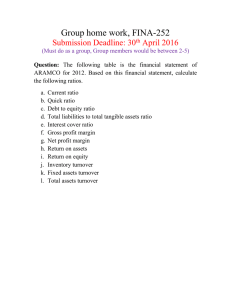

Chapter 03: Financial Analysis Chapter 3 Financial Analysis Discussion Questions 3-1. If we divide users of ratios into short-term lenders, long-term lenders, and stockholders, in which ratios would each group be most interested, and for what reasons? Short-term lenders–liquidity ratios because their concern is with the firm’s ability to pay short-term obligations as they come due. Long-term lenders–leverage ratios because they are concerned with the relationship of debt to total assets. They also will examine profitability to insure that interest payments can be made. Stockholders–profitability ratios, with secondary consideration given to debt utilization, liquidity, and other ratios. Since stockholders are the ultimate owners of the firm, they are primarily concerned with profits or the return on their investment. 3-1 Chapter 03: Financial Analysis 3-2. Explain how the Du Pont system of analysis breaks down return on assets. Also explain how it breaks down return on stockholders’ equity. The Du Pont system of analysis breaks out the return on assets between the profit margin and asset turnover. Return on Assets Net income Total assets = Profit Margin Net income Sales × Asset Turnover Sales Total assets In this fashion, we can assess the joint impact of profitability and asset turnover on the overall return on assets. This is a particularly useful analysis because we can determine the source of strength and weakness for a given firm. For example, a company in the capital goods industry may have a high profit margin and a low asset turnover, while a food processing firm may suffer from low profit margins, but enjoy a rapid turnover of assets. The modified form of the Du Pont formula shows: Return on equity = Return on assets investment 1 Debt/Assets This indicates that return on stockholders’ equity may be influenced by return on assets, the debt-to-assets ratio or a combination of both. Analysts or investors should be particularly sensitive to a high return on stockholders’ equity that is influenced by large amounts of debt. 3-3. If the accounts receivable turnover ratio is decreasing, what will be happening to the average collection period? If the accounts receivable turnover ratio is decreasing, accounts receivable will be on the books for a longer period of time. This means the average collection period will be increasing. 3-2 Chapter 03: Financial Analysis 3-4. What advantage does the fixed charge coverage ratio offer over simply using times interest earned? The fixed charge coverage ratio measures the firm’s ability to meet all fixed obligations rather than interest payments alone, on the assumption that failure to meet any financial obligation will endanger the position of the firm. 3-5. Is there any validity in rule-of-thumb ratios for all corporations, for example, a current ratio of 2 to 1 or debt to assets of 50 percent? No rule-of-thumb ratio is valid for all corporations. There is simply too much difference between industries or time periods in which ratios are computed. Nevertheless, rules-of-thumb ratios do offer some initial insight into the operations of the firm, and when used with caution by the analyst can provide information. 3-6. Why is trend analysis helpful in analyzing ratios? Trend analysis allows us to compare the present with the past and evaluate our progress through time. A profit margin of 5 percent may be particularly impressive if it has been running only 3 percent in the last ten years. Trend analysis must also be compared to industry patterns of change. 3-3 Chapter 03: Financial Analysis 3-7. Inflation can have significant effects on income statements and balance sheets, and therefore on the calculation of ratios. Discuss the possible impact of inflation on the following ratios, and explain the direction of the impact based on your assumptions. a. b. c. d. Return on investment. Inventory turnover. Fixed asset turnover. Debt-to-assets ratio. a. Return on investment Net income Total assets Inflation may cause net income to be overstated and total assets to be understated causing an artificially high ratio that is misleading. b. Inventory turnover Sales Inventory Inflation may cause sales to be overstated. If the firm uses FIFO accounting, inventory will also reflect ―inflation-influenced‖ dollars and the net effect will be nil. If the firm uses LIFO accounting, inventory will be stated in old dollars and too high a ratio could be reported. c. Fixed asset turnover Sales Fixed assets Fixed assets will be understated relative to their replacement cost and to sales and too high a ratio could be reported. d. Debt to total assets Total debt Total assets Since both are based on historical costs, no major inflationary impact will take place in the ratio. 3-4 Chapter 03: Financial Analysis 3-8. What effect will disinflation following a highly inflationary period have on the reported income of the firm? Disinflation tends to lower reported earnings as inflation-induced income is squeezed out of the firm’s income statement. This is particularly true for firms in highly cyclical industries where prices tend to rise and fall quickly. 3-9. Why might disinflation prove to be favorable to financial assets? Because it is possible that prior inflationary pressures will no longer seriously impair the purchasing power of the dollar, lessening inflation also means that the required return that investors demand on financial assets will be going down, and with this lower demanded return, future earnings or interest should receive a higher current evaluation. 3-10. Comparisons of income can be very difficult for two companies even though they sell the same products in equal volume. Why? There are many different methods of financial reporting accepted by the accounting profession as promulgated by the Financial Accounting Standards Board. Though the industry has continually tried to provide uniform guidelines and procedures, many options remain open to the reporting firm. Every item on the income statement and balance sheet must be given careful attention. Two apparently similar firms may show different values for sales, research and development, extraordinary losses, and many other items. Chapter 3 Problems 1. Profitability ratios (LO2) Low Carb Diet Supplement, Inc., has two divisions. Division A has a profit of $100,000 on sales of $2,000,000. Division B is only able to make $25,000 on sales of $300,000. Based on the profit margins (returns on sales), which division is superior? 