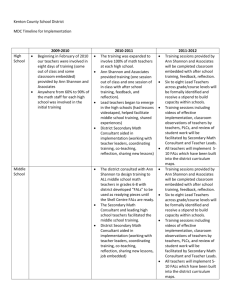

lOMoARcPSD|15703194 Chapter 08 International Strategy Strategic Management (Carleton University) Studocu is not sponsored or endorsed by any college or university Downloaded by Linh B?o (baolinhsjk@gmail.com) lOMoARcPSD|15703194 Name : Clas s: Dat e: Chapter 08: International Strategy True / False 1. In place of relatively stable and predictable domestic markets, firms across the globe find that they are competing in relatively unstable and unpredictable global markets. a. True b. Fals e ANSWER: True 2. After a firm decides to compete internationally, it must select its strategy and choose a mode of entry into international markets. a. True b. Fals e ANSWER: True 3. Because there are still several industrial and consumer markets in which only domestic firms compete, many firms do not have to be able to compete internationally. a. True b. Fals e ANSWER: Fals e 4. One reason why firms pursue international opportunities is to extend the product's life cycle. a. True b. Fals e ANSWER: True 5. A reason that firms use international strategies is to secure needed resources, especially minerals and energy. a. True b. Fals e ANSWER: True 6. In some industries, technology drives globalization because the economies of scale necessary to reduce costs cannot be met by competing in domestic markets alone. a. True b. Fals e ANSWER: True 7. A major incentive for the use of international strategy by French-based Carrefour Group is the potential for large demand for goods and services from emerging markets such as China and India. a. True Copyright Cengage Learning. Powered by Cognero. Downloaded by Linh B?o (baolinhsjk@gmail.com) Page 1 lOMoARcPSD|15703194 Name : Clas s: Dat e: Chapter 08: International Strategy b. Fals e ANSWER: True 8. The three basic benefits of international strategies are 1) increased market size; 2) increased economies of scale and learning; and 3) development of competitive advantages through location. a. True b. Fals e ANSWER: True 9. Rivals Airbus and Boeing have multiple manufacturing facilities and outsource activities partly for the purpose of developing economies of scale as a source of being able to create value for customers. a. True b. Fals e ANSWER: True 10. As an indication of the importance of economies of scale, Ford Motor Company runs a single global business developing cars and trucks that can be built and sold through the world. a. True b. Fals e ANSWER: True 11. Coca Cola and PepsiCo are examples of firms that have found it unnecessary to aggressively pursue international strategies because of extensive growth opportunities available in the U.S. market. a. True b. Fals e ANSWER: Fals e 12. Multinational firms have many opportunities to learn from their experiences in international markets, but they must have a strong R&D system to absorb the knowledge. a. True b. Fals e ANSWER: True 13. Cultural differences affect location advantages in that business transactions are less difficult for a firm to complete when there is a strong match among the cultures with which the firm is involved. a. True b. Fals e ANSWER: True Copyright Cengage Learning. Powered by Cognero. Downloaded by Linh B?o (baolinhsjk@gmail.com) Page 2 lOMoARcPSD|15703194 Name : Clas s: Dat e: Chapter 08: International Strategy 14. Location advantages are influenced by costs of production, access to natural resources and critical supplies, as well as the needs of customers, but not culture. a. True b. Fals e ANSWER: Fals e 15. The three corporate-level international strategies are cost leadership, differentiation, and focus. a. True b. Fals e ANSWER: Fals e 16. When a firm initially pursues an international business-level strategy, the resources and capabilities established in the home country frequently allow the firm to pursue the strategy into markets located in other countries. a. True b. Fals e ANSWER: True 17. Michael Porter's Determinants of National Advantage describe factors associated with the firm's domestic environment that contribute to its dominance in a particular global industry. a. True b. Fals e ANSWER: True 18. Both the size and the nature of a country's domestic demand for a particular industry's good or service are important in Porter's determinants of national advantage. a. True b. Fals e ANSWER: True 19. Having substantial supplies of critical basic natural resources is a necessary condition for a country to support businesses that can successfully compete in international markets. a. True b. Fals e ANSWER: Fals e 20. South Korea's success in international markets is primarily a result of its abundant natural resources. Copyright Cengage Learning. Powered by Cognero. Downloaded by Linh B?o (baolinhsjk@gmail.com) Page 3 lOMoARcPSD|15703194 Name : Clas s: Dat e: Chapter 08: International Strategy a. True b. Fals e ANSWER: Fals e 21. Italy has become the leader in the shoe industry because of related and supporting industries such as a well-established leather-processing industry that provides the leather needed to construct shoes and related products. a. True b. Fals e ANSWER: True 22. A firm based in a country with a national competitive advantage is not guaranteed success as it implements its chosen international business-level strategy. Instead, the actual strategic choices managers make may be the most compelling reasons for success or failure. a. True b. Fals e ANSWER: True 23. A multi-domestic strategy is an international strategy in which a firm's home office determines the strategies business units are to use in each region. a. True b. Fals e ANSWER: Fals e 24. A major advantage of multi-domestic strategies is the ability to customize products and services for the specific market, although this sacrifices economies of scale. a. True b. Fals e ANSWER: True 25. The firm using a global strategy seeks to develop economies of scale as it produces the same or virtually the same