be considered. a) Should a distinction be made between completed units from beginning WIP inventory& from current period? b) Should cost of beginning WIP inventory be added to costs of the current period? c) Should all units completed during the current period be included 100% in equivalent production regardless of the stage of completion? The answer to the above questions will depend on the method chosen to account for beginning WIP inventory. There are two common methods of computing average costs per unit are the weighted average method and the FIFO method. I. Weighted-Average Method Calculates cost per equivalent unit of all work done to date (regardless of the accounting period in which it was done) Assigns this cost to equivalent units completed & transferred out of the process, and to incomplete units in still in-process Weighted-average costs is the total of all costs in the Work-in-Process Account divided by the total equivalent units of work done to date The beginning balance of the Work-in-Process account (work done in a prior period) is blended in with current period costs For each category of cost in each processing department the following calculations are made: Costs to be Accounted for = costs of beginning WIP inventory + costs added during current period Equivalent unit = Physical unit x Percentage of completion Equivalent units of production = units transferred out + Equivalent units of ending WIP inventory Units transferred out of the department are 100% complete with respect to the work done in the department. Cost per EU = costs to be accounted for Equivalent units of production Costs of units Transferred out = units transferred out X cost per EU Costs of units in ending WIP inventory = EUs of ending WIP inventory X cost per EU Example 3: The following data are for the first processing department at Midwest Refining, a company that reclaims petroleum products from used motor oil. Units Materials Conversion Percentage completion .................................. 60% 50% Cost of beginning inventory .......................... $4,300 $7,600 Work in process, beginning: Units in process ............................................. 10,000 Units started into production ............................. 190,000 Costs added in the department during the current period ................................................ Units completed and transferred ....................... 180,000 $74,100 $140,400 80% 25% Work in process, ending: Units in process ............................................. 20,000 Percentage completion .................................. Required: Prepare a cost of production report to department A of XYZ using weighted average and FIFO method. XYZ Company Cost of production report- Dep’t A (weighted average) Step-1 Step-2 Equivalent Units (EU) Physical units Materials Conversion Flow of production WIP inventory beginning 10,000 Started during current period 190,000 To account for 200,000 Completed and transferred out 180,000 180,000 180,000 WIP ending (20,000*80%, 20,000*25%) 20,000 16,000 5,000 Accounted for 200,000 Work done to date 196,000 185,000 Total Direct Conversion Step-3 production cost materials cost Work-in-process beginning 11,900 4,300 7,600 Cost added during February 214,500 74,100 140,400 Total cost to account for 226,400 78,400 148,000 Step-4 Cost incurred to date 78,400 148,000 Divided by equivalent units of work done in current period 196,000 185,000 Cost per equivalent unit 0.4 0.8 Step-5 : assignment of costs Completed and transfer out(180,000 Birr216,000 180,000*0.4 180,000*0.8 units) Work-in-process ending (20,000 units) 16,000*0.4 5,000*0.8 Birr 10,400 Total cost accounted for Birr 226,400 Note: The quantity schedule is based on the following equation: Units in beginning work in process + Units started into production = Units transferred out + Units in ending work in process II. FIFO Method The FIFO method separates the costs of beginning inventory from the costs incurred during the current period. (The weighted-average method combines them.) The beginning balance of the Work-in-Process account (work done in a prior period) is kept separate from current period costs. FIFO assumes the beginning inventory is completed before any new units are started. Assigns the cost of the previous accounting period’s equivalent units in beginning workin-process inventory to the first units completed and transferred out of the process. Assigns the cost of equivalent units worked on during the current period first to complete beginning inventory, next to start and complete new units, and lastly to units in ending work-in-process inventory. Formulas for to compute equivalent units of production in FIFO method A separate calculation is made for each cost category in each process department. Costs to be Costs of Costs added accounted = beginning WIP + during the for inventory current