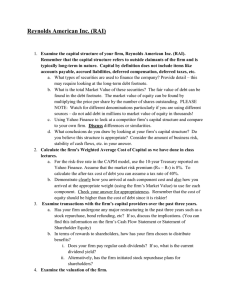

Lesson 02 - RETURN AND RISK MEASURES 1. Introduction Risk in finance is related to uncertainty that could represent a potential loss or gain on the basis of the strategy implemented by the company. Risk is a mix of danger and opportunity. It illustrates very clearly the tradeoff that every investor and business has to make: - Higher rewards: potentially come with the opportunity Higher risk: is born as a consequence of the danger The key is to ensure that when an investor is exposed to risk, it would be rewarded for taking this risk. 2. Measuring risk Investors who buy an asset expect to make a return over the time horizon that they will hold the asset. The actual return that they make over this holding period may be very different from the expected return, and this is where the risk comes in. Ex. Consider an investor with a 1-year time horizon buying a 1-year Treasury bill (or any other default-free one-year bond) with a 5% expected return. At the end of the 1-year holding period, the actual return that this investor would have on this investment will always be 5%, which is equal to the expected return. There’s no risk. The risk analysis has to consider not only the expected return, also its variability due to unforeseen events that may take place in the future. When we define the risk, the first issue for us that matter is to consider the time horizon. The time horizon is the number of years of month, weeks, days for which the investor is planning to retain the asset. It’s important to know our time horizon to the analysis of our performance. The shorter is our time horizon —> the lower is the risk that we are assuming. We have more information available and the uncertainty would be lower. The longer is our time horizon —> the higher is the risk for our investment opportunity. The current set of information will be never enough in order to make the proper forecast of the cashflows. Higher uncertainty. When we talk about risk we need to have a forecasting return -the expecting return you will receive from an investment opportunity- and we have to compare it with the actual return -the real return you will receive for an investment opportunity. In other words, we have to identify if there is a gap between our forecast of the return with the expect of the return we will receive for an investment opportunity. The higher is this gap, the higher would be the uncertainty and the higher would be the risk assumed by the investor. To sum up, we have to consider year by year, month by month and so on, and we will have an expected return and actual return. And the essential thing to take account is the gap between these two. The higher is the variability of these gap, the higher is the risk that we are assuming by investing. So normally, a higher of this gap means that we are assuming a risk in our investment strategy, so for that, we have to be rewarded for the risk that we are assuming. When we talk about this variability, we are comparing the actual and expected return. So, what matters for us it’s not everything related to variability, but it’s essential the unforeseen events -unforeseen scenarios that we might face-. If the scenario is already forecasted/predicted, it would be in the expected return. So, if we analyses the gap between expected return and actual return, what we are studying is essentially the unpredictable variability of the return – the unpredictable risk exposure that we have for our investment opportunity. Return of our investment strategy: V_t = current value of our security V_t-1 = past value of our security This formula tell us the return achieved in the time horizon. This proxy of return will help us to analyse the performance of investment on several years, months, weeks, days, etc. What is done is compute a distribution of the return that we are achieving in different time period. This is a plot (histograma) in which we have the performance achieved by project, in this case, 3 years time horizon of an investment in a treasury bond. Is reedit in past data. We can see that there is more frequent return that we can achieve. The line red indicates the average return that we can achieve and we can see an scenario were we loose money (bear markets – performance bellow the average) and a scenario that we can see that we earn money more than the average (bull market – scenario where the return is higher than the average). By considering this plot, what matters would we compare? The shape (black line) is the normal distribution. What is a normal distribution? Is an statistic distribution that is characterised by the overlap between the medium value and the minim value. We can describe the distribution by considering only two variables: the average and the standard deviation. - The average (mean) will tell us what is the expected return of the investment Standard deviation will tell us how much is the risk that we are assuming related to unpredictable events If we have exactly normal distribution, by using the mean and the variance of the mean standard deviation, we could describe fully the return and the risk assume. The spread of the actual returns around the expected return is captured by the variance or standard deviation of the distribution: - The greater the deviation of the actual returns form expected returns, the greater the variance. The bias towards positive or negative returns is captured by the skewness (asimetría) of the distribution. The shape of the tails of the distribution is measured by the kurtosis of the distribution: - fatter tails lead to higher kurtosis o Kurtosis: Kurtosis is a statistical measure that determines the degree of concentration that the values of a variable present around the central area of the frequency distribution. In the special case of the normal distribution, returns are symmetric and investors do not have to worry about skewness and kurtosis, since there is no skewness and a normal distribution is defined to have a kurtosis of zero. What matters for us? The skewness and the kurtosis. - Skewness: how much the medium value is different to the expect to the average. o If we have a negative skewness, means that the observations are more positive with the respect to negative. We have a higher frequency of a scenario which we earn more than the average, to the expect than less than average (una fumada que no s’enten res). If we consider a standard investor, what matter is to minimise the number of cases when the return is lower than the average. - Kurtosis: is telling how much the distribution is high or the contrary. In other words, the relevance of the values that are extreme values, positive or negative, with the expect to those that are near to the average. What matter is to consider distribution in which the number of cases that are extreme values are reduce at the minimum. So, the higher is the kurtosis, the higher is the number of observation that are in the extremes, the worst it is for the investments opportunities. The lower is the kurtosis (the lower is the number of extreme values negative or positive), the better will be for the investor point of view. Risk can be measured by using formulas: Formulas that we use for evaluating the risk, the return of a project. - Average return Variance Standard deviation Rank the following investment opportunities: First, we have to calculate the weekly performance of the shares (in other words, the return of the share in a daily time. And we have do it applying the R_i formula). Secondly, we have to construct a plot (histogram) in order to understand if the distribution of the returns, in the time period that we are considering, is a distribution that is a normal one or something different. For knowing that, we have to insert a plot and look for the statistical one and select the histogram. Once we have done it, we have to compare this distribution with a normal one. We have to plot the blue line that in the past example put “normal”. However, for doing a better comparison, the better option is to have some statistics that are telling us what is the behaviour of the company and what is the risk that we are assuming with the company. Instead of plotting the shape on our histogram, we will go directly to compute some statistics on our data. And then, after analyse the statistics, we will be able to know the best investment opportunity in the market. We have to see if we have a normal distribution, and if we don’t have it, what is the skewness and the kurtosis. In the excel, we have to go to: DATA > DATA ANALYSIS > DESCRIPTIVE STATISTICS > new workbook > summary statistics Now, it’s time to analyse: - Standard deviation and variance would indicate the same things more or less, for this reason is indistinct. However, we have to choose only one for analysing the situation The skewness is telling if we have more frequently values higher than average or values that are lower than average. Lets start: o The mean is telling the expecting return of the investment opportunity. For this reason, Google is the best in this aspect. o The standard deviation is higher for Apple and Facebook, so this are an investment that is worse for an investor. While Amazon and Google is lower, this means that the risk is lower. o Kurtosis is telling us how much is the extreme values. The higher is this value, the worst it is for an investor. The information coming from the mean is less relevant and useful for analysing the data. The kurtosis is higher for Google. o Skewness is telling us if we have more positive values vs. Negatives values. If this value is negative, normally the probability of losses is lower respect the probability of gains. Apple and Amazon have negative values, for this reason, are better than Facebook and Google o By considering all information together, we can say that the better will be Apple. It’s characterised by a higher standard deviation, lower set of extreme value (kurtosis is the minimum), and we have more extra gains than extra losses (skewness). o The second is Amazon. o The third Google o The fourth Facebook, due to a higher risk. Have the higher skewness. Px. Let’s assume that the investor is a risk averse investor (someone who wants to avoid the risk). If this is the scenario, first of all, we have to have an idea about how much de distribution is different from the normal one. This information is coming from the skewness and the kurtosis. What matters is the skewness, in the basis of the skewness we have to identify the share that is caracterised by the more negative value, and this could be the most relevant information. Next, we will analyise the kurtosis: the higher is the kurtosis, the worst it is for the investment strategy (if we considera a risk averse investor), because we try to minimise the kurtosis. Once consider them, we have to analyise all the standard deviation or the variance for identify the investment opportunity that is less variable overtime. If we can’t identify with this information a rank, we have to look at the end the leverage return. Will be changes if we have an other type of risk investors. When we have a risk lover investor (someone who likes the risk), we consider, first of all, the skewness, next the kurtosis, and then, in this case, we look at the mean. Only at the end, we will look the standard deviation or the variance. 3. Rewarded and unrewarded risk Risk is the deviation of actual returns from expected returns and it can occur for any number of reasons, and these reasons can be classified into: 3.1. Project risk An individual project may have higher or lower cash flows than expected, either because the firm misestimated the cash flows for that project or because of factors specific to that project. When firms take a large number of similar projects, it can be argued that much of this risk should be diversified away in the normal course of business. Px. Disney releases several movies a year, for this reason, some of the risk should be diversifiable across movies produced during the course of the year. Specific activity that is done by the company. The risk of making mistakes in estimating cash flows for a project. You can have some events that may affect the project that we are considering in our business plan. If this is the scenario, we have to consider to reduce the overall risk by starting several projects, and we do several projects at the same time, the probability that all of them will fail at the same time will be almost 0. If we diversify our portfolio, we can reduce the risk of our project, and we don’t be rewarded for it. The diversification strategy will create a gain by reducing the overall risk of the company 3.2. Competitive risk Earnings and cash flows on a project are affected (positively or negatively) by the actions of competitors. While a good project analysis will build in the expected reactions of competitors into estimates of profit margins and growth, the actual actions taken by competitors may differ from these expectations. In most cases, this component of risk will affect more than one project and is therefore more difficult to diversify away in the normal course of business by the firm. The risk related to the competition that we have in the market (new or existing ones). Px. Increase the competition of a company. The competitors will change the strategy being more or less aggressive for selling goods or services. This type of risk may matter for our company. We can reduce this risk in differents ways: - - If we are big enough, we can diversify our activity by entering in more than one sector. The competitive risk is different in every sector. Not all the companies are able to doing this action, the majority has to be multinationals (because they have the skills and the capital). If we are not big enough, the best option is to assume the risk. 3.3. Industry specific risk Industry specific risk includes all the factors that impact the earnings and cash flows of a specific industry. There are three main sources of industry specific risk: Here we talk about the possibility that all the companies that work in the same industry are affected by external events. INDUSTRY SPECIFIC RISK. - - Technology developoment: we are talking about the amount of many spent by the company for increasing the expecting growth of our company. If we are in a sector that there are a huge sector opportunities for developing new tecnologies, this scenario is no the best one for us, because you may be affected by the choise of making project that in the end will not successful. The more we have technology development opportunities, the worst is for managing the risk. Legal framework: some markets may be affected by the more frequent change in the law applied in the company. Companies that work in the financial sector, every year or even, every month, there is new regulation. Lot of innovation in the regulation applied, every time we have new regulation, we have to sustain the cost of adapting the new rules for running the business. Then, we would have to modify the portfolio, and change the criteria. The more you have constrains that the law is changing over time, worst will be for the risk assume because we are assuming a higher risk. - Commodity market: commodities that are used for our production process. We can have some of the comodities that are used for our production process that are limited supply -worldwild or county- and this produce a lot of variability in the cost of the supply. Px. Products that are not produced in every country, and so we have to buy it from the international market., px.microchips. If all the production is concentrated in some areas, the worst would be for the industry, because the industry risk would be higher. 3.4. International risk A firm faces this type of risk when it generates revenues or has costs outside its domestic market. In such cases, the earnings and cash flows will be affected by unexpected exchange rate movements or by political developments. Companies can also reduce their exposure to the exchange rate component of this risk by borrowing in the local currency to fund projects. Investors should be able to reduce their exposure to international risk by diversifying globally. Events that may matters only for investments done in an specific area or zone. - - Exchange rate: the price of a currency respect to another. Px. Exchange euro dolar. This means how many euros you need for buying a dolar. o When we have a country that would increase the exports worldwild, the country may act on the exchange rate by change the value of its owns currency in order to make the exports more convininent worlwilde. Every time we have such type of policies adopted for the central bank of the country, this matter for the risk exposed to the company. For this reason, the company has to diversify its global strategy, try to opperate to new countires. o Identify the differents markets: px. Exchange with France will not take in advantatge because the currency used is the same and, for this, we won’t have a profit or loss related to exchanged rate. 3.5. Market risk Macroeconomic factors affect essentially all companies and all projects, to varying degree on the basis of the business features. In other words, refers to the unanticipated changes in project cashflows created by changes in interest rates, inflation rates and the economy that affect all firms, though to differing degrees. Main drivers are: Is realted to financial dinamics that may affect all investment opportunities. - - - - Interest rate: the higher is the interest rate, the lower will be the value of future cash flows. If the interest rate are increasing, we are suffering lower actual value of cahsflows for all the projects we have in the portfolio. Real GDP (gross domestic product): the higher is our GDP, the higher is the demand of goods in our company. So, by investing in countries that are growing, is easier to maximise the revenues of the project and take benefit for it. Term structure: we are talking about the link between the time horizon of the investment and the return offered by tresuared bons on a period. We will consider the return offered by a treasuring bond that is expiring in 3 years, and the return ofered by treasuring bond that will expire in 10 years or in 50 years or 3 months. This matters because normally what happens is that you will never have the same return offered from different time horizon for investment opportunities. In the treasury bons we can see that if the time horizon is growing, nomally, the interest rate is growing. We have a positive shape of the stracture. For this, the longer is the time horizon, the higher will be the rewerded given year by year for the investment opportunity. By analysin term structure, we may see what happen in the future: we have the return of a treasury bond on 1 year, and the return of a treasury bond on 2 yeas time horizon. Each of them are expresed in annual value, so is the annual return of an investment in 1 year (2%) and the annual return of an innvestment in 2 years (5%). If we compare them, we descover that the return in 2 years time horizon is higher than the annual return in 1 year. We descover that the choice of investing in 2 years may provide the same returns if we invest one year and collect the same amount and invest it the second year, so, the return is the same. This gap between the 2% and the 5%, that give the same return is due to a higher interest rate Risk aversion: when we consider different countries and different financial markets, we have tot take care the risk adversion. Invest in US is not the same than in Japan. Investors in US are more risk lovers than Japanese people. If we consider multiple countires, we have to consider that there are different level of risk aversion and different premium requested for investing in a project. For this reason, if we invest in Japan we have to provide a higher risk premium (for compensate being subjected to an increased level of risk). The volatility of a portfolio is not the sum of the assets’ volatilities and the risk may be affected by the portfolio composition choices. Here we have a simple table that helps us identify how to combine investment opportunities in order to reduce the overall risk by reducing the unrewarded risk. There are 3 companies. We have the return of each share and volatility. In the portfolio we can see the mix of 50% of north aire and the 50% of west air, and in the second, we can see a 50% of north aire and a 50% of tex oil. - - What is changing is the risk, and we can see it by the volatility. If we compare two companies from different sectors, the risk measure is significantly lower. This happens because when the performance is negative for one share, frequently the performance from the other share is positive (true for 4 of the 6 years we are analysing). The correlation or covariance is done by doing the difference between the return that we achieve (the % of every year) and the average value. The risk of a portfolio of investments could be defined as following Correlation or covariance: a relation that is telling us how the 2 shares are performing in the same way for a time period. If we found that the covariance or the correlation is negative (but no so much), it means that we can take advantatge from a diversification strategy. So, we can reduce the overall risk by using a diversification strategy. Covariance and correlation are both measures that can do by Excel. - Covariance vs. Correlation: o Both of them can assume positive and negative values (the negative values are the most relevant for us) o Correlation is a value that goes from -1 to +1. o Covariance may go -unlimited values and +unlimited values (is not as reliable and credible as the correlation, due to a huge number of infinite number) A breakdown of risks and the role of diversification for an investment strategy This is telling how much is relevant the diversification opportunity if we consider the different type of risk that we talk before - The advantages of diversification, the opportunities to identify assets or investments with a negative correlation or negative covariance are significative higher when we consider the project risk and we have assets that are characterised by project risk - If we have assets or investments that are characterised by market risk the opportunity of diversify is not worthy because we cant find a negative correlated set of assets (and we can not explore fully the advantages of diversification). 4. Behavioral finance issues Irrational behavior may affect the investment selection process for a lot of investors. The most relevant issues are related to: (how to select the best investment opportunity would affected by) - - - Loss aversion. Every time we are losing money by doing an investment strategy, you as an investor will be disappointed. The “goods” steps for an investor are: reduce the risk; once reduced the risk, you will take care about the return achieved. The risk is more relevant than the return. Familiarity bias. Choice done by the investor for focus on assets that have been invested in the past . If you have invested in the past in one share, and the performance was good (you didn’t suffered losses), you will try to do the same investment, in the same company in the future. This familiarity bias tell us that a lot of new companies may face a problem in raise money for financing their projects because no one knows them. We have to analyse what we have to do for being more relevant in the market and as a consequence, we will raise more money in financial terms. Emotional factors. We have a lot of emotional factors that affect us. Most of them are related in economics fundamentals, some of them not. The cost of collecting money, a rainy day s higher. The investors during a rainny day will not be happy and this mood affects the investions (are lower). Or, for example, collecting money during october to may is easier because there are a lot of people still working (during the summer, workers don’t think about the market and the investment strategies). ESG —> environment, society and governance. The more you respect this parameters in the company, the more investors will consider your company as a reputate company (bc is working in the interest of the society). The argument that investors should diversify is logical, at least in a mean–variance world full of rational investors. The reality, though, is that most investors do not diversify enough - - - Gambling instinct. If you diversify the risk, the risk is lower but the return also is lower. If we go to a casino, and we invest only on red, we have a 50% of probability to win, but the amunt rewarded is only 2 times the amount you have invested. However, instead of doing that, we invest in one number, if we are able to select the properly number, the casino will pay us 30 times what we have invested. Overconfidence. Scenario that we are doing an investment strategy, not only once. We do several times. I invested yesterday, I will invest today and I will invest today tomorrow. Every time we see the past investment opportunity, we assume that in the future wil be able to identify the more performing investment opportunity. We suppose that if we had lucky in the past, we will have it in the future. If we do that, we increase the exposure day by day, and you will discover that probably you were wrong, and the future not react in the same way than the past (is impossible to bit he market every time you are investing in the financial markets). Narrow framing. Issue related with how many information you collect for identify your investment strategy. What we have to do is collect all the data aviable and process them in order to identify the best strategy for us. Investors never do it, and only focus in the last data, that is the most updated one (we cant assume that the company or the investment will be the same in several years). Is correct, but we avoid the general trend in the market (the market and the economy is ciclical, px. crisis) 5. Conclusion Rational investors select among investment opportunities on the basis of the risk and return trade-off expected in over the time horizon. Risk has to be classified on the basis of the main drivers of performance and investor expected to be rewarded for the systemic risk assumed while the specific risk may be not so relevant for a diversified investor. Investors are frequently not rational and their investment strategy may suffer from the mistakes that they normally do in selecting the best opportunities available and in constructing their portfolio. Lesson 03 Lesson 03 - RISK FREE RETURN AND RATING 1. Introduction Today we will talk about hurdle rate, how to measure the expected return of an investment opportunity. The expected return for an investment opportunity has to be computed by considering: In the simpler scenario The measurement of the expected return requires: What we are going to do is to try to understand what is for an investment opportunity the minimum acceptable return that we may ask for a market. We are going to compute the first formula: the minimum return (r_f) plus a set of risk premiums, each of them related to the different risk of our investment opportunity, px. Project risk. E(Ri) = expected return of investment R_f=risk-free rate [interest rate that an investor can expect to earn on an investment that carries zero risk] B = beta of the invesment (Rm – Rf) = (expected market return – risk free rate) = market risk premium [the rate of return on a risky investment] However, what we are going to do is apply this formula in a simple scenario, an we will summarize the formula by considering only one risk premium, that is the difference between the return of the market and the return risk free. We are assuming that the market is fully discounting all the risk assumed by the project, is not always true but we are doing this assumption. 2. Risk free features A risk free asset is an investment opportunity for which the ex-post return is exactly equal to the ex-ante forecast. The choice of the proper benchmark for the risk free rate has to consider: Lesson 03 a) Bonds without risk of default The risk of default of a bond is normally measured by considering the rating assigned by the rating agencies. We assume that the return is a risk free return only if the issuer, only if the company is selling a financial instrument, is a company that is not exposed to a risk of bankruptcy. For this reason, we say that the company has bonds without risk of default. Here we have the rating scale of 3 famous agences. This rates scales are a judgment about the quality of the bond. - The safer assets: AAA The riskier assets: C or D This rating scale allows us to identify and classify investment oportunities in several types of assets. - Prime assets: higher rating High grade Upper mediu grade Lesson 03 - … Below triple B, you have all the especulative invesments. Especulative invesments are those that are fully exposed to the risk of bankruptcy and cannot assume as a proxy of risk free rate. What matters the most is that anything what Is below triple B, may be considered risk free asset. In the worldwide market, only a few countires are classifyied as high grade. After covid, the probability of having high grade is difficult. In Italy, for exemple, we have around double B. When we look at the market, is not common, identify financial proxies that are classified as a safer assets. So, we have to consider double A, A or, even somethime, triple B, becasuse otherwise we will not have a benchmark for our risk free rate b) No re-investment hypothesis Bonds could offer a remuneration only at the expiration date (zero coupon bond) or they can offer payments (coupons) during the full life of the contract with a frequency of payments defined in the contract (coupon bonds). Another assumption that is important is that when we are selecting the risk free, and we try to mesure the risk free return, we have to consider bonds. We have to choose bonds that are no characterized by NO cupons. This no cupons means that the payment is done only the expiration date of the contract. Before the expirato nthere are no payments done for the issuer. Is important because if we have cupons or intermediated payments, we need also to collect information about the reinvestment oportunities, and how the investment rate is changing alll time. Why is important to avoid selecting bonds with coupons? If we have coupons, what matters for us is, how to use this coupons for computing the value of bond. Let’s start with a zero coupon bond. The zero coupon bond is a bond without coupons. You know the price paid in time 0, you know the refounding value in time n, and you can compute the interest rate of this bond. In the basis of the contract, we have the information for evaluationg this type of bond. Every time you have a coupon bond, we will have several payments that are the coupon payments for the bond. What is the problem of having coupon payments before the expiration date? In order to have an evaluation of the bound, you have to make an assumption about the reinvestment rate of this coupon payment. We cannot assume that the coupon payments is _____? by cash for the investor, you have to assume what is the return that you will achieve by reinvesting the coupon. Every time you do so, there is a high risk of selecting the wrong investment rate, because the information is not enough for doing a propierly forecast. What we have to do is: - Consider bonds that are classifyed not as especulative bonds And then, among this bonds, you have to prefer the zero coupon respect the coupon bond. Is not easy, because the zero coupon bond are aviable in a short tima horize. While the coupon bond is the standard solution by the goverment for raising money in the medium-long term. Lesson 03 Investment opportunities normally generates cash flows in different points of time and this issue may affect the risk free rate choice. The proper risk free is not the same for every type of project. In order to select the risk free rate, you have to know what is the time horizon of your investment. It’s a difficult concept to establish because if we have a project that start now, and finishes in 10 years, the time horizon is not 10 years, the time horizon of the project is the time you need in order to recover the initial investment. For this reason, the best option is to establish a duration, that is a measure that tells us what is the average time necessary for get refunded of the initial investment. We have several cash flows (F_1) that appear in different times (t_1). Theoretically, for each cashflow is expected that you use a different discount rate (i_n=r_fn). However, if you do that you may have mistakes (if you want to know that in the 13th year, you don’t have the information for making the proper forecast of the discount rate). For this reason, the most accurate way for calculate this is: instead of using several discount rates, you select only one that is representative for your project. How to compute it? - - - You use a measure of duration. This is the sum of the cashflows, from 1 to 10 -we don’t consider time 0-, and each cashflow is multiplied for the time in which the cashflow will appear. We make the sum of each items We consider that the cashflow has to be evaluated in the actual value (we discounted with a properly discount rate. This yield to maturity (YTM) is the discount rate provided) And we make the ratio of this sume with respect to the price, the price is the outflow in time 0 that we don’t considered before. Once we have this proxy of duration, your discount rate will be a fixed discount rate that is considered the duration of the project. Px. If the duration is 6.3 years, I will look Lesson 03 - in the market if I can found a bound with an expiration of 6.5 or 7 years (something similar to the duration of our project). I will use the same discount rate for all the cashflows of my project, instead of using a set of discount rate different for each cashflow If we don’t have enough information for forecasting every cash flow of our project, you can not compute the duration. In this case, your proxy for the discount rate is a proxy that consider a average time horizon in the financial market, that is assumed 10 years. The duration of an investment opportunity has to be computed by using the following formula Price at time 0, the sume of all the discounted cashflows 3. Risk free computing The measurement of the risk free rate is affected by the currency used for cash flow flow computation that the analyst select. What can happen if we are considering: - - A safe and low risk country (easy scenario for the investment opportunity) —> here you have a AAA or AA. Once you have the duration, you have the discount rate that you can use for your “r” rate. Investment opportunities that involve more than 1 country —> here you have to consider what can happen to the project when we select a risk free rate. Risk free rate that we are looking for is the risk free rate that is representative for your investor. So, is the minimiun return, that is requested for your investors. So, when we talk about, multy countries or risky, we are talking about the country from which we are collecting money (may be the country that is risky or not are one country or several ones. We not only talk about the domicile company, we talk about the country for which you raise money). Lesson 03 - Or you are developing a project in a risky country —> the same as multiple countries. Sometimes, you can be a company that is crosslisted, and so the issue of selecting the risk free rate could be more complex. When we talk about crosslisted, we talk about the opportunity of a company to rasie money in the same time from multiple financial markets. Px. Ferrari is listed in Milan Stock Exchange and in New York stock Exchage (you can buy the shares in Milan or in New York). In this type of companies, you have to consider that discount rate, risk free rate, has to consider the different markets that you are collecting money. In this case, if we want to evaluate ferrari and we want to set the “r” rate, and now we want to establish the risk free rate, which one we have to consider? The italian or the US benchmark, due to the fact we are cross-listed? We have to consider how much is colected in each market, and we consider the market that earn more. In this case, the 90% of the shares are trade in Milan market exchange, and only the 10% is in US makret exchange (and i’m in the US market for having better reputation). Even this situation, even the discount rate is lower in US, my proxy for the discount rate has to be the italian benchmark, because my main source of capital is the italian market. If the market has the same wight, 50% in italian market and 50% US market, the will choose the lower one, this would be my proxy of the risk free rate (we have to choose one because only one market could be your benchmark). a) Safe and low risk countries The selection of the risk free rate is based on the currency of the cash flows and could be based on the market data available in the market. Here we have an exemple of the comparison between the US bond overtime. - - The trend of the return offered by bonds in one month, three months, six months, 1 year, etc. expiration date This plot is improtant because is showing us one problem that we have every time we consider a safer country with no specific problem. The problem is that until we consider short-term investmet, the interest offered will not change year by year (the interest rate will be the same if we consider bond with an expiration below 1 year). IF we consider investment long-term time horizon, we have to take care about the evaluation date. Every time we have a new event that is coming to the market, this will have a huge impact on the interest rate in the medium-long term. We can see the gap between the differens years of 0,5-0,7% only in one year gap. This means that every time we are evaluation the project, we have to update the discount factors especially if our project is long-term one. Lesson 03 - If the project is a short-term one, not updated information can be usefull, if the project is a long-term one we have to take care about updated information because we will have a lot of difference in our estimation in selection the discount factor, the risk free rate (one of the factors of our discount factor). b) Multiple countries with the same currency If for each currency there are multiple Countries that are issuing bonds is necessary to identify a selection criteria among the issuers. Here we have an exemple how much could be different for you to select one country instead another if you have a multiple counties that are relevant for your project. This table shows the return of 10 years government bond issued by germany, UK, french, etc. They gives us the YIELD, the most important information for us by this type of bonds. Px. If you invest in a 10 year trearsury bond issued by germany, the return offered was negative (-0,46%). If you want to invest in Greece the result was positive (0,58%) for investing in the bond issued by Greece. When we select multiples currences and multiples countries, you have to take about the discount rate bc it could be that in the same geographical area there are a set of huge differences among the interest rate offered by this countries. REMEMBER! If you select the lower discount factor, what you are doing is discountless the future cashflows and probably you are overestimating your performance. You will suffer of a loss that you are not expected because if you discount by using a lower interest rate, probably you will pay more for a project (bc the price is the acutal value of all the cashflows) and once you have paid, you can not recover the investment and sometimes you can loose money. c) Risky countries For riskier countries the currency denominated sovereign bond could be too risky for being considered as risk free. Solutions available are the following: Lesson 03 If we want to invest in India is a problem. It’s a developing country and when you are investing, the interest rate offered by the bonds is quite high. - - - India has a double digit interes rate. If we use this type (double digit interest rate), every cashflow that you obtain is descounted so much and project will be never convinient for you. If we want to evaluate a project for a company that is raising money for india, we can not use the interest rate offered by the indian government in their bounds. Because if we do so, every investment won’t be worthy for us. We have an outflow now that is not descounted (bc is on time 0) and all the cashflow descounted in the future would be the 9%, 8% or 10%. For this reason, in actual value would be value less than the inicial price. In this scenario, instead of using the risk free rate of India, you have to adpt alternatives solutions: o Use the sovereign default spread: return offered by another country + spred o Cash flow translated: translate the cashflow to another currency (strong one) o Real discount rate: use a discount rate that is corrected by the inflation rate. Cash flow translated If we translate the cash flow in the equivalent vale in euro o dolar, once we have translated the cashflow, we can consider this cashflow as an investment in Euro or Dolar. By transfering the cashflows in a forent currency, once we have done it we can descount his cashflow using the interest rate or the strong foreign currency. The problem is the volatility of the exchange rate: we are evaluating a project in a medium-long term and if we want to make a forecast about the euros vs dolar in 10 years from now, we don’t have the information for doing the forecast and using for translating to cashflow. It’s a theoretical approach but we never use it because we don’t have the information for doing an accuratly analysis. In conclusion, we have no idea of the value of the future currency, for this reason we almost never use this approach. Real discount rate We have to consider the nominal discount rate minus the inflation rate. We need to have the forecast of the inflation rate, in order to make an analysis of real discount rate Theoretical we can do it, bc we have some organisms that provide us the forecast of the inflation rate in the next years (in the same could be done in all developed countries). The problem is when we consider investors, almost never evaluating a project in real terms. They evaluate the project in nominal terms. If you invest in a bond, what matters is what we Lesson 03 are going to obtain in the end as nominal value (px. how much I will earn in 20 years without taking care of the inflation rate). Thanks to the inflation, if it continues growing, what we will have is a redution of the purchasing power of your money of 8%. If this situation continues, all the inversions will be a waste of money (bc you will never have the opportunity to buy the same amount of goods with the amounts that you are investing now). IF the nominal rate is low than the 8%, the inflation rate is taking out all the return achieved by your investment. Sovereign default spread This will be the approach that the investors will follow. Approach of developing countries. The estimation of the sovereign default spread could be performed as follows: This tree options are solutions that we can adopt every time we are in a country in which the return offered by the bond is too high, so our risk free rate estimated is too high, and we want to create a benchmark that is a better proxy of a risk free rate. Foreign bond spreds – the opportunity that a state or a company have to issue bonds that are reserved to foreigners (strong foreign country). In other words, special type of bonds denominating in a foreign currency that are addressed to a foreign investor. I can try to issue this type of bond every time my currency is too much volatile for being appearing for a foreign investor. CDS spread – creadit default swap. If we invest in a company or state that is exposed to the risk of default, you can buy an issurance or a protection of someone that allow you to have, in the event of default, a refound form this seller. The seller give you a protection that the seller will pay instead of the issurer. CDS is normally presented in the market as credit default spread, that is the additional return that is requested by the company that is selling you the protection in order to offer you this type of contract. IS essencially, the price of the insurance. This credit default spread are listed in a market in which every day you can be updated about what is the current price if you want to buy a protection for the debt bond or debt issurer. Rating score based models, we have already described (AAA, BB+ examples) Lesson 03 Foreign bond spreads could be computed only for countries that have foreign currencies bond outstanding. The foreign bond or the Eurobond are instruments normally used by developing economies in order to attract foreign capitals. What we have to consider is the foreign bond spread. The foreign bond spread is the gap between the interest rate ofered by bonds of acompany or state in local currency with respect to the interest rate offered by the same company or state in the foreign currency. We are evaluating one issuer, so 1 company o state that is planning to issue bonds, and we are comparing the return of the bonds issued in the local currency with respect of the return of the bonds issued in the foreign currency. The bonds issued in a foreign currency are less volatile (are issued in a US, EURO, IEND bonds), for this reason, the risk related to this type of bonds is normally lower than the local currency bonds. So, we expect that the gap between local (i_LC) minus foreign (i_FC) will be always positive because it will be the gap between a risky bond (local) and a safer bond (foreign). We can issue local and foreig bonds in differents expiration dates, 1-2-5 years. For each expiration date, you have to compute all the dates. For this reason we do a average of all the years. Once done the average, I will use it for computing my risk free rate (i_rf). My risk free rate will be the interest rate in a local currency for my time horizon (px. 6 years), minus the foreign bond spread. It’s super important remember to do the average gap! The Credit Default Swap is a financial instrument traded in the market that offer the protection in the case of default of an issuer and they are available for almost all countries. The return requested for buying the bankruptcy protection is a proxy of the risk of sovereign bond. The CDS is the price that you have for the protection from bankrupcy risk, bankrupcy of the issuer (the issuer in our case is a government, bc we are focused on the risk free rate, so our proxy are the bonds issued for the government, but you can have the same approach for a company too.) Is computed as a %. In order to compute the discount factor, start from the interest rate in a local currency and we deduct the price of the protection, the CDS spread. In the financial markets, for every country that is issued at least one bond, you have the CDS available. For goverments and countries, we always will find the CDS spread. For companies don’t. The only problem of this approach is that this CDS spread is updated daily, every day will change this %. So we have to consider that this CDS spread is very volatile and, for this reason, Lesson 03 you don’t fully trust in this approach (especially when you have extrem event that may matters for the goverments that you are analysing). The risk of the issuer has an impact on the return requested by investors and the market price an investment on the basis of the rating assigned by rating agencies. Here we are considering the apporach of rating. You consider your contry and we have to indetify the rating of our country. Once we have the rating assigned of our company, what we have to do is to consider the interest gap between the return offered by all the countries with the same rating of you with respect to the rating assigned to the safer country that you can see in your sample. This gap represents how much is the premium that you have to offer as a country with a rating with respect to the sagest country. Px. How much you have to pay more than the US (bc i’m riskier than US). After doing that, I will use this interest gap for compute my discount factor, as the local interest rate minus the average premium offered by countries with the same raiting than mine. 3.1 Measuring risk (EXCEL) Risk can be measured by using formulas. Identify the market in which the minimum return of investment is expected to be the highest and the lowest. Lesson 03 4. Conclusion The risk free rate is the minimum return requested for starting an investment and it represents the return offered by investment opportunities for which the return is already known. Market data allow identifying the proper return for the investor on the basis of currency denomination of the cash flows. The measurement of the risk free may be not so easy for riskier countries and the evaluator has to make some assumptions for identifying the proper benchmark. Lesson 04 - EQUITY RISK PREMIUM 1. Introduction The expected return for an investment opportunity has to be computed by considering: In the simpler scenario The measurement of the expected return requires: - Risk free rate Risk premium Risk parameters So today we will move to the second item that we need to compute for measuring the outdoor rate. So last Friday we were discussing about how to measure the risk free rate. What we have to do is try to understand how to measure the equity risk premium. The last step that would be done next Thursday will be on the beta. So we have already done the risk free. What we will do today is only to focus on these item these risk premium and auto measure it. The risk premium is the additional return requested by investors for starting a risky project. It has to be: - Higher than zero Higher for the more risk adverse investors than for risk lovers Increasing with the uncertainty of the investment opportunity The risk premium may be different investor by investor Well, we'll talk about risk premium. There are some assumptions that are always satisfied by a measure of risk premium independent with respect to the approach that we will use. So essentially there is premium has to be: - Higher than 0 - Has to be higher for more risk averse investor with respect to the risk lovers. So what you can expect is that people that are less worried about risk may accept a lower risk premium - normally the higher is the uncertainty of the market, the higher has to be the risk premium for every investor. These are the three rules that are always supplied for computing the risk premium. When we consider the risk premium we have to take care because the some of the features of the investor may affect our risk premium estimation. Some examples that they matter for the risk premium estimation:: - The age may matter. Why the age may matter? Because normally investor that are younger have the opportunity to wait more for a return and they are not worried about the return that will be achieved only one year or a couple of years. - - The gender may matter. The females are more risk averse with respect to the males, and so normally, you can expect that the risk requested by females is higher than the risk premore requested by males The time may matter. The time horizon for your investment strategy is affecting the risk premium because what you can expect is that the longer is the time horizon, they higher will be the risk premium. 2. Survey approach The survey approach measures the risk premium by considering the point of view of a set of investors. The survey could be submitted to: Now we will analyze one by one, what are the approaches and what are the limits of each approach that you can use for measuring the risk premium. We start from the expert opinion, the survey approach for measuring the risk premium of an investment strategy. Essentially what you have to do if you want to apply this survey is: - to select a set of people that you want to interview. And try to submit them a survey about the risk premium. How does it work? normally if you ask to someone to measure directly the risk premium, the investor is not able to measure it. What you can ask to the investor? Is “what is the additional return requested for investing in our risky project?” So instead of asking directly what is your risk premium, what you would submit is a survey which you provide the several investment opportunities and try to understand what is the return requested with respect to a risk free return. So I'm offering you a share with the return of 8%, 9%, 5%, what is the minimum treasure that will accept for investing in the share. The minimum treasure, the will be your proxy of the risk premium that you request for such type of investment. When you select the people that has to be interviewed for measuring the risk premium, you have to take care because investor may have a different set of information and a different point of view in estimating the risk premium. Individuals What you can do is for example to consider individuals, as a target for your survey. What you think about if we target as interviewed only individual investors, what could be the problem of doing the survey with them? Individual investor means people that are already working, people that are, is already retired and so on. So everyone that is doing is own investment strategy with his own money. When are you target this type of people and you try to make an interview with them? What you have to be worried about? - You have to be sure that the risk premium estimate is arise on board or could be useful for you. The idea is that you have to understand how much they know about the market. The best proxy that you can found in order to understand it is a for how many years they have treated in the market. Because if I am 50 years old and I have never treated a share, probably, I'm not the right guy that you are to interview for having an estimate of the risk premium. If I have 30 years, and I was treading since I was twenty, I have 10 year of experience and so probably I can tell you something about the risk premium. So what matters for you when you are selecting individuals,you start to understand how these individuals have made an experience or not in investing in the market. The more they have experience, the more you can trust them. When you do such type of interview, what matters is the experience in the financial markets cause not an exercise in the same security or in the same financial instrument is only necessary that they know how to trade in the market. Financial advisors What other you can try to consider as target for your survey the financial advisor. Who are them financial advisor? Are people that are doing as work, advice for investing. So you go to your financial advisor in order to understand where you can trade or what you can trade in the financial market and you pay him or you pay her for this type of advice. When we talk about financial advice or we can expect is that we hope that they know how to trade in the market, so they have an experience at a knowledge in the market. We want to know how much they are independent. - What does it mean how much they are independent? They can work for a bank or for a financial institution, and they can try to promote only the investment supported or offered by this type of financial institution. So what matters for you is that to be sure that when you are computing the risk premium, you will not focus only on the shares the advisor is trying to sell. Otherwise they will be biased in selecting the risk premium because they want to sell these security because it's their own job. So, here you have only a problem of a conflict of interest that you are have to manage in constructing your risk premium survey. Don't ask them about their securities. Ask them about other securities that are not treated by them. Institutional investors Talking about institutional investor, it may happen something else, but we talk about this solution, we are talking about mutual funds, hedge funds, pension funds. So every company that is specialized in trading securities. This type of institutional investor, when you try to make the survey on the risk premium, you have to be worried about if they have a conflict of interest, related not to the fact that they work for someone else, but really to the fact that they have an investment strategy and so they want to support their investment strategy. So for example, if you make an interview with one manager of an Edge Found, normally the manager of the Edge found, they try to promote the asset that he's sellinger and he's trying to do not promote or to reduce the value of the securities that is trying to sell. So essentially you have another type of bias, always an agency problem. But related to date investment strategy (not really to the job they are doing really to their investment strategy). So what you have to take care is: - where they are investing Because if you ask about their strategy, the information will be always biased. Corporations Finally, you can have corporation. So, when you interview corporation you can be less worried about the information provided because corporations are every company that is not classified as as a financial institution, so their job is not to invest in securities. Probably when you interview them, they will provide an objective evaluation on the financial markets because: - They don't have a an agency problem They don't have a conflict interest. They can provide their view about how they are using their cash for investing in the financial markets. So this scenario you can be less worried about the quality of the survey. Others These are the four main type of people that you can interview. Sometimes you can decide to interview some someone else among these guys, the others that you can see over there. Normally you will found also nterview with the experts or academicians that are working in the field, that may provide you their point of view about the market. Another example of a category that is in the other classification could be, for example, a no profit organization. That will provide you a point of view about where you are investing. Every time you are selecting someone in the other category, again you have to be worried about if they have a full overview of the market or if they are focused only on something. For example, if you make an interview of an Academician that is specialized in the bond market, could be a good source of information for the bond market and for the risk premium in the bond market, but probably is not that nothing about the derivatives market, the stock market, the emerging markets and so on. They same if you ask to are no profit organization to provide you a point of view about the risk premium because they know what is the performance of no profit organization and how they can raise money from the financial markets. So every time you go in the other category, take care about it because normally they are specialized then focusing only on some areas. And so this could be an issue that you have to consider in constructing your risk premium survey. Exemple Results of the survey may be different on the basis of the interviewed and the time period in which the survey was submitted. You're only an example about risk premiums surveys done. In the last, let's say 10 or 15 years, with the results or the estimate of the risk premium, for a survey done on: individual investors, institutional investors, CFO corporations, industrial companies analyst that are special in this type of financial advisor and, finally, academician that are working in the field. So this was at the survey done by the Security Industry Association, Merrill Lynch and here you had the estimate of the survey. These data, you don't need to remember them. This data allow you only to understand how much their estimates could be different (when you switch from a survey from individuals with respect to corporation with respect to academicians). Here you have a minimum -that is the minimum estimate from corporation- that is around the 3.44% In the same year, institutional investor says that the primium has to be 1.5. That's the touch points either and only one year before the academicians and the financial analyst say that the gap is not one point 4%, but 1.6% or two point 2%. So, every time I you switch from 1 sample to another, you can expect to have a change in the risk premium of one to three percentage points, even in the same year. If you change the year, as you can expect, hey estimate could be totally different because, for exemple, theses estimates weres a 10 year before the others, and were significantly higher with respect to what we can see in 2013 or 2012. Main limits of the survey approach are: • There are no constraints on reasonability; individual money managers could provide expected returns that are lower than the risk-free rate, for instance. The ideal this survey approach is that the there are no constraints on how to select the set of people that has to be interviewed, but you have to be sure that the survey is reasonable and is coherent with your idea or with your hypothesis. What does it mean? It means that if you need a risk premium for investing in companies that are working in the itech sector probably a survey on employees of a nonprofit organization are not the best solution that you can found (because the service to be consistent with the type of investor and normally nonprofit organization are almost never investing in the itech). So what you have to consider is that that the selection has to be reasonable for your target. So in this case, you have to select correctly the interviwed. • Survey premiums are extremely volatile and largely reactive; the survey premiums can change dramatically, largely as a function of recent market movements. This type of survey premium are volatile and they are reactive to new market condition. What does it mean? If you have a bad news coming to the market, is almost never suggested to use this type of survey approach for the estimation of the risk premium. Why? Because normally when the bad news will go to the market, the market will react immediately by revising the risk premium and requesting a higher risk premium (because the risk perceive is higher). On the other hand, If you have a market in which good news are coming, because the GDP is growing with the double growth rate than expected, if you do this survey, you will have an underestimation of the risk premium. So, in both cases, every time you have a extreme good or extreme bad news that are coming to the market, try to avoid these approach because this approach could be significantly biased. • Survey premiums tend to be short term; even the longest surveys do not go beyond one year. Lastly, this type of survey estimates are working only in the next month. Only one year after or a couple of year after, the estimate that you have done is no longer representative of the market. So if you are planning to do an investment strategy in the short term horizon, you can evaluate the survey approach. In the other cases, you have to choose another option because it's more objective, it's more reasonable and probably a better proxy of what is requested by the market for the risk premium. The two other approaches (historial risk premium & forward looking premium) are based on formula and are based on data and so we can describe how to apply them and how to use them forever, while we are waiting an investment opportunity. Essentially what you can do is to start from historical data or to try to extract data from the current values. 3. Historical risk premium The most common approach to estimating the risk premium(s) used in financial asset-pricing models is to base it on historical data. Hypothesis are: Data availability In the historial risk premium what we have to do is to check how many data you have for measuring the historical risk premium. Also, we have to check if, in the risk premium that you are estimating, there is no bias related to a change in the risk aversion or a change in the systemic risk. Risk aversion (what is?) The risk aversion is how much investor wants to have in exchange for each unit of risk. If you assume that there is no huge change in the strategy of the investor, as you can normally do, you can use the historical data as a proxy for your historical risk premium. Otherwise you cannot do it. Systematic risk If we talk about systemic risk, we say that this systemic risk was the risk that cannot be reduced by diversification strategy. So we say that there is a change in the macroeconomic condition, a change in the interest rates and so on. Every time you have such type of shocks, you cannot trust this historical data in all the other cases, you can use the data and try to apply them for computing your risk premium. - Time period: In order to get reasonable standard errors, we need very long time periods of historical returns, but a shorter time horizon allow to obtain a more updated premium. Talking about the the time period and the type of data that you need to find, first of all, you need to consider a time period that that may fit with your analysis. What does it mean that may fit with your analysis? We will see later that we are paying formulas for computing the historically premium. However, we have to be sure that the historical premium is computed on data that are not too long: not too historical or not too much updated. So, you have to have a figure of the company that allow you to study what happened to the company and what is still relevant for the company. Let's make an example. You have a company that was the target for an M&A. What is an MA? Major acquisition. All the data before the M&A are no longer useful for you, because it was another company. It was before the merger, before the acquisition. So you don't care about it. If you have a company that is working in the industry and it's already reaching its market share that will have also in the future (maturity statge), probably the longer is the time horizon that you can evaluate, the better it is. So what you have to take care is to consider the company, the extraordinary events and the life cycle and how much you can describe the life cycle by collecting data. - Risk free security: The risk-free rate chosen in computing the premium has to be consistent with the risk-free rate used to compute expected returns. For the most part, in corporate finance and valuation, the risk-free rate will be a long-term government bond rate and not a short-term rate. What else has to be considered is that in your selection of the investment opportunity, you have to consider as benchmark a risk free proxy that is consistent with your investment strategy. We had said that the risk free rate has to be selected on the basis of where you are collecting money, from where you are collecting money and for a time horizon that is similar to the time horizon of the investment strategy. So, if you are investing on the 10 year time horizon, you would not consider the treasury bond with an expiration date of three months, but you will consider an expedition data near to the 10 years if you can found it. So by selecting the risk free rate, take care about the time horizon and try to be sure that the time horizon is always consistent. - Average type: The arithmetic average return measures the simple mean of the series of annual returns, whereas the geometric average looks at the compounded return. Finally you can consider to compute the risk free rate by using an arithmetic average or a geometric one. - Arithmetic average means that every observation has the same weight in your analysis. Geometric average means that you are not applying the same way to do each of them, but we are applying a different weight of each observation on the basis of the time in which you will have the return for your investment. Historical data can be easily processed in excel: Arithmetic average: R_i = return of investment R_f=risk free rate For you is important to know how much you are earning from the risk investment opportunity with respect to risk the free in each of the data you're analysis. Geometric average Here instead of considering the return day by day, you consider the compound return that you receive by investing in a time horizon from one to end So you have time to compute, also their returner related to the reinvesting cash flows during the time horizon of the project. Again, you consider it for the risky project and you consider it for the risk free asset. What matters for you is again the difference of the gain of investing in the risky asset with respect to investing in the risk free rate. Identify the best estimate for the historical risk premium This is the plot about the risk premium geometric versus arithmetic one. And here, you have the data about the S&P 500 in blue and the US Treasury bond in yellow and the three month Treasury bill in grey. What I'm asking you now by using a game mentimeter is that these are the risk premium arithmetic and geometric average. On the base of what you can see in the plot, if there are shocks, if there are trends that you can identify from these easy plot, which type of premium you will trust more, among the six premiums that you can see over there? So, you have to identify if you want to analyze the full time horizon or the time horizon from 1971 to 2020 or the time horizon from 2011 to 2020. And once you have done it, you have to select if you want to use the arithmetic or geometric. When you look at this plot, first of all, what you have to take care is if there is any trend in this data that is a significantly changing over the time horizon. And so probably may matter, may be relevant for your analysis. If you look at the trend over the run up to let's say 1968, You have always that the return offered by the S&P is significantly higher than the return offered by the bond. Immediately, after you will have been some years is more convenient treausry bond in some others is more convenient that the S&P 500. This means that all the data that you can see over there right before, let's say, 1970 or 1968, are no longer representative of the current market. - So first of all, all the choices that are from 1928 to 2020 arithmetical geometric average are not to be considered (because the data is totally different from the actual). Let's move to the other two time Horizon Sun 1971, 2020 and 2011, 2020. - - - - - - - If you look at them, what you can see is that there is not a huge change from 2011 ongoing. Because the trend that you have over there is quite similar, even if it's a little bit higher, is quite similar with respect to what you you can see over there. But they are still comparable. Talking about the choice between arithmetic and geometric, what we say before is when we talk about arithmetic, what we're talking about is to assign the same weight to each other returns in the time horizon considered (the data only annual data and so we have only one return buyer). If we use the return related to the geometric average, what we are doing is to assume that every euro earned is reinvested. Ee are analyzing is the return that we are achieving by investing all the money from a time horizon. If you have the return of the investment opportunity that is significantly volatile overtime, you cannot trust to have exactly the same reinvestment rate. So what you have experienced in the pasta could be not a good proxy or the return that you will achieve votes in the future. So, essentially by looking at the blue line or the yellow line we can say that the return is volatile. What you prefer? Arithmetic or geometric? The volatility will help us choose between the artihmetic or geometric o We cannot assume that their investment rate is behaving like a couple of years ago or 10 years ago (we use the geometric when we see something that is more stable over time and so you can trsut more about the reinvestment rate). In this case, the huge volatility says that we have to choose the arithmetic options. We have finally 2 options aviable: o 4.9% from 1970 to 2020 o 7% from 2011 to 2020 For obtaining the correct option, we have to make an assumption about what is more reasonable for the near futre (the more conservative) So, there is not a rule for doing it, but if you have nothing that allow you to select one option is the best one, what you have to do is try to be the more conservative that you can so, you will go for 1970 one 2020 o You cannot expect that the risk premium stay at around of the value that you reached in the last 40 years. So the more conservative is this one, and so you will go for 4.90% Although historical data on stock returns is easily available and accessible in the United States, it is much more difficult to get for foreign markets. Let’s do an example: I'm investing in Zimbabwe. But I cannot trust that the stock price in Zimbabwe are efficient are all the share are priced correctly and so on. So instead of using that the least premium of Zimbabwe and we use the something else that is more reasonable for me. What I will do is to consider the risk premium and make a correction, so make a an adjustment on the result achieved on the base of the risk of the country or on the basis of the type of investment that I'm analyzing. The formula are quite easy. - One of them is based on the country bond default spread (the CDs spend that we analyze the last week). Another one is based on the relative standard deviation The last one is based on the default spread + relative standar deviation Solutions available are the following: a) Country bond spend ERP^hbmk = historical risk premium You you use the historical data for your benchmark country could be US could be UK, could be Germany whatever you want. So you apply the formula that we described before on the US data. But for analyzing your company, that is not listed in US but is listed in Zimbabwe, you are the premium that is called the country premium. What is the problem that we may have in applying this approach and what is the advantage of using it? The country premium is computed by: - the foreign bond spread CDS spread Rating score based models What was the foreign bond spread? The gap between returns and bonds denominated in a different currency. You compare the return of bonds denominated in local currency with respect to the return of bonds denominated in a strong foreign currency, like US. Otherwise, what you can do is to look directly in the financial market and try to understand the in the financial market what is the price for the risk of bankruptcy of your country. Is measured by the CDs spread, so you are the director of the CDs spread and that's your new implied historical risk premium for your analysis. The last approach you consider their return of your of the bonds issued by your country with respect to the return of bonds with the same rating class. And on the basis of this difference, you point out what is the rating score based model. So, exactly the same format that we discussed applied that to the risk premium and the the historical risk premium approach. What are the pros and what are the cons? So what we're saying is that we start from an historical spinning approach based on a developed economy, US. And we apply a premium, related to what we have analyzed the for the bonds issued by that country. So, something ready to foreign bonds, to CDs spread to reading premium, whatever you want. - Let's start from the problem. o It’s subjective. You can do the choice that you want in the three proxys, but it is even something worse. o Benchmarks. What we are seeing in this formula is that by considering the bond market, we can construct a proxy of the additional risk premium in the stock market. And these not so reasonable. I nvestors in the bond market are not the investors that are looking for the stock market and so you cannot derive the premium requested by looking at the bond market. For example, if you are not in Zimbabwe, but if you are in Asia. In a South South Asia, a lot of us countries in South Asia are target for an investment strategy in the bond market by international players. Almost no one of the international players is taking care about stocks shares in the same market. So we cannot assume by analyzing the bond, we can have a good proxy about the stock market because we cannot assume that the investors are exactly the same. In some less developed markets, the bond market is still appealing while the stock market is no longer appealing because it's too risky and no one is staying care about it. So when we are trying this approach, we have a huge risk of mistakes related to the fact that we are assuming that the bond market analysis has to be done like the stock market one, that is not always true, especially in developing economies or less developed countries. o Another issue: What is the volume of trades in a stock market? ▪ Normally is the number of trades by date that you have in the financial market. ▪ If you have a number of trades are by day in the financial market that it is quite low, you will have a lot of outliers. Why? in some days you will have trades and in some others you will haven’t and you will have a huge volatility in the price. ▪ ▪ ▪ ▪ It is not representative of a real risk is only representative of a lack of liquidity because no one is trading and there is a liquidity issue for the financial market. So every time you evaluating a market, a developing market that is characterized by only few trades, you can be worried because probably these historical risk premium may be overestimated. Why? Because you have a lot of variability driven by only few trades in few days in the market. So if you have a market that is a not so liquid with not many trades, probably you have to avoid this type of approach because you can suffer of losses or you can make mistakes. b) Relative standard deviation An alternative way is to do what is to consider in your country, some data that may be useful for your analysis. The approach that you can use is this approach over there in which we start again from a benchmark country. That is again US. But for computing the risk premium, the historical risk premium that we have to apply, we don't apply the same historical risk premium of US, but we consider how much our shares are more or less volatile than the shares in US. So, we compute the standard deviation (relative o) or the variance of return of the shares in Zimbabwe. If we compare it wit the standard deviation or the variance of the shares in US and we put out a ratio, tells us how much should the investment in Zimbawe is risker with respect to US. If this value is equal to 1, you are saying that Zimbabwe is the same in terms of this with respect to US. - If it's higher than one, you say that Zimbabwe is riskier than US. If it's lower than one, you say that Zimbabwe is safer than US. As you can imagine, by considering that developing economy, you will have almost always a ratio that is higher than one. So at the end you will have a risk premium that will be the risk premium of US multiplied for something that is higher than one. c) Default spread + relative deviation The last alternative that you can have is the one that you have over there. What we're doing is a mix of the last two approaches that we have just described. In the first approach that we described before, we were saying that we start from the equity risk premium of the benchmark country, again US and in the first approach we were adding a country premium on the basis of the bond market. Here what we're saying is that we don't trust that these country premium because we know that the country premium is based on bonds and is not based on equity. So what we can do is to adjust the country premium for a ratio between the variability of shares in the country and the variability of bonds in the same country. So, we're not comparing the US with a foreign country that could be characterized by different level of liquidity, but we are considering the volume of trades of shares in Zimbabwe and the volume of shares of bonds trade in Zimbabwe. What we want to understand is how much is riskier to invest in bonds with respect to investing in equity or vice versa. As you can imagine, what we can expect, this ratio is almost always lower or higher than 1? Is the equity market riskier or safer than the bond market? At least, I expect that the variability of the equity will be higher than the variability of the bond. So this ratio will be almost always higher than one (relative o^11 ratio). I will apply it to the country premium, so I will increase the country premium on the basis of the additional risk of the equity market, local equity market versus the local bond market. This approach can be done almost always. You have to collect more data, but you can apply it. These are the three alternates that you have in front of you for computing the historically premium. Theoretically - Default spread + Relative standard deviation is the best choice. More completed Relative standard deviation is the second best Country bond spread is the lesser coherent approach, and so the last choice for you. 4. Forward looking premium The forward looking premium is computed by considering the trend of the stock market index and the return expected by owning the market portfolio. The starting assumption is that we are not computing at the risk premium by looking at the historical data, but we try to extract the risk premium by looking at the current market price. Essentially what we have to do is to consider the stock market index for our market and try to use this information for computing what is the implied risk premium currently requested by the market So the difference is that before we were studying about the historical data and we were trying to analyze what was the time horizon for the historical data, here we are trying to have an updated information about the risk premium currently requested by the market. Let's look at this formula. Is a formula discounted cash flow, for an unlimited time horizon Yeah. What is written is: - - your initial investment time 0 is equal to the sum of cash flows that you obtain from one to end discounted, in actual value, plus this normally called the terminal value (F_n(1+r_f)) in time N, that you can achieve for investing in that type of project. The terminal value could be the liquidation value or a selling price. o The liquidation value if the investment is no longer useful, so no one will buy it. o The selling price if there is still a market for selling the investment in the market. This terminal value is discounted at time zero, and this terminal value is considering all the remaining cash flows that you obtain from the investment strategy. We have to try to adjust this formula that we already know on the topic of our lecture, so on how to measure the implied risk premium. How to measure the implied risk premium is doing what? How much is requested by the market? As a risk premium for investing in riskier assets? In order to do it, you have to consider not one investment, but the investment in the stock market and try to use this information for extracting the risk premium. If you want to buy a stock market, what is the best proxy that you can find in the market that is representative of the stock market trend? - If you are investing in US. How you can have an idea about the return that you can achieve by investing in the stock market in US? What you will look for? o Stock market index. That could be, for example, as your colleagues said, the standard input 500. So if I want to understand what is the return of the US stock market, I will check what is the performance of an index standard input 500, Russell, willshare, whatever you want. Let's say standard put 500. o if you want to understand how much you earn by investing in the standard and poor 500. What you had to know for each company listed in the stock market? You can have a capital gain, but you will obtain the return on what you said them, but before selling them or what you can obtain dividends and the results and other type of remuneration less common that is called the buyback. Dividends are the dividend paid by share for all the owners of the shares. All the shareholders of the company. So I will pay €1.00 to all the shareholders on my company for the current year or 2€, €3.00 and so on. The buyback is the opportunity given by the company to sell back the shares to the company at a price higher than the market. So the current price is 100 and if you want you can sell back me the shares at 101 or 102. The gap between the current price and the selling price is the return that you are achieving because if I sell on the market, I will earn only 100. If I sell to the company will earn 102 for each share. This is called buyback. You need to understand what is the return that you can achieve by investing in the US stock market. You have to know what is the dividend yield and the the buyback return (DY% + BB%) - These are the type of remuneration that you can receive by the company if they have something that can pay to the shareholders. At the end of the period, the one you want to exit from investing in the market, what you can try to do?If you want to exit, what you can do as share holder? You cannot ask for a refounding to the company. You have only to sell the share. So, you need to understand is what will be the selling price at the end of the period at time “n” for selling your shares. This is the format that you can have for computing all the cash flows for your project. What is only missed is the growth rate of the payments in the limited time horizon. If you want to compute the forward risk premium, normally you assume that the growth rate is exactly equal to the risk free rate. Why? Because you want to be conservative in the estimation of the growth rate and the company, in order to survive in the market, has to grow at least the minimum return requested by the market. The minimum return is the risk free. So, this is the most conservative hypotesis that you can do for the growth rate. If for you use this formula (F_0) you can extract the return requested by the market and you can compute the forward-looking risk premium. Forward-looking risk premium is the “r” that you compute from this formula minus the risk free. Is the return requested by the market for investing in the market minus the risk free. Let's make a simple example (EXCEL) For markets that cannot be consider mature the approaches for computing the market risk premium are the same used for the historical risk premium. If you are evaluating a country in which you cannot trust the market data, you can use the same approach that we discussed before (with the historical risk premium approach). In formulas: - Country bond default spread If we don’t like this approach because the bond market is not coparable with stock market, we can go to the other alternative. - Relative standard deviation BMK equity = benchmark equity ERP^flbmk = forward-looking risk premium - Default spread + relative standard deviation These are exactly the same formula, but what is changing is that we are not starting from the historical risk premium. We're starting from the forward-looking risk premium (ERP^flbmk). 