products for distribution to customers throughout the world who are assumed to have similar needs. a. True b. Fals e ANSWER: True 26. The global strategy offers greater opportunities to take innovations developed at the corporate level or in one market and apply them to other markets. a. True Copyright Cengage Learning. Powered by Cognero. Downloaded by Linh B?o (baolinhsjk@gmail.com) Page 4 lOMoARcPSD|15703194 Name : Clas s: Dat e: Chapter 08: International Strategy b. Fals e ANSWER: True 27. Research suggests that the performance of the global strategy is enhanced if it deploys in areas where regional integration across countries is occurring. a. True b. Fals e ANSWER: True 28. A transnational strategy is an international strategy in which the firm seeks to achieve both global efficiency and local responsiveness. a. True b. Fals e ANSWER: True 29. A transnational strategy is difficult to use because of its conflicting goals. a. True b. Fals e ANSWER: True 30. Even if effectively implemented, the transnational strategy often produces lower performance than does the implementation of either the multi-domestic or global strategies. a. True b. Fals e ANSWER: Fals e 31. The growing number of global competitors heightens the requirements to keep costs down and there is the desire for more specialized products to meet customer needs. These two pressures make transnational strategies increasingly necessary. a. True b. Fals e ANSWER: True 32. A company that chooses a truly global corporate-level strategy assumes that the liability of foreignness will be minimal. a. True b. Fals e ANSWER: True Copyright Cengage Learning. Powered by Cognero. Downloaded by Linh B?o (baolinhsjk@gmail.com) Page 5 lOMoARcPSD|15703194 Name : Clas s: Dat e: Chapter 08: International Strategy 33. Four types of distances are associated with the liability of foreignness: cultural, administrative, geographic, and economic. a. True b. Fals e ANSWER: True 34. The "regionalization" environmental trend means that firms can focus on a region (customization) but also have some standardization or sharing within the region. a. True b. Fals e ANSWER: True 35. By choosing a region where markets are more similar, the firm may be able to better understand those markets and cater to their needs, but also achieve economies through sharing of resources. a. True b. Fals e ANSWER: True 36. International associations such as the European Union, the Organization of American States, and the North American Free Trade Association encourage regionalization of competition rather than globalization. a. True b. Fals e ANSWER: True 37. Exporting and licensing are the most appropriate ways for smaller firms to first enter international markets. a. True b. Fals e ANSWER: True 38. The high cost of transportation, expense of tariffs, and loss of control are three disadvantages of exporting. a. True b. Fals e ANSWER: True 39. Evidence suggests that, in general, using an international cost leadership strategy when exporting to developed countries has the most positive effect on firm performance while using an international differentiation strategy with larger scale when exporting to emerging economies leads to the greatest amounts of success. a. True b. Fals Copyright Cengage Learning. Powered by Cognero. Downloaded by Linh B?o (baolinhsjk@gmail.com) Page 6 lOMoARcPSD|15703194 Name : Clas s: Dat e: Chapter 08: International Strategy e ANSWER: True 40. Because of the lack of protection of intellectual property in some foreign countries, licensing arrangements are one of the best ways for a firm to protect its technology from being appropriated by potential competitors. a. True b. Fals e ANSWER: Fals e 41. Although licensing is the least costly method to enter a foreign market, its disadvantages include high costs of transportation and low control over the marketing and distribution of goods. a. True b. Fals e ANSWER: Fals e 42. Strategic alliances tend to increase the risk associated with international expansion for the U.S. partner because of the greater dependence on the foreign firm. a. True b. Fals e ANSWER: Fals e 43. Establishing a wholly-owned subsidiary provides the quickest access to a new market. a. True b. Fals e ANSWER: Fals e 44. Research suggests that wholly owned subsidiaries and expatriate staff are inappropriate for service industries because those industries require close contact with customers, high levels of professional skills, specialized know-how, and customization. a. True b. Fals e ANSWER: Fals e 45. The greenfield venture option is useful when control of proprietary technology is important in an international expansion. a. True Copyright Cengage Learning. Powered by Cognero. Downloaded by Linh B?o (baolinhsjk@gmail.com) Page 7 lOMoARcPSD|15703194 Name : Clas s: Dat e: Chapter 08: International Strategy b. Fals e ANSWER: True 46. When the country risk is high, firms prefer to enter with a greenfield investment rather than a joint venture. a. True b. Fals e ANSWER: Fals e 47. While there are multiple means of entering new international markets, firms should use one method consistently with all of its various products and across its different markets in order to reduce administrative complexity. a. True b. Fals e ANSWER: Fals e 48. Export, licensing, and the strategic alliance entry modes are all appropriate for early market development. a. True b. Fals e ANSWER: True 49. Acquisitions, greenfield ventures, and sometimes joint ventures are appropriate when firms want to establish a strong presence in an international market. a. True b. Fals e ANSWER: True 50. International diversification can help to reduce a firm's overall risk through the stabilization of returns. a. True b. Fals e ANSWER: True 51. Research has shown that, as international diversification increases, firms' returns decrease initially but then increase quickly as firms learn to manage international expansion. a. True