period Equivalent units of production = equivalent units to complete beg. WIP Inventory* + Units started & completed during the period + Equivalent units in ending WIP inventory. Equivalent Units Equivalent units units of = transferred + of ending WIP production out inventory *Equivalent units to complete beg. WIP inv = WIP in beg. Inv. × (100 – percentage completion of beg. WIP inventory. Or, the equivalent units of production can also be determined as follows: Equivalent units of production = Units started & completed during the period + Equivalent units in ending WIP inventory Equivalent units in beg. WIP Inventory Cost per EU = cost added during current period only EU of Work done in current period only Costs of units = Units × Cost transferred out transferred out per EU Costs of units in = Equivalent units of × Cost ending WIP inventory ending WIP inventory per EU XYZ Company Costs added to complete EU of beg. = EU of beg WIP inventory× cost per EU Cost of production report- Dep’t A (FIFO method) Step-1 Step-2 Equivalent Units (EU) Physical units Materials Conversion Flow of production WIP inventory beginning 10,000 Started during current period 190,000 To account for 200,000 Completed and transferred out From beginning WIP inventory* 10,000 4,000 5,000 Started and completed† 170,000 170,000 170,000 Work-in-process ending 20,000 16,000 5,000 accounted for 200,000 190,000 180,000 Total Direct Conversion Step-3 production cost materials cost Work-in-process beginning 11,900 Work Work done in current period only period done in previous Cost added during February 85,200 74,100 140,400 Total cost to account for 214,500 74,100 140,400 214,500 74,100 140,400 190,000 180,000 0.39 0.78 4,300 7,600 4,000*0.39 5,000*0.78 Step-4 Cost added in current period only Divided by equivalent units of work done in current period Cost per equivalent unit Step-5 : assignment of costs Completed& transferred out(180,000) WIP beginning inventory(10,000 units) 11,900 Cost added to beginning WIP inv. In 5,460 current period Total cost from beginning WIP inventory 17,360 Started and completed (170,000 units) 198,900 Total cost of units completed 170,000*0.39 170,000*0.78 & 216,260 transferred out WIP ending (20,000 units 10,140 Total cost accounted for 214,500 * Materials: 10,000 × (100% 16,000*0.39 – 60%) = 5,000*0.78 4,000 EUs Conversion: 10,000 × (100% – 50%) = 5,000 EUs † 190,000 units started – 20,000 units in ending WIP = 170,000 units Transferred in Cost Many process-costing systems have two or more departments or processes in the production cycle. As units move from department to department, the related cost is also transferred by monthly journal entries. If standard costs are used, accounting for such transfers is simple. However, if the weighted-average or FIFO method is used, the accounting can become more complex. Conversion cost added Evenly during the process Assembly Department WIP Transfer Finishing Department Direct material Added at the end Transferred-in costs (also called previous departments’ cost) are the cost incurred in the previous process in the production cycle. That is, as the units move from one department to the next, their costs are transferred with them. Computations of finishing department costs consist of transferred-in costs as well as the direct materials and conversion costs added in finishing department. Transferred-in cost is treated as if it is a separate type of direct material added at the beginning of the process. When successive departments are involved, transferred units from one department become all or part of the direct materials of the next department; however, they are called transferred-in costs not direct materials costs. Transferred-In costs and the Weighted-Average Method To examine the weighted-average process-costing method with transferred-in costs, we use the five-step procedure described earlier to assign costs of the finishing department to units completed and transferred out and to units in ending work in process. Let us assume the following data for SNAP computer for the month of April, 2008. Illustration 4: The assembly department of SNAP computer transfers assembled units to its finishing department. Here, the units receive additional direct material such as crating and other packing material to prepare the units for sell at the end of the process. Conversion costs are added evenly during the process. As units are completed in finishing department, they are immediately transferred to finished goods. Physical units WIP beginning ----------------------------- 240 units Transferred in Cost (100% complete) Direct material (0% complete) Conversion cost (62.5% complete) Transferred in during April -------------- 400 unit Completed during April ------------------------- 440 unit WIP ending ---------------------------------------200 units Transferred in Cost (100% complete) Direct