3-5 Chapter 03: Financial Analysis 3-1. Solution: Low Carb Diet Supplements Division A Net income Sales 2. 3-2. Division B $100,000 $25,000 5% 8.33% 2,000,000 $300,000 Profitability ratios (LO2) Database Systems is considering expansion into a new product line. Assets to support expansion will cost $500,000. It is estimated that Database can generate $1,200,000 in annual sales, with a 6 percent profit margin. What would net income and return on assets (investment) be for the year? Solution: Database Systems Net income = Sales profit margin = $1,200,000 0.06 = $72,000 Return on assets (investment) Net income Total assets $72,000 $500,000 14.4% 3-6 Chapter 03: Financial Analysis 3. 3-3. Profitability ratios (LO2) Polly Esther Dress Shops, Inc., can open a new store that will do an annual sales volume of $960,000. It will turn over its assets 2.4 times per year. The profit margin on sales will be 7 percent. What would net income and return on assets (investment) be for the year? Solution: Polly Esther Dress Shops, Inc. Assets Sales Total asset turnover $960,000 $400,000 2.4 Net income Sales Profit Margin $960,000 0.07 = $67,200 Return on assets (investment) 4. Net income Total assets $67,200 16.8% $400,000 Profitability ratios (LO2) Billy’s Chrystal Stores, Inc., has assets of $5,000,000 and turns over its assets 1.2 times per year. Return on assets is 8 percent. What is the firm’s profit margin (return on sales)? 3-7 Chapter 03: Financial Analysis 3-4. Solution: Billy Crystal Stores, Inc. Sales Assets total asset turnover $6,000,000 $5,000,000 1.2 Net income Assets Return on assets $400,000 $5,000,000 8% Net income $400,000/$6,000,000 = 6.67% Sales 5. 3-5. Profitability ratios (LO2) Elizabeth Tailors, Inc., has assets of $8,000,000 and turns over its assets 2.5 times per year. Return on assets is 9.5 percent. What is the firm’s profit margin (returns on sales)? Solution: Elizabeth Tailors, Inc. Sales Assets total asset turnover $20,000,000 $8,000,000 2.5 Net income Assets Return on assets $760,000 $8,000,000 9.5% Net Income $760,000 / $20,000,000 3.8% Sales 3-8 Chapter 03: Financial Analysis 6. Profitability ratios (LO2) Dr.Zhivago Diagnostics Corp. income statements for 2010 is as follows: Sales .......................................................................................$2,000,000 Cost of goods sold .................................................................. 1,400,000 Gross profit ............................................................................ 600,000 Selling and administrative expense ........................................ 300,000 Operating profit ...................................................................... 300,000 Interest expense ...................................................................... 50,000 Income before taxes ............................................................... 250,000 Taxes (30%) ........................................................................... 75,000 Income after taxes .................................................................. $ 175,000 a. Compute the profit margin for 2010. b. Assume in 2011, sales increase by 10 percent and cost of goods sold increases by 20 percent. The firm is able to keep all other expenses the same. Once again, assume a tax rate of 30 percent on income before taxes. What are income after taxes and the profit margin for 2011? 3-6. Solution: Dr. Zhivàgo Diagnostics a. Profit margin for 2010 Net income $175,000 8.75% Sales $2,000,000 b. Sales .............................................................. $2,200,000* Cost of goods sold ........................................ 1,680,000** Gross profit ................................................... 520,000 Selling and administrative expense .............. 300,000 Operating profit ............................................ 220,000 Interest expense ............................................ 50,000 Income before taxes ..................................... 170,000 Taxes (30%) ................................................. 51,000 Income after taxes (2011)............................. $ 119,000 3-9 Chapter 03: Financial Analysis 3-6. (Continued) * $2,000,000 × 1.10 = $2,200,000 ** $1,400,000 × 1.20 = $1,680,000 Profit Margin for 2011 Net income $119,000 5.41% Sales $2,200,000 7. Profitability ratios (L02) The Haines Corp. shows the following financial data for 2009 and 2010. 2009 $ 2,500,000 1,500,000 1,000,000 205,000 795,000 40,000 755,000 264,250 $490,750 Sales Cost of goods sold Gross Profit Selling & administrative expense Operating Profit Interest expense Income before taxes Taxes (35%) Income after taxes 2010 $3,000,000 1,875,000 1,125,000 210,000 915,000 45,000 870,000 304,500 $565,500 For each year, compute the following and indicate whether it is increasing or decreasing profitability in 2010 as indicated by the ratio. a. b. c. 3-7. Cost of goods sold to sales. Selling and administrative expense to sales. Interest expenses to sales. Solution: 3-10 Chapter 03: Financial Analysis Haines Corp. a. Cost of goods sold Sales 2009 2010 $1,500,000 60.0% 2,500,000 $1,875,000 62.5% 3,000,000 It is decreasing profitability. b. Selling & admin. expense Sales $205,000 $210,000 8.2% 7.0% 2,500,000 3,000,000 It is increasing profitability. Interest expense Sales It is increasing profitability. c. 8. $40,000 $45,000 1.6% 1.5% 2,500,000 3,000,000 Profitability ratios (L02) Neon Light Company has $1,000,000 in assets and $600,000 of debt. It reports net income of $100,000. a. What is the return on the assets? b. What is the return on the stockholders’ equity? c. If the firm has an asset turnover ratio of 3 times, what is the profit margin (return on sales)? 3-8. Solution: Neon Light Company a. Return on assets (investment) Net income Total assets $100,000 10% $1,000,000 3-11 Chapter 03: Financial Analysis b. Return on equity Net income Stockholders' equity Stockholders' equity total assets total debt $1,000,000 $600,000 $400,000 Net income $100,000 25% Stockholders' equity $400,000 OR Return on equity Debt/Assets Return on equity Return on assets (investment) (1 Debt/Assets) $600,000 60% $1,000,000 10% (1 .60) 10% 25% .40 3-8. (Continued) c. Sales total assets total assets turnover $1,000,000 3 $3,000,000 Profit margin Net income $100,000 3.3% Sales $3,000,000 3-12 Chapter 03: Financial Analysis 9. 