5. Conclusion The risk premium estimate could be based on the survey, historical data or implied market data and each solution may bring to different estimates about the additional return requested for risky investments. The choice of alternative approaches for computing the risk premium is done by considering: - Predictive power Belief about the markets Purpose of the analysis The market risk premium may be affected by the degree of diversification of the company and so it can be customized on the basis of the international revenue exposure by using the following formulas: Chapter 4 pp. 93-108 LESSON 5 – RISK PARAMETERS 1. Introduction The expected return for an investment opportunity has to be computed b considering: In the simpler scenario: The measurement of the expected return requires: - Risk free rate Risk premium Risk parameters These parameters, so the beta and try to identify for the risk parameter what are the main characteristics of the company that may affect it. So what are the choices in the business strategy in the cost structure, in the type of activities that may matter for the beat of the company. 2. Historical market Betas For firms that have been publicly traded for a length of time, it is relatively straightforward to estimate returns that an investor would have made investing in its equity Where 𝛼 is the intercept and 𝛽 is the slope and fitness of the regression (R^2) tells you how much of the risk of the investment is coming from the market. We will talk about how to adjust the historical market beta by considering the fundamental of the company. Thise fundamental betas are the adjustments necessary for adapting the historical beta to the characteristics of the company. In order to measure the B we need only to consider some information related to the performance of the share: historical performance of the share, historical performance of the market. And once we have them, we have only to apply a formula that is available on Excel that allow us to measure this beta. We don't need to know in detail how it's measured. What we need to know is that we have a formula in Excel that is called “slop”e that will tell us directly what is the B of the company. So essentially for computing it what you need is a simple series of data. Chapter 4 pp. 93-108 What else you will obtain is that the linear regression will allow you to have also a proxy of the quality of the regression model, so the statistical fitness of the regression model that is this square that goes from zero to one they agreed is the better. It doesn't matter. We will focus only on the slope and we will use only the simple formula on Excel that I just showed you. That is our proxy of the B of the company. To set up the standard process for estimating the beta in the CAPM, let us revisit the equation it provides for the expected return The intercept 𝛼 has to be compared to the predicted intercept in the CAPM equation When we talk about the beta. Why is it relevant to have this beta? Because this beta is used for computing one proxy that is called the Jensen Alpha. What is this proxy called the Jensen Alpha? Is a proxy that is measuring the overperformance of the share with respect to the expected return. So is the overperformance with respect to our forecast on the return. The higher is the Jensen Alpha, the better it is the performance of the share. This Jensen, when you do it, you have to consider the return obtained by the share minus the expected return obtained by the share. What is the expected return of the obtained by the share? The R rate that we are studying the since the last week, so this formula over there “E(R_i) —> (simple scenario)” So we have to compute day by day, week by week, month by month how much we are earning more with respect to these expected return. Thise Jensen Alpha is telling you how much you are earning more than the forecast. We say the the higher it is the better it is, and is related to the beta. How is related to the beta? simple algebra over there, showing that the Jensen Alpha can be rewritten as the intercept of a linear regression minus 1 minus, beta multiply for the risk free. So what I have done here is the: return of the shared that is completed by using a simple regression model minus the “r” rate that we have introduced since the last week. If you made some algebra over there, what you would find at the end is that the Jensen Alpha is only: Alpha minus one minus beta multiplied for the risk free “a-(1-b)*r_f” What is telling us is that the Jensen Alpha is maximized the when the risk free is lower. Chapter 4 pp. 93-108 Normally, if this lower this better for the Jensen Alpha because this is multiply for minus something, so the sign of this relationship will be minus something and so, the lower is the risk free the higer will be the Johnson Alpha. Why? Because when we talk about the risk free is the minimum return requested for a risk free asset and the higher is this value the lower is the probability to beat the market (be able to achive something higher than the market). If it’s lower it's easier to achieve something higher than the expected return. Talking about the beta.So what is the impact of the beta on the Jensen Alpha? The greather is the beta, the higher has to be the Jensen Alpha for the investment opportunity. Remember, the beta is our risk parameter. If the risk of the investment is higher, we can expect that the performance and so, the Jensen Alpha, has to be higher because otherwise the investment will be never worthy. No one will start the project because there is not a risk return trade off that is convenient for the investor. So this is how to link the beta with this proxy of active performance: the Jensen Alpha, that we have to consider for every investment opportunity. The more the Jensen Alpha is higher, the higher will be the beta. So if you want to achieve a better performance, you have to assume a higher risk. The historical return beta computation requires to make the following choices - Time horizon Frequency Market proxy What is important is that you, as an evaluator of the investment opportunity, so you as an analyst that is trying to identify the best investment opportunity in the market, you have to select the data that are used for computing the slope. What does it mean? Have to select four how many weeks, years, months. You will analyze the share and the market. You have to consider only daily data or weekly data or annual data and so on. And finally you have to identify what is the most reasonable proxy that you can use for the market. OK, so we have seen that he's a simple formula, but there are some assumption behind the assumption. Are the time horizon, the frequency and the market proxy selection. 2.1. Time horizon The choice of the time horizon is significantly affected by the availability of data but for investment opportunities with long history the analyst has to consider the following trade-off. ● ● Short time horizon: Updated but limited data set for the analysis Long time horizon: Longer data set under the assumption of no change in the company Let's start with the time horizon. Talking about the time horizon, essentially what we have to consider is that we have a trade off in the choice of the time horizon, for our analysis. If we select the short time horizon, so let's say a couple of months or 10 weeks and so on now, this time horizon is the most updated one. So you have a picture, you have a a description of the company that is the most updated one. But if you do so, the number of observation that you may call letter is limited. Chapter 4 pp. 93-108 So if you want to have an updated picture of the company, the trade off for you is that the data that you have are not too many and so probably you can be worried about the quality of your beta estimation on the basis of the Excel data. On the opposite, if we consider a long term horizon, so let's say the last four years, the last 10 years and so on, you have a wide set of information that you can use so you don't have a problem in applying the formula in Excel, but you are evaluating a company assuming that in the time horizon that you are studying at the companies, not changing at all. Saying that the company is not changing at all in five years or 10 years, maybe not reasonable. Maybe not realistic and so maybe a bias or a mistake that you are doing in your evaluation of the share. So the trade off that you have to go see there is a how many data you want to collect and how much you want to consider as a time horizon, in which the company is not changing at all. The choice is among these two uh elements, so the shorter versus the long term horizon has to be done consistently with the frequency of the data. You know that for considering one week, you can consider one observation by day, one observation by hour, one observation by transaction. And as you can imagine, if I consider one observation by day, I have only five observation -because there are some off days in the stock market-, so five days of observation that I can use and probably they are not too much, not not sufficient for your analysis. If you want to analyze hour by hour data, probably you can reach more than 50 observation and so probably you can use this data for your analysis. If you use a tick by tick observation so transaction by transaction observation, even one day you can collect more than several thousand of observations. So probably they will be always enough for your analysis. So the choice of the time horizon has to be done jointly with the frequency of the data. 2.2. Frequency Data may be available with different level of frequency and the selection of the return interval depend on the trade-off between noise and number of observations. Chapter 4 pp. 93-108 The frequency of the data here you have only some example. These are the transaction by transaction data tick by tick. These are the hour by hour data that you can collect in the stock market and after you have a one observation by day, one observation by week and one observation by month. In order to have a sample that is useful for your analysis, you have to be worried about what is happening if I'm selecting a tick by tick data, what is happening if I'm selecting a hour by hour data and so on. Tick by tick Let's think about the tick by tick data (transaction by transaction data). We say that if we use this approach theoreticaly in one day, we have enough observation for every type of analysis. But if we analyze tick by tick transaction, probably what can happen is that the information that we are collecting is affected by noise that we cannot manage. Because you will have a big investment bank that is submitting an order during the day, everyone is following them. And so at the end what you will see is that the observation related near to the transaction or the big player will be totally different than the observation in the remaining of the day. So, what will happen is that every time you have a big players investment banks that are trading the share, they will affect significantly the tick by tick data and so you cannot trust in a market about the tick by tick data because you don't know when the institution investors will submit an order or buying or selling a share and how much these order will affect the stock market. Hourly The idea of considering our by our data in the stock market is affected by another issue that always matter in the financial markets. When we talk about the financial markets, they are not open 24 hours by day, but they have some opening hours during the day. From 9:00 in the morning, up to three or four in the afternoon, you can trade in the stock market. What will happen is that if you consider this time horizon due to the fact that there are some closing hours, the starting our and the closing hour of the training day are the ones in which you have at the higher number of orders submitted for buying or selling shares. Think about: if I have an exposure with respect to a share and I don't know what will happen in the future, what will happen next day, what I will do always is to close the transaction before the end of the day, in different words, I will reopen the transaction in the beginning of the next day because I don't want to be exposed to the share when I cannot react with an order. So do the fact that I have a closing hours, all the tradings are mainly concentrated at the beginning of the day or at the end of the day, because everyone wants to avoid the risk of having an exposure without being able to react to new information. If this is true, essentially by considering our by our data, I will have some hours that doesn't matter at all because there are no transaction. So there are what's in the middle of the day and some hours in which I have a lot of transaction. As you can imagine by mixing them, the result that I will obtain for my slope is totally wrong or totally exposed to mistakes. So again, this approach cannot be used forever within the beta. Chapter 4 pp. 93-108 Daily If we consider the daily data, we have a problem that is quite similar to the problem that we are just described on the on the hour by hour data, because the stock market is not only not working for 24 hours, but it's also not working seven days by week. You have some closing days, so Saturday and Sunday for the European countries, in which you cannot trade in the financial market. Again, what will happen is that on Friday you will close the position and on Monday you will open it again. So by considering it daily data you will have a three days in which the number of transactions are not too many: Tuesday, Wednesday and Thursday, and two days in which you have a almost all the transaction that are Monday and Friday. So again, if you mix these data for computing your slope probably you can make a mistake. What is the remaining for us? Are only these two solutions that are the weekly and monthly solution that you may use for computing your slope for computing your proxy or beta. Weekly and Monthly In order to select a between a weekly and monthly, we have to consider jointly the choice of the frequency with the choice of the time horizon. So, now in order to select which one is better, weekly or monthly, we have to consider what is the impact of the frequency choice on the time horizon. In order to have our slope, there can be computed on the basis of the data, you have to collect at least 100 observation. Happen so because there is something related to statistics that doesn't matter too much for us now that tells us that in order to have a reasonable estimator of the slope, we have to collect around 100 observation, OK. If if this is true, if we select a weekly data, how many years we have to consider? 2 years. In two years we have 104 observation that we can collect by using weekly data. If we want to analyze the monthly data, how many years we have to consider? You know more than eight years. Now what do you think about? Is it reasonable to assume that the company cannot change and is always the same in more than 8 years? I don't think so, because normally in 80 years, but even in five years you will have a change in the market, changing in the demand, and so changing the company that you have to consider. Is it a reasonable to consider that in a couple of years the company may be still the same? Probably can happen, not always, but probably can happen. So, our approach will be mainly to consider the weekly data on the two year time horizon because in that way we can assume that the company is not changing in the estimation period. Remember, it's not true for every company, but it may be true for a lot of companies that you are evaluating. For example, if you did an m&a llast year, you are not able to collect at the weekly data for estimating your slope because since last year you are a different company and so you cannot Chapter 4 pp. 93-108 use the current date of the last year with the the the data of before the m&a and mix them for your slope computation. But if you are lucky and the company is not changing too much, you can say that in a couple of years the company still the same. 2.3. Market proxy Now what we have to do is to consider what is our market proxy and how we can select it for measuring our slope. What is our market proxy? the market proxy that we are considering is normally an index that is already available in the financial markets. It could be the standard and poor 500. It could be the SNP need for the Italian market, it could be the kak for the French market. So you have a market index that you may select for measuring the return of the market. What can happen is that in some markets you don't have only one benchmark, but you can have several ones. And among them, you have to select which one is the best for your analysis. Think about the US market. You know for sure the S&P 500, you know for sure the Dow Jones. But there are also some other index, not so well known, like the Russell or like they were Shire that are indexes on the stock market that theoretically you can use. What we are to identify now is a set of criteria that you may adopt when you have multiple indexes, in order to select them in order to select the best proxy for you. The choice of the market proxy has to consider the main features of the market indexes available. ● ● ● ● Small vs. Large Equally weighted vs Value weighted Local vs International Sector vs Diversified Normally you have to consider the size of the index. You have to consider the weighting criteria. You have to consider the focus on a geographical area and you have to consider the focus on a sector or a type of activity. And on the basis of this issue, you can select one index with respect to another. Size of the index: small vs large For the size of the index, essentially you can have the S&P 500 which is composed by around 500 every week is changing, could be 504 for 499, but it's around 500. The Dow Jones is composed by what? Composed by 30 shares. 500 versus 30. The “weshare” is considering a 5000 shares. There are series considering a 10,000 shares. Now we have to identify what is our treasured to say that in order to say if the index is big enough or if the index is too small. What is a showed, in order to on the literature about the selection of the index, is that in order to be a representative index for a stock market, you have to include the from 30 to 50 shares at least. So in order to be a benchmark that is a representative, you have to consider from 30 to 50 shares in the index. Chapter 4 pp. 93-108 30 shares when we are talking about our market that is developed with a lot of transaction done in the market, at least 50 when we're talking about a market that is less liquid, less efficient and so, probably we need to consider more shares in order to be sure that the index is working. So, this is the first treasure that we had to apply, at least the 30 or 50 shares for our analysis. US is normally a market considered a developing market, so theoretically, even the Dow Jones that is including only 30 shares could be a good proxy of the index for your market. So this is a treasure 30 to 50 and all the indexes that I have just proposed, you are respecting this treasures, OK. Equially weighted vs Value weighted Once we have analyzed how many shares are in the index, the next step is to consider how these shares are considered in the index. Essentially you have a 2 alternative approaches that may be used for constructing the index. One approach is the simpler one, and it this approach what you do is to consider that each other as the same weight in your index. So if you have a 50 shares, each of them has a weight of 1 divided 50. If you have 100 shares, each share has a weight of 1 divided 100. These are equally weighted approach. When we talk about equally totally approach we are talking about weights that are 1 divided N for all the shares. An alternative approach that you may use is the approaching which you consider as weight, not the same weight for every share, but you try to assign a different weight to each share on the basis of the relevance of the company, in the stock market. How is measured the relevance of the company in the stock market? is measured by considering the market value of the company divided for the sum of all the market values of the companies that you have in your sample (so this is the sum of from one to end of all the market values in your sample). What is the market value of a company? Is The value of the shares that are treading in the market, so the number of shares outstanding multiply for the price of the shares that you are evaluating. So if I have 1000 share and each of them is evaluated 10, my market value is 1000 multiply ro410 so €10,000 as market value of my company. Yeah, you were computing a ratio which should we compare the market value of each company with the overall market value of all the companies that are in the index. This ratio is composed by the market value of the company divided for the sum of all the market values of all the companies in my sample. (MV/sum(MV) - So these ratios by definition going from 0 to 1. The larger is the company the higher would be this weight. The smaller is the company the near will be the way to 0 because it's not the most relevant one. OK. Chapter 4 pp. 93-108 So these are the two approaches, the equally weighted the versus the value weighted. Now the question is, what do you think about which solution we had to prefer? So for example, if you look at the US market and you look at the fungal? companies, so Facebook, Google, Amazon, Microsoft and so on, these companies are driving the market. When you see that this company are increasing their performance, normally all the US market will follow because they are the benchmark for the investment opportunity of all the players in that market. If we consider the value waited, we are considering that each share has a different role in the financial market. Some of them are more relevant like the fungal companies, some others are less relevant because they are not so interesting, not so requested by the market. So if we can normally we have to select always a value weighted index instead of equally weighted once. - The standard input 500 is a value weighted index. The Dow Jones is a equally weighted one. So if we want to analyze US, we have two indexes that are respecting the minimum threshold, but only one of them is a value weighted one, and so our proxy for the financial market will be the standard and poor 500, OK. Local vs International What else we can do is to consider indexes that are based only on one Financial market or indexes that are looking at the multiple markets worldwide, and so are representative of the trend on the financial markets in several countries. Let's go back to the standard and poor, we have the standard and poor 500 that is focused on the New York Stock Exchange. So it's representative only of the US. But we can have also another index that is called the standard and poor global that is considering the New York Stock Exchange, the European markets, and also the Southern American ones. This index are has to be preferred or not with respect to the local one? Is always a very with it one and he's always considering more than several hundred of shares, so it's respecting all the criteria that we have just described over there. So if you are considering the standard and poor 500 versus standard and poor global on the visual, we will select global index. Remember that we are selecting an ardor rate that is relevant for us in order to identify what is the return that we had to receive from the investment at least. Because the ardor rate is the minimum return requested for an investment. This ardor rate has to be computed, not on the basis of the type of project that you are financing, has to be computed on the basis of where you collect money for financing the project. Because you can invest in Russia by collecting money in Russia and so, you have to consider the global index because it's discounting also the effect of the russian crisis. But if you are investing in Russia by collecting money in US, what matters for you is the minimal return requested by US investors. So, your proxy has to be the standard and poor 500 and not the standard and poor global. So what matters for you is how you are collecting money for selecting an investment opportunity (on the basis if you will select the global versus the local Chapter 4 pp. 93-108 index and every company may do a different choice on the basis of the founding strategy adopted). Sector vs diversified The last aspect that we have to consider is how to select the index if we have a different indexes: some of them are considering a companies coming from every sector so, diversified index, and some others are considering companies that are coming only from one sector of activity. Let's make an example always focusing on the standard and Poor's. We say that we have the standard poor 500, that is a large index value weighted focused on US. That is providing you an overview about the performance of every companies -the top 500 companies in the New York Stock Exchange-. The same provider of data, so always standard and poor, it's also offering you the possibility to have specialized index. So, for example, you can have the standard and Poor's energy. The standard and poor energy is the standard and poor index that is analyzing only the companies among the 500 that are working in the energy sector. Every type of activity related to energy sector, they are like 60 or 70 companies. Is always an very weighted indexes, so it works for us, and let's assume that we are doing an investment only US or collecting money only from US. On the visual, what I have to select the energy index versus the the diversified one? (the example of energy is not a random example, but is an example that nowadays matters). - - - - Think about we are identifying with the minimum return requested for an investment. If we are doing an investment in the energy sector, nowadays, the return requested by the shareholders by the investors will be significantly higher than a few months ago. So if we are investing in the energy sector, we cannot look at the standard put 500 because we will underestimate the return requested by the investors because the investors knows that nowadays the price of the energy is 10-20 times with respect to some months ago. And so they want an either return. So every time we have an investment focused in an area and we assume that this area matters for the investor point of view, we have to consider this type of return, the sectoral one, instead of the diversified one because it's a better proxy of what is requested by the financial markets. If instead of considering the investment in energy, we think about investment in newspapers or information and so on. Nowadays there is not a difference between the return of this sector with respect to the average return. Because goes nowadays there is no reason for expecting an higher or a lower return for the company that are offering a newspaper service with respect to all the others. So if your sector is not as specific one, probably is better to go for a diversified and less specialized index. So every time you're doing the evaluation, you have to consider if your project is in an area that is currently an area that matters for the investors and may affect the return requested. If it's not, you go for the diversified index. If it's true, so if there is something that justify the focus on this area, you will look for the sectoral indexing if you can found it. Chapter 4 pp. 93-108 What you have is a set of a couple of companies. One is Dell and the other is British Petroleum. Here you have, if you don't know the description of Dell and the description of British Petroleum. Essentially Dell is producing computers, laptops and it's selling them worldwide, while British Petroleum is a multinational company that is working in the oil and gas. What we will have is a surveyor mentimeter in which I will ask you to identify for these companies, what is the best proxy, the best market proxy that you can found in the list provided. So you got the Dow Jones, the standard and poor 500 (S&P 500), the FTSE 100, the standard and poor global, and the CAC 40. - Dow Jones: the 30 top companies in US S&P 500: the 500 top companies in US FTSE 100: this is the European index with the top 100 companies in Europe S&P Global: is considering the America's plus, the European something in Asia CAC 40 is the index for the French market, the Top 40 companies in the French market. Which market index you will select for evaluating DELL? - - - - OK, let's describe the index, and let's try to understand how to arrive to the selection of the index. First of all, we say that we have to consider the number of companies that that are in the index. You know Dow Jones, I told you that he's only 30 shares; CAC 40 is a 40 Shares; S&P Global is is several 100 shares; stand and poor 500 is around 500 shares; and the FTSE 100 is around 100 shares. So the only index that may be a problem for the size of the index, for the number of companies that maybe the CAC 40. Because of French is a developing market but is not a liquid with market. So probably leaving only 40 companies could be not the best choice. Talking about the second criteria, so equally versus value weighted index all the index that you have over there excluding in the Dow Jones are they weighted index. So theoretically, the optional Dow Jones says to be excluded because it's considering a equally weighted index instead of a value weighted one. Talking about Dell is mainly a U.S. company that is collecting money mainly from US. Chapter 4 pp. 93-108 - So if this is the scenario, doesn't matter to look at the global market and it doesn't matter to look at the European market with the FTSE 100. The bus choice will be the standard and poor 500. Which market index index you will select for evaluation BP? - - Now the choice that you have done no is mainly between this the FTSE 100 and the standard and poor global. Let's try to understand why. First of all, British Petroleum is a company based in UK but is a multinational company. You can say that Dow Jones and CAC 40 are not approximate may be relevant for you, because they are focused on a small sample, one US and one in France Almost the same for standard and poor 500 because it's a large index, but always based on US. And you are talking about a UK company. Between the S&P Global and the FTSE 100, what you have to consider is where the companies collecting money. This company is a multinational company and is not collecting money only from UK is collecting money on a worldwide basis, but it's collecting a lot of money also from US. So the best proxy here will be not the index focused on Europa, but will be the index and the wider index that is considering the global scenario. What you have to understand is that among them, the choice is only based on where the companies raising more money. OK, you don't have the information that is telling you that the money is coming only from European investors and due to the size of the company, you can expect that some investor will come from Asia, from US and so on. So the S&P Global index will be the best proxy for your company where there. Historical market Betas The historical beta could be too much volatile and normally data providers compute also an adjusted beta Before going to the adjustments of the historical data that is the issue related to the value of the beta. So here you have a formula that type to explain you something that is relevant for every company that you are analyzing. When we are analyzing a company, remember we select a time period, we select the frequency of the data and on the basis of this choice, we will point out that the beat of the company and there's a bit of that is evaluating almost only the last two years of history of the company and probably may change in the future. So every time you change the estimation window, you will have a change in the beta. When you are applying these beta for computing at the ardor rate, normally you can adopt a safer approach for estimating the beta in order to consider that you may do a mistake in selecting a the estimation window because you can start today and go back two years before or you can start one month ago and go back for two years from one month ago. If you change the estimation window, you will see that the beta will change. Chapter 4 pp. 93-108 In order to avoid to make huge mistakes in estimating the beta, normally instead of using the beta we use this formula over there that is called adjusted beta. These adjusted beta is what is an average of the beta that we have estimated before with the slope function in Excel plus the beta that is characterizing the market. If we do a regression of the market index versus itself (so versus the same market indexer) what will be the result of the slope? How they behave? They behave the same, and so there's global will be equal to 1. Because every time I have an increase in the return of the index, I will have the same increase in the same index by definition. So what we are doing over there is, instead of using the beta as computed by Excel, try to adjust it by considering that all the shares as to behave, if they are in the same market, has to behave in the similar way, so has to behave like the market. Normally this adjustment is done by considering the two divided 3 multiply for the beta for the slope, computing in Excel plus one divided 3 multiplied for the bit of the market, so multiply for one. The assumption behind this formula is that every share is linked with the average of the market, so the behavior cannot be too much different with respect to the behavior of the market. How we can do it? by applying this formula. These weights 2 divided 3 and 1 divided three are computed on the basis of some empirical evidence already available in the literature. And that you can trust that these weights are quite good for our analysis. So we will not go in detail why we have two divided 3 instead of having 3 divided 5 or 3 divided 4. Let's assume that these weights are consistent with the market. Over time each company adjust to the market risk 3. Fundamental Betas The beta for a firm may be estimated from a regression, but it is determined by fundamental decisions that the firm has made. The beta of a firm is determined by three variables: - Type of business Operating leverage Financial leverage These are called the fundamental betas. Fundamental betas are related to some of the choices made by the company that may affect these risk proxy. The main issue that you have to consider are related to: - The type of business: where you are investing Operating leverage: cost structure Financial leverage: financial strucutre Each of these items may have an effect on the beat of the company 3.1. Type of business The more sensitive a business is to market conditions, the higher its beta. Thus, other things remaining equal, cyclical firms can be expected to have higher betas than noncyclical firms. Business solutions for reducing such type of risk are: - Costumer behaviour Chapter 4 pp. 93-108 - Brand loyalty How the market is a competitive, how much the market is competitive,m and how the company is able to be a leader or a follower in that market. Let's start with the competition. The competition is related to the customer behavior. So how the customer is selecting the supplier for a good. Think about if you are selling pizza: normally, your market in Rome, your market is focused on all the buyers that you can have in Rome for pizza delivery or you have to consider only those that will come to your shop and will eat in your shop. If we want to analyze our customer base, on the basis of what we can select our customer base and we can identify the number of potential customers that we have (and how much we can trust them)? Geographical area. First of all, we have to consider a how much time does it take for the customer to have your service in your shop or with the delivery. In your shop, probably I can go by car, but I don't want to spend more than one hour, in order to reach our place in which I want to have dinner. So, probably, in a distance of more than one hour from the shop, there is no longer a demand for eating in my shop. No one will come. And that's a reasonable time horizon. Sometimes it's even shorter the time I want to spend in order to reach the the shop. If I want to take care about the delivery, I have a technical constraint about how much time does it take in order to do the delivery. If again, you are far away or more than one hour or even more than 30 minutes from the shop, probably you cannot serve this customer because when you will arrive everything is cold and they will complain about the quality of the food. So, in order to identify your customer base and you have to have an idea about how much time the customer wants to spend, in order to receive the good from you. And that's the main proxy that you will consider for identify your customer and the target of customer for your company. Normally on the visual the type of food that you are selling, you will have a stricter constraint on the distance or you will not have a distance constraint. For example, if you are selling mobile phones, there is no cost time for you, because you use a delivery and you can send it in a couple of days everywhere. Even in a different country, you can sell it, send it when it's requested. So on the basis of the type of the good that you will have a different constraint on selecting your customer. Brand Loyalty What else is important is how you can be sure that the customer will come again and will buy again from you. This called the brand loyalty. Let's go back again to the example of a food. Every one of us is using I think so, TripAdvisor, and other using a probably the fork. What is it? These are not that you have on the mobile phone that for all the restaurants that are in TripAdvisor, if there are, it will show some special offer for a discount. So 30%, 20% up to 50% during this summer if you want to eat in some days in that type of restaurant or that type of pizzeria. Chapter 4 pp. 93-108 What matters for you is how much you have to take care about at the discount policy in order to be sure that the customer will come again and how much you can take care less and so you can be sure that the customer will always come. If you choose the fork, during the summer, you will have several small shops or smaller restaurant or small pizzeria that will offer you a discount of 50%, because otherwise there will be empty. You will have some other restaurants that even during the summer, even in September, whenever you want that they will never apply you a discount. Why? Because they know that they have a corridor the food or a type of food experience they are offering that is quite unique and so they don't need to apply discount. Every time you can be sure that you have a brand loyalty so you don't care about the discount policy, you can be sure that your estimation of beta will be always the same over time. Every time you have to take care about the discount policy or the competitors and you have to adapt to them. So you have to follow them in order to avoid the risk of being out of the market. If you have such type of events you cannot trust about the historical estimate of the beta, because the market condition are changing day by day for you. So normally the higher is the number of customers that you have and the higher the loyalty to of these customers, the more you can trust the historical beta. If you don't have too many customers, or if you don't have too many loyal customers, the less you have to trust in the story would be that we have described before because every week or every day the market is changing and what we have estimated yesterday is no longer useful for you. 3.2. Operating leverage The degree of operating leverage is a function of the cost structure of a firm and is usually defined in terms of the relationship between fixed costs and total costs. Business solutions for reducing such type of risk are: - Labour Sub-contracting Joint venture What that's matters is how you are identifying your cost structure in the company. You know that when we talk about cost structure, what matters for you is the role or the relevance of fixed cost versus variable ones. Fixed cost is a cost that will be always the same, independently with respect to the volume of sales. So I cannot adapt to do the volume of sales. If the sales are like the last year, probably the cost is sustainable, if the sales are even less, probably the cost would be not no longer sustainable for the company because the cost is not adapted to the volume of sales. Chapter 4 pp. 93-108 The variable cost on the opposite. The costs that are related to the unit of sales, and so they will go exactly like the revenues. As you can imagine, what matters the most for us in evaluating the risk of the company, and so the role of the beta, is the role of the fixed cost among overall cost. The more you have fixed cost, among over costs, the probably your estimate of the beta could be wrong. Because again, the market is changing over time and you cannot adapt your cost structure to the new market. So every time you have a lot of fixed cost, you can be worried about the relevance of these beta and how you are computing this beta. Here you have some business solution that you can consider in order to modify your exposure to fixed cost in order to have an an estimate of the historical beta that will be also consistant for the future. What you have to consider is how you have structured your cost of Labor, how you have structured if you are structured any subcontracting cost and if you are able or not to be a member of a joint venture. Labour Normally, if we consider that developing economies, not so market oriented, so we excluded the UK, we excluded the US essentially the labor cost is mainly a fixed cost for the company.So the more you have employees, the more you will have fixed the cost. So the less you can trust the historical beta that we have estimated. In UK, in USA, in some other countries worldwide, what they are trying to do is try to increase the percentage of variable wage paid to your employees with respect to the fixed one. So they are transforming the wage into a variable cost by applying a premium incentives and so on, that will change on the basis of the revenues. If you are able to apply this approach. So if you are able to change the wage scheme for your employees, probably you can reduce the fixed cost. And so probably you can trust more they estimate of the beta that we are done before. Sub-contracting Another approach that you can do is for example, is quite common in the real estate sector. In the real estate sector, a lot of companies are working with the subcontracting. What does it mean? You have one company that is assigning a contract for doing a job in the real estate for building a new house, for building a new office,etc.but every activity is not done by the employees of the company. This is offered with a contractor to other companies that are working in this project. So every time you have a project you have new companies for each of the activity related to the project. In this way, what you are doing is reduce the minimum the number of employees, reduce at the minimum at the fixed cost related to the employees and try to have the cost of the employees, the people that have to work in the project, only once you assign the agreement for the big project. So essentially you expect to receive revenues, or a contractor that will ensure you revenues, and once you have the revenues you will set the constructural the cost structure of your company. In some sectors like real stage are quite common. Chapter 4 pp. 93-108 Join Venture Firms create a common unit, so the idea is that you have normally small companies or medium companies, not large ones, that will decide to make an agreement for doing some activities together. In this way what you can do is that you can construct your company with the minimum number of employees, those that you are sure will always work also in the future even if the revenues will go down, and the try to identify our partner for a joint venture only when you have a big project that you cannot afford only with your employees. So instead of hiring new employees in your company, you will create an agreement without another existing company for managing the big project. Once the project is ended, the joint venture will end and that's it Every time for example, you are applying for a project from a public administration that is requiring you to have a minimum size of the company, you can apply as a company or as a joint venture. If a day minimum constraint of the size of the company is too wide for you, so you cannot apply by your own, you create a join venture and you can apply as a joint venture. 3.3. Financial leverage An increase in financial leverage will increase the equity beta of a firm. Intuitively, we would expect that the fixed interest payments on debt to increase earnings per share in good times and to push it down in bad. Business solutions for reducing such type of risk are: - Maturity Guarantees Taxes Last aspect that we have to consider is that every time we have a company, we have also financial structure so we can collect money from that And this choice will have an impact for the risk of the company. Maturity What does it mean that this choice would have an impact for the risk of the company? First of all, the debt will have a maturity, that is the expiration date of the data. And by the maturity they provide, the investment project has to be ended or has to be able to produce enough money for the refunding. If the project is not working properly, so it's not producing enough return for the refunded the debt, the companies exposed to a risk of bankruptcy.So saying differently, when we borrow money, we are creating a a fixed cost for the company. They fixed financial cost. o sis that an additional special cost that we will always have for our company. Chapter 4 pp. 93-108 Guarantees What else is important is that every time we ask for money from a bank, from a financial institution more generally, they will ask for guarantees and these guarantees may matter because the guarantee will be used only for this loan and cannot be used for something else. And we had to protect these guarantee until the loan expires. For example, if you borrow money you offer as a guarantee, a building, you have to be sure that the building is in place until the loan expires. If there is an earthquake, or if there is any event that destroyed the building, theoretically the bank can ask back the money fully immediately (because the guarantee is no longer available and so the contract is cancelled by definition). Taxes Last aspect that when we borrow money, we have to take care about the financial effect of borrowing money. Every time you borrow money, remember that the interest paid are fully deductible from taxes. So real cost of borrowing money for you is not the interest rate applied by the company, but is the interest rate applied by the bank net with respect to the tax advantage that you will receive. Normally is called the tax shield. Every euro that you pay as interest can be deducted from the taxable income. So you will pay lower taxes if you borrow more money. This aspect masters because these reduction of the cost for the company matters for computing what is the constraint that you have in terms of minimum return. Is not like the return requested by the bank, but the return requested by the bank minus the tax sheet that you obtain. So it's not so high what you had to receive as return. Fundamental beta computation a. b. c. d. Identify the businesses Identify competitors for each business Compute unlevered weighted average Lever up using the firm debt/equity ratio OK, so the idea is that when we are computing the fundamental beta and we are trying to measure the fundamental beta because we know that the number of customer is not enough, we know that the customers are not so loyal, we know that we have a lot of fixed cost or we know that we have a lot of leverage (one of the items that we have described before), we hav to consider what is our business, we have to identify what are the competitors for our business and compute a levered weighted average of the beta of the competitors and adjust these unlevered weighted average of the bit of the competitors with respect to our debt equity ratio. That's the procedure for computing the fundamental beta, every time we have one of the issue that we're described before. This assumption on this approach is to say what: I want to have exactly the same beta of the competitors and that we use this information for my analysis. But this is not always the best approach that you can adopt. Chapter 4 pp. 93-108 Think about: if you are Apple. Are you sure that you are the same beta or would the companies that are working in the mobile phone production? Are you risky as them, or are you less risky or more risky? Probably you are less risky because you are a market leader, they can switch to Samsung against which to away, but it's not so frequent. So you have a lot of brand loyalty. You can have a lot of fixed cost, that's true. You can have a leverage, is almost true because it's not so levered at the company, but the you can have leverage. But when you are using this approach, you are saying that you want to be like the competitors. For not all the companies this approach could be reasonable. If you are a market leader, probably this approach is not working for you. Getting every time you are one of the players in the market, this approach may work for you and may be a good alternative with respect to this historical beta that we have described before. The fundamental beta is computed as follows: Where: ⋅ ⋅ ⋅ 𝛽𝑈 is the asset beta computed business and the operating leverage 𝐷/𝐸 is the leverage ratio of the company 𝑡 is the marginal tax rate by considering the Il the company has relevant amount of cash: Analyse the differences in the fundamental beta computed sector by sector for all the companies listed in the NYSE (excel) So the fundamental beta starts from the unlevered beta. It has to be adjusted for the leverage. how it has to be adjusted? it has to be adjusted for one plus depth divided equity that divided equity is the leverage. For each company, you compute the debt divided equity and for considering debt there is a tax advantage for using the debt. Instead of using the 100% of the debt, you use one percentage of depth that is 1 minus tax rate applied to the company. Tax rate could be the 40%, the 35%, the 50%. So instead of using the 100% of the debt, you will use only the 50%, the 60% of the 75%. Why you do so? Because we say that we have a a tax shield advantage for using debt inside the company, because we deduct interest from taxes. Chapter 4 pp. 93-108 You have an additional adjustment that you may do forever waiting a company, that is the cash adjustment. When you have cash, the company is more or less risky with respect to a company that is doing the same job but is without cash? So one is retaining cash, the other one is not retaining it. What is the return of cash investment for a company? The same business, the same type of activities that they are, both constructors for one company, you have a €10,000 in cash for the other, everything is already invested in buildings, which one is riskier? Cash. And more over when you invest in cash, what is the return of cash? How much you earn from your bank account if you retain cash? Zero or minus something because it normally apply also some fees and so you lose money. So if you have a lot of cash, probably the company that you have is not performing at its best for the future because you don't know how the company we use this money if it's able or not to use this money. So in order to consider it when you compute a beta cash adjusted, you divide the better leverage, o the one that we are computed with the historical data, for one minus cash divided firm value. Cash divided for firm values by definition goes to zero to 1. So 1 minus something from zero to one is something near to zero. You divide this stuff for something near to zero. It means that you multiply it for 2-3 or four or five. It depends on what is it. If this is at 0.20 – 1/ 0.20 is 5. If this is a 0.50, 1/ 0.5 is 2, so you are computing the new beta cash adjusted that will be something multiplied for beta, unlevered. And this something will be always something positive and higher than one. How much? I don't know. It depends on the race, this ratio, but it's something higher than one. Yeah, you have a simple Excel file that I will show you. 4. Accounting Betas A third approach is to estimate the beta of a firm or its equity from accounting earnings declared by the company on its balance sheet or intermediate report. Changes in earnings at a division or a firm, on a quarterly or annual basis, can be regressed against changes in earnings for the market, in the same periods, to arrive at an estimate of an “accounting beta” that measures the reaction of the company earnings to the overall market trend. Essentially, when we talk about accounting rules, what can happen is that you can have some options available in the tax rule for computing the income that has to be taxed year by year. OK, so these are options that your account that is considering for evaluation your company for writing your balance sheet and income statement talking about the this issue. What matters for us are the account smoothing, the accounting choices and the low frequency data. The approach has some intuitive appeal, but it suffers from three potential pitfalls: - Accounting smoothing Chapter 4 pp. 93-108 - Accounting choices Low frequency data Accounting smoothing Let's start with accounting smoothing. What does it mean? when you are talking about a company that is trying to minimize the impact of taxes, what is done by that count and it is always to postpone some revenues or anticipate some cost in order to reduce the taxable income of the company. What is the idea behind that? The idea is that when you are running a company, you want to avoid to have excessive variability of the performance over time. Why you want to avoid it? Because an excessive variability of the performance is perceived by the investor as a signal of a higher risk of the company. So the higher is the variability of the return achieved, the higher is the risk perceived by the investors and for you in the finance function, if the investors are perceiving and higher risk, they want to have an higher return. So for you, the accounting policy matters because if you don't do accounting smoothing the higher variability of the return of the company will have an impact on the return requested by the investors. And normally, you want to avoid to have these additional return requested by the investor due to the higher risk recived. In some cases, you can have accounting opportunities that you can exploit for your company. For example, you can have a tax credit that you can use for your company. Let's make an example nowadays. For all the Italians over there, do you know what is the 110 incentive for construction in Italy? You do some Jobs are your house to announce the energetic efficiency of your building and you create a tax credit of 110% of what you spent. In Italy we have the stock of buildings are less efficient on the energetic point of view with respect to the average of Europe. So we are one of the worst countries in terms of efficiency of our buildings and consumption of energy. Our buildings are quite old that they are not fully refurbished on average and so they are consuming a lot of energy. In order to reach the goals of the reduction of the energy consumption in the near future, set it by the European Commission, we are to support the investment in the buildings, in the refurbishment of the buildings in order to reduce the consumption of energy. In order to do it last year, our government set out a new law that allow you to do what you do an investment and for the investment that you do on your House, on your building IIf these investment is reducing the energy consumption, you will have the opportunity to fully deduct even more than 100% of the expanded that you have done from your taxable income in the next year's. Not today, but in eight years or 10 years from now. OK, so you have the 110% that you can deduct in the next years. This is the rule and this is the law. This type of creditor you can use by your own. So you as owner of the house or you can sell it to someone else. Chapter 4 pp. 93-108 There are some companies in there are some banks that have to last month and now there are there are some problems that they stop it. But up to last month they were buying from individuals this tax credit because for them it was convenient to use it in the future in order to deduct taxes. Think about eye as individual. I can have a low income and so I don't take advantage from this tax credit because I cannot reduce too much the amount of taxes paid in the near future. I can sell it to a company that has an I get income and so has better opportunity to fully exploit these tax credit. Every time you have a tax credit that you can create by your own or you can buy from the market. Also if you buy from someone else. This issue will matter for the company point of view. Essentially, if you have a lot of tax credits what will happen to your income in the future? If your tax credit to what is the fact for your company? You pay less taxes, so you have less fixed cost or less cost for your company and so you can maximize the revenue, maximize the income. So you can have an effect on the beat of your company that will be safer, lower the beta, only because the company is able to reduce that the minimum, the amount of expenditure related to taxes, thanks to these tax credits that are created by the company, or bought by the company from someone else. Finally, talking about the data and the accounting data, we have to take care about them because they counting data are normally available once per year or if you are listed in a stock market once by quarter. But they are not available every month or every week or every day. So, what will happen when we are considering the accounting issues for the beta iIs that the estimation of the beta with the historical or the fundamental approach doesn't matter, is less easy or is less trustable if the balancesheet was published several months ago. So the more you are far away from the publication date of the balance sheet or of the quarterly results, the less you can trust the historical beta or the fundamental beta. Why it happens so? because the market is not able to anicipate the information available in the balance sheet. And so, the older is the balance sheet or the older is the quarterly reporter, the more you can expect the near future, once the new report will be published something will change. So due to the low frequency of the accounting data, every time you are near to a publication of a new report, a new annual report, a new quarterly report, the more you are near to this date, the less you have to trust that historical data or the fundamental the destination (because these are information that will matter in the market and every time you will have this information, this will change the value of the beta or may change the value of the beta). 5. Conclusion Beta is a proxy of sensitivity of the stock performance with respect to a market benchmark in order to distinguish between defensive and speculative investment opportunities. Betas could be computed by using historical data, firm’s fundamentals or accounting information and the different choices in the beta computation will affect the results. The choice of the methodology is driven by the firm’s feature and the current market dynamics. Chapter 4 pp. 137-145 Lesson 06 – COST OF NON-EQUITY FINANCING So the lecture for today, we will focus on special type of financing opportunities. So we're talking about not equity financing opportunities. So we will discuss about debt financing and after we will talk about hybrid securities. So we will discuss about the leasing, we will we will discuss about convertible bonds, we will discuss about callable bonds and so on. So the idea is to provide you an overview about what else you can have as a source of capital instead of the equity investment. So yesterday we have ended with the discussion of the expected return of an equity investment and now we are starting talking about the alternative financing solution. 1. Introduction Companies are rising money not only as equity but they borrow money from the market or from financial institutions in order to develop their investment strategy. Main financing solutions alternative to standard equity are: - Debt Financing Leasing Hybrid securities So we are talking about how to use debt as an alternative financing opportunities. What is the difference between using depth and using leasing for a corporation? And after we will talk about how to construct a special type of securities, hybrid securites; and how they work and for which type of company may perform, may represent a good financing solution. 2. Debt financing The main difference between debt and equity is that every time you are signing a contract for a debt financing solution, you are assuming a fixed obligation of payments. So it's not up to you to decide if you want to pay dividends or not, like a in the share in the equity financing solution, but now you have a commitment to make a fixed and predefined payments overtime. Debt is represented by all the financing instruments that have the following characteristics: - Commitment to make fixed or pre-defined payments in the future What does it mean “Fix or predefined payments”? Fixed is the amount is always the same during the life of the contractor, but you can have also some type of debts for which you have a rule that is applied for the full life of the contract in order to compute the payments. But the payments may be different year by year or month by month. A standard example is the mortgage. That could be a fixed rate mortgage and so they stallment is always the same for the full life, for the contractor or could be a variable interest rate mortgage and so on. The basis of the interest rate dynamics you will have the stallment that is growing or decreasing over time, but the rule is already defined is written in the contract and so you know how the payment will be computed for the company. - Fixed payment (or part of them) are tax deductible for the company. These type of payment as an advantage for the company because they fix a payment or better the interest payment in the STALLMENT is fully deductible from the taxable income. So before Chapter 4 pp. 137-145 paying taxes, you deduct the interest payments and so you have a tax shield or a tax saving related to this type of financing opportunity. - Failure to make payment can lead either default of loss of control of the firm to the party to who payments are due. The last aspect that matters for identifying a debt financing solution is that every type of debt financing solution is exposing the company to a risk of bankruptcy. So if you fail to pay an stallment relate to the debt, you can be declared in bankruptcy. Normally is not after one stallment, but theoretically even after one stallment, you can be declared in bankruptcy. And so you can be excluded from the market and you can be no longer able to run your business. These are the three characteristics that classify a debt financing solution. So remember, you have: - A fixed payment or a rule for identifying the payments over time. - You have a tax deduction opportunity - You are exposed to the risk of bankruptcy If at the financial opportunity we are analyzing is the respecting all the three requirements described here, it could be classified as debt. Otherwise if it's not that it's something else could be leasing, could be IB securities or could be equity. The analysis of the balance sheet may allow to identify items that are classifiable as pure debt financing. When we talk about that, they company we're trying to identify in the company what are the debt financing solution we have to consider that among the debt, the liabilities of the company, some of the items may be classified as debt some others cannot. These are simple example of a balance sheet of a company in which you have a short term borrowing, you have trade payables, other current liabilities, short term provisions and total current liabilities plus total capital and other long term liabilities. Chapter 4 pp. 137-145 If we look at this type of; let's say securities or this type of contracts, we have some of them that are by definition classified as debt. Which one what do you think about? In the non current liabilities, what you can have? - Long term borrowing for sure is at debt - You can have Deferrred Tax Liabilities that could be considered like debt Other long term liabilities: We don't know because we need to have more details about how they work Long term provision are all the reserves that you create for the company and so probably they don't create for you an obligation of payment in the medium long term, it depends if the event happens you will pay, otherwise you will not pay. Talking about the current liabilities, debt You will have the short term borrowings are like debt financing solution. So are for sure Trade payables are not debt: Because you cannot deduct them from the taxable income because there is not an explicit interest payment in the in the trade payable. - For other current diabetes and the short term provisions: is like we discussed before. So essentially by going seeing the balance sheet of the company, only four of the items that you have over there in the liability side may be classified as debt. All the others we need to collect more information for some others? We know that they are not that at all, like equity. Chapter 4 pp. 137-145 The cost of debt is the rate at which the company can borrow money for the long term today that can be measured by using the following approaches Well, we talk about debt financing. We have to consider in the debt financing, how we can identify the measure of the cost of data for our company. Essentially we have two solutions that may be adopted and that the choice among them depends on the quality of information that you have of the debtor. So what you know about the debtor and who is the debtor that you have for your analysis. - Rating based model Such as you can have a model in which you use ratings in order to apply in order to identify the cost of debt. There's some option is that the debt or so our company is a rated company so we can assign a rating to our company and we can use the reading information for evaluating our company. - Implicit rating model If we are not so lucky because our company is not readied, we have to construct a model that is called implicit rating model in which we try to identify the cost of debt even for a company that is not rated. As you can imagine, if we talk about the smaller medium enterprises, this is will be the. standard forever within a company because a lot of small and medium enterprises are not rated and so you don't have the information for evaluating them by using their own rating. If we talk about a large corporation, this will be the main approach forever within the company, Let's analyse 1 by 1 Audi worker and how we can assign a cost of debt on the basis of the rating or on the basis of a model that we construct by our own. When the rating is not available. a. Rating based model The model is quite easy. I want to understand what is the rating of the company. Typically AA, double B, whatever you want, and we use something that we have already discussed when we were talking about the risk free rate. When we were talking about the risk free rate that we say that we can have some states, some governments that are not considered free risk countries, they are not, they cannot be considered that countries in which the bond issue is almost at risk free. And we have identified the several proxies that may be used in order to adjust the risk free rate for the risk of the country. When we talk about a corporation, the assumption that the bond issued is a risk free rate, is almost never respected. So you have to start with a model that is assuming that the debt of this company is a a debt that is exposing you to a risk of default. The rating based model may be used only for rated companies and allow to measure the return on debt on the basis the average Credit Default Spread of the rating class: Chapter 4 pp. 137-145 When we are trying to measure this type of return related to the risk of default, what we have to do is to use the CDS (Credit Default Spread) model that we discussed when we were talking about the risk free rate. So our proxy of the cost of debt will be: • Risk free rate + Average of CDS. Although the companies with the same rating. (Can I bully our company? We look for all the companies we try Poly the CDs that are outstanding for them and we compute an average of the CDs for them. The same if we have double B, tripod, C, whatever you want as a rating of our company) 𝐶𝑜𝑚𝑝𝑎𝑛𝑦 𝑅𝑎𝑡𝑖𝑛𝑔 = ABC rf = Risk free 𝑇𝐶= Tax rate 𝑟𝑑 = (rf + 𝐶𝐷𝑆ABC)× ( 1 − 𝑇𝐶) So our measure of the cost of debt will be: We have to consider that describing the debt, we say that one of the assumption of the debt is that the interest are tax deductible. So we can deduct them from taxes and so the net cost for our company, net with respect to taxes is: • this amount x 1 - marginal tax rate a corporation level. Example: If we have a risk free that is 2%, a CDS for our rating class that is on average 4%, the cost of debt for us is not 2 + 4, so 6%, but 2 + 4. So 6% multiply for 1 minus marginal tax rate. If the tax rate is 50% 𝑟𝑑 = (0,02 + 0,04)× ( 1 – 0,5) = 0,3 cost of debt for us We are considering that when we are using debt we are paying less in taxes. So we are considering the tax advantage for our company. Our real cost of data will be not the six, the 6%, but 6% multiplied for 1 -, 50%, so only 3% as cost of debt for us. If the interest rate has to be translated in the local currency value, the inflation gap will matter: Sometimes you can be also interested to do what try to make an adjustment of the cost of debt for considering the inflation and the trend of inflation among countries. Here what we are saying is that we want to create a proxy of the cost of the data for a country that is characterized by higher inflation rate every year. Normally this type of formula is working and is requested to be applied every time you have a double digit inflation rate by year. Double digit means 10%, eleven percent, 20% whatever you want. So we are still far away from this scenario not too far away, but if the inflation rate is higher than 10%, this is the approach that you have to use for computing the cost of debt. Chapter 4 pp. 137-145 In this approach, what we are doing is to consider the cost of debt computer with this formula (previous one, 𝑟𝑑 = (rf + 𝐶𝐷𝑆ABC)× ( 1 − 𝑇𝐶)) and adjusted for the dynamics of the inflation rate of your country ((1 + 𝜋LC)/ (1 + 𝜋BMK)) remember the country from which you borrow money, with respect to the inflation rate over developing the economy, for example, US and Germany. So your cost of debt would be adjusted for this ratio that will be higher than one for sure. And so your cost of that has to be increased for considering the impact of the inflation rate. Remember, every time you have a double digit inflation otherwise that's the solution that you will use and you don't care about the inflation rate. b. Implied rating model The rating of a company is constructed by considering a set of financial characteristics of the firm that could be summarized in a qualitative judgment. The rating process cannot be replicated directly by an investor, but some relevant indexes could be computed for identifying a reasonable rating. And after a solution that you may have is the solution that you can apply, for example, for every smaller medium enterprise The idea is that when we are talking about a smaller medium enterprise we don't have a rating outstanding. So we cannot collect the information directly from the market. What we have to do is try to construct a proxy that allows us to measure the risk of default of the company. There are several approaches that can be used for measuring the risk of bankruptcy of accompany; the one selected by the textbook is the easier one, and these are measure of sustainability of the cost of debt. A proxy normally considers is: 𝐼𝐶𝑅 = EBIT/INT This measure of sustainability of the cost of debt is called the interest coverage ratio - ICR, and these interests covered the ratio is the ratio between the earnings before interest and taxes divided it for the amount of interest in the last year available. For both the EBIT and the interest rate. So the idea start to measure if the EBIT is enough for covering the interest payments or if they EBIT is not enough, SO it's not sufficient for even covering the interest payment. If this ratio is below 1 is that for the current year, probably you cannot pay the interest. Probably because you have some cost that you are assigned to the balance sheet that are not real monetary cost. For example: amortization or depreciation. They are not real expenditure for the current year and so theoretically if you have something of these ratio that is below 1 you still have a probability to survive, if you have a lot of amortization and a lot of depreciation that you have applied in a balance sheet. But every time these ratio goes below one, it means that your risk of default is increasing significantly. So the treasure for us is the higher or lower than one, the nearer we are to one, the worst it is. The higher is the ratio the better it is. Chapter 4 pp. 137-145 The procedure for using the ICR for identifying a proxy rating is the following:ç Where we compute this formula? We apply this formula for a set of corporations that is partially not rated and rated. So in our example we have to have both rated and not rated corporation. 1) Compute the ICR for a set of companies with rating outstanding Once we are computed this index, what we will do is to compute the interest coverage ratio for every company. 