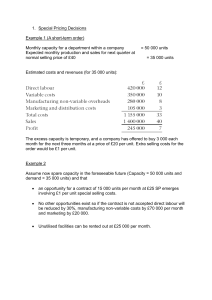

Suppose that a company makes and sells 100 units of a product each week. The prime cost per unit is $6 and the unit sales price is $10. Production overhead costs $200 per week and administration, selling and distribution overhead costs $150 per week. The weekly profit could be calculated as follows: Sales (100 units x $10) Prime costs (100 x $6) Production overheads Administration, selling and distribution costs Profit $1,000 $600 $200 $150 $950 $50 In absorption costing, overhead costs will be added to each unit of product manufactured and sold. Prime Cost per unit Production overhead ($200 per week for 100 units) Full Factory Cost $ Per Unit 6 2 8 The weekly profit would be calculated as follows: Sales Less: Factory cost of sales Gross Profit Less: Administration, selling and distribution costs Net Profit $1,000 $800 $200 $150 $50 Sometimes, but not always, the overhead costs of administration, selling and distribution are also added to unit costs, to obtain a full cost of sales: Prime Cost per unit Factory overhead cost per unit Administration, selling and distribution costs Full Cost of Sales $ Per Unit 6.00 2.00 1.50 9.50 The weekly profit would be calculated as follows: Sales Less: Full cost of sales Net Profit $1,000 $950 $50 It may already be apparent that the weekly profit is $50 no matter how the figures have been presented. So, how does absorption costing serve any useful purpose in accounting? 1 A company has two production departments (A and B) and two service departments (maintenance and stores). Details of next year's budgeted overheads are shown below: Heat and Light Repair Cost Machinery Depreciation $19,200 $9,600 $54,000 Rent and Rate Canteen Machinery Insurance $38,400 $9,000 $25,000 Details of each department are as follows: (m2) Floor area Machinery book value ($) Number of employees Allocated overheads ($) A 6,000 48,000 50 15,000 B 4,000 20,000 40 20,000 Maintenance 3,000 8,000 20 12,000 Stores 2,000 4,000 10 5,000 Total 15,000 80,000 120 52,000 Service departments’ services were used as follows: Maintenance hours worked Number of stores requisitions Required: How departments? overheads A 5,000 3,000 B 4,000 1,000 should be Maintenance 1,000 apportioned Stores 1,000 - between Total 10,000 5,000 the four Stage 1: Apportioning general overheads Item of Cost Heat and Light Repair costs Machinery Depreciation Rent and Rate Canteen Machine Insurance Total Allocated overheads Grand Total Basis of Apportionment Floor area (W1) Floor area (W1) Machinery value (W2) Floor area (W1) Number of employees (W3) Machinery value (W2) A ($) B ($) Stores ($) 2,560 1,280 2,700 Total ($) 5,120 2,560 13,500 Mainten ance ($) 3,840 1,920 5,400 7,680 3,840 32,400 15,360 3,750 10,240 3,000 7,680 1,500 5,120 750 38,400 9,000 15,000 6,250 2,500 