3-9. Profitability ratios (LO2) Network Communications has total assets of $1,400,000 and current assets of $600,000. It turns over its fixed assets 4 times a year. It has $300,000 of debt. Its return on sales is 5 percent. What is its return on stockholders’ equity? Solution: Network Communications total assets – current assets Fixed assets $1,400,000 600,000 $ 800,000 Sales Fixed assets Fixed asset turnover $3,200,000 $800,000 4 total assets $1,400,000 – debt 300,000 Stockholders’ equity $1,100,000 Net income = Sales profit margin = $3,200,000 5% = $160,000 Net income Stockholders' equity $160,000 14.55% $1,100,000 Return on stockholders' equity 3-13 Chapter 03: Financial Analysis 10. Profitability ratios (LO2) Fondren Machine Tools has total assets of $3,000,000 and current assets of $800,000. It turns over its fixed assets 2.6 times per year. Its return on sales is 6.5 percent. It has $1,200,000 of debt. What is its return of stockholders’ equity? 3-10. Solution: Fondren Machine Tools Total assets – Current assets Fixed assets $3,000,000 800,000 $2,200,000 Sales Fixed assets Fixed asset turnover $5,720,000 $2,200,000 2.6 Net income = Sales profit margin $5,720,000 6.5% = $371,800 Total assets –Debt Stockholders’ equity $3,000,000 1,200,000 $1,800,000 Return on stockholders' equity 11. a. b. Net income Stockholders' equity $371,800 20.66% $1,800,000 Profitability ratios (LO2) Alpha Industries had an asset turnover of 1.4 times per year. If the return on total assets (investment) was 8.4 percent, what was Alpha’s profit margin? The following year, on the same level of assets, Alpha’s assets turnover declined to 1.2 times and its profit margin was 7 percent. How did the return on total assets change from that of the previous year? 3-14 Chapter 03: Financial Analysis 3-11. Solution: Alpha Industries a. Total asset turnover × Profit Margin = Return on Total assets 1.4 × ? = 8.4% Profit margin = b. 1.2 × 7% 8.4% 6.0% 1.4 = 8.4% It did not change at all because the increase in profit margin made up for the decrease in the asset turnover. 12. Du Pont system of analysis (LO3) AllState Trucking Co. has the following ratios compared to its industry for 2010. Return on sales……….. AllState Trucking 3% Industry 8% Return on assets……… 15% 10% Explain why the return-on-assets ratio is so much more favorable than the return-on-sales ratio compared to the industry. No numbers are necessary; a one-sentence answer is all that is required. 3-12. Solution: Allstate Trucking Company Allstate Trucking Company has a higher asset turnover ratio than the industry. Calculations are not necessary to answer the question, but just in case a student did the calculations here is the comparison. 3-15 Chapter 03: Financial Analysis Return on Assets =Asset Turnover Return on Sales 15% 10% vs 3% 8% Allstate’s Turnover 5×vs 1.25×Industry Turnover 13. Du Pont system of analysis (LO3) Front Beam Lighting Company has the following ratios compared to its industry for 2010. Return on assets…………… Front Beam Lighting 12% Industry 5% Return on equity…………… 16% 20% Explain why the return-on-equity ratio is so much less favorable than the return-on-assets ratio compared to the industry. No numbers are necessary; a one-sentence answer is all that is required. 3-13. Solution: Front Beam Lighting Company Front Beam has a lower debt/total assets ratio than the industry. For those who did a calculation, Front Beam’s debt to assets was 25% vs 75% for the industry. 3-16 Chapter 03: Financial Analysis 14. Du Pont system of analysis (LO3) The King Card Company has a return-on-assets (investment) ratio of 12 percent. a. If the debt-to-total-assets ratio is 40 percent, what is the return on equity? b. If the firm had no debt, what would the return-on-equity ratio be? 3-14. Solution: King Card Company a. Return on equity Return on assets (investment) (1 Debt/Assets) 12% (1 0.40) 12% 0.60 20% b. 15. The same as return on assets of 12% because with no debt, the denominator would be 1. Du Pont system of analysis (LO3) Using the Du Pont method, evaluate the effects of the following relationships for the Lollar Corporation. a. Lollar Corporation has a profit margin of 5 percent and its return on assets (investment) is 13.5 percent. What is its assets turnover ratio? b. If the Lollar Corporation has a debt-to-total-assets ratio of 60 percent, what would the firm’s return on equity be? c. What would happen to return on equity if the debt-to-total-assets ratio decreased to 40 percent? 3-15. Solution 3-17 Chapter 03: Financial Analysis Lollar Corporation a. Profit margin Total asset turnover Return on Investment 5% 13.5% ? Total asset turnover Return on assets (investment) (1 Debt/Assets) Return on equity b. 13.5% (1 0.60) Existing return on equity 13.5% 2.7x 5% 13.5% 0.40 33.75% 3-15. (Continued) c. Return on equity Return on assets (investment) (1 Debt/Assets) 13.5% (1 .40) 13.5% 0.60 22.50% 3-18 Chapter 03: Financial Analysis 16. Du Pont system of analysis (LO3) Jerry Rice and Grain Stores has $4,000,000 in yearly sales. The firm earns 3.5 percent on each dollar of sales and turns over its assets 2.5 times per year. It has $100,000 in current liabilities and $300,000 in long-term liabilities. a. What is its return on stockholders’ equity? b. If the asset base remains the same as computed in part a, but total asset turnover goes up to 3, what will be the new return on stockholders’ equity? Assume that the profit margin stays the same as do current and long-term liabilities. 3-16. Solution: Jerry Rice and Grain Stores a. Net income Sales profit margin $4,000,000 3.5% $140,000 Stockholders' equity Total assets Total liabilities Total assets Sales/Total asset turnover $4,000,000/2.5 $1,600,000 Total liabilities Current liabilities Long term liabilities $100,000 $300,000 $400,000 Stockholders' equity $1,600,000 $400,000 $1,200,000 Net income Stockholders' equity $140,000 11.67% $1,200,000 Return on stockholders' equity 3-19 Chapter 03: Financial Analysis 3-16. (Continued) b. The new level of sales will be: Sales Total assets Total asset turnover $1,600,000 3 $4,800,000 Net income Sales Profit margin $4,800,000 3.5% $168,000 Return on stockholders' equity 17. Net income Stockholders' equity $168,000 14% $1, 200,000 Interpreting results from the Du Pont system of analysis (LO3) Assume the following data for Cable Corporation and Multi-Media, Inc. Net income ................................ Sales .......................................... Total assets ................................ Total debt .................................. Stockholders’ equity ................. Cable Corporation $ 30,000 300,000 400,000 150,000 250,000 Mu1ti Media, Inc. $ 100,000 2,000,000 900,000 450,000 450,000 a. Compute return on stockholders’ equity for both firms using ratio 3a. Which firm has the higher return? b. Compute the following additional ratios for both firms. Net income/Sales Net income/Total assets Sales/Total assets Debt/Total assets c. Discuss the factors from part b that added or detracted from one firm having a higher return on stockholders’ equity than the other firm as computed in Part a. 3-20 Chapter 03: Financial Analysis 3-17. Solution: Cable Corporation and Multi-Media, Inc. a. Cable Corporation MultiMedia, Inc. Net income $30,000 12% Stockholders' equity $250,000 $100,000 22.2% $450,000 Multi-Media Inc. has a much higher return on stockholders’ equity than Cable Corporation. 3-17. (Continued) b. Net income Sales Net income Total assets Sales Total assets Debt Total assets Cable Corporation $30,000 10% $300,000 $30,000 7.5% $400,000 $300,000 .75x $400,000 $150,000 37.5% $400,000 MultiMedia, Inc. $100,000 5% $2,000,000 $100,000 11.1% $900,000 $2,000,000 2.2x $900,000 $450,000 50% $900,000 c. As previously indicated, Multi-Media, Inc. has a substantially higher return on stockholders’ equity than Cable Corporation (22.2% versus 12%). The reason is certainly not to be found on return on the sales dollar where Cable Corporation has a higher return than Multi-Media, Inc. (10% vs. 5%). 3-21 Chapter 03: Financial Analysis However, Multi-Media, Inc. has a higher return than Cable Corporation on total assets (11.1% vs 7.5%). The reason is clearly to be found in total asset turnover, which strongly favors Multi-Media, Inc. over Cable Corporation (2.2x versus .75x). This factor alone leads to the higher return on total assets. Multi-Media, Inc.’s superior return on stockholders’ equity is further enhanced by a higher debt ratio than Cable Corporation (50% vs. 37.5%). This means that a smaller percentage of Multi-Media, Inc.’s total assets are being financed by stockholders’ equity and thus the potentially higher return on stockholders’ equity. 3-17. (Continued) Although not requested in the question, one could show the following: Net income Net income / TotalAssets Stockholders' equity (1- debt/assets) Multi-Media, Inc. = 11.1%(1–.05) = 11.17%/.50 = 22.2% Cable Corporation = 7.5%(1–.375) = 7.5%/.625 = 12% 18. Average collection period (LO2) A firm has sales of $1.2 million, and 10 percent of the sales are for cash. The year-end accounts receivable balance is $180,000. What is the average collection period? (Use a 360-day year.) 3-22 Chapter 03: Financial Analysis 3-18. Solution: Accounts receivable Average daily credit sales ($1,200,000 90%) $180,000 360 days $180,000 $3,000 per day 60 days Average collection period 19. Average daily sales (LO2) The Chamberlain Corporation has an accounts receivable turnover equal to 12 times. If accounts receivable are equal to $90,000, what is the value for average daily credit sales? 3-19. Solution: Chamberlain Corporation Average daily credit sales Credit sales 360 To determine credit sales, multiply accounts receivable by accounts receivable turnover. $90,000 12 $1,080,000 Average daily credit sales $1,080,000 $3,000 360 3-23 Chapter 03: Financial Analysis 20. Inventory turnover (LO2) Kamin Corporation has the following financial data for the years 2009 and 2010: 2009 2010 Sales………………………… $4,000,000 $5,000,000 Cost of goods sold…………… 3,000,000 4,500,000 Inventory…………………….. 400,000 500,000 a. Compute inventory turnover based on ratio number 6, Sales/Inventory, for each year. b. Compute inventory turnover based on an alternative calculation that is used by many financial analysts, Cost of goods sold/Inventory, for each year. c. What conclusions can you draw from part a and part b? 3-20. Solution: Kamin Corporation 2009 a. b. Sales Inventory $4,000,000 10x 400,000 Cost of goods sold $3,000,000 7.5x Inventory 400,000 2010 $5,000,000 10x 500,000 $4,500,000 9x 500,000 c. Based on the sales to inventory ratio, the turnover has remained constant at 10x. However, based on the cost of goods sold to inventory ratio, it has improved from 7.5x to 9x. The latter ratio may be providing a false picture of improvement in this example simply because cost of goods sold has gone up as percentage of sales (from 75 percent to 90 percent). Inventory is not really turning over any faster. 3-24 Chapter 03: Financial Analysis 3-20. (Continued) Nevertheless, cost of goods sold is used by many analysts in the numerator of the inventory turnover ratio because it is stated on a ―cost‖ basis as is inventory. This is an important theoretical consideration. Nevertheless, the authors prefer to use sales in the numerator of the inventory turnover ratio because that is the procedure used by Dun & Bradstreet, the most widely quoted sources for ratio analysis. Furthermore, for privately traded companies there may be only information available on sales and net cost of goods sold. 21. Turnover ratios (LO2) Jim Short’s Company makes clothing for schools. Sales in 2010 were $4,000,000. Assets were as follows: Cash………………………………………. Accounts receivable………………………. Inventory………………………………….. Net plant and equipment………………….. Total assets…………………………… $ 100,000 800,000 400,000 500,000 $1,800,000 a. Compute the following: 1. Accounts receivable turnover 2. Inventory turnover 3. Fixed asset turnover 4. Total asset turnover b. In 2011, sales increased to $5,000,000 and the assets for that year were as follows: Cash………………………………………... $ 100,000 Accounts receivable……………………….. 900,000 Inventory…………………………………... 975,000 Net plant and equipment…………………... 500,000 Total assets…………………………….. $2,475,000 Once again, compute the four ratios. c. Indicate if there is an improvement or decline in total asset turnover, and based on the other ratios, indicate why this development has taken place. 