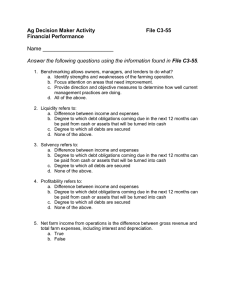

SECTION 4(b): BUSINESS INCOME TUTORIAL 4 – BUSINESS INCOME Net Profit/ Loss before tax Other income not falling under S.4(a) eg. rental, interest, dividend, disposal of fixed asset Other income not falling under S.4(a) eg. rental, interest, dividend, disposal of fixed asset not yet recorded Business income not yet recorded All non-allowable expenses eg. depreciation, non-trade bad debt write-off, excess of 19% EPF, renovation, donation All non-allowable expenses eg. depreciation, non-trade bad debt write-off, excess of 19% EPF, renovation, donation not yet recorded Allowable expenses not yet recorded Double deduction e.g salary of disable employee, halal certification, advertising on Malaysian brand name Adjusted income from business Add: Balancing charge Less: Capital allowances Unabsorbed CA Less: Current year CA Less: Balancing allowance Statutory income (if more than 1 source, add every sources and becoming aggregate income) Less: Unabsorbed business losses Add: Other taxable income under 4(c), 4(d), 4(f) Aggregate income Less: Approved donation (10% from company aggregate income) Total / Chargeable income 1 (-) xx (+) XX XX Nil XX XX Nil XX XX (XX) XX XX XX (XX) (XX) (XX) XX (XX) XX XX (XX) XX SECTION 4(b): BUSINESS INCOME QUESTION 1 Encik Zami; a sole trader operating an established landscape shop in Kuala Terengganu. The following is the Statement of Comprehensive Income of ZLPP for the year ended 31 December 2021 ZLPP Statement of Comprehensive Income for the year ended 31 December 2021 Notes Sales Less: cost of goods sold Gross profit Add: Dividend Other income Less: operating expenses Advertising Water and electricity Telephone Staff remuneration Fees' Repairs and maintenance Entertainment Provision for bad debts Depreciation General expenses Donations Transportation Insurance Net profit RM 1 2 54,500 56,300 3 18,200 9,500 4,200 270,750 16.000 202.000 112,600 17,200 47,000 14,150 40,000 37,000 24.000 4 5 6 7 8 9 10 11 12 RM 2,800,000 (1.350,000) 1,450,000 110,800 1 ,560,800 (812,600) 748,200 Additional information: 1. Dividends: Received from Pernas Bhd (net) Received from Telekom Malaysia Bhd (net) Received from Multi Computer Bhd (net) 2. Other income: Interest on fixed deposit Compensation received from customers due to breach of contract Rental of house in Ampang 2 RM 16,000 28,000 10,500 54,500 RM 15,900 29,000 14,400 56,300 SECTION 4(b): BUSINESS INCOME 3. Advertising cost of RM4,000 for placing an advertisement in "Home Concept" magazine for the months of November 2020 up to February 2021 was not recorded. 4. Staff remuneration: RM 98,500 95,000 18,000 27,700 5,250 22,100 4,200 270,750 Zami’ salary, bonus & EPF Salary - Normal employees - Disable employees Bonus - Normal employees - Disable employees EPF - Normal employees - Disable employees 5. Fees Legal fees on the recovery of loan to ex-employee of ZLPP Legal fees on income tax appeal Cost for renewal of land lease agreement Approved training fees Annual fees to Persatuan LandskapTerengganu 6. Repairs and maintenance: 4,000 RM 3,100 6,000 1,000 1,900 16,000 RM 170,000 26,800 5,200 202,000 Renovation of showroom Repairs on machines En. Zami’s car repair 7. Entertainment: Staff annual dinner Hosting dinner for clients & staff Leave passage for employees to Bukit Merah RM 48,600 58,000 6,000 112,600 8. Bad debts and provision for doubtful debts: Bad debts and provision for doubtful debts RM Bad debts written Off 9,500 Specific provision b/d Specific provision c/d 50,000 General provision b/d General provision c/d 26,000 Bad debts recovered Profit and loss 85,500 3 RM 38,700 18,800 10,800 17,200 85,500 SECTION 4(b): BUSINESS INCOME Off the RM9,500 bad debts written off, RM2,900 was