𝐼𝐶𝑅i = EBITi/INTi 2) Identify the average of the ICR by rating class And try to consider for a level of interest coverage ratio. What is the average ICR for our rating class. So we're going to see at the sample or companies that are rated, and for them we will consider what is the interest coverage ratio for the companies that are already AA, A, double B, C and so on. 3) Assign the rating class and credit default spread on the basis of the average ICR of the company What we will do is that for our company, we will assign a rating on the basis of the more similar ICR that we can found in our previous analysis. So if we say that the rating class AA has an interest coverage ratio of 2. And our company is an interest coverage ratio of 1.95. We can say that the rating class of our company is the one that we have just identified. So essentially we consider rated companies, we compute the average ICR for all the rating classes, and on the basis of the average ICR and our ICR we assign a rating to our company. The nearer that we can found. The correct rd could be easily estimated by using excel functions on real data (Excel) _____________________________________________________________________ (2. Debt financing) When we talk about the debt financing and we are trying to measure the cost of debt financing and there are some aspects that may matter for us, that has to be considered in computing this cost of debt. - Some aspects are related to how the rating agencies are working. - Some aspects are related to how we are planning our debt. Chapter 4 pp. 137-145 Let's start with the issue related to the rating agencies. Rating agencies they are giving a judgment about the risk of the company. So they are giving their opinion, their point of view on the risk of a company or the risk of a security, for us now the risk of a company. When we talk about these judgment, normally they have some constraints that they always supply for evaluating the risk of the company. In computing the cost of debt starting for the rating assigned, the analyst has to consider the rating anomalies that may affect the company valuation: - Country Ceiling The most important constraint that that matters for us is that these companies are evaluated by applying a rule that is called the country ceiling. It means that if you are a company that is not classified as a multinational company, so you are a company that is working mainly in one country, the rating assigned to the company cannot be higher than the rating assigned to the country. What is the assumption behind these hypotheses? That if the country is performing badly, so if the countries are suffering of problems the company will be affected from it. Think about what happened in Greece in 2010? They were exposed to a risk of bankruptcy at country level. All the companies that were working mailing lists were affected from it because the wages were cutted. the expenses done by individuals and corporation were reduced and so on. And so it's quite reasonable that every time you have such a stream event, you can assume that all the companies are affected from it. And so you can assume that the companies will suffer from this type of problem. This principle that is correct in theory is applied by the rating agencies by saying that if you are evaluating a company that is a local one, so or not an international diversified one, the reading assigned cannot be better than the reading of the country. So every time you have a country that is performing words also the company is assumed to perform words(?). This is true, but you have to take care because if the rating of the country is, let's say A, or triple B, so not the maximum, but still good, still a safe country not exposed to a risk of bankruptcy, is not always true that the company may suffer from this type of problem. Because you will suffer when the country is supposed to default, the example of Greece, and it's true that every company will suffer from it. But if you are in a country that is really AA or A, for U.S. company doesn't matter, because it's still a safe country, you still have revenue, so you still have a demand for your goods. And so essentially you don't care about it. What is done by the rating agencies that they don't apply a flexible criteria and they will supply these countries healing and this could be a problem for a company that is working in a country that is as safe one. Because probably they are underestimating the rating quality of a corporation only because they say that the country may perform a little bit better, but remember if the country is safe, it doesn't matter too much for the company level. Another problem that you may have and normally you have, is that we say that the rating is a judgment. The rating agencies say that the rating is not a judgment but is an opinion on the credit risk. And as every opinion, you can be wrong. You can be right or you can be wrong. Chapter 4 pp. 137-145 So when we have a a rating we have to be sure that the rating agency is able to evaluate properly the risk. What does it mean? That if we apply this approach in a country in which the reading agent is not working at all, Or is not working too much, Probably we cannot trust about our measure of the cost of debt. Think about if we focus on feature, feature among the three players that we described before is the smaller one. And these mainly working in US and Europe. In Asia they have something, but they are not a big player and in Australia they almost have nothing, so they have no idea about the credit risk. If we use the reading of fetch (?) for evaluating an investment in Australia, probably we are doing a mistake. Because they don't have information. They don't work in in that area. They're not work too much in that area, and so the probability of having a rating failure, so rating mistake is significantly higher. So every time we look for a small player or not the larger we can have a risk of mistakes. How many rating agencies exist worldwide? Now we're talking about only three rating agencies up to now. There are other and there are a lot of other rating agencies in order to give you an idea, up to three years ago we had in the world market more than 120 different rating agencies. So we know and we normally use the rating of standard and poor (feature. Mood ?), but theoretically the approach that we described up to now can be applied for every rating agency that is operating worldwide. The smaller is the rating agency, the higher is the probability of rating failures. So if you focus on small local rating agencies, for example, there is one rating agency that is operating on Sri Lanka and they are rating only companies based in Sri Lanka. The probably of making mistakes is quite high, because they don't have an expertise about what can happen in different countries, they don't have an expertise that is historical based because they are operating only in the last 10 years, let's say. And so probably you can make a lot of mistakes by consider the rating. So every time we look for rating or smaller companies, the rating failures will matters the most. - Time horizon Last aspect that we have to consider is that the cost of debt, different with respect to the cost of equity that we discussed, is a significantly affected by the time horizon of the debt. So if we consider a company with a debt structure that is expiring one year, so all the debt will expire in one year, the cost of debt will be significantly low. If we consider the same company with the same assets but a liability structure focus on 10 year time horizon or 20 year time horizon. T he cost of that would be significantly higher. So when we are considering the cost of debt is necessary for us to customize the analysis on the basis of the time horizon on the debt. Otherwise we will do several mistakes in estimating the cost of debt and so when we construct the, for example, the ICR ratio for our corporation, so we have to be sure that the corporation that we are analyzing have almost the same time horizon for the debt. If it's not true, probably is better to drop this type of companies from your analysis because the cost of debt for them will be not consistent, not comparable with the cost of debt of our company. Chapter 4 pp. 137-145 In the debt market, every time the time horizon is longer, the cost of debt will increase independent with respect to the company independently with respect to the investment independently with respect to any choice that the manager can do, so our analysis to be focused on time horizon that are comparable each other. - Rating failures 3. Leasing and hybrid securities Let's talk about special type of securities that are: the leasing contracts, and the hybrid securities. 3.1. Leasing The leasing contracts are special type of loans that are not real loans, but are renting contracts. So you are renting something and you are paying a rent for using one good. They are called the normally financial rent contract. Took care about the hybrid securities we're talking about instruments in which we have a debt securities and equity component. Normally we call it equity kicker. The equity kicker is the equity component of the security. When we talk about the leasing, I told you that these are renting contract but it could be different on the basis of the type of assets that is necessary for the company. We can have assets that are expected to be owned by the company and so we talk about the financial lease or we talk about assets that are not expected to be owned by the company but are only expected to be used by the company. So in the first case, the company will become the owner, in the second case once the company is no longer using the asset we give back to the real owner to the one that is renting you the asset. Leasing contracts are special type of financing solutions available for the company that could be classified as: Chapter 4 pp. 137-145 A firm that leases substantial assets and categorizes them as operating leases owes substantially more than is reported in the financial statements. All lease payments are financial expenses and the analyst has to convert future lease commitments into debt by discounting them back to the present, using the current pretax cost of borrowing for the firm as the discount rate. These are a couple of formulas about the evolution of a company that is using leasing. When we are evaluating a company that is using leasing, we say that the leasing is not a debt, especially if we talk about the operating leasing, but this is still an exposure and this is still an obligation for the company that we are evaluating. So when we are analyzing a company that is characterize by using the leasing, our measure of debt, so the amount of debt of our company, is not only the amount of debt that we define before, So the one related that to contracts that are characterized by fixed payments, full deductible for the interest component and characterize the by attack shield advantage for our company, But has to be the amount of debt (D) + Every obligation related leasing This obligation related to leasing is the actual value of the leasing payments. Then, when we are evaluating a company that is using leasing in order to have a measure of leverage, there's only leasing payments discounted on the base of the debt, which you will have it. And if we want to understand how much are the, let's say fixed cost for the financial structure, we have to consider all the interest payment related to the debtor, so essentially cost of debt multiply for the amount of debt, that these are the interest payments year by year, or month by month for our company plus the cost of the data that we have for the leasing contract. I'm saying exactly the same thing that I said before. My focus was on the amount of data and now my focus is on the cost of debt. The amount of debt has to be increased by the amount of the actual value of the leasing contracts. The cost of debt has to be increased by the cost of our leasing contract if exist. Chapter 4 pp. 137-145 3.2. Hybrid securities We may use hybrid securities as a corporation for raising money. We have some examples about the hybrid securities that are mostly used worldwide for a corporation. The first one probably you know it because you have seen it several times are the preferred shares. Preferred shares: Special type of shares so different than the ordinary ones for which you have specified already the amount of payment that you will do for the shareholders. So these are special type of equity financing solution for which instead of linking the dividends to the performance of the company, you set now what will be the return offered to this special type of equity holders. The preferred stock shareholders. Why a bank or an investor like a bank could be interested to this type of security. What's the reason behind? The type of investor in this type of security is a low risk investor could be a bank, could be an individual that wants to avoid excessive risk in the investment strategy, could be a pension fund, could be an insurance company… Is a low risk profile investor. This low risk profile investor is accepting a fixed return from this type of security and is also sure that if there is an event of bankruptcy, the company will pay before the preferred stock orders, preferred stock shareholders, with respect to the ordinary ones. There is still a risk of bankruptcy. So there is still a risk of losing money, but the risk is significantly lower with respect to the ordinary shareholders. Preferred stock shares some of the characteristics of debt—the preferred dividend is prespecified at the time of the issue and is paid out before common dividend— and some of the characteristics of equity—the payments of preferred dividends are not tax-deductible. Payments are expected to be stable over time: The return that you had offer to the preferred shareholders is higher than the cost of debt but is lower than the cost of equity. Because the risk assumed for the bankruptcy is at the maximum of for the ordinary shareholders is less for the preferred shareholders is almost zero, is significantly lower for the debtholders. Chapter 4 pp. 137-145 Because the debtholders are paid at the beginning and all if something remains, it will go to the other stakeholders of the company. In order to compute these measures, so in order to compute what is the return for the preferred shareholders, you have to make a ratio between the dividend given promised and written in the contract, with respect to the price of the security. So it's a dividend deal that you compute by making the ratio between the preferred dividend and the cost of the preferred share, so the price of the preferred share. By knowing that the dividend, you can have an idea about the price that you can pay, the price that is reasonable for you, by applying this standard formula, an actual value, dividend payments. Like a share with some special features related to the dividend that is already fixed and you have a better protection with respect to the bankruptcy risk, so the cost that you pay is to be higher than the cost of debt, but has to be lower than the cost of equity. In some cases, the preferred shares may be constructed as hybrid securities by offering additional rights that have to be evaluated separately What else you can have are that securities with a new equity kicker. They could be convertible preferred shares callable preferred shares, or could be convertible bond or bond with warrant. Let's start with the cases that are based on preferred shares. Prefer shirts are everything that is not an ordinary share, so it includes this type of stocks, but it may include also some other type of stocks. A convertible preferred share offers an option for the holder to convert preferred shares into a fixed number of common shares after a predetermined date. Every time the shareholder, so the investor, has the right to convert the preferred share into a number of ordinary shares. In this case, what is the equity kicker? The equity kicker is the opportunity for you as investor to move from a safer security, that is the preferred share, into a riskier one, that is, the ordinary share. The issue is not one to one could be different is written in the contract, but it could be different and what you can do is if you want use which(?). When you use which(?), you lose the preferred shares and you obtain the ordinary shares and there is no opportunity to go back and to change your mind. So once you change your status, you are an ordinary shareholder. And if something goes wrong, you suffer of more losses because you are now an ordinary shareholder and you are no longer a preferred shareholder. So every time I have a forecast about the growth of the company, the positive growth of the company and so the increase in the value of the ordinary shares, I can consider this opportunity as a safer strategy in order to take benefit from the growth of the company if it happens. So if you have only a forecast of the growth of the company, but you don't fully trust about it, this is the security that you have to look for; because with this security, if everything works, you will change your status from preferred shareholder to the ordinary one and you will obtain a security that has a higher value in terms of market price. Chapter 4 pp. 137-145 As you can imagine, if you want to have this type of right and if you want to have this opportunity again, you have to pay for it. So a convertible preferred share is more expensive than a preferred share. Because with the convertible preferred share, if you are lucky, if the companies growing, you can exploit some better return opportunities. And so in order to add these right, you have to pay something now. We will pay something more related to this opportunity to switch from preference share into an ordinary one. A callable preferred share is a preferred shares that may be redeemed by the issuer at a set value before the maturity date. The callable preferred share is totally different with respect to the previous security because when we talk about the callable preferred share, we are talking about preferred shares that may be redeemed by the corporation, if the value of the company is increasing too much or is behaving like written in the contract. So they ishwar is having a right if they want to refund the preferred shareholders with a fixed payment already written in the contact if something happens to the company. In this case the option is for the company and is not for the investor. So the investor will suffer the choice made by the company and is not able the investor to react from it. Every time you have a callable preferred share, this type of preferred share is a soul that are discount with respect to the preferred shares. Because the preferred shares are security that you buy now and you know that we'll pay up to 10 years or up to 20 years dividend payment if you have a callable preferred shares, you may be exposed to the risk that the company changes its mind and decide to buy back this shares. And remember that you cannot refuse to sell this security, and so you are obliged to sell them to their company, if it is the scenario, if this is the security, is sold at a discount. Because the right is bought by the company and the investor is not taking advantage from it. - I can do a callable preference share when for example. I don't know if all the money collected will be necessary for the next investment strategy. So I have collected some money now for 10 year time horizon, but I have only a business plan for the next three years. I don't know what will happen in the 4 or 5 year and so on. And so I do a callable preferred share because if I have no more good investment opportunities I will refund the shareholders and that will no longer pay the dividends. What else can happen is that that this type of preferred shares., callable preferred shares, will have a value changing over time on the basis of the risk of the company, so the safer is the company, the higher will be the value of these preferred shares because if the company is not exposed to risk of default as an interest coverage ratio higher than 20, So it's always paying the debt, probably this preferred shares are like bond. So what I can do is that if my company is expected to be safer in the future, instead of issuing preferred shares, I will issue callable preferred shares, because if everything works for me, it's more convenient and less expensive to call back the preferred shares and issue bonds when the market is evaluating my company as at 0 risk or a low risk company. Chapter 4 pp. 137-145 - So the second scenario, for which I use a callable preferred shares is when I think that the quality of my company or the risk of my company is increasing, and so the risk of default of my company is significantly decreasing. You remember that the cost of the preferred share is higher than the cost of the debt. So if I can call back the preferred shares, I can issue that that is less expensive. These are the two scenarios for which I will use the callable preferred shares. Otherwise I will not use them. Remember that I'm selling them other discount as all the rest to be a reason for which I don't receive a full price and set discount price and these are the two reasons that justify this choice. Hybrid securities can be also constructed starting from a bond security and offering as additional right the opportunity to switch to a shareholder status. A convertible bond offers an option for the holder to convert the debt securities into a fixed number of common shares after a predetermined date. The first alternative is similar to the convertible preferred share. Here we are starting from a bond and we are giving to our investor the opportunity to switch from the bond into an ordinary share or into a number of ordinary shares, a fixed number of ordinary shares. So if you want you can change your status from debtholders, bondholder, into ordinary shareholder. He's like before, but we are not starting from a preferred share. We're starting from a bond, Almost the same approach for our analysis. A bond warrant package is a bond that offer the additional right to buy share at fixed price after a predetermined date. What that second do is to consider not a convertible bond, but I can decide to sell a package of securities. One of them is a bond. There are other is an option to buy ordinary shares at a fixed price. So we had two contracts sold to the same investor. One is a bond and the other one is the right, If the investor wants to buy a share at a fixed price. When it's convenient to use this right? In this option you have the right of buying the share of the company and number of shares of the company at a fixed price set it now. If the price of the share is growing, probably what you can do is to make a zero risk investment strategy in which you exercise the option, you buy these share at a fixed price and you sell immediately them at a premium in the market. So if they fix the price is 100 and that the current market price is 105 for each share that I will sold, I will obtain a gain of 105 -, 100, so €5 per share, with zero risk, almost zero risk. This type of bond warrant package is also another advantage because the two contracts, so the bond and the warrant are independent each other. The bond of the warrant are sold at the same investor, but once the investor received the bond with warrant, the investor may decide to retain both the securities, the bond and the warrant, or to sell both of them, or to sell only one of them. So you have a package of securities that once I receive them, they are totally independent. And so I can decide what I want in retaining or selling them. Chapter 4 pp. 137-145 The only issue that you have to remember, is that differently with respect to the convertible bond, if the investor exercise the option; the investor, still a bondholder that will become also a shareholder. So if you as investor, you retain both bought the bond and the warrant, once you exercise the warrant you don't lose the bond status. You are still a bondholder. That is also a shareholder of the company. This type of securities are frequently used by the company. The advantage is that when you are selling the convertible bond with respect to a standard bond, you are selling it as a premium. I'm giving you the right if you want to convert your status from bondholder to shareholder. If you want. If you want to have this right, you have to pay for it. I’m selling you not only one security, but a couple of securities. So the bond plus the warrant you have to pay something for the warrant. So every time I measuring a convertible bond, the bond with warrant I can collect more money because I can take advantage from it. On the company point of view, you have to consider that every time you are issuing a convertible bond or bond with warrant you have to be worried about the concentration of the ownership. If the ownership is not too much concentrated, by using a convertible bond or by using bond with warrant, you are increasing the possibility of a change in the ownership, and so you have to take care about it. So it's convenient for the company because you cannot take more money but take care about it, because if they converted the bond or if they exercise their option, the number of shares will increase. You have to be sure that the ownership will not change. That's the only issue that matters for the company point of view. Consider the following security and identify the most appealing investment security for an investor interested only to maximize the return American Express: You have a trend in the share price for American Express for the 2019. We are focusing on the data that are available and this is the current price. So 163 at the end of 2019. Which type of security may be more convenient for the investor point of view, if the investor wants to maximize the return, The option that is for sure wrong is the one that is not selected at all from you, so is the callable preferred share. We cannot say if it's convenient or not because we have only the ordinary stock price. We don't know the value of the preferred share and what we can understand is only that the value of learning(?) share is growing up and if we buy a preferred share, we don't know if it's growing at the same time. And most important, we don't know if the company will exercise the option to refund us. Ao essentially this is for sure the wrong option. After we have some option that are ready to bond and some option that are ready to convertible preferred shares. The convertible preferred shares are not an option either because the convertible preferred share is the opportunity to switch from the preferred share into the ordinary share. You don't Chapter 4 pp. 137-145 have the plot about the preferred share, and so you don't know if it's convenient or not to switch from preferred shares to the ordinary ones. The only information that you have over there, are the ordinary shares and that the securities that may benefit from it, for sure, are the convertible bond and the bond with warrant. Now, among them there is an information that is missed and don't allow us to evaluate if both of them can benefit from it. Why? Because if we look at the convertible bond, in order to understand if it's convenient or not to exercise the option of conversion, what matters for us is the number of shares that we will obtain in exchange of the bond. And there is not written. So you don't have any idea about how much could be convenient because you don't know what is the conversion ratio applied for bond into shares. What you know is that the price is growing at day by day for the American Express. And so if you have a warrant, the warrant will be always worthy for you. Because if the prices growing, you know that the warrant will be an opportunity for you to have at zero risk return rate to the fact that you exercise the warrant and you sell at a premium, the share that you obtain in the stock market. So what you know for sure by looking only at the ordinary shares is that the bond with warrant is the most convenient solution for Amex. 4. Conclusion Debt is a financing solution that is characterized by pre-defined payments that are tax deductible that expose the issuer to default risk. Cost of debt has to be evaluating by considering the current amount outstanding the expected cost for the roll-over when the debt will expire. Leasing contracts are special types of debt financing that has to be evaluated differently when the company enter in an operating lease with respect to a financial one. Preferred shares are financing solution that offer rights similar to those of the shareholders but are addressed to low risk profile investors. Chapter 4 pp. 146-156 LESSON 07 – WEIGHTED AVERAGE COST OF CAPITAL We will move from the hurdle rate to another proxy that is relevant for us, that is to compute the starting from the hurdle rate, a benchmark; that allow us to understand if the investment strategy is sustainable or not, on the basis of our financing policy. We wil try to understand how to compute the weighted average cost of capital for different type of companies, even the private ones or the unlisted ones. How to compute it and how to use it for evaluating the company. Essentially what we'll do is to recap, because probably you already know, how to compute the weighted average cost of capital, and once we have identified the general format that will be used, we will focus on how to apply the weighted average cost of capital in an evaluation strategy. So by comparing it with the hurdle rate in order to identify something that is relevant for us. 1. Introduction Talking about the weighted average cost of capital, what matters the most for us, is to consider what are the weights that we have to assign to each financing solution available for the company. And once we have identified it, how to apply the weighted average cost for capital as a criterion for selecting investment opportunities. FIrst, we have to focus on the weights, and how to compute them, and after we will talk about the formula and how to use it. Cost of financial resources for a company is computed by considering the financial structure choices and the cost of each financing solution currently available in the market. Once the hurdle rates are computed, the last steps are the following: - Weights WACC 2. Calculating the weights It's actually it when we talk about the weights, we have two approaches that may be used for computing the weights: 1) Accounting approach or the book value approach What we talk about the book value, what we are trying to use only the balance sheet of the company in order to construct our weights for a financing solution. This assumption, this choice, may be reasonable every time you consider that the balance sheet is describing fully the characteristics of the company. The balance sheet is updated and in line with the new market condition. Every time this type of assumption are not satisfied, are not respected, probably you have to look for something else, so that could be the market value approach. Chapter 4 pp. 146-156 2) The market value approach Talking about the book value, the main advantage is that you consider the balance sheet and if you want to know how much is the weight of equity, or how much is the weight of debt, you consider only how much is the equity in the balance sheet, how much is the debt in the balance sheet and you do a simple ratio. So in a couple of minutes you can compute the ratio that you need for the weighted average cost of capital. Talking about the market value, we are doing something else, we have to assign a market value which of the financial instruments are used by the company. So we have to assign a value to the share, we have to assign a value to the mortgage, we have to assign a value to the bonds and so on. Financial instruments that are treated in the market: If we want to measure the value of the equity, what we can do with a market value approach? Assign a value to the equity used by the company for financing its own activity. What is our easier solution for measuring it? Consider the market as a proxy of the real value of the security, and your value of the equity will be the number of shares outstanding multiplied for the current price of the share. They seem approach could be done with the bonds. You have the number of bonds outstanding multiplied for the price of the bonds. But when we have a mortgage they approach could be not so easy because the mortgage by definition is not traded in a financial market and so you don't have a a real value or a real market value for it. So you have to identify a proxy that may matter for you. Why may a mortgage change its value over time? I have requested and I have obtained a mortgage five years ago from my bank. That is a 15 year mortgage and they have to evaluate it. What is the issue on defining its market value? On the visual what? What is important for the lender? The lender is looking at what are the pricing condition applied to you and what could be nowadays the pricing condition applied to another customer (borrower). Nowadays, the interest rate are growing or decreasing? Growing, so if you have a signed agreement with a customer five years ago, when the interest rate were below one or around 1%, nowadays this type of mortgages is valuing less, because nowadays the interest rate is around the 3%. So for the bank point of view, this type of mortgage is no longer a good loan offer to the customer, because it's too cheap or it's not so expensive as you can apply to a new borrower. So every time you are evaluating a mortgage, even if it's not treated in the financial markets, the trend in the markets may matter for the evolution of this type of asset or this type of loan. Weights can be computed by using alternatively book or market values: Talking about the book value versus the market value, here you have a table that allow us to identify three main characteristics that may matter in selecting one approach with respect to another. Chapter 4 pp. 146-156 1) Volatility of estimates over time If we compute the weights by using the book value approach, how much we can expect that they will change in the next year, in five years from now. As you can imagine, accounting data (talking about the liability side) are quite stable overtime, so essentially you cannot expect to have a volatility overtime. On the opposite, when we talk about the market value, we can always expect that even in a short time horizon (few weeks, few days…) you can have a huge change in the weights if you consider the most updated data available in the market. So the volatility is at the minimum or is even equal to zero, when we talk about the book value approach and is significantly more relevant when we talk about the market that you approach. 2) Conservative estimates of the cost of resources Talking about the impact of the choice: market value vs book value on the estimate of the weighted average cost of capital, when we use the book value approach; essentially, our estimate is like the one that we did when we start collecting money, when we start borrowing money. So essentially what we are doing is to make an estimate on the basis of historical data, that is not updated at all on the new market condition, so it means that you are doing a conservative estimate of the cost of resources because you are looking only at the current contracts and the current condition applied for a loan or for a financing solution. What we talked about the market value approach on the opposite, we are trying to update the pricing condition of our debt, or the pricing condition of our equity, on the basis of the most updated information available in the market. So we are trying to do a less conservative estimate of the cost of collecting money because we want to be updated on the basis of the new market condition. This issue matters the most when we are considering a companies that are collecting frequently money from the market. Chapter 4 pp. 146-156 Example: If I borrow money with a mortgage on 30 year time horizon, probably the book that you approach, the conservative one, may work for my company. If I have to borrow money every year with a new mortgage, so every year I have to borrow new money from the market, because I need more money for my business, in this scenario, the book value approach is no longer useful for you because the data that you are looking for, are not so updated, and so when you will borrow again new money, you will discover the deposit condition are changing. So the conservative estimate matters the most every time we are considering short term horizon loans or short term financing solution more generally, because if we borrow money only once during the life of the company, we can stay with the conservative approach and the book value approach we don't care about it. In all the other cases that are the standard that we have to be worried about how to measure the market value. 3) Consistency with accounting proxy By definition, if we consider the book value, the value that we are considering are constructed by looking at an accounting rule. So you will have a weight that is consistent with what we have written in your balance sheet. If we consider the market value, the market value is not looking at the history of the company, but is looking at the perspectives of the company. So what will happen to the company in the future and so you can have that the weights are identified by the market value may be totally different than the way suspected on the basis of the balance sheet. So you can have a company that is now not performing so well and in the future is expected to perform even worse. This will be immediately discounted in the weights with the market that you approached, will be no relevant at all or almost not relevant at all, if we consider the book value approach. So when we look at the choice of the weights, so we have to consider which type of company we are analysing and which type of approach we may use. Remember the book value approach is the easier one. The other approach (market value) is the complex one, but it's also the most updated, is considering more the future of the company, and so how the company will be evaluated in the next years. Compare the book value and the market value of weights Chapter 4 pp. 146-156 You have two plots about the book value and the market value. A set of companies in US classified by the type of activity (advertising, building materials, entertainment…) And you have the gap between the average book value role of that debt and the average market value of the debt. So in blue you have the book value; in grey you have the market value. For which sector sthe choice of the type of weights (book vs market value) matters less? The area in which you say that the difference are lesser relevant are bank or financial services, that are those that are listed more frequently in this survey. Essentially what you have to do is to go back to these plot and try to identify where you find a novel (?) lap between the value identified with the book value and the value identified with the market value, essentially what you have over there is that here financial service is almost the same. There's also another sector that is rubber and ties for which she's almost the same. And the for the others, there is a gap for some of them is quite relevant. For example here, in electrical equipment is quite significant the gap, but for some others is less relevant. What I want to point out with this plot and this analysis, is essentially that there are some ideas or some companies for which the choice of the book value versus the market value will be more relevant and more significant in measuring the weighted average cost of capital, but for selecting them, for identifying which type of company is more focused on market value or more focused on the book value, we have to consider the characteristics of the business in order to identify why for some companies may be relevant or not. Let's focus only on the two that are the most relevant on the visual, financial service and rubber and tires. Are you able to identify any similarity among these sectors that may justify the that you can do whatever you want in selecting the weights? (market weights or book weights are almost the same) It's not relevant to make a choice. And probably we will go for the book value because it's easier to compute it, instead of computing the market value. So essentially when we attend to identify a sector or a company for which we can do whatever we want for computing the weights, it's because book weights are equal to the market weights. What matters for us is the time horizon of the liabilities or the time horizon of the financial instruments used. The more the sector is characterized by having a short term borrowing or short term issuing of or any type of security, the more the approach based on the book value will be similar to the market one. So financial institution are an example, talking about the rubber and tires, this type of companies are normally working with short term borrowing from suppliers and from banks. So this type of sector are sectors in which you collect money frequently from the market. And so even your accounting data are updated on the basis of the market condition. The other aspect that may matter is that if we do the same analysis in different years, sometimes we will discover that some sector will lose these characteristics of being the same to use book weights versus market weights. Because every time you have a negative shock in Chapter 4 pp. 146-156 the market, even if you we are talking about differential sector or the rubber and tires sector, we can have that due to the shock in the market, this equivalence is no longer something that you can expect. Every time you have a shock, even in a sector which there are not huge difference between a book value market value, you will see that the market value will react immediately. So every shock will change this type of classification and will not allow you to use the book value or market value as you prefer. You have to go with for the market value because it's the most updated one. As a general rule, the weights used in the cost of capital computation should be based on market values because the cost of capital is a forward-looking measure and captures the cost of raising new funds. Because new debt and equity has to be raised in the market at prevailing prices, the market value weights are more relevant. Here you have some rules that has to be considered when we are computing the weights. We will distinguish the rules of that has to be applied for computing the equity weights and the rules that has to be applied for computing the debt weights. - Equity weights Debt weights 2.1. Equity weights For the equity we have securities that are traded in the market normally for which the value of the equity could be computed as a simple product between the number of shares for the current price of the share. So if we want to compute the role of equity, we consider the number of securities that we have on the market and we consider the price of each security in the market. The market value of the equity is computed as follows: 𝐸𝑡 = 𝑛°𝑠ℎ𝑎𝑟𝑒𝑠𝑡×𝑃𝑡 The measurement of the equity market value could be more complex when: - Multiple classes of shares exists But we can have multiple classes of shares. And these may matter for our equity computation, equity weight computation. - Equity options are available in the market We can have a special type of securities with equity kickers. What were the equity kickers? Different type of securities (bond with warrant, convertible bond, convertible equity...) in which we have the right to switch from a security to another if you want. Don't care about the multiple classes, you will normally have a several ones. So it's only a sum of different shares, number of shares outstanding multiplied for the current price. Talking about these equity option, these are not so easy to be analysed because what you have to know is how much is the probability that the equity option will be used. Chapter 4 pp. 146-156 For example, if you have an option to convert a bond into a share. And the share price is decreasing over time. What is the probability to have a conversation? Almost 0. If the price of the market is going down, it means that I will pay more than the current price of the market, and so it's not worth it for me to do this conversion strategy. If on the opposite, the price of the share is going up, the probability of having the condition will be almost equal to 1, because it's convenient for me to do the conversion and set the share instead of retaining the bond. So this type of equity option has to be evaluated on the basis of the trend of the price and how much the trend of the price makes possible or makes relevant for the investor to exercise the option. We have several approaches that can be used, but we don't care about them up to now. In case of private (not listed) companies the equity weights could be computed by considering competitors and using one of the following approaches: What can happen is that you can have some companies that are not listed. So companies that are private, so they are not listed, and you have to evaluate for them are weight that you want to assign to the equity. If the company is not listed, you can for sure compute the book value and the book value weights, because you have a balance sheet and already you can compute it when you want. But what can happen is that you cannot compute easily or directly the market weights. So we have to understand if there is any solution that we can adopt even for unlisted companies or private ones, for measuring the market value, normally the two approaches that are used are: - Approaches based on multiples – Multiples of revenues or net income Approaches based on average from some market debt – Average market debt equity ratio You can identify a company or a set of companies in the market that are strictly comparable to your company. So they are listed, but they are doing the same business they are offering the same type of product and service to the same type of customers. If this is the scenario so you have at this type of company. So they are listed, but they are doing the same business they are offering the same type of product and service to the same type of customers. If this is the scenario, so you have at this type of company, that you can consider as a benchmark for your private company, you would use the data of the benchmark companies for constructing your own weights. Remember the assumptions that I'm able to identify in the market a set of companies that are doing almost the same. Chapter 4 pp. 146-156 - Multiples of revenues or net income How it works? You select a sample of benchmark companies, comparable companies, for which you consider or the revenues or the income, normally based on the revenues, and you make the ratio of the revenues of with respect to the equity of each of the benchmark companies. What is telling us this ratio? We are trying to measure how much we can produce as revenues starting from an equity investment. So this ratio is normally higher than one. It's telling us for each euro invested as equity, how much we are creating as revenues. The higher is the ratio, the better it is. If the ratio is 50, it means that we have 50 times as revenues with respect to the equity investment. If the ratio is one, we are not so good in the performance achieved, because we are obtaining a revenue that is exactly the same of the money invested as equityholders. So these ratios computed for every company that we consider comparable benchmark for us. And we compute an average of these ratios, for all the comparable companies. Chapter 4 pp. 146-156 So a simple arithmetic average of all the multiples are computed for each comparable company. If this is 50 and this is 10 now and we have all the two comparable companies, we do 50 + 10, multiply for 1 divided 2, so our average will be 30. Once we have this 30, what we will do is to use these 30 in order to compute our value of equity, the value of equity for the private company based on market data, as the ratio between the revenues and our multiple. These out to compute for a private company a proxy of a market equity weight. Once we have this equity, we will do equity divide total asset and this is the weight of the equity on the company. If you want to have that divided total asset, you do 1 minus equity divided total asset and you have what you are looking for. The last part, once we have the equity, what we have to do is to compute the weights. The weights are how much I have finance it through equity with respect to the overall resources. You know that the overall resources, so that plus equity has to be equal to the total assets because that's a rule for the counting data. And So what you will do is that your equity weight is this equity for private company divided for your own total assets. If you need to compute the debt weight, you do only one minus equity for private companies divided for total asset, because what is not financially to equity has to be financed through debt. - Average market debt equity ratio And alternative approach that you can adopt is instead of using multiples, let's try to use directly the information about the financial structure of our comparable companies. So again the same set of benchmark companies that we have identified before, but instead of computing a multiple, we try to compute the directly an index on the leverage. Normally what you will use is this proxy of leverage that is debt divided equity, for each of the company that you consider comparable and you will compute it for every company and at the end you will do a simple average. The leverage of your company, the private company 1; is the arithmetic average of the leverage ratio, for all the other companies. The benchmark companies that you have selected. Chapter 4 pp. 146-156 OK, so now we're two approaches. One is say it's a based on multiples, one is based directly on leverage. We have to understand that which scenario is better to use the first solution and the which scenario is better to use the second one. So once we have identified the set of benchmark companies which approach may perform better. Let's think about when you will use this approach and when you will use. . What we are we are to think about is when it's better to go through multiples and one is better to go through leverage directly. What you have to consider is the type of debt. Let's make a simple example: If your benchmark companies are using as debt only bonds, you will go for this solution because it's quite easy for you to compute the value of debt, the market value of debt, for your comparable companies. You are the number of bonds and you are the price of each bond. So you had the value of the debt and so you have the ratio, that is the value that divided for the value of the equity. If the comparable companies are using mainly mortgages offered by financial institutions, probably this solution is no longer working for you and it's better to go for this approach over there . Because remember, average market debt equity ratio is assuming that you can compute the equity value for the comparable listed companies and this is quite reasonable, but it's also written that you have to compute the debt value for a listed company and you don't know if the listed company is using only market debt or also something else. ● Debt weights When we talk about debt, what we have to consider is the type of debt that we are evaluating and try to use it for computing the book value or the market value of this item. Let's start with the weights that we can assign to a standard bond with coupons. A standard bonds with coupons, you have to consider the value of the debt as the actual value of the interest plus the refunding value. For example you can have a bond that is not offering you a fixed coupon but a variable interest one. And so in order to compute the coupon, you have to have a forecast about the benchmark that allow you to understand what will be the coupon payment in every day, in every month, or even every quarter, when the payment is scheduled. The market value of debt is usually more difficult to obtain directly because very few firms have all of their debt in the form of bonds outstanding traded in the market. Many firms have nontraded debt, such as bank debt, which is specified in book value terms but not market value terms. To get around the problem, many analysts make the simplifying assumptions that the book value of debt is equal to its market value. A simple way to convert book value debt into market value debt is to treat the entire debt on the books as a coupon bond, with a coupon set equal to the interest expenses on all of the debt and the maturity set equal to the face-value weighted average maturity of the debt, and to then value this coupon bond at the current cost of debt for the company. Chapter 4 pp. 146-156 Talking about the refunding value. seems to be easy because the refunding value for a bond is normally the face(?) value. But sometimes you can have bones that are offering you a refunding value that is indexed to a parameter, normally the inflation rate, and so the refunding value is not the face value, but it's the face value plus something related to the inflation rate. The inflation may matter for the performance of a bond, if the inflation is below 2%, you cannot avoid to consider it. But once you are near to 10%, these are information may matter in evaluating your bond. You can compute it directly, or you can assume that the current price of the bond in the market is a proxy of these payments. So what is normally done is to consider that the market is able to discount properly all the cash flows relate to each security, and so the current that you debt is coherent with this formula. When you have to compute this formula, every time you have a debt financing solution that is not at debt security, but is at debt financial instrument (a mortgage). Every time you have a mortgage, you have to compute by your own: The ? at each data and refunding value. A more accurate computation would require valuing each debt issue separately using this process. As a final point, we should add the present value of operating lease commitments to this market value of debt to arrive at an aggregate value for debt in computing the cost of capital. What will happen if you have a multiple debt? You make the sum of all the depth exposure for each type of debt. So the sum of all the interest actualized, the sum of the refunding value actualized. Like the formula that we described before, but with several times on the basis of the different type of debt that we have, each debt is a series of payment that are respected, and so you have to compute it. Chapter 4 pp. 146-156 If you have a special type of financing solution, like leasing, that may be a problem for you in computing the weights. What matters for us for computing the value of debt, is to have an idea about the probability of exercising the option to buy the asset. If we have an idea about this probability to exercise the option, we can compute the value of the leasing by using this formula, because we know if at the end we have a price paid the for being the owner or if we don’t have. The probably is related to the price applied for exercising the option. The more the price is near to the market value, the lower is the probability to exercise the option, because if I want I can buy from the market. If the price that I'm applying to being the owner is significant at a discount with respect to the market value, the probability of the exercising the option will be significant, it will be higher not equal to 1 but near to 1. So what matters for us when we talk about leasing is to have an idea about the last payment and the last payment is related to the difference between the market price and the exercise price. The more you can find that different, the higher will be the probability to have a last payment. The lower is the difference, the lower will be the probability to have an exercise option used by the borrower. And to select only the government. Essentially when we talk about the operating leasing, you can avoid the considering the refunding or the last payment that because no one will exercise the option, almost no one. If we talk about the financial leasing, our analysis has to consider also the last payment because the probability that in the end we will buy the asset it’s significantly higher. When we talk about the leasing everything, financial and operative is, still a financing solution. So even if they are similar to a rent, even if you will not exercise the option, is still a financing solution. So you have to consider it in your financial structure independently with respect to the type of listing we are talking about, always has to be considered. What will change is that for the operative one here you don't have a last payment. For the financial one, probably here you will have a last payment because you will exercise the option to become the owner. 3. Estimating the WACC So yeah, you have the final formula of the weighted average cost of capita. The weighted average cost of capital is computed as follows: You have to know: The cost of the equity (re), the cost of debt (rdWe have described how to compute the truck because we were talking about how to measure it by using a CPM or a security market line approach for the return on equity. We had discussed about how to compute the cost of debt starting from the risk free rate plus a CDS premium or whatever you want in order to consider the risk of the borrower. And if you ever the cost of the hybrid securities ((rH) that could be the leasing contract, the bond with warrant, the convertible bond, whatever you want. Chapter 4 pp. 146-156 Weighted average cost of capital is the weighted average of each of the cost item for our company. What are the weights, the role of each financing solution on the overall resources collected for the equity, for the debt, and if you have, also for the hybrid financing solution. As you can imagine, the weights are defined from 0 to 1. So each of the weights has to go from 0 to 1 and you are not allowed to have a negative value of these weights. When we're talking about the cost of debt and when we are talking about the cost of equity, remember that when we're talking about the cost of debt and the cost of hybrid security, we are talking about the cost net to taxes. The cost of capital is a measure of the composite cost of raising money that a firm faces. It will generally be lower than the cost of equity, which is the cost of just equity funding, and higher than the cost of debt, that cannot represent the 100% of the company funding. Compute the weighted average cost of capital of a set of sector in a developed economy. Sometimes what you can do is also to start from the weighted average cost of capital that we have identified before, and try to make an adjustment about the inflation rate that may matter for your country or for the country which the companies operating. Essentially the adjustement that is done is the weighted average cost of capital computed as before, adjusted before the gap between the inflation rate in the local currency, so in the local country, divided for the inflation rate in a benchmark country. What we are trying to identify is a premium or a penalization., that has to be applied to the weighted average cost of capital estimation in order to consider the difference in the inflation rate applied to a country. The weighted average cost of capital is normally used as hurdle rate for selecting investment opportunities but cash flows have to be consistent with the choice of the discount factor Essentially, when we talk about an investment and we consider the free cash flow to equity holders, so how much the shareholders are earning from an investment strategy, in this case, our benchmark, our outdoor rate, has to be the return on equity. We don't need to compute the with the average cost of capital is sufficient for us to have the hurdle rate related to the return on equity and this is out proxy for evaluating the project. This will be our discount factor for computing the net present value of the investment strategy for the shareholder point of view. Chapter 4 pp. 146-156 If we are not considering the shareholder point of view, but we are considering the free cash flow to the firm, so all the cash flow, for all the stakeholders that are including the shareholders, but also someone else. In this case the discount rate for our evaluation formula has to be the weighted average cost of capital. So the formula that we have introduced today, is necessary for us every time we are evaluating the cash flow for the company and not the cash flow for the shareholder. If we have to compute the cash flow for the shareholder, is enough to have our hurdle rated related to the equity. So risk free + beta * risk premium. These are rules that you have always to remember, that you have always to apply, when you are evaluating a project. So before doing an evaluation, you had to focus on who will be the user, so we have to measure the value for all the stakeholders or only some of them. If he look only at the stakeholders, you will go for the weighted average cost of capital. If you are focusing only on the shareholders, will go for the return on equity. The weighted average cost of capital cannot be computed for every firm because for some business model the approach may fail if there are not clear principles that can be used to identify the amount of debt. Before ending our lecture of today only one disclaimer that is important every time we talk about special type of companies. One type of company, or one type of sector, that may be relevant for us when we are evaluating the weighted average cost of capital. So we're talking about the financial service industry. So we are talking about banks, insurance company, investment banks, leasing companies, whatever you want that are working in the financial service area. What we talk about these type of companies, we have to be worried about applying the weighted average cost of capital, without making some, let's say stupid mistakes in evaluating them. What are the characteristics of the companies that are working in the financial service? They characteristics are related to the type of good (type of service) they are selling to their customer. What is a bank selling to the customers? Their money. Chapter 4 pp. 146-156 When we're talking about one company that is selling you a service related to your resources, the one that you will invest in the bank. So saying differently, if we look at the liability structure of the bank, you will find deposits, that is their money that we are giving to the bank in order to obtain the service of managing money, investing money, and provide the retirement. What we had to ask for ourself is, is a deposit, a liability or an asset? So what I have is that, the deposit is an amount of money that I have to refund, but it's also the type of good the time selling or better and selling a service already to the depositor that I'm giving to the bank. If I'm giving €1.00 deposit to the bank and the service will be almost zero because they cannot invest your money at all, they will retain the money in your bank account and that's it. He finally investing a let's say 10,000€/20,000€, the type of service they can provide you is a little bit better because they can invest your money, they can provide you a return. So when we talk about this type of liabilities, we have to consider that the liability structure of bank is not driven by adapt equity strategy. But it's driven by something else, so a bank is offering you deposit, not he is looking for money or he is looking for borrowing money; but he's offering you a deposit, because they want to sell you a service, related to the money that you will give them. So it's a liability, but it's not a choice made by the bank for its own financial structure is a choice. It's a choice made by the bank for its business. The higher is the amount of deposits that I can collect, the more I can sell services. I'm trying to increase my customer base. So when we talk about deposits in the financial service, this is not something that is related to the liability structure, this is not something that I have to consider when I'm evaluating the depth equity ratio of the bank, because the bank is selling services related to deposit, so the bank has to offer deposits independently to the leverage structure. May happen when we talk about interbank loans. These are market only for banks or for financial institution more generally, in which they exchange money for a short term horizon; could be one day, could be a couple of days… is almost never more than one week. So a short term borrowing in a specialized market. This type of short term borrowing is not driven by a return, because the return offered by this type of interbank loans is quite low. But it's driven by the services that are sold by the bank. One of the main service that we request from a bank is the credit card or the debit card, so payment service. In order to work in the payment service, sometimes you are obliged to give a short term credit to another bank, waiting for get refunded. So if I'm using my debit card in a shop, what will happen is that the money will not go immediately to the selling point, will go in a couple of days or three days. In these couple of days, there is a short term loan in the interbank loans market. So again, these amount of loan is not a choice of the bank, but is that choice of the user of the credit card. Chapter 4 pp. 146-156 But essentially, this type of loans is not a loan that has to be considered in your leverage policy because it's not up to you to decide how much you we use as interbank loans. Lastly, what you can have is a type of loan offered, for example by central banks. When the central bank wants to increase the money that is available in the economy, what is offering is the opportunity to discount some type of, let's say, safe securities, treasury bonds and so on, in order to obtain a loan from it. OK, so you, U.S. bank, you can borrow money from the central bank when is necessary. This type of loan is a loan that is offered at the lowest Interest rate significantly lower than the market one. So essentially when the central bank decides to offer new money, all the banks will accept it. Theoretically, they can refuse it, so you are not obliged as a bank to finance yourself from the central bank. But if the cost is so low, probably is always convenient for you. So again, what we talk about the loans from central banks, the pricing policy is so convenient for you that at the end is not your choice to borrow money because when he's available, you will always borrow it. These items, including deposit interbank loans and loans from central banks are not type of debt securities that you consider in your leverage structure. If you are evaluating a bank or a financial institution. 4. Conclusion The cost of capital is a weighted average of the costs of the different components of financing, with the weights based on the market values of each component. The weights can be computed directly for public companies while for private ones is necessary to consider comparable firms for assigning the weights. The cost of capital is the minimum acceptable hurdle rate that will be used to determine whether to invest in a project. It can be computed for almost every firm that has a core business that allow to identify clearly the amount of debt outstanding. Chapter 5 pp. 167-188 LESSON 08 - CASH FLOW FORECAST What we have to do starting from today is to analyse the cash flow forecast and how we can make a cash flow forecast for a company. Remember, yesterday we have introduced the weighted average cost of capital and I told you that if we are analysing the free cash flow to equity holders we don't need to use the with the average cost of capital, we use the hurdle rate, so the return on equity. If we construct the cash flows on the company at formal level, we will use a discount rate the weighted average cost of capital. So what we will do today is to construct the cash flow at formal level in order to measure the value of our project for a company, so for all the stakeholders of the company. We will talk about the main issue of cash flow versus accounting data, how to distinguish them and what matters for us when we are trying to extract the cash flows from accounting data, we will discuss about some of the most important issues for measuring cash flows, like opportunity cost and so on. And that we will introduce why is important to discount cash flows that will appear in the future. What are the main motivation provided and what are the formulas that we have in Excel for computing the actual value of this cash flows. 1. Introduction The return measurement requires to identify inflows and outflows from balance sheet by considering the accounting standards adopted by the company. When we talk about the cash flows and we try to extract cash flows from accounting data, we have to consider that the approach that we are following up is to analyse instead of the revenues and the cost that are assigned on the basis of when the cost is may be ascribed or when the revenue may be ascribed, so is related to the production process when it's done, and so when the cost has to be assignedWhen we talk about cash flows, we are talking about when a revenue will imply an inflow and when a cost will imply an outflow. So what matters for us is when the inflow or the outflows will appear for the company and nothing else is relevant for us. When we are evaluating at this type of approach, based on cash return, we have to consider that every company is normally not running only one project in one period, but is running several project at the same time. So what matters for us is to have an idea about not the overall cash flows for the company, but the incremental cash flows for the company. What does it mean incremental cash flow? What will happen to the company if the project starts. Our focus will be on what will happen to the company in terms of inflows and outflows if the manager decide to start a new project or not. Finally, it has to be time weighted because we know that cash flows available in different time period, have a value in terms of purchasing power, in terms of liquidity, in terms of risk, that is totally different. So when we are computing a measure of return, this measure has to be time time-weighted. Chapter 5 pp. 167-188 2. Cash flows vs accounting earnings The most important choice in measuring returns is the one between the accounting measure of income on a project (accounting statement data) and the cash flow generated by a project (inflows and outflows). - Operating vs capital expenditure Cash vs accrual value Noncash charges When we are trying to extract the cash flows from accounting data, what matters for us is first of all to distinguish your operating versus capital expenditure that may be analysed in a different way in the balance sheet. And so we have to consider how to transform them into cash closer. We had to consider if there are some assets that have an accrual value instead of a cash value. So if they have only a an estimate assigned by the accountant, or if they have already are real market value that we can use forever within them. And what are the noncash charges that we had to do not consider in our analysis. So what are the items in the balance sheet that will never matter for our cash flow analysis, for our financial analysis of our project. 2.1. Operating vs capital expenditure Talking about operating versus capital expenditure, what is the difference? When we talk about operating expenditure, we're talking about all the expenses related to the operating cycle. Operating cycle means the inputs that you will buy, the production process that you will do, and the goods or the service that you will sell. Is the core business of our company and when we are analysing the core business, the approach for evaluating the project is quite easy because our revenues and cost related to the operating cycle are almost like inflows and outflows, are not really the same, but they are almost like inflows and outflows. Accountants draw a distinction between expenditures that yield benefits only in the immediate period or periods (such as labor and material for a manufacturing firm) and those that yield benefits over multiple periods (such as land, buildings, and long-lived plant). The former are called operating expenses and are subtracted from revenues in computing the accounting income, whereas the latter are capital expenditures and are not subtracted from Chapter 5 pp. 167-188 revenues in the period that they are made and spread over multiple periods and deducted as an expense in each period. Every time we talk about the capital expenditure, is something different, because when we talk about the capital spending, what are they? Investment that you are doing in the medium/long term for your company for buying: building, machinery, every type of asset that you will use for several years. In the accounting point of view, you have to assign the economic value, that are set up, to each of the year on the basis of the expected economic life of the asset. If I'm buying a building, and the building will be used for five years, every year will have a depreciation of the building of 1 divided 5. This depresation of the building, is not at all a cash outflow, so it's not represented your cash out flow, and the when we are assigning at the initial investment, so the expanded or that we have for buying the asset, we have to consider that this expenditure will appear only once during the investment period. So we have to consider that for every type of asset that will be used for several years, we have to avoid to consider the depreciation and we have to consider the outflow only the beginning. That could be also something else that talking about capital spending that may matter; when you have an asset, sometimes in order to increase the economic life of the asset, you can do refurbishment that will have an impact on the economic life of the asset. So again, we have the same building that we discussed before, but we do a refurbishment of the building, in order to increase the economic life of two more years. What will happen in the balance sheet if you are doing so? You have an additional cost in the income statement that you will have for the type of refurbishment, and the asset will be depreciated for a longer time period, so every year you will have a deduction not all 1 divided 5, but one divided 7 in our example. The investment that you are doing for the refurbishment, could be an investment that is creating for you an outflow or is an investment that you do by your own, you as a company, and so it's not a real expenditure, but it's only a time, a number of hours, or number of days, that your employees will spend for the refurbishment. If it is the 2nd scenario, even the initial outflow, has not to be considered in your analysis, because these are an outflow that we are assigned to the balance sheet, but is not a real outflow for the company, so it's a cost, but it's not an outflow. Talking about capital expenditure, another aspect that may matter, is that every time you make an amortization over time, you will have an impact on the taxes paid by your company. So the amortization doesn't matter for you, in terms of how much I will deduct every year, but it may matter for you on how much I can save from taxes, due to the fact that I'm doing an amortization. So if I am amortizing every year $20,000, this $20,000 are a cost that we reduce my taxable income and so we reduce the amount of taxes paid. When we are evaluating the cash flows, we have to think about if there is an amortization, what is the tax advantage that we are obtaining from it. So the outflows ready to amortization don't matter at all, but the tax saving that you can receive from this amortization has to be considered in your analysis. Chapter 5 pp. 167-188 2.2. Cash vs accrual value Accountants define working capital as the difference between current assets and current. In finance we use the non-cash working capital computed as the difference between noncash current assets and non-debt current liabilities. Differences between accrual earnings/expensed and cash earnings/expenses, in the absence of noncash charges, can be captured by changes in the noncash working capital. A decrease in noncash working capital will increase cash flows, whereas an increase will decrease cash flows. Also, we can have some items in the balance sheet that are evaluated with, let's say, an estimate made by the accountant, so an accrual evaluation of this type of asset, and this estimate could be different with respect to what is the real value of these items in the balance sheet. For example, if you have a trademark, you don't have a real value about the trademark. What you can assign is a value on the basis of what you expect to do with the trademark. But if we want to talk about the core business or the company, there is also something else that always matters for you that is related to the selling policy. When are you are issuing an invoice, as a company, you are assuming that the invoice is the amount that you will receive from the customer. And these are almost never true. Because when you should invoice what can happen is that the customer will not pay, because it's not able to pay, or will pay with a delay, and so the value of the payment would be lower because it will happen later. Also, it can happen that when, especially when we talk about the business to business transaction, when you deliver the good, the customer will complain about the quality of the assets. So you send a truck full of your items to your customer, the customer received the truck, and inspect the goods received. The customer discovered that the quality was not as expected, some of the goods are broken, whatever can happen during the shipment of the good, and what the customer will say “I don't want to have this type of good, please resend again all the goods”. You as supplier you will never do it, because it's not economically convenient, what you will do is to offer a discount. Normally this is called a delusion. Delusion means that I have an invoice of 100, but instead of being paid 100, I will be paid 97, only because the quality of the goods or the type of goods that I'm delivering, is not like the one expected by the customer already. This means that every item that you have in the balance sheet is always an estimate and you are not sure about the real value these items. So when we talk about the cash flows, we have also to made an estimate about the mistakes that can be done in the in assigned the value in the balance sheet to some of the items. If you are media world and you are selling only to retail customers, you have no risk of dilution. Because the retail customer will take the good, and if it's broken there is an insurance. As a company I have no risk, but if I'm doing a transaction business to business is not true and that the risk related to the transaction is normally assumed by the company and there's to be discounted in your evaluation. When we talk about this type of items, the items always related to an evaluation made by the accountant, we have to consider the difference and we had to try to identify what could be a Chapter 5 pp. 167-188 reasonable gap that we can assign between the accounting value, the invoice value, and the real value of the payment. In order to do it what you need to found or what you need to collect is a set of information about the historical behaviour of your customer that allow you to understand if the customer is always complaining or if the customer is accepting everything, and if the customer is able or not to pay on time. All this information are collected by the company, and by creating this database on your customers, you can improve your forecast about cash flows. If you have a new customer for which you don't have an existing business relationship, you are fully exposed to risk of making a huge mistakes in this forecast about cash flows. 