b. Fals e ANSWER: True 52. International diversification is a strategy through which a firm expands the sale of its goods and services across Copyright Cengage Learning. Powered by Cognero. Downloaded by Linh B?o (baolinhsjk@gmail.com) Page 8 lOMoARcPSD|15703194 Name : Clas s: Dat e: Chapter 08: International Strategy borders of global regions and countries into a potentially large number of geographic locations of markets. Instead of entering one or a few markets, international diversification means that the firm enters multiple markets. a. True b. Fals e ANSWER: True 53. The chief risks in the international environment are political and cultural. a. True b. Fals e ANSWER: Fals e 54. Fluctuation in the value of different currencies is a major economic risk associated with international diversification. a. True b. Fals e ANSWER: True 55. A U.S. manufacturer of pigments for household paint that exports about 40 percent of its production to European markets will find its sales will be harmed by a weak dollar. a. True b. Fals e ANSWER: Fals e 56. An increase in the value of the U.S. dollar is an example of an economic risk in that it can reduce the value of U.S. multinational firms' international assets and earnings in other countries. a. True b. Fals e ANSWER: True 57. Some of the costs incurred by firms pursuing international diversification may derive from higher coordination expenses, trade barriers, and lack of familiarity with local cultures. a. True b. Fals e ANSWER: True 58. Although leaders in Russia have tried to reassure potential investors about their property rights, political risks in the form of weak laws and commonplace government corruption make firms leery of investing in Russia. a. True b. Fals Copyright Cengage Learning. Powered by Cognero. Downloaded by Linh B?o (baolinhsjk@gmail.com) Page 9 lOMoARcPSD|15703194 Name : Clas s: Dat e: Chapter 08: International Strategy e ANSWER: True 59. The amount of diversification in a firm's international operations that can be managed varies from company to company and is affected by managers' abilities to deal with ambiguity and complexity. a. True b. Fals e ANSWER: True Multiple Choice 60. International strategy refers to a(n): a. action plan pursued by American companies to compete against foreign companies operating in the United States. b.strategy through which the firm sells products in markets outside the firm's domestic market. c. political and economic action plan developed by businesses and governments to cope with global competition. d.strategy American firms use to dominate international markets. ANSWER: b 61. Raymond Vernon states that the classic rationale for international diversification is to: a. pre-emptively dominate world markets before foreign companies can establish dominance. b. avoid domestic governmental regulation. c. extend the product's life cycle. d. avoid international governmental regulation. ANSWER: c 62. Which of the following is NOT an incentive for firms to become multinational? a. To gain access to consumers in emerging markets b. To gain easier access to raw materials c. To avoid high domestic taxation on corporate income d. Opportunities to integrate operations on a global scale ANSWER: c 63. The increased pressures for global integration of operations have been driven mostly by: a. new low-cost entrants. b. increasing demand for similar products. c. increased levels of joint ventures. d. the rise of governmental regulation. Copyright Cengage Learning. Powered by Cognero. Downloaded by Linh B?o (baolinhsjk@gmail.com) Page 10 lOMoARcPSD|15703194 Name : Clas s: Dat e: Chapter 08: International Strategy ANSWER: b 64. The benefits of expanding into international markets include each of the following opportunities EXCEPT: a. increasing the size of the firm's potential markets. b. economies of scale and learning. c. location advantages. d. favorable tax concessions and economic incentives by home-country governments. ANSWER: d 65. U.S. companies moving into the international market need to be sensitive to the need for local country or regional responsiveness because of: a. increasing rejection of American culture across much of the world. b. the sophistication of the international consumer because of the Internet. c. consumer needs, political and legal structures, and social norms vary by country. d. the increasing loss of economies of scale. ANSWER: c 66. Which of the following is NOT a factor pressuring companies for local responsiveness? a. Differences in employment laws b. Customization due to cultural differences c. Government pressure for firms to use local sources for procurement d. Availability of low labor costs ANSWER: d 67. U.S. cola companies entered the global market because of: a. limited growth opportunities in their domestic market. b. lower labor costs in the emerging markets. c. economies of scale that offset research and development costs. d. an increase in the return on investment from their U.S. bottling plants. ANSWER: a 68. Moving into international markets is a particularly attractive strategy to firms whose domestic markets: a. demand a differentiation strategy for success. b. are limited in opportunities for growth. c. have developed unfriendly business attitudes toward the industry. d. have too much regulation. ANSWER: b 69. Working in multiple international markets can provide firms with __________ perhaps even in terms of __________. a. location advantages; larger markets b. research and development activities; larger markets Copyright Cengage Learning. Powered by Cognero. Downloaded by Linh B?o (baolinhsjk@gmail.com) Page 11 lOMoARcPSD|15703194 Name : Clas s: Dat e: Chapter 08: International Strategy c. new learning opportunities; research and development activities d. economies of scale and learning; larger markets ANSWER: c 70. Firms able to standardize the processes used to produce, sell, distribute, and