1,250 25,000 78,030 15,000 40,670 20,000 22,840 12,000 13,660 5,000 155,200 52,000 93,030 60,670 34,840 18,660 207,200 19,200 9,600 54,000 Workings: 1. Overhead apportioned by floor area 2 𝑂𝑣𝑒𝑟ℎ𝑒𝑎𝑑 𝑎𝑝𝑝𝑜𝑟𝑡𝑖𝑜𝑛𝑒𝑑 𝑡𝑜 𝑑𝑒𝑝𝑎𝑟𝑡𝑚𝑒𝑛𝑡 𝐹𝑙𝑜𝑜𝑟 𝑎𝑟𝑒𝑎 𝑜𝑐𝑐𝑢𝑝𝑖𝑒𝑑 𝑏𝑦 𝑑𝑒𝑝𝑎𝑟𝑡𝑚𝑒𝑛𝑡 = 𝑥𝑇𝑜𝑡𝑎𝑙 𝑜𝑣𝑒𝑟ℎ𝑒𝑎𝑑 𝑇𝑜𝑡𝑎𝑙 𝑓𝑙𝑜𝑜𝑟 𝑎𝑟𝑒𝑎 For example: 6,000 𝐻𝑒𝑎𝑡 𝑎𝑛𝑑 𝐿𝑖𝑔ℎ𝑡 𝑎𝑝𝑝𝑜𝑟𝑡𝑖𝑜𝑛𝑒𝑑 𝑡𝑜 𝐷𝑒𝑝 𝐴 = 𝑥19,200 = $7,680 15,000 2. Overhead apportioned by machinery value 𝑂𝑣𝑒𝑟ℎ𝑒𝑎𝑑 𝑎𝑝𝑝𝑜𝑟𝑡𝑖𝑜𝑛𝑒𝑑 𝑡𝑜 𝑑𝑒𝑝𝑎𝑟𝑡𝑚𝑒𝑛𝑡 𝑉𝑎𝑙𝑢𝑒 𝑜𝑓 𝑑𝑒𝑝𝑎𝑟𝑡𝑚𝑒𝑛𝑡𝑠 ′ 𝑚𝑎𝑐ℎ𝑖𝑛𝑒𝑟𝑦 = 𝑥𝑇𝑜𝑡𝑎𝑙 𝑜𝑣𝑒𝑟ℎ𝑒𝑎𝑑 𝑇𝑜𝑡𝑎𝑙 𝑣𝑎𝑙𝑢𝑒 𝑜𝑓 𝑚𝑎𝑐ℎ𝑖𝑛𝑒𝑟𝑦 For example: 48,000 𝐷𝑒𝑝𝑟𝑒𝑐𝑖𝑎𝑡𝑖𝑜𝑛 𝑎𝑝𝑝𝑜𝑟𝑡𝑖𝑜𝑛𝑒𝑑 𝑡𝑜 𝐷𝑒𝑝 𝐴 = 𝑥54,000 = $32,400 80,000 3. Overhead apportioned by number of employees 𝑂𝑣𝑒𝑟ℎ𝑒𝑎𝑑 𝑎𝑝𝑝𝑜𝑟𝑡𝑖𝑜𝑛𝑒𝑑 𝑡𝑜 𝑑𝑒𝑝𝑎𝑟𝑡𝑚𝑒𝑛𝑡 𝑁𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝑒𝑚𝑝𝑙𝑜𝑦𝑒𝑒𝑠 𝑖𝑛 𝑑𝑒𝑝𝑎𝑟𝑡𝑚𝑒𝑛𝑡 = 𝑥𝑇𝑜𝑡𝑎𝑙 𝑜𝑣𝑒𝑟ℎ𝑒𝑎𝑑 𝑇𝑜𝑡𝑎𝑙 𝑛𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝑒𝑚𝑝𝑙𝑜𝑦𝑒𝑒𝑠 For example: 50 𝐶𝑎𝑛𝑡𝑒𝑒𝑛 𝑎𝑝𝑝𝑜𝑟𝑡𝑖𝑜𝑛𝑒𝑑 𝑡𝑜 𝐷𝑒𝑝 𝐴 = 𝑥9,000 = $3,750 120 Stage 2: Reapportionment of service department costs 1. Direct method of reapportionment (ignores inter-service department work) Allocated costs (given already) General cost (calculated earlier) Maintenance hours worked Number of stores requisitions Service department Maintenance Stores Previously allocated costs Total overhead A ($) B ($) 15,000 78,030 93,030 20,000 40,670 60,670 A 5,000 3,000 B 4,000 1,000 Basis of apportionment Maintenance hours (W1) Number of requisitions (W2) Maintenance Stores ($) ($) 12,000 5,000 22,840 13,660 34,840 18,660 Maintenance 1,000 Stores 1,000 - Total 10,000 5,000 Total cost ($) Dept. A Dept. B 34,840 19,356 15,484 18,660 13,995 4,665 53,500 153,700 207,200 33,351 93,030 126,381 20,149 60,670 80,819 3 Workings: 1. Maintenance department overheads reapportioned as follows: Total hours worked in Dep A and B = 5,000 + 4,000 = 9,000 hours 5,000 𝑥 $34,840 = $19,356 9,000 4,000 𝑟𝑒𝑎𝑝𝑝𝑜𝑟𝑡𝑖𝑜𝑛𝑒𝑑 𝑡𝑜 𝐷𝑒𝑝 𝐵 = 𝑥 $34,840 = $15,484 9,000 𝑟𝑒𝑎𝑝𝑝𝑜𝑟𝑡𝑖𝑜𝑛𝑒𝑑 𝑡𝑜 𝐷𝑒𝑝 𝐴 = 2. Stores department overheads reapportioned as follows: Total number of stores requisitions Dep A and B = 3,000 + 1,000 = 4,000 3,000 𝑥 $18,660 = $13,995 4,000 1,000 𝑟𝑒𝑎𝑝𝑝𝑜𝑟𝑡𝑖𝑜𝑛𝑒𝑑 𝑡𝑜 𝐷𝑒𝑝 𝐵 = 𝑥 $18,660 = $4,665 4,000 𝑟𝑒𝑎𝑝𝑝𝑜𝑟𝑡𝑖𝑜𝑛𝑒𝑑 𝑡𝑜 𝐷𝑒𝑝 𝐴 = 2. Step down method of reapportionment Allocated costs (given already) General cost (calculated earlier) A ($) B ($) 15,000 78,030 93,030 20,000 40,670 60,670 Maintenance Stores ($) ($) 12,000 5,000 22,840 13,660 34,840 18,660 Service department’s services were used as follows: Maintenance used Number of requisitions A hours 5,000 (50%)* stores 3,000 (60%)** B 4,000 (40%)* 1,000 (20%)** Maintenance 1,000 (20%)** Stores 1,000 (10%)* - Total 10,000 (100%) 5,000 (100%) * 5,000/10,000 × 100% = 50%, 4,000/10,000 = 40%, 1,000/10,000 = 10% ** 3,000/5,000 × 100% = 60%, 1,000/5,000 = 20%, 1,000/5,000 = 20% A ($) B ($) Overhead costs (allocated & general) Apportion