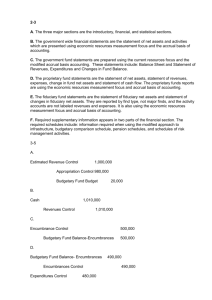

Quiz 1 Chapters 1-4 Student: ___________________________________________________________________________ 1. Governmental-type funds label the excess of assets over liabilities on the balance sheet as: A. Net Position B. Net Fund Balance and Liabilities C. Assets Net of Liabilities D. Fund Balance 2. Which of the following is true with respect to the General Fund? A The General Fund is considered to be a major fund if the combined total of assets, liabilities, revenues . and expenses exceeds 10% of the total of all governmental funds. B The General Fund is considered to be a major fund when preparing fund basis financial statements if it . bears a financial benefit or burden to the primary government. C. The General Fund is always considered to be a major fund when preparing fund basis financial statements. D. The General Fund is not reported as part of the CAFR. 3. Governmental fund statements are prepared using: A. Economic resources measurement focus and modified accrual basis of accounting. B. Current financial resources measurement focus and modified accrual basis of accounting. C. Economic resources measurement focus and accrual basis of accounting. D. Current financial resources measurement focus and accrual basis of accounting. 4. Which of the following is true regarding the governmental fund financial statements? A The governmental fund financial statements include the Balance Sheet, and the Statement of Revenues, . Expenditures, and Changes in Fund Balances. B The governmental fund financial statements are prepared on the current financial resources . measurement focus and modified accrual basis of accounting. C. The governmental fund Balance Sheet reflects the difference of assets minus liabilities as Fund Balance. D. All of the above are true. 5. Funds other than the General Fund must be considered a major fund when A Total assets, liabilities, revenues, or expenditures/expenses of that fund constitute 10 percent of either . the governmental or enterprise category. B Total assets, liabilities, revenues, or expenditures/expenses of that fund are 5 percent of the total of the . governmental and enterprise category. C. Conditions of either A or B exist. D. Conditions of both A and B exist. 6. A statement of Cash Flows is required for which type of Fund? A. Governmental B. Fiduciary C. Proprietary D. All of the above 7. The modified accrual basis is a distinct system of accounting that: A. Differs from accrual accounting only in its failure to recognize long term assets and liabilities. B. Records expenses and revenues the same as accrual accounting. C. Records expenditures and fund balances. D. Is equivalent to cash basis accounting. 8. The Township of Thomasville's General Fund has the following net resources at year end: • $77,000 of prepaid insurance • $375,000 rainy day fund approved by the township governing board with specific conditions for its use • $2,500 of supplies inventory • $61,000 state grant for snow removal • $150,000 contractual obligations for the purchase of equipment • $200,000 to be used to fund government operations in the future • Outstanding encumbrance of $80,000 for the purchase of furniture & fixtures (assume no contractual obligation) What would be the total Restricted fund balance? A. $61,000 B. $150,000 C. $200,000 D. $375,000 9. The Township of Thomasville's General Fund has the following net resources at year end: • $77,000 of prepaid insurance • $375,000 rainy day fund approved by the township governing board with specific conditions for its use • $2,500 of supplies inventory • $61,000 state grant for snow removal • $150,000 contractual obligations for the purchase of equipment • $200,000 to be used to fund government operations in the future • Outstanding encumbrance of $80,000 for the purchase of furniture & fixtures (assume no contractual obligation) What would be the total Unassigned fund balance? A. $80,000 B. $200,000 C. $280,000 D. $375,000 10. Which of the following is true with respect to rainy day funds? ARainy day funds are classified as committed if they are created by a resolution or ordinance that . identifies the specific circumstances under which the resources may be expended. B. If rainy day funds are available "in emergencies" or periods of "revenue shortfalls" they are classified as committed. C. Both A and B. D. Neither A nor B. 11. The general ledger journal entry in the General Fund to record the adoption of a budget would include: A. A debit to Estimated Revenues Control B. A credit to Estimated Other Financing Sources Control C. A debit to Budgetary Fund Balance-Reserve for Encumbrances D. A debit to Appropriations Control 12. The general ledger journal entry in the General Fund to record encumbrances for the issuance of purchase orders would include: A. A credit to Encumbrance Control B. A debit to Expenditures Control C. A credit to Accounts Payable D. A credit to Budgetary Fund Balance-Reserve for Encumbrances 13. GASB standards ____________ that each governmental reporting entity display ___________ General Fund in its general-purpose financial statements. A. recommend; one or more B. recommend; only one C. require; only one D. require; one or more 14. Assume estimated revenues exceed appropriations. When the budget for the General Fund is recorded, the journal entry will include: A. a credit to Budgetary Fund Balance. B. a credit to Estimated Revenues Control. C. a debit to Appropriations Control. D. a credit to Budgetary Fund Balance - Reserve for Encumbrances. 