service their products across country borders enhance their ability to: a. learn how to continuously reduce costs while increase the value of their products. b. increase investment in research and development. c. access to a low-cost labor force in the host market. d. mitigate cultural differences. ANSWER: a 71. Firms with core competencies that can be exploited across international markets are able to: a. achieve synergies and produce high-quality goods at lower costs. b. enter new markets more quickly. c. enhance their market image and brand loyalty among local consumers. d. meet local government requirements more quickly than their international competitors. ANSWER: a 72. The location advantages associated with locating facilities in other countries can include all of the following EXCEPT: a. low-cost labor. b. access to critical supplies. c. access to customers. d. evasion of host country governmental regulations. ANSWER: d 73. Factors of production in Porter's model of international competitive advantage include all of the following EXCEPT: a. labor. b. capital. c. infrastructure . d. technology. ANSWER: d 74. In Porter's model, if a country has both ________ and __________ production factors, it is likely to serve an industry well by spawning strong home-country competitors that can also be successful global competitors. a. basic; advanced b. advanced; generalized c. basic; generalized Copyright Cengage Learning. Powered by Cognero. Downloaded by Linh B?o (baolinhsjk@gmail.com) Page 12 lOMoARcPSD|15703194 Name : Clas s: Dat e: Chapter 08: International Strategy d. advanced; specialized ANSWER: d 75. Japan, due to a lack of undeveloped land, would be an unusual choice of location for a U.S. cattle company to set up local grazing operations. This limiting factor would be identified in what part of Porter's determinants of national advantage? a. Factors of production b. Demand conditions c. Related and supporting industries d. Firm strategy, structure, and rivalry ANSWER: a 76. A fundamental reason for a country's development of advanced and specialized factors of production is often its: a. lack of basic resources. b. monetary wealth. c. small workforce. d. protective tariffs. ANSWER: a 77. The four aspects of Porter's model of international competitive advantage include all of the following EXCEPT: a. factors of production. b. demand conditions. c. political and economic institutions. d. related and supporting industries. ANSWER: c 78. Which pair of industries would NOT be considered as "related and supporting" under Porter's diamond model? a. Japanese cameras and copiers b. Italian leather-processing and shoes c. U.S. computers and software d. highway systems and the supply of debt capital ANSWER: d 79. In France, fine dressmaking and tailoring have been a tradition predating Queen Marie Antoinette. Cloth manufacturers, design schools, craft apprenticeship programs, modeling agencies, and so forth, all exist to supply the clothing industry. This is an example of the ____ in Porter's model. a. strategy, structure, and rivalry among firms b. related and supporting industries c. demand conditions d. factors of production ANSWER: b Copyright Cengage Learning. Powered by Cognero. Downloaded by Linh B?o (baolinhsjk@gmail.com) Page 13 lOMoARcPSD|15703194 Name : Clas s: Dat e: Chapter 08: International Strategy 80. A large domestic market can provide the country's industries a chance at dominating the world market because: a. they have been able to develop economies of scale at home. b. they have access to abundant and inexpensive factors of production. c. the related and supporting industries will have been developed. d. the nation's culture and educational system will be adapted to producing the labor force needed for the industry. ANSWER: a 81. In addition to the four basic dimensions of Porter's "diamond" model, ____ may also contribute to the success or failure of firms. a. national work ethic b. educational requirements c. government policy d. national pride ANSWER: c 82. All of the following are correct about what managers should know about firms based in a country with a national competitive advantage EXCEPT: a. success is not guaranteed as the firm implements its chosen international businesslevel strategy. b. the actual strategic choices made are most compelling reasons for success or failure. c. success is guaranteed as the firm implements its chosen international business-level strategy. d. the determinants of national competitive advantage provide a foundation for a firm's competitive advantages. ANSWER: c 83. All of the following are international corporate-level strategies EXCEPT the ____ strategy. a. multidomestic b. universal c. global d. transnational ANSWER: b 84. International corporate-level strategy focuses on: a. the scope of operations through both product and geographic diversification. b. competition within each country. c. economies of scale. d. sophistication of monitoring and controlling systems. ANSWER: a Copyright Cengage Learning. Powered by Cognero. Downloaded by Linh B?o (baolinhsjk@gmail.com) Page 14 lOMoARcPSD|15703194 Name : Clas s: Dat e: Chapter 08: International Strategy 85. Effectively implementing the ________ international corporate-level strategy often produces higher performance than does implementing either the _______ or _________ strategies. a. multi-domestic; global; transnational b. global; multi-domestic; transnational c. cost leadership; differentation; focus d. transnational; multi-domestic; global ANSWER: d 86. A multi-domestic corporate-level strategy is one in which: a. a corporation chooses not to compete internationally but where there are a number of international competitors in the firm's local marketplace. b.the firm produces a standardized product, but markets it differently in each country in which it competes. c. the firm customizes the product for each country in