stores (60%/20%/20%) 93,030 60,670 11,196 3,732 Apportion maintenance (5/9 / 4/9) 21,429 125,655 17,143 81,545 Maintenance Stores ($) ($) 34,840 18,660 3,732 38,572 (38,572) NIL (18,660) NIL 4 If the first apportionment had been the maintenance department, then the overheads of $34,840 would have been apportioned as follows: Overhead costs general) Apportion (50%/40%/10%) A ($) B ($) & 93,030 60,670 maintenance 17,420 13,936 (34,840) 3,484 16,608 127,058 5,536 80,142 NIL 22,144 (22,144) NIL (allocated Apportion stores (3/4 / 1/4) Maintenance Stores ($) ($) 34,840 18,660 Note: Notice how the final results differ, depending on whether the stores department or the maintenance department is apportioned first. If one service cost centre, compared with the other(s), has higher overhead costs and carries out a bigger proportion of work for the other service cost centre(s), then the overheads of this service centre should be reapportioned first. 3. The repeated distribution (or reciprocal) method of reapportionment Allocated costs (given already) General cost (calculated earlier) Maintenance hours worked Number of stores requisitions A ($) B ($) 15,000 78,030 93,030 20,000 40,670 60,670 A 5,000 3,000 B 4,000 1,000 Maintenance Stores ($) ($) 12,000 5,000 22,840 13,660 34,840 18,660 Maintenance 1,000 Stores 1,000 - Total 10,000 5,000 Show how the maintenance and stores departments' overheads would be apportioned to the two production departments and calculate total overheads for each of the production departments. Note: To apportion both the general and allocated overheads. The bases of apportionment for maintenance and stores are the same as for the above examples (that is, maintenance hours worked and number of stores requisitions). A ($) B ($) Overhead costs (allocated & general) Apportion maintenance (note A) 93,030 60,670 17,420 13,936 Apportion stores (note B) 13,286 4,429 Apportion maintenance Apportion stores (note C) 2,215 332 126,283 1,772 110 80,919 Maintenance Stores ($) ($) 34,840 18,660 (34,840) NIL 4,429 4,429 (4,429) NIL - 3,484 22,144 (22,144) NIL 442 (442) NIL 5 Notes: A. It does not matter which department you choose to apportion first. Apportionment is as follows: 𝑀𝑎𝑖𝑛𝑡𝑒𝑛𝑎𝑛𝑐𝑒 ℎ𝑜𝑢𝑟𝑠 𝑤𝑜𝑟𝑘𝑒𝑑 𝑖𝑛 𝐷𝑒𝑝 𝑥34,840 𝑇𝑜𝑡𝑎𝑙 𝑚𝑎𝑖𝑛𝑡𝑒𝑛𝑎𝑛𝑐𝑒 ℎ𝑜𝑢𝑟𝑠 𝑤𝑜𝑟𝑘𝑒𝑑 𝑃𝑟𝑜𝑑𝑢𝑐𝑡𝑖𝑜𝑛 𝑜𝑓 𝐷𝑒𝑝 𝐴 = 5,000 𝑥34,840 = $17,420 10,000 𝑃𝑟𝑜𝑑𝑢𝑐𝑡𝑖𝑜𝑛 𝑜𝑓 𝐷𝑒𝑝 𝐵 = 4,000 𝑥34,840 = $13,936 10,000 𝑆𝑡𝑜𝑟𝑒𝑠 = 1,000 𝑥34,840 = $3,484 10,000 B. Stores overheads apportionment are as follows: 𝑁𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝑠𝑡𝑜𝑟𝑒𝑠 𝑟𝑒𝑞𝑢𝑖𝑠𝑖𝑡𝑖𝑜𝑛𝑠 𝑓𝑜𝑟 𝐷𝑒𝑝 𝑥22,144 𝑇𝑜𝑡𝑎𝑙 𝑛𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝑠𝑡𝑜𝑟𝑒𝑠 𝑟𝑒𝑞𝑢𝑖𝑠𝑖𝑡𝑖𝑜𝑛𝑠 𝑃𝑟𝑜𝑑𝑢𝑐𝑡𝑖𝑜𝑛 𝑜𝑓 𝐷𝑒𝑝 𝐴 = 3,000 𝑥22,144 = $13,286 5,000 𝑃𝑟𝑜𝑑𝑢𝑐𝑡𝑖𝑜𝑛 𝑜𝑓 𝐷𝑒𝑝 𝐵 = 𝑀𝑎𝑖𝑛𝑡𝑒𝑛𝑎𝑛𝑐𝑒 = 1,000 𝑥22,144 = $4,429 5,000 1,000 𝑥22,144 = $4,429 5,000 C. The problem with the repeated