in respect of a loan to En. Zami’s brother and the balance was a trade debt. Included in bad debts recovered, RM3,000 is in relation to non trade debt. 9. General expenses: Fine paid to customs office Medical fees for employees Penalty for late submission of En. Zami’s annual return to IRB Miscellaneous expenses (it was agreed that 2/3 was for business purposes) 10. Donations: Donation to "Rumah Kebajikan Masyarakat" (approved under section 44(6)) Donate six computers to Kuala Terengganu Public Library 11. RM 3,000 6,000 800 4,350 14,150 RM 8,000 32,000 40,000 Transportation: The transportation expenses included rental of two lorries since November 2020 for the delivery of garden furniture. The amount of rental paid was RM1,250 per month. 12. Insurance: Premium on fire insurance policy for the shop Life insurance policy of the employees Life insurance policy of En. Zami’s family members 13. RM 8,000 12,000 24,000 The balancing charge, balancing allowance and capital allowance for the year of assessment 2021 were RM5,000, RM3,000 and RM64,300 respectively. Required: Compute the statutory business income for En. Zami for the year of assessment 2021. QUESTION 2 4 SECTION 4(b): BUSINESS INCOME Encik Kamarul owns a mini market business in Batu Pahat. The following was the statement of comprehensive income for the year ended 31 July 2021 RM RM RM Sales 365,000 Less: Cost of goods sold (1) 140.000 Gross profit 225,000 Add: Other income Dividend (net) 9,500 Rent received 3,000 Gain on disposal of van 2,000 14,500 239,500 Less: Expenses Salary, bonus and EPF (2) 71,600 Transportation (3) 5,850 Water & electricity (4) 2,700 Insurance (5) 4,000 Entertainment (6) 3,500 Fees and donations (7) 9,700 Depreciation 12,000 Bad debts (8) 3,000 Tax (9) 2,100 Repair and maintenance (10) 2,700 Rent (11) 9,000 126,150 Net profit 113,350 Notes: 1. Included in the cost of goods sold was RM8,OOO (at cost) of goods taken by Encik Kamarul without paying for them. The market value of these goods were RM9,500. 2. Salary, bonus and EPF for Encik Kamarul were RM25,OOO, RM4,OOO and RM3,OOO respectively. The salaries, bonus and EPF for the employees were RM26,000, RM6,600 and RM7,OOO respectively. 3. The carriage inwards and outwards were RM1,800 and RM2,200 respectively while the cost of moving into new house (Encik Kamarul) was RM1,850. 4. Two thirds (2/3) of the water and electricity expenses was for business use. 5. Insurance premium on Encik Kamarul’s life was RM1,500, educational insurance for the children were RM1,OOO while the fire insurance premium on business premises was RM1 ,500. 5 SECTION 4(b): BUSINESS INCOME 6. 10% of the entertainment expenses was spent to celebrate Hari Raya for the employees, 20% to celebrate Encik Kamarul’s children birthday parties and the balance was to entertain the current and potential clients. 7. The fees and donations consist of trade debts collection fees RM4,900, donations to the Rumah Anak Yatim (approved) RM4,200, personal overdraft application fees RM500 and penalty for late payment of income tax RM100. 8. One half (1/2) of the bad debts written off was related to trade debts while the other half (1/2) were loans to the employees written off. 9. The quit rent for the mini market premises was RM900 while Encik Kamarul’s income tax on business income was RM1,200. 10. Three quarter (3/4) of the total repairs and maintenance cost was for business purpose. 