which it competes. d.the firm competes in a number of countries, but it is centrally coordinated by the home office. ANSWER: c 87. A multi-domestic corporate-level strategy has ____ need for global integration and ____ need for local market responsiveness. a. low; low b. low; high c. high; low d. high; high ANSWER: b 88. A global corporate-level strategy differs from a multi-domestic corporate-level strategy in that in a global strategy: a. competitive strategy is dictated by the home office. b. competitive strategy is decentralized and controlled by individual strategic business units. c. products are customized to meet the individual needs of each country. d. the firm sells in multiple countries. ANSWER: a 89. A global corporate-level strategy emphasizes: a. differentiated products. b. economies of scale. c. sensitivity to local product preferences. d. decentralizing control and limited monitoring. Copyright Cengage Learning. Powered by Cognero. Downloaded by Linh B?o (baolinhsjk@gmail.com) Page 15 lOMoARcPSD|15703194 Name : Clas s: Dat e: Chapter 08: International Strategy ANSWER: b 90. A global strategy: a. is easy to manage because of common operating decisions across borders. b. achieves efficient operations without sharing resources across country boundaries. c. increases risk because decision making is centralized at the home office. d. lacks responsiveness to local markets. ANSWER: d 91. A global corporate-level strategy assumes: a. efficiency and customization can be achieved simultaneously. b. a rise in income levels across the world. c. increasing levels of cultural differences among nations. d. more standardization of products across country markets. ANSWER: d 92. The transnational strategy is becoming increasingly necessary to compete in international markets for all the following reasons EXCEPT: a. the growing number of competitors heightens the requirements to keep costs down. b.the desire for specialized products to meet consumers' needs. c. differences in culture and institutional environments also require firms to adapt their products and approaches to local environments. d.it is easy to use. ANSWER: d 93. In China, Starbucks is standardizing its operations while simultaneously decentralizing some decision-making responsibility to local levels to meet customers' tastes. Starbucks is following the __________ international corporatelevel strategy. a. transnational b. global c. differentiation d. multidomestic ANSWER: a 94. Increasingly, customers worldwide are demanding emphasis on local requirements and companies require efficiency as global competition increases. This has triggered an increase in the number of firms using the ____ strategy. a. multidomestic b. transnational c. universal d. global ANSWER: b Copyright Cengage Learning. Powered by Cognero. Downloaded by Linh B?o (baolinhsjk@gmail.com) Page 16 lOMoARcPSD|15703194 Name : Clas s: Dat e: Chapter 08: International Strategy 95. The two important environmental trends that influence a firm's choice and use of international corporate-level strategies are _________ and __________. a. culture; geographic scope b. cost; quality c. regionalization; globalization d. liability of foreignness; regionalization ANSWER: d 96. Disney suffered lawsuits in France at Disneyland Paris as a result of the lack of fit between its transferred personnel policies and the French employees charged to enact them. This is an example of: a. the effects of regionalization. b. the risks of a multi-domestic strategy. c. the liability of foreignness. d. the effect of demand conditions. ANSWER: c 97. _________ is the set of costs associated with unfamiliar operating environments; economic, administrative and cultural differences; and the challenges of coordination over distances. a. Transnational risk b. Regionalization c. Liability of foreignness d. International risk ANSWER: c 98. Associations such as the European Union, Organization of American States, and the North American Free Trade Association, encourage: a. global strategies. b. domestication. c. regional strategies. d. nationalization. ANSWER: c 99. A firm may narrow its focus to a specific region of the world: a. because that market is most different from its domestic market and so represents an unexploited "greenfield opportunity" for its products. b.in order to obtain greater economies of scale. c. so that it can better understand the cultures, legal and social norms, and other factors that are important for effective competition in those markets. d.to take advantage of limited protections of intellectual property so that it can manufacture innovative products without restrictions. ANSWER: c Copyright Cengage Learning. Powered by Cognero. Downloaded by Linh B?o (baolinhsjk@gmail.com) Page 17 lOMoARcPSD|15703194 Name : Clas s: Dat e: Chapter 08: International Strategy 100. Skaredykat Inc. is considering initial expansion beyond its home market. The firm has decided not to enter markets that differ greatly from its home market, instead expanding within the twelve-nation region that includes its home country. Which one of these is true? a. The firm is not engaging in international trade. b. The firm is using a regional approach to international expansion. c. The firm will not be able understand the cultures, legal, and social norms of this market. d. Skaredykat is too afraid to implement an international strategy. ANSWER: b 101. Most firms enter international markets sequentially, introducing their ____ first. a. most innovative products b. largest and strongest lines of business c. most generic products, which will be more likely to generate universal product demand, d. products customized to the region ANSWER: b 102. A U.S. manufacturer of adaptive devices for persons with disabilities is considering expanding internationally. It is a fairly small company, but it is looking for growth opportunities. This company should primarily