distribution method is that you can keep performing the same calculations many times. When you are dealing with a small number (such as $442 above) you can take the decision to apportion the figure between the production departments only. In this case, we ignore the stores requisitions for maintenance and base the apportionment on the total stores requisitions for the production departments (that is, 4,000). The amount apportioned to production departments A and B is calculated as follows: 𝑆𝑡𝑜𝑟𝑒𝑠 𝑟𝑒𝑞𝑢𝑖𝑠𝑖𝑡𝑖𝑜𝑛𝑠 𝑓𝑜𝑟 𝐴 3,000 𝑥𝑆𝑡𝑜𝑟𝑒 𝑜𝑣𝑒𝑟ℎ𝑒𝑎𝑑𝑠 = 𝑥$442 = $332 𝑇𝑜𝑡𝑎𝑙 𝑠𝑡𝑜𝑟𝑒 𝑟𝑒𝑞𝑢𝑖𝑠𝑖𝑡𝑖𝑜𝑛𝑠 (𝐴 + 𝐵) 4,000 𝑆𝑡𝑜𝑟𝑒𝑠 𝑟𝑒𝑞𝑢𝑖𝑠𝑖𝑡𝑖𝑜𝑛𝑠 𝑓𝑜𝑟 𝐵 1,000 𝑥𝑆𝑡𝑜𝑟𝑒 𝑜𝑣𝑒𝑟ℎ𝑒𝑎𝑑𝑠 = 𝑥$442 = $110 𝑇𝑜𝑡𝑎𝑙 𝑠𝑡𝑜𝑟𝑒 𝑟𝑒𝑞𝑢𝑖𝑠𝑖𝑡𝑖𝑜𝑛𝑠 (𝐴 + 𝐵) 4,000 4. The reciprocal (Algebraic) method of reapportionment 6 The results of the reciprocal method of apportionment may also be obtained using algebra and simultaneous equations. Whenever you are using equations you must define each variable first. Let M = total overheads for the maintenance department S = total overheads for the stores department Remember that total overheads for the maintenance department consist of general overheads apportioned, allocated overheads and the share of stores overheads (20%). Similarly, total overheads for stores will be the total of general overheads apportioned, allocated overheads and the 10% share of maintenance overheads. Therefore, 𝑀 = 0.2𝑆 + $34,840 (1) 𝑆 = 0.1𝑀 + $18,660 (2) Solve the equations now Multiplying equation (1) by 5 will give us 5𝑀 = 𝑆 + $174,200 (3) It can be rearranged as 𝑆 = 5𝑀 − $174,200 (4) Subtract equation (2) from equation (4) 𝑆 = 5𝑀 − $174,200 (4) − 𝑆 = 0.1𝑀 + $18,660 (2) We get 0 = 4.9𝑀 − $192,860 4.9𝑀 = $192,860 𝑀= 192,860 = $39,359 4.9 Substitute M = 39,359 into equation (2) 𝑆 = 0.1 𝑥 39,359 + $18,660 = 22,596 These overheads can now be apportioned to the production departments using the proportions above. A ($) B ($) Maintenance Stores ($) ($) 7 Overhead costs (A & G) Apportion maintenance (50%/40%/10%) Apportion stores (60%/20%/20%)) Total 93,030 19,680 60,670 15,743 34,840 (39,359) 18,660 3,936 13,558 4,519 4,519 (22,596) 126,268 80,932 NIL NIL Example: The Basics of Absorption Costing Anila & Co makes two products, Slippers and Shoes. Slippers take two labour hours each to make and Shoes take five labour hours. What is the overhead cost per unit for Slippers and Shoes respectively, if overheads are absorbed on the basis of labour hours? Solution: Step 1: Estimate the overhead likely to be incurred during the coming period. Anila & Co estimates that the total overhead will be $50,000. Step 2: Estimate the activity level for the period. This could be total hours, units, or direct costs or whatever it is upon which the overhead absorption rates are to be based. Anila & Co estimates that a total of 100,000 direct labour hours will be worked. Step 3: Divide the estimated overhead by the budgeted activity level. This produces the overhead absorption rate. 