11. The rent was for the three-story shop houses where Encik Kamarul occupied the top floor while the other two floors were used for operating the mini market business. Required: Compute the statutory business income for Encik Kamarul for basis year 2021 (Commence your calculation from the net profit). QUESTION 3 6 SECTION 4(b): BUSINESS INCOME Mr Ong Kah Jun is the sole proprietor of Ong Enterprise, a stationery store, in Kuala Ibai, Terengganu. The following is Statement of Comprehensive Income for the year ended 31 December 2021. RM Gross sales RM RM 298,800 Cost of sales (194,220) Gross Profit 104,580 Profit from sale of van 2,000 Gross dividends 1,500 108,080 Less: Expenses Salary, Bonus and EPF (a) 46,125 Interest (b) 2,925 Bad debts (c) 900 Entertainment (d) 1,500 Rent (e) 7,200 Water and Electricity 1,000 Depreciation (f) 3,000 Taxes (h) 1,875 Donations (i) 3,975 Motor Vehicle Expenses (j) 750 Miscellaneous Expenses (k) 3,750 (73,000) Net Profit 35,080 Notes to the accounts: (a) Salary, bonus and EPF consist of the following: Salary Bonus EPF RM RM RM Ong Kah Jun 18,000 9,000 2,000 Employees 10,800 1,800 4,525 28,800 10,800 6,525 7 SECTION 4(b): BUSINESS INCOME (b) Interest is based on loans taken in the previous year at the rate of 9 per cent per year. RM12,500 loan was taken for the purpose of buying shares and RM20,000 used to purchase assets of the business. (c) Trade debts written off was RM700, and specific and general provisions for bad debts of RM300 and RM400 respectively. (d) Entertainment expenses include RM1,000 Chinese New Year lunch for employees and RM500 for entertaining potential clients. (e) Ong Kah Jun rented a double story shop house where his family occupied the upper floor. The IRB has agreed to allow 60 per cent of the rent as business expenses. (f) Depreciation is on fixed assets used in the business. The capital allowances related to these assets are RM2,400. The balancing charge related to the sale of van is RM1,100. (g) Taxes consists of the following:RM Road tax for van used in the business 400 Income tax of Ong Kah Jun 1,325 Penalty on late submission of income tax return 150 (h) Donations were made to a political party of RM3,000 and Universiti Utara Malaysia of RM975 (i) It has agreed that 2/3 of the motor vehicle was for business used (j) Miscellaneous expenses include RM2,000 air ticket to Taiwan for Ong Kah Jun’s daughter. 8 SECTION 4(b): BUSINESS INCOME (k) Some supplies costing RM400 were taken out by Ong Kah Jun for personal consumption. The market value of these supplies was RM500 and it was not recorded anywhere. REQUIRED Determine the statutory income of Ong Kah Jun’s business for the year of assessment 2021 QUESTION 4 9 SECTION 4(b): BUSINESS INCOME Sathiya is a sole trader operating a mini market in Kuala Berang since 2014. He thought that the income tax he has to pay was based on the net profit shown in the Statement of Comprehensive Income. You, as the tax consultant, are asked to advise him on his tax chargeability. The following was Sathiya Statement of Comprehensive Income for the year ending 31 December 2021 Note RM Sales Less: Cost of sales Opening stock (+)Purchases (-) closing stock Gross Profit Add: Other Income Dividend (net) Interest Gain on disposal of a car RM 189,500 26,000 111,500 137,500 (34,500) (a) (103,000) 86,500 (b) (b) 5,000 1,000 10,200 16,200 102,700 Less: Salaries Bonus EPF Insurance Advertising Bad debts & provision for doubtful debts Depreciation Fees and donation Entertainment Rental Water and Electricity Telephone Transportation (c) (c) (c) (d) 31,900 2,525 3,598 1,930 1,500 (e) 940 1,700 3,200 1,500 2,700 1,474 2,700 2,925 (f) (g) (h) (i) (j) (k) (58 592) 44,108 Net Profit Notes to the accounts: 10 SECTION 4(b): BUSINESS INCOME (a) Closing stocks has already taken into accounts the stocks taken by En Sathiya for personal consumption. The costs of the goods was RM3,425 and the market value was RM3,600. (b) Dividend and interest were all derived from Malaysia. (c) En Sathiya is entitled to a salary of RM16,600. Details of the