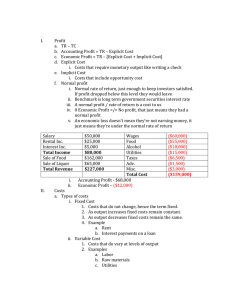

11/29/20 Chapter 5. The theories of producers’ behaviors I. The theory of production II. The theory of cost III.The theory of profit 1 I. The theory of production 2 The Production Function • A production function shows the relationship between the quantity of inputs used to produce a good and the quantity of output of that good. • Q= f(X1, X2, ..Xn) • Q = f (K, L) • 𝑄 = 𝐴𝐾 % 𝐾& (Cobb Douglass function) 3 3 1 11/29/20 Short run vs Long run • Short-run: • Period of time in which quantities of one or more production factors cannot be changed. • These inputs are called fixed inputs. • Long-run • Amount of time needed to make all production inputs variable. • Short run and long run are not time specific 4 4 L K Q 0 10 0 APL 1 10 10 10 2 10 30 15 3 10 60 20 4 10 80 20 5 10 95 19 6 10 108 18 7 10 112 16 8 10 112 14 9 10 108 12 10 10 100 10 0 MPL 10 20 30 20 15 13 4 0 -4 -8 5 Marginal Product and Average Product • The marginal product of any input is the increase in output arising from an additional unit of that input, holding all other inputs constant. • Marginal product of labor (MPL) = ∆Q ∆L • Average product of labor (APL) =Q L 6 6 2 11/29/20 7 II. The theory of cost 8 Fixed and Variable Costs • Fixed costs are those costs that do not vary with the quantity of output produced. • Variable costs are those costs that do vary with the quantity of output produced. 9 3 11/29/20 Fixed and Variable Costs • Total Costs • Fixed Costs (FC) • Variable Costs (VC) • Total Costs (TC) • TC = FC + VC 10 Costs Q FC VC TC $800 FC $700 VC TC $0 $100 $600 1 100 70 170 $500 2 100 120 220 3 100 160 260 4 100 210 310 5 100 280 380 6 100 380 480 7 100 520 620 Costs 0 $100 $400 $300 $200 $100 $0 0 1 2 3 4 5 6 7 Q 11 Fixed and Variable Costs • Average Costs • Average costs can be determined by dividing the firm’s costs by the quantity of output it produces. • The average cost is the cost of each typical unit of product. 12 4 11/29/20 Fixed and Variable Costs • Average Costs • Average Fixed Costs (AFC) • Average Variable Costs (AVC) • Average Total Costs (ATC) • ATC = AFC + AVC 13 Average Costs AFC = Fixed cost FC = Quantity Q AVC = Variable cost VC = Quantity Q ATC = Total cost TC = Quantity Q 14 Average Fixed Cost FC 0 $100 AFC n/a 1 100 $100 2 100 50 3 100 33.33 4 100 25 5 100 20 6 100 16.67 7 100 14.29 $200 Average fixed cost (AFC) is$175 fixed cost divided by the quantity of output: $150 Costs Q AFC = FC/Q $125 $100 Notice $75 that AFC falls as Q rises: The firm is spreading its fixed $50 costs over a larger and larger $25 number of units. $0 0 1 2 3 4 Q 5 6 7 15 5 11/29/20 Average Variable Cost 0 VC $200 Average variable cost (AVC) is$175 variable cost divided by the quantity of output: $150 AVC $0 n/a 1 70 $70 2 120 60 3 160 53.33 4 210 52.50 5 280 56.00 6 380 63.33 7 520 74.29 Costs Q AVC = VC/Q $125 $100 As$75 Q rises, AVC may fall initially. In most cases, AVC will $50 eventually rise as output rises. $25 $0 0 1 2 3 4 Q 5 6 7 16 Average Total Cost Q TC 0 $100 ATC AFC Average total cost (ATC) equals total cost divided by the quantity of output: AVC n/a n/a n/a 1 170 $170 $100 $70 2 220 110 50 60 3 260 86.67 33.33 53.33 4 310 77.50 25 52.50 5 380 76 20 56.00 6 480 80 16.67 63.33 7 620 88.57 14.29 74.29 ATC = TC/Q Also, ATC = AFC + AVC 17 Average Total Cost Q TC 0 $100 ATC $200 Usually, as in this example, $175 the ATC curve is U-shaped. n/a $150 170 $170 2 220 110 3 260 86.67 4 310 77.50 5 380 76 $25 6 480 80 $0 7 620 88.57 Costs 1 $125 $100 $75 $50 0 1 2 3 4 5 6 7 Q 18 6 11/29/20 Fixed and Variable Costs • Marginal Cost • Marginal cost (MC) measures the increase in total cost that arises from an extra unit of production. • Marginal cost helps answer the following question: • How much does it cost to produce an additional unit of output? 