𝐴𝑏𝑠𝑜𝑟𝑝𝑡𝑖𝑜𝑛 𝑟𝑎𝑡𝑒 = $50,000 = $0.50 𝑝𝑒𝑟 𝑑𝑖𝑟𝑒𝑐𝑡 𝑙𝑎𝑏𝑜𝑢𝑟 ℎ𝑜𝑢𝑟 100,000 ℎ𝑟𝑠 Step 4: Absorb the overhead into the cost unit by applying the calculated absorption rate. Labour hours per unit Absorption rate per labour hours Overhead absorbed per unit Slippers 2 $0.50 $1.00 Shoes 5 $0.50 $2.50 It should be obvious to you that, even if a company is trying to be 'fair', there is a great lack of precision about the way an absorption base is chosen. This arbitrariness is one of the main criticisms of absorption costing, and if absorption costing is to be used (because of its other virtues) then it is important that the methods used are kept under regular review. Changes in working conditions should, if necessary, lead to changes in the way in which work is accounted for. For example, a labour-intensive department may become mechanised. If a direct labour hour rate of absorption had been used previous to the mechanisation, it would probably now be more appropriate to change to the use of a machine hour rate. 8 Example: Overhead Absorption The budgeted production overheads and other budget data of Bridge Cottage Co are as follows: Budget Overhead cost Direct materials cost Direct labour cost Machine hours Direct labour hours Units of production Production Dep A $36,000 $32,000 $40,000 10,000 18,000 Production Dep B $5,000 1,000 Calculate the absorption rate using the various bases of apportionment? Solution: Department A $36,000 1. 𝑃𝑒𝑟𝑐𝑒𝑛𝑡𝑎𝑔𝑒 𝑜𝑓 𝑑𝑖𝑟𝑒𝑐𝑡 𝑚𝑎𝑡𝑒𝑟𝑖𝑎𝑙 𝑐𝑜𝑠𝑡 = $32,000 𝑥100% = 112.50% $36,000 2. 𝑃𝑒𝑟𝑐𝑒𝑛𝑡𝑎𝑔𝑒 𝑜𝑓 𝑑𝑖𝑟𝑒𝑐𝑡 𝑙𝑎𝑏𝑜𝑢𝑟 𝑐𝑜𝑠𝑡 = $40,000 𝑥100% = 90% $36,000 3. 𝑃𝑒𝑟𝑐𝑒𝑛𝑡𝑎𝑔𝑒 𝑜𝑓 𝑝𝑟𝑖𝑚𝑒 𝑐𝑜𝑠𝑡 = $72,000 𝑥100% = 50% $36,000 4. 𝑅𝑎𝑡𝑒 𝑝𝑒𝑟 𝑚𝑎𝑐ℎ𝑖𝑛𝑒 ℎ𝑜𝑢𝑟 = 10,000 ℎ𝑟𝑠 = $3.60 𝑝𝑒𝑟 𝑚𝑎𝑐ℎ𝑖𝑛𝑒 ℎ𝑜𝑢𝑟 $36,000 5. 𝑅𝑎𝑡𝑒 𝑝𝑒𝑟 𝑑𝑖𝑟𝑒𝑐𝑡 𝑙𝑎𝑏𝑜𝑢𝑟 ℎ𝑜𝑢𝑟 = 18,000 ℎ𝑟𝑠 = $2 𝑝𝑒𝑟 𝑑𝑖𝑟𝑒𝑐𝑡 𝑙𝑎𝑏𝑜𝑢𝑟 ℎ𝑜𝑢𝑟 Department B The department B absorption rate will be based on units of output. 𝑅𝑎𝑡𝑒 𝑝𝑒𝑟 𝑢𝑛𝑖𝑡𝑠 𝑜𝑓 𝑜𝑢𝑡𝑝𝑢𝑡 = $5,000 = $5 𝑝𝑒𝑟 𝑢𝑛𝑖𝑡 𝑝𝑟𝑜𝑑𝑢𝑐𝑒𝑑 1,000 𝑢𝑛𝑖𝑡𝑠 Bases of Absorption: The choice of the bases of absorption is significant in determining the cost of individual units, or jobs, produced. Using the above example, suppose that an individual product has a material cost of $80, a labour cost of $85, and requires 36 labour hours and 23 machine hours to complete. The overhead cost of the product would vary, depending on the basis of absorption used by the company for overhead recovery. In theory, each basis of absorption would be possible, but the company should choose a basis for its own costs which seems to be 'fairest'. 