2.3. Noncash charges The distinction that accountants draw between operating and capital expenses leads to a number of accounting expenses, such as depreciation and amortization, which are not cash expenses. These noncash expenses, though depressing accounting income, do not reduce cash flows. In fact, they can have a significant positive impact on cash flows if they reduce the tax paid by the firm since some noncash charges reduce taxable income and the taxes paid by a business. It is important to consider what is the impact of the accounting choices on the cash flows. We have already said that when we have, for example, an amortization; we can have an advantage because we can have some tax saving. But what matters for us is also how the amortization is done, because sometimes you can have a company that is adopting a amortization scheme, that is more or less convenient. So it's not like the simple example that I've done before, you can have a companies that are adopting a different type of approaches. Although there are a number of different depreciation methods used by firms, they can be classified broadly into two groups. The first is straight-line depreciation, whereby equal amounts of depreciation are claimed each period for the life of the project. The second group includes accelerated depreciation methods, such as double-declining balance depreciation, which result in more depreciation early in the project life and less in the later years. For example they can use or a straight line depreciation. or they can use a double declining balance sheet depreciation. In this case you will have a higher amount of sales at the beginning, and a lower amount of sales at the end. So you say that the depreciation is most important at the beginning and is less important at the end. These are choice made by the accountant. So the choice between the simple approach and something that is more complex, is done by the accountant on the visual of: (Imagine that you buy a truck. And that you want to make a monetization on your balance sheet, you know that once you get out from the selling point, the car will lose around 20 or 30% of its value) Chapter 5 pp. 167-188 - So if you have an asset for which you can assume that there is a huge decrease in the value at the beginning, you can go for the double declining balance sheet depreciation. In all the other cases you have to stay with the straight-line depreciation. That is the simpler one and the easier one to be justified to everyone that is evaluating your balance sheet. So, what you have to think is, is there any economical reason that justify this double declining approach? Remember that the fact that you will have is significant because you are moving some of the cost that you will deduct from the future to the next year. And so in the next year, these amount of deduction will value, in actual value, more with respect to what you can have in the future because in that total value, the nearer you are, the better it is for this type of tax saving. (2. Cash flows vs accounting earnings) How it works to compute the cash flows. Here you have 2 formulas that we will discuss now for computing the cash flows at company level and the equity level. For computing cash flows starting from accounting earnings is necessary to: - Subtract out all cash outflows that represent capital expenditures - Net out the effect of changes in noncash working capital - Add back all noncash charges So the first one, the free cash flow to firm (FCFF) are the cash flows at company level, the free cash flow to equity holders are the cash flows at a equity level so for the shareholders. Talking about how they are computing, they start from the measure, of the performance of the company, that is almost always; EBIT multiplied for one minus marginal tax rate applied to the company (Gross measure of performance). So, I'm trying to compute a measure of returns, that is a gross with respect to the interest payment, but net to the taxes. It's not the final income of the company, because we are not considering the financial structure of the company and the interest payments for our company. So, once we have identified this proxy of the return of the company, we will consider what is done by the company in terms of capital expenditures, how much the company is investing for long term assets that will be used in the future; so we have to consider in the current year, what is the amount of capital expenditures done by the company. Every euro that we spend for a new long-term investment will be a euro less that is available for the free cash flow to firm. After we had to consider what is happening to the networking capital of the company. So what you have to consider is, in the balance sheet, you classify all the assets and the liabilities for the time horizon and you will focus your attention only on the assets and liabilities that will expire in one year. Once you have done it, in the asset side you will have the cash, that is retained by the company, you will have the warehouse so much you have as inputs, semi products or final Chapter 5 pp. 167-188 products, and you will have the customer credits, What else you can have, but it's not compulsory to have it. are short term financial assets, that you may have decide to buy in the past for investing your cash. In the liability side, you will have the debt that you have with respect to your suppliers, so what you have already received as goods and you still have to pay to your suppliers. And the short term financial debts. So, let's say, the loan offered on the invoice by the bank, the factoring contact, that is expiring in no more than one year. What we talk about the networking capital we are talking about the difference between the short term assets and the short term liabilities. Normally every company is run with a gap positive gap between short term asset. And theshort term liabilities. So normally the company has more shorter assets with respect to short term liabilities. You can have 3 scenarios: - Short term assets = Short term liabilities Short term assets > Short term liabilities (most common) Short term assets < Short term liabilities When are you are trying to identify the financing strategy for an asset, you have to try to match the time horizon of the asset with the time horizon on the liability. So if you are investing in the short term, theoretically you have to finance it with the short term liability. But why it happens that some short term liabilities are financed with long term financing solution (long term liabilities)? I'm paying more as cost of debt. So why I am doing so? - Remember that the long term debt and equity are more expensive than the short term debt or the credit given by the suppliers. – What will happen to the short term assets at the end of the year? So once they expire? What the company has to do? If we're talking about cash, once they expire, the company can not be run without using them at all for the next years, it has to replace them. You can have some of the cash that is always necessary for running the company. And if this is the scenario, for you could be more convenient to do not renew the assets and renew the depth every year, but you will renew, you will substitute the assets, by using the same debt that you have already agreed with your bank or the same equity that you have already collected from your shareholders. So now we are running the company with a positive networking capital because we know that some of the short term are always necessary for running the company. Not all of them, but some of the short term assets are always necessary. Once you have done it, that's all you have computed. The gross measure of performance you have computed the new investment in the long term assets, your computed that your policy on the short term net investment networking capital. What you have to consider is the effect of the accounting policy in terms of depreciation and amortization. Chapter 5 pp. 167-188 Remember, depreciation and amortization are already considered in the a EBIT, but they are not real outflow for the company. - If you have done a depreciation that was reducing the earnings before interest and taxes, you had to add it back. If you're done an amortization, that was reducing the earnings before interest and taxes, you have to add it back. This is how to compute the cash flows that are necessary when we are evaluating a company or the impact of a project for a company. Remember, if we are using the free cash flow to firm, we will discount them by using the within the average cost of capital. FCFE: Free Cash Flow to Equity-holders If we want to compute the free cash flow to equity holders, we start from the free cash flow to firm. And what we have to consider is only the impact of the debt policy. The impact of the debt policy means how much I have collected as new resources from the debt market and how much I have refunded of the existing debt. If I have borrowed the new money from the market, so I have a new debt, the amount of new debt that I have created in the year, is a an additional cash flow that matters for the equity holders. If I have refunded some of the debt that the company has already in the balance sheet, these are an amount of money that will be spend for the debt holders and so it's no longer available for the equity holders. These are to compute the free cash flow to equity holders, starting from the free cash flow to firm. 3. Cash flow features In order to evaluate properly the investment opportunities available is necessary to evaluate the impact of specific project features. Talking about the cash flow features or how much they matter for the evolution of project here, you have to consider some aspects that may be relevant in your evaluation on the project. One aspect that matters is the sunk costs another aspect that may matter is allocated existing cost to different, let's say, expenditure center or invoice center in your company. Chapter 5 pp. 167-188 3.1. Sunk costs Sunk costs: They refer to an investment already incurred that can’t be recovered. Ex; Mkt, research, new software installation… When we talk about sunk costs we are trying to identify which type of cost, already sustained by the company, are no longer relevant for the evolution of the project. So we are trying to understand that what is already done by the company and is not relevant on an incremental cash flow approach. Remember that we have to use an incremental cash flow approach that is considered that some of the projects are already in place, and the new project has to be evaluated by considering what is new and what will happen as new to the company if we start the project. When we talk about the sunk cost. We can have: Hidden costs related to a project that can affect the overall performance of the investment - Fixed Overhead Expenses: For example, if we want to run a company, you have to have one accountant (compulsory). If you have to contract one accountant; for you the cost of the accountant, will be the same until the accountant is able to follow all the projects. So if I have already have an accountant and accountant is not working for the full day, probably the choice of doing an additional investment is not increasing the cost for the company. If I want to run a company normally, I have to buy a software; for managing the company and the transactions. The software is a fixed cost that is not proportional to the number of transactions done. So, if I'm using the same software that is already available for the company, probably not to consider this type of cost, as a cost related to the new project. So every time you can identify something that is already available for the company, something that was already bought from the company, and these can be used also for your project (without any increase of cost), these are fixed overhead expenses. And it doesn't matter at all for evaluating your project. So all the expenses already done that are used for a project, are not relevant for your evaluation. Think about that this fixed overhead expenses, sometimes (maybe not fully fixed) but may change once you reach a minimum size of the company or a minimum size or the project. So if I double my revenues, I'm not sure if the accountant can follow by zone my company as he did in the past. Because if I'm making the double of the revenue, probably the accountant is the double of the work, and I don't know if he is able by his own to do everything. If I had twice someone else for working with this account, and this is no longer a fixed overhead expenses, the new account that will come with the new project, will be a fixed cost that you have to consider in your project. Only if you have a fixed cost already paid that is not changing at all; this is a fixed over expenses and you can avoid to consider it. Chapter 5 pp. 167-188 - Past R&D Expenditures: Expenses that you have already done in research and development. Think about all the companies that are working in the Pharmaceutical industry. Normally they try to develop, every year 100/200 patterns, and of them, only a couple will have a market value. For all the others, they spend time, but they cannot produce an income from it. All the past R&D expenditures, before you start with a project, are not relevant for you. Because otherwise every project will be avoided because you are considering all the researchers expenditure done in the past, and no one on the project will be convenient. So if you have already spent the money and you have a patent that is available, and you can use it for the project, you will not consider the cost of the patent as initial outflow, but you will consider only what else you need for running the project, what is already available what you have already developed has not to be considered in an incremental analysis. - - Unavoidable Competitive Effect: When you are innovating, the main effect when you put on the market a new product, is that the other products that you offer lose value, the value of the warehouse will decrease. Because if I'm selling something that is better, I can expect that the demand that we shift from the old model to the new one. So the price of the old model will decrease, because otherwise I will never sell the warehouse. If I'm launching a new computer in the market that will be faster, that will be able to do something, etc. The main effect for the company is that the other computers that we offer, lose value. Every time you are innovating, you are losing some of the value your warehouse. So theoretically, if you are innovating, what you can expect is that the new project has to include the reduction of the value of the warehouse as an initial outflow for your project. Because every time you are innovating you decrease the value of the existing assets. And so you're warehouses will be depreciated that you will obtain a lower amount of revenues by selling what is already in the warehouse. (video) 3.2. Allocated costs Talking about the cost that you sustain for the company, that has to be allocated to different invoice points so to different cost center in your company, what you have to consider is, what is the best criterion that you can use for allocating cost among them. Here you have some examples. An accounting device created to ensure that every part of a business bears its fair share of costs is allocation, whereby costs that are not directly traceable to revenues generated by Chapter 5 pp. 167-188 individual products or divisions are allocated across these units, based on revenues, profits, or assets. You can assign the cost on the basis of the number of units, on the number of employees that are working in the area, on the basis of the revenues produced by each project, on the basis of the profits produced by each projector, on the basis of the investments in assets. All the criterias could be used, it depends on the type of the project and the type of epxenditure that you are considering. If you have an expenditure that is related to the number of people that are working in the project, the number of units is that the best proxy for you. If we talk about a project that is a creating revenues or profits for the company, these approach are even better than the approach based on the units. Sometimes you can have some projects that that are not creating a real revenue or a real profit for the company, and so for them and the only solution available is to split the cost on the basis of the amount of assets that you have invested on it. Let's make some examples. - If you have an internal control center for internal committee/audit in the company, the internal audit is not producing income, is not producing revenues. The only two alternatives that you have is to consider: 1) The number of employees that are working in the internal auditor 2) The amount of investment that you have done in assets that are used by the internal audit function. Normally the number of the assets is not relevant, so you qwill go for the number of employees. When you are investing in I&D, you can produce by your own, so you use your employees, so you can split on the basis of the number of employees or you can buy from outside, so you buy from someone else the output over a research and development project. If this is the scenario, so you have both from an external source the items are probably the value of the assets, so how much you spend, is the best proxy for splitting the cost. For everything else, you will go for revenues or profits, that are the best proxy for splitting cost among them. When you split the cost, you have to take care that some of the costs could be related to the number of projects that you are using or could be independent with respect to the number of project that you are developing. - If they are independent, we are back over there (fixed overhead expenses) and you are not to consider them. If they are related to the usage you are to consider them. You have to split and allocate somehow for the company, One way to estimate the incremental component of these costs is to break them down on the basis of whether they are fixed or variable and, if variable, what they are a function of. Chapter 5 pp. 167-188 4. Time weighted average Cash flows across time are not comparable, and a cash flow in the future is worth less than a similar cash flow today. - Intertemporal preferences Purchasing power Uncertainty Talking about the time weighted average, so how to assign a different value? In order to assign a different value to the cash flows on the basis of when they will appear, essentially, we have to consider that: 1) This is necessary because we have a a different behaviour of the company in terms of when they prefer to have cash flows, so they have intertemporal preferences. 2) We may have a different purchasing power of the same nominal cash flow if it happens in the future. 3) And we may have a risk related to uncertainty every time we are postponing a cash flow for the future. So these are the three reasons that justify the need of constructing a formula that is discounting cash flows in a different way on the basis of when the cash flow will appear. 4.1. Intertemporal preferences Individuals prefer present consumption to future consumption. People would have to be offered more in the future to give up present consumption—this is called the real rate of return. The greater the real rate of return, the greater the difference in value between a cash flow today and an equal cash flow in the future. Talking about the intertemporal preferences; essentially, every time we are evaluating a project, they company or the individual, will prefer immediate cash flows with respect to the one that will appear later. Why it happens so for several reasons. First of all, there is a a liquidity preference for the company and the liquidity preference for the individual. What is the liquidity preference? If instead of postponing a cash flow you have it immediately available, this cash flow may be used for covering unexpected expenses. So I get out of my car is broken. If I have cash, I can repair immediately. Otherwise I took all the assistance, with my insurance company waiting there drive and try to fix it out and after I will obtain back my car. If I have cash totally I can go. I can pay. and after I can try to ask for a refund if it's allowed by the insurance company. This is a precautionary reason that justified the preference of liquidity. Every time you have cache, you are safer as a company or safer as an individual because you can call those unexpected expenses. There is something else, every time you have cash., you not only can cover unexpected expenses, you can also exploit new investment opportunities. Those that are already available or those that will be available in the near future. So if I have already cash, and I found a good Chapter 5 pp. 167-188 investment opportunity, I can start immediately without borrowing money from a bank or without asking to my shareholders to provide the new money. And so I can save time and I can like start immediately. This allow me to have a returned it to this investment strategy. This preference of cash immediately available with respect to cash postponed is also related to the fact that by having cash immediately I can have more investment opportunities and so I can increase my performance by exploding more investment opportunities. 4.2. Purchases power When there is inflation or deflation, the value of currency will change over time and for longer time horizon investments it may matter the most. The greater the inflation, the greater the difference in value between a cash flow today and the same amount in the future because companies and individuals are more interested to goods and services they can obtain from a nominal value od money. Every time that you have a cash flow that will appear in the future, the cash flow will may have a different purchasing power. What is the current inflation rate? 8%. It means that in one year from now, if I have €100 that will get paid and the inflation will remain the same, I can buy an asset in one year from now that has an equivalent value of an asset is nowadays sold at 92. So I can buy only a cheaper asset because the €100 in one year with value 8% less than what they are valuing now. So every time we have an investment strategy, especially in the medium-long term, so more than one year, we will have to take care about how much I will lose as purchasing power by postponing a cash flow. What matters for you is to understand how much this inflation rate may affect your purchasing power. Remember, every time we are near to a double digit inflation, there's an issue that may matter for every investment choice. If we are near to 2%, probably these issues no longer relevant, is not so relevant for our investment strategy, but every time we are in a scenario like the one that we have today, we have to consider about this issue. 4.3. Uncertainty Cash flows are related to contract signed among individuals and/or companies Any uncertainty (risk) associated with the cash flow in the future reduces the expected value of a future cash flow and may create an incentive to invest in the short term horizon instead of the long term one. The greater the uncertainty associated with the cash flow, the greater the difference between receiving the cash flow today and receiving an equal amount in the future. Every time we postpone our cash flow, we are signing a contractor and we don't know if the counterparty of our contractwill be able to respect it. So we sign a contract with a customer, in which we say that the customer will pay 90 days from now. We don't know if the customer after 90 days will pay and the good is already delivered. Chapter 5 pp. 167-188 So we are assuming a risk because we are postponing an inflow and we hope that the counterparties able to pay as expected, if the counterpart is not able to pay or if something happens in the middle, we may be exposed to a loss. For comparing cash flows that will happen in different time periods in necessary to compute the value equivalent cash flow at time zero. In formula: How to do it? With a simple formula that is a present value formula. This is the main formula that we use for evaluating a project, that is a formula which we compute the present value of future cash flow, by considering the nominal value of the cash flow discounted by using an interest rate and by considering the time horizon for which we are postponing the cash flow. So, if the cash flow is postponed or five years, we have to divide it for one plus interest rate, powered 5, 5 is the number of years for which we are postponing the cash flow essentially the highest is the interest rate, the lower would be the present value. The longer is the time horizon for which we postpone the payment, the lower will be the present value. If the project has multiple cash flows, in order to compare it to other projects the formula is the following: Normally you have a project that are characterized by cash flows that are not only one cash flow but several cash flows. So one schedule a time 1, 1 schedule at time 3, 1 schedule at time 10, and so on. In order to compute the value of this project, what you have to do is to make the simple sum of all the present value. Starting from time zero, the time in which you have the outflow normally and arriving to time n, that is the last payment data for your project. This formula is called a net present value formula. It’s the simple sum of all the present value of inflows and outflows for a time horizon that goes from zero to N. (Excel) 5. Conclusion Cash flows are different than accounting earnings because the inflow-outflow analysis requires to consider capital expenditures, the accounting and the payment policy. For computing cash flows is necessary to avoid considering sunk costs and it is necessary to identify the best criteria for allocating costs and revenues. Projects characterized by cash flows scheduled in different time period period cannot be compared directly and it is necessary to translate them into actual value. Weighted average cost of capital – the weights are coming form the comparables and the returns has to be costumized Chapter 4 pp. 93-108 LESSON 09 – CASH FLOW RISK Today we are going to discuss how to measure the risk of a cash flow. Here we are considering the risk, the measure of risk, that is, let's say uncertainty. So everything that is related to uncertainty. And the idea is that we have to identify several approaches that may be used for measuring at this level of uncertainty. What we will do is, to first of all, recap something that probably you already know, related to the investment decision rules. So how to classify an investment on the visual of the performance, what are the indexes that are mostly used forever waiting it. After we will talk about the probabilistic approach that we can use for measuring the risk, related to an investment, and how to read it. 1. Introduction Investment selection has to consider proxies for the expected return and measures of risk that can be constructed starting from the data available: - Investment decision rules Probabilistic approaches Essentially, for the investment choice, every format that we will analyse today, is related or is a coming from the NPV formula. So, everything that we will discuss is related to the MPV formula. Talking about the probabilistic approach of what we will try to do is to measure how much we are exposed to a risk of mistakes in forecasting cash flows. So our idea is that we had to understand how much we can make wrong in our forecast and so how much we can trust our evaluation. 2. Investment decision rules Analysts can select different investment decision rules but characteristics we would like a good investment decision rule to have: - A good investment decision rule has to maintain a fair balance between subjective assessment and objective evaluation; Objective evaluation (that for the same type of project every evaluator we have the same result). Talking about the investment choice, normally investment choice is based on an evaluation that has to be objective: the more objective it is, the better it is. So we are to identify our criterion that allows to be objective. Objective means that for the same type of project with the same set of data, every evaluator will have the same result. On the opposite the subjective will be an evaluation in which the assumption made by the evaluator, will change the ranking among the investment opportunities. So, we are no longer one solution that is the best one, we have one solution that is the best one for someone; and these are subjective evaluation that we have to try to avoid if we're doing an investment evaluation approach. - A good investment decision rule will allow identifying projects that maximize the value of the firm; Chapter 4 pp. 93-108 The value for every stakeholder of the company that may be involve in the company. The aim of this investment evolution approach is always the same. We want to maximize the value of the company. What does it mean? The value for every stakeholder of the company. So our approach will be not only focused on the shareholder, but our approach will consider every type of stakeholder that may be interested or may be involved in the company. - A good investment decision rule should work across a variety of investments. Different projects with different characteristics. Finally, this proxy, the one that we will select, has to be a proxy that is useful for evaluating and comparing different projects, with different characteristics. So we are not to have a measure that is fully customized on a project. We are to have a measure that can be used for several projects, for several time horizon, etc. 2.1. Return on capital If these approaches are useful or not. Here you have some alternatives that we have to consider: First of all, the simpler ones. These are coming from accounting formulas that you already know, and have to identify if this approach is useful or not for evaluating our company. Here we we have the return on capital (ROC) and the return on equity (ROE) The return on capital on a project measures the returns earned by the firm on it is total investment in the project. Consequently, it is a return to all claimholders in the firm on their collective investment in a project. In formulas: Return on capital (first formula): Is the ratio between Earnings Before Interests and Taxes (EBIT) or net value respect to taxes (EBIT*(1-Tax Rate)). Divided the average of the book value of all the assets. It is the average because you have to consider that during the time horizon, it's possible that the assets invested but the company, will increase or will decrease. So in order to have a proxy that is measuring the performance of the asset used by the company, we will not consider the total asset at the end of the year, but we will consider the average of the total asset of the end of the current year and the end of the of the past year. And alternative approach that you can use, is the return on equity in which you have the net income, produced by the company, divided for the average of the book value only of the equity. Chapter 4 pp. 93-108 So again, is the equity at the end of the current year plus the equity at the end of the past year divided for two. The idea is always that during the year the equity may increase or may decrease because you have additional capital provided by the shareholders or you do are refunding of some of the existing shares. When we consider these formulas, the return on capital or the return on equity, in order to make a judgment about the quality of the investment, we have to identify a benchmark that allow us to identify which projects are worth it, so they are creating value for the company, and which projects are destroying value for the company and so it's not worth it to start them. Talking about the return of capital, we are focusing on every activity done by the company, o our benchmark will be the weighted average cost of capital. - If the return of capital is higher than the weighted average cost of capital, you can start the project. If the return on capital is lower than the weighted average cost of capital, you have to avoid to start the project. For the return on equity, the approach is the same, but the benchmark is different. The benchmark is the hurdle rate, so the return on equity, so risk free plus beta multiplied for risk premium. - If the return on equity is higher than the hurdle rate, we start with the project. If the return on equity is lower than the hurdle rate, we will avoid the project. When we have such type of formula for evaluating a project, we have a problem. The problem is that what we use as benchmark (average cost of capital or return on equity) is not fully compatible with our proxy of the return. Our proxy of the return, is the proxy of the return for the company or for the shareholders for the one year time horizon. So we are looking at the last information available. We are computing the return on capital or the return on equity for the last year. The WACC is the cost of the resources used by the company; some of them will expire in the year, some of them will expire later, a lot of them will expire later with respect to the one year time horizon. What we talk about the return on equity, we say that this return on equity is a hurdle rate for an investment strategy in the company, and we say that these hurdle rate is normally for our time horizon that is around 10 years. So we are comparing the results of the project for the one year time horizon with some benchmark that are studied for multiple year time horizon. If you use this approach, the risk of mistakes is quite relevant for you and so probably you have to avoid if you can to use this type of approaches. 2.2. Cash flow decision rules The payback on a project is a measure of how quickly the cash flows generated by the project cover the initial investment. And alternative approach that you can use with respect to the NPV is an approach that is constructive from a proxy of time necessary for recovering the initial project. Chapter 4 pp. 93-108 So the time and exercise for recovering the initial investment, that you have done for starting the project. Here you have two proxies. One again is on the company, the other one is on the equity in which we consider all the outflows of the company with respect to the inflows of the company up to a date. So here you can see the sum from one to N of all the outflows here you can see the sum of from one to payback overall of all the inflows and payback overall by definition is lower or equal than N. The same when we talk about equity. The treasure of these payback equity that is lower than N. The idea of this formula is try to understand how many years I need for recovering all the money spent for the project. For example, the initial expenditure is €1000. The project is earning every year €100 as positive inflow. What is the time that I had to wait for recovering the €1000 invested? I have to wait ten years until I receive as inflow the same amount of money that I spent as outflow. This could be done by considering the free cash flow to firm or the free cash flow to equity. Pay attention these two formulas are doing something that is a little bit strange because all the cash flows are taking in nominal value, they are not taking in actual value. So every nominal cash flow has the same weight independently with respect to the date in which the payment will be done. What we have seen last week is that normally a cash flow that is postponed has to be actualized, because a future cash flow will lesser than a present one. The idea is that this type of proxy may be used in order to identify which type of projects are acceptable for a company, normally the company will set a treasurer(?), so a number of years that is the maximum number of years, for which the company is accepting or is evaluating a project. So I will never start a project with a payback higher than five years. Every project with a payback higher than years has to be excluded. This means that this type of criterion is used only as a second level criterion in order to identify from a set of opportunities, those that will be evaluated. Saying differently, you will never make a choice on the basis of the payback, is not enough. You will do only a selection among investment opportunities, starting from the payback. Chapter 4 pp. 93-108 Here you have a the NPV we have already discussed about what is the NPV, the NPV, what is it is the actual value of all the cache flow. So you can compute it as the actual value of the free cash flow to format. Or to take the free cash flow to equity. If you use the free cash flow to form, the discounting factor is to be there with the verge cost of capital. If you use the free cash flow to ACQUITY, your discount factor has to be the harder rate, so the return on the equity holders. The net present value of a project is the sum of the present values of each of the cash flows—positive as well as negative—that occurs over the life of the project. The general formulation of the NPV rule is as follows: Here you have a the NPV, that is the actual value of all the cash flow. You can compute it as the actual value of the free cash flow to firm or to free cash flow to equity. If you use the free cash flow to firm, the discount factor has to be the weighted average cost of capital. If you use the free cash flow to equity, your discount factor has to be the hurdle rate, so the return on the equity holders. For the NPV, NPV is the actual value of a series of payments, positive or negative, doesn't matter. When we construct the formulas, focusing our attention on the company, we will look at the free cash flow to firm. And when we are looking to the free cash flow to firm, the discount factor has to be coherent with the type of cash flow that we are analysing. And you know that the cash flow produced by the company may be financing through equity, may be financing through debt maybe financing through leasing whatever you want. So your discount factor has to be WACC. If in the opposite, we consider the free cash flow to equity holders, our point of view is the one of the shareholders. So we focus on the return expected by the shareholders and the more coherent, the more correct discount rate, will be the return expected by the sahreholders. It means that we have to use the hurdle rate or the return of the equity holders as discount factor. Here in the formula you can see that there is an additional item in the formula that is called the terminal value. Why matters to consider separately the terminal value with respect to the free cash flow to firm or the free cash flow to equity. Chapter 4 pp. 93-108 The terminal value is the remaining value of the asset. So we are doing an investment, we are starting a project at the end we will have some remaining assets that could be sold in the market. These value of the remaining assets at time n, will be estimated in a different way with respect to the free cash flow to firm or with respect to the free cash flow to equity, so essentially it's always an inflow but the formula used for computing it will be a little bit different. NPV is measuring the value created or for the company (NPV overall) or for the equity holders (NPV equity), but is the value created by a project. Every time the value is higher than zero, so the NPB is higher than zero, the project is working and you can start it. Every time the value is below 0, the project is destroying wealth and so it's not worthy for the company to start it or to continue with the project or do something with this type of project. This type of criterion with respect to the one that we described before is significantly better, because is objective, because all the parameters here can be estimated, because is based on information that you can collect and is evaluating everything that can happen for a project. This type of criterion could be classified as a first level criterion. It means that I can select investment opportunities by looking at the NPV. NPV results have to be evaluated by considering the following properties This NPV formula has some characteristics that may matter for us. 1) NPVs are additive First of all, the NPV formula is offering you the opportunity to compute the value of a project, as the value of each step of the projector or each part of the project. So essentially for computing the value of a complex project by using the NPV, you can do it, part by part, so item by item. So you can compute what is the NPV of the cost, what is the NPV or the revenues, you can compute the NPV related to the expanded during R&D and so on. And you add everything and you obtain the NPV of your project. This type of property is useful for you because sometimes you can have a project for which is not easy to measure all the items, to measure all the characteristics of the project and so if you can have at least an estimate, a broad estimator of the NPV, could be enough for selecting a project. If for example, I cannot compute the NPV of the R&D expenditure, but the NPV of everything else is more than one billion of euro, I'm quite sure that I can start with the project, because even if I don't know the R&D expenditures and I don't know the performance of it, I can still trust that by considering them the net NPV will be higher than 0. If I have a net NPV without considering R&D expenditure, that is only €10, probably I have to avoid the project because the error they spend you may be more relevant than the €10 that I have estimated. 2) Intermediate Cash Flows Are Invested at the Hurdle Rate Chapter 4 pp. 93-108 The other aspect that is important is that the assumption made by the NPV is that every investment is producing cash flows during its life and these cash flows that are producing by the investment, are reinvested in the market. So the cash that you produce has a company, will not stay in your bank account, but will be reinvesting in something else. In what will be reinvested? - If we compute the NPV overall, we are investing in the weighted average cost of capital. If we are computed the NPV equity, we are investing at the return on equity holders, so the hurdle rate. Is this assumption reasonable or not? Let's focus on the 1st formula. When you select an investment, what is the most reasonable approach for selecting an investment opportunity? I will select an investment opportunity that allow me to do what? So theoretically you have to select an investment opportunity in which you know or you hope to obtain a positive return, but it isn’t enough to have a positive return , should be higher than the cost of the resources in the case of the NPV overall, we are saying that we are reinvesting at a minimum return that is at least a covering the WACC and this is quite reasonable or better is an underestimation of the return that I can obtain, but could be as safer measure that we are computing. When we consider the NPV equity, we are saying that we will reinvest and will not give back money to our equity holders only if we cannot obtain a return that is higher than the return requested by the equity holders. So what we are doing with this formula, is to make a safe assumption about their reinvestment rate. We are assuming that the reinvestment rate is at the minimum acceptable for the company point of view. Could be higher, but at least it's something that could be reasonable. 3) NPV Calculations Allow for Expected Term Structure and Interest rate shift The estimate that we are doing in this formula are assuming something that can be strange. It is assuming that the discount factor (WACC or re) is always the same independently with respect to the time horizon for which the resources are invested. So the discount rate for one year is the same discount rate with the respect to a cash flow of five years, 10 years and so on. So the yearly discount rate is exactly the same- Same differently we are assuming that the yield curve, so the relationship between the return and the time, is flat. We can construct a formula starting from these two formulas, that is removing this assumption, so it's not using a flat interest rate over time, but it's using an interest rate over time that is changing. Normally how it has to change? How the interest rate is related to the time horizon on the investment? Already I have to expect a growing yield curve because the higher is the time horizon for which I investing money, they higher has to be the return offered. But we can work on this formula, Chapter 4 pp. 93-108 we will not do it, but we can work on this formula and create a new formula that is also respecting this type of assumption or more reasonable assumption. 4) Not useful for comparing project with significant differences in the outflows When we consider this type of projects with the NPV formula, we have to be worried because that they are not so useful for making comparison every time there is a huge difference in the outflows. If I have a project that has an NPV equal to 1,000,000 and a project that has exactly the same NPV but the capital invested in the first project is 10 times the capital invested in the second one, I cannot say that the two projects are almost the same. Because in order to start the first project you need more money and so you as company If you select the first project that you will be not allowed to do a lot of alternative projects available in the market. So every time you have a huge difference in the outflows, take care because then the NPV cannot be the only criterion used for evaluating the project you need to identify something else that allow you to distinguish on the basis of what the amount of capital invested in each project. 5) The result obtained is affected by the time horizon of the investment The result obtain is normally affected by the time horizon and again if you are comparing projects with different time horizon then, the NPV would be not so reasonable for making the comparison. What you think, a shorter time horizon normally implies a higher or lower NPV? Let's assume that it's positive, but his higher or lower? Lower, because the shorter is the time horizon, the lower is the risk that you are assuming and so the NPV would be lower. So what will happen is that if you consider only the NPV, you can be biased because you will look only for long term investment opportunities because they are the only one that I have the higher NPV that is not always true that the company wants to have only long term projects in its portfolio. Sometimes it's better to have something that is more balanced with something that will expire in two years and suddenly that will take more years in order to produce a positive return. The IRR is the discount rate that makes the NPV equal to zero and it represent the minimum return by the project in order to create value for the company. Chapter 4 pp. 93-108 Here you have an approach that can be considered jointly the NPV as a criterion for evaluating a project. What you have is a formula that is coming directly from the NPV, but is analyzing something a little bit different. The difference between this formula and the one we analyse before, is that instead of having NPV here you have 0, instead of having here the WACC you have IRR (Internal Rate of Return) overall. In the second formula the same, zero and instead of having the hurdle rate for the equity holders, you have the IRR equity of the equity holders. Is a formula which our variable of interest is the discount factor. So we have to measure the discount factor that makes these equation correct. So we're to identify, what is the discount rate that makes the actual value of the free cash flows and the terminal value equal to 0 for both of the firm side and the equity side. The main problem that you have over here is that, this is an equation of order. What is the order of this equation over that? N And you know probably how to compute the solution of an equation order two(?). Sometimes you can reach a solution of an equation order three. No one of us can solve an equation of order 2050 or 100. So essentially this type of formula is, first of all a problem related to how it's computed, normally you can compute it with a computer and accepting that the solution obtained is already one of the solution available, so it's not the only one, but it's only one of the solution available. You can trust the less that these result is always the same independently with respect to who is running the solver for the function or who is doing the computation. For applying this formula, if the IRR overall is higher than your treasure(?), do you start with the project. IRR overall is the IRR for the company and our treasured will be WACC. We will invest in a project only if the internal rate of return on this project is at least equal to the cost of the resources used, the WACC. What we talk about the free cash flow to the equity holders, the approach is the same, but they IRR for the equity holders as to be higher than the return requested by the shareholders. So the hurdle rate that we have already discussed. When you use this formula, take care because it could be useful, it could be one solution that you are to adopt, but remember that even a good software, even a good computer, is able to identify a set of the solution available. Not all the solution available and so sometimes you can make a mistake every time you use this type of formula instead of the NPV. What is the advantage with respect to the NPV? The IRR if we have project with a positive NPV, allow us to make also comparison between project with different amount of initial expenditures. Because if I say that both of the projects are earning 1,000,000 of euro, but for one of them and they rate is 5% and for the other they are 8%, I can understand that the second project is better because probably the amount of expenditure done for the second project will be significantly lower. So I can use the IRR in order to have an idea about how much the outflows matters in evaluating your performance. Chapter 4 pp. 93-108 For the same level of NPV, if the IRR is higher, it means that the outflows are significantly lower and so the performance is significantly better and you will go for that project, for similar level of NPV. If we have two project like we described before, both of them are producing an NPV of two million of euro. So theoretically they are the same, but the initial outflows are totally different; for one of them is significantly higher than the other. By looking at the IRR, I have one measure about how much it matters. If I discover that for two projects with the same NPV, the IRR on the second project is significantly higher, I will go for the second project. The second project will be the one characterized by the lower outflows, because otherwise you will never have an higher IRR for your project. (If you have two projects with almost the same NPV, you will select among them by looking at the IRR) All we have done up to now are based on free cash flow to equity and free cash flow to firm. What matters for us is that sometimes we can do mistakes in forecasting the free cash flow to firm or the free cash flow equity. So everything that we are putting in our NPV formula may be wrong. And so we have to be sure about the data that we are using and we have to have an idea about how much is the risk of making a mistake by using this type of data. 3. Probabilistic approaches The approach that you can use are the sensitivity analysis, the decision tree approach and the MonteCarlo simulation. Risk evaluation for projects has to be performed by considering the risk related to forecasting cash flows. Main methodologies for measuring risk are: - Sensitivity analysis When we talk about the sensitivity analysis, we are evaluating 1 by 1 each item, that may matter for our NPV formula, for our estimate of FCFF or FCFE. - Decision tree When we consider the decision three, we are trying to assign a probability, to each of the events that may matter for us. So we know that something may go wrong, or maybe better than expected, but we are also able to assign a probability to each of these events. - MonteCarlo simulation The last approach that is the Monte Carlo simulation is an approach that you use when you know that different events may happen and may affect the FCFF or the FCFE estimation, but you are not able to make a proper forecast about the probability. 3.1. Sensitivity analysis Chapter 4 pp. 93-108 Sensitivity analysis can be used to analyze how much you can afford to be off in your estimates of revenue growth and margins without altering your decision to accept or reject the investment. We say that we are identifying each item that may affect the performance of the project, so the return of the project. (Excel) For example, let's say that we are constructing them NPV formula and we want to identify some items that may affect our projects. Here you have a list, for example you can have: - - - The market share, so how much you are relevant with respect to your competitors, that may increase or may decrease over time and so may affect the performance of your project. The technology innovation, saying differently that may matter for the performance of your project. The more you have innovation, the lower will be the time period for which the project will be working, because something else will replace it. The duration of the share of the market, so for how many years you can maintain the share of the market. The price per unit. The total amortization cost (TAM) The annual investment that you can suffer, so the amount of expanded that you have a year by year. The cost period operating unit Initial cost Here you have is a, let's say, a tornado plot, in which it shows how the NPV of the project in millions of dollars is changing, if we are at the minimum of the market share or at the maximum of the market share. if you we are in the minimum of the market share, the NPV of our project will be around 40 millions of dollar. - I the market share of our company goes to 15% ( that's the minimum) our NPV will go to 40 millions of dollars. Chapter 4 pp. 93-108 - If, on the opposite, we are lucky because our market share will go to 30%, then the NPV of our project will be a little bit less than 130,000,000. And you do it for each of the items, so for the technology innovation, the duration of the project and so on, you know, to understand how the NPV may be changed on the basis of this assumption in the minimum of maximum value. What's the problem of this tornado plot? The problem of this tornado plot is that the assumption done in the sensitivity analysis is that each item is independent. Let's make an example on this plot; we are saying that the market share of the company is independent with respect to the pricing of our good. - If you reduce the price, the market share will increase. If you increase the price, the market share will decrease. Excluding the scenario in which you are a market leader and the consumer cannot survive without your good; in all the other cases, what you will have is that these two items at least will be not independent each other. The same would be for all the items that you can see here in the list. Probably excluding this initial cost. Everything else is a really did and in the sensitivity analyse you are assuming that they are independent. So this is the main problem that you can have in this approach, but before going to the next one, let's try to understand how to read it. Let's look at the market share. Does it matter or not for the NPV of our project? So essentially this is the item (market share) that is modifying the most the NPV on the basis of how much the market share may change over time. The range that you have over there is around, let's say 90 millions of dollars on the basis of the market share. On the opposite, if we go over there on the initial cost, does it matter or not for the NPV? Almost no. Because the NPV is always near to this 70 million. That is the average NPV estimated for the project, almost independent with respect to the initial cost, it could be 69 million or 71, but it doesn't matter too much. When we are evaluating a project, what else matters for us is also to consider the role of the green area in this plot and the blue area this plot. Because the green area is telling you how much you can earn more than expected. The blue area is telling you how much you can earn less than expected. For a standard investor, that is a risk averse, normally, which type of information matters the most? The green one or the blue one? The blue one, so if you can see that there is a for example, the market share over there, the market share is true, that is the one that is driving the variability of the NPV but there is a higher probability that a change in the market share, will have a positive impact on the NPV, Chapter 4 pp. 93-108 with respect to a change in the market share, will have a negative impact on the NPV. So these item matters, but it is not the riskier one. Probably the riskier one is the duration of share for which you have exactly the same change in the NPV positive or negative, and so you will have almost the same level of losses with respect to the level of gains if you have made a mistake in forecasting. So what matters for you is the length of this plot for each of the items, but also the composition. How much is a loss and how much is a gain. Below the average is a loss above the average is a gain, so blue is the loss and green is the gain. (EXCEL) The application of the sensitivity analysis requires to pay attention to: - Overdoing what if analyses Losing sight of the objective Not considering how variables move together Double counting risk When we do the sensitivity analysis, we have to be worried about some mistakes that we can do, by using the sensitivity analysis. What are the mistakes that we can do by using the sensitivity analysis? When are you do this type of analysis, remember that you have one parameter and for each parameter you compute the maximum and the minimum and the impact on the performance. It means theoretically you can do it for every parameter that is relevant for the project. If you do so, at the end, you will have a tornado plot that you cannot read at all. So you will have something that theoretically could be useful, but in reality will be never useful. Because it's not so easy to idntify how many parameters I have to follow, which one is more relevant and so on. So first of all, you have to consider that this approach has to be focused only on the relevant parameters for your estimation. We are not to consider all the parameters you for the NPV formula, you have to consider that your focus is to compute the variability. And the role of a negative variability with respect to the positive one, because the positive one matters less with respect to the negative one. And these approaches are assuming that a lot of variables or almost all the variables are not related to each other. When you select the parameters, try to be sure or try to select the parameters that are not related each other. For example, if you consider the number of sales and you consider the price is not reasonable to say that they are independent of each other. Because the number of sales is driven by the price and also vice versa somehow. And finally, do not make double counting of at risk. If for example you consider the price and the cost, you cannot add the profit margin as an additional parameter for evaluating the NPV. Because it's true that the profit margin is affecting the NPV, but the profit margin is coming from the difference between price and cost and you don't need to double count this item with respect to something else. Chapter 4 pp. 93-108 So what matters for you is that this type of approach is not objective. You have to select the parameters and maybe an approach that is not useful every time the assumption of independence is not respected. 3.2. Decision tree The construction of the decision tree requires to identify: 1. The root node represents the start of the decision tree, where a decision maker can be faced with a decision choice or an uncertain outcome. 2. Event nodes represent the possible outcomes on a risky gamble. (1 i 2)What else we can do? We can do something better. Trying to construct a model that allows us to remove the assumption of independence. So, remove the assumption that each item that we use for the NPV has to be independent from the others. So the price is not independent from the number of savings, and the NPV has to consider this type of linkage. How it works? If we are able to assign a probability, what we have to do is to use this probabilistic approach. What does it mean? We have to identify a tree in which we do several assumptions on the items used for the NPV formula, so we can say that the cost is growing at 20%, the cost is remaining stable, the cost is decreasing of 10%. So we have 3 nodes, in our tree and we are to assigned to each of them a probability. Once we have assigned a probability to each of them, we can compute for each node, what is the impact on the cost, on the price applied; if the costs are going up, what will happen to the price? Let's say that he's going up or 15%, what you expect on the price of the good if the costing is growing up? Will increase as well. I don't know if it's the same percentage or not. Depends if you have fixed cost or variable cost, how much they matter. But for sure the price will go up. So what you can do is to make a more reasonable assumption for each of the nodes because you know what is the link between each item in your formula. So the item are not independent because in each node we do one starting assumption, for one of the items, and we are adjust all other items coherently. If the price is going up, because we are to cover the cost that is higher; probably the volume of seats will go down. I don't know how much, but it will go down and so on you construct assumption that are reasonable for considering the linkage between the economic variables that you are using in your NPV formula. So essentially you construct a several nodes, you identify nodes and probability of each node. 3. Decision nodes represent choices that can be made by the decision maker. Sometimes you can have also nodes at that are special ones, for which you don't have an event that is affecting the company, but you can have a manager or a decision maker in the company that may make a choice. This type of nodes is called decision nodes. They are different than the event nodes because these are related to the choice made by the management. What you do every time you are launching a new product or a new service in the market? (Before doing it) What do you do? Chapter 4 pp. 93-108 You do a market, a marketing researcher, for understanding if there is a demand. So you spend money for the market researcher and you wait for the results. Once the results are available, we have two choices. - The results are positive and so you spend more money for continuing the project The results of the analysis were not good as expected, and so you leave it the project and you don't spend money on it. This is a decision node. Because I have some information that I will use for doing a choice. So all these events are decision node events in which you as a manager you will decide what you want to do. 4. End nodes usually represent the final outcomes of earlier risky outcomes and decisions made in response. At the end you will have the final nodes, that will bring you the return. Which one of the solution is the one that is relevant for you? How you can use this information? In this example; - If I am a risk lover: I will win $50 If I am a risk lover, but I'm not lucky, I will win $10 If I am a risk averse, I will take $20. On the visual, what we can say if this project is risky or not? We must consider the maximum gap. The maximum gap between the best scenario and the worst on is $40, this is the range of variation that matters for evaluating the risk. In order to, in the end, to have a synthetic measure of risk, I can say that the range operation is $40. How can I see if this project is risky and how much is risky? First of all, I will look at what I can earn at the maximum and what I can lose in this case here, analyse at the minimum. In this case, we're lucky because we are always earning money. Chapter 4 pp. 93-108 But in only one case we are learning more than what we have invested. So the three scenarios: - - If I am a risk lover: I will win $50 – This is a gain because we are investing 30 and we are taking back 50. If I am a risk lover, but I'm not lucky, I will win $10 - So this is a loss because we are investing 30 and we are taking back 10. If I am a risk averse, I will take $20 - These are loss because we are investing 30 and we are giving up taking back only 20 If I this is a loss because we are investing 30 and we are taking back 10. These are loss because we are investing 30 and we are giving up taking back only 20 these again because we are investing 30 and we are taking back 50. In this case, we're lucky because we are always earning money, but in only one case we are learning more than what we have invested. So what we can do in order to have an idea about the risk of this project? You have to consider the probability of these nodes (50%) in order to understand on the basis this probability, what is the weighted average of these returns; because you can have that the value seems to be not so good. But this event is the one with the higher probability and so the project is still worth. On the opposite, if the other events (earn 20 or earn 10) were those with the higher probability the project is not worth at all because you have a higher probability of having losses instead of adding gains. What matters for you to have the probability of each node and compute the probability of this event. You have to assign a probability in the decision probability. You can decide to give up or you can stay in the game. Remember the probability would be the probability of all the nodes that you need to follow for reaching one scenario. The main problem this approach is that we have to know every item and every probability for each item. And normally you don't have this information and so theoretically you can apply this approach, but normally you don't have enough information for doing it. ⋅ Step 1: Divide analysis into risk phases. ⋅ Step 2: Estimate the probabilities of the outcomes. ⋅ Step 3: Define decision points. ⋅ Step 4: Compute cash flows/value at end nodes. ⋅ Step 5: Folding back the tree Chapter 4 pp. 93-108 What you can do is consider this approach as let's say, an idea that you will use for applying this idea into a software, into a simulation software. So what we will do is to use this approach for adding a preliminary performance evaluation, to have an idea about the impact of risk by having all the information and all the estimates on the probability. At the end you will have some outcomes are probability estimate and normally rationality assumption. But at the end you don't have a real measure of risk, because all the estimate of probability are totally subjective and so you cannot say that they are correct or wrong, especially those that are related to your choice with respect to those that are related to the event. 3.3. Montecarlo simulation An alterative approach is to incorporate probabilistic estimates rather than expected values and to use simulation tools for predicting the NPV and its risk. What we do normally is to use this approach that is called the Monte Carlo simulation. The Monte Carlo simulation try to analyse the project removing the assumption of independence of each parameter, so we are moving on with respect to the sensitivity analysis, but trying to extract the probability not from your idea or your subjective evaluation about a projector, but on the basis of simulation of trials. Simulation of trials means that this software is able to make some forecast several forecasts and on the visual these several forecaster may provide an output for the evaluation. The analyst has to: - Determine probabilistic variables What you have to do is to define the variables of interest, those that think may matter for the project. Remember, you cannot study all the items, some of them has to be assumed as fixed. Some others you can try to test how much they matter for your evaluation. - Define the probability distribution You have to identify not the probability, but the probability distribution. What is the difference between probability and probability distribution? When I'm assigning a probability distribution, I'm only saying what is the expected behaviour of the probability and not assigning a value to the probability. I'm only the identifying what is the more reasonable distribution of probability. - Check correlation and exclude unnecessary variables for the simulation process Once you have done it, you apply all these data in a formula. And you avoid to have unnecessary variables for the simulation process and you compute an NPV. Chapter 4 pp. 93-108 So you select the variables, you assign a probability distribution, you drop all the variables that are not strictly necessary or they are correlated each other. And you focus only on the items that are mostly relevant for your NPV. Consider the following plots and identify the type of distribution that fits the best for describing the item. What matters for you is first of all, is trying to understand the probability distribution, because that's the most important issue for you. Yeah, you have an example of one item that I've selected the randomly that could be relevant for your project. These are the energy price before the current crisis and these energy prices going from 2008 to 2020. And you have the energy price per kilowatt, in Europa because these are data from Eurostat. You have the trend in the price over time. And the histogram on the trend in the price. The trend in the price was 0.10 in 2008 Semester 1 and it reached the around, let's say 0.135 or around the 14 at the end of the period in 2020, semester 2. So there is a growing trend in the price, that you can consider for analysing your data. First of all, starting from this data you have to construct a different type of plot. What matters for you is not the historical trend but is the frequency of the values. These are histogram with the frequency of the values. So here you can see that in the time horizon analysed for three semesters, the value of the index was 0.10 for four semesters it was 0.11. For 11 semesters it was at 0.12. For 7 semesters was a 0.13, and for one semester it was 0.14. This is a different way of analysing the same type of data, but when you are attempt to assign a distribution, that's the plot to that you have to construct. You cannot assign distribution by looking at the historical data over there, you have to create an histogram on the performance. So remember: 1) We select the parameters Chapter 4 pp. 93-108 2) We assign a distribution to each of them. 3) We use a software. Types of distribution: - Normal distribution: When you have a mean value that is equal to the median value and the number of cases below and above the median are almost the same. - Log normal distribution: When values are mostly concentrated on the negative side with respect to the positive one. - Triangular distribution: When only some values are relevant, the one in the middle or the one in the extreme of the distribution. - Uniform distribution: When you say that all the values has the same probability. - Discrete uniform distribution: It is like the uniform, but only some values are allowed. So you can not have 0,102 you can only have 0,10. Yes/No distribution: When there are only two values that matters for you. - Once the variables are identified, the analysis will use tools for running simulation with an high number of trials (>10000) and the additional choices that has to be done are: Chapter 4 pp. 93-108 What is the software doing? The software is making a simulation on NPV estimation. Why we need to use the software? Because in order to have something that is reasonable, something that could be used, we have to run more than 10,000 trials. And manually it will take too much. You can do it only a few seconds even with Excel and you will have a set of results by using the parameters that you have selected, the distribution that you have assigned, and at the end you will have your NPV. - Select the performance measure for running the simulation Before doing it, you have only to select the performance measure that you will use at the end, almost always the NPV. - Identify the outliers and the criteria for managing these data You have to drop if there are some outliers. - Summarize the results and measure the level of risk And after you summarize the results. In order to show you how it works and how much is useful and easy to do it. This is the result of a simulator normal used made by Oracle. The name is Crystal Ball. I don't have a commercial agreement with them, so you can use whatever you want, even excel. Here you have the assumption of the baseline. So our baseline with our value NPV, so the NPV of this project is 500 and $2000 computing with a discount rate of 15%. And this is the distribution that I assigned to some of the items (third picture). For example, the cost distribution, the cost package is assumed to be with a normal distribution and that's the output of the simulator and NPV with a CSO frequency. Chapter 4 pp. 93-108 Now if you have more than 10,000 observation, because that's the number of simulation that you have done, and so probably each of them will have a different NPV. You construct an histogram like the one that you can see over there, on the visual. For selecting or evaluating the risk of the project. What you have to do now? We have done 10,000 thousand trials. Theoretically we have 10,000 different NPV, something less because you can be lucky and sometimes you can have exactly the same NPV even if you are changing some assumptions. Now, how you can read this output to the one that you can see over there? What you can see here with this black line is the estimate of the NPV. So this is the average of these estimates, so is $254,000. Saying differently, we have an average value that is around enough of our estimate of the NPV. Is it a safe project or is it a risky project? A risky one, because what we're saying is that by doing our simulation, 10,000 simulation, we obtained as mean value something that is an alpha of what we are forecasting as a return. If this is the scenario, the project is quite risky because our estimate, our baseline estimation of the return of the project, may be significantly wrong. Because the average of these simulation tells that there is a higher risk of mistakes. What else you can do is now to look at the red area and the blue one. Even if I'm wrong with my NPV estimation. How much I'm exposed the two losses. And how much I'm still in the profit area. Even if I have a high risk of making mistakes, the probability of suffering or losses is lower than the probability of turning gains. So it's not the best scenario. We have to be worried, but we can also be lucky and earn more than expected. So the first comparison is your estimate of NPV with the average of this estimate. After you look at the composition of the events, positive and negative ones. And after what you can do at the end, is also to work on the file and try to do something a little bit different. What does it mean something a little bit different? When you run 10,000 simulation, there is a higher probability to have values that will never be coherent with the reality. Extreme values, positive or negative, that could be too far away with respect to what you can really have in the project. So we are making assumption, we are doing a simulation with a software, that could be some assumption that are too strict or too penalizing or too positive and so we are to avoid to consider them. What you have to do is to consider by using this plot to create an interval or confidence. What is the interval of confidence? Try to drop out extreme values. Chapter 4 pp. 93-108 Why I have to do it? That because sometimes this value could be significantly far away with respect to the average and so could be one of the biases in estimating the NPV average value. So if you are doing a simulation, sometimes you will do an interval of confidence by dropping the extreme values, the two positive one or the two negative ones. If you do it with the software, the software will cancel this observation and we revise carefully the average. So you will see that the average will move, on the left or on the right, on the basis of our many extreme values, you are dropped. What you can do at the maximum is to remove from your analysis, no more than the 5% of the observation. Then 95% has to be your analysis, Sir. But you can decide that if you have a lot of extreme values, you drop the words 2.5%, and the best 2.5% in order to have a more reasonable estimation about the NPV. Remember when you do it, what will happen is that also this line, we'll be revised and will be moved somehow in the plot. 3.4. Probabilistic approaches comparison This table summarize the assumption that you are doing when you sensitivity analysis, decision tree analysis and Monte Carlo simulation. 4. Conclusion Any decision that requires the use of resources is an investment decision that has to be evaluated by comparing the performance with respect to the proper hurdle rate; Discounted cash flow methods provide the best measures of true returns on projects because they are based on cash flows and consider the time value of money. Uncertainty is a given when analysing risky projects and there are several techniques, we can use to evaluate the consequences of the investment decision in the medium long term Chapter 7 pp. 310- 325 LESSON 10 – FINANCIAL STRUCTURE PRINCIPLES 1. Introduction Nobel declaration A pioneering contribution to financial economics concerns the theory of corporate finance and the evaluation of firms on markets. This theory explains the relation (or lack of one) between firms' capital asset structure and dividend policy on one hand and their market value on the other. In a perfect capital market, the total value of a firm is equal to the market value of the total cash flows generated by its assets and return for security holders is not affected by the financial structure Modigliani & Miller Hypothesis 1. Market are liquid and securities price is based on expected cash flows 2. No taxes, no transaction costs (issuance and trading costs) 3. Debt policy does not affect firm performance or information disclosure 2. Internal vs External Financing Cash flows generated by the existing assets of a firm can be categorized as internal financing. Because these cash flows belong to the equity owners of the business, they are called internal equity. Cash flows raised outside the firm, whether from private sources or from financial markets, can be categorized as external financing. External financing can, of course, take the form of new debt, new equity, or hybrids. Use of external and internal funds in Europe Chapter 7 pp. 310- 325 The choice of the source of of capital depends on the company and its access to financial market. Firms have to recognize that internal equity has the same cost as external equity, before the transaction cost differences are factored in. The hurdle rate for the investment opportunities has to be computed coherently: In the simpler scenario: Internal financing cannot represent the unique source of capital for a company that is planning to growth because internal equity is clearly limited to the cash flows generated by the firm for its stockholder. Depending entirely on internal equity can therefore result in project delays or the possible loss of these projects to competitors and the expected decrease in the market share of the company. Managers should not make the mistake of thinking that the stock price does not matter just because they use only internal equity for financing projects. In reality, stockholders in firms whose stock prices have dropped are much less likely to trust their managers to reinvest their cash flows for them than are stockholders in firms with rising stock prices. The negative effects of a not profitable re-investment strategy of cash flows available could be long-lasting on the WACC of the company. 