19 Marginal Cost MC = (change in total cost) DTC = (change in quantity) DQ 20 Marginal Cost TC 0 $100 1 170 2 220 3 260 4 310 5 380 6 480 7 620 $200 MC $175 $70 $150 50 $125 40 50 70 100 140 Costs Q $100 $75 $50 $25 $0 0 1 2 3 4 5 6 7 Q 21 7 11/29/20 The Various Cost Curves Together $200 $175 $150 Costs ATC AVC AFC MC $125 $100 $75 $50 $25 $0 0 1 2 3 4 5 6 7 Q 22 ACTIVE LEARNING Calculating costs 3 Fill in the blank spaces of this table. Q VC 0 1 10 2 30 TC AFC AVC ATC $50 n/a n/a n/a $10 $60.00 20 36.67 80 3 16.67 4 100 5 150 6 210 150 12.50 8.33 $10 30 37.50 30 260 MC 35 43.33 60 23 ACTIVE LEARNING Answers 3 Use relationship AFC = TC/Q ATC FC/Q First, deduce AVC VC/Q FC between = $50 andMC useand FCTC + VC = TC. Q VC TC AFC AVC ATC 0 $0 $50 n/a n/a n/a 1 10 60 $50.00 $10 $60.00 2 30 80 25.00 15 40.00 3 60 110 16.67 20 36.67 4 100 150 12.50 25 37.50 5 150 200 10.00 30 40.00 6 210 260 8.33 35 43.33 MC $10 20 30 40 50 60 24 8 11/29/20 When MC < ATC, $175 $150 ATC is rising. $125 Costs When MC > ATC, The MC curve crosses the ATC curve at the ATC curve’s minimum. ATC MC $200 ATC is falling. $100 $75 $50 $25 $0 0 1 2 3 4 5 6 7 Q 25 III. The theory of profit 26 • We assume that the firm’s goal is to maximize profit. Profit = Total revenue – Total cost the amount a firm receives from the sale of its output the market value of the inputs a firm uses in production 27 27 9 11/29/20 Costs: Explicit vs. Implicit • Explicit costs require an outlay of money, e.g., paying wages to workers. • Implicit costs do not require a cash outlay, e.g., the opportunity cost of the owner’s time. • Remember one of the Ten Principles: The cost of something is what you give up to get it. • This is true whether the costs are implicit or explicit. Both matter for firms’ decisions. 28 Explicit vs. Implicit Costs: An Example You need $100,000 to start your business. The interest rate is 5%. • Case 1: borrow $100,000 • explicit cost = $5000 interest on loan • Case 2: use $40,000 of your savings, borrow the other $60,000 • explicit cost = $3000 (5%) interest on the loan • implicit cost = $2000 (5%) foregone interest you could have earned on your $40,000. In both cases, total (exp + imp) costs are $5000. 29 Economic Profit vs. Accounting Profit • Accounting profit = total revenue minus total explicit costs • Economic profit = total revenue minus total costs (including explicit and implicit costs) • Accounting profit ignores implicit costs, so it’s higher than economic profit. 30 10 11/29/20 Figure 1 Economic versus Accountants How an Economist Views a Firm How an Accountant Views a Firm Economic profit Accounting profit Revenue Implicit costs Explicit costs Revenue Total opportunity costs Explicit costs Copyright © 2004 South-Western 31 ACTIVE LEARNING 2 Economic profit vs. accounting profit The equilibrium rent on office space has just increased by $500/month. Compare the effects on accounting profit and economic profit if a. you rent your office space b. you own your office space 32 ACTIVE LEARNING Answers 2 The rent on office space increases $500/month. a. You rent your office space. Explicit costs increase $500/month. Accounting profit & economic profit each fall $500/month. b. You own your office space. Explicit costs do not change, so accounting profit does not change. Implicit costs increase $500/month (opp. cost of using your space instead of renting it), so economic profit falls by $500/month. 33 11 11/29/20 Profit maximization • 𝜋 = 𝑇𝑅 − 𝑇𝐶 • Profit reaches its maximum when 𝜋′. = 0 ↔ TR3 − TC3 = 0 ↔ 𝑴𝑹 = 𝑴𝑪 34 Total revenue maximization • Total revenue reaches its maximum when 𝑇𝑅′. = 0 ↔ 𝑴𝑹 = 𝟎 35 12