9 Example: Separate absorption rates The Old Grammar School has two production departments, for which the following budgeted information is available: Budgeted overheads Budgeted direct labour hours Dep A $360,000 200,000 Hrs Dep B $200,000 40,000 Hrs Total $560,000 240,000 Hrs If a single factory overhead absorption rate is applied, the rate of overhead recovery would be: $560,000 = $2.33 𝑝𝑒𝑟 𝑑𝑖𝑟𝑒𝑐𝑡 𝑙𝑎𝑏𝑜𝑢𝑟 ℎ𝑜𝑢𝑟 240,000 If separate departmental rates are applied, these would be: 𝐷𝑒𝑝 𝐴 = $360,000 = $1.80 𝑝𝑒𝑟 𝑑𝑖𝑟𝑒𝑐𝑡 𝑙𝑎𝑏𝑜𝑢𝑟 ℎ𝑜𝑢𝑟 200,000 ℎ𝑜𝑢𝑟𝑠 𝐷𝑒𝑝 𝐵 = $200,000 = $5 𝑝𝑒𝑟 𝑑𝑖𝑟𝑒𝑐𝑡 𝑙𝑎𝑏𝑜𝑢𝑟 ℎ𝑜𝑢𝑟 40,000 ℎ𝑜𝑢𝑟𝑠 Dep. B has a higher overhead rate of cost per hour worked than Dep. A. Now let us consider two separate jobs: Job X has a prime cost of $100, takes 30 hours in department B and does not involve any work in department A. Job Y has a prime cost of $100, takes 28 hours in department A and 2 hours in department B. What would be the factory cost of each job, using the following rates of overhead recovery? (a) A single factory rate of overhead recovery (b) Separate departmental rates of overhead recovery Solution: (a) Single Factory Rate Prime Cost Factory overhead (30 x $2.33) Factory cost Job X $ 100 70 170 Job Y $ 100 70 170 (b) 10 Single Factory Rate Prime Cost Factory overhead: Dep A Dep B Factory cost Job X $ 100 (30 x $5) 0 150 250 Job Y $ 100 (28 x $1.80) (2 x $5) 50.40 10.00 160.40 Using a single factory overhead absorption rate, both jobs would cost the same. However, since job X is done entirely within department B where overhead costs are relatively higher, whereas job Y is done mostly within department A where overhead costs are relatively lower, it is arguable that job X should cost more than job Y. This will occur if separate departmental overhead recovery rates are used to reflect the work done on each job in each department separately. If all jobs do not spend approximately the same time in each department then, to ensure that all jobs are charged with their fair share of overheads, it is necessary to establish separate overhead rates for each department. Example: Over and under absorption Suppose that the budgeted overhead in a production department is $80,000 and the budgeted activity is 40,000 direct labour hours. The overhead recovery rate (using a direct labour hour basis) would be $2 per direct labour hour. Actual overheads in the period are, say, $84,000 and 45,000 direct labour hours are worked. Overhead incurred (actual) Overhead absorbed (45,000 x $2) Over absorption of overhead $ 84,000 90,000 6,000 In this example, the cost of production includes $6,000 more of overhead than was actually incurred. An adjustment to reconcile the overheads charged to the actual overhead is necessary and the over-absorbed overhead will be credited to the profit and loss account at the end of the accounting period. Example: Reasons for under-/over-absorbed overhead Pembridge Co has a budgeted production overhead of $50,000 and a budgeted activity of 25,000 direct labour hours and therefore a recovery rate of $2 per direct labour hour. Calculate the under-/over-absorbed overhead, and the reasons for the under/over absorption, in the following circumstances. (a) Actual overheads cost $47,000 and 25,000 direct labour hours are worked. (b) Actual overheads cost $50,000 and 21,500 direct labour hours are worked. (c) Actual overheads cost $47,000 and 21,500 direct labour hours are worked. 