3. Debt/Equity trade-off The debt equity trade-off may be summarized as follows: Chapter 7 pp. 310- 325 3.1. Tax benefits In a scenario with taxes the tax shield allow minimizing the amount of wealth taken from the Tax Authorities Tax shield opportunities could be be measure as following: Chapter 7 pp. 310- 325 This amount is the amount on percentage rate that I am saving, if this is 2% tells you that starting from a cost of debt, you save the 2% by using the tax shield opportunity, if it’s 1, you save only the 1%. The main problem that this formula doesn’t allow you to measure what is the gap, between this value and the value to here in blue. In order to have the gap between this value, the Yellow and Blue, versus the Blue that you can see over there, you have to compute the amount of savings that we will have during the life of the company related tot his tax shield opportunity. And here you have the formula: The saving are the Delta of the interest rate, so exactly what you can see over there, multiplied for the amount of debt. So the idea is that I want to computer, what is the gap between the Blue area for the unlevered company, and the Blue plus the Yellow area for the levered one. The main problem is that with this formula I am only able to identify what is the saving that I can achieve by using a debt financing, for your the borrow, that’s the amount that I will save. But I don’t know exactly how much I am using as debt, and how much I’m saving as euro for exploiting the tax shield opportunity. How to do it? You use this value (first formula), so the gap related to the tax shield and you multiplied it for the value of the debt, for all the years in which the company is in the market, it is operating. So if the debt is 1000, I multiply the two percent for One thousand in the first year, if the debt in the second year is a eight hundred, I multiply 800 for the 2% in the second year, and so on. So I compute the tax shield per year in euros, not in percentage rate. It depends on this gap in percentage rate multiply per the cost of debt. As you can imagine the cash flows are appearing in several years, different years over time, this time horizon is quite long in order to have a measure that is reasonable you have to discount the future cash flows in to actual one. So every cash flow that will appear in the future, will be discount with one plus the cost of debt and the cost of debt we said that is the risk free plus the CDS spread. This is the tax saving in the percentage rate. (first formula). This will be the tax saving in euro (Second formula) for our company. If we want to measure this gap, we need the proxy in euro. The proxy in euro will be gap over there (interest tax shield in unlevered firm), so at the end, what we will obtain as value will be this interest tax shield that you can see over there. So the formula over there (Second formula) is the interest of shield that you can see in the plot. The value of the company levered, how much is different with respect to the company unlevered for the present value the tax shield? So if you consider a company that is not using leverage, the gao between a company that is using leverage will drive driven by only the price value the tax shield. Normally the price value of the tax shield could be negative or not? Is always positive. Chapter 7 pp. 310- 325 Every company that is using debt, by exploiting the tax shield, is a value that is higher than a unlevered company. So company levered are valued better and a higher valued respect to the unlevered company. And the gap is this present value of the tax shield. When we evaluate a company and we try to assign the market value of a company, so how much we will pay for buying a company, how much I will pay, depend on how much I will earn from the company (actual value) if we are earning more, it means that we will pay more for buying the company. So the value is the price of the company that you will pay for buying it. Considering the equity and debt. And this is increasing wrongly because the net payment that you receive, net with respect to taxes, is higher when you are losing leverage with respect to the scenario in which you are not using it. 3.2. Management discipline An increase of leverage will reduce the management entrenchment problem due to: - Risk of firing Creditors monitoring Investment strategy Talking about the discipline or the agency problem, that you can solve by using debt, there are some aspects that may matter for you. Let’s start of the control of the managers, so the CEO of the company, if we are using leverage, what will happen to the company is that for the same level of assets, the value of the equity will be lower or higher? If some of the assets are financed to debt, with respect to a scenario which there is nothing collected thorough debt, what is the impact of the equity? When is higher? By focusing only on the equity side, shares, ordinary shares, when they vaue more, when the company is a company that is using debt or not using debt? Assuming that the total assets are the same. Two companies, one of them is 0 debt, the other one is using debt, I don’t know how much but doesn’t matter for us too much, but the assets are exactly the same, for the equity when do you expect that the value of the equity is higher? A company with or without leverage? Think about the value of the company; the value of the company are the value of the assets versus the value of all the liabilities. If I am telling you that in the liabilities there are only equity or there is equity+debt, when the value of the equity is higher? If you have 100 as assets, and you have only equity; the value of the equity is 100, if you have 100 of assets and you have some debt, the value of the equity will be a little bit lower than 100. When I am using debt, what happens is that the value of the equity outstanding, will be lower, for the same level of assets. If the value of the equity of outstanding is lower, what you think about if I want to become the majority shareholder, for me is more expensive for less expensive when invested in a levered company? I have to spend more or less money to becoming the majority shareholder of a levered company with respect to the unlevered one? Chapter 7 pp. 310- 325 Less money, because we say that the value of the equity is lower, so in order to have the 51% we spend a little bit less. What does it mean, that every time we are using leverage, the cost of obtaining the control, so make a takeover on the company, is significantly lower. And if the risk of takeover is lower, what will happen to the manager? Why matters for the manager (CEO) point of view? The issue is that every time that there is a takeover, some of the managers will be replaced, probably the CEO, and so when you have more leverage, the risk of takeover is higher, the risk of losing job for the manager is higher. When you are exposing to the risk of losing job, normally you work better, you are less lazy, you try to maximize the return, you try to satisfy the shareholders, and so on. So every time we talk about the leverage policy, and higher usage of the leverage policy, increase the risk of takeover and so create an incentive for the manager to work its best in the interest of the stakeholders, specially the shareholders, only because is exposed to a risk of being fired and replaced when there is a new takeover. Remember that the takeover with the leverage is less expensive, so is more frequently done for the company. What else can happen is that when we use leverage, we can have also some advantages related to the especially financial institutions, that are offering us loans, mortgages… When you are requesting a loan from a bank, and you are requesting a loan asking only for 5000€. What you think about the bank is evaluating you properly in the tail that is worried about losing the money, and so on? Not too much. There is a certification effect when you obtain the money and so from the market recognize that you have the possibility to be financed through a bank, and so there is a positive effect. Normally, what matters for you is not only if you receive money, but also how much you receive. Because if I am asking only for 5000€, the bank will never control if I am paying on time, if I have problems and so on, if I fail to pay after the bank will try to recover the money, when you use your credit card, you pass the card and you do the payment, no one is controlling it, until you reach the maximum of your credit card. If I want to invest in a house, and I need not 5000€, but I need 3000€/2000€ an so on, the exposure for the bank is significantly higher, do the bank is certify that I am able to pay a huge amount of money, and before doing it, will do a screening and after they will do a monitoring, the screening means not everyone of us is able to obtaining the loan, so only those that are worth it can received this type of loan, the monitoring means that once you receive the loan, every year, or every semester, I will check what you are doing with the money, and if you are still able to repaid the loan as expected. Every time you are using leverage, the more we use leverage the higher will be the roll of the creditors in a screening and monitoring the company, so the more you are able to use leverage, the more you will have the certification effect that we were discussing with you college, so you will have a positive judgment from the bank that may matters for the financial markets. If Intesa SanPaolo give me 1000 euro, probably they know that I can refund it, otherwise they will not give me. If Intensa SanPaolo give 1000€ I don’t know why they are doing it, probably the will get refunded but doesn't matter to much for the Financial markets point of view. Because they know that Intensa is not making screening and is not making monitoring at all. Chapter 7 pp. 310- 325 What else is important is that when you use leverage, different with expect to use equity, so we talking about debt financing versus equity financing with the debt financing you are assuming fixed obligation of payments overtime. So you payments that they are respective to be done now, the year after, in two years from now and so on. Fixed o variable payments doesn't matter matters, but assuming fixed outflows overtime. If you are doing so, normally in selecting new investment opportunities, you will try to select only that ones that allow you at least to repay the loan. So if I know that every year I could pay 1000€ as a interest, the return every years has to be 1000€. So what you will have is by using leverage, the manager has an incentive to select investment that are profitable and investment that are characterized by stable cashflows. Saying differently, investment that are less risky with respect to others that are available in the market. Because they know that you have to do a payment, and they want to be almost sure that they are able to pay by using the money produced by the project. The benefits related to the management discipline are affected by the following company’s features: Talking about the management discipline so decision, the one related to the takeover risk, to the monitoring and, the investment strategy. ⋅ Public vs privately owned When we consider the management issue, the management issue are different if we consider public versus private owned companies. Because for them may be less relevant to have of this type of control. If we talk about privately owned companies, normally they are expected to be smaller. Normally here you have a family firms and they are smaller. If they are smaller normally, they don’t have a lot of problems in controlling the management, in controlling the employees., you don’t have a lot of employees, yo have 5/10 employees and is quite easy to control them without using leverage. So, for private companies, normally the management discipline is not relevant with respect to the public companies. ⋅ Concentration of the ownership Talking about the concentration of ownership, think about if we are talking about a public company in which we have 1 shareholder that has the 51%, with respect to a company always public, in which you have the majority with the 5%, for listed companies are quite common, when is more relevant to have a management discipline? When you take the control with the 51% or with the 5%? let's focus on this issue, equity versus debt. If we have a company that is tease owned with a 3/5% as control majority. This means that the risk of firing is already high. So theoretically, you don’t need to use leverage in order to have a risk of takeover. What matter for you that can justify what was saying your colleague is that every time you have an ownership that is a wide spread, among different type of shareholders, this type of shareholders they don’t have a direct incentive to control the company, if you are investing only, let’s say 15.000€, this investment strategy, it may matter but it is not all your wealth probably. So you will not spend so much time in controlling this type of investment. Chapter 7 pp. 310- 325 If in the opposite, you are investing several billions of euros, in the same company, you are already controlling the company. So the more the ownership is wide spread, the less the shareholders are controlling directly the company. By using the leverage they can take advantage from the control done by the bank. So for you what matters the most is that by using leverage, when the ownership is no concentrate, you will give the control, the monitoring, directly to the bank. And all the shareholders will benefit for it. ⋅ Role of institutional investors What else is important is the role of institutional investors, that may affect your leverage policy. Think about who are the institution investors? Are, let’s say, investment banks, hedge founds, mutual funds, pension founds, insurance company, so every time of financial institution that is collecting money from someone else and investing in their own. You can do it and investment Bank, you can do it as a pension found, as an insurance company, as a mutual found, so you collect money from the public and you invest this money on their own. Every time you and institutional investor, what is changing in terms of management discipline? Mutual found: Is a financial institution in which several individuals, so all of us, invest money, they obtain a certificate representing a right related to this money invested, and the money is invested by a professional manager. So I will not do the investment strategy by my own, because I don’t know how to invest money, I will give the money with someone else to a manager, and he will invest the money for us. So what is changing is that instead of having small individuals investors, I will have some large institutional investors that are investing money in my company. What is changing In the management discipline, what is happening if for the same amount of money that I’m collecting, instead of having 1.000.000 million of small investors, I have 900.000 plus a couple of institutional investors? What do you think about, institutional investors is using the money of someone else for making an investment strategy, we hope that the manager is able to collect more or less information with respect to the individuals? Normally they are able to collect more information, or better information with respect to what can be done by individuals. Because If I have to pay a fee to a manager, for managing my own money, I expect that the manager is able to manage better to respect of what I can do by my own. How the manager is able to do it better, because he has skills but also because he has more information than I have. Talking about this scenario in which that I have more information than the investor, that are binging money to my company, what do you think about? This issue is more or less relevant? What I am asking is if there are some institution investors that are investors that are bringing some money with more information available to my company, the management discipline is more or less relevant? (due to the fact that they have more information or better information about my company, because is their job, so invest the money of someone else, and so they have to collect more information about where they are investing). Chapter 7 pp. 310- 325 So if they are more experts, they don’t need to have a creditors monitoring, they don’t need to create constrains for evaluating the investment strategy. They have to take care abou the risk of hiring? It depends on if they are actiive or notbut later we will discuss about it. Theoretically, if you know more, you are less interested to this issue. Because if you know more, you don’t need to create additional controls on the company, because you already know what the company is doing. So the information assymentry is lower, and your are less worried about controlling the company. ⋅ Degree of activism What matters is when they are investing money as institutionals, normally they are investing a huge amount of money, so they are buying the 5/10% of the shares outstanding. So the investment done is an investment ina percentage of he outstanding capital that could be significant,. If this is the scenario, what matters is also to understand what is the strategy in investing in the company. Normally you distinguish the strategy on the basis of this activism. What is this activism? Means that if the institutional investor is interested to take the control, or to influence the strategy of the company, or not. You can have institutional investors that are bringing you several of euros, but they don’t want to be involve in the control of the company. So they are not active investors, they are passives ones, and so they only bring the money and wait for the results. On the opposite you can have a lot of institutional investors that even with a smaller amount of money, they want to be involve in the control of the company. So they want to be in the meeting, vote in the meeting, and so on. These are active investors. Every time you have an active investor, what will happen to the management discipline? Normally this type of investor, are those that are trying to control the manager, by using constrains in the investment strategy, by using the bank for controlling the manager and the management choices, and also by increasing the risk of turn over because sometimes they don’t want to be only in the general meeting and vot for it, but sometimes they want to take the control, and so they want to replace immediately the manager and so on. So every time that you have a institutional investors that are active, the management discipline will be significantly more relevant. If you have a institutional investor that are not active, they are onlgy invested for because they trust the company, the management discipline will be not so relevant for you. 3.3. Bankruptcy cost A firm that fails to make the required interest of principal payments on debt is classified as “default”. Bankruptcy is frequently a long and complicated process that imposes different costs: Let's go on the cost related to using leverage. Remember here we are talking about not the choice of using a little bit more leverage, or a little bit less leverage, we are talk about using leverage that becomes unsustainable. Unstable means that you can't refund the debt because you assume to debt of the performance of the asset were not so good as expected. Now we have two main costs related to the excessive usage of debt; one is called direct cost the other one is called indirect cost, the difference is related to when they will appear. Chapter 7 pp. 310- 325 - Direct costs We talk about direct cost, when we are analysing a company that is near to the bankruptcy or is already in bankruptcy. - Indirect costs When we talk indirect cost, we are talking about a company that is still performing but will reach the bankruptcy status in a couple of years, approximately. So we have a debt that is already unsustainable, but the company can survive for a few years (3/4 years, no more normally). a. Direct costs Talking about the direct cost, remember the company is in bankruptcy, and essentially you have already filled, or you wil fill the bankruptcy declaration, that is when you declare that you are no longer able to repay the debt, and so you declare that now you have to start a recovery procedure on the stakeholders of the company because the company will go out of the market. Costs related to bankruptcy declaration: - Hiring outside professionals (lawyers, accountants, etc…) What you need to do is that this type of preclude, the bankruptcy procedure, is a procedure that you do by going to a trial, by asking to a judge, to follow the procedure. The judge will ask you to hire lawyers, accountants, consultants and so on, in order to be sure that the value of your company that is written in the balance sheet is the real value of your company. So the judge before deciding how to split money among the stakeholders, has to be sure about what is the value of the company. And the evaluation has to be done, removing the assumption that the company will be in the market, so we are estimating the liquidating value of all the assets own by the company. If there are the conditions, the judge can decide to create a reorganization plan, so create the condition for the company in few years, to go back to the market. - Reorganization plan and legal advice Theoretically you can have a company that is applying for the bankruptcy, they create the reorganization plan and if it doesn’t work, they can do even another reorganization plan, and so on. It depend on the judge, it depends on the interest behind the company. Theoritcally, if the judge say OK every year you can apply for the bankruptcy. Once you decide to do this type of reorganization, what you are doing is creating a new company and try to run in a different way the same company. Alternative solutions for avoiding bankruptcy - Workout The alternatives solutions that you can have is to do a workout, so you sell everything and you pay with the money collected to all the stakeholders,. It takes a little bit of time and in a couple of years you can complete the procedure. As you can imagine, not all the stakeholders will be fully paid, some of them will lose part of the money and so on. Chapter 7 pp. 310- 325 - Prepackaged bankruptcy The company sell a proposal to the stakehoders in which they say “I will not refund you the 100%, but I will refund you by cash, the 20/30% of the nominal value.” If the majority accepts, you can do the prepackaged bankruptcy and follow the payment schedule that you have declare in this email, and you can still survive, and you can still run as a company. What you have to be worried is if the stakeholders have an interest or not to accept a huge reduction of their credit, 20 or 30% of the nominal value is the only amount that you will recover, is means that you will lose the 80 or 70%. Atac (transport in Rome) was so lucky because the owner is the municipality. And the 45% of the debt that was not paid at all by Atac, was with respect to the municipality. So the owner is deciding if they want to still run the company or not. If we consider all these costs together, normally the cost that you can suffer, related to all this procedure that you cave to manage, is on average the 3 or 4% of the firm value. So the maximum that the company can recover is the 97 or 96%. (Average costs 3-4% of firm value) The estimate of the expected direct cost of bankruptcy is driven by: The issue is that this type of costs area affected by the EBIT size, the variability of the EBIT, and the amount of debt payments you have. - The EBIT size The variability of the EBIT over time It matter because if you have the EBIT that are negative and signifally volatile, which solution will be used for solving the problem of the company? Pre-packaged bankruptcy or even the workout in order to find a solution. You will never try to do a reorganization because you know the business is no longer profitable and so there is no reason to try to create a new company for running the same type of business. - The debt payments amount If the debt amount is too high, you can try to prepackaged bankruptcy, because there are in some countries (even in Italy) some rules related to try to help individuals companies when they have excessive debt (strategic default). These are a set of rules that allow you to obtain more convenient prepackaged bankruptcy because by law when the debt is unsustainable, the full repayment is no longer an option as lender. b. Indirect costs Costs that will affect the firms before or after the bankruptcy declaration Talking about indirect cost, we are talking about something that will happen before you make the declaration of bankruptcy. Chapter 7 pp. 310- 325 In this situation, what will happen is that some of the stakeholders may be worried about this risk and may react to this risk of bankruptcy even before it happens. - Loss of customers Normally you can buy a product that is a complex one, for which in the price there is already an insurance or an assistance for a couple of years, if the company goes to bankruptcy, what you are paying as an insurance has a value of 0. So you are paying for not obtaining a service. What else is important is that when you are buying a complex item, during its life, you may need to do a refurbishment, so you may need to fix out some of the problems, if the company is already of bankruptcy, the cost of the refurbishment is significantly higher, because the item is no longer produce, I can not replace some of the items and it is so expensive for me to do the fixing of the items. What else is important is that there are customers that can buy once, but sometimes we have fixed an agreement with them for receiving goods for a time horizon, let’s say, 3/5 years, and they need to have a supplier that is able to give me the goods when expected for the full life of the contract. If the supplier is exposed to a risk of default, I will look for another supplier, so as a customer I will look for another company and the company that is exposed to the indirect cost of bankruptcy will lose a lot of customers. - Loss of suppliers If the customer will go to default, the value your the warehouse will go immediately to 0, you have no longer opportunity to sell it someone else, and so you want to avoid this risk, it means that you will not create warehouse, and the effect was that my suppliers will not create a warehouse for me and so every time I ask for a new good they have to produce by 0, I will be the last on the line in order to receive the products from the supplier. - Loss of employees Employees may react to the risk of bankruptcy. They will try to leave the company as soon as they can, for economical reasons. If you leave the company before the company declares bankruptcy, the company has to pay you a finally stallment related to the fact that you are leaving the company. If you leave the company when the company is already in bankruptcy, probably you will receive somehow the finally stallment but will come in a couple of years, when the bankruptcy declaration is closed. What else is important is that when you leave a company, and the company is still in the market, when you apply for a new job in another company, the other company has almost always to offer you at least the same wage condition. If you apply when you are a formal employee of a defaulted company they will decide the wage that they want to offer you, and normally is lower. - Costs to creditors Every time that we are near to the bankruptcy, those that will identify in advanced for sure are the lenders. The lenders will react to the risk of default, by increasing the cost of borrowing, so the interest rate will be higher, or by increasing the amount of guarantees requested for each euro loan. Saying differently, by reducing the amount of credit given. Chapter 7 pp. 310- 325 - Fire sales of Assets and inefficient liquidation Finally, you can have the opportunity, if you want to survive, to sell some assts that are not necessary for the company. If you are doing it, and you are near to the default, normally the buyer, who is buoying from you, will use his own market power for having a lower price for buying this type of assets. So you will have an inefficient liquidation related to fire sales of assets that are not strategic for the company. (Average costs 10-20% of firm value) The estimate of the expected indirect cost of bankruptcy is driven by: - Economic life of the product/service sold Normally the indirect cost is related to the economic life of the product or service that you are selling. Normally the longer is the economic life of the product that you are selling, for sure you will have an impact on the customers, because as a customer you has to be sur that the supplier will still in the market so I can use the guarantee, the refurbishment and so on. - The role of quality in the final price This means what is the impact of the brand on the price of the good, if you are buying an iPhone, more than a half of the price that you are paying is only related to the iPhone (brand). When the company goes to bankruptcy, the value of the brand will go immediately to 0, so if I bought a mobile phone yesterday and the company goes on default today, if I bought an iPhone I am not so lucky because more than the half of the price will disappear in a day. - Additional services and complimentary products If there are additional services and complimentary products (everything that is related to the good) for example, the apps in a mobile phone. If you are no longer a supplier of apps, that’s it for the mobile phone. - Post-sale guarantee and service If there is a service that you are providing after selling the good or not. 3.4. Agency cost Capital structure can alter manager’s incentives and change investment and lending decisions and the overall effect for the company could be a reduction of the firm’s wealth. - Risk shifting New financing Dividends and buyback What we are going to talk about in this point is what can happen if we use excessive average in a company. Risk Shifting Risk shifting is a risk related to the fact that when the cost of debt is unsustainable, what is the only way to avoid the bankruptcy of the company (cost of debt to high, what you have to do to avoid the bankruptcy)? Chapter 7 pp. 310- 325 - - - If you want to avoid the bankruptcy, the easiest solution is making the cost sustainable. For doing that we have to increasing the return achieved by the investment done. If 10% WACC is unsustainable now (because the return of asset or the “r” rate is only 5%), I have to more than double the return on my asset in order to make the cost of debt sustainable. If, for example, the return of the asset is 11%, with a WACC is 10%, the current leverage became sustainable —> when you increase the return, in finance, you increase the risk. In this case, you are doing a risk shifting strategy, moving from safer projects to risky ones, in order to have a return that is at least equal to the current WACC. When your WACC become unsustainable: you have to avoid safer project and go to the risky ones, that if they work, they will offer you the opportunity to refund the debt. New financing Every time we are experiencing a problem related to leverage, we can be worried about what can happen in the future, or better, how much time will be able to collect new money new financing from the market. Normally, if the market discovers that the debt is unsustanible, they will stop giving you the opportunity to raise new money. Because they want to avoid to increase the risk exposure in a company that is exposed to a risk of default. If this is the scenario, what will happen is that you know that in the future you will be not able to raise new money, and so you probably you will be more conservative in exploiting the current investment opportunities (px. If I know that I won’t have more new opportunities for raising money in the market, I have to be sure that the project is the best one that I can find). What will happen is that you will wait more for starting a new project because you know that you can not start all the project that can be worthy, you have to select the project that you think that wil performance as the maximum. This will take several time. Until you wait, the money that you retain in the bank account, are offering a return equal to 0. So the more you wait for the best investment opportunity, the more you reduce the wealth created for the stakeholders (by the money will stay at the bank with a 0 return). Dividends and buybacks Every time we are near a default, the policy adopted by the manager is a special type of actions that are only decide by the manager. These type of actions are actions related to how to remunerate the shareholder. For remunerating you shareholders, you as manager, you have to ways for doing it. The first way is paying dividend and the second one is to make a buyback. The buyback is essentially to buy from the market, by from the shareholders, their own shares at a premium. The current price of a share is 10, if you want as a shareholder, you can sell your share to the company at a 10,5%. The gap between the price supplied for the buyback and the market price is the return that will give to the shareholders. Normally, near to the default, frequently, you will have that the dividend policy or the buyback policy of the company will change. And how it will change? They will pay more dividends or they will do more frequently buyback. Chapter 7 pp. 310- 325 Why they do so? Why the manager is doing so? It could be a issue related to information asymmetry. So you try to show that the share is still performing and you can still invest on the company (because I’m paying dividend, I’m paying you more than the current value of the market). But, what else is important? Why you prefer to pay shareholders instead of paying a bank, instead of paying the bondholders near a bankruptcy situation? Why you as manager you are more worried about the shareholders with respect to all the others? Because this manager has to look for a new job. And if the shareholders, are shareholders of other companies, by paying them by buyback or dividend, you reduce their lost related to the company and if the bankruptcy can been driven by something extern you, the shareholders will evaluate positively your application to became the new manager. The estimate of the expected cost related to the agency problem is driven by: - Objective estimation of assets’ value Market benchmark for investment value Time horizon of the investment strategy Predictability for the projects’ cash flows Talking about agency cost, what matters for you is identify the agency cost on the basis of the assets value on the company. - The larger are the assets own by the company, the agency cost will increase. If we are near bankruptcy, px. we have to switch from safer assets to riskier ones, if you have assets owned by the company that are billions of euros, it means that you have to identify several risk investment opportunities that allow you to cover the cost of debt that is currency unsustainable. The probability that you can find all the projects that are performing enough for covering the cost of debt will be significantly lower. (And the same in the contrary). Market benchmark is telling what is the average return in the market. - - The higher is the market benchmark, the lower is the probability to find something that is performing better, and higher would be probability to wait without founding a project that is able to safe your company. So normally, the better is the average performance in the market, the less easy for you will be the strategy for saving the company. Talking about the time horizon - The shorter is the time horizon, the complex will be apply one of the before’s approach. If I have to safe the company that is going to go in bankruptcy in a couple of weeks, I cannot doing anything. If I have a couple of years still of life of the company, I can be lucky and I can find something that is useful for me. Talking about predictability for the projects’ cash flows - The more the cashflows are predictable, the more you can find financial resources in the market (so you are less exposed to this type of risk), and the more the cash flows are predictable, the more you are able to manage this type of risk (because at least you know how much you are earning and so you know Chapter 7 pp. 310- 325 which type of project you can consider as a project with a higher risk for saving the company). 3.5. Flexibility needs Firms value financial flexibility for two reasons: 1 - The value of the firm may be maximized by preserving some flexibility to take on future projects as they arise. 2 - Flexibility provides managers with more breathing room and more power, and it protects them from the monitoring that comes with debt There is also a trade-off between not maintaining enough flexibility (because a firm has too much debt) and having too much flexibility (by not borrowing enough). The last item is related to the flexibility. Flexibility means that every company has a maximum amount of money that may be collected externally (from equity holders or debt holders). Every time you are near to the maximum, every time you are using all the debt financing solution available or all the equity financial solution available, the more you are near to this scenario, the less you are flexible (because what will happen in the future cannot be managed by using the same financial instrument and so you will have a lower number of alternative for financing new projects or expected events or expected losses). Flexibility means try to understand how much else you can collect from the financial markets: - The more you can collect, the more you are flexible (so the safer you are as a company) The more you are using, so the less have still available, the more you are to be worried about this type of flexibility (for equity and debt financial instruments). The estimate of the expected cost related to flexibility needs is driven by: - Capability to have easy and not too expensive access to financial markets Potential excess return related to investment opportunities Stage of the life cycle of the product or service This type of issuer is driven by the cost of accessing to financial markets. - - Normally, the higher is the cost of accessing to financial markets, the more you are constrain in using this resources. So, the less you are flexible. Also, how much you can offer as return when you are requesting new money. The more you are able to investing in good performing projects, the more you can pay to the debt holders or equity holders. So, the more are you flexible because you can collect new money for the financial markets. The stage of the life cycle means if you are in the introduction, development, etc. of the company or of the product. If you are in the decline stage, nobody will still finance you. If you are in the maturity, it could be easier, and if you are in the growth or introduction, now you are constrain that you can operate in the future the amount of resources available will be higher. o So the flexibility in the growth introduction will increase, will be at the maximum in the maturity stage and will be 0 in the decline stage. Chapter 7 pp. 310- 325 4. Conclusion Corporations have to identify the best trade-off between rating capital externally and use only internal resources for supporting their growth. A company may take advantage from the leverage by increasing its tax shield and by creating constraints on the management activities. The risk related to excessive leverage usage is related to the increase in the bankruptcy risk, the change in the management behavior and the reduction of the flexibility opportunities for the next years. Chapter 7 pp. 327-332 Lesson 11 – FINANCIAL STRATEGY So today we will talk about how to construct a financial strategy. So what we will focus today is how to evaluate the characteristics of the company that may affect the benefits or the cost related to using leverage. So what we will try to do is try to identify on the basis of the characteristics of the company, if the leverage strategy may change, how it may change, qnd what is most important to be considered. The focus will be essentially on the life cycle or the company and how it matters for the financial strategy. After we will talk about how to use information about comparable companies for identifying the financial strategy, the optimal financial strategy. And finally we will talk about the issues related to Information asymmetry that may matter for the choice of your financial strategy. 1. Introduction We have argued that firms should choose the mix of debt and equity by trading off the benefit of borrowing against the costs. There is not a solution that fits for all companies and the strategies adopted could the following: - Life cycle Essentially, the idea is that when we talk about the life cycle, we are trying to identify how the financial strategy is changing over time. - Comparable firms We will talk about to the comparable firms, we are trying to the identify how the financial strategy may be different sector by sector - Financial hierarchy And finally, when we talk about the financial hierarchy, we are talking about if information asymmetry may matter or not for selecting your financial structure, So these are the three-point of views that we will discuss today about the financial strategy. 2. Life cycle Life cycle and key drivers of performance for a corporation Here you have a simple plot that is showing how we can classify a company on the basis of the stage of the lifecycle. Chapter 7 pp. 327-332 So essentially here you have a plot related to the company over time starting from the initial stage of the growth, let's say the startup stage. The growth stage classified as a rapid and slowing growth. So these are two, let's say parts of the same stage of the life cycle. The maturity stage and the decline stage. So essentially when we talk about a company, we have always said the startup stage. One or two stages are related to the growth of the Company. One maturity stage. And finally the decline stage. In order to classify the company, one of these stage are essentially what matters for you is to evaluate the trend in the revenues and try to understand how the trend in the revenues are changing over time. When we talk about a startup, but normally the startup is not producing or is producing only a small amount of items, so essentially the amount of revenues is near to 0. What we talked about at the development stage, the company has already developed a product that is requested by the market, and year by year, or even month by month, the volume of sales will increase significantly. This the growth stage. When we arrive to the maturity stage, it means that we have reached our market share, the maximum that we can reach. And so the volume of revenues will be almost stable until the good or the service provided is requested by the market. When we arrive to the decline stage, it means that the good or the service is no longer requested by the market, and so the revenues are decreasing year by year, or month by month. This is the scenario that we have in front of us, and we have to understand in each of these stage, what can happen to the financial strategy of the company. What could be the best strategy for the company by considering the trade off theory that we have. So we will try to understand in each stage of the life cycle if the benefits or the cost may be different. Chapter 7 pp. 327-332 Here you have a plot that is explaining you what is happening to the company in terms of benefits and costs over time. Let's focus first of all on the tax benefit: What we talk about tax benefits, we're talking about how much you can reduce of the tax paid by using the tax shield. - - - - Start-up company: Normally the start-up companies are run with a loss. So it's not that company that is producing a positive net income, but it's producing a negative net income. So a start-up is not paying taxes. Because the taxable income is lower than zero, and so you don't pay taxes at all. If you are in this scenario, the tax benefits for using debt in a startup will be 0. Growth stage: Normally the revenues are growing and you will enter in the profit area. So you will start earning more with respect to how much you are spending. So there is a positive net income that could be taxed and so; the faster is the growth of the revenue, the higher will be the interest of using the tax shield. Maturity stage: Your profit is at the maximum, so the benefits are ready to the tax shield are again at the maximum. Every euro that you can borrow may create for you a tax saving. And the more you can borrow money, the better could be for you, until the debt is sustainable. Decline stage: The revenues are start declining. We don't know how fast they are declining but they are start declining and the more they decline the less is useful for you to have debt. Because you don't have more opportunities to exploit the tax shield because your revenues are decreasing year by year or month by month. Talking about the discipline. So the discipline of the management related to using debt. - - - - Start-up: Normally we're talking about a simple company with a couple or three or five employees. So we are talking about a micro company, for which should the agency problem doesn't matter at all. Because we can control directly what is done by the employees and we don't need to use the debt as a solution for controlling it. Growth stage: We can start thinking about collecting money from the financial markets. So increasing the number of shareholders, increasing the size of the company. And so the agency cost may have a role that is increasing over time. Maturity stage: The discipline of the management and the advantage is really to using debt for controlling that management are at the maximum, because you have a complex company which several managers, with several employees, divisions and so on. The more you can control them. Decline stage: The company is losing revenue. So normally the size of the companies decreasing over time and so the role of the DCB on the management will decrease coherently, almost coherently. Let's go to the bankruptcy cost when we talk about the bankruptcy cost, we are talking about the possibility to have a bankruptcy for the company. - Start-up: Normally it changes a sector by sector. The survival rate of a start-up is around 10 to 20%. It means that 80%, 90% of the start-up will go to bankruptcy. So when we talk about a start-up, the risk of bankruptcy, especially the direct cost related to the bankruptcy may be relevant because the probability of survival is quite low. And Chapter 7 pp. 327-332 - - - so a lot of these companies will not go to the growth stage. They will stop working before. Growth stage: You are increasing the size of the company, so you are investing more money for developing the company and you hope that the revenues will grow. If this is the scenario the more you invest money, the more it matters the risk of bankruptcy. Because you are investing money, you hope that you can recover the investment in 5 years or 10 years, but if you don't survive, you will never recover the initial investment. Maturity stage: Normally you have a market share that is the maximum that you can reach and normally you have a level of competition that is not so high because you are already one of the market leaders. In this scenario, the risk of bankruptcy significantly lower. Decline stage: Theoretically the risk of bankruptcy, will decrease because you are investing less in the company. But if you decide to start a new project in the decline stage, the risk of bankruptcy will be even higher than what we have identified in the growth stage. So if you are only dismissing existing projects, here it doesn't matter too much because you have already recovered the initial investment. But if you start to do something else, in this stage, the bankruptcy cost may matter. Talking about the agency cost we are talking about what can happen to the company related to using excessive debt. - - - - Start-up stage: We have a problem, to reach the level of debt that is considered unsustainable for a start-up is quite easy, because you have a low amount of assets owned, because you are stuffed up. Normally you are run from a garage, you are run with what you can find for doing your business. So the investment in assets is at the minimum. In this scenario, the capability to borrow money is essentially 0. And so the sustainability of the debt for a start-up is almost zero, because they don't have asset that they can provide us a guarantee, they don't have revenues that they can show, that could be a signal of their capability to produce an income and so on. Growth stage: The risk of making mistakes for the managers is quite high, because they don't know exactly what they can obtain as return from the investments, so frequently they make a risk shifting strategies and frequently they are worried about collecting your money for the new project, so they are making also under investment strategies. Two of the three items that we classified as agency cost may matter for this type of scenario. Maturity stage: When you're at the maturity stage, the agency cost are no longer necessary or no longer relevant for you, because you already know what is your job, you already know what is the performance of your project and until you arrive to the decline stage, no problem for the agency cost. Decline stage: If you start new projects, the agency cost will start increasing again. If in the decline stage you stop investing in new projects, they agency cost will decrease as the bankruptcy cost that we described before. Talking about to the flexibility. That is the need of collecting new money for future investments. - Start-up stage: Is almost not able to raise money from the market, so for the startup, in order to increase the probability of survival is necessary to plan properly how to invest money and how to use the money collected for aninvestment strategy. So the need for flexibility is at the maximum. Chapter 7 pp. 327-332 - - - Growth stage: You still need the something for supporting your growth, but normally the flexibility is not the main issue for you, because you cannot predict exactly what will be the need for new investment in the future. So you know that you have to grow, but you know exactly what is the amount that you will spend. So there is a need of flexibility, but there is a huge uncertainty about the amount of resources. Maturity stage: You have no longer the need to invest in new projects, because you have already reached your market share, and so your need for flexibility is at the minimum. Decline stage: Essentially, we are not worried about the number of years, or number of months for which the company will continue to work, because we are already in the decline stage. And so, we don't care at all about the flexibility issue. Because we don't know if we close in one year, on two years, but doesn't matter too much if we stop one year before or one year later. What are the benefits, the net benefits or the net losses related to using that? (net trade-off) - - Start-up stage: Normally for a start-up using debt is not worthy because the cost of debt is significantly higher than the benefits related to the debt. Growth stage: At the beginning is not requesting, or is not taking advantage from using debt. In the late growth, so once you arrive near to the end of this growth stage, you may have a net benefit from the usage of debt that is positive. Only at the end of the group stage. Maturity stage: You have to use debt, because you can exploit all the benefits and you have only some of the cost. Decline stage: The debt is still useful, but you have a lot of constraints applied by the market, in order to identify how much you can collect. So theoretically, you can still have some benefits, but frequently you are financial constrained by the market, and so you cannot exploit all the opportunities related to your financial strategy. So what we can expect is that in the beginning of its life, a company has a leverage near to 0. In the growth stage, especially at the end of the growth stage, the leverage will grow. The leverage will reach the maximum of during the maturity stage and will decrease slowly during the decline stage. That's the scenario that we have for every company in every sector related to the life cycle of the company. 3. Comparable firms Firms within a business or sector share common characteristics, it should not be surprising if they choose similar financing mixes. Thus, choosing a debt ratio similar to that of the industry in which you operate is appropriate, when firms in the industry are at the same stage in the life cycle and, on average, choose the right financing mix for that stage. We will discuss about how we can identify some differences among companies, that are working in different sectors, in their financial strategy. So the idea is trying to identify which characteristics of the business may have an effect on the financial strategy and how much is relevant. Chapter 7 pp. 327-332 Essentially what we want to point out are a set of common characteristics that are relevant for every company, that is working in the same sector. What we are trying to identify is, if for company in the same stage of the life cycle, there could be a difference in the financing mix, only driven by their business model or the business model of the sector. The imitation strategy may show some pitfalls in reality when one of the following event will happen: Essentially, what we have to consider is when it's convenient to try to have the same strategy, financial strategy, of a comparable company or a competitor, and in which scenario is no longer useful. - Heterogeneity Talking about when is useful, we have to identify among the companies that are operating in the same sector, if there is an issue or not related to heterogeneity and how much it matters. - Market shock 3.1. Heterogeneity Companies that are competing in the same sector and servicing the same type of customers may experience differences in: In this scenario a more detailed analysis of the comparable sample is necessary in order to identify companies that can be considered a benchmark for the leverage policy. What we talk about heterogeneity, essentially what matters for us are only two items: one at the growth opportunities, the other, the risk exposure. So we want to understand if the companies that are working in the same sector may have the same growth opportunities or not, and if the companies that are working in the same sector may have the same risk exposure or not. What we talk about the growth opportunities we have already discussed about it, the growth opportunities, how they are measured on the basis of what is the forecast of the market on the value of the company, with respect to the historical value of the company that we can collect, for example, from the balance sheet data. So in order to have an idea about the growth opportunities, you have to compute the price to book value (PTBV). So the ratio between the market price of the share and the accounting price or the share. - If we have at the price of the share that is higher than the book value, it means that the market is assuming or is expecting a growth of the company. Chapter 7 pp. 327-332 - If we have the price of the share is lower than the book value, so it's lower than the value that we have from the balance sheet. It means that the market is not expecting a growth of the company. When we talk about the growth opportunities, the proxy that is normally used, is this price to book value (PTBV). The price to book values is a ratio between one market variable, that is the current price of the share, with respect to one account in variable, that is a proxy of this story of the company, that is the accounting value of the share. - - If you have that the price to book values is higher than one, so the price is higher than the book value the share, it means that the market is expecting a growth of the company for the future, because they want to pay more than the historical value and they will do it only if they expect that that the company will perform better in the future. If we have a price to book value that is lower than one, it means that the market is no longer trusting the company, and is expecting that in the future the company will perform even worse with respect to what was done last year or in the last years. So one proxy that has to be considered in order to understand if in the sector there is heterogeneity on the growth opportunities, instead of analyse the price to book value of the comparable companies, if there is a huge difference among them, some of them are able to grow, those with a price to book value other than one, some of them will be not able to grow, because they will have a price to book value lower than one or lower than the average of the market. What that's is important is try to understand the from the data that you have, if there is a different risk exposure assumed by the companies that are operating in the same sector. The main proxy that you normally consider is that the operating leverage. So you look at the balance sheet and you try to construct a measure of operating leverage. Operating leverage: When you run a production process, you can reach the same volume of final goods or final services produced by the company, by using a cost structure that is mainly driven by fixed cost or by using a cost structure that is mainly driven by variable cost. Variable cost are those that are affecting the company only when the company is producing something, so they will go to zero when you stop the production. Fixed the cost are those that you cannot avoid. So independently with respect to the volume of production, you will always serve this fixed payment that you have to do for the suppliers, for paying whatever you want for the company. Every time you run a company with a huge relevance of fixed cost, you are more exposed to risk. Because if you have variable cost when you see that there is no longer demand for the good, you stop the production and the variable cost will disappear. When you have fixed costs, if you discover that there is no longer demand from the market, you can stop the production, but the fixed cost will be still in place. So the more you have fixed cost, the worse it is for you if the demand for your good and services will change over time. Chapter 7 pp. 327-332 So your measure of operating leverage is a measuring which you consider the overall cost and the role of fixed cost on the overall cost. The higher is this ratio, between fixed cost and overall cost, the worst it is in terms of risk assumed by the company. It is a risk related to the demand that we cannot control, but remember, every time you have a lot of fixed cost, if something goes wrong, you will lose more money. If you have a theoretical company with a fully variable cost structure, if the demand goes to zero, you don't lose money; you stop the production and that’s it. So the idea is that we are evaluating the cost structure, we are measuring the fixed cost divided the overall cost. The higher is this ratio, the higher is the risk exposure of our company. This type of risk exposure is not driven by financial variables, is driven by production choices. The more you have fixed cost in the production process, the more you are exposed to risk. Because the demand may change you cannot reduce this type of fixed cost. Essentially, when we are trying to identify a set of companies that we can consider a benchmark for our financial structure, we have to consider companies with the same, or almost the same, price to book value and almost the same role of the operating leverage. If we are able to identify 2/3/5 companies that are respecting these constraint, so they are the same for the price to book value and the same for the operating leverage, we can decide to mimic (copy) their strategy and to adopt exactly the same financial strategy they are using. What do you think about the why could be reasonable for a company to mimic someone else for the financial strategy? Normally you do this mimic strategy every time you think that someone else in the market can know better how the cost of the financial resources will change over time. So if there is someone that is better in predicting the cost of financial resources, by adopting a mimic strategy, I will have the same strategy and so probably we can, I can take the same benefits. So every time you know or you expect that someone else has an informational advantage, the mimic strategy may work. 3.2. Market shock The current leverage of competitors matter only if the assumption of stable market condition holds: When we talk about at the mimic strategy, we have to be worried because is not enough to select companies with the same risk exposure and the same growth for costs, but we have also to be worried about any event that can make this mimic strategy no longer useful for the company. Here you have the main events that you have always to consider when you are evaluating a mimic strategy. So every time some of these items/events may happen, probably the mimic strategy has to be avoided. - Financial market shock A financial market shock is an event that is changing the cost of collecting money in the financial markets. Chapter 7 pp. 327-332 What can happen in order to give you an idea, the central Bank (CB for us), may decide a new policy for offering money in the financial markets, so they change the reference interest rate for offering money in the market. So we have a new money supply higher or lower than before and this will have an impact on the financial strategy. Nowadays, every central bank worldwide are raising the interest rate in order to avoid one negative effect related to excessive inflation rate. So the prices are growing too faster, we have to slow down them, raising the interest rate, so the cost of collecting money will be higher and so the growth of the price will be slow down somehow in the near future. Every time you have something that may affect in this way, the financial markets, so the cost of collecting money, every financial strategy adopted by a competitor, adopted by a benchmark company, is no longer relevant. Because if I now analysing the financial structural company that borrowed money a couple of years ago, the interest rate applied to this company will be totally different with respect to the interest rate I can receive now for the same financial strategy. And so it's no longer useful for me to mimic the strategy, because for me the cost of this strategy will be significantly higher than the cost of my benchmark. - Credit standard What else can happen is something that is affecting the capability to borrow money that is related to the credit standards. The credit standards in order to define them easily, they are essentially the rules applied by the banks or by the lenders for selecting the borrowers. Not everyone can obtain a loan because there is not enough money for giving loans to everyone. If we talk about the credit standards, normally every, let's say 5 or 10 years, we have a new set of rules that has to be followed by the banks and we'll change the capability to collect the money for a company. These are set of rules apply to banks for identifying who can borrow money. Every time you have an innovation in the regulation applied for offering a loan, again, you cannot trust the financial structure adopted by your benchmark, because the financial structure of your benchmark was defined with a different set of rules for the lenders, and so you don't know if the lenders now wants to offer the same condition that were offered to the benchmark companies that you were analysing, that you are analysing. - Real market shock What else can happen is that you can have a real shock in the market that may affect the value of the guarantees that you can offer for a loan. When we talk about this type of real market shock, we're talking not about the inflation rate in generally, we're talking about the value of our assets. If for any reason there is a huge shock in the value of the asset that we are owning; this has to be considered in evaluating the opportunity or not to mimic the financial strategy. For example, nowadays if you are selling gas. Chapter 7 pp. 327-332 You will never go for asking a new loan, because you don't need new money for supporting your business; because the price of gas nowadays is a 10 times a couple of months ago. So you can self-sustain your growth, and is no longer necessary to borrow money or to issue equity for supporting your business. So, every time you have a shock that is affecting your own assets, the assets of the company, this may affect the interest or the usefulness of using leverage. And every time you have such type of shock again, you don't consider the competitors as a benchmark for evaluating your financial strategy. - Technology innovation Talking about the technology innovation, the technology innovation is relevant only when there are some innovation that will change the economic life of the product that you are offering. So it's not enough to have an innovation that is changing a little bit the product, is still an innovation, but it's not relevant for the financial structure and for our approach on a mimic the financial structure, what is relevant if the innovation is changing or not, the economic life of the product. Let's make an example. (What is Kodak) Nowadays cameras for making pictures, cameras and some video cameras, but not too many, mainly cameras, so only for making pictures and in 1980s, they were the leader of the market also in 1990s, there were still the leader of the market. In 2000, they disappeared. Why they disappear? Because before the 2000 that they were producing only cameras, so that were using films for printing your pictures. So you go to the shop and you print your picture and you store them your house, you show the book when someone comes to your home and that's it. Only few of us knows that Kodak was also the first producer that was developing at the digital camera. So the first digital camera in 1970, was developed by Kodak. So they were the innovators in the sector, but they were not using the innovation at all, because for them it was more convenient to sell the films for printing the cameras. What happens is that the same innovation went also for the competitors, several years later in 1990s, they knew cameras were available in the market, and the old cameras were no longer requested by the market. So the primary good, essentially went out of the market, and so their strategy was no longer a strategy that can allow the company to survive. The company went to bankruptcy and what you see today is called Kodak is a branch of the initial company that was created as a spinoff. But the main company went to bankruptcy. Every time you are a technology innovation that makes your good not longer requested by the market, so obsolete, you have to be worried because your financial strategy, even if the is the best one, will be not a benchmark, will be not useful at all for any other company or for any other competitors. - Regulation Chapter 7 pp. 327-332 You can have also of some regulation that is changing and not for the lenders, but at least is changing for you own market, so for the marketing which you are working. Think about what is happening nowadays for the automotive industry where everyone is saying that we are to produce a Euro for 4/5/6/7 cars or electric cars. If you are not able to follow the new regulation in some markets in few years, you will be no longer able to sell your cars and so you will be out of the market. That's a problem, not for a small player, because nowadays for example Volkswagen is not able to have a electric car that is competitive, the same for Audi, the same for other big players in the automotive industry. Every time you have a change in the regulation that is changing the type of business that you can do, some of the best players are no longer a benchmark for your financial strategy; because they will be out of the market in few years if they don't innovate and it's better to avoid to mimic them in their financial strategy. So you can mimic Tesla because they have only cars with an energy engine, so without fuel and so on, but for all the others probably have to think about if they can survive as they are or not. 4. Financing hierarchy Companies may select among financing sources in order to manage the trade-off between pros and cons related to different financing solution. The main issues considered are the following: And let's go to the last topic for today. So the financial hierarchy, how to identify the priority among the financial solution that are available for a company. What we want to understand now is how the information asymmetry may affect your financial structure choice. So we want to understand if the market is not perfect and someone has an informational advantage, how the information advantage may be used by the company and how much it matters. Essentially, for considering the choices of in the financial structure, the company point of view is normally based on these three items, how the choice of these instrument is affecting the flexibility, how the choice of these instruments may affect the degree of control of the company and now the choice of this instrument may increase the cost of the company. As you can imagine, the best scenario for the company will be to maximize the flexibility, to do not have an effect on the control, ad try to reduce that the minimum the cost. This is what is looking for the company point of view, what they are trying to achieve as a target. - Flexibility Control Cost Surveys on the financial choices done by companies show the following ranking among financing alternatives Chapter 7 pp. 327-332 Yeah, you have a set of the financing resources that you may use for the company and for financing the investment strategy of the company. Is not a full list, but is a list that allow us to understand what are the main choices that the company has to consider. First of all, you can do self financing so you use internal resources by retaining earnings for the company. Or you can use a debt financing that could be a mortgage, could be a leasing, could be even a bond, that you issue in the market. Or you can use something with an equity kicker, for example a convertible bond, or financing your activity. Let’s say convertible debt. You can go to equity financing solution (common stock). And you can go for equity financing solution with special rights like the preferred shares. Or equity financial solution with the gain an equity kicker (convertible preferred stock). We want to understand how much they are relevant by considering the flexibility, the fact of control and the effect on cost for the company point of view. 1) Retained earning Essentially, if we could see at the flexibility; normally we can do whatever we want on managing the earnings produced by the company. So theoretically, if we use the earnings, we are not affecting at all what can be done in the future by the company in terms of financial structure. So if you want to have a day higher benefits on flexibility, probably you can consider the retained earnings. Considering the control; normally what will happen is that the impact on control, realted to return earnings is almost zero. You are not issuing securities, so you are not changing the number of stakeholders of the company. And so essentially there is no impact on the control. Chapter 7 pp. 327-332 Talking about the cost retained earnings, remember, they are not financial solution without 0 cost. That is a financial solution for which there is an implicit cost that is the hurdle rate, because you can reinvest until you produce at least the hurdle rate but essentially among all the other financing solution they may be among the less expensive, not to the one that is offering you the lowest cost but among the less expensive. 2) Debt financing When you use debt, think about that every company has a maximum amount of debt that can be collected from the financial markets, from the financial institutions. So every time you use one Europe debt, you lose the opportunity for the future to increase the debt of €1.00. So essentially you have a maximum treasure that is 1,000,000 of euro that you can raise as debt; the more you are near to the treasure, the less you can use that in the future. You cannot operate(?) in the future, the banks will accept to give you even more money, you know that there is a treasure every time you use the debt, you know that there is a cost for the future. The cost is that you are no longer able to use more of this financing solution. (flexibility?) Talking about the impact on control, especially if we talk about debt in which there are no covenants. Essentially, the impact of control will be almost 0. If there are covenants, this is no longer true. What are the covenants? Are the constraints we train the contract that says, for example, that you cannot distribute dividends, you cannot increase the leverage. So the lender is applying, you are set of rules during the life of the loan that you have to respect for maintaining the loan. So for obtaining the money, these are the condition applied. The more you have a covenant, the higher will be the impact on control and so here will be not green will be yellow, will be red, because you have a lot of constraints in your activity. Talking about the cost, the cost of borrowing through debt is normally the less expensive solution that you have for your company. So until you can borrow money and until you can provide guarantees, this type of financing solution will be worthy for you because it's the less expensive that you can find in the market. When we talk about the debt financing, normally this type of financing solution that is less risky for the lender because there are guarantees, sometimes there are covenants, they are paid in advance with respect to the shareholders, and so on. Due to the fact that they are less risky, less exposed to the risk of the company, they accept to receive from the company a low amount of payment for the money given. So a low interest rate for the money given. Normally the debt financing is the less expensive financing solution available for the company. So until you can, you borrow money because it's the less expensive solution you have. 3) Convertible debt Talking about the convertible debt, what is the difference for convertible debt versus debt financing? Is still a financing solution that is quite cheap, but is more expensive than the debt financing, especially if the debt holders decided to convert, once they decide to convert, it would become more expensive. They have the same problem of flexibility that we described with the debt financing. Chapter 7 pp. 327-332 Again, I have a maximum treasure of money that I can borrow, the more near to a treasure, the more I have no longer opportunity to raise money to the banks or to the bonds. And on the impact of control, take care, because every time the company is performing properly, so is achieving good results, the convertible bond that will create problems of control, because the convertible bond will be exercised, so you will translate your status from bond holders to equity holders, only when the price of the share is growing, and normally the price of the share is growing when the company is performing good, and so he's able to obtain net profits significantly higher than before. So every time the company is performing, the convertible bond is creating more problems on control. If the company is are not performing good, so it's achieving a low performance or losses, no impact on the control. 4) Common stock What we talk about the common stock, the cost of the common stock is significantly higher. We are paying the hurdle rate here. Talking about the flexibility, theoretically you don't have a maximum amount of equity that you can issue. You can increase the equity year by year until the market trust you. So theoretically by using equity can be not worried about how much are using today, because tomorrow I can still issue you equity, until the market trust you, until the market is accepting your shares. And the talking about the degree of control, when you issue the shares, you create immediately a problem of control, because if the shares are bought by someone that is a minority shareholder or was not one of the shareholders, you are changing the ownership of the company somehow, and so you have to be sure that this will be not a problem for the company because there is still a majority shareholder that is able to run the company. 5) Preferred stock Talking about the preferred stock, what are the difference that we have with respect to the common stock? Again the cost is quite high, a little bit lower than the common stock, but it's still quite high, significantly higher than the cost of debt. There is no impact on control because you don't have voting rights. You have only one representative that is voting in the general meeting. Talking about the flexibility you have to be worried because the market is perceiving the preferred stocks like bonds. So also for the preference stock, there is a maximum amount of money that you can raise to the preferred stock. You cannot use preferred stock how much you want, and the nearer you are to the maximum, again, the lower you will be in the future able to use the same type of security. So we have a a cost that is higher, we have no impact, almost no impact on the control. But think about that we have still a constraint about the maximum amount of preferred stock that we can issue. Chapter 7 pp. 327-332 6) Convertible preferred stock They are preferred stock that may be converted into stocks, when it happens? When there is the conversion normally? It’s like a convertible bond, so you will convert when is convenient, so when the price of the share, ordinary share, will go up. Otherwise, you will retain the preferred share. If we're talking about this type of security, we had the same problem that we had for the preferred stock in terms of maximum amount, we have a maximum and the nearer we are to the maximum the less we can use the financing solution in the future, Talking about the control, here we don't have an effect until we switch from preferred shareholder to the ordinary ones. And the talking about the cost here, what you have is that this type of cost will be almost in line, a little bit smaller, than the cost of the preferred stock, a little bit smaller because you have an additional right to converting to ordinary shares and if you want the additional(?) right, you have to pay something, so to accept a lower return for this type of security. These are not the callable preference stock, these are the convertible preferred stock. So it's up to the investor to decide when to switch. If you want to have this right, you pay for it, how you pay it by adding a lower return from the security, so from the sahre that we are analysing. An additional explanation for the financing hierarchy is related to information asymmetry When we talk about these type of securities on the basis of this description, theoretically you will follow this grid for selecting which type of solution is better for the company. So you will combine retained earnings, debt financing, common stock, etc. whatever you want in order to exploit the reduction of the cost, in order to exploit the reduction of the effect on control, and in order to exploit the reduction of the effect on the future flexibility. Chapter 7 pp. 327-332 But there is also something else, these instruments, that I classified for you (here in the in the pyramid), are also instruments that are characterized by a different impact on the information asymmetry. What does it mean? When the company is using one instrument instead of another is providing an information to the market. Or is not providing any information to the market. So the choice among them is also driven by; what you can or what you want to give as an information to the market. That's that one is 1 by 1. If I use retained earnings. What is the information that I'm giving to the market? I am selffinancing my activity, I don't need to do information disclosure. Because I can't stay with my business, I can stay with my assets, I don't care about exploring a new growth opportunities, so will retain earnings and I will support the small growth year by year of my company. Here you have an impact of information asymmetry for the company that is almost 0. If you are worried about giving information to the market, you will use at the maximum the retained earnings. Because that's the way which you don't give information to the market and if there is something wrong that is happening to the company, they will not know it immediately. What we talk about the debt financing we have to consider which type of debt financing we are talking about. If we talk about debt financing from financial institutions, so I go to a bank and I request a loan, this type of loan application we are providing information only to some players on the market, the banks, the banks that we are contacting for the loan. This information will be never disclosed to the market if we are not financed by the bank. So when I apply for a mortgage in a bank and they refuse my request, they cannot disclose that I was not finance it. Because these are information privacy rule I have applied for a loan, you decide to do not give me money, it's OK, it's up to you, you have your credit standards and you decide who can be financed or not; but if you reject my request for a loan, you cannot disclose it. What is the information that will go to the market? Only if I get the financing, so only if I am evaluating the possibly by the bank, by the lender; this information will go to the market, and I will have what we are classified a certification effect, because there is in case that is providing me loan, so it's certifying that I'm able to repay the loan and so the market will receive this type of information. So when we talk about that financing from financial institutions, only the positive information will go to the market. Everything that is negative will be disclosed only to few players in the market. The banks that I contacted for the loan and that rejected my application for the loan. If it's a bond, because if it's a bond, what I have to do for issuing a bond is essentially going and asking to the financial market money, in this case as debt, because I'm issuing a bond, for financing my activity, every time you go to the market, you are subject to information disclosure rules. So before collecting money, what you have to do is to contact the company that is managing the market, apply for issuing this new securities, the bond in this case, and the publisher an information memorandum. Chapter 7 pp. 327-332 The information memorandum is the information that you had to disclose that the minimum or collecting money from the financial markets. This information memorandum will provide that to all the players in the market, everyone, some data about my company. So every time I go for debt financing, I have to reduce the information asymmetry, by disclosing some information in the market. Now the type of information may change market by market, so the management company of the market, may define different type of rules for the information memorandum. But I have to publish this data online and everyone is able to read them. So every time you are worried about what you can disclose, this type of debt financing may be not the best solution for you. Because you have to disclose something. When are you have to discuss something, you have to think about which type of information they are asking me to disclose. When you are issuing a bond, normally the authority that is in charge of managing the market cannot ask me to disclose everything because otherwise we will have a lot of problem of competition in the market, they will ask me to provide only some information that are relevant for the investor and we are issuing a bond, so essentially what they are asking us, is not to describe the business of the company, what we will do in the near future, but to describe what is the amount of money that you will collect, where this money will be used, and what you can provide as guarantee of the refunding at all the payments related to this type of security. So the type of information that has to be disclosed that is not strictly related to the business of the company, but it's strictly related that to the type of security that we are issuing, that is a low risk security for which what is most important for the investor is what are the guarantees that you are offering for supporting these type of bond. What we move from bond to convertible bond and even worse when we arrive to the different type of stocks, the analysis is different. Because when we are issuing a convertible bond, we have to provide also the information about the core business of the company, because the value of the share in which we can convert our bond, if we want, is related to how the business of the company will be running the near future, what are the strategies adopted by the company and so on. So every time we move from the debt financing to the convertible debt, the information requested is significantly higher because we're to disclose more details about all the activities that will be done by the company. Not only the activities is that matters for the bond, but also that is that matters for the equity. So these are items, those that comes from here to the end (convertible debt to convertible preferred stock) are those that are characterized by the highest impact on the information asymmetry. So I had to disclose more information in order to collect money through this financial instruments. If I use that, that retained earnings, I have no effect. If I use debt financing from financial institution, almost no effect, only a certification effect when everything works. Chapter 7 pp. 327-332 If I issue bonds, I have some constraints on information disclosure, but they are not like all the securities that you can see over there. 