15. All of the following are commonly used major revenue source classes except for: A. Taxes B. Intergovernmental revenues C. Fines and Forfeits D. Transfers from other funds 16. What is the first step a government takes in acquiring goods or services through the General Fund? A. Appropriation B. Expenditure C. Requisition order D. Encumbrance 17. Revenues of governmental fund types should be recognized when: A. collected in cash. B. authorized by the budget ordinance. C. taxes become delinquent. D. measurable and available. 18. Wages that have been earned by the employees of a governmental unit, but not paid at year-end, should be recorded in the General Fund by a debit to which of the following accounts? A. Appropriations. B. Encumbrances. C. Expenses. D. Expenditures. 19. The Revenues account of a government is credited when: A. the budget is recorded in the accounts. B. property taxes are collected. C. property taxes are levied. D. budgetary accounts are closed at the end of the year. 20. In a budgetary entry, if Appropriations Control exceeds Estimated Revenues Control, the excess would be: A. debited to Budgetary Fund Balance. B. credited to Budgetary Fund Balance. C. credited to Fund Balance-Unassigned. D. credited to Fund Balance-Reserved for Encumbrances. 21. The General Fund of the City of X passed a budget, providing for $2,000,000 in anticipated revenues and $1,990,000 in anticipated expenditures. The journal entry(s) to record the budget would result in a: A. credit to Appropriations Control in the amount of $1,990,000. B. debit to Estimated Revenues Control in the amount of $2,000,000. C. credit to Budgetary Fund Balance in the amount of $10,000. D. all of the above. 22. All of the following are budgetary accounts except: A. Estimated Revenues B. Appropriations C. Expenditures D. All of the above 23. The legal authorization for the administrators of the governmental unit to incur liabilities during the budget period for purposes specified in the appropriations statute or ordinance and not to exceed the amount specified for each purpose is a (an): A. Appropriation B. Encumbrance C. Other financing source/use D. Expenditure 24. Revenues in governmental fund accounting: A. include taxes, fees, resources provided by other governments, and interfund transfers B. are recognized when earned C. are recognized in the fiscal year they are available for expenditure D. none of the above describes revenues in governmental accounting 25. The purpose of an encumbrance is to prevent governments from: A. Overriding Unauthorized Contracts B. Spending in Excess of the Amounts Authorized C. Revising the Approved Budget D. Misappropriating Tax Revenues 26. The journal entry to record the budget of a Special Revenue Fund would include: A. A debit to appropriations Control B. A debit to Estimated Revenues Control C. A credit to Estimated Revenues Control D. None of the above, Special Revenue Funds do not record budgets 27. The Town of Little River expects to collect $90,000 in sales tax from the state government within 30 days of the end of fiscal year 2015 for retail sales taking place in fiscal year 2015. What entry, if any, would Little River make at the end of 2015? A. B. C. D. Option A Option B Option C Option D 28. The General Fund of the City of Lexington approved a tax levy for the calendar year 2015 in the amount of $2,000,000. Of that amount, $30,000 is expected to be uncollectible. During 2015, $1,750,000 was collected. During 2016, $100,000 was collected during the first 30 days, $50,000 was collected during days 31-60, and $70,000 was collected during the days 61-90. During the post-audit, you discovered that the City showed $2,000,000 in revenues. How much revenue should the City recognize in 2015 from this tax levy? A. $1,850,000 B. $1,900,000 C. $1,920,000 D. $2,000,000 29. Interfund services purchased by the General Fund are recognized as: A. Transfers Out. B. Decreases in Fund Balance. C. Expenditures. D. None of the above. 