salaries, bonuses and EPF of the employees were as follows: Salaries Bonus (RM) EPF (RM) (RM) Ishak 8,400 1,400 1,756 Yusuff 5,400 750 1,486 Zainab 1,500 375 356 (d) Insurance Fire insurance for the shop Insurance for the business van Son’s educational insurance (started paying in January) RM780 RM550 RM50 per month (e) Bad debts and provision for doubtful debt account: RM RM Bad debts write off 520 Specific provision b/d 220 Specific provision c/d 780 General provision b/d 470 General provision c/d 890 Bad debts recovered 560 _______ Profit and Loss 2,190 2,190 Note: all the debts recorded were trading debts (f) Fees and donation RM Donation to a poor cousin 400 Trade debts collection fees 800 Annual fees for Mini Market Association 500 Personal overdraft application fees 1,500 (g) Entertainment expense: 11 940 SECTION 4(b): BUSINESS INCOME RM 800 700 Family day gathering for staffs Entertainment for clients (h) Rental expenses referred to a double storey shop house where, En Sathiya occupied the second floor (i) The portion of water and electricity was shared according to the space occupied in the shop house (j) Telephone bill RM 700 2,000 Personal calls Business call (k) Included in the transportation costs were the cost of holiday passage to Thailand given to Encik Yusoff, being the best employee of the year. The cost was RM1,000. En Sathiya attended a seminar on IT in Singapore which related to his personal development and the traveling cost amounted to RM1,125. The balance was referred to transportation cost for delivering of goods to customers. (l) For the year of assessment 2021, the capital allowances claimed amounted to RM3,600 (m) All the advertising expenses was spent for the business. Required: Compute the adjusted and statutory business income for Encik Sathiya for the year of assessment 2021 (compute to the nearest RM) QUESTION 5 12 SECTION 4(b): BUSINESS INCOME OMARHANA Enterprise is a sole proprietorship business of Omar, which deals in retailing electronic products. Below is the Profit or Loss Account of OMARHANA Enterprise for the year ending 30 June 2021. Note RM RM Sales 2,100,000 Less: Cost of foods sold 1 1,470,000 Gross Profit 630,000 Add. Recovery from insurance Dividend income (net) 2 3 30,00 10,800 Less: Payroll Rental Expense 4 5 243,000 36,000 6 7 8 10,000 12,000 50,000 25,000 40,000 6,000 3,000 20,000 30,000 6,000 Entertainment Interest Repairs & Renovations Depreciation Utilities Bad & Doubtful Debts Fines & Penalties Donations General Operating Expenses Provision For Tax Net Profit 9 10 11 12 13 14 40,800 670,800 481,000 189,800 Notes: 1. In March 2021, Omar took a TV set without paying, for the use of his family. The cost of the TV set was RM2,000, which was included in the cost of goods sold. The selling price was RM2,500. 2. In November, due to floods, some equipment and electronic goods were damaged. Omar made a claim and was paid compensation by an insurance company, the amount being as follows: RM Compensation for the damaged electronic goods 20,000 Compensation for the damaged equipment (fixed assets) 10,000 3. The dividends were received in April 2021 from Malaysian resident companies. 4. Payroll expenses are as follows: RM 13 SECTION 4(b): BUSINESS INCOME Salaries (Omar) Salaries (sales & technical employees) Bonus (for all employees) EPF Contribution (for all employees) 60,000 110,500 30,000 30,500 Each employee was paid bonus equivalent to three months of his/her remuneration. EPF contributions amounted to 20% of each respective employee's remuneration. 5. The rental expense was for a two storey- shophouse. The ground floor was used by OMARHANA Enterprise, while the first floor was occupied by Omar's family. It was agreed that only 60% of the expenses were attributable to OMARHANA Enterprise. 