consider the option of: a. licensing. b. exporting. c. a strategic alliance. d. a greenfield venture. ANSWER: b 103. The choices that a firm has for entering the international market include all of the following EXCEPT: a. exporting. b. licensing. c. leasing. d. acquisition . ANSWER: c 104. The problems associated with exporting include: a. merging corporate cultures. b. a partner's incompatibility. c. difficulty in negotiating relationships. d. high transportation costs and the expense of tariffs. ANSWER: d 105. Which of the following is NOT a disadvantage associated with exporting? a. Potential loss of proprietary technologies Copyright Cengage Learning. Powered by Cognero. Downloaded by Linh B?o (baolinhsjk@gmail.com) Page 18 lOMoARcPSD|15703194 Name : Clas s: Dat e: Chapter 08: International Strategy b. High transportation costs c. Loss of control over distribution activities d. Tariffs imposed by local governments ANSWER: a 106. A licensing agreement: a. results in two firms agreeing to share the risks and the resources of a new venture. b. is best way to protect proprietary technology from future competitors. c. allows a foreign firm to purchase the rights to manufacture and sell a firm's products within a host country. d. can be greatly impacted by currency exchange rate fluctuations. ANSWER: c 107. Which of the following is NOT a typical disadvantage of licensing? a. Little control over the marketing of the products b. Licensees may develop a competitive product after the license expires c. Lower potential returns than the use of exporting or strategic alliances d. Incompatibility of the licensing partners ANSWER: d 108. All of the following are reasons why firms use international strategic alliances EXCEPT: a. sharing of risks and resources. b. alliances facilitate the development of new capabilities. c. learning new competencies particularly those related to technology. d. strategic alliances are easy to manage. ANSWER: d 109. One of the primary reasons for failure of cross-border strategic alliances is: a. the incompatibility of the partners. b. conflict between legal and business systems. c. security concerns and terrorism. d. high debt financing. ANSWER: a 110. If conflict in a strategic alliance or joint venture is not manageable, a(n) _______may be a better option. a. licensing strategy b. exporting strategy c. acquisition d. new wholly owned subsidiary ANSWER: c Copyright Cengage Learning. Powered by Cognero. Downloaded by Linh B?o (baolinhsjk@gmail.com) Page 19 lOMoARcPSD|15703194 Name : Clas s: Dat e: Chapter 08: International Strategy 111. Which of the following is NOT a disadvantage of international acquisitions? a. They are very expensive and often require debt financing. b. The acquiring firm has to deal with the regulatory requirements of a host country. c. Merging the acquired and acquiring firm is difficult. d. It is the slowest way to enter a new market. ANSWER: d 112. The means of entry into international markets that offers the greatest control is: a. licensing. b. acquisitions. c. joint ventures. d. greenfield ventures. ANSWER: d 113. Which of the following is an advantage associated with greenfield ventures? a. Governmental support and subsidies in the host country b. The lower cost of this type of venture c. The level of control over the firm's operations d. The lower level of risks involved ANSWER: c 114. If intellectual property rights in an emerging economy are not well-protected, the number of firms in the industry is rapidly growing, and the need for global integration is high, ____ is the preferred entry mode. a. exporting b. strategic alliance c. a joint venture or wholly owned subsidiary d. licensing ANSWER: c 115. The decision of what entry mode to use is primarily based on all of the following factors EXCEPT: a. the industry's competitive conditions. b. the country's situation and government policies. c. the worldwide economic situation. d. the firm's unique set of resources, capabilities, and core competencies. ANSWER: c 116. When a firm INITIALLY becomes internationally diversified, its returns: a. remain stable. b. decrease. c. become more variable. Copyright Cengage Learning. Powered by Cognero. Downloaded by Linh B?o (baolinhsjk@gmail.com) Page 20 lOMoARcPSD|15703194 Name : Clas s: Dat e: Chapter 08: International Strategy d. increase. ANSWER: b 117. An international diversification strategy is one in which a firm: a. expands into nearby markets. b. expands into a potentially large number of geographic locations and markets. c. expands into one or a few markets. d. acquires a firm in a foreign country. ANSWER: b 118. Internationally diversified firms: a. earn greater returns on their innovations through larger or more numerous markets. b. are more likely to produce below-average returns for investors in the long run. c. may need to decrease international activities when domestic profits are poor. d. are generally unable to achieve high levels of synergy because of differences in cultures. ANSWER: a 119. Bunyan Heavy Equipment, a U.S. firm, is investigating expanding into Russia using a greenfield venture. The committee researching this project has delivered a negative report. The MAIN concern of the committee is probably: a. loss of intellectual property due to Russian piracy. b. the fluctuation in the value of the ruble. c. the numerous and conflicting legal authorities in Russia. d. Russia's recent actions to gain state control of private firms' assets. ANSWER: d 120. Terrorism creates an economic risk for firms, which: a. reduces the amount of investment foreign companies will make in a country perceived to be terror-prone. b.is created by governmental bans on doing business with terrorist regimes. c. is offset by the above-average returns for firms that have learned how to operate in such an environment. d.is absorbed by firms that are highly geographically diversified and