material (0% complete) Conversion cost (80% complete Cost for finishing department in April: WIP beginning Transferred In cost --------------------------Br.672, 000 Direct materials ---------------------------------Conversion cost 0 ---------------------------- 360,000 Transferred in during April: Under WA method -------------------------------Br.1, 040,000 Under FIFO method ----------------------------- 1, 049,600 Direct material cost added during April --------- -- -- 13,200 Conversion cost during April ----------------------- --- 48,600 The production report for the month of April for finishing department can be prepared under weighted average method as follow: (Step 1) Flow of production Physical flow Work in process beginning 240 (Step 2) Units started in current period 400 Equivalent Units Transferred Direct Conversion 640 in cost material costs transferred out: 440 440 440 440 Work in process ending 200 200 0 160 Units accounted for 640 - - - 440 600 Units to account for Units completed and Work done in current period only (Step 3): Cost summary 640 Work in process beginning Br. 1,032,000 Br. 672,000 0 Br. 360,000 Costs added during March 1,101,800 1, 040,000 13,200 48,600 Total cost Br. 1,712,000 Br. 13,200 408,600 Divide by equivalent units ÷ 640 ÷ 440 ÷ 600 Cost per equivalent units Br. 2,675 Br. 30 Br. 681 (Step 4) Total cost to account for Br.2,133,800 (Step 5) Assignment of cost: To completed units (440 units) Br.1,489,840 (440×2,675) + (440×30) + (440×681) To work in process ending (200×2675) + (0×30) + (160×681) (200 units) 643,960 Total cost accounted for Br. 2,133,800 The computations are the same as the calculations of equivalent units under the weightedaverage method for the assembly department, but here we also have transferred-in costs as another input. The units, of course are fully completed as to transferred-in costs carried forward from the previous process. Direct material costs have a zero degree of completion in both the beginning and ending work-in process inventories because, in finishing department direct materials are introduced at the end of the process. Beginning work in process and work done in the current period are combined for purposes of computing equivalent-unit costs for transferredin costs, direct material costs and conversion costs. The necessary journal entries for the month of April in the finishing department are given as follows: Work In process – 13,200 Finishing Raw material control 13,200 (To record the use of direct materials in the production process) Work In process – Finishing 48,600 Various accounts 48,600 To record the use of conversion cost in the production process) Finished Goods 1,489,840 Work in process – 1,489,840 Assembly (To record the transfer of completed products from finishing department to warehouse) 2. Transferred-In Costs and the FIFO Method: The cost of production report for finishing department for the month of April can be prepared using FIFO method as follows: (Step 2) (Step 1) Flow of production Physical flow Work in process beginning 240 Units started in current period 400 Equivalent Units Transferred Direct Conversio 640 in cost material n costs From WIP Beginning 240 0 240 90 Started and completed 200 200 200 200 WIP Ending 200 200 0 160 Units accounted for 640 - - - 440 450 Units to account for Units completed Work done in current period 400 only (Step 3): Cost summary Work in process beginning Br. 1,032,000 Incurred last month Costs added during March 1,111,400 Br.1, 049,600 Br. 13,200 48,600 Divide by equivalent units ÷ 400 ÷ 440 ÷ 450 Cost per equivalent units Br. 2,624 Br. 30 Br. 108 (Step 4) Total cost to account for 2,143,400 (Step 5) Assignment of cost: To completed units (440 units) From WIP Beginning (240 units) Br.1,032,000 Cost added to WIP Beginning 16,920 Total from beginning Inventory Br. 1,048,920 Started and completed 552,400 Total cost of units completed Br. 1,601,320 To WIP ending (200 units) 542,080 Total cost accounted for Br.2,143,400 (0×2,624) + (240×30) + (90×108) (200×2,624)+(200×30)+ (200×108) (200×2,624) + (0×30) + (160×108) To examine the FIFO process-costing method with transferred-in costs, we again use the five step procedure. Other than considering transferred-in costs in the computations of equivalent units, the remaining are the same as under the weighted average method for the assembly department. The necessary journal entries for the month of April in the finishing department are given as follows: Work In process – 13,200 Finishing Raw material control 13,200 (To record the use of direct materials in the production process) Work In process – Finishing 48,600 Various accounts 48,600 To record the use of conversion cost in the production process) Finished Goods Work in 1,601,320 process – 1,601,320 Assembly (To record the transfer of completed products from finishing department to warehouse)