5. Conclusion Firm’s financial strategy has to consider the trade-off theory and adapt it by considering company’s features. The life cycle theory evaluates cash flow dynamics on the basis of the stage of growth and identifies the best solution for company in the next years. The comparable firms approach mimic the strategy adopted by competitors assuming the average strategy is the best solution to pursue. The hierarchy approach rank financing solutions on the basis of the impact on the asymmetric information on the raising capital solutions. Chapter 9 pp. 394 - 423 LESSON 12 – TARGET LEVERAGE AND SPEED OF AJUSTMENT 1. Introduction Once a company has identified its optimal leverage on the basis of the trade-off theory the financial planning has to be focused on maximizing the benefits for the stakeholders by acting on: - Speed of adjustment Debt design 2. Speed of adjustment The advantage of an immediate shift to the optimal debt ratio is that the firm immediately receives the benefits of the optimal leverage, which include a lower cost of capital and a higher value. The disadvantage of a sudden change in leverage is that it changes both the way managers make decisions and the environment in which these decisions are made. If the optimal debt ratio has been incorrectly estimated, a sudden change may also increase the risk that the firm has to backtrack and reverse its financing decisions. The choice about the time necessary for the leverage change depends on: - Confidence on optimal leverage estimate Comparability on the industry Likehood of a takeover Need of financial flexibility: The possibility in the future to look for more money. There are four basic paths available to a firm that wants to change its financing mix: We reduce the leverage/opposite, leverages increase over time. Here we are acting only on new equity or existing debt. This is an expensive solution, because we have to issue new bonds/new debt/new mortgages, the issue is that there are information disclosure constraints that will require months. Expensive and time consuming. Reducing the debt, so the leverage of the company. If we want to increase the leverage we have to do a buy-back and pay dividends, this will increase the equity. Selling procedure: when we sell assets for… is almost like a liquidation of assets, so the player we will obtain is significant lower than we accounting value. Refund debt: normally not so expensive, sustainable cost for the company. Buyback of the shares: opportunity to buy shares dorm the market, we are giving in this way a remuneration to stakeholders and modifying the leverage. When we do this we can do it in the Chapter 9 pp. 394 - 423 open market, can be completed in a couple of days or we can do an auction, so identify the number of days in which we collect the proposal, the re-buy the shares. Auction is a bit more time consuming. Paying dividends can be done almost anytime you want, takes about a couple of weeks form the announcement to actual pay day. These solutions are less expensive and less time consuming than the previous ones. Trying to modify what will be done by the company in the future. Decrease the leverage: increase the equity % used for financing new projects. Increase the leverage: increase debt % used for financing new projects. These types of solution are the more time consuming because if my company has already 5 million of assets in place, to have an effect on the leverage we have to start a set of 1,2 million of euros. Very time consuming but almost a zero cost. Not change the finance of the new project and change only the retention rate of your company. It is a solution with 0 cost. We need to wait several years (10 years) to make an effect. Retain more to increase the leverage, retain less to reduce leverage. Very lost costm, ever more time consuming than solution numer 3. If we increase the retention rate, value of equity will increase over time. The choice of alternative solution for modifying the leverage depends on: - Time available New investment opportunities: What matters is to understand the risk of the new investment strategy. Some of the riskier projects may not be the best solutions. Quality of existing assets A framework for leverage change Chapter 9 pp. 394 - 423 Behavioural finance and leverage change Speed of adjustment could be slow down because there are potentially unhealthy responses to having to making larger debt payments that the company wants to avoid. - - - Decision paralysis: If we modify the speed of adjustment, every strategy is changing the equity/debt for the company point of view. This could be a problem because every time you chance this strategy you are exposed to mistakes. So managers will try to postpone the decision making until there is enough information to make sure that leverage Is properly set up. Short term focus: When we talk about the management point of view, if a manager works to a company for 10 years, he will only care those 10 years, and later problems will be the new manager’s responsibility. Problem ver common in UK/US/continental Europ, less so in Italy. Self selection 3. Debt design The bankruptcy risk may be affected by the debt design choices Chapter 9 pp. 394 - 423 Overtime, during a several years. The firm value will change, depending on market situations. Debt value is almost always stable. When the company plans the debt, it has yo be worried about the exposiure, that will last several years. If firm value is under the debt value, the company is technically in bankruptcy. We have to understand how to create the condition for making also the value of the debt variable over time. HOW? Valor of equity: has to be never negative. The right plot shows us how to adjust the firm value to the debt value though the value of equity, so modifying many times the debt value. Financing choices have to be guided by the nature of the cash flows generated by asset and the main issue to consider are: - Maturity Interest rate Currency Option Customized The leverage policy has to be constructed by considering the impact of these issues on the value of debt over time 3.1. Maturity If the basic idea is to match the duration of a firm’s assets to the duration of its liabilities, it can be accomplished in two ways: by matching individual assets and liabilities or by matching the overall assets of the firm with its collective liabilities. The first approach is theoretically more precise but it is expensive to have independent financing solutions for each project and interaction between asset cash flows may matter for the strategy. Rank the following alternatives on the basis of the maturity mismatch Chapter 9 pp. 394 - 423 3.2. Interest rate One of the most common choices firms face is whether to make interest payment with fixed rate or a floating rate, pegged to an index rate (which can be a treasury bill or bond rate or LIBOR). - - Uncertainty about future projects: The more the company is expected to risk because the cashflows are not easy to forecast, the less we can be interested in a floating rate solution. Cash flow and inflation rate: Instead of suing one of the indexes form before, you can try to link the outflows to the inflation rate. If we do so, when the inflation rate is going up, the cost of our loan will increase, but also our revenue is increasing. Also the opposite is true, profits going down, cost of debt goes down too. 3.3. Currency If any of a firm’s assets or projects generate cash flows denominated in a currency other than its domestic currency, currency risk exists and the firm should consider financing those assets in the foreign currency to reduce the currency risk. - - - Dual currency financing: Our cash flows are related to different currencies, so we only want the coupons to be bond denominated in the foreign currency, and the refund in our own currency. Principal exchange rate linked: Payments will be done in euros but the amount of the payments will change depending on exchange rate dynamics. I am protecting myself form exchange rate risk. Index currency option: I will do an auction on an exchange rate, if the exchange is higher than… I will be refunded by the lender. Chapter 9 pp. 394 - 423 3.4. Option The option related to a debt security for converting the exposure may affect the cost of borrowing and may contribute in creating more sustainable debt outflows 3.5. Customized Every firm is exposed to risk, coming from macroeconomic sources (such as recessions), natural event (such as the weather), competitors’ strategies, or technological shifts. Firms can partially protect themselves against this default risk by incorporating special features into debt, shielding themselves against the most serious risk or risks. Examples: - Insurance Commodity ____________________________________________________________________________ Debt design has to consider the trade-off between the optimal design and the impact on other business features for the company. - Tax effects Market players Information asymmetry Agency costs 4. Conclusion The debt design process is defined as follows: Chapter 9 pp. 394 - 423 LESSON 13 - DIVIDEND POLICY AND INSTRUMENTS Assignment 3 First of all that you can add the indexes that are available among these index, the one that is mostly important is the price to book value, that is telling you the growth opportunities. So on the basis of the price to book value you can identify which company is the most similar to yours. Several you have made a huge mistake in selecting the comparable on the base of the company. That is all that has almost the same leverage. If our aim is to identify the target leverage, we cannot identify the comparable on the basis of the current leverage, otherwise we are already in line with the leverage policy. So your main proxy is the one that you can see over there. You can consider something else, but you cannot consider the leverage as a proxy for select your comparables. Once you have identified that the two companies that are similar to yours, So what you have to compute is a simple average of their leverage policy in order to understand what is your target leverage. Let's say for example that your benchmark car NVDA and Intel, what you will do is to make the simple average of 29.1 and 28.5 arithmetic average. This will be your target leverage. Once you have your target leverage what you have to do is to consider the current leverage or your company, in this case 4%. The historical trend of the leverage over time in order to identify if the companies aligning or not to the target leverage. And once you have identified the gap in this case will be around 25%, you have to select one instrument for reaching the target. What you can do in selecting the instrument, essentially what matters for you is the size of the difference. If for you ever, like in this example, that the gap is around the 25%, you cannot write that you will reach the target leverage by using the retainer Ding strategy, because it will take too much time. If the gap is only one or two percent, you can use the retainer rings. Otherwise you have to select if you want to use the data a different data with the ratio for the new projects or only for all for all the existing projects. Again, it depends on the size of the gap. The larger is the gap, the more you have to modify your strategy, since now. So every project now has to change the leverage. Then the lower is the gap, the more you can go or for changing the leverage all the of the new project or even if the difference is very small to work only on the retained earnings. 1. Introduction Consider once we have identified the core business performance of the company, we try to identify how much of these cash flows will be used for covering the debt expenditure. So our financial structure, the payment schedule for the debt toll… and what else remain for the equity holders. We know that when we talk about what is remaining for the equity holders, the choice for the manager is to use this money for self financing the group or to distribute them. Our focus of today is what we are to do for distributing are ammunition to our shareholders, when is better to use dividend, when is better to use our payback and what are the implication for the company, when is using a dividend or when he's using a payback. 2. Dividend In order to evaluate the impact of the dividend on the share prices and the shareholder’s wealth is necessary to consider its time scheduling When we talk about the dividends, we have to clarify how to read the information about the dividend payment. Here you have a simple time frame about a dividend payment declared by a company. The dividend time-line is the following: You have normally the Board of directors that agree with the proposal made by the manager for distributing dividends, and so he's disclosing how much it will be paid to every shareholder for each share. The you have to set a date from which the new shareholders will not receive the dividend payment. We have to set the maximum deadline, over which you will lose the right of obtaining the next dividend because the next dividend will be paid to the owner that has this share at this date. If you buy after is not longer an in a dividend that he's paid to you, but it will be paid to the previous owner, over which you will lose the right of obtaining the next dividend because the next dividend will be paid to the owner that has this share at this date. If you buy after is not longer a dividend that he's paid to you, but it will be paid to the previous owner. Once you have done it, you have to record the payment, so you have to make some accounting adjustment in order to start the payment and after you can have the dividend that is available to the shareholders. When we talk about the dividend payment from the announcement date to the payment date, normally you have around a little bit less than two months. 2/3 weeks from the announcement date to the ex dividend data, a couple of days for the recording day and two or three weeks for the payment date. So essentially we can expect that from the degradation date, we can wait up to two months in order to receive the payment. Why is necessary wait such quite long time period? Because you don’t have one shareholder, but you have a several of them and the procedure will take some time. And you were to disclose what you are paying, wait until the dividend payment and once you have recorded this, the time requested by the bank in order to settle the payment, so in order to transfer the money from the company bank account to the investor's bank account. When we talk about the dividends, we have different type of dividends that you may pay and that this different type of dividends have different impact for the company point of view and also change the meaning of the days that we have described before. So for some dividends some dates are mostly relevant than others. Types of dividends Firm has to select the type of dividend that will be paid to the shareholders We distinguish the dividend paid by cash with respect to the dividend paid by shares. - Cash dividend is the dividend pay cash. You say how many euros or how many cents you will pay for each share on that by your shareholders. Ex: I will pay 0.5€ for each share. - The stock dividend: I will give to the shareholders additional securities in a proportion that is already fixed and defined by the company. So for example, I can tell you that if you have every five shares that you own, I will give you an additional share. So if you have 5 shares, you will obtain one, if you have 20 shares you will obtain 4. If you have 22, you again you obtain 4 shares and that's it. When we are using cash dividend versus stock dividend, the impact for the companies totally different. When we pay a cash dividend, essentially, we have only a reduction of the cash available, so the liquidity available for the company. When we stock dividend we have to be worried because what we are doing is to do not lose cash now, but we will lose cash in the future because the number of shares outstanding will be more and so I had to pay a little bit more to all the shareholders that I have for my company. And even most important, if the share that you are offering is an ordinary share, you are changing the voting power in the general meeting, because you will increase the number of shares owned by someone. These investor may retain the share or may sell them and so probably the control of the company may change over time. What is important is to consider the type of dividend that we are discussing. Normally the distinction is the dividend that is paid when one balance sheet or interim report is published and this is the ordinary dividend. The ordinary dividend is the dividend paid every time my publishing one report for my company, that could be the annual report or the interim report, so the quarterly report if you publish it every quarter. And when we talk about these ordinary dividend, these ordinary dividend is not normally computed as a percentage of the earnings produced. So we pay the 50% of their earnings, the earnings per share are €1.00 so I can pay a dividend per share of 0.5 euro. The ordinary dividend is strictly linked with the earning per share of the company. When we talk about the special dividend, we’re talking about something totally different because this amount of money that you pay as a company when you want, so you are not obliged to pay them when you disclose an annual report or an interim report. And the amount that you pay depends on the research you have already created. It’s not linked with the earnings per share, but is linked with the amount of money that you have already stored for your company, the more you have created yourself in the past, the more you can use special dividend. If you don’t have resources, theoretically you cannot pay special dividends. Liquidating dividend We can have an amount to dividend that this coming from a percentage of earnings, so like the ordinary dividend. So what I created as earnings, I will decide how much I can distribute, all you can use what you have as a reserve or you can even sell some assets in order to pay the dividend. In this case, we're talking about liquidating dividend. So the difference between distributed earnings and liquidated dividend is that this amount is linked with the earnings produced. Every ordinary dividend is distributed earning it dividend. While when we talk about the liquidating dividend that we're talking about something that we can pay by using reserves like the special dividend or by selling assets as an additional solution for paying dividends. Let's focus on the 1st classification, the one on the type, and let's go back to the timeline that we have described before. If we talk about a cash dividend, what do you think about which dates are relevant for us and which ones are not relevant? When we talk about cash dividend, we have only three dates that matters for us for our analysis: payment date (when I will receive the cash), the ex dividend date (the day from which the price of the share will no longer discount the next dividend), so we can expect that immediately after the ex dividend date, the price of the shell will drop because there is one cash flow less and all the others are almost the same, we have only one day less for discounted cash flow, but it doesn't matter too much. The other date that may matter for us is the announcement date because this is the date starting from which we will have that the next dividend is discounted for computing the price of the share. The price of the share will consider the next dividend from the announcement date to the ex dividend date. So what you can expect is that the announcement date the price of the show will go up but after the ex dividend date, the price of the show will go down. And lastly, what is important for us is when we have the cash available, so when will we receive the money. Once we added to the ex dividend date, so these are right is no longer available, we will have the pressure to show will drop because no one wants to buy the share at the price that was paid before. Talking about their record day, the record day is the day from which you are owning the new shares assigned to you. So essentially, starting from this day, you will have the rights of obtaining dividends also on the basis of the new shares assigned to you. And you will have also the right to use the voting rights related to these additional shares in the general meeting. What matters less for us is when this share is in our, let's say trading account in our bank because what matters most for us is a from when this type of right is owned by us and so I can receive new dividends and use voting rights as starting from this date. I didn't understand what why they share the goes up in value then goes down for the cash dividend Essentially, if you declare that there is a dividend payment that is coming here, (that's the date in which you will have the dividend available), once you declare that this payment will be done, the price of the share will be revised upwards for considering the fact that there is an additional dividend that we already know the amount that will take place at this date. After the ex dividend date, you know that if you buy the share, the next dividend will be not paid to you, but will be paid to the previous shareholder. And so your price will be revised downward because there is a smaller or a lower number of dividends that you will receive by this share. Measures of the dividend policy: These are the proxies we normally use for evaluating a share and the dividend policy related to the share. The proxy are quite easy. We have a dividend yield that is what the dividend yield is, the amount of dividend per share paid divided for the price of the share. What is telling us this proxy? This proxy is telling us if we invest now in the share, what is the short term return that we can receive by this investment. So what I can expect to receive in few weeks or few months by doing this investment. The idea is this ratio, the more profitable is for you in the short term, the investment strategy What is better for you: when the dividend per share is higher or when the price of the share is low? Lets say that I have a dividend yield that is 10%, it could be driven by a huge dividend per share or by a very low price per share. What is better for me? So the idea is that the deviant per share is only the return that you achieve at this month or this year. The price per share is the value of the company in the medium long term divided for the number of shares. If the price of the share is quite low, it means that the company has no law, not a huge growth opportunities, not a long term horizon investment and probably is a company that is a little bit in trouble. So normally if I have that the dividend yield is driven by the dividend per share, they higher it is the better it is. If I have the dividend yield is driven by the low price per share when you have two high dividend yield, you have to be worried about it because it means that the company is near to close the activity or is not growing as expected as some troubles that you have to consider. Remember these are one year time horizon or 1/4 time horizon analysis. This is the life of the company, so for the full life of the company what is the value? The dividend yield is coming from the dividend payout ratio and the dividend payout ratio is the ratio between the amount of dividends paid and the earnings. Normally these are computed dividend per share divided for earnings per share at sometimes you can complete them also by making their share of overall dividends divided for overall earnings, is almost the same. These dividend payout ratios telling us how much you want to reward your shareholders starting from a set of earnings. I want to use the 50% of the earnings, I want to use the 20% of the earnings and so on. When you are reading the dividend payout ratio and you are trying to analyze the dividend payout ratio for evaluating an investment to opportunity, you cannot evaluate it without having benchmark. It changes company by company and so we have to identify our set of comparables for selecting our dividend payout policy. Sometimes instead of using the dividend payout, we use the retention rate that is only one minus dividend payout ratio. So when we consider the dividend payout ratio is like looking at the retention rate because they are complementary, if the dividend payout ratio is 30%, the retention rate is 70%. Talking about the return for the investors, so the equity holders, the return for the equity holders has to be computed by considering the dividend yield + the capital gain or the capital loss expected on the share, what are the capital gain and the capital loss? Essentially the growth or the decrease in the value of the share overtime. So normally if I have a low dividend yield, what I can expect is that the dividend yield is driven by the retention rate. When you have to retain earnings in your company only when you expect that your company is expected to grow in the future and so it's worth it to self finance the growth. So theoretically can have a dividend yield equal to 0 and the return offer to the shareholder that is quite high only because the money retained is used for investing in high growth opportunities projects that will increase the value of the share, so we'll create a huge capital gain. On the opposite, what I can have is that I have a company with a huge dividend yielder because it's a distributing almost everything as dividends, but the company is no longer able to identify good projects available in the market, so every year the value of the share is decreasing and every year I'm suffering over capital loss. So again, they can have a company with a huge dividend yield, but at zero or even negative return for the equity holders. That's if the company is losing value on the financial markets. Remember when how much you increase or how much you decrease your value depends on how you use the money that is available for the company. If you are no longer able to identify good projects, that's an issue that you have to consider in constructing your payout policy. You have a plot about water plot about the dividend policy bisector in 2021 US. Here you have the different sectors for which you have the dividend payout and the dividend yield. What I want to show you by using this plot is that you can have a huge difference between the dividend payout and the dividend yield given. Let's make some examples. Here you have the advertising area. In the advertising, you can see that the companies are paying dividends with respect to the earnings that are 9 times the earnings, 900% in 2021.So they are using reserves for paying huge dividends. If we look at the dividend yield over there, the dividend yield is still quite high because it's around, let's say it will be 22.3 (aprox) is return for the company, but it's not as expected on the basis of the payout, because if you give as dividend 9 times the current earnings, I can expect that I receive at least a double digital return by investing in that company. But this is not true. What does it mean that these companies in that period of 2021 were experiencing a huge decrease in the growth of opportunities for the next year and so the price was increasing so high that the amount of dividends was not enough for increasing the dividend yield. Here you have on the opposite another sector that is oil and gas that was experiencing a dividend yield of quite huge because it's around more than 10%, while the dividend payment is near or, the dividend payout ratio is near to 0. It means that in that periods of 2021 (nowadays will be totally different) the price of this company will be out (es deixa d’escoltar) They are paying a small amount and the price of these companies will be out in order to justify these pick order. (es deixa d’escoltar) So they are paying around the 1 or 2% of the earnings as dividend and the dividend yield is around the 10%. What I want to do with you now is to compare countries by considering the dividend yielder and they payout ratio. Here you have Canada, France, Germany, Italy, Japan, UK and US. And here you have the average dividend yield for all the countries and the payout ratio for all the countries. These are in absolute value, so it means that in 2021 in Canada they were paying 1.46%, around 5% of the earnings as dividend, while in Japan they were paying only 0.58, so th 58% as dividend. So if you look at the dividend yield and if you look at the payout ratio, what are the countries that seems to you stranger? UK you can see that the payout ratio over there for that year, that was an extraordinary year, they were paying nine times the earnings as dividend. How you can read it, you can read it that they are able to do it only because they were able to create a huge reserves before the covid pandemic and they decided to maintain a stable level of dividends, so do not decrease them too much in order to retain the investors also for the after pandemic period. If we look on the opposite, for example, the Japan now, they were all notable or not interested to use reserves for paying dividends and so they have cut their dividend payment, but consider the earnings in that period where significantly lower than in the past. Talking about the dividend yield, you have the maximum that is for the Italian market (2.43%) and the minimum that is for the French market (1.46%) (nose si sha equivocat perque elm es peque es eeuu) Dividend yield is the ratio between the dividend and the priceHere we are paying in the case of Italy, 1.5 times the earnings as dividend. So we are using reserves for paying this amount of dividend and we are giving up a return that is significantly bigger than the average. In the UK we are paying even more but the payout ratio is significantly higher. Now if you consider and you compare UK versus Italy, you know that UK is paying 7 or 8 times the payout ratio of Italy, but the gap is only 0.20 (that's the gap in the dividend yielder). The dividend yield is driven by the dividend or by the price? Where is the dividend deed is coming from, the price or from the dividends? From the price, because the dividends are not so high, they are significantly lower than UK, while the gap in the interest rate is not so significant. Talking about the French market and if you want also the US market that are among the lowest in terms of return, they have almost the same payout ratio and the return is even worse in the US with respect to French. To analyze companies by this method, you have to focus on the payout jointly with the dividend yield in order to identify if the dividend yield is driven by a dividend payment or a trend in the stock price, because the impact would be totally different. 3. Buyback The main choice for a firm that wants to proceed with a share repurchase is the transaction type The buyback is a transaction proposed by a company and only some of the shareholders may accept the proposal. So the impact will be a direct impact only on the shareholders that accepts this type of proposal. What is the proposal? The company wants to pay a remuneration to the shareholders (those that accept the proposal) by buying their shares at a premium with respect to the current market price. So what I'm offering to my shareholders is the opportunity to sell to the company, the shares they own, not at the current market price, but the market price plus a 10% of premium, plus a 20% of premium, whatever you want. So if the current price is €8 per share, you can sell at €9 per share your stocks if you want to the company. In order to do it you have 3 solutions that may be adopted: 1. Open market repurchases. 2. Tender offer or Dutch auction (different solution for doing the same type of transaction) 3. Target repurchase Open market repurchases The open-market stock repurchase program is a commonly used method for distributing corporate cash to shareholders. In a repurchase program, a firm buys back its shares in the market over a period lasting from months to years. The company identifies the time horizon, the price but the final amount will be decided by the market on the basis of the selling orders received and the activity is done directly in the financial market. This is the simplest solution for a company for making up buyback. The company is only saying how many shares they want to buy from the financial market and that they are deciding also the price and they are also deciding the time period for which they want to collect proposals. At the end, what you will obtain is that you will rebuy a fixed number of shares, but the price in the overall expenditure will be defined by the market. The company is telling that they only want to buy the shares from the market up to a maximum of 100,000 shares in the next couple of days. Let's wait for the proposal for selling the shares to the company at a minimum price. You can sell at the minimum or you can sell at a price that is a little bit higher. Essentially what will happen is that you received this proposal, and the approach that you are adopting is the approach of first in first out. So the first one that send the order is the first one that is accepted. So if you submit the order that is respecting the guidelines provided by the company in the time horizon, you will be immediately executed and so you will be immediately able to sell the share, I will not wait until the end of the period in order to check how many proposal I will receive. These are selling orders that are binding for the shareholders. So once they give the selling orders, they know that they will sell the shares if it’s accepted by the company. The only constraint for the company is the maximum price they want to pay, and even most important, the number of shares that they want to rebuy with the buyback procedure. To understand the impact of the open market repurchase, we have to consider: The return that you can achieve by accepting this proposal, so essentially the gap between the price that you obtain and the price that was in the market before, is telling you how much you are obtaining as yelled by doing the investment. You can compute it transaction by transaction, or you can compute it by doing an average of all the prices. What is this average of all the prices? Consider all the price for all the beats, multiply for the quantity, divided for the quantity. So someone may sell a 12, some other sell 11. I would do an average, but not arithmetic average, a weighted one. Finally, the average yield for all the placement will be the average price computed before minus the price the day before divided for the price the day before. What is changing over there is that I get over there between the average price and the price at time t - 1. (Example on Excel ) You're doing a buyback in the seven days of a tender offer and you see the following bids. The bids are: Investor A wants to sell 20,000 shares at one point, €5 per share. Investor B 25,000, €1.8 Investor C 14.000, €0.71 and so on up to the end. The overall amount that is requested is 129,000 and if everyone is accepted at the end you will have to pay as a company for buying these shares 161.500€. The current market price is 0.90€ per share. What is the return offered to the shareholders if the company use an open market repurchase for doing a buyback of 100,000€? So the same data, that's your constraint because you have to pay only €100,000 Essentially what you have to consider is by following the time order, nothing else. So when you receive the order you executed, you consider only the order by time of these proposals and you arrive up to the amount that you can pay. So 30,000 + 45 was 75,000 + 10, 85.000 you can give also 15.000 to the last order. How much you will obtain as an average price? Is the amount that you paid for each transaction excluded the one over there for which you consider only the 15 that I can give, that is not the 20 that you can see over there. The current price is the one given in the text that was 0.9€ per share. So the return offered to shareholders will be this average price minus 0.9 divided by 0.9. Return offered to shareholders is 56% as return for this open market repurchase. Tender offer/ Dutch auction A tender offer is typically an active and widespread solicitation by a company or third party (often called the “bidder” or “offeror”) to purchase a substantial percentage of the company’s securities. The company identifies the maximum amount of shares that will be buyback, and the price is settled directly by the company at a premium with respect to the current market price. Sometimes a tender offer is conditioned on security holders tendering a minimum number or value of securities. A Dutch auction is typically an active and widespread solicitation by a company or third party (often called the “bidder” or “offeror”) to purchase a substantial percentage of the company’s securities. The company identifies the maximum amount of shares that will be buyback and the range of acceptable prices for the bids. Each accepted bid will be paid at the minimum price necessary for re-buying all the shares. Sometimes a tender offer is conditioned on security holders tendering a minimum number or value of securities. Auction 🡪 we are talking about a different scenario in which you set the number of days for which you collect proposals not the binding orders, but proposals for selling shares with the company. At the end of this period, you will decide who will be able to sell the share to the company and at what price. The difference here is that the order is not executed immediately, but the orders will be executed only at the end of the period by considering all the not binding orders received by the investors. You can have a tender offer or a Dutch aucion. What is the difference? The difference is that when we talk about a tender offer, everyone that is submitting an order is setting a price for the order, so I will accept to sell you the share at 0.91€ per share and if the proposal is accepted, the price that has to be paid is 0.91 and every shareholder may have a different price because I am accepting that they want to sell at 0.91, someone else wants to sell all only 0.93. If both of us we are accepted, one will pay 0.91, the other one will pay 0.93. When we talk about the Dutch auction, the only difference is in the final price because the final price is not a separate directed by the investor but is the minimum price for rebuying all the shares. So if I submitted an order in which I say that in order to sell, I wish to sell 0.91, but someone else is accepted and wants to sell at 0.95, in order to sell all the shares, the companies have to pay to one of the investor 0.95. In order to be fair with everyone, everyone will receive 0.95. So in the previous case I'm setting the price in my proposal and if I'm accepted, I know that I can receive the amount that I expected for each share. In the Dutch auction is different because in the Dutch auction everyone will receive the price for each share that is the minimum necessary for buying everything, that could be higher than the price that I was accepting. When we talk about that this type of auction, what we need to consider is: Again, the yield for each of the transaction computed as the ratio between the price and the price at time t – 1. We have to consider the average price as the minimum price that would be applied subject to the possibility to rebuy all the quantity expected. We don't have an average price because the price paid by everyone is always the same and is the price that is necessary for selling all the shares, for buying all the shares is expected by the company. So it's not an average price as before because everyone is paying the same price, the price of the last order accepted. And the average yield will be this price, the minimum price applied to everyone minus the price at time 1 divided the price at time 1. The main huge difference is that we don’t have a different price for every investor, but in the Dutch auction we have a price that is the only one price applied to everyone and this price is the price that allow us to rebuy all the shares that we want in the Dutch auction. (An example on Excel of the Dutch auction) Here you have again all the orders, all the dates, but here we're talking about an auction. So you are not using the data as they are, but you have to order the data by considering the price that the company has to pay for rebuying. So this table that you can see over the error is the same table that you have on the top, but ordered on the visual of the price, from the lower price to the higher one. So if I want to buy all the 14,000 shares, I will pay 0.71€ because that's the minimum price that is requested by one of the investors. If I want to sell not 14,000 but 14,000 + 15, I have to pay 0.8€ to everyone. If I want to sell 15 + 15, so 30,044 (no he entes gaire be el num) shares, I have to pay €1.00 because that's an acceptable price for the investor E F C What do you have over there? Is the amount that you pay for buying this share at this minimum price that you are paying for everyone. In the first case is the price multiply for the quantity. In the second case you have to consider the new price 0.8 multiplied for this quantity. etc At the end you want to rebuy €100,000. Here you set the price of 1.25, you are paying €92,000. If you want to spend all the budget, you have to set a price of 1.5 for everyone and you will be able to rebuy up to 156,000. So it means that these amount will be not paid fully, will be paid only partially because you don't want to spend more than €100,000 So that's the current price, and the return offer for the shoulders is quite easy because it's the price that you have settled at the end, 1.5 - the current price 0.9 divided by 0.9. Remember, in this case the price is always the same for everyone. Target repurchase A target repurchase is the strategy to buy repurchase a substantial percentage of the company’s securities by targeting only some investors. The company identifies the amount of shares that will be buyback and the price offered. The target repurchase could be used also as instrument for avoiding an hostile M&A by sending a green-mail to the raiders for avoiding the takeover When you are doing a targeted purchase, what you do, you select a set of investors that you think may be interested about your proposal, and you start discussing with them what is the reasonable price for selling you the shares. This transaction is done privately, so every transaction is independent and the price set depends on the market power of the two parties. If they want to sell probably, you can buy at the discount. If they don't want to sell, you can buy but you have to buy it a premium. This type of transaction normally are done when you want to replace the management. And as you can imagine the management is not so appealed to be replaced by a new owner and so on. When you have a target repurchase, what will happen is that the manager will always react by sending a greenmail. A Green Mail is a reaction with respect the target repurchase in order to avoid a takeover. So we have some investors in the financial markets that become rich by doing only this type of strategy, they try to start a target repurchase and they accept greenmail. What is this green mail? Is the proposal by the manager in order to stop the takeover to buy all the shares that you own for the company. Normally this premium was quite huge because if you want to stop a takeover made by a target repurchase, normally you have to offer a premium of more than 50%. So when we talk about target repurchase, we're talking about this type of transaction in which you select a target of investors and you negotiate with them at which condition you want to buy from them. Frequently this transaction is not completed because the manager react with a green mail. So let's summarize the difference between the open market repurchase, the Dutch auction, the tender offer and the target repurchase. For summarizing the difference, I have selected the four issue that may matter, the price, the risk of the transaction, the time horizon and the market effect. A comparison among alternative buyback options for the corporation Let's start with the price. When we talk about the price, normally what will happen is that the price that you pay for the buyback is significantly lower when we talk about an open market repurchase, a Dutch auction or a tender offer with respect to what you can pay every time you try to do a target repurchase. So the price paid here is at the maximum with respect to what you can pay over there. If we compare the open market repurchase with the tender offer or the Dutch auction when we pay less? If we want to compare this type of solution that are always not so expensive for the company, this one is more expensive with respect to the tender offer and the Dutch auction. Seems to be not so reasonable but normally if you do a Dutch auction, you will pay a little bit more than a tender offer. Is it more expensive for us as company to do a tender offer or to do a Dutch auction? When we are in the Dutch auction, there is an issue that may matter for the company point of view because if you know that the price that you will pay is not the price that you declare in the bid, what matters for you is to be accepted in selling your shares because you know that the price will be settled on something else, it's not your price, but it is the price that is settled by the company. So what you will do when you submit the order is revised downwards so to set a lower price for your bid in order to be sure that your order is accepted. If you have the lower price, probably you will be accepted. If everyone do the same strategy because they want to get accepted at the end, what will happen is that the price paid by the company in the Dutch auction will be lower than the tender offer. Because in the tender offer you declare what are the conditions, in the Dutch auction you know that you don't control the price, so what you want to be sure is that your order is accepted and so normally you accept to sell even it has more discount because you don't know what will be the real price that will be accepted. So the less expensive would be the tender offer, while the Dutch auction could be more expensive than the tender offer. We have the risk. The risk of not having all the shares bought by the company. So the risk here is that I want to rebuy €100,000 shares but I am not able to do it, I will rebuy less. When I do a target repurchase the risk of this type of transaction is high, because you don't know if everyone will accept the proposal, and so you don't know if you are able to complete it. When we talk about another market repurchase, what we are saying is that we go to the market and we try to sell in the market. The longer is the time horizon for which we are in the market for selling the security the lower is the risk of not being able to buy all the shares. So essentially the more you stay in the market, the more you can trust that you will be able to rebuy everything that you want. For Dutch auction it depends because you can be lucky and you receive all the orders that you want in the time period that you provide for submitting orders. Or you can be not so lucky and at the end you are not able to rebuy everything. So in this scenario you don't know if you are able to buy even only one share because it's an hostile takeover and someone can be against data. In the other scenario, the more you stay in the market, the higher is the probability that you are able to buy everything. In this scenario, it depends on how long is the time horizon for which you do the auction and how many people want to join the auction. Talking about the time horizon for the open market and the auction, normally is only few days or few weeks. For the open market 🡪 few days or few weeks Target repurchase 🡪 several months, even years Talking about the market effect, all the market is affected by this type of transaction. We have to consider which type of information is available for the investor in the market. If we do an open market repurchase, we are trading in the market as one of the investors, but we want only to buy our shares. Every transaction that we do is an information that could be used by the market. So the impact on the market is maximized every time we are using the open market repurchase. When we do an auction, is not done in the standard financial market, is done in a market for auction where only the investors that are interested too can trade and So what matters in the end is not the set of order that you receive, but what is the final price that you will apply for the auction. The more the final price is different than the current price, the higher will be the impact, but nothing else will matter for the investor point of view. Finally, when we talk about the target repurchase here, normally this information is almost never disclosed in the market. So you will discover only at the end if the takeover will take place, if there were or not some target repurchases scheduled in the past, but only once at the decoder is ended and once the decoder is completed. If you have a green mail for example, and you accept the green mail, the information about the takeover will never go to the market. You don't have an effect to the target repurchase. If you complete the takeover, you take the control, there will be an effect on the market. Here you have a plot again for 2021 again for US. Buyback size vs cash dividends amount in 2021: Is telling, sector by sector, what is the role of dividends versus buybacks. Blue 🡪 how much is paid to the shareholder as dividend Red 🡪 how much is paid to the shareholder as buyback The ratio between the amount of dividend paid with respect to the amount of payback is lower than one. If it's lower than one, what matters the most is the buyback? So what is telling us these ratio that in US is mostly relevant in economic value to have a buyback instead of dividends in the year analyzed Talking about the percentage of cases for which the dividend is lower than the buyback, so essentially what you will have is that you have a less blue than red for each of the line over there. For the 43.6 cases, 6% of cases you have these result. While for the 56%, you have the percentage of data is higher than the buyback. Are these data consistent with what we have discussed over there is something strange? So what you can see over there in these two other lines on the table is already to how many sectors I have dividend lower than buyback or dividend higher than buyback. So if you see that normally here the dividend are higher than the buyback with respect to the scenario which they are lower, because this is 56% and this is 43%, it means that every time we have this scenario (%D<BB), the amount paid is significantly higher, while when we have this scenario (%D>BB) the amount paid is significantly lower. What happens is that not only at the country level buyback matters more than dividends, but we have sectors in which we pay more buyback with respect to dividends that are also those that are paying more the shareholders. And so again at country level that's the figure that we will have. So even if there is a higher number of sectors in which the dividends are higher than the buyback, this country level doesn't matter because the sector that are paying lower dividend than buyback are also those that are paying higher amounts of remuneration to the shareholders. Sector by sector you can have huge difference. In some cases you can have a difference that are driven by, for example, law. Real estate investment trust 🡪 These are special financial instruments like mutual funds that are investing in the real estate sector. By law they have to pay at least every year more than the 70% of their earnings as dividend. As you can see over there for them there is a dividend payment that is the 100% with respect to the buyback because if every year you have to pay dividend buy law, for sure the dividend payment would be the best solution for you. There are some other sectors for which there is not constrained by law, for example, home furnishing that are characterized by dividend payment that are the 100% of the remuneration paid. And these are sectors that are more interesting for us to study because we have to understand why in 2021 they decide to pay dividends instead of buyback. In the first case over there, the rates up, you have no need to analyze them not because you know that by law that's their choice. When you see some sector like the home furnishing over there that are quite unique with respect to the average. https://uniroma2.sharepoint.com/sites/msteams_5dbb59/_layouts/15/stream.aspx?id=%2Fsit es%2Fmsteams%5F5dbb59%2FDocumenti%20condivisi%2FGeneral%2FRecordings%2FSolo%20 visualizzazione%2FCorporate%20Finance%2D20221010%5F125356%2DMeeting%20Recording %2Emp4 Chapter 10 pp. 443-469 Lesson 14 – DIVIDEND TRADE-OFF THEORIES 1. Introduction The impact of new dividend payment on the shareholders’ wealth. The net return offered by the new dividend payment is zero because the amount paid payoff exactly the reduction in the overall equity value. When we talk about dividends we were talking about how to identify if it's better to pay dividends, instead of making a share repurchase and which type of dividend there may be the best for the shareholder point of view. Here you have a theorem that is called the Modigliani–Miller theorem on the dividend policy, that is showing us when the dividend policy doesn't matter at all. Essentially, the theory proposed by Modigliani–Miller is telling usif we have a company that has to decide how much has to be paid as dividend, and we have only one year that we have to analyze in our framework, what we had to focus is essentially the impact on the value of debt and value of equity for the stakeholders of the company. Let's assume that the market is without taxes and without market imperfection. And let's type to analyze what happen if we pay a dividend. In this case if we pay a dividend by cash. First formula Here you have a company that is using leverage. So has some debt and some equity. And let's assume that they cannot change more the depth policy because they have already reached the the maximum leverage for the company. So we have already discussed about what is the maximum leverage and what matters. And the company has the opportunity to pay a dividend to the shareholders. The amount of the test to be paid is these X euro so let's say 1,000,000 of EUR 10 Millions of euro doesn't matter at all. If we do a dividend payment what will happen is that we use some of the cash available for the company in order to do the payment. So essentially we are reducing the assets owned by the company by the amount of dividend that we are planning to pay. Second Forumla We say that the debt is already the maximum, so it's not changing at all. What will happen to the company when the dividend is paid? if the debt is always the same and their sets are decreasing, what you expect what will happen to the equity? Decrease currently with the amount of decrease that we have in the asset side. So essentially the equity of the company at time one, the levered company, will be the equity available at time 0 minus the amount that we have spent for paying the dividends. Chapter 10 pp. 443-469 So, the value that you obtain at time one for the equity holders is equity level at time 0 minus X euros, that is the dividend payment done by the company. Third formula If we consider the capital gain for the shareholders or the capital loss for the shareholders is essentially the gap between the value of the equity at time 1 minus the value of the equity at time zero. We say that the value of the equity at time 1 is equity level at time 0 minus X Euro. The value the equity time at zero is the value of the equity at time 0. So, the capital gain or capital loss is a capital loss and is equal to minus X Euro. Fourth formula So if we consider the overall return for the shareholders, this will be the dividend payment plus the capital gain. As dividend payment you obtain now a cash payment of X euro and you will have a decrease of the equity of the same amount. So essentially they return for you will be almost equal to 0. In this scenario, the scenario Modigliani–Miller theorem if you decide to pay a dividend you are not creating value for the shareholders. You are only replacing a capital gain with a capital loss, and you are doing a payment now by cash. And what you lose by the capital loss is exactly what you earn as dividend by cash now. So essentially you can decide to do a dividend payment or you can do not because there is no impact for the shareholders wealth. The impact of a share repurchase on the shareholders’wealth The net return offered by the share repurchase is zero because the amount paid payoff exactly the reduction in the overall equity value. If we do, instead of doing a divident payment, a share repurchase what will happen to the companies that something different that matters for us or not. First formula We have a exactly the same scenario we had before. The companies using equity and is using debt. The debt is already at the maximum level. Now we want to do not a dividend payment by cash, but we want to do a share repurchase for the same amount that we have discussed before. I want to spend 1,000,000 of euro not for making a dividend by cash, but I will spend 1,000,000 of EUR for rebuying 1,000,000 of EUR shares from the market. Chapter 10 pp. 443-469 Second formula What will happen is that what you will have at time one, will be a value of the share that will be lower due to the fact that some of the shares are bought by the company. So, the video directly time one will be the value equal time 0 multiplied for 1 minus the percentage of shares that are in the share repurchase. How we compute the percentage of shares that are in the share repurchase? The amount of the repurchase divided for the value of the equity in time 0. So if they should able chases support 1,000,000 and we have 10 million of shares outstanding, this the 10%. In conclusion, the value of the equity in the time one will be the value of the equity at time 0 multiply for 1 minus 10%, so multiply for 90%. The percentage of shares that will be cancelled through the shares repurchase is the amount that we spend for the share repurchase divided for the value of the equity at the time of the repurchase. In this case is X euro, the amount of the repurchase, divided for the equity value at time 0. Third formula The capital gain and the capital loss that we can suffer is exactly the same formula so, equity level minus at time 1 minus equity level at time zero. This is equity level at the multiplied for one minus the percentage of the share repurchase, with respect to the total equity, minus the equity level at time 0. If you made some algebra: equity leverage multiply for one minus equity level at a time zero, and the value is exactly the same. Equity levered at the multiplied for X euro divided for equity level. What we have at the end is minus X euro. Fourth formula If you compute the overall return is like before. Is the repurchase effect plus the capital gain. The repurchase effect is X euro, the capital gain is minus X euro and the net effect is 0. When we talk about the share repurchase chase, there is an effect for the shareholders. Because immediately after the share purchase at the number of shares outstanding would be lower, so the liquidity of the security will be lower and this may matter for taking the control of the company so do a take over or may matter if you want to sell your share in the market. When we talk about the dividend, there is not at all an effect. When we talk about share repurchase, there is not an economic effect,so financial loss or a financial gain, but there are some implication for the number of shares outstanding (that will be lowered with respect to before). Chapter 10 pp. 443-469 In perfect efficient markets payments released through dividends and share repurchases will not affect shareholders’ wealth. Modigliani–Miller theorem is telling that if we want to pay our shareholders with dividends or with share repurchase, if doesn’nt matter at all what we select as a channel for paying our shareholders. The result that the shoulder will obtain will be almost the same if we use dividends or if we use share repurchase and there is no gain for using them. The assumption are there is no taxation, the assumption are that there is a only one year that we are considering, so we are evaluating only one year in our analysis (we are not considering a time horizon longer than one year), There are no preferences for shareholder between the Share repurchase and the dividend payment and the markets are efficient and there is no information asymmetry. As you can imagine, in the real world we have taxation; we don't consider only one year, but we have to consider the dividend policy or multiple year time horizon; the shareholders may have preferences between the share repurchase and the dividend payment and finally there is an information asymmetry. So what we're to consider is that these assumption made by Modigliani–Miller are not realistic for a comparible evaluation. Andwe have to consider how the company may adjust due to the fact that at least, these four items may matter for the dividend policy or for the remuneration policy of the shareholders. 2. Dividend matrix Companies normally identify their remuneration strategy on basis of the current and expected business performance. A dividend matrix is a framework that you can follow in order to identify year by year what could be the optimal dividend policy for your company. So, what we want to point out is what Chapter 10 pp. 443-469 could be the remuneration strategy for our shareholders in order to make for them more convenient to invest in our company. Essentially, what you have to do is: - - You have to consider the payout ratio, so how much you want to distribute of the earnings that you are producing. You are two identify if, once you have selected your payout ratio, what is the new sustainable earning value that you can have overtime. So, you have to set also when you want to change the amount of earinings paid. How to just to the new earning policy First of all you set your target payout ratio. Once the market is changing or the company is changing, you define the newer earning policy (the new regulation policy) and once you have set the the new regulation policy, you will define the so-called speed of adjustment to the new share earnings policy or ammunition policy. Is almost like the debt structure that we have analyzed. The remuneration policy will change during the life of the company: We have a plot of the life cycle of the company. Instead of analyzing the leverage, as we did last week, now we want to analyze how the dividend policy or the remuneration policy of the company may change during the lifecycle of the company. So we want to understand what matters and what are the key issue that justify a change in the policy, in the remuneration policy, during the life of the company. We have the start-up stage, the early growth statge, late growth statge, mature statge, decline statge. Chapter 10 pp. 443-469 Here we have analysis about the funding needs of the company the opportunities for internal financing, the capacity or the interest to pay dividends, and finally, what are the growth or the expectation of growth in the earnings overtime. External funding needs When we talk about the introduction stage, we have say that the company is suffering of a lack of money for supporting its investment strategy. So, what we have to consider is that these companies looking for money, but is constrained by the market that is not offering a lot of financing solution for the investment strategy of the company. So in this scenario, we have that the external funding needs is at the maximum but the capability to raise money is at the minimum. So, theoretically need a lot of money, but in reality no one or almost no one is offering me money for supporting my investment strategy. When we move from at the startup stage to the early growth stage, we have a funding needed that is quite high and is even higher than the form value. So we are growing, we are going faster and so we need to raise money the more that we can from the market. The main problem is that in this stage we don't have a lot of guarantees that we can provide for collecting money and so frequently we are constrained by the market (less constrained than before, but still constrained by the market). When we talk about the late stage of our growth of the company, we are near to the maturity stage. What will happen is that they need for new funding is not so high as before so there is still a need but this need is decreasing over time and so probably we don't need too much external financing opportunities. When we talk about the maturity stage, we have almost no need of external new financing opportunities because we have already reached the our market share. We have already started almost all the project that we want to run and so essentially we continue with the company as it is. In the decline stage we have that the external funding needs are low, not only because we don't have no projects that are available, because the lender will never trust us if we request new money because they know that we are in the decline stage and in a few years we will go out of the market. Internal financing Here we have to consider is that how much we can cover financing needs of the company by using internal sources. And as you can imagine, this is linked with external funding needs that we discussed before. Essentially, where we talk about the startup company, the startup company is run at a loss and it’s hoping to survive in the next years. If this is the scenario, normally you don't have the opportunity to have money that you can use for self financing because you don't have a positive income and so you cannot retain earnings (because you don't have earnings you have a lost sister every year). What we talk about here early growth again we still have the same problem because we are growing here by year, we are using all the money that is available and so probably we cannot collect internally new money for supporting our growth. Chapter 10 pp. 443-469 When we arrive to the late group stage, there are opportunities for internal financing even if the amount of money that we can use is still low. So here we can try to use internal financing even if it will be one of the sorts of money (not the main source of money for our company). When we arrive to the maturity stage, we are exploiting the scenario in which we can use the the maximum self financing. So, here we can decide to finance some project by using only internal source of capital (because we have positive income that is stable over time and we can decide how much we want to retain and how much we want to distribute with dividends share repurchase whatever you want). When we go for the decline stage, the internal financing could be even higher than our needs because if we are a stopping some of the production process, for some years, we can have an excess of internal sources with respect to the needs of the company so in this scenario. We can think that probably internal financing would be even overestimated, even too much, with respect to the real needs of the company (only because the companies there is downsizing, is reducing the amount of investment and so as no longer the need of a lot of money). Capacity to pay dividends When you have internal financing opportunities that are zero or negative, you cannot pay dividends. In the startup or in the early growth, you have no opportunity to pay dividends. When are you started to have internal financing opportunities you may decide somehow to pay a small amount of dividends, but is not so frequent. In this stage if you have internal financing and you are still in the late growth probably you will use internal financing, instead of doing a payment of dividends. When you arrive to the maturity, you pay dividends and probably year by year, you try even to increase the dividend payment. And when you arrive to the decline stage, we have said it when we were discussing about the leverage policy, near to the closing of the activities for the company the manager has an incentive to pay dividends even more than before. To cash out and make dividends higher than before. Growth stgatge What we talked about the growth stage, the first stage that is the one in which we are in the introduction the startup, is a scenario which the dividends are at zero and they are not growing at all. They same my for the first stage of growth. In the late growth, we can have dividends that may change with a positive rate over time.The same for the maturity stage Normally, in the decline stage, we will have a dividend payment and this dividend payment may matter, but it will be decreasing over time. So here you have growth rate positive and positive for the dividend payment (growth and maturity). Here normally you have a growth rate that matters, but normally is a negative value (declive). So now I can pay you €1.00 in two years I will pay you 0.5 euro per share, because we are closing down the activities and once we start selling that activities, we are no longer able to pay the dividends as before. Chapter 10 pp. 443-469 The remuneration policy has to be monitored and updated on the basis: Now we try to analyze 4 different choices that you can do when you are planning to identify your remuneration strategy. These called dividend matrix and the dividend matrix is comparing: the amount of cash available and the return related to the investment opportunity, the return of equity. What we will try to identify is a set of the four scenarios, depending the cash and the ROE (return on equity). In the first scenario, which we have the return on the equity that is negative. So we have the performance of the company that is not like we expect. So it's lower than zero, is lower than the average. And the cash availability that is higher than zero. So we have a lot of cash that we can distribute. We can have a scenario number 2, which we have a lot of cash and also the return on equity is positive or higher than the average. The scenario 3, we have a lack of cash but we have the return on equity that is still hight. And the scenario 4, in which we have a lack of cash and the return of the equity is quite high. What we have to do in each of the scenarios for selecting our dividend remuneration policy? Scenario 1 If we have a cash surplus, so we have a lot of cash, but the project that are available are not so performing, so cash surplus + poor projects, with the return on equity below the average. You have to maximize the dividend or do buybacks of your shares. The more you can do the better it is. Scenario 2 Chapter 10 pp. 443-469 We have a cash surplus and we have also some good projects available. What we can do is what we prefer to do so. We can do dividend payments. We can do buybacks or we can sell finance our growth. Scenario 3 We have a cash deficit and we have only two projects available. We can reduce the remuneration policy for our shareholders and start planning a new investments with better performance with respect to those that are already existing. Scenario 4 We have a cash defiicit + good project. What we have to do is to reduce the remuneration policy and the invest money in our company. HERE EXCEL FILE & MENTIMETER 3. Dividends are bad You have some aspects that may matter for identifying your strategy. In this case, we will focus on all the theories that are against the dividend payment. In favor of the buyback strategy. When we talk about the dividend payments, what we have to consider is the impact of the dividend policies or our choice of doing a dividend payment on the taxation for our investors And on the preferences or on the strategy adopted by the institutional investors. Preference of buyback with respect to dividends may be related to: - Taxation Older and poorer investors may pay no taxes on income if it falls below the threshold for taxes. The capital gains taxes can be higher for some of these individuals than the ordinary tax rate they pay on dividends. Overall, however, wealthier individuals invested more in stocks than poorer individuals, and it seems fair to conclude that individuals have collectively paid significantly more taxes on the income that they have received in dividends than on capital gains over the past few decades. Let's start with the taxation. What does it mean? In the real world, so not in the scenario proposed the memory Modigliani–Miller, but in the real world, you may have that the investors are taxed with different tax rate on the basis of their income. Normally what will happen is that the investor that are characterized by a lower income are paying a lower tax rate. Does that have an I get income are expected to pay a higher tax rate because they can afford it, and so they can pay more and support what is offered as a social service offered security and so on. What we have some uh investor with a low income, if we pay dividend to them there is almost no problem. Because the tax rate that they will pay will be quite low and so they will be happy or they can afford the payment of the taxes on the dividend payment. Every time we have a wealth individuals have a higher income tax with respect to the poorer one and if you pay a dividend to them, this dividend will be taxed on the basis of the tax rate applied to the individual. Chapter 10 pp. 443-469 So if you have an income in Italy that is higer than let's say €30,000 per year, gross amount. Normally you pay a tax rate that is around the 40%. This means that every euro that is paid as dividend will not go fully in cash to the investor. But the investor will obtain only the 60% of the €1.00 paid as dividend. If you have a low income, normal you are taxed with a lower tax rate (let's say 20% and so for each euro, you will obtain the 80%). So what matters for you is to identify how many wealth individuals and how many poor individuals you have among your investors. The more you have wealth individual it's the less you have to prefer to pay dividend because they will suffer of a lot of taxes. Those that are doing the investment are mainly or mostly people that have an excess of money that they want to allocate in financial investments. Wo normally we have more wealthier individuals than poorer ones that are investing in our company. So when we pay dividend we have to consider that the tax rate that matters is the one for WellCare and not the one for poorer investors (more wealthcare investors). We talk about capital gain is the same. So, when we wash shared purchase, we are taxed on the capital gain and the tax rate applied is the same for everyone, independently with respect to the income. So, when I do a share repurchase ,I will pay normally they 20% of the taxes on the capital gain. Independently, with respect to what is my income, what is my wage, what is my wealth. So, saying differently if I have a lot of high wealth individuals that are investing in my company by doing a share purchase I can offer them a tax saving opportunity. If on the opposite I pay a dividend they can complain because at the end, they will pay more taxes on the dividend due to the fact that their income tax is higher than the 20% (maybe 40% or even more). So if we focus on the taxation for our investors, there is an interest of doing a share repurchase instead of dividend payments. - Institutional investor About two-thirds of all traded equities are held by institutional investors rather than individuals. The main issues are: - Tax exemption Indirect taxation Corporate exemption What that's matters is how much you have an institutional investors that are buying your shares. What are the institutional investors? - Mutual funds, pension funds, insurance company, Banks and so on. Here, there is a number that may matter for you, in worldwide basis: two third of all trading securities are owned by institutional investors. Only one third is owned by individuals. So it means that independently with respect to the company that you are analyzing, will have a lot of institutional investors. And when we talk about the institutional investors, we have to consider if there are for this institutional investors, special rules that will have an effect on the net income for them. Chapter 10 pp. 443-469 Tax exemption What are the special rules that you may have? You may have a special rules, The tax exemption for the institutional investor. Let's say for example, that you are a foundation. If you're a foundation and you have a lot of investments that you do for the interest of the community for offering services, and so on, not in this case you are not paying taxes at all, in order to provide this type of service. So there is an agreement between the state and this type of Foundation: they have a tax exemption of the 100% if they do mainly activities that are in the interest of a group of people of citizens. If it happen so, when you are planning your dividend policy, you have to consider it because this may have an effect for the convenience or not of doing a share repurchase instead of a dividend payment. If you have a tax exemption. What do you think about what is the best solution, do a share repurchase or you do a dividend payment? I have to go for the the dividend payment instead of doing the share purchase, because in this case, the tax rate of the investor is 0. The tax rate or or the share repurchase is 20 and so what is more convenient is to offer the dividend payment instead of the share reprchase. - The more you have tax exempt investor the more you will go for dividends. The less you have tax exemption the lower will be the interest to to do a dividend payment. Indirect taxation When we talking about indirect transaction we are mainly focusing on what international investors in our case international institutional investors. When we talk about international institution investor what we have to consider is that if you are not domiciliated in one country, but you are paying tax in a foreign country, and if there is an agreement among the states what you can do is to decide to pay taxes in your own country and do not pay taxes in the country from which you are earning money. This can be done for everything also for your income. If you are working in Greece and you are paying taxes in Italy, you can clear that you will pay taxes in Greece and so you will not pay taxes for the same amount in Italy. Every time there is a this type of rule, that the taxation may change on the basis of the nationality of the investor, what matters for us is not the tax rule applied in Italy, matters the tax rule applied in the foreign country from which investors are coming because if the investors are coming from Bermuda (they have a tax rate equal to 0 and so, if they are allowed to pay taxes in Bermuda they will pay taxes in Bermuda. They will not pay taxes in Italy or in Europe or in Germany) So again, if they have an opportunity to have a different tax rate, we have to revise our strategy and consider if it's still convenient to do a share repurchase or to do dividend payment. If they are based in Bermuda, I will do dividend payment, because they will pay 0 taxes on it. Otherwise, the to pay the 20% of the capital gain and is not convenient for them. Corporate exemption Chapter 10 pp. 443-469 A company that iis not performing good so is a company that is suffering of a loss and is suffering of loss for several years in this case if I pay dividend to this company the taxable income or the company can be still negative. And independently with respect to the tax rate applied to the company, if you have a taxable income that is a lower than zero, the amount of taxes that you will pay are 0 So again I have to consider if there are corporate investors that are suffering of losses and so for them, could be convenient to receive dividends because at the end, they will pay zero as taxes. The analysis is always the same. We have to compare the 20 fixed the percent of the taxes on capital gain without much I will pay if I'm tax that corporate level, individual level, on the basis of my tax rate. What matters for you is when it's convenient or not. These are the scenarios for the institution investor that are different than the individuals that we described before. So every time you have tax exemption, you have opportunity to be taxed abroad. You have a company that is run at a loss, you have to move from the share repurchase that was our best scenario in the scenario that we discussed before, to the dividend payment because we can offer a tax saving opportunity to our investor. 