3-25 Chapter 03: Financial Analysis 3-21. Solution: Jim Short’s Company a. 1. Accounts receivable turnover = Sales/Accounts Receivable $4,000,000 5x 800,000 2. Inventory turnover = Sales/Inventory $4,000,000 10 x 400,000 3-21. (Continued) 3. Fixed asset turnover = Sales/(Net Plant & Equipment) $4,000,000 8x 500,000 4. Total asset turnover = Sales/Total Assets $4,000,000 2.22 x 1,800,000 b. 1. Accounts receivable turnover $5,000,000 5.56 x 900,000 2. Inventory turnover $5,000,000 5.13x 975,000 3. Fixed asset turnover 3-26 Chapter 03: Financial Analysis $5,000,000 10.00 x 500,000 4. Total asset turnover $5,000,000 2.02 x 2,475,000 c. There is a decline in total asset turnover from 2.22 to 2.02. This development has taken place because of the slowdown in inventory turnover (10x down to 5.13x). The other two ratios are slightly improved. 22. Overall ratio analysis (LO2)The balance sheet for the Bryan Corporation is shown below. Sales for the year were $3,040,000, with 75 percent of sales sold on credit. BRYAN CORPORATION Balance Sheet 201X Liabilities and Stockholders’ Equity Assets Cash…………………… $ 50,000 Accounts payable…………….. $220,000 Accounts receivable…... 280,000 Accrued taxes………………… 80,000 Inventory……………… 240,000 Bonds payable 118,000 (long-term)…………………… Plant and equipment…... 380,000 Common stock……………….. 100,000 Paid-in capital………………… 150,000 Retained earnings…………….. 282,000 Total liabilities and Total assets………... $950,000 stockholders’ equity… Compute the following ratios: a. b. c. d. e. Current ratio. Quick ratio. Debt-to-total-assets ratio. Asset turnover. Average collection period. 3-27 $950,000 Chapter 03: Financial Analysis 3-22. Solution: Bryan Corporation a. Current ratio Current assets Current liabilities $570,000 $300,000 1.9x 3-22. (Continued) b. Quick ratio (Current assets inventory) Current liabilities $330,000 $300,000 1.1x c. Total debt Total assets Debt to total assets $418,000 $950,000 44% d. Asset turnover Sales Total assets $3,040,000 $950,000 3.2x 3-28 Chapter 03: Financial Analysis Accounts receivable Average daily credit sales ($3,040,000 0.75) $280,000 360 days $280,000 $6,333 per day Average collection period e. 44.21 days 23. Debt utilization ratios (LO2) The Lancaster Corporation’s income statement is given below. a. What is the times-interest-earned ratio? b. What would be the fixed-charge-coverage ratio? LANCASTER CORPORATION Sales .............................................................................. Cost of goods sold ......................................................... Gross profit ................................................................... Fixed charges (other than interest) ................................ Income before interest and taxes................................... Interest........................................................................... Income before taxes ...................................................... Taxes (35%) .................................................................. Income after taxes ......................................................... $200,000 116,000 84,000 24,000 60,000 12,000 48,000 16,800 $ 31,200 3-23. Solution: Lancaster Corporation a. Income before interest and taxes Interest Times interested earned $60,000 12,000 5x 3-29 Chapter 03: Financial Analysis b. Fixed charge coverage Income before fixed charges and taxes Fixed charges $60,000 24,000 $12,000 24,000 $84,000 $36,000 2.33x 24. Debt utilization and Du Pont system of analysis (LO3) Using the income statement for J. Lo Wedding Gowns, compute the following ratios: a. The interest coverage. b. The fixed charge coverage. The total assets for this company equal $160,000. Set up the equation for the Du Pont system of ratio analysis, and compute the answer to part c below using ratio 2 b on page 59. c. Return on assets (investment). J.LO WEDDING GOWNS Income Statement Sales .............................................................................. Less: Cost of goods sold ............................................ Gross profit ................................................................... Less: Selling and administrative expense .................. Less: Lease expense ................................................... Operating profit* ........................................................... Less: Interest expense ................................................ Earnings before taxes .................................................... Less: Taxes (40%) ...................................................... Earnings after taxes ....................................................... *Equals income before interest and taxes. 3-24. Solution: 3-30 $200,000 90,000 110,000 40,000 10,000 $ 60,000 5,000 $ 55,000 22,000 $ 33,000 Chapter 03: Financial Analysis J. Lo Wedding Gowns a. Times interest earned Income before interest and taxes Interest $60,000 5,000 12x 3-24. (Continued) b. Fixed charge coverage Income before fixed charges and taxes Fixed charges $60,000 10,000 $5,000 10,000 $70,000 $15,000 4.67x c. Return on assets (Investment) Net Income Sales Sales Total assets $33,000 $200,000 $200,000 $160,000 16.5% 1.25x = 20.625% 3-31 Chapter 03: Financial Analysis 25. Debt utilization (LO2) A firm has net income before interest and taxes of $96,000 and interest expense of $24,000. a. What is the times-interest-earned ratio? b. If the firm’s lease payments are $40,000, what is the fixed charge coverage? 3-25. Solution: a. Times interest earned Income before interest and taxes Interest $96,000 $24,000 4x b. IBIT + Before tax fixed charges Interest Fixed charges Fixed charge converage $96,000 $40,000 $24,000 $40,000 $136,000 $64,000 2.13x 26. Return on assets analysis (LO2) In January 2001, the Status Quo Company was formed. Total assets were $500,000, of which $300,000 consisted of depreciable fixed assets. Status Quo uses straight-line depreciation of $30,000 per year, and in 2001 it estimated its fixed assets to have useful lives of 10 years. Aftertax income has been $26,000 per year each of the last 10 years. Other assets have not changed since 2001. a. Compute return on assets at year-end for 2001, 2003, 2006, 2008, and 2010. (Use $26,000 in the numerator for each year.) b. To what do you attribute the phenomenon shown in part a? c. Now assume income increased by 10 percent each year. What effect would this have on your above answers (A comment is all that is necessary.) 