that operate in both secure and insecure locations. ANSWER: a 121. Arkadelphia Polymers, Inc., earns 60 percent of its revenue from exports to Europe and Asia. The CEO of the company would be: a. concerned if the value of the dollar strengthened. b.pleased if the value of the dollar strengthened. c. unconcerned about the fluctuation in the value of the dollar because the company is widely diversified geographically. d.likely to consider moving to international strategic alliances or acquisitions if the value Copyright Cengage Learning. Powered by Cognero. Downloaded by Linh B?o (baolinhsjk@gmail.com) Page 21 lOMoARcPSD|15703194 Name : Clas s: Dat e: Chapter 08: International Strategy of the dollar fell and remained low. ANSWER: a 122. The positive results associated with increasing international diversification have been shown to: a. continue as the level of international diversification increases. b. level off and become negative as diversification increases past some point. c. become negative quickly. d. be centered in only one or two industries. ANSWER: b 123. All of the following complicate the implementation of an international diversification strategy EXCEPT: a. widespread multilingualism. b. increased costs of coordination between business units. c. cultural diversity. d. logistical costs. ANSWER: a Essay 124. What are the incentives for firms to use international strategies? What are the three basic benefits firms can derive by moving into international markets? ANSWER One reason is to extend the life cycle of the firm's products. Gaining access to needed : and potentially scarce resources is another reason. There is also pressure for global integration of operations, driven by growing universal product demand. Companies also want to take advantage of opportunities to better use rapidly developing technologies such as the Internet and mobile applications, which permit greater integration of trade, capital, and culture. Finally, the potential of large demand for goods and services for people in emerging markets is an important incentive. When firms successfully move into international markets, they can experience: increased market size, economies of scale and learning, and location advantages. 125. What are the three basic benefits of international strategies? ANSWER Firms derive three basic benefits by successfully using international strategies: (1) : increased market size, (2) economies of scale and learning, and (3) advantages of location. Increased market size is achieved by expansion beyond the firm's home country. International expansion increases the number of potential customers a firm may serve. Starbucks is a firm that has increased its market size through international expansion (Opening Case). Other firms such as Coca Cola and PepsiCo have moved into international markets primarily because of limited growth opportunities in their domestic markets. Economies of scale and learning is a second benefit. Leveraging a technology beyond the home country allows for more units to be sold and initial investments recovered more quickly. Rivals Airbus and Boeing have multiple manufacturing facilities and outsource some activities in order to gain scale advantages. Lastly, advantages of location can be realized through internationalization. These advantages include access to low-cost labor, critical resources, or customers. Copyright Cengage Learning. Powered by Cognero. Downloaded by Linh B?o (baolinhsjk@gmail.com) Page 22 lOMoARcPSD|15703194 Name : Clas s: Dat e: Chapter 08: International Strategy 126. Discuss the three international corporate-level strategies. On what factors are these strategies based? ANSWER International corporate strategy focuses on the scope of a firm's operations through : both product and geographic diversification. The three basic international corporatelevel strategies vary on the need for local responsiveness to the market and the need for global integration. The multi-domestic strategy focuses on competition within each country in which the firm operates. Firms employing a multi-domestic strategy decentralize strategic and operating decisions to the strategic business units operating in each country so business units can customize their goods and services to the local market. The use of global integration in this strategy is low. The global strategy assumes more standardization of product demand across country boundaries. Therefore, competitive strategy is centralized and controlled by the home office, placing high emphasis on global integration of operations. The strategic business units in each country are interdependent and the home office integrates these businesses. The firm offers standardized products across country markets. It emphasizes economies of scale and the opportunity to use innovations developed in one nation to other markets. The transnational strategy seeks to achieve both global efficiency (through global integration) and local responsiveness. This strategy is difficult to implement. One goal requires global coordination while the other requires local flexibility. Flexible coordination builds a shared vision and individual commitment through an integrated network. The effective implementation of the transnational strategy often produces higher performance than either of the other corporate-level strategies. 