30. $60,000 of property tax owed to the city of Akron will not be collected within 60 days after year end. The year-end journal entry to record this information would include a: A. A credit to Revenues Control. B. A debit to Deferred Inflows - Property Taxes. C. A credit to Income Taxes Receivable. D. A debit to Revenues Control. Quiz 1 Chapters 1-4 Key 1. Governmental-type funds label the excess of assets over liabilities on the balance sheet as: A. Net Position B. Net Fund Balance and Liabilities C. Assets Net of Liabilities D. Fund Balance 2. Which of the following is true with respect to the General Fund? A The General Fund is considered to be a major fund if the combined total of assets, liabilities, . revenues and expenses exceeds 10% of the total of all governmental funds. B The General Fund is considered to be a major fund when preparing fund basis financial statements if . it bears a financial benefit or burden to the primary government. C. The General Fund is always considered to be a major fund when preparing fund basis financial statements. D. The General Fund is not reported as part of the CAFR. 3. Governmental fund statements are prepared using: A. Economic resources measurement focus and modified accrual basis of accounting. B. Current financial resources measurement focus and modified accrual basis of accounting. C. Economic resources measurement focus and accrual basis of accounting. D. Current financial resources measurement focus and accrual basis of accounting. 4. Which of the following is true regarding the governmental fund financial statements? A The governmental fund financial statements include the Balance Sheet, and the Statement of . Revenues, Expenditures, and Changes in Fund Balances. B The governmental fund financial statements are prepared on the current financial resources . measurement focus and modified accrual basis of accounting. C. The governmental fund Balance Sheet reflects the difference of assets minus liabilities as Fund Balance. D. All of the above are true. 5. Funds other than the General Fund must be considered a major fund when A Total assets, liabilities, revenues, or expenditures/expenses of that fund constitute 10 percent of . either the governmental or enterprise category. B Total assets, liabilities, revenues, or expenditures/expenses of that fund are 5 percent of the total of . the governmental and enterprise category. C. Conditions of either A or B exist. D. Conditions of both A and B exist. 6. A statement of Cash Flows is required for which type of Fund? A. Governmental B. Fiduciary C. Proprietary D. All of the above 7. The modified accrual basis is a distinct system of accounting that: A. Differs from accrual accounting only in its failure to recognize long term assets and liabilities. B. Records expenses and revenues the same as accrual accounting. C. Records expenditures and fund balances. D. Is equivalent to cash basis accounting. Copley - Chapter 02 #56 Copley - Chapter 02 #61 Copley - Chapter 02 #65 Copley - Chapter 02 #77 Copley - Chapter 02 #82 Copley - Chapter 02 #111 Copley - Chapter 03 #59 8. The Township of Thomasville's General Fund has the following net resources at year end: • $77,000 of prepaid insurance • $375,000 rainy day fund approved by the township governing board with specific conditions for its use • $2,500 of supplies inventory • $61,000 state grant for snow removal • $150,000 contractual obligations for the purchase of equipment • $200,000 to be used to fund government operations in the future • Outstanding encumbrance of $80,000 for the purchase of furniture & fixtures (assume no contractual obligation) What would be the total Restricted fund balance? A. $61,000 B. $150,000 C. $200,000 D. $375,000 Copley - Chapter 03 #61 9. The Township of Thomasville's General Fund has the following net resources at year end: • $77,000 of prepaid insurance • $375,000 rainy day fund approved by the township governing board with specific conditions for its use • $2,500 of supplies inventory • $61,000 state grant for snow removal • $150,000 contractual obligations for the purchase of equipment • $200,000 to be used to fund government operations in the future • Outstanding encumbrance of $80,000 for the purchase of furniture & fixtures (assume no contractual obligation) What would be the total Unassigned fund balance? A. $80,000 B. $200,000 C. $280,000 D. $375,000 Copley - Chapter 03 #64 10. Which of the following is true with respect to rainy day funds? ARainy day funds are classified as committed if they are created by a resolution or ordinance that . identifies the specific circumstances under which the resources may be expended. B. If rainy day funds are available "in emergencies" or periods of "revenue shortfalls" they are classified as committed. C. Both A and B. D. Neither A nor B. 11. The general ledger journal entry in the General Fund to record the adoption of a budget would include: A. A debit to Estimated Revenues Control B. A credit to Estimated Other Financing Sources Control C. A debit to Budgetary Fund Balance-Reserve for Encumbrances D. A debit to Appropriations Control Copley - Chapter 03 #65 Copley - Chapter 03 #73 12. The general ledger journal entry in the General Fund to record encumbrances for the issuance of purchase orders would include: A. A credit to Encumbrance Control B. A debit to Expenditures Control C. A credit to Accounts Payable D. A credit to Budgetary Fund Balance-Reserve for Encumbrances 13. GASB standards ____________ that each governmental reporting entity display ___________ General Fund in its general-purpose financial statements. A. recommend; one or more B. recommend; only one C. require; only one D. require; one or more 14. Assume estimated revenues exceed appropriations. When the budget for the General Fund is recorded, the journal entry will include: A. a credit to Budgetary Fund Balance. B. a credit to Estimated Revenues Control. C. a debit to Appropriations Control. D. a credit to Budgetary Fund Balance - Reserve for Encumbrances. 