4. Dividends are good Dividends are good when they can be appreciated. Essentially you can have investor preferences, the so called clientele effect and the information signal or the information advantage that you can have from paying dividends instead of doing a buyback. Preference of dividends with respect to buyback may be related to: - Investor preferences Rational investors, it was argued, would prefer that firms buy back stock (rather than pay dividends) and rational mangers would oblige by eliminating dividends. Absence of self control Investor preferences are something related to, we can call it, irrationality that may matter for the investor point of view. So our focus will be mainly on what could be the negative effect if we do a payback instead of doing a dividend payment. So why we are to prefer the dividend payment. If you do a share repurchase what you are doing with the the Investor? You are doing an agreement for which you do a payment now and the investor is no longer a shareholder of the Chapter 10 pp. 443-469 company. The advantage is that you are buying at a premium and so the investor is earning more than the current price of the share. But when you do a share repurchase, you are giving a lot of cash available to the shareholders that wants to join these repurchase plan. What matters for us is how much they are able to replan their investment strategy. What can happen normally is that when you receive a lot of money, you spend it for consumption. You book for an holiday, you book for a flight, tat you spend money going for restaurants every week and so on. What matters for us is that we understand how much the investor is the rational. The more the investor is rational, the less we are worried about to doing dividends versus share repurchase. If we think that there is irrationality, as normally happened, what we have to consider is that is better to do a dividend payment instead of buying shares from the individual. Because we don't know if the individual will be able or would be interested to make a new investment plan. If the investor is not doing it in the future will discover that there will be a problem of a lack of liquidity, a lack of income and so on. Mental accouting Mental accounting means how is evaluated at dividend and how different is evaluated an opportunity to sell at a premium a share, so to join a share repurchase. Normally, when you receive a dividend, you perceive it as a remuneration expected, that is already to the investment strategy that you have adopted. So you perceive it as something that has to happen, something that was already planned. And so normally you have already made also an idea about how to use this money and how much has to be reinvested and how much has to be spent. When are you receive a payment, related to a shared repurchase, and you you discovered that you are able to sell the share at a premium, with respect to the market, what you think as a rational investor is that you were able to beat the market and obtain an extra return with respect to what was requested by the market. So essentially what we discovered is that after a shared purchase, they investor in replanning this strategy is normally risk averse with respect to the past. So, I was able to sell the share at a premium, I will be able to obtain exactly the same return or even morals in the future. I am more risk lover, less risk adverse, and probably sometimes I can be too much optimistic in my strategy and so I may suffer loses related to these increase of risk in my investment strategy. Regret avoidance Finally, what I can have is also a issue related to a company that is not performing as good as in the past. If the company is not performing good as in the past and I'm planning to do a share repurchase. When I'm doing a share purchase, I'm paying a premium, with respect to the current market price. But this price that I'm paying, may be lower than the price paid by the shareholder when the shareholder bought the share. Chapter 10 pp. 443-469 Some years ago, the share was treated at 20 nowadays is treated at 10. I do the share repurchase at 12. I'm giving you a gain of two if you want with respect to the current market price. But if you consider what was the price paid at the beginning, you are suffering a loss of eight (20-12=8). By doing a share repurchase the number of people that will join the program will be normally lower than the one expected. So saying differently, I will be never able to complete the share repurschaseI can buy some shares. Someone will accept to sell but some others will never accept to sell it. These are regret avoidance problem, so it's essentially the investor do not want to recognize that made a mistake in the past, paying too much for a share that is now there with less. So every time you are in a decreasing trend in the price of the share, for you there is no choice for doing the payment for your shareholdres. You have to go for dividends, because otherwise the share repurchase will not be accepted. A lot of Sherrod that's will never consider it. - Clientele effect Stockholders in high tax brackets who did not need the cash flow from dividend payments tended to invest in companies that paid low or no dividends. By contrast, those in low tax brackets who needed the cash from dividend payments, and tax-exempt institutions that needed current cash flows, invested in companies with high dividends. This clustering of stockholders in companies with dividend policies that match their preferences is called the clientele effect. There is something else that may matter this is mainly related to institutional investors. We want to create our strategy in order to serve them, and in order to give them a value or a net return that is the higher that we can. We are to consider is how many investor are in high tax brackets and how many are in low tax brackets. And what you want to do is try to offer them solution that allowed to maximize the net return for each Europe paid by the company. So the net return with respect to taxes for each euro that I will pay as remuneration to them. That analysis is the same that we had discussed before. So, if I have high taxt brackets I will not pay dividends (I will do a share repurchase). If they have low tax brackets. I will go for the dividend payment, especially if I have tax exempt institution and so on. It's like before, we are looking at the different sign of the same coin before we were discussing about when it was convenient to do a dividend payment, now we are talking about when it's no longer convenient to do a share repurchase, but the analysis is is almost the same. What matters for you is to try to make a cluster of your shareholders, and try to idenitfy, which type of shareholder you want to increase in the future. So essentially, when you are planning your dividend payments, if you want to have a more low tax brackets Individuals, you will pay dividends and you will increase year by year, the dividend payments. Chapter 10 pp. 443-469 If you want to have a more high tax brackets Individuals, you will reduce the dividends and you will maintain it at the minimum in the next year. So in planning, what will be your shareholders, that's how you have to act in the dividend payments. What else is important is that when we talk about the clientele effect there is an additional feature that may matter, related to the impact of your remuneration policy on the portfolio owned by the shareholders (your institutional shareholders). Let's say you have a pension fund that is investing in your company. And let's do not think about the tax bracket supplied, but let's think about the portfolio when you do a dividend payment or when you do a share repurchase. We had said that the dividend payment could be by cash or by share. And the share repurchase is only buying shares at a fixed price. If I do a payment by cash the implication for the portfolio of your shareholder is that the pension fund there is more cash and can decide the new investment strategies with the cash obtained. If instead of doing the cash dividen, we do a dividend shares, the impact on the portfolio of the pension fund will increase this exposure with respect to our company, because we'll have more shares of our company. I don't know how much it depends how many shares I'm giving and how much is invested by the pension fund but it will increase its own exposure with respect to our company. On the opposite, if we do a share purchase what will happen to the pension fund portfolio. The pension fund will retain less, we will loan less, shares of our company. When we're talking about an institutional investor that remember is a company that is managing money collecting from from someone else. If we modify their portfolio, is it good or bad for them? - So by doing a share repurchase or by giving a dividend in shares. In the first case, we are reducing the number of shares owned of our company. In the second case we are giving a dividend per share, so we are giving more shares of our company and we are increasing the exposure with respect to our company. Does this strategy affect or matters for the pension fund, for the mutual fund, for the bank for the insurance company? (remember they are managing the money of someone else) - - Normally, these institutional investors they have to report about what they're doing with the money collected from someone else. Every time they have to report, they may be worried of showing a novel exposure with respect to our company or an underexposure with respect to our company. So if we are doing a remuneration payment by shares repurchase, dividend by cash, we have also to consider for our shareholders (institutional ones), if they are near to a disclosure date. Because if they are near to a disclosure data, we have to avoid share repurchase and dividend by share. Because we will modify their portfolio and the reporting of the activity may be affected from it. We have to prefer to go by dividend by cash. Chapter 10 pp. 443-469 - If they are far away from the disclosure data, it doesn't matter too much. They have some weeks or some months for rebalancing their portfolio and so it doesn't matter, too much for them. - Information signal Financial markets tend to view announcements made by firms about their future prospects with a great deal of skepticism, because firms routinely make exaggerated claims. By increasing dividends, firms create a cost to themselves, because they commit to paying these dividends in the long run. Decreasing dividends is a negative signal, largely because firms are reluctant to cut dividends. What else is important is how the market is reacting when we do a dividend payment or when we do share repurchase. If we do a dividend payment there is an an effect, immediate effect, on the price of the share. If for you increase the dividend, what will be the effect on the price? - - - They expected cash flow for the shareholders will increase proportionally, so essentially the shareholders will use this information for revising the forecast about the dividend payments. And if we are increasing our dividends this year, the shareholders will expect the thought in the future: the dividends will be at the same amount and in this way, you will have a positive effect on the price of the share. So the more we increase the dividend, the more we increase the price of the share, but remember that this will commit us, so we'll be a constraint for us, in the medium long term. The shareholders are expecting that you maintain the new level of dividends and you don't change your mind in the next year. Talking about the choice of decreasing dividends. The fact will be the opposite, so the price of the share will be revise downwards because this will be a scenario in which the shareholders will be worried that you are defining a new policy with lower dividends in the medium long term. And the normally the impact on the price will be a reduction, that is even higher than the reduction of the dividend, because the shareholders will be disappointed about these unexpected reduction of the income produced by the share. But think about, if instead of doing a dividend, we do a share purchase are we giving or not any information to the market? which type of information we are giving? So this is the advantatge of using dividend, especially if we can increase the dividends and so we can increase the price. Let's think about a share repurchase and let's evaluate if the share repurchase may avoid for us at this negative effect. What do you think about, if I we do a share repurchase? What is the impact on the market in terms of information? So, if I am a company that is not performing good. If I want to pay a dividend, I had to reduce the amount of dividends and so the price of the share will go down. Instead of doing a payment by dividends to think about a share repurchase and do the payment to my Chapter 10 pp. 443-469 shareholders with the share repurchase? What could be the advantage or what could be the loss if I decide to do so? Hmm almost so if we think about the share purchase, and we compare the share purchase with the dividend payment, the point of view of the market is quite easy. If the company is deciding to use one solution with respect to another, there has to be a convenience for the shareholders (for the investors) or a convenience for the company. For the convenience for the shareholders, we have already discussed about taxation and so on. But for the convenience of the company, what does it matter? If I do a share repurchase, when is more convinient for me as a company to do it instead of doing a dividend payment? Essentially, I will try to do a share repurchase when I think that the share of the company is under valuate by the market. So is underpriced by the market. If on the opposite, the share is overpriced highest company, I will prefer to do dividend payment instead of paying more than the current market price that is already overestimated, for buying the shares from my shareholders. We have to try to identify what could be the impact of this choice of investing in my company, by buying my shirts showing that that the companies underestimated underpriced by the market. If this is the scenario, so if I do the share repurchase and the market is perceiving that is more convenient for the company (because the price is underestimated), what you will have is that instead of having a decrease of the shares, you will have an increase in the price of the shares. So if I cannot increase the dividend or if I cannot maintain a stable dividend, probably the share repurchase may be a good solution (because instead of suffering over reduction in the price, I may expect even an increase in the price, by showing for me as company, the share of the company is underpriced). And if the market trusts me, I can experience a growth in the price of the share, even in the scenario of the reduction of dividends. 5. Conclusion There are three schools of thought on dividend policy. The first is that dividends are neutral and neither increase nor decrease value and is assuming a simplified market scenario. The second view is that dividends destroy value for stockholders because they are taxed at much higher rates than capital gains especially for institutional investors. The third school of thought makes the argument that dividends can be value increasing, at least for some firms and some shareholders. Chapter 12 pp. 515-519 Lesson 15 – FIRM VALUATION METHODOLOGIES 1. Introduction Once we now know about investment, financing, and dividend decisions, it will be possible to estimate the firm’s value by using one of the following approaches: - Intrinsic valuation Relative valuation Special cases and contingent claim This would be the structure of the next 4 lectures: - One will be focused on intrinsic evaluation, so discounted cash flow analysis. After we talk about relative valuation, how to use it and when it's worth it to use it and Finally, we will talk about some special cases for valuation and contingent claim valuation, so we will analyze the special type of companies for which their approaches to be customized on the basis of the specific characteristics of the company. 2. FCFE methodologies Company evaluation could be done by applying a simple discount formula on the FCFE. When we talk about free cash flow with equity approach we consider the cash flows that are available for for the equity order holders and we actualize them in order to identify the proper price that we want to pay for buying the shares. So the target will be to set this target price -the maximum price that we want to pay- on the basis of the actual value cash flows for the equity orders. For the discount factor we have already discussed about it. We are using our ardor rate: so the risk free plus the beta multiplied for the risk premium, with the same format that we were discussing since the first week of the course. For the cashflows, what we have to use here on the top, we have to consider the different data that we can collect starting from the balance sheet and the accounting data available for each company. Normally in order to compute the free cash flow to the equity holders what we have to do is to start from a measure of performance that is the EBiT. Net to the taxation applied on the EBIT Chapter 12 pp. 515-519 produced, so is the earnings before interest and tax is a multiplied for one minus marginal tax rate applied to the company. This is telling us how much is created as value, in the year, that theoretically may represent a cash flow. Theoretically because some of the items are considering the EBIT are not real outflows or really inflows and so we have to adjust the EBIT in order to have something that is representing for us the cash flow to the equity holders. Depreciation + Amortization When we talk about the adjustments that are necessary for the analysis of the free cash flow to the equity holders, what matters for us is to avoid the considering any depreciation or amortization that could be done during the time period. So, for the EBIT, we have already completed the EBIT by deducting the depreciation and the amortization. In order to have a measure that is not considering these not monetary outflows, what we have to do is to add the gain, the depreciation and the amortization. Remember here in the EBIT, when we are computing the EBIT, this is a revenues minus cost and, among the cost, you have already depreciation and amortization. So you have deducted a cost that are not a monetary cost and so you had to sum them back (here in the formula). NCWC – Non-Cash Working Capital What else is important is: what you can do with the money produced by the company in terms of investment in the short term (NCWC) and in the medium-long term (capital expenditures). So here, at the NCWC flow, what we are computing is the rate of change on the annual basis of the investment in networking capital. What is the ne tworking capital? Current assets minus current liabilities and we have said that the companies run with a positive networking capital (on the asset side). And then, we have to deduct everything that we are spending more for increasing the networking capital. So if we register an increase of the networking capital, it means that we are using some of the resources for increasing the net working capital, so the cash flow available for the equity holders will be lower. Capital Expenditures The same has to be done, by considering not the short term investment in the networking capital, but the long term investment in assets. So every capital expenditure that you can have in the period that may represent for you, an additional investment in fixed assets. So if you use the money for buying a new facilities, new warehouses or whatever you want, this is an amount of money that is no longer available for the shareholders because we are using it for increasing the size and the assets owned by our company. NewDebt - DebtRefund Finally, here, you have something related to the depth policy. What is it? this is the change in the debt. If the debt is increasing or not. When you have a change in the liability, we are talking about a source of money and if we have a new debt it means that we have more cash available for the company. So every time you have an increase in the new depth, It means that you have more cash that theoretically you can use also for the equity holders. Chapter 12 pp. 515-519 If on the opposite, you do debt refounding or you pay interest related to debt, so every everything that you can consider and expenditure related to debt, has to be deducted from the cash flows that you are computing. By applying this formula, you will have at the end of the free cash flow to the equity holders. These approaches not that the so-called the dividend discount mode,l because here remember that, we are talking about the free cash flow to the equity holders. This meas that the cash flow are paid to the shareholders because you can retain some of the free cash flow to the equity holders for self financing. If you want to do the same approach the same formula back considering the evidence so by applying the dividend discount mode,l what you have to do is only two change. A special case of FCFE methodology is the Dividend Discount Model (DDM): Over there, the inflows that you consider on the top of the formula. Instead of having free cash flow to the equity holders, you have free cash flow to the equity orders multiplied for one minus retention rate. Saying differently, you will have a dividend payment. So, for obtaining D_t formula you have to compute EBIT multiply for one minus tax rate ,minus the interest payment, minus so much you want to retain in the company. The formulas are quite are quite the same. You are using even the same discount rate, but remember that the value that you can define by using these approach may be different with respect to the value that we can define by using the free cash flow to the equity form. - The formula is the same, what is changing is only what we have all here on the top (FCFE vs. Dt). When you would prefer one solution when you will prefer another solution? And why? (Now, we are comparing the two formulas) One aspect to consider is that it's more time consuming applying the FCFE, because the dividends, normally, you have already underestimate about them. You have already a forecast about the dividend for each. But, there is something else. Is that something relative for example to the time horizon, that may matter for selective free cash flow for equity holders versus dividend payments in the formula of the value of the equity? When we talk about free cash flow to equity holders, we are considering how much we use for paying a dividend and how much we use for sustaining the growth of the company (by using internal source of money). What does it mean? if I'm using the free cash flow to the equity holders, even on a short time horizon, I have a full picture (a detailed picture) about what is done by the company. Chapter 12 pp. 515-519 If I focus on the dividends and I analyze only a couple of years or five years, what I can miss in my analysis is the growth opportunities, how much they will impact on the future dividends. So if you're analysis is on the short term horizon, you have always to prefer the free cash flow to the equity holders, because you consider the dividend but also much I'm already investing in the growth of the company. If you are analyzing 10, 20 or 30 the approach of the dividend will be easier faster and so probably better and there would be even complete for evaluationg the company, because how much you are retining now, in 10 years will be disclose algo by the dividend payments. Shorter time horizon, you go for the free cash flow to equity holders, and with a longer time horizon you go for the divident discount model. The choice between the standard FCFE and the DDM model is related to: - Possibility to estimate the FCFE for the company under valuation (i.a. financial service companies) Leverage policy is expected to change over time and the estimation of the FCFE becomes cumbersome. Normally the estimate with the FCFE is more realistic while the analysis based on the DDM may represent an underestimation of the company value because most companies pay less dividend than they can afford to. When we talk about this approach there is also an additional aspect that may matter related to the possibility to compute the free cash flow o equity and the possibility that there is something related to the leverage policy that may matter. Let's start for the first scenario: possibility to estimate the FCFE. FCFE scenario When we talk about the possibility to estimate the free cash flow to the equity holders, we may have some sectors for which the equity holders have cash flows that are not easy to be estimated because a lot of them are appraised values. - Appraised values means that there is an expert that is doing an evaluation because you don't have a market Benchmark. Every time you don't have amarket benchmark and so you cannot assign objectively a value to the assets or a value to the liabilities, the free cash flow to equity will be not so easy to be computed. So how much we are increasing the networking capital, the capital expanded or the value of debt, if we don't have a market value is not so easy to be computed. Because remember, you had to considered differently what is an investment and what is an evaluation. If you don't have a benchmark that is telling you what is the real value or the more reasonable values, is not so easy for you to have differences between these items. Leverage policy When you change your leverage polic what will happen is that the main effect will be more relevant for the free cash flow to equity with respect to what you will have on the on the dividend payment Chapter 12 pp. 515-519 So every time you are planning to revise your leverage policy, normally is easier and probably is also more correct to focus your attention on the dividend payment instead of trying to compute the the free cash flow to the equity holders by making assumption, now and for the next year, about your new leverage. So if we are in one of the scenario that we discussed the last week about how to identify target leverage and adjust to the target leverage, we have to go for the dividend model for evaluating the equity and we have to avoid using the free cash flow equity (because the assumptions that we have to do are so many and probably there is no clear usefulness using this approach instead of the dividend payment). If I want to use the free cash flow for equity holders I have to estimate the new interest, but also the new debt how it will change over time and so the subjectivity of the analysis would be higher so it's better to avoid it. SUMMARY - So remember first of all you have a criterion based on the time horizon. Only for the long term, you can use the dividend discount model. If you have a problems in the evaluating the assets, because they are appraisal value or the liabilitie,s if you have a change in the leverage structure, you will go to the dividend model instead of using the free cash flow to the equity holders.+ The choice of the FCFE or Dividend for the time period 1-n is based on the estimation of the expected growth rate in operating earnings: When we try to compute the free cash flow to the equity holders and the dividend, what else matters is to consider in our analysis that goes from one to n, because it's the sum from one to n of the dividends or one to n to the free cash flow to the equity holders. We have to identify the growth rate for the free cash flow to equity and the growth rate for the dividend payments. So we have to make a forecast for the next 10 years, ee are to identify an information that allows us to measure what will be the growth rate year by year of the dividend payments or the free cash flow. Chapter 12 pp. 515-519 How it works? Normally you link these amount, so the FCFE holders growth or the dividend growth to the net income or the earnings growth rate. So normally you start from the balancesheet data, you compute the net income or the earnings growth and you apply it to the dividend growth or to the free cash flow to the equity growth What are the cashflows after debt payments from existing assets? What is important is that when are you start from these item you have also to consider what are the cash flows after that payments from existing assets. So you have to understand how much of this growth could be reduced due to the fact that we are using debt and so, we have debt payments obligation for our company. The higher is the leverage -so the higher is the amount of debt that you have- the lower has to be the impact of these net income or earning growth on the growth rate of your dividends or on the growth rate of your free cash flow to the equity holders. You will not use the 100% of these amount, but you will use a percentage of that is lower on the basis of how much we're using as debt. The more you use debt, the more you have fixed cost that are assumed by the company due to the financial structure. This fixed cost will reduce, if the market is not performing well, your growth perspective because the first one that will lose the money are the shareholders. So, for both the dividends in the free cash flow to equity if you have a company that is using a lot of leverage, you cannot assume that the dividends and the free cash flow to equity will grow as the net income or as the earnings. In order to make a forecast that is reasonable or that can be verified in the future, you will use not the 100% but the 50 the 40% of this growth rate (on the basis of how much you're using as leverage). What is the value added by growth assets on equity earings / cashflows? What else is important is try to consider what is the value added by growth and equity earnings of cash flow assets. What does it mean growth asset? The assets that are expected to create a money in the future by increasing their own value. So the market is appreciating this type of asset, so in a couple of years, the value of assets will grow up. So when we talk about this type of growth asset we're talking about assets for which the market is expected to increase the avaluation over time. When we talk about cash flow asset that we're talking about assets that are producing cash flows, so assets for which every or every month we have an income -related to rent payments related to whatever you want- so every every year or every month we have a cash flow from them. If we have a lot of growth assets, so assets that will create value by growing their evolution in the market, instead of having assets that have value due to some income produced, cash flows produced every month or year, which one is better for the growth opportunities? So we have an asset for example, we have a warehouse that is empty. But the area in which they warehouse is based, there is appreciating over time. So we can expect that the warehouse will double its value in a couple of years. On the opposite we have a warehouse that is rented, that is an in an area that is not characterized by a group in the value, but I have an income Chapter 12 pp. 515-519 produced by the asset related to the rent. Which one is better for supporting the growth of the company? Which type of project is riskier? The warehouse that is empty and is expected to be sold at a premium or the warehouse that is rented and is producing an income even if the value is not increasing over time, which one is riskier? The first on is the risk, the one that is empty ,is the one for which the shareholder will expect a growth rate on the income because they are assuming a higher risk. So what we have to think about is that the more we have growth assets, the higher has to be de divident growth in order to be sure that the shareholder will remain with the company. If we don't do so, probably the shareholder will sell the share and we'll go for another company, which safer assets. If you want the shareholder assume higher risk, you have to reward them by paying a higher dividend or a higher free cash flow to the equity holders. So normally, the higher is the risk of the asset that you are owning, the higher has to be the percentage of these net income and earnings, that you use for estimating your growth rate -the growth rate of the dividends and the growth rate of the free cash flow to the equity holders-. How risky are the cash flows from both existing assets and growth assets for the company shareholderes? In other words, how much is risky your business? The more the businesses are riskier, the higher has to be the reward given to the shareholders. So independently to the fact that is driven by existing or growth asset or income producing assets, if your core business is a riskier you have to reward more your shareholders. When will the firm become a mature firm, and what are the potential roadblocks? Roadblocks means: what are the means step necessary for reaching this target. I have to start selling goods also abroad, so I to become an international company, i have to invest in a new era in the expenditure and so on. The more you are near to the maturity stage, the higher to be the growth rate of your dividend of free cash flow to equity holders, what you think about? If we are one year away from the maturity stage, so we are almost arrived, we expect to give up a higher growth rather than in the past or a lower or the same? When we move from the let's say introduction of development stage into the majority on the basis, we say that the dividend payment until the maturity stage is almost zero. So you can expect that when you arrive to the maturity stage, you will have a huge growth in the dividend payment, the same for the free cash flow to the equity holders. So when we are near to the maturity stage, we have to start planning at the growth of the dividends because this is the expectation from the investor point of view- from the shareholder point of view-. So, they know that during the first stage of the life of the company, you are not able to pay, once you are near to the maturity stage you have to plan a growth in this payments in order to satisfy the needs of your investors. And, if we have a lot of roadblocks in front of us, -so in order to reach the maturity we are not one year away but we need to do an internationalization strategy, we need to do a new investment and so on, we are not near to the maturity stage- in this case, with the growth Chapter 12 pp. 515-519 rates (equity or dividents) we have to still keeping the law(?) until you solve some of the problems that may happen with the roadblocks. I can be able to open the branch and go easily to the maturity stage or I can find that there are some problems in developing the new branch abroad, or some problems in starting a newer the project and so on. So the more you don't know when the maturity stage will start -because there is a lot of uncertainty about it- the lower has to be the dividend payment and the FCFE. So you have not to apply the net income or the earnings growth rate, as they are to the dividend or to the free cash flow to equity. Only a small percentage or even zero could be the growth rate of your FCFE or dividend payment. 3. FCFF methodologies Company evaluation could be done by applying a simple discount formula on the FCFE Let's try to analyze what happens if instead of analyzing the point of view of the equity holders, we want to analyze the point of view of every stakeholder of the company. So our evolution now will be based on the free cash flow to the firm, and not the free cash flow to the equity holders. The formula is almost like the one that we described before. What is changing is what we have on the top, because what we have on the top now is the free cash flow to firm and not the free cash flow to the equity holders. What is changing when we talk about the free cash flow to the firm instead of free cash flow to the equity holders is that here you don't have the items related to debt. Now there are no longer in the formula, so you compute the free cash flow to the firm by considering the EBIT net to taxes, so we consider the EBIT(1-Tax rate); you consider the impact of not cash items (depreciation and amortization) and you consider the investment done in fixed assents or the investment done in net working capital What else what else is changing is that the discount rate has to be consistent with the type of cash flow that we have on the top. Now we are no longer considering the point of view of the shareholders, now we are considering every stakeholder of the company. So our discount factor will be no longer the ardor rate, but will be the weightet average cost of capital (WACC). Chapter 12 pp. 515-519 So the cost of the financial resource is used by the company that could be equity, could be debt, or could be hybrid securities. He's always a weighted average in which we consider the role of equity on overall resource, the role of debt on overall resources, the role of hybrid security is on overall resources. Remember, what we have said when we were talking about the WAAC, all these values are market value of debt, equity and hybrid securities. They are not accounting value, they has to be market value or estimate of the market value of these items. What we think about this formula, we cannot so think about how this formula may be revised or maybe change it a little bit, in order to analyze 1 by 1, the contribution of equity, debt, hybrid securities to the overall performance. so this formula can be changed into this over there. FCFE and FCFF have to provide consistent results Instead of writing the FCFF is equal to the value of the firm, we can split the value of the company in to the value of the equity, the value of the debt and the value of the hybrid securities. We have the value of the equity that is the formula that we described before, the FCFE methodology. The value of the debt will be the free cash flow to debt holders, actualized for the cost of debt. The value for the hybrid securities holders is the FCFE to the hybrid securities holders, actualized for the return of the hybrid securities. These formulas are the one that you can see over there are exactly the same approach that we have discussed before about the free cash flow to equity holders, but now from the point of view of the debt holders; how much they obtain if they are one of the lenders of the company; or the cash flow for the hybrid securities holders if you own an hybrid security, how much you will obtain from the company year by year. The time horizon here is always the same, so nothing is changing. What is changing is the discount factor. This is the return for the equity holders, is the return of the debt holders and the return of the hybrid securties holders. Chapter 12 pp. 515-519 What do you think about, what is the avantage of splitting the value of the company into all these items?What we can learn from it when it would be useful? We may disclose this information in the market for doing what? If let's say that the main source of capital, so the main source of value for the company is coming from the equity, what you are telling to the market is that the performance of the company will be used prevently for paying the shareholders and the shareholders may decide how to use this money (because they are main source of money for the company) So what you are telling to the market is that if this is the main driver of the value of the company, investor can perceive your company as a safer strategy because they will be more protected with respect to anyone else. If on the opposite, you say that everything is coming or almost everything is coming from debt, what you are saying is that the company is using a lot of leverage, probably the companies worth it because someone is giving money to them, so he's offering a new loan and so on, but the company is a company that is characterized by huge fixed cost, at least related to the cost of debt. So this type of company is a company that in a downturn market scenario, so when the market will revise the demand and will reduce the demand for the goods.,it's significantly exposed to a risk default. So if you want to invest in my company take care about it because if something goes wrong with the market, I don't know if my debt would be still sustainable over time. If we have that the main source of capital,One of the main source of capital, is coming from hybrid securities, this means that the company in the future is exposed that were changing the governance if the hybrid securities by using the warrant. Essentially when we have this amount quite higher, we have to be worried about the governance of the company and the risk of takeover, because we don't know how these type of securities will be in the future (if they will remain like they are now or if they will become only equity securities or only debt securities) and this will change the control and so the governance of our company. The estimation of the FCFF for the time period 1-n is based on the forecast of the expected growth rate in operating earnings: Chapter 12 pp. 515-519 When we talk about the estimation of free cash flow to firm, what we have to do is to start again from operating earnings and growth rate. Why we are talking about operating earnings over there. What do you think about? Before I was talking about net income or earnings, so everything that is produced by the company net income and earnings that are produced by the company, the growth rate of this earnings Here we're talking about operating earnings growth rate? What I think about why we are focusing on the earnings or the core business instead of analyzing everything? When we talk about the core business and we measure the performance of the core business what we can expect in the future? If you consider the overall income and you compare it with the income related to the core business what you can expect for the future? What could be the difference from the operating income and the overall income of the company. What are the drivers of the difference between them? When we can have a gap between the overall income and the operating income so the income of the core business. So you can have a financial investments that are not the business of the company, so you do an investment because you have an excess of cash. You can have assets that are no longer necessary for the production process and so you can sell them and obtain revenue from selling them, or you can have something that is related to the debt policy that you change and so the cash flows available will change accordingly. So, everything that is out of the core business with respect to the core business is normally not so easy to be forecasted in the future. The forecast for your core business performance is significantly easier for you with respect to what you can do if you look at the overall performance of the company. Because you don't know if you will sell the securities, you don't know at which price you will sell the building that you don't need and so on. By focusing on the operating earnings I can have a better estimate and a more reasonable estimate of the future value of these items. What are the cashflows before debt payment from existing assets? Chapter 12 pp. 515-519 What that said to consider is once a year the operating earnings, Wwhat is the impact of debt payments yhat I have already planned for my company. So for the assets that I have already bought some of them are bought through that or with a percentage of debt, what are the obligation for the company related to this debt What are the value added by growth assets on operating earnings cash flows? Well, here is important is to consider again growth assets and operating earning cash flows. So again, what is the role of this type of assets because this type of assets will tell you again the type of risk. And the type of risk matters because the higher is the risk, the higher has to be the reward for the stakeholders. Not in the same way for every stakeholder, but almost in the same way. How risky are the cash flows from both existing assets and growth assets for the company stakegholders? Existing assets, different type of assets, on the visual your core business. So on the visual where you are obeying which is the risk that you assuming. And finally, when will the firm become a mature firm, and what are the potential roadblocks? Finally, these items, so we'll have an impact on the free cash flow to firm like the one that we have described for the FCFE holders. That's for the same analysis that we have done on the FCFE, that's to be done for considering the impact of these items on the free cash flow. - So the higher is the leverage, the higher will be the fixed cost that you have in the company, so the higher is the risk and the growth rate that you have to give. The higher is the role of growth assets, the higher is the risk of the company, so the higher has to be this growth rate. The risky is your business, the higher has to be this growth rate The more you are fare away from the maturity stage, the less you has to be worried about the payments, even the payments for every security holder -so, every stakeholder- (we can pospone to do the choice not now). 4. Principles for a good valuation The choice between FCFE and FCFF models depends on: - Aim of the analysis Quality of the data available Expected change in the financial policy of the company Analyst experience There is not a unique approach that has to be preferred to the other even if FCFF models are more frequently used in the industry. Chapter 12 pp. 515-519 So the last part of the lecture of oday is to try to understand what are the problems every time you try to run an analysis, based on free cash flow to equity holder so free cash flow to firm. So what is important is try to identify what is the solution more reasonable for us between free cash flow to equity holders and free cash flow to firm and after what are the problems in collecting and analyzing the data that are necessary for both of them. So let's start from how to select the free cash equity versus free cash flow to firm. First of all, you have to identify what is the aim of your analysis. The aim of your analysis could be what? To disclose between the value of the company and so your approach is the free cash flow to firm or could be to provide a point of view, only for one of the investors normally, the shareholder, that has to spend money for buying your shares. Remember that every time you get listed in a stock market, you have to provide, at least every quarter, an estimate of data that is necessary for identifying the free cash flow to equity for your investors. So the more you collect the money from the market, so the more this approach may matter for you. The less you collect the money from the market, the more you will go for free cash flow to firm approach, because not always you have to take care only all the shareholders, you have to take care of at the same level with the same attention to the shareholders, the debt holders and the hybrid security holders. What that is important is the quality of data available. For which approach the quality of the data is normally higher. The free cash flow to equity or the free cash flow to firm? Why? When we talk about the free cash flow to firm, what is the problem? the problem is that we don't have a real benchmark that allow us to understand if the value or if the forecast that we are doing is the reasonable or not. So we cannot have for the debt or the hybrid securities a value in the market that is telling us if the actual value estimated is correct or not. What we talk about the equity, and we're talking about a company that is listed, this benchmark is always available because what we are doing with our formula (so the value of the equity [V(E)] is to compute that has to be consistent to the current price in the stock market). The more we are far away from these benchmark the more we are exposed to our risk of making mistakes in our forecast. So every time we have a security that is listed like there equity it's easier for us to have a benchmark and check the quality of the data. Every time we have a seguirty that it is not listed for example, the debt that is offered by a financial institution, in this scenario, we will never have a benchmark that is telling us if I would estimate is correct or not. So the quality of the data is driven by the type of the security and the possibility to have the security listed in a market. I'm not telling you that the value of the market is always correct, what I'm telling you is that the way the market is a proper benchmark for checking ,for verifying your assumption. Chapter 12 pp. 515-519 The more you are far away from the price applied in the market, the more you have to be worried about the assumption that we are doing . You can be right or you can be wrong, but you are exposed to a risk of doing a huge mistakes. And so probably you have to be more careful in applying these approach, in using these evaluation approach. What that is important is that to consider if the company is planning or not are changing the financial strategy. Every time we have a company that is planning to revise the strategy, what is the best for us is to go for the free cash flow to equity holder solution or even better, to go for the dividend discount model. So every time we have this issue, because we are changing the leverage, we don't know exactly the speed of adjustment, we don't know exactly what would be the final leverage, is better to avoid all these assumption in evaluating our company and focus only on the items that we can easily compute the dividend payments. So we will go for free cash flow to equity solutions or more in detail to dividend discount model solution in this framework. Finally, you have to consider the analyst experience? What does it mean the analyst experience? When we talk about free cash flow to firm solution you have to assign a value to the debt, a value to the equity a value to the hybrid securities. You can be able as analyst to do so, because you have already an experience about how to compute free cash flow to the equity holders, free cash flow to the debt holders and free cash flow to the hybrid securities holders or you may not. If you have no experience in computing the value of a hybrid security or the value of the debt is better to go for the free cash flow to equity evaluation. If you have already an experience about how to measure the value of the debt or how to measure the value of hybrid security you can trust more your evaluation and so you can go for a free cash flow to firm approach. A good valuation has to be constructed by considering jointly two different point of views: Chapter 12 pp. 515-519 What we talk about free cash flow to equity o free cash flow to firm, for both of them normally we have a problem in constructing our analysis. Remember, we are doing a forecaster for the time one to “n” of the free cash flow to equity holders or the free cash flow to the firm. For doing these analysis, you were to do some assumption. Now you have two oposite scenario with two different ways, totally different ways for doing an analysis or an evaluation of a company of our share. One is called the numeric approach and the other one is called the narrative approach. Numerical approach All the data that I'm using for the analysis have to come from balance sheet, statistical measure, or market pricing. Nothing else is allowed in doing my analysis. So I would take all the objective benchmark coming from the balance sheet, coming from a statistical approach, coming for market data or pricing data and I will apply them as they are for my evaluation. These approach as a problem, a huge problem: - The data may be wrong. So they are not always precise, sometimes are wrong . And these most relevant when we talk about the market data. The market data is significantly volatile and if I do an evaluation now with respect to five days ago, probably the data may be changed. And my analysis may be a different it may bring me to a different value of the company or a different value the equity .So due to the fact that data may be wrong trust the data, especially the market data as they are maybe a mistake. - The data has bias What that is important is that the data may have bias and what are the data that has bias? For example, in the balance sheet that you have a lot of accounting data for estimating the value of the assets a long term once, estimating the value of the liabilities long term ones and there's some show made by the accountant may be wrong. May be non not consistent with the reality and this may matter for your evaluation. - Statistical data Finally, if we use only statistical measures, so we apply the the formula to the data as they are. What is the role of the analyst? Why someone has to be paid for doing this job is enough to have an excel file with a formula already in that I will apply for every company. What is important is that the analyst needs to have on the basis of its own experience the capability to read the data and identify when they are precise and when they are not, when there is a bias and when there is not. So,you cannot apply only statistical measures, otherwise essentially the analyst is no longer necessary. A good excel file will replace the analyst. Narrative approach On the opposite we have those that are doing the analysis by using a so-called narrative approach. What is this narrative approach? Is an approach in which the analyst has the full controller about the estimation. What does it mean as the full control? Starts from the experience, So it's own experience on evaluating a company or evaluating a share, Is based the normally on events that happen in the past t-hat are considered a benchmark also for the Chapter 12 pp. 515-519 future, so we have some events, so some let's say companies that for us are big example for constructing what will happen to our company And finally we have also the assumption that the market is not efficient and so there are a lot of behavioral issue in estimating the value of the company. This type is called the narrative approach, essentially by doing the approach every estimator may be justified. You change only the assumption,you change your benchmark, but at the end every number can be justified. The problem is that the creativity could be not control or not under controller, so essentially you cannot have an idea about how much is driven by an idea of the analyst and how much is driven by something that could be the reality. If you follow the strategy, so if you follow the narrative approach frequently, the investment is not working because the assumption done are totally wrong at the end. And what you are thinking is that the only video your experience you can always beat the market and this is never true. You can be able to beat the market a couple of times 10, 20 times, but later you will be unsuccessful and you will fail. These are the two approaches that you have. In reality, what you have to do is try to mix out, the numericalapproach with some aspects of the narrative approach. So the best evaluation is the one that is almost in the middle, in which you use numeric approach adjusted for some narrative approach or narrative approach items. The weight to be assigned to numeric data with respect to narrative ideas depends mainly on: - Innovation Competition Historical data What matters in order to identify how much is relevant to the narrative approach and how much has to be relevant the numeric approach, is related to the degree of innovation of the company or of the market, the competition in the market and the quality of the historical data. Innovation The more you are innovating, so the more you are able to change the product or the service offered the frequently during the life of the company, the less you can trust the historical data. Saying differently, the more you are innovating, the more you have to follow the narrative approach (instead of using the numeric one) Because data that you can use are by definition, not updated. And so there are no longer useful for evaluating your company. If we have a market that is significant exposed to competition, what you think about which type of approach may be better for us? The market is characterized by an eye level of competition.if the market is competitive is harder to increase the market competition. And it’s not easy to change the approach and try to modifying the type of product or the type of service. If there are a lot of competition and there are a lot of condition that justify that historical data will remain the same (even in the medium long term). So if the data will remain the same even in the medium-long term you can trust more a numerical approach instead of using a narrativeapproach so the weight that you are to Chapter 12 pp. 515-519 assign to the numeric approach it's significantly higher than the way that you it was sign to the narrative one. Historical data These entirely to the company and salty related to the events that affect or characterized the life of the company. For example, you can have a startup company. They're starting to work only a couple of years ago. And if you have such type of company, what do you think about you can trust the data? For a start up. No If you look at the balance sheet of a Startup, you will never finance. It so if you don't have another dive approach, probably no one will invest money . Talking about the accompany that is already in the maturity stage, what that's the main matter for us? What that's may matter for us is from when the company get listed, because the historical data rate to a balance sheet are available since the beginning, since you start operating in the market, because by law, you have to publish a balance sheet with a different detail but you have to publish a balance sheet. When you get the list, you will have also the market benchmark for your company. The more you have historical data on market performance, the more you can trust that the historical approach. The less you have this data because, for example, is the first time that you get list as an IPO (initial public offering), the more you have to add the some narrative features in order to justify your evolution of the company and the performance for the shareholders. Talking about the history, what else matters is: if the company has experienced or not any M&A activity, any extraordinary event like a M&A, spinoff whatever you want. When we talk about M&A or spin off? What is the effect on the data? What is a M&A? So you create one company by mixing 2 company together (marger), or one companies buying another company (acquisition) and is including all the asset, and all the employees in the previous company. When we talk about the spinoff, we have a company that is divided into two different companies. Normally with different specialization, with different market and so on. If one of these events is affected the company? What happened to the data? So if you have done last year a merger, last year acquisition, last year you have made a spinoff you don't have data for your company. Because what you have before the event was not comparable at all with what you have after the event. But every time you have such type of scenario, you go for the narrative approach because it's the only way for doing the analysis. You cannot do analysis on on the visual historical data over different company because you had such type of event. OK, so now I want to show you a special case, we are talking about the IQ of Facebook 2012 me 13th 2012. Chapter 12 pp. 515-519 They were not all talking about the assets on the by the company because Facebook has almost a 0 assets only few buildings for offices, but that's it. They were not talking about competitors because they were saying, and writing several times that they were the only one in the market, so they were promoting them as a leader without competition. They were not describing a the market diversification only because the business of Facebook is quite strange. It's true that Facebook has several line of business. But the the different line of business with respect to the web portal are not developed by Facebook are acquired by Facebook from outside. For example, WhatsApp that is owned by Meta. So is owned by Facebook was not developed by Facebook was bought by Facebook. So five or six years ago, I don't remember from a startup company that was developing. This type of product so they don't have a market diversification because when they diversify they acquire the new product from external sources. The revenues from advertising that they were described as one of the most important items as revenues for them and they were also providing some forecast about this growth already news. What was not described at the time was the technology innovation. Nowadays you know that Facebook investing in technology innovation because they want to develop the metabase. At the time, 2011 was not an issue because they were thinking about only updating the system. Without improving too muc this type of system. Now they're changing this strategy, so Chapter 12 pp. 515-519 nowadays could be an item that you can use but at that time, 2011. It was not a key issue or relevant source of income expected income for the player so essentially the focus will be on social networking usage and the revenue from advertising. 5. Conclusion Company valuation could be focused on the shareholder cash flows and the final value of the company can be computed by considering FCFEs or dividends. Company value could be measured by considering all the stakeholders and the FCFF related to asset in place and growth opportunities. The choice of the approach could be done by the analyst and both the solutions have to bring to similar results even if there could be misallingments because the evaluation is never fully objective. LESSON 16 - REAL DATA ANALYSIS AND VALUATION PRINCIPLES 1. Introduction Once we now know about investment, financing, and dividend decisions, it will be possible to estimate the firm’s value by using one of the following approaches: ● ● ● Intrinsic valuation Relative valuation Special cases and contingent claim Alternative formulas that could be used are the following: We will focus only on two items that matters for the formula: How the cash flows that could be dividend, free cash flow to equity holders… doesn’t matter how the cash flows will change over time so how to estimate the growth rate. The second issue that we will consider is how to set a value for the last cash flow and that is necessary for our analysis, so the two items that we will discuss today are only the growth rate and the terminal value. The terminal value is the value of the last cash flow time and (no hi ha manera que entengui que cony diu aqui) in this sum of cash flows. 2. Growth Rate Company growth rate is affected by size, current profitability margin, and competitive advantage. Let's focus first of all on the growth rate and let's try to understand what are the alternatives that we have in front of us and how to select among them? What we talk about the growth rate essentially we have 3 approaches that may be used for computing the growth rate. The first one, is based on historical data 🡪 compute the growth rate by analyzing this historical data, the past performance of our company. Analyst forecast 🡪 so the forecast made by specialized investors that are providing information to the market. Finally we can try to the deduct the growth rate by analyzing some of the information available in the balance sheet or information available in the income statement so try to analyze that this growth rate starting from the fundamental value. Fundamental means based on balance sheet or documents produced by the company. - Historical data Analysts that want to use historical data for analysing the growth perspectives of the company has to make the following choices: When we talk about the historical growth rate what we are saying, is essentially that by looking at the past, we can have a forecast about the performance of the company in the future. In this case what we are focusing at is not the performance of the company, but the growth in the cash flow for the company. So our assumption is that the growth rate that we experienced in the past may be used also for forecasting the performance of our company, so we are assuming that the company is not changing over time and the growth rate on the historical data is a good proxy for the growth rate that we need for our analysis of the company. To compute the historical growth rate we compare the cash flow at time T minus the cash flow time T - 1 divided for the cash flow time T - 1. When you see cash flow in this formula, this could be the dividend if we are talking about the dividend discount model, could be the free cash flow to the equity holders, if we're talking about the free cash flow to equity holders model or it could be the free cash flow to the form (???) if we're talking about the free cash flow to the former methodology so all the items that you can see over there, so dividends, free cash flow to the equity holders or free cash flow to the firm may be used for computing our growth rate. As you can see the formula is quite easy, so the growth rate is this formula : What matters for us is to make some choices about how many historical data are necessary for our analysis. First of all we have to consider what is the length of our time horizon if we want to analyze only the last year, the last couple of years, the last 10 years… We have to identify what is our performance proxy but this is related to the type of analysis that we are doing, could be dividend, could be free cash flow to equity, could be free cash flow to firm (mai entenc que diu), and we have to identify which type of average we want to apply. So essentially these are growth rate estimated on annual basis. If we consider a Time Horizon that is longer than one year, we have to apply a (credit union???) for making an average among them. How can we select the length of the time horizon on the basis of what we selected? Normally, if we are analyzing historical data, the longer is the time horizon, the less you are exposed to a risk of leaving an outlier that is driving your growth rate. Normally the longer time horizon is the best option for you, but when you select the longer time horizon, that has to be longer than one year for sure, but could be 10 years 20 or 30 years in order to identify how many years you want to analyze you have to consider the characteristics of the company and if the characteristics of the company are changing over time (if for example, the company is changing his stage of the life cycle, probably you cannot look at that stage of the life cycle that is different than the current one) so if you move from the introduction stage to the group stage a couple of years ago you cannot look to more than two years ago for your analysis, because the company was more than two years ago in a different stage of the life cycle and so it's no longer comparable with the current growth rate or the current condition of the company. What else is important is that you have any extraordinary events, like merger, acquisition, spinoff… that may affect the type of company. You cannot analyze the company before the merger, before the acquisition or before the spinoff. So normally you go for the longer time horizon that you can find, but you have to take care about the characteristics of the company that has to be the same now with respect to the past. If in the past, there was an event that affected the company, probably you had to stop your analysis and avoid to consider the years that are not related to the same company or the same stage of the life of the company. The type of average essentially here you can have: weighted average (means that you apply a different weight to each of the years on the basis of your assumption) or arithmetic average (means that every year is the same weight) As you can imagine the most updated information, the more useful ones. So when are you are trying to do an average you almost never apply an arithmetic average, you always try to apply a weighted average in which the weight assigned that to the last information available has to be higher, while the historical data has to be lower. - Analyst forecast Growth forecast could be done by using analysts’ point of view but the evaluation has to consider: - There is far less private information and far more public information in most analyst forecast than is generally claimed. - The biggest source of private information for analysts remains the company (information bias and correlation). - Forecast cannot be trusted when there is too much consensus (lemmingitis) or too much disagreement (noise). We're talking about is the opportunity to use information providers in order to make an estimate of the growth rate. If you go to any database that is specialized on collecting financial data, you will have always for each of the company that is listed, a set of analyst forecast for the earnings, for the dividends, for the revenues…For every item that matters for the analyst point of view,. So essentially for our free cash flow to the firm, free cash flow to the equity or dividend payments, we have already someone that is providing us a forecast about the next three to five years. If the company is not listed and it's private, probably you don't have the same type of information, but for listed companies you have an information provider. Now, when you're using this type of information, what you have to think about is, first of all, is this information better than the one that I can construct by myself? If it's true, the analyzed information is working, if it's not true, then the information is not worthy because it's better to make your own estimate based on your own data. So essentially what we're saying is that we will trust that these information providers are only if we think that they have an information advantage. Otherwise, we can do by ourselves, and we don't need to use an external source of information that we are not controlling. If we want to have an idea, if they have or not private information, what we have to consider is the experience of the analyst and also the sides of the analyst, because normally the more you have experienced, the more you are able to collect information, and the bigger you are as company, the more you can invest money in accessing data and collecting data. So essentially the two main proxies are related to the size and the number of years for which this player is providing analyst forecast in the market. If the analyst is only the first year that is working and there's only two or three employees, probably the value of this analyst would be almost zero with respect to what you can do by yourself. Also you have to consider where the information comes from. The private information comes from the company. The better information is always available for them. The formation related to the problems, to the issue that is facing the company, they are not so available for them, so normally you will see that this type of analyst are better able to make a focus about a group scenario with respect to a scenario which there is a decrease in the value of the company, because for the growth scenario the company is providing them all the data and so they can measure what will be the impact for the company. For the crisis or for the reduction of the income scenario, normally, the company is not disclosing information even to them and so they can make a lot of mistakes in forecasting the decrease of revenues, the decrease of earnings, the decrease of dividends… When we are evaluating the analysts results is also something else that may matter for using the information provided by the analyst is not enough to have the information about 1 analyst and it's forecast about the growth or the decrease of revenues for the company. But it's necessary to have all the information about all the analyst that are looking at the company. By comparing the forecast made by different analyst, you can have an idea about the quality of the forecast done and how much you can trust it. Essentially you can have a two type of events that may matter for you. One is the scenario, which everyone is agreeing about the forecast, so there is a consensus from every analyst about the forecast of earnings, revenues... And the forecast is always the same forecast provided by everyone. These are called the lemmings effect. And in this case, the value added of the information provided is almost zero because if the first mover is making a mistake, everyone is making the same type of mistake, so every time you have a huge consensus among all the analyst you have to be worried about it because it's not a set of analysts that are providing an information, is only one leader that is trusted by everyone if the leader is making is made a mistake that's a problem because you will not understand immediately the type of problem. On the opposite what you can have is a scenery, which no one is giving you the same forecast. If no one is giving you the same forecast, so everyone has a different forecast for the earnings, for the revenues… in this scenario, this means that the set of information available for the analyst is incomplete and everyone is doing a different forecast because everyone is doing a different set of assumptions due to the lack of data available for analyzing the company. In this scenario, you have not to trust the analyst forecast because there is a huge risk of making mistakes if you follow one of these forecast. - Fundamentals The estimate on the basis of the fundamentals has to consider: The fundamental approach is an approach that is starting from balance sheet data and income statement data in order to identify what is the growth rate or the most reasonable growth rate. There are two type of growth rates that you can measure: The first one (gE) is when you have an equity side valuation, so the dividend discount model or the free cash flow to the equity holders. The other one (gF) is when you have a firm valuation and so you are analyzing the free cash flow to the firm. In the first case your growth rate has to be computed assuming the minimum growth rate that you can provide as a company for your shareholders. The minimum growth rate that you can provide them: how much you are retaining year by year (the retention rate) multiplied for how much you can offer as return to the to the equity holders. 🡪 retention rate multiplied for the return on equity (ROE). The retention rate is computed by considering 1 minus dividend per share divided for earnings per share. And the return on equity is coming from the net income divided for overall equity. If you want to make a forecast about the firm not the forecast about the equity, you have to consider the investment rate in the company multiplied for the return on capital. What is this reinvestment rate? is how much you use from the EBIT net to taxis for making investment in working capital or for making investment in fixed asset (capital expenditures). So, your investment rate will be the Capex plus the change in the networking capital if it's positive divided for EBIT multiplied for 1 minus tax rate (T). These are investment rate multiplied for the return on capital. This product will tell you what is the growth rate that you can offer to the stakeholders of your company. Remember all the stakeholders and not the shareholders because for the shareholders we have one formula (gE) that we can use. When we are using this approach the problem for us could be related to the proxy of return (return on equity, return on capital) and also could be related to the policy of the company (reinvestment rate, retention rate) Let's start from the retention rate or investment rate, every time you have a company that is changing its stage of the life cycle, the reinvestment rate and the retention rate will be totally different. So every time we have a company that is moving from introduction to growth stage from growth to maturity from maturity to decline, we cannot use the historical data for forecasting the growth rate. If we have a company that is always in the same stage of the life cycle, what matters for us is also the return on equity and the return on capital. For the return on equity: dividend divided for net income. The net income is quite objective, we have to take it from the balance sheet. The dividend is a choice made by the management, because the dividend is the amount of net income that you decide to distribute for the company. And how much you distribute as dividend is related to the dividend matrix. If you are suffering of a lack of cash, probably you will retain more if you have a project that is able to produce a positive income. When you are analyzing the retention rate you are applying the fundamental approach. Try to test if you are changing the area in the dividend matrix, because if you are changing the area in the dividend matrix moving from area 2 to area 4 or from Area 2 to area... The data about the retention rate and the ROE are not useful for you. It's not only related to the stage of the life cycle of the company, it's also related to the choice in the dividend matrix. If you consider that your company is changing the policy, is changing the area and the dividend matrix probably, this approach are no longer working for you. In all the other cases, you can still trust about them. Then you have a format that is linking the return on equity with the return on capital (rd). It’s important to understand the difference in the growth rate of the company with respect to the growth rate of the equity. The return for the equity holders is the return from the capital invested + a premium. This premium is coming from the return on the capital invested - the cost of debt. The premium is telling you how much you earn from an investment strategy with respect to the cost of borrowing money from a lender. As you can imagine normally this gap is positive, if I'm doing an investment I hope to obtain a return that is at least equal to the cost of the money used. Otherwise I'm destroying value for my company so this value here is always a positive value and it represent the premium that I obtain for assuming the risk in my company. I'm assuming the risk by using the money taken from someone else's. How much I’m earning more, it cannot be 0 and it cannot be negative otherwise, the companies are in trouble and probably is going out of business. The more you use leverage, the more you are exploiting this benefit related to the gap of return on capital - return on debt. The less you are using leverage, the less you are taking advantage from this gap. These formula was telling us how to compute the return on equity starting from the return on capital (ROE=ROC+D/E (ROC – rd). As you can see the main drivers that justify a difference in the group rate are the debt and the cost of debt. The more you use debt, the more you can take advantage from this opportunity. The less is expensive for your debt, the more you will have for each euro that is used an advantage from it, so saying differently, the growth of the form will be significantly higher than the growth of the equity every time we have a gap, we have a huge amount of debt used and we have a cost of debt that is not so high. You will have a huge difference in these two estimates every time the debt is quite high and every time the cost of debt is quite low. 🡺 When do we have to use the 3 approaches? The best solution for identifying properly the growth rate is to combine the difference source of data. - Historical data May be used only if on weighted average, not arithmetical one, in which the weight assigned to the most updated information has to be higher and the weight assigned to the more historical data has to be lower. - Analyst forecast Is normally used only as a benchmark a signpost about what could be a reasonable estimate, so you almost never use the analyst forecast for your analysis. What you will try to do is to use this analyst forecast in order to check if your estimato may be correct or wrong. - Fundamentals The fundamental approach is normally the main estimation criteria every time you can trust the fundamental data for your company. So essentianly, the main estimation criterion could be the first choice, the second one could be the one of historical data and the last one the analyst forecast one., which is only for checking 3. Terminal value The terminal value is necessary because there is gap between the time horizon for investor and company. We are trying to measure the final cash flow that we will apply to our formula for estimating the value of the equity, the value of the firm… What is important for us is understand that every valuation theoretically could be done with a different point of view and a different time horizon. For example here you have: Investor 1, investor 2 and investor h, each of them has a different time horizon, longer for the investor 1, shorter for the investor 2 and in the middle for the investor h. When we do our analysis, we have to be worried because this type of analysis, in which every investor can have its own time horizon, may bring us to a problem: we cannot identify objectively the value the company, because the value will change if I want to invest for two years, if I want to invest for five years… The time horizon of the company cannot be used because the time horizon on the company is essentially the time horizon for which the company will be in operation. If the company survived the introduction stage and so reach the maturity stage for how many years, the company will be working? We can expect more than 30 or 50 years. In formula, when you have a cash flow that is coming after 51 years, this cash flow is no longer relevant. For us, making an evaluation of 50 years or 55 or 56 is exactly the same, so when we talk about the life of the company, we are assuming a life that is almost near to the unlimited time horizon, because after 50 years, the value is almost the same. For assign the value to the last payment, to the last cash flow, we have three different approaches that may be used. Remember, these are formulas that we will use only for the cash flow at time n, everything else will be computed with the growth rate until time n. - Liquidation value The liquidation approach is used for all the businesses that are in the end of their economic life and the entrepreneur is not longer interested to run the business. The terminal values will be the actual value of the prices that you can obtain by selling the assets owned. The solution is mainly used for special primary sectors (mining, natural resources, etc…) or more generally for private companies that cannot be easily sold directly in the market for new entrepreneur. The liquidation value is what you expect from the company for the shareholder or for all the stakeholders once the company stopped working. So we are trying to identify what will be the remaining value of all the assets when the company will stop working. Problems of applying this approach: assign a estimated or to assign a value to each of the items under the hypothesis of a liquidation. When we talk about an appraisal value of an asset (valor de tasación), the estimate of the value of an asset, is normally done on the hypothesis of continuation of activity. So, I will assign a value to a building for a company that is now operating, assuming that the company is still operating. You have several approaches that allow you to reach this target and to assign a value to the asset under the assumption that the company is still working. Every time we remove this assumption, the value of the asset for the company will be no longer a market value, but will be only a residual value that we have to estimate. 