3-32 Chapter 03: Financial Analysis 3-26. Solution: Status Quo Company a. Return on assets (investment) = Income after taxes Total Assets The return on assets for Status Quo will increase over time as the assets depreciate and the denominator gets smaller. Fixed assets at the beginning of 2001 equal $300,000 with a ten-year life which means the depreciation expense will be $30,000 per year. Book values at year-end are as follows: 2001 = $270,000; 2003 = $210,000; 2006 = $120,000; 2008 = $ 60,000; 2010 = -0Return on assets (investment) = Income after taxes Current assets + Fixed assets 2001 = $26,000/$470,000 = 5.53% 2003 = $26,000/$410,000 = 6.34% 2006 = $26,000/$320,000 = 8.13% 2008 = $26,000/$260,000 = 10.00% 2010 = $26,000/$200,000 = 13.00% 3-26. (Continued) b. The increasing return on assets over time is due solely to the fact that annual depreciation charges reduce the amount of investment. The increasing return is in no way due to operations. 3-33 Chapter 03: Financial Analysis Financial analysts should be aware of the effect of overall asset age on the return-on-investment ratio and be able to search elsewhere for indications of operating efficiency when ROI is very high or very low. c. 27. As income rises, return on assets will be higher than in part (b) and would indicate an increase in return partially from more profitable operations. Trend analysis (LO4) Jodie Foster Care Homes, Inc., shows the following data: Year 2007 2008 2009 2010 a. b. Net Income $118,000 131,000 148,000 175,700 Total Assets $1,900,000 1,950,000 2,010,000 2,050,000 Stockholders’ Equity $ 700,000 950,000 1,100,000 1,420,000 Total Debt $1,200,000 1,000,000 910,000 630,000 Compute the ratio of net income to total assets for each year and comment on the trend. Compute the ratio of net income to stockholders’ equity and comment on the trend. Explain why there may be a difference in the trends between parts a and b. 3-27. Solution: Jodie Foster Care Homes, Inc. a. Net income Total assets 2007 2008 2009 2010 $118,000/$1,900,000 = 6.21% $131,000/$1,950,000 = 6.72 $148,000/$2,010,000 = 7.36 $175,700/$2,050,000 = 8.57 Comment: There is a strong upward movement in return on assets over the four year period. 3-34 Chapter 03: Financial Analysis b. Net income Stockholders' equity 2007 2008 2009 2010 $118,000/$700,000 = 16.86% $131,000/$950,000 = 13.79 $148,000/$1,100,000 = 13.45 $175,700/$1,420,000 = 12.37 Comment: The return on stockholders’ equity ratio is going down each year. The difference in trends between a and b is due to the larger portion of assets that are financed by stockholders’ equity as opposed to debt. 3-27. (Continued) Optional: This can be confirmed by computing total debt to total assets for each year. Total debt Total assets 2007 2008 2009 2010 63.2% 51.3 45.3 30.7 3-35 Chapter 03: Financial Analysis 28. Trend analysis (LO4) Quantum Moving Company has the following data. Industry information also is shown. Industry Data on Net Income/Total Assets Year 2008 2009 2010 Company Data Net Income $350,000 375,000 375,000 Total Assets $2,800,000 3,200,000 3,750,000 Year 2008 2009 2010 Debt $1,624,000 1,730,000 1,900,000 Total Assets $2,800,000 3,200,000 3,750,000 11.5% 8.4 5.5 Industry Data on Debt/Total Assets 54.1% 42.0 33.4 As an industry analyst comparing the firm to the industry, are you likely to praise or criticize the firm in terms of: a. Net income/Total assets. b. Debt/Total assets. 3-28. Solution: Quantum Moving Company a. Net income/total assets Year 2008 2009 2010 Quantum Ratio 12.5% 11.7% 10.0% Industry Ratio 11.5% 8.4% 5.5% Although the company has shown a declining return on assets since 2008, it has performed much better than the industry. Praise may be more appropriate than criticism. 3-36 Chapter 03: Financial Analysis 3-28. (Continued) b. Debt/total assets Year 2008 2009 2010 Quantum Ratio 58.0% 54.1% 50.7% Industry Ratio 54.0% 42.0% 33.4% While the company’s debt ratio is declining, it is not declining nearly as rapidly as the industry ratio. Criticism may be more appropriate than praise. 29. Analysis by divisions (LO2) The Global Products Corporation has three subsidiaries. Medical Supplies Heavy Machinery Sales ....................................... Net income (after taxes) ......... Assets ..................................... $20,000,000 1,200,000 8,000,000 $5,000,000 190,000 8,000,000 Electronics $4,000,000 320,000 3,000,000 . a. b. c. d. Which division has the lowest return on sales? Which division has the highest return on assets? Compute the return on assets for the entire corporation. If the $8,000,000 investment in the heavy machinery division is sold off and redeployed in the medical supplies subsidiary at the same rate of return on assets currently achieved in the medical supplies division, what will be the new return on assets for the entire corporation? 3-29. Solution: Global Products Corporation a. Net income/sales Medical Supplies 6.0% Heavy Machinery Electronics 3.8% 8.0% The heavy machinery division has the lowest return on sales. 3-37 Chapter 03: Financial Analysis b. Net income/ total assets Medical Heavy Supplies Machinery Electronics 15.0% 2.375% 10.67% The medical supplies division has the highest return on assets. 3-29. (Continued) Corporate net income $1, 200,000 $190,000 $320,000 c. Corporate total assets $8,000,000 $8,000,000 $3,000,000 $1,710,000 $19,000,000 9.0% d. Return on redeployed assets in heavy machinery. 15% x $8,000,000 = $1,200,000 Return on assets for the entire corporation: Corporate net income $1, 200,000 $1, 200,000 $320,000 Corporate total assets $19,000,000 $2,720,000 $19,000,000 14.32% 3-38 Chapter 03: Financial Analysis 30. Analysis by affiliates (LO1) Omni Technology Holding Company has the following three affiliates: Sales ................................. Net income (after taxes) ... Assets ............................... Stockholders’ equity ........ a. b. c. d. e. f. g. Software Personal Computers Foreign Operations $40,000,000 2,000,000 5,000,000 4,000,000 $60,000,000 2,000,000 25,000,000 10,000,000 $100,000,000 8,000,000 60,000,000 50,000,000 Which affiliate has the highest return on sales? Which affiliate has the lowest return on assets? Which affiliate has the highest total asset turnover? Which affiliate has the highest return on stockholders’ equity? Which affiliate has the highest debt ratio? (Assets minus stockholders’ equity equals debt.) Returning to question b, explain why the software affiliate has the highest return on total assets. Returning to question d, explain why the personal computer affiliate has a higher return on stockholders’ equity than the foreign operations affiliate even though it has a lower return on total assets. 