15. All of the following are commonly used major revenue source classes except for: A. Taxes B. Intergovernmental revenues C. Fines and Forfeits D. Transfers from other funds 16. What is the first step a government takes in acquiring goods or services through the General Fund? Copley - Chapter 03 #74 Copley - Chapter 03 #83 Copley - Chapter 03 #85 Copley - Chapter 03 #86 A. B. C. D. Appropriation Expenditure Requisition order Encumbrance Copley - Chapter 03 #87 17. Revenues of governmental fund types should be recognized when: A. collected in cash. B. authorized by the budget ordinance. C. taxes become delinquent. D. measurable and available. 18. Wages that have been earned by the employees of a governmental unit, but not paid at year-end, should be recorded in the General Fund by a debit to which of the following accounts? A. Appropriations. B. Encumbrances. C. Expenses. D. Expenditures. 19. The Revenues account of a government is credited when: A. the budget is recorded in the accounts. B. property taxes are collected. C. property taxes are levied. D. budgetary accounts are closed at the end of the year. Copley - Chapter 03 #90 Copley - Chapter 03 #91 Copley - Chapter 03 #92 20. In a budgetary entry, if Appropriations Control exceeds Estimated Revenues Control, the excess would be: A. debited to Budgetary Fund Balance. B. credited to Budgetary Fund Balance. C. credited to Fund Balance-Unassigned. D. credited to Fund Balance-Reserved for Encumbrances. 21. The General Fund of the City of X passed a budget, providing for $2,000,000 in anticipated revenues and $1,990,000 in anticipated expenditures. The journal entry(s) to record the budget would result in a: A. credit to Appropriations Control in the amount of $1,990,000. B. debit to Estimated Revenues Control in the amount of $2,000,000. C. credit to Budgetary Fund Balance in the amount of $10,000. D. all of the above. 22. All of the following are budgetary accounts except: A. Estimated Revenues B. Appropriations C. Expenditures D. All of the above 23. The legal authorization for the administrators of the governmental unit to incur liabilities during the budget period for purposes specified in the appropriations statute or ordinance and not to exceed the amount specified for each purpose is a (an): A. Appropriation B. Encumbrance C. Other financing source/use D. Expenditure 24. Revenues in governmental fund accounting: A. include taxes, fees, resources provided by other governments, and interfund transfers B. are recognized when earned C. are recognized in the fiscal year they are available for expenditure D. none of the above describes revenues in governmental accounting 25. The purpose of an encumbrance is to prevent governments from: A. Overriding Unauthorized Contracts B. Spending in Excess of the Amounts Authorized C. Revising the Approved Budget D. Misappropriating Tax Revenues 26. The journal entry to record the budget of a Special Revenue Fund would include: A. A debit to appropriations Control B. A debit to Estimated Revenues Control C. A credit to Estimated Revenues Control D. None of the above, Special Revenue Funds do not record budgets Copley - Chapter 03 #99 Copley - Chapter 03 #110 Copley - Chapter 03 #111 Copley - Chapter 03 #113 Copley - Chapter 03 #115 Copley - Chapter 03 #116 Copley - Chapter 04 #50 27. The Town of Little River expects to collect $90,000 in sales tax from the state government within 30 days of the end of fiscal year 2015 for retail sales taking place in fiscal year 2015. What entry, if any, would Little River make at the end of 2015? A. B. C. D. Option A Option B Option C Option D Copley - Chapter 04 #65 28. The General Fund of the City of Lexington approved a tax levy for the calendar year 2015 in the amount of $2,000,000. Of that amount, $30,000 is expected to be uncollectible. During 2015, $1,750,000 was collected. During 2016, $100,000 was collected during the first 30 days, $50,000 was collected during days 31-60, and $70,000 was collected during the days 61-90. During the post-audit, you discovered that the City showed $2,000,000 in revenues. How much revenue should the City recognize in 2015 from this tax levy? A. $1,850,000 B. $1,900,000 C. $1,920,000 D. $2,000,000 29. Interfund services purchased by the General Fund are recognized as: A. Transfers Out. B. Decreases in Fund Balance. C. Expenditures. D. None of the above. 30. $60,000 of property tax owed to the city of Akron will not be collected within 60 days after year end. The year-end journal entry to record this information would include a: A. A credit to Revenues Control. B. A debit to Deferred Inflows - Property Taxes. C. A credit to Income Taxes Receivable. D. A debit to Revenues Control. Copley - Chapter 04 #70 Copley - Chapter 04 #93 Copley - Chapter 04 #107 Quiz 1 Chapters 1-4 Summary Category Copley - Chapter 02 Copley - Chapter 03 Copley - Chapter 04 # of Questions 6 19 5