11 Solution: (a) $ 47,000 50,000 3,000 Overhead incurred (actual) Overhead absorbed (25,000 x $2) Over absorption of overhead The reason for the over absorption is that, although the actual and budgeted direct labour hours are the same, actual overheads cost is less than expected. (b) $ 50,000 43,000 7,000 Overhead incurred (actual) Overhead absorbed (21,500 x $2) Under absorption of overhead The reason for the under absorption is that, although budgeted and actual overhead costs were the same, fewer direct labour hours were worked than expected. (c) $ 47,000 43,000 4,000 Overhead incurred (actual) Overhead absorbed (21,500 x $2) Under absorption of overhead The reason for the under absorption is a combination of the reasons in (a) and (b). The distinction between overheads incurred (actual overheads) and an overhead absorbed is an important one which you must learn and understand. The difference between them is known as under- absorbed or over-absorbed overheads. Ledger Entries Relating to Overheads Example: The under-/over-absorbed overhead account Mariott's Motorcycles absorbs production overheads at the rate of $0.50 per operating hour and administration overheads at 20% of the production cost of sales. Actual data for one month was as follows: Administration overheads Production overheads Operating hours Production cost of sales $32,000 $46,500 90,000 $180,000 What entries need to be made for overheads in the ledgers? 12 Solution: Journal entries: Production overheads (W.I.P) (90,000 x $0.50) Production overheads (Under-absorption) Cash $45,000 $1,500 $46,500 Admin overheads (To Cost of Sales $180,000 x $0.20) Cash Admin overheads (Over-absorption) $36,000 $32,000 $4,000 Ledger entries: Cash Cash Over-absorbed overhead Production overheads A/C $46,500 Absorbed into (W.I.P) Under-absorbed overhead $46,500 Admin overheads A/C $32,000 Absorbed into Cost of Sales $4,000 $36,000 UNDER-/OVER-ABSORBED OVERHEADS A/C Production overhead $1,500 Administration overhead Balance to P&L account $2,500 $4,000 $45,000 $1,500 $46,500 $36,000 $36,000 $4,000 $4,000 Less production overhead has been absorbed than has been spent so there is under-absorbed overhead of $1,500. More administration overhead has been absorbed (into cost of sales, note, not into WIP) and so there is over-absorbed overhead of $4,000. The net over-absorbed overhead of $2,500 is a credit in the statement of profit or loss. 13