3-30. Solution: Omni Technology Holding Company a. Net income/sales Personal Foreign Software Computers Operations 5.0% 3.3% 8.0% The foreign operation affiliate has the highest return on sales. Personal Foreign Software Computers Operations b. Net income/total assets 40.0% 8.0% 13.3% The personal computer affiliate has the lowest return on assets. 3-39 Chapter 03: Financial Analysis 3-30. (Continued) c. Sales/total assets Software 8.0x Personal Foreign Computers Operations 2.4x 1.7x The software affiliate has the highest return on total asset turnover. Personal Foreign Software Computers Operations d. Net income/ Stockholders’ equity 50.0% 20.0% 16.0% The Software affiliate has the highest return on stockholders’ equity. e. Debt/total assets Personal Foreign Software Computers Operations 20.0% 60.0% 16.7% The personal computer affiliate has the highest debt/total assets ratio. f. This is because of its high total asset turnover ratio of 8.0x in part c. g. This is because the personal computer affiliate has a higher debt ratio (60.0%) than the foreign operations affiliate (16.7%). 3-40 Chapter 03: Financial Analysis 31. Inflation and inventory accounting effect (LO5) The Canton Corporation shows the following income statement. The firm uses FIFO inventory accounting. CANTON CORPORATION Income Statement for 2010 Sales ..................................................................... Cost of goods sold ................................................ Gross profit .......................................................... Selling and administrative expense ...................... Depreciation ......................................................... Operating profit .................................................... Taxes (30%) ......................................................... Aftertax income ................................................... a. b. c. $100,000 (10,000 units at $10) 50,000 (10,000 units at $5) 50,000 5,000 10,000 35,000 10,500 $ 24,500 Assume in 2011 the same 10,000-unit volume is maintained, but that the sales price increases by 10 percent. Because of FIFO inventory policy, old inventory will still be charged off at $5 per unit. Also assume selling and administrative expense will be 5 percent of sales and depreciation will be unchanged. The tax rate is 30 percent. Compute aftertax income for 2011. In part a, by what percent did aftertax income increase as a result of a 10 percent increase in the sales price? Explain why this impact took place. Now assume that in 2012 the volume remains constant at 10,000 units, but the sales price decreases by 15 percent from its year 2011 level. Also, because of FIFO inventory policy, cost of goods sold reflects the inflationary conditions of the prior year and is $5.50 per unit. Further, assume selling and administrative expense will be 5 percent of sales and depreciation will be unchanged. The tax rate is 30 percent. Compute the aftertax income. 3-31. Solution: Canton Corporation a. 2011 Sales .................................. Cost of goods sold ............ Gross profit .................... Selling and adm. expense Depreciation ..................... Operating profit ............. Taxes (30%) ..................... After tax income ............ 3-41 $110,000 (10,000 units at $11) 50,000 (10,000 units at $5) $ 60,000 5,500 (5% of sales) 10,000 $ 44,500 $ 13,350 $ 31,150 Chapter 03: Financial Analysis 3-31. (Continued) b. Gain in aftertax income 2011 2010 Increase $31,150 24,500 $6,650 Increase $6,650 27.14% Base value (2010) $24,500 Aftertax income increased much more than sales because of FIFO inventory policy (in this case, the cost of old inventory did not go up at all), and because of historical cost depreciation (which did not change). c. 2012 Sales .................................. Cost of goods sold ............ Gross profit .................... Selling and adm. expense Depreciation ..................... Operating profit ............. Taxes (30%) ..................... After tax income ............ *$11 × 0.85 = $9.35 $93,500 (10,000 units at $9.35*) 55,000 (10,000 units at $5.50) $38,500 4,675 (5% of sales) 10,000 $23,825 $ 7,148 $16,677 The low profits indicate the effect of inflation followed by disinflation. 3-42 Chapter 03: Financial Analysis 32. Using ratios to construct financial statements (LO2) Construct the current assets section of the balance sheet from the following data. (Use cash as a plug figure after computing the other values.) Yearly sales (credit) ..................................................................... Inventory turnover ....................................................................... Current liabilities ......................................................................... Current ratio ................................................................................. Average collection period ............................................................ Current assets: $ Cash......................................................................... ______ Accounts receivable ................................................ ______ Inventory ................................................................. ______ Total current assets ............................................. ______ $420,000 7 times $80,000 2 36 days 3-32. Solution: Inventory = $420,000/7 = $60,000 Current assets = 2 × $80,000 = $160,000 Account rec. = ($420,000/360) x 36 = $42,000 Cash = $160,000 – $60,000 – $42,000 = $ 58,000 Cash ................................ Accounts receivable ....... Inventory ........................ Total current assets $ 58,000 42,000 60,000 $160,000 3-43 Chapter 03: Financial Analysis 33. Using ratios to construct financial statements (LO2) The Shannon Corporation has credit sales of $750,000. Given the following ratios, fill in the balance sheet. Total assets turnover ................................... Cash to total assets ...................................... Accounts receivable turnover ..................... Inventory turnover ...................................... Current ratio ................................................ Debt to total assets ...................................... 