6. Entertainment expenses are as follows: RM Lunch %& dinner for employees Drinks for customers Dinner for business associates 3,000 2,000 5,000 7. Interest of RM12,000 was on a RM100,000 bank loan from Mmaybank Bhd. Omar used RM60,000 of the loan to buy shares, while the balance of RM40,000 was used as working capital for OMARHANA Enterprise. 8. Repairs and Renovation are as follows: Minor repairs to equipment RM5,000 Renovations to showroom 45,000 9. The expenses for utilities were for water, electricity, quit rent and assessment for the shop house. It was agreed that 30% of these expenses be attributed to private and domestic purposes. 10. Bad Debts are as follows: Provision for doubtful debts- specific Provision for doubtful debts - general Trade debts written off Loan to an employee written off 11. Fines & Penalties were for not displaying price tags. 12. Donations were given to: 14 RM 2,000 1,000 500 2,500 SECTION 4(b): BUSINESS INCOME RM 12,000 8,000 Government General Hospital Electronic Dealers Association 13. All general operating expenses were for the purpose of the business. 14. Provision for tax was for Arshard's personal income tax for the year of assessment 2019. Required: Based on the given information, compute the Adjusted Income of OMARHANA Enterprise for the year of assessment 2021. Commence your computation with the Net Profit. QUESTION 6 Encik Nasa owns a Mini Market in Pahang. The following is the Profit or Loss Account for the basis year 2021 Profit or Loss Account For the Year Ended 31 December 2021 RM Sales Less: Cost of Goods Sold Opening Stock Add: Purchases (1) 104,000 446,000 550,000 (5,000) 545,000 (138,500) Income from other sources Dividend (net) Rent received Gain on disposal of fixed asset (13) (13) (14) 10,000 1,850 1,200 Expenses Salary Bonus EPF Transportation Water and Electricity Rent Insurance (2) (2) (2) (3) (4) (5) (6) 62,600 6,250 2,754 5,850 2,950 10,800 3,860 Less: Returns outward Less: Closing stock Gross Profit Add: Less: 15 RM 758,000 (406,500) 351,500 13,050 364,550 SECTION 4(b): BUSINESS INCOME Entertainment expenses Fees and donations Advertising Depreciation Bad Debts Tax Medical expenses Repairs and maintenance of motor vehicle Net Profit (7) (8) (9) (10) (11) (12) 3,000 12,800 6,050 6,750 2,500 2,400 3,500 2,700 134,764 229,786 Notes: 1. Included in the cost of goods sold figure was RM6,850 (at cost) of supplies taken by Nasa’s wife without paying for them. The market value of these goods was RM7,200. 2. Salaries, bonuses and EPF: Encik Encik Encik Encik 3. Nasa Ramlan Ridhuan Haris Salary (RM) 32,000 16,800 10,800 3,000 62,600 Bonus (RM) 4,000 1,500 750 6,250 Transportation expenses : Transporting supplies to and from the Mini Market Private moving expenses 4. EPF (RM) 1,512 972 270 2,754 RM 4,550 1,300 Water and electricity: RM 2,000 950 For Encik Nasa’s business For Encik Nasa’s residence 5. Rent: The rent paid included RM3,600 which was rent paid for Encin Nasa’s own residence. 6. Insurance: Insurance premium on Encik Nasa’s life Fire insurance premium on Encik Nasa’s residence Fire insurance premium on business premises 7. Entertainment: 16 RM 800 920 2,140 SECTION 4(b): BUSINESS INCOME RM Hari Raya treat for the employees Encik Nasa’s birthday party expenses 8. 2,000 1,000 Fees and donations RM Trade debts collection fees Mini Market Association fees Donations to government Donations to Mini Market Association Personal overdraft application fees and interest 9. 5,700 600 2,500 1,000 3,000 Bad debts RM Trade debts written off Loan to a friend Loan to Ramlan (employee) written off 10. 