127. Identify and describe the modes of entering international markets. What are their advantages and disadvantages? ANSWER Firms may enter international markets in any of five ways: exporting, licensing, : forming strategic alliances, making acquisitions, and establishing new, wholly owned subsidiaries (greenfield ventures). Most firms, particularly small ones, begin with exporting (marketing and distributing their products abroad). This involves high transportation costs and possibly tariffs. An exporter has less control over the marketing and distribution of the product than in other methods of entering the international market. In addition, the exporter must pay the distributor or allow the distributor to add to the product price in order to offset its costs and earn a profit. In addition, the strength of the dollar against foreign currencies is a constant uncertainty. But, the advantages are that the company does not have the expense of establishing operations in the host countries. The Internet makes exporting easier than in previous times. Licensing (selling the manufacturing and distribution rights to a foreign firm) is also popular with smaller firms. The licenser is paid a royalty on each unit sold by the licensee. The licensee takes the risks and makes the financial investments in manufacturing and distributing the product. It is the least costly way of entering international markets. It allows a firm to expand returns based on a previous innovation. But there are disadvantages. Licensing provides the lowest returns, because they must be shared between the licensee and the licensor. Licensing gives the licenser less control over the manufacturing and marketing process. There is the risk that the licensee will learn the technology and become a competitor when the original license expires. If the licenser later wishes to use a different ownership arrangement, the licensing arrangement make create some inflexibility. Strategic alliances involve sharing risks and resources with another firm in the host country. The host country partner knows the local conditions; the expanding firm has the technology or other capabilities. Both partners typically enter an alliance in order to learn new capabilities. The partnership allows the entering firm to gain access to a new market and avoid paying tariffs. The host-country firm gains access to new technology and innovative Copyright Cengage Learning. Powered by Cognero. Downloaded by Linh B?o (baolinhsjk@gmail.com) Page 23 lOMoARcPSD|15703194 Name : Clas s: Dat e: Chapter 08: International Strategy products. Equity-based alliances are more likely to produce positive gains. Alliances work best in the face of high uncertainty and where cooperation is needed between partners and strategic flexibility is important. But, many alliances fail due to incompatibility and conflict between the partners. Cross-border acquisitions provide quick access to a new market, but they are expensive and involve complex negotiations. Cross-border acquisitions have all the problems of domestic acquisitions with the complication of a different culture, legal system and regulatory requirements. Acquisitions are expensive and usually involve debt-financing. The most expensive and risky means of entering a new international market is through the establishment of a new, wholly owned subsidiary or greenfield venture. Alternatively, it provides the advantages of maximum control for the firm and, if successful, potentially the greatest returns as well. This alternative is suitable for firms with strong intangible capabilities and/or proprietary technology. The risks are high because of the challenges of operating in an unfamiliar environment. The company must build new manufacturing facilities, establish distribution networks, and learn and implement new marketing strategies. 128. Discuss the effect of international diversification on a firm's returns. ANSWER Research shows that returns vary as the level of diversification increases. At first, : returns decrease, then as the firm learns to manage the diversification, returns increase. But, as diversification increases past some point, returns level off and become negative. Firms that are broadly diversified in international markets usually receive the most positive stock returns, especially when they diversify geographically into core business areas. International diversification can lead to economies of scale and experience, location advantages, increased market size, and the potential to stabilize returns (which reduces the firm's overall risk). International diversification improves a firm's ability to increase returns from innovation before competitors can overcome the initial competitive advantage. In addition, as firms move into international markets, they are exposed to new products and processes that stimulate further innovation. The amount of international diversification that can be managed varies from firm to firm and according to the abilities of the firm's managers. The problems of central coordination and integration are mitigated if the firm diversifies into more friendly countries that are geographically and culturally close. 129. Identify and describe the major risks of international diversification. ANSWER International diversification carries multiple risks. The major risks are political and : economic. Political risks are related to governmental instability and to war. Instability in a government creates economic risks and uncertainty created by government regulation. Governmental instability can result in the existence of many potentially conflicting legal authorities, corruption, and the risk of nationalization of company assets. Economic risks are related to political risks. Economic risks include the increased trend of counterfeit products and the lack of global policing of these products. Another economic risk is the perceived security risk of a foreign firm acquiring firms that have key natural resources or firms that may be considered strategic in regard to intellectual property. In addition, differences in and fluctuations of the value of different currencies is another economic risk. The security risk created by terrorism prevents U.S. firms from investing in some regions. The relative strength or weakness of the dollar affects international firms' competitiveness in certain markets and their returns. Copyright Cengage Learning. Powered by Cognero. Downloaded by Linh B?o (baolinhsjk@gmail.com) Page 24