🡺 Example. If you want to sell a building owned by the company when the company is in bankruptcy. What is the mechanism that you have to use? An option is a foreclosure auction (subasta de ejecución hipotecaria), in which there are set of dates in which you can collect proposals from the buyers and if you fail, the price has to be reduced and you have to open again, another week or another set of days, for collecting new calls. When you try to sell these assets, these assets are sold at a huge discount that could be up to the 50% of the value. When we talk about the liquidation value, the main issue is how to set a reasonable price for selling these assets, because it's no longer a market value, but it's a value that we assign for liquidation of the assets. Normally this solution is used the only when we talk about companies that are working in a sector for which the value of the assets is not so volatile over time, for example, I am extracting gold, even if I'm doing a five sale, the value of the gold is quite clear what is it, we have a benchmark and so my gold can be sold at a reasonable Every time we have mining, natural resources or any type of extraction activity, even petroleum, you can use the liquidation value because you have a benchmark. And these benchmark will matter even for the auction, for the five sale and so you know almost what will be the amount of money that you will collect by selling these assets. This approach will be the only solution available every time we talk about private companies (companies that are not listed in which the ownership is concentrated) Every time you are evaluating this type of company there is no market for almost all the assets owned by the company and so there is a need to use this approach because it's the only way to assign a value to these assets. And so there is a need to use this approach because it's the only way to assign up value to these assets. So only these two cases (mining, natural resources… and private companies) you will go for the liquidation value approach, in all the other cases for all the other companies, you will prefer something else . - Multiple approach The multiple approach is the assumption of trying to collect from the market, and most important, from a set of companies that you consider comparable to your company, so the benchmark companies for you, try to extract from these information, the final value of your company. The most common proxy used are based on a ratio of a profitability measure (EBIT, EBITDA, Net Income, etc…) and the market value of the company. Firms considered are public companies and the choice of including the multiple in an intrinsic value formula makes the approach hybrid and more exposed to estimation bias. The idea behind is that if I run the company for any years and I'm able to obtain cash flows for any years, when I arrived to the end, so a time n, what remains to the company cannot be so different with respect to the competitors. I can be lucky that in the firsts 10 years I'm outperforming with respect to my competitors, but after 20, 30 or 50 years I cannot expect to be still the best company in the market. For measuring the value of the company at the end of the period of time n, instead of using my own data, I will use the average data from the market, assuming that a time n all the companies would be almost the same. What you have to consider is a set of data related to EBIT, EBITDA, net income… a performance measure, and compare it with the market value of the company (the value of the equity in order to understand what the ratio between the performance achieved by the company is and the market value of the company). This value has to be computed for all the competitors you have and after you do a simple arithmetic average. I compute the ratio between EBIT and market value of a set of three companies that are my comparable companies, and after I do the simple arithmetic average among them. After I will use my earnings before interest and taxes or my earnings before interest, taxes, depreciation, and amortization for forecasting my market value. If I know that the ratio between EBIT and market value is 0.20%, and I know that my EBIT at time n would be 1,000,000, I know that my company has to have a market value of 5,000,000. - Stable growth hypothesis The stable growth hypothesis assumes that for the long term it is possible to assume a fixed rule for identifying the trend in the cash flows. The approach could be used for all the sector and companies in which there are data available for evaluating the long term value of the company by considering both the fundamentals of the firm and the perspectives of the sector. You make a forecast about the free cash flow to form at time n for the free cash flow to equity at time n, or the dividend in time n, so the top of the formula that we discussed before, and you assume that this amount will be growing at a fixed rate (forecast divided by Interest rate minus growth rate) Now, what I'm asking you is if we want to estimate a growth rate in the long term, what is different with respect to these data? For considering this approach is important inflation (especially depends if the cash flow on the top are real or nominal one). They are nominal so we don't care about inflation that the discount rate. What that's is important when we are considering this approach? Is that something different with respect to approach of historical data if we want to estimate it at time Anna? if I'm using the historical approach at time n, is there something different that I have to consider or not ? If I'm using the historical data approach, the estimation at time n, or the estimation at time.1 or 4… is exactly the same. If we talk about the analyst is that something different in the analyst data that had to be processed at time n with respect to the analyzed data that I can process at time 1, 2, 3, 4…? Again no. What is changing is the fundamental approach that was our main criterion for the growth rate. So if our companies are evaluated by using the fundamental approach, there is something relevant for us in estimating the growth rate time n. What is changing for us is the formula (ROE) for which these amount (D/E), is not the current amount of debt the equity, but has to be the amount of debt of the equity in the medium long term. So the only item that is changing for estimating the growth rate at time N with the fundamental approach is the leverage structure, you cannot assume that is always the same in the medium long term. So essentially when we are using the fundamental approach for computing the growth rate at time n, this leverage has to be the target leverage of the company. The only solution for us is to use the target leverage of the company. While if we are evaluating the growth rate at time one we can still be far away from the target leverage and doesn't matter too much for us. So what matters for us is that this amount (D/E) will change because we had to use only the target leverage and not the current leverage. When you can try to use the stable growth hypothesis approach for computing the terminal value, if you cannot go for the multiple approach. Only in specific cases use the liquidation value. Why the stable growth hypothesis has to be preferred to the multiple approach? What is the principal problem of using multiple approach instead of stable growth? The main problem is that if I use for the terminal value the multiple approach, I am creating a an hybrid approach in which some of the cash flows up to n – one, are based on the fundamentals of the company, so the cash flows are estimated one by one on the basis of the characteristics of the company. The cash for time n is based on an average of the market that represents a good estimate of the value of the company. This type of hybrid approachare normally characterized by a higher probability of making mistakes with respect to approaches that are totally consistent in each stage of the process. When you're using the stable growth hypothesis instead of the multiple approach for your cash flow at time n, you are always discounting the cash flow at time n of your company assuming a stable growth rate constructed for your company, so by using this approach, normally you are consistent in the analysis up to n - 1 versus the analysis after N periods. If you use this approach you are no longer consistent and you can make mistakes. So normally is always better to be focusing only on one approach, one methodology. This means that the best option for you is the terminal value based on the stable growth hypothesis. Formulas for the terminal value The stable growth rate hypothesis allow to identify the terminal value of the company or the equity by using one of the following formulas: 1. Dividend formula 2. Free cash flow formula 3. Free cash flow to equity holders formula Gn 🡪 is always the growth rate in the medium long term. Rne 🡪 The discount rate is changing in the first two formulas is ready to return for the equity holders In the last formula is the return for the stakeholder so the company, so we did the average cost of capital. The weighted average cost of capital here at N (last formula WACCn), is not the weighted average cost of capital that you have now because the leverage has to be the target leverage, so you have to adjust the weighted average cost of capital by considering what will be your target leverage. There's also something else related to the return for the equity holders (rne). The return for the equity holders you made a different assumption. - Systematic risk in the medium-long term In the medium-long term the risk profile of a stock align with the market and the differences related to specific risk dynamics are minimized. If we consider a Time Horizon that is quite long. (30,50,100years), saying that your share is behaving differently than the market, is no longer a reasonable hypothesis, because if you survive for 20 years, for 50 years, for 300 years, the market is performing like you and so you are no longer different than the market. So they will follow what is done by the top players so for your return on equity at time n, you have to make an adjustment in our ardor rate formula because you have to remove the assumption that the beta can be positive or negative and you have to set the beta equal to 1. - Growth opportunities in the long term The growth opportunities are related to the retention strategy that by definition is company specific and by the return of the re-investment opportunities. In the long term the return for the reinvestment strategy is expected to be the same for all companies in the market. For the growth opportunities at time n is the estimate that we are doing by using the retention rate, and investment rate as we did the time 0, the only difference is that these estimates of the return on equity and the return on capital, has to be adjusted on the basis of the new leverage policy, the target leverage policy. So it's not the current return on equity, but is the return on equity when you will reach your target leverage. What is important is that you change the weights. These weights has to be changed by considering your target leverage and by setting equity debt and securities on the basis of your target leverage. - Financial structure in the long term Companies in the maturity stage will adjust their financial structure to the target leverage in order to reach the optimal trade-off. https://uniroma2.sharepoint.com/sites/msteams_5dbb59/_layouts/15/stream.aspx?id=%2Fsit es%2Fmsteams%5F5dbb59%2FDocumenti%20condivisi%2FGeneral%2FRecordings%2FSolo%20 visualizzazione%2FCorporate%20Finance%2D20221017%5F122736%2DMeeting%20Recording %2Emp4 Lesson 17 – RELATIVE VALUATION 1. Introduction Once we now know about investment, financing, and dividend decisions, it will be possible to estimate the firm’s value by using one of the following approaches: - Intrinsic valuation Relative valuation Special cases and contingent claim 2. Indexes and companion variables In relative valuation, the objective is to value assets, based on how similar assets are currently priced in the market. The most common indexes constructed from the stock market price are: The first formula is price earnings ratio that is the ratio between the current price in the market and the earnings per share, the last earnings per share paid (Earnings multiples) What else you can have is the ratio between the price and the book value of the share, so we considering the last price available and that the value of the share on the basis of the last balance sheet available, that could be one month ago, three months ago, up to one year ago. (Book value multiples) And finally, we have the ratio between the price and the sales per share, we are talking about the income statement, and we are computing in the income statement, what is the value of the sales for each share outstanding. By using these proxies you can try to identify in the market, what is an average price earning ratio. What is an average price to book value ratio. What is an average price to sales ratio. The assumption in this model is that you can have your company that has a price, earning or price to book value or a price to sales, different than the average now; but in the medium long term at the company has to aligned to the average. So our assumption is that we can use these average from the market as a benchmark that is representative for the long term behavior of the company. So remember nowadays, so today, the value could be different. But in the medium long term, you have to align somehow. What is important is to identify the set of comparable the type of the average, and use it for your analysis. In order to read the indexes could be useful to identify the companion variables. Let’s assume that the price of the share is the following: Normally, what you do is also to consider that the format that we had discussed before, may be revised a little bit by trying to understand how the market proxy is measured. Here you have an example about an assumption that we can do, for measuring the market proxy. What we are saying, is that we are using the dividend discount model, the one that we have analysed the last week, when we were talking about the dividend discount model, and for the dividend discount model we are assuming that instead of having a set of payments from one to n, we have a value of the dividends that is growing, with the same rule in the medium long term. If this is true, you know that this sum of cash flows for the limited time horizon, we converge to the cash flow at time one, divided for 1 minus the growth rate. In our case, it will be not the cash flow time one, but the dividend per share of time one, because we are talking about the dividend discount model, and the discount factor will be the return for the equity holders, so the hurdle rate that we have described in our course. The growth rate and we know how to compute it and how to measure it. - Earnings multiples Book value multiples Revenue multiples 𝐷𝑃𝑆 = 𝐷𝑖𝑣𝑖𝑑𝑒𝑛𝑑𝑠 𝑝𝑒𝑟 𝑠ℎ𝑎𝑟𝑒 𝐸𝑃𝑆 = 𝐸𝑎𝑟𝑛𝑖𝑛𝑔𝑠 𝑝𝑒𝑟 𝑠ℎ𝑎𝑟𝑒 𝐵𝑉𝑃𝑆 = 𝐵𝑜𝑜𝑘 𝑉𝑎𝑙𝑢𝑒 𝑝𝑒𝑟 𝑠ℎ𝑎𝑟𝑒 𝑆𝑃𝑆 = 𝑆𝑎𝑙𝑒𝑠 𝑝𝑒𝑟 𝑠ℎ𝑎𝑟𝑒 𝑅𝑂𝐸 = 𝑅𝑒𝑡𝑢𝑟𝑛 𝑜𝑛 𝑒𝑞𝑢𝑖𝑡𝑦 𝑁 𝑃𝑀 = 𝑛𝑒𝑡 𝑝𝑟𝑜𝑓𝑖𝑡 𝑚𝑎𝑟𝑔𝑖𝑛 𝑟𝑟 = 𝑟𝑒𝑡𝑒𝑛𝑡𝑖𝑜𝑛 𝑟𝑎𝑡𝑒 𝑔 = 𝑔𝑟𝑜𝑤𝑡ℎ 𝑟𝑎𝑡𝑒 𝑟𝑒 = ℎ𝑢𝑟𝑑𝑙𝑒 𝑟𝑎𝑡𝑒 Before we use this formula and we put this formula in the ratio that we described before, we can underline some results that may be relevant for us, so now we are taking these formulas (earnings multiples, book values multiples, revenue multiples) and instead of writing price, we will write our formula for the price value on the basis of the dividend discount model. ● Earnings multiples These are the formulas that we can obtain, so PRICE/EPS becomes a (DPS/(Hurdle Rate Growth Rate)) / EPS. The price earning 🡪 Second formula. At the end your price earning would be 🡪 Third formula What is important is that, this formula allow us to understand that something that is useful for reading the price earning and for understanding the meaning of the price earning. Here what you can see in red (rr and re) are the items that have a negative impact on the price earning. The higher is the retention rate, the lower will be the price earning, because there it's on the top of this ratio, but the sign is with minus. The same for the hurdle rate; if the hurdle rate higher, the price earning will be lower. Because it is with a sign of plus but at the denominator. The growth rate is an impact that is positive, because he's at the denominator, but with a sign that is minus. So when we are reading the price earning of a company, we have to consider that a mismatch between the percentage of 1 company with respect to another, may be driven by the retention rate, may be driven by the hurdle rate, may be driven by the growth rate. So same differently, in order to have a set of comparable companies for which I can assume that the average price earning matters, what I have to do is to consider companies with the same retention rate policy with the same risk (same hurdle rate) and with the same growth expectation. If I don't do so, the analysis that I'm doing probably is biased and the result that I'm obtaining probably is not so reasonable or so economically reasonable for our analysis. This was how extract from the price earnings what are the drivers and so how to select companies that are comparable each other; remember retention rate, growth rate, and hurdle rate, and so a proxy of risk of the company. ● Book value multiples If we work on the book value and we do the same analysis. So, we replace the price with the dividend per share time 1 divided for hurdle rate minus growth rate. You can rewrite the dividend pressure by considering that are related somehow with the book value of the share. Essentially, the book value of the share is used for computing at the performance of our company, saying differently; for computing the return on equity. So if you compute the return on equity multiply for the book value per share, what you are having is the past value of the earnings per share. How much you are earning on the basis of was available at the beginning of the year for the company. If you want to compute the DPS time 1, you consider the EPS at time zero, you multiply it for 1 + g in order to have the EPS at time one, and once you have the EPS at time 1, like we did before. The third formula is telling us the drivers for our price to book value. The impact of the growth rate is not so easy to be identified because it could be positive or negative, it depends on which one matters the most. The effect of hurdle rate is always negative. The retention rate is always negative. The return of equity holders (ROE) that has a positive impact on the price to book value, the company. This means that every time we are using the price to book value for comparing companies, we have to be sure that also the return for the equity holders is comparable. Otherwise, again we do a mistake because the results could be biased. ● Earnings multiples (Revenues multiples) 𝑆𝑃𝑆 = 𝑆𝑎𝑙𝑒𝑠 𝑝𝑒𝑟 𝑠ℎ𝑎𝑟𝑒 𝑁𝑃𝑀 = 𝑛𝑒𝑡 𝑝𝑟𝑜𝑓𝑖𝑡 𝑚𝑎𝑟𝑔𝑖𝑛 Lastly, we have the earnings multiple that is the one on the sales per share. So we are reusing the indexes, we are replacing the price value with a formula on discounted cash flows, dividend discount model, in order to identify what are the drivers that are necessary for us for selecting comparable companies. Once we have the set of comparable companies we may use the data, as we will see later, for evaluating our company. The most common indexes constructed from the company market value are following exactly the same criteria adopted starting from share price evaluation. Indexes are: Here you have almost the same type of analysis done not at the share level, but then at the company level. What is the only difference that matters for us? That instead of having the price over there, you have the market value of the company (price of the share multiplied for the number of outstanding shares). So if the price is 10 and we have 1,000,000 of shares outstanding. The market value is 10 multiplied for one million so 10 million as market value of the company. The analysis is like the one that we have described before, the only difference is that we will have an additional item over there, that is the number of shares. When it's convenient to use this approach, based on market capitalization, and when it's convenient to use an approach that is based on the price of each share? First of all, this approach is always used, the enterprise value approach, every time you have a different type of shares outstanding, so ordinary shares versus special ones. Every time you have different type of shares outstanding you will consider all the shares multiply for the price of each category of shares. So this approach is more correct every time you have a different equity securities outstanding. What else could be important to use this approach instead of the other? Think about if you have an ownership that is significantly concentrated, so one shareholder has the 51% of the shares; in this scenario is most relevant to use this approach or the approach that we described before? If someone is owning the 51% you think that these investor is willing to sell the shirts or not? Probably not. Until you decide to give up top, but normally no. If you use this approach every time you have a company that is a significantly concentrated, you are evaluating some shares that are not traded in the market. And so you are doing a huge mistake in evaluating the company. This approach may be used every time you have the 0% or the 80% of the shares that are freely traded in the market. In this case, it could be reasonable to have an estimation of the company market value because theoretically you can buy all the shares that are outstanding, so the 100 per shares that are outstanding. If on the opposite, you have someone that is already controlling the company, and you cannot make a takeover because he owns so she owns the 51%, in this case, this approach will be totally unreasonable totally without an economic meaning behind. So these are the two issues that matters for you, if you have multiple securities outstanding, this approach is better than the previous one, because in the previous one you have to select which type of share and probably you can do a mistake, and the second assumption for using this approach, is that the company may be exposed to a takeover and a lot of shares are traded in the market, if this assumption is not respected again, this approach is not worth it. In order to read the indexed could be useful to identify the companion variables. Let’s assume that the enterprise value is the following: Here you have the same analysis that we have done before, starting from the enterprise value, trying to deduct from the enterprise value and its formula. This is again F1/Discount value – growth rate. Our F1 is FCFF, our discount factor is the WACC, and the growth rate is the growth rate to the free cash flow to the company. ● Earnings multiples 𝐸𝐵𝐼𝑇 = 𝐸𝑎𝑟𝑛𝑖𝑛𝑔𝑠 𝑏𝑒𝑓𝑜𝑟𝑒 𝑖𝑛𝑡𝑒𝑟𝑒𝑠𝑡 𝑎𝑛𝑑 𝑡𝑎𝑥𝑒𝑠 𝐶𝐸 = 𝐶𝑎𝑝𝑖𝑡𝑎𝑙 𝑒𝑥𝑝𝑒𝑛𝑑𝑖𝑡𝑢𝑟𝑒𝑠 𝑅𝑂𝐼𝐶 = 𝑅𝑒𝑡𝑢𝑟𝑛 𝑜𝑛 𝑖𝑛𝑣𝑒𝑠𝑡𝑒𝑑 𝑐𝑎𝑝𝑖𝑡𝑎𝑙 𝑁 𝑃𝑀 = 𝑛𝑒𝑡 𝑝𝑟𝑜𝑓𝑖𝑡 𝑚𝑎𝑟𝑔𝑖𝑛 Here you have again the same algebra, that we have done before, for computing at the enterprise value and the drivers of the enterprise value divided for the EBIT. Enterprise value divided for the EBIT, what is it? You can make some algebra and the comput the free cash flow to the firm are coming from the EBIT multiply for one minus tax rate (net to taxies) plus or minus the depreciation/amortization that you may have done in computing, the EBIT plus, the investment that you want to do in the network in capital, minus the capital expenditure that you are doing for the company in the medium long term. Here you a have a way in order to summarize a little bit better, what is the impact of each driver on the company's. What matters for us is only to understand that in order to identify companies that are comparable: - The tax rate has to be similar The accounting policy has to be comparable (so the depreciation/amortization rules has to be similar). The investment in network in capital, the investment in the medium long term has to be almost the same. As you can see when we move from the price earning approach to the enterprise value EBIT approach; we are increasing the number of assumptions necessary for selecting the comparable companies. So this approach is not always the best one, because the number of comparable firms that you can find is significantly lower. In the previous analysis, it was easier for us to identify comparables that match with our criteria. ● Book value multiples 𝑅𝑂𝐼𝐶 = 𝑅𝑒𝑡𝑢𝑟𝑛 𝑜𝑛 𝑖𝑛𝑣𝑒𝑠𝑡𝑒𝑑 𝑐𝑎𝑝𝑖𝑡𝑎𝑙 We can do the same also for the enterprise value to the book value. And these are the results. Is coming from the return on invested capital, the tax rate, the retention rate, the growth rate and then the WACC and again the growth rate. ● Revenues multiples Lastly, for the enterprise value divided sales; we have net profit margin, 1 minus retention rate, growth rate, with the average cost of capital and again growth rate. These are the assumptions that we are to follow in selecting the comparables. Remember, these are only examples, this is not a comprehensive list. So you can see more or different indexes that may work for you. The only assumption is that the index has to be constructed by comparing a market proxy with an accounting one. 3. Comparable and difference control procedure Let's try to understand once we have this index, and once we have selected comparable companies, how we can use this data for evaluating our company. So once we have representing for three comparable companies, what we can do for our company and that we can measure the value of our company. A comparable firm is one with cash flows, growth potential, and risk similar to the firm being valued. It would be ideal if we could value a firm by looking at how an exactly identical firm—in terms of risk, growth, and cash flows—is priced. In most analyses, however, analysts define comparable firms to be other firms in the same business or businesses. Talking about the comparable selection we have to consider that on the basis on the index that we have some requirements, there are some other criterias that matter aleways independently with respect to the index. What are the criteria that you have to follow? - The company has to work in the same sector Same type of customer (similar level price and the similar level of technology) If you have more than one comparable you select the index, and you try to identify on the visual of the index, which company maybe a comparable. Once identified the set of comparable firms, data may be controlled in order to avoid bias: - An anomaly on one or few ratios An anomaly on several ratios What happens always is that you can have a set of comparables that are affected by anomalies. Anomalies means some outliers, that by chance you can have among your competitors. What does it mean outliers? You look at the history of the comparable companies, and one company, for example, was exposed to negative news in the market. These negative news were affecting the price, the negative news we're not confirmed by the history, so at the end, it was a fake news, and so it's no longer relevant for the company. What you have to do is to consider the impact of this fake news, for how many days, or for how many months, or for how many years, matters the company point of view. Because in order to have an estimate that is reasonable you have to work on data that are not suffering from outliers. And for doing it, you have essentially what approaches that you can do: - - One that is an approach that is always used every time you have that the normally is affecting only one ratio or only one item in the balance sheet (An anomaly on one or few ratios) On the opposite you can have a scenario, which you can have the same anomaly is affecting at the same time, different items in the balance sheet and so different indexes (An anomaly on several ratios) OK, so in the first scenario is easier because there is only one item that is wrong, and I had to correct it that somehow; in the secondary is not so easy because it was assign up value by considering that a lot of indexes will be biased. ● An anomaly on one or few ratios For each company is possible to identify outliers for each parameter and identify a criterion for adjustment When you have an outlier, I say that if that outlier is only one, or they are only few; it's quite easy. You have to replace them, and essentially you have 3 approaches that you can follow for replacing them, that are based on three statistics that you can easily compute by using excel. 1) The average value or the mean value 2) The median value so the value for the 50% of the possible values 3) The most frequent value that is called the modal value. Essentially, what you have to do is to consider all the data. Compute the mean/median/modal value and replace it. Replace all the outliers with all these data. Let's try to understand when would be better the mean, the median or the modal value. What do think about what is the value that is mostly reasonable if we have outliers? Let’s think about the option to using the mean. We are assigned to this to all the items the same weight independently to the fact that they are real or acceptable value with respect to being outliers. IIf you do so and the outliers are totally different than the real value, so the acceptable values for you. the mean will be significantly biased. If instead of using the mean I use the median probably I can obtain something better. Because the median is the value that is representative of the 50% of the population or the events that I have in my analysis. Now, if three are outliers, the value, the media will not be modified significantly, because what matters for me is not the value the outliers, but the value of the 50% of my distribution of events. So would be not exactly the 50 would be the 49, or the 46, or the 59, or the 52, but the value that I will obtain will be almost the same independently with respect to the existence or not of outliers. So, when I don’t know what is the size of the outliers, the best scenario for me I always go to the median value. If I know that the size of the outliers is not so big, so there are outliers but they are not so significant, so they are almost in line with the other values, I can still use the mean value. The modal value is the value that is more frequent. So I will look at the last let's say five months of data. Let's focus on the price of the share. I want to understand what is the price that in the last months was the more frequent one. When is the reasonable to do it for replacing outliers and when it’s not? (So we say that the main criterion will be the medium value. The second best would be the mean value. Now we're to understand that when if there are some cases in which instead of using the median and instead of using the mean we can go for the modal value) If you have your distribution of values, a lot of values that are almost the same, let's say, at least the 30% of the observation has almost the same value. It may be useful for you to go for the modal value. Because what is not the modal value could be considered like an anomaly. So when you are replacing the data you will go for the modal value, but you can do it only when you have a lot of values that are equal to the modal value. If the model value is coming only because for two days you obtain the same price, in the last six months, you will never go for the modal value. In order to have a treasure that matters for us for selecting when you will use the modal value, at least 1/3 of all the observation has to have the same value. So the modal value has to come from the 33% of all the values that you have in your analysis. If you are below this treasure, that you will never use it. If you are above this treasure, you can use it and you can trust the modal value. Remember this one has special case that you will use every time you have several times, the same value (At least 1/3 of all the values that you have in your analysis). In all the other cases , these approaches has to be avoided and never to be used. So, your first choice will be the medium value, followed by the mean value, only for some special events or some special ratios, you can consider the modal value. 𝐴𝑣𝑒𝑟𝑎𝑔𝑒 = 𝑚𝑒𝑎𝑛(𝑉𝑎𝑙𝑢𝑒𝑠) 𝑀𝑒𝑑𝑖𝑎𝑛 = 𝑚𝑒𝑑𝑖𝑎𝑛(𝑉𝑎𝑙𝑢𝑒𝑠) 𝑀𝑜𝑑𝑎𝑙 = 𝑚𝑜𝑑𝑒(𝑉𝑎𝑙𝑢𝑒𝑠) (Excel) ● An anomaly on several ratios Looking at the comparable set the analysis allow identifying the rule for computing reasonable values for each parameter Let's try to identify now, what can happen if instead of having one outlier, we have several outliers at the same time. We cannot replace one value, but we have to identify reasonable values, for replacing all their outliers. In order to give you a description with a plot about this problem, here, you have a the description of the events. Where you have all the values that are in green that are the observed values. So what I received directly from the market. And the values in red are the forecasted values (predicted values). So what I'm replacing in order to have data that are not affected by outliers. If you look at this plot over there: What you have to understand is that every time we are doing this type of control procedure on the data, we are modifying the data in order to follow one rule; in this example the rule is a linear regression rule. Because we are assuming that there is a linear regression rule for the values that are here on the Y and the values that are here on the X. We can do a linear we can do a not linear assumption, we can do whatever you want, as assumption of this trend. (type of regression) Let's make it easier and let's think about the linear regression model in order to understand how it works, and how we can use it. Once, she had done the linear regression, so you have computed this value, the values in red, what matters for you is to consider if the set of parameters that you are analyzing are complete or not. Considering the price earning, and looking to the retention rate, to the growth rate, to the hurdle rate, probably could be enough for the type of analysis that we are doing. If I'm doing an analysis on the enterprise value, probably the number of parameters that I have to consider is significantly higher, because again we have showed before that, the number of drivers are totally different. Once you have identified the set of parameters that you trust, so you consider complete for your analysis, the last step is to is to measure the fitness of the model (statistical fitness) What is the fitness of the model? How much the real values are different than the forecasted ones. The more you have values like the one that you can see over there (far from the predicted values on the line), the worst is the performance of your model. The more you have values that are nearer to the line that you are assuming, the better will be the performance. Essentially what you have to consider is how match the forecast is different than the real values. The higher is the difference, the worst it is for the statistical fitness of the model. (Excel) (3. Comparable and difference control procedure) Once the set of comparable firms is identified and data are cleaned the procedure for the company evaluation is quite easy Let's focus on few issue that still remain. That is once we have the data that we have cleaned from all the outliers, what we have to do with this data, how we can use this data for evaluating our company? Essentially, what you have to do is to consider all the companies that are comparable to your company and you use your index, remember every indexer that is comparing a market proxy with an accounting one, you will compute the simple arithmetic average among them. So 1 divided n, multiply for the sum of the market proxies divided for the accounting proxies. And that you will use this indexe for forecasting your company. How you will do it? You will start with your company accounting data, that could be the current one or the target that you want to reach, let's say the current one that is easier, and your market proxy will be the average index multiplied for the accounting proxy. So I select a set of comparables, I compute an index for each of them, the same index for each of them, I make the arithmetic average I make a forecast about the market proxy as the accounting proxy multiply for the average index. Now the problem is how many comparables you may found, how many you will expect? we have already said that in order to identify comparables there to offer the same type of good, to the same type of customerm and for each of the indexes, you have to be sure that the fundamentals are comparable (so the retention rate is the same in the growth rate is almost the same and so on). When we are identifying the set of comparables what you think about it the end this n iIs equal to…? What is a reasonable number that I can set for my comparable companies? How many it look for? Normally is up to five. Normally even three companies will be enough. Normally from three to five what could be a reasonable set of comparable so that you are considering. So essentially here you have 5 indexes at the maximum; you compute an average, you make a proxy or an estimate about a market proxy for your company. Remember that when you are identifying these comparable: 1) You select them (the comparables, I guess) 2) You apply some outliers, treatment rules. a. If there is only one applier you use the mean the average of the model value b. If there are multiple problems you use the regression model 3) Once you have this data that are cleaned 🡪 You compute the average, and you apply it. Normally this type of approach will take for you a couple of hours and that's it. So it's not time consuming, it's not requesting a huge amount of data and nobody is quite fast, even if you want to do trading on real time on some securities or some investments. So this approach is frequently used every time you need to have a response in a short term, and you trust that the market is efficient, because if the market proxy that you are comparable is wrong, everything that you are pointing out is not relevant or is not consistent with what you will face in the future. 4. Conclusion Relative valuation allow to measure the value of company or equity of a corporation on the basis of the data collected for a set of comparables. The main issue id to identify the best set of parameters e identify the companion variables that justify differences among companies. In order to apply the relative valuation approach is necessary to identify a set of strictly comparable firms and analyse data in order to avid bias. Lesson 18 - SPECIAL CASES OF COMPANY VALUATION 1. Introduction Once we now know about investment, financing, and dividend decisions, it will be possible to estimate the firm’s value by using one of the following approaches: We are talking about evaluation, and now we are going to the last topic that are the special cases, that are private companies, and the contingent claim valuation. So the idea is to identify for this special type of companies how the approach may be different and what are the key issue that matters for us in valuing this type of companies. - Intrinsic valuation Relative Valuation Special cases and contingent claim 2. Value of private business The value of a private company is the present value of the expected cash flows that you would expect that company to generate over time, discounted back at a rate that reflects the riskiness of the cash flows. Let's start with the value of private companies, private business. When we talk about the value of private company, or private business; the problem that we have is that some of the assumption made in the DCF model or made in the multiple approach are no longer acceptable. So some of the assumption that we have done up to today cannot be applied to the private business valuation. The main problem that you have are related to the cash flow uncertainty. Two, the discount rate premium and finally to the terminal value. The main issue are related to: - - - ● Cash flow uncertainty: We are talking about the problems in forecasting the free cash flow to firm and for the private companies, there could be some events that may affect our capability to estimate the free cash flow to the firm. Discount rate: We are trying to evaluate for this type of company, what are the problems in the financial market they are facing that may be relevant in our evaluation. So they had to be evaluated differently because they don't have access to the market like the big players, like the listed players. Terminal value: We are trying to identify how to measure the terminal value, if we're talking about a private business that frequently is also a family firm. Not always. Cash flow uncertainty Accounting standards may not be adhered to consistently in publicly traded firms, they can diverge dramatically in private firms. In small, private businesses, we should reconstruct financial statements rather than trust the earnings numbers that are reported. Let's start talking about the cash flow uncertainty, why it matters, and why is relevant for the private companies. Essentially what we can have, is that some of the cost of the company are not considered all in evaluating the company. So some of the cost that you are sustaining for running the business, are not disclosed in the balance sheet. And so you cannot have a full estimate about all the cost of your business. Let's make an example. Every time you have a family company and you have an entrepreneur that is running the company, so the head of the family is also running the company. The wage for this employee is not always one of the items in the balance sheet. These guys running the company, because he knows that can give a wage to the son or to the daughter, can have in the future return if everything works, but it's not obtaining a payment every month as a wage. If this is the scenario, every time you are evaluating a private company, you are underestimating the cost of running the business. So by looking only at the balance sheet, by looking only the data that you have in the balance sheet, you can be biased and you can overestimate the value the company because you underestimate some of the cost. How much this type of cost are relevant? They are quite relevant because especially if we talk about family firms, it's quite common that you have such type of problem. What is the difference between a private company or family form? How you how you define a family firm normally? When we talk about the family firm, we are not talking about the private companies, because we can have private companies that are not classified as family firm, and we can have even listed companies that are classified as a family firm. What matters for you is a who is running the company. So who is owning the company and how many people from the same family are working in the company. If you have that in the company, the owner is also the head of a family and a lot of employees are coming from the same family, you can assume that this is a family firm. Every time you have such type of scenario, this will have an impact on the cost that you can measure and how much the cost are listed in the balance sheet or not listed in the balance sheet. What else is important for every private business is that when we have a private business; the entrepreneur and some of the top manager (if there are) may have a problem in separating their own wealth with respect to the wealth of the company. So what will happen frequently in order to give you an example, is that the entrepreneur is not owning a car, because the car is owned by the company, and the company is giving for free this car to the entrepreneur. So what matters for you is that there is a mix between the wealth of the individual and the wealth of the company. Every time you have such type of mixing, there is a problem in evaluating the company because you don't know exactly what are the asset in place for your company and what are the assets used on the fully by the entrepreneur of the top manager. When we talk about this type of problem, the main problem for us when we have such type of assets owned by the company fully used by an employee or fully used by an owner is to identify the terminal value the company. So what matters for us, is at what price I can sell the company once I decide to close it down. If you have a such mixture of assets owned by the company and owned by the employee, you don't know really what will be the selling price or the final value of your company at the end of the period. Main issues are: - - Failure on the part of many owners to attach a cost to the time that they spend running their businesses - So for this issue, the problem is that I cannot forecast the free cash flow during the life of the company. The intermingling of personal and business expenses that is endemic in many private businesses - When we talk about the second issue over there, the main problem for me is try to measure what is the terminal value at time n forever within the company. Remember this matters the most, every time you have a family firm, this matters for every type of private business, and so maybe a problem that you may face in evaluating the company. • Discount rate premium When estimating discount rates for publicly traded firms, we hewed to two basic principles. With equity, we argued that the only risk that matters is the risk that cannot be diversified away by marginal investors, who we assumed were well diversified. With debt, the cost of debt was based on a bond rating and the default spread associated with that rating. - Under diversification What else you can have is that when we are talking about the private companies, normally private companies are small companies or micro companies. So they are quite small in terms of revenues, in terms of assets, and in terms of employees. This matters because if you have a small company, normally first of all you cannot start too many projects at the same time. Because you have a lack of money, you cannot start the multiple project at the same time, and so you will suffer over problem that is called under diversification, that means that I cannot start jointly more than one project If the project fails, the company is exposed to a risk of bankruptcy because all the money was invested in the project and if the project is not working as expected, this will be an insurance for the survival of the company. What is the implication of this under diversification for evaluating the company? Is essentially related to the hurdle rate. The hurdle rate for us was the minimum return for an investment strategy and if you're investing all your money in one project, the return has to be higher. Because if you are exposed to a risk of bankruptcy, if something is not working, you want to be rewarded for such type of risk. So the under diversification matters because the hurdle rate has to be higher, so has to consider a premium, for the risk of bankruptcy related to the company that is investing all the money, or almost all the money, only in one project. - Local lenders The other point that you can have, always related to the fact that the company is quite small, is that every time we talk about a small company, the capability to raise money, from the financial institutions, is quite limited. So when I try to collect money from the financial institutions only some of them may provide me money, and so I am a financial constrained because I cannot raise the money that I need for running my company. Most important, when you have only few lenders that can provide you money, you are subject to the condition applied by these lenders. So there is no other way for raising money. I will accept everything that is proposed by the lenders, in order to start the project and run the company. In this scenario, what will happen is that there will be a cost of debt, that will be significantly higher than the scenario that we have described up today because they lenders knows that they can apply a premium when they offer the loan. Because you have no alternative with respect to collect the money from them, and so they want to be paid more for giving you money. What do you think about, who are the lenders that normally may trust the small company/private company that is looking for money? When you go to a bank with a balance sheet in which you show only losses, no one will give you money. The only way for you to have a lender that is accepting to give you money, is to start establishing a long term relationship with this type of lender. So essentially in the first stage of your life cycle or until you are a private business, normally you cannot, or you have not a convenience, to change your lender over time. So if we look at the smaller medium enterprise in Italy and in Europe you will see that, until they are private business companies, they will never change the lender. So we start with Intesa (a bank) and then we go with Intesa until I decide to get listed. This is a scenario that we don't have at the US, US is totally different. But in Europe, in continental Europe, this is quite common. So you will have that the lender is also stronger with respect to what we've discussed before because it's knowing that you cannot raise money from someone else and you have not the convenience to change the lender. So essentially, they can apply the pricing condition they want, because you have no alternative with respect to accepting the condition applied, because you know that only few lenders will give you money and you have no convenience to switch the lender and move to another lender. Think about that Europe, this issue matters because we have some rules that are rules apply to all the banks, for which you will collect data about your customer over time and these data are private data. So the bank is not disclosing this data on the market. So by working with the bank, I'm providing to the bank private information that will be used in the future and is not available to all the other competitors in the banking industry. So we stay with the lender because once I stay with the lender for a couple of years, the lender will understand what is my business, how I'm working and so may provide me money. If I switch, the new lender will have a 0 private information and then we start again from no opportunity to raise money or too expensive cost of borrowing money and so on. So every time we're talking about a private business, this is an issue because I have only few lenders that can finance me and I cannot change the lender at all. So the cost of debt would be significantly higher than the cost of debt applied in our formula (the formula that we use up to today for the with the wedge cost of capital). So the impact in: - Under diversification is the return on equity and the hurdle rate Local lender is in the cost of debt and in the WACC. In both cases we will have an effect on the discount rate that will matter for us because every cash flow for the future will value less, due to the fact that the discount factor is higher. ● Terminal value With publicly traded firms, we assume that firms have infinite lives and use this assumption, in conjunction with stable growth, to estimate a terminal value. Private businesses, especially smaller ones, often have finite lives since they are much more dependent on the owner/founder for their existence. When we talk about the terminal value, the main problem for us is a related not to every private firm, but mainly to the private firm at that are family firms. In the private firms that are family firms, the problem is that this type of companies are not run professionally. Normally they are run by an entrepreneur, that started the activity several years ago and is still running the company as it was run 50 years old, 40 years ago. So the problem is that when we arrived to the closing of the activity, we have a company that is no longer able to be treated at a reasonable price, because it's a company that is not using the same strategy, or using the same approach, that is defined by the top players in the industry. So essentially the business model is no longer updated and so probably the company is not performing at its best. The more you have a family firm, the idea is this type of risk; because in the family firm nor my entrepreneur we run the firm for 40/50 years and after 20/30 years normally the entrepreneur is no longer new ideas or something new that can provide to the business. Every time you cannot move from a family firm to a firm that is managed professionally, that's an issue that you have to consider. Video resolution: - Timothy and David Jr: Maybe worthy because in the video are the only ones that are providing a new idea for running the company. We don't know if it's working, but the best for you when you are running a private business is to have at least an idea, after you will discover if it works or not, but the main issue is to have an idea that can be exploited in the future. Private business valuation is normally significantly affected by the management turnover and the governance issues 3. Option pricing and contingent claim And alternative approach that we may use for evaluating a company is this option pricing and contingent claim valuation. What is the idea of this option pricing and contingent clean valuation? Try to use a financial instrument, in order to describe but the value of a company. What will we use as financial instruments are the option contracts. Do you know what is an option? The option contract is a contract which now you pay a premium, so you pay now an amount of money, in order to make cut choice in the future. The choice could be to sell a share, or to sell a bond, at a fixed price, or to buy a share, or to buy a bond, at a fixed price. Essentially, I am paying you now for fixing the condition for a transaction that will be done in the future. It is up to me in the future if I want to do the transaction or not. So I can pay and I decide that I changed my mind, I will be no longer interested to buy or sell the security in one year from now, or I can pay and once I arrive to the time scheduled in the contract, I will decide to do the transaction. In most publicly traded firms, equity has two features. The first is that the equity investors run the firm and can choose to liquidate its assets and pay off other claim holders at any time. The second is that the liability of equity investors in some private firms and almost all publicly traded firms is restricted to their equity investments in these firms. A company may be described with financial options contracts that allow describing the value od debt and equity, What we want to do is to consider this type of option contract and try to use it for evaluating a company. So for making a firm evaluation, essentially when we want to use the option for a firm valuation, we have to consider that among the stakeholders of the company, we have the shareholders and the debt holders (we don't consider the hybrid securities holders). So we have only two types of securities; it could be equity or debt. The option is the opportunity for the shareholders, if they want, to leave the company to the debt holders when the company is performing poorly. So when we talk about a company, normally the company is a legal status that allow you to have a limited liability. Limited liability does it mean that the money that you can lose as shareholder of the company, are only the money that you have invested in the company, so the shares that you have bought of the company, your private wealth is not exposed to a risk, if the company goes to bankruptcy. These always true when you have a company that has a limited liability or is a listed company, as a protection for the shareholders with respect to the rights of the debt holders. The protection is that what I'm exposed to lose by my investment, is only the amount of money that I spent for buying the shares. If something goes wrong, that’s the maximum amount of money that I can lose. If everything performs as expected, I will not lose money, I’ll earn money and we will measure how much I can earn. An option is a contract which conveys its owner, the holder, the right, but not the obligation, to buy or sell (call vs put) an underlying asset or instrument at a specified strike price prior to or on a specified date (american vs european). This is the scenario and we want to do an option pricing model, so an option a model based on option contracts, in order to describe the company and what is the value of the company for the shareholder point of view. How we can do it? We use call or put option. What is the difference? - The call is the right to buy so I pay now a premium for buying something in the future. The put option is the right to sell. I pay a premium now for selling a security in the future. And that we use this type of contact call or put contract, in order to describe the value of my company, and in order to assign up value to my company. When we talk about call and put the results, another difference that may matter, that is related to the type of call or type of put. Normally we distinguish the American put or call versus the European put or call. What is the difference? The difference is that the American option give you the opportunity up to a date, so from now to a date, for to buy or to sell a security (Call or put). So starting from now, I'm paying a premium now, for the next, let's say three months, five months to two years, whatever you want, I can buy or sell a security at a fixed price. The European contract is a little bit different because instead of having a set of dates in which you can exercise this option, you have only one date. So you pay now, and on the, let's say, the 30th of November, you can decide to buy or to sell, only on the 30th of November. So the European option is giving you the right only at that data to buy something or sell something at a fixed price. Buy if it's a call cell, sell if it's a put. These are the only difference that matters for us and for the analysis that we are doing today. The option has an initial price. Holder: shareholders Contract: Call Type: European Underlying asset: Company Strike price: Value of debt Now let's try to describe the company by using the call and the put contract in order to understand the value or the return for the shareholders. The point of view will bel the shareholder; we will talk about a call contract, so the right to buy something. We'll talk about a European contact because it's easier, so we have only one data. The underlying assets are the company and the exercise price, so the price that I to pay for buying the company, that is normally called also strike price, is the value of the debt. So here what we are saying is that we are applying a call contractor for describing the limited liability. What we have said that was the limited liability? I am exposed to the risk of default, only for the amount of money that I have spent for buying the shares. What does it mean? That I had the right to buy the company, so to run the company only if I'm able to repay the debt. Otherwise, I leave the company to the debt holders, and it's up to them how much they can recover from it. That's how we can apply the core contract for explaining the limited liability. The value of the company is: The limited liability assumption allows the shareholders to obtain gain to start recovering their investment only when the company value is higher than of the debt. Here you have a plot that we will construct now about the payoff for the shareholders, and the payoff for the debt holders on the basis of the value of the company. Let's start with the debt holders. (Red line) If the company has a value of 0, essentially all the money given to the company is lost. So the debt holders are losing all the money given, because they cannot recover at all, the exposure they have with respect to the company. So the debt is not repaid. We are given 1,000,000 of euro, we are losing 1,000,000 of euro. If the company is not valuated with the zero but has a value that is higher than 0. The value that we can obtain by selling the company or by selling the assets of the company, may allow us as debt holder to recover some of the debt exposure. This scenario we are still running our exposure at a loss, we as debt holders, because we are not fully recovering our exposure, but we are reducing our loss because the value of the company is increasing. Once we are after this point, we are recovering the net exposure, so we are recovering the debt, and we are also obtaining the interest payments. So here, the next value of the security is higher than zero, because I've given you one million of euro, you are refund me one million of euro, but you have also paying me some interest and the interest are over there. I have €100,000 of interest, 200,000 and so on, up to the maximum amount over there, hat is the amount that related to the contract. So the contract is telling me that I had to be paid the 10% of the value of the loan, so I can reach as maximum payment how much 1,000,000 plus the 10% of 1,000,000. The contract is establishing how much you will pay for this type of loan. So remember here I'm losing all the money here. I'm recovering partially the amount of money given initially. Here I have already recovered all the money, but I most obtaining someone the interest payments. If the value of the company is higher than this value over there, the value for the debt holders would be always the same. You had the 10% on the 1,000,000, if the company is able to pay, that's the maximum that you will obtain. Let's talk about the equity side (blue line). So let's talk about how much they shareholders are earning from the investment strategy. The shareholders have paid something for buying the shares if the companies are not performing at all, so the value is zero., they are losing all the money invested in the shares. Remember all the money invested in the shares, not all their wealth, because they are exposed to the risk only for the money that they spent for buying the shares. Until you fully repay the debt holders, you don't have a return as shareholder. You are losing all the money and that's it. Once you have paid the debt holders, the money that remains will be used for you for recovering some of the exposure that you have. Until this point, that is the break-even point for the shareholders, after which the shareholders will start earning money. That's the plot about the trade-off for the equity holders. Essentially, what matters for us is how much is the present value of the debt. So how much is the amount of money given by the bank. How much is the price paid for buying the shares? And what is the value of the firm that is equal to the value of the debt? On the basis of items, we can have an idea about the value of the company. The plot to that you can see over there, the one in blue, the one of the shareholders, is exactly the plot of an option pricing model. The option pricing model is a contract which you have a premium paid at the beginning, until it's convenient for you to exercise a right, in this case a right to buy the company by refunding the debt. So what you can see here in blue is exactly the plot of an option contract. So when we are analysing a company and we are assuming the limited liability, we can see that the performance for the equity holders is exactly the performance that we expect from a call contractor in which the premium paid at the beginning is the amount spent for buying the shares, and the strike price is the value the company equal to the value of the debt. When we look at these blue plot, that is the performance for the shareholders, this blue plot is exactly the same of an option contractor pay off plot. OK, they option that we are to consider is an option which the premium paid at the beginning. So the premium that you pay in order to do something in the future if you want, is the price of the share that you are paying now. And the strike price or the exercise price is the scenario which the value of the company is exactly equal to the value of the debt. So our exercise price will be the value of the debt. If we use that only these two assumptions, on the initial premium and on the strike price, we can describe, the value the company easily by using a formula that we will not analyse in detail, that is the option pricing formula that you can see if you want over there. This strange formula is the option pricing formula. Don't worry, you have a tool that is telling you by putting the input what is the value of the option. So we can derive the value the option by using all these formulas we don't care about them. That will allow us to evaluate this blue line. Now we will not look at the formula, but we will look at the drivers of the formula, so the inputs that you have to provide. So if I have a, this called the Black and Scholes formula, this the option pricing formula; if you we have the black and Scholes formula, what are the items, the information that we have to provide to the formula, in order to have this blue line, in order to understand the value of the company for the shareholder point of view. (Black and Scholes formula) Inputs necessary for the model are: The items are listed over there, that are, related to the company, to the variance of the firm value, to the value of the debt, and the maturity of the debt. What is the requested to collect for evaluating the company (value of the company) by using the option pricing model? First of all you have to consider the value of, the liabilities and the value of the assets. Take care because this has to be market value, not accounting value. So I have to be able to identify the value of the liabilities and the value of the assets are at current market prices. I have to consider the liquidation value in the to have an evaluation of the value of these liquidation value and I have to have few ratios about the company. The ratios are mainly related to the leverage and the ratio related to the performance. So saying differently the return on equity and the return on assets. So I need to have an estimate of assets and liabilities, a forecast for an appraisal value, the liquidation value. And finally I had to collect at least two multiples that are: the leverage value and the performance or return on equity or return on assets. What else is important is to have a measure of the variance, so the variability of firm value. How is proxied normally? By using the debt or the equity variability overtime. This is always a solution that you can do every time the companies listed and the securities are all listed. So I will compute the standard deviation of the return of the share; the standard deviation of the return of the bonds issued by the company. Every time you don't have a lot of securities trading the market, so, for example, you borrow money from a bank, instead of using the debt and equity variability, what you will use is the variability of the performance. So of the income of all the companies in the sector. So the model may work for listed companies, but also for unlisted ones; for listed is easier and more customized, for unlisted is less easy because you have to use a proxy coming from the sector forever within your company. (Value of debt) You have to consider the time period of the debt existing and also you have to do a year by year analysis about the expiration date of the debt. So I have to know how much of the debt is sparring in one year in two years in five years and so on. So breakdown by expiration data on my debt. (Maturity of the debt) For the debt is also necessary to have the average duration and if the debt is a 0 coupon bond debt, the maturity. By adding all these data that is not so easy, but by having all these data you put them in the formula and you will obtain the value of your company. LET'S THINK ABOUT BY ANALYSING THE DATA. 1) Value of the company What could be the impact of each item on the value of the company? So first of all, let's look at liabilities and assets value, liabilities and values of assets. What do you think about what is the impact on the evaluation done with the Black and Scholes formula, what we can expect? Remember, is an option in which in order to remain the owners of the company, we have to refund the debt. Otherwise, we leave the company to the to the debt holders and we are no longer shareholders. So what you can expect about the liabilities and assets? How they will have an impact on the value of the company in these contingent claim valuation or option pricing valuation? When you will have a value, the company that is a higher than zero and where you will have a value, the company that is lower than zero. When you have more assets or more liabilities in your model? When is more convenient for you to exercise the option? these are the liabilities excluding the equity side, these are the asset. So here you have debt for financial institution, bonds or whatever you want; as a debt security and here you have the assets. What do you think about which one is driving an increase in the value of the company? Which one is driving a decrease in the value of the company? (We are the shareholders) - If the assets are higher, the value of the company will be higher If the liabilities are higher, the probability to exercise the option will be lower, because we don't know if the assets are enough for justifying the choice of the shareholders to become the owner. So essentially this (assets) has a positive impact on the evaluation, this (liabilities) will have a negative impact on the evaluation. For the multiples I told you that one is the leverage and we have adjust already described how much it matters, and the other one is the profitability measure. What do you think about if the profitability is higher the value the company for the shareholders will increase but will decrease? Will increase. You will buy the company only if the companies performing. If the company is running at a loss, so the turn on asset is the lower than zero, you will never exercise their option and so you will lose the money invested in the company. That equation value matters only if the company has some real assets. And so in this case, this is an additional asset that you can have. So the remaining value of the assets once you close the business, and that the higher is that with the liquidation(?) value again the higher is the interest of the shareholders to buy the company. So you can expect that this is as a positive effect on the value of the company. 2) Variance of the firm’s value The variance of the company, so the variance of the firm value over time, do you think it's positive or negative for the equity point of view, for the shareholders point of view? Remember, variance here is our definition of variance, so it's the variability of the value over time, could be positive change or negative change. Now, if the company is exposed to a significant variability over time of its value, is it good or bad for the shareholder point of view? Shareholders have a limited maximum loss and they have an unlimited maximum gain, so this line can go on and so you can earn 1,000,000, ten million, 1 billion and so on. But you can lose only the amount of money that you spent initially for buying the shares of the company. So you have a mismatch between what could be the gain and what could be the loss. The gain is unlimited. The loss is limited to a treasure that we already know. If there is variability, what will happen for the company is that there will be an increase of the number of cases in which could be convenient to exercise the option to become the owner, because if everything goes wrong, remember that you have still a stop loss, you lose the money that you have invested and that's it. So every time you have variability in the option pricing model, you will have an increase in the value of the company, only because the shareholder have a stop loss in their investment strategy. And so for them, the higher is the risk, the higher is the possibility to obtain more gains, not more losses, because the losses they already know how much they can be at the maximum. So due to the fact that there is an asymmetry between the gains and the losses, the higher is the variability, the more you will have a positive valuation on this type of company , in the option pricing model. 3) Value of debt Let's talk about the third term, about the value of debt, overall time period and the year by year analysis. What you think about if you have a debt that is expiring in one year or if you have a company that has a debt that is expiring in 10 years. In which scenario you have a higher probability to have an interest to become the shareholder? (So same amount of debt, same amount of assets, same type of assets. But one company is a debt that is expiring one year, let's say the 100% will expire in one year, or you have another company with the debt that is expiring in 10 years). So if we have that the debt is spinning one year, it means that in one year you have to be able to have a value the company higher than the debt. Otherwise, you as a shareholder you give up and you leave the company to the debt holders. If on the opposite, you have 10 years, is true that you have to pay more, probably, as cost of debt, but you have 10 years in order to reach a value of the company higher than the value of the debt; which scenario is easier for you? The 10 years one. If I can wait ten years, I can be more able, could be easier for me, to have a value of the company higher than the value of the debt. If I have only one year or few months before the deadline, that's a problem for me because I don't know if my company will grow enough in order to justify the choice of remaining with the company running the company. So when we talk about the time and the expiration date of the debt, what matters for us is that how much time we have for increasing the value of the company. The more we have time, the better it is, so the higher will be the evaluation on the company. 4) Maturity of the debt Lastly, we have something about the duration, this matters every time you have a instalments for the debt that are quite significant. So you have a mortgage and every month you have to pay something. In this case you have also to consider the maturity of the debt. Because if you have that a lot of payments are scheduled frequently for the company, there is a higher probability that the company is running a loss, and so the shareholders will not exercise the option to become the owner of the company. If instead you can wait until to the end, because you have only 0 coupon bond, you know how much you have to refund, and once you're arrive to the expiration date, probably you have a value of the company that is higher than the value debt. So the higher is the frequency of the payment, the higher are the problems in managing the liquidity for the company, and so probably the lower will be the evaluation on the company. But these are not so relevant as the expiration day of the debt, because the coupons are significantly lower than the refunding value, and so what matters the most is when the debt will expire, but both of them are affecting the value of the company. The option pricing approach allow evaluating some special cases of companies: - Distressed companies High risk business No credit default spread When we use these approaches? When we use the option claim approach, the option pricing will contingent claim approach? Essentially, we can use them when we talk about distressed companies. When we talk about companies in high risk business or companies for which you cannot compute the default credit spread. ● Distressed companies In discounted cash flow valuation, we argue that equity is worthless if what we own (the value of the firm) is less than what we owe. Call options command value because of the possibility that the value of the underlying asset may increase above the strike price in the remaining lifetime of the option, equity commands value because of the time premium on the option (the time until the debt mature and come due) and the possibility that the value of the assets may increase above the face value of the debt before they come due. What is a distressing company, how we can define it? The value of the assets is currently lower than the value of the debt or the value of every type of liabilities they have. So the company that we are analysing, a distressed company, if we apply the free cash flow model or the multiple approach has to be evaluated with a value of 0. What we're saying is that a distressed company cannot be solved, can only be given to someone for free. And this is false, because every time we have a distressed company, there is a market for buying a distressed company; and what matters for you are the growth opportunities of the company and how much you can exploit by buying this company, the growth opportunitiesSo normally when we talk about the distressed companies, the only way for assign them a fair price, is the option pricing contingent claim valuation. So the formula that we had described before is the only formula that we can use for assign a value to a company that is already in distress. And remember that the transaction on distressed companies are not an event that is extreme or will never happen in the future, we have every year, several companies in distressed, that get out from the bankruptcy stage by being sold to someone else. And we need a model that is the option pricing model for setting this price. For example, Bank of America was sold at one other company that take the control of Bank of America and Bank of America is still one leader in the banking industry in US. So when we are talking about selling a company in distress doesn't mean that we are shut down the business, means that we are giving the opportunity to the company to exploit growth opportunities. If you have growth opportunities, it will work. If you don't have, probably the approach is not working and the solution is not worthy at all. ● High risk business In traditional discounted cash flow valuation, higher risk almost always translates into lower value for equity investors. When equity takes on the characteristics of a call option, we should not expect this relationship to continue to hold. Risk can become our ally, when we are equity investors in a troubled firm. In essence, we have little to lose and much to gain from swings in firm value and a risk shifting strategy may be beneficial for shareholders. Talking about the other companies for which it may be useful to use option pricing and contingent claim, these are all the companies that are working in the high risk business, let's say differently, the option pricing and the contingent claim valuation is the main approach when you are evaluating a start-up. Every time you are evaluating a start-up, we have already said that the probability of survival or start-up is around the 20%, so a lot of them will go to bankruptcy because they don't have an idea or a business idea that will work in the future. If you use the option pricing contingent claim valuation, you can assign a value to them, so the venture capitalist when they are buying some of the shares of the start-up companies are using a mainly option pricing contingent claim valuation models. Because otherwise, when you have a start-up of what is the problem? The companies that run at a loss, you have only few assets in place, you don't know if the company will survive, so the price for buying the shares to be 0. Otherwise, I will not invest money. By using these models, you can assign a value that is higher than zero and is considering the growth expectation and the probability of survival. ● No credit default spread In the Black-Scholes model, we can estimate the probability of default starting from the probability that the value of the firm’s asset will exceed the face value of the debt. The interest rate from the debt allows us to estimate the appropriate default spread to charge on debt on the basis of the specific features of the company even if CDS are not available for the company (without making assumption on the best proxies of CDS risk). Lastly, you can have in some cases you cannot compute the credit default spread for your company. What was the credit default spread? We used it for doing what? For adjusting, there is creepy in computing the cost of debt. (?) So the cost of debt was the risk free plus the CDS spread (one of the solution available). Sometimes in some markets you cannot be able to measure the CDS, because the CDS is the premium that is requested by the market, for investing in your company due to the fact that you are riskier than a sovereign, so then a state. And the assumption is that there is someone in the market that wants to trade your securities, wants to buy your securities. If there is no demand for your securities, so no one is buying the bond, you cannot measure the CDs. So every time you have a market for your bonds that is not a liquid market, you cannot have a benchmark for the CDS and so you cannot use this approach. In the Black and Scholes formula, even if you don't know the CDS, you can still have a value the company, so in some cases, for some companies, in some markets, the CDS is the only solution available, because you miss some of the other data that are necessary for measuring the cost of debt and the discount factor. 4. Conclusion Company valuation for private business is more complex with respect to standard companies due to the higher cash flow uncertainty, discount rate premium and terminal value computation. The option pricing and the contingent claim valuation allow to evaluate better distressed companies, high risk businesses and companies for which not CDS are available.