1,550 500 450 Tax RM Quit rent – business premises Property tax – business premises Encik Nasa’s income tax – on business income 300 600 1,500 11. Medical expenses included treatment for Encik Nasa’s wife RM1,600 12. Repairs and maintenance RM Cost of fuel and repair of motor vehicle. 1/3 of the total cost is for private use Cost of fuel and maintenance of a van that was used for delivering goods 13. 1,050 1,650 Dividend and rental income were derived from Malaysia 14. This gain was from the disposal of Encik Nasa’s car which had a book value of RM13,500. The car was purchased on 30 April 2021 at the cost of RM18,000. 15. Business adjusted losses carried forward from the basis year 2019 is RM16,600 16. Total capital allowance for the year of assessment 2019 is RM9,500. Required: Determine Encik Nasa’s statutory income from business and also his total income for year of assessment 2021 QUESTION 7 17 SECTION 4(b): BUSINESS INCOME Hakim commenced business on 1 April 2012 as a sole-proprietorship. The net profit of RM43,260 was extracted from the profit and loss account for the year ended 31 March 2021, after charging and crediting the following items: (extracted) Credit side (Revenues) RM (1) Sales 350,000 (2) Commission 2,560 (3) Dividends (Net) 8,320 Debit side Expenditures) (4) Salary 43,200 Bonus 17,800 EPF contribution 12,290 (5) Traveling expenses 6,750 (6) Water and electricity 1,756 (7) Telephone bill 3,675 (8) Insurance 2,432 (9) Entertainment 6,543 (10) Bad debts 2,818 (11) Fees 2,160 (12) Donation 4,427 (13) Depreciation 9,200 (14) Tax 3,750 (15) Sundry expenses 7,542 Additional Information: 1. Sales did not include RM5,560 for goods drawn by Hakim. Cost of goods was RM5,050 and was recorded in the accounts. 2. The commission was not received until 31 May 2021 3. Dividends were from: 5 November 2019 10 January 2019 15 February 2019 Nur Bhd (Malaysian resident company) Ambo Ltd ASM (Pioneer status company) 4. Salary, Bonus and EPF contribution: Salary RM Hakim 24,000 Budin (employee) 12,000 Adam (employee) 7,200 43,200 5. Traveling expenses: Bonus RM 10,000 6,000 1,800 17,800 EPF RM 6,800 3,600 1,890 12,290 RM 18 RM 2,765(gross) 1,037 4,518 SECTION 4(b): BUSINESS INCOME Carriage inwards 4,550 Hakim’s holiday to Langkawi 2,200 6. Water and electricity: Including two-third (2/3) for private use 7. Telephone bill: Charges related to his wife’s business Hakim’s business RM1,500 RM2,175 8. Insurance: Premium paid on life of Hakim RM950 Premium on fire insurance for shop premises Premium paid on life of Hakim’s wife 9. Entertainment: Annual anniversary for Hakim’s wedding Special gift to regular customer RM508 RM 974 RM 2,000 1,143 Hari Raya gathering for staff 1,500 Free 2019 diary with the business logo 10. Bad debts: Loan to ex-worker General provision for Bad Debts 1,900 2,000 Debts to client written off Bad debt recovered from Sundry debtor 11. Fees: Fees to Golf Club Fees to a political party 1,200 250 (632) 1,350 250 Entrance fees to business association 12. Donation: 19 560 SECTION 4(b): BUSINESS INCOME Donation to Hospital USM (approved) 650 Donation to Public Library Donation to Political party Business zakat 1,655 1,500 622 13. Depreciation on the following assets used in business: Depreciation (RM) Cap. Allowance (RM) Furniture 2,200 2,000 Motor vehicle 4,500 4,700 Refrigerator 1,500 2,300 Other equipments 1,000 14. Tax: Hakim’s business tax Quit rent for business premises 250 3,500 15. Sundry Expenses included medical expenses RM320 for Adam (employee) who was handicapped and for Hakim’s wife RM265. Required: Determine Hakim’s Income from business and also his total income for the year of assessment 2021. (Start your answer with Net Profit of RM43,260) 20 SECTION 4(b): BUSINESS INCOME 21 SECTION 4(b): BUSINESS INCOME 22 SECTION 4(b): BUSINESS INCOME 23 SECTION 4(b): BUSINESS INCOME 24