2.5 times 2.0 percent 10.0 times 15.0 times 2.0 times 45.0percent SHANNON CORPORATION Balance Sheet 201X Liabilities and Stockholders’ Equity Assets Cash .............................. Accounts receivable ...... Inventory ....................... Total current assets ... Fixed assets .................. Total assets ................ _____ _____ _____ _____ _____ _____ Current debt ............................................. Long-term debt......................................... Total debt .............................................. Net worth ................................................. Total debt and stockholders’ equity ............................ 3-33. Solution: Shannon Corporation Sales/total assets Total assets Total assets = 2.5 times = $750,000/2.5 = $300,000 Cash Cash Cash = 2% of total assets = 2% × $300,000 = $6,000 Sales/accounts receivable Accounts receivable Accounts receivable = 10 times = $750,000/10 = $75,000 Sales/inventory Inventory Inventory = 15 times = $750,000/15 = $50,000 3-44 _____ _____ _____ _____ _____ Chapter 03: Financial Analysis 3-45 Chapter 03: Financial Analysis 3-33. (Continued) Fixed assets Current assets Fixed assets = Total assets – current assets = $6,000 + $75,000 + $50,000 = $131,000 = $300,000 – $131,000 = $169,000 Current assets/current debt Current debt Current debt Current debt =2 = Current assets/2 = $131,000/2 = $65,500 Total debt/total assets Total debt Total debt = 45% = .45 × $300,000 = $135,000 Long-term debt Long-term debt Long-term debt = Total debt – current debt = $135,000 – $65,500 = $69,500 Net worth Net worth Net worth = Total assets – total debt = $300,000 – $135,000 = $165,000 3-46 Chapter 03: Financial Analysis Shannon Corporation Balance Sheet 201X Cash ..................... A/R ...................... Inventory ............. Total current assets Fixed assets ......... Total assets .......... 34. $ 6,000 Current debt ........ $ 75,000 Long-term debt ... $ 50,000 Total debt ........ $ 131,000 $ 169,000 Net worth ............ $ 300,000 Total debt and stockholders’ equity $ 65,500 $ 69,500 $135,000 $165,000 $300,000 Using ratios to determine account balances (LO2) We are given the following information for the Pettit Corporation. Sales (credit) ............................................................. Cash .......................................................................... Inventory .................................................................. Current liabilities ...................................................... Asset turnover .......................................................... Current ratio ............................................................. Debt-to-assets ratio ................................................... Receivables turnover ................................................ $3,000,000 150,000 850,000 700,000 1.25 times 2.50 times 40% 6 times Current assets are composed of cash, marketable securities, accounts receivable, and inventory. Calculate the following balance sheet items. a. Accounts receivable. b. Marketable securities. c. Fixed assets. d. Long-term debt. 3-34. Solution: 3-47 Chapter 03: Financial Analysis Pettit Corporation a. Accounts receivable = Sales/Receivable turnover = $3,000,000/6x = $500,000 b. Marketable securities = Current assets – (cash + accounts rec. + inventory) Current Assets = Current ratio × Current liabilities = 2.5 × $700,000 = $1,750,000 Marketable securities = $1,750,000 – ($150,000 + $500,000 + $850,000) = $1,750,000 – $1,500,000 = $250,000 3-34. (Continued) c. Fixed assets Total assets Fixed assets d. Long-term debt Total debt Long-term debt = Total assets – Current assets = Sales/Asset turnover = $3,000,000/1.25x = $2,400,000 = $2,400,000 – $1,750,000 = $650,000 = Total debt – current liabilities = Debt to assets × total assets = 40% × $2,400,000 = $960,000 = $960,000 – $700,000 = $260,000 3-48 Chapter 03: Financial Analysis 35. Using ratios to construct financial statements (LO2) The following information is from Harrelson, Inc.’s, financial statements. Sales (all credit) were $20 million for 2010. Sales to total assets......................................... Total debt to total assets ................................. Current ratio ................................................... Inventory turnover ......................................... Average collection period .............................. Fixed asset turnover ....................................... 2 times 30% 3.0 times 5.0 times 18 days 5.0 times Fill in the balance sheet: Cash..................................... Accounts receivable ............ Inventory ............................. Total current assets ........... Fixed assets ......................... Total assets ........................ ______ ______ ______ ______ ______ ______ Current debt .......................................... Long-term debt...................................... Total debt ............................................ Equity .................................................... Total debt and equity .......................... 3-35. Solution: Harrelson Inc. Sales/total assets Total assets Total assets =2 = $20 million/2 = $10 million Total debt/total asset Total debt Total debt = 30% = $10 million x .3 = $3 million Sales/inventory Inventory Inventory = 5.0x = $20 million/5x = $4 million Average daily sales = $20 million/360 days = $55,555.55 per day Accounts receivable = 18 days × $55,555.56 = $1 million (or) 3-49 ______ ______ ______ ______ ______ Chapter 03: Financial Analysis 3-35. (Continued) Accounts receivable = $20 million $1,000,000 360 18 Fixed assets = $20 million/5x = $4 million Current assets = Total assets – Fixed assets = $10 million - $4 million = $6 million Cash = Current assets – accounts receivable – inventory = $6 million – $1 million – $4 million = $1 million Current liabilities = Current assets/3 = $6 million/3 = $2 million Long-term debt = Total debt – current debt = $3 million – $2 million = $1 million Equity = Total assets – total debt = $10 million – $3 million = $7 million 3-50 Chapter 03: Financial Analysis 3-35. (Continued) Cash................ Accounts receivable..... Inventory......... Total current assets............ Fixed assets..... Total assets..... 36. $ 1.0 million Current debt.............$ 2.0 million $ 1.0 $ 4.0 Long-term debt............. $ 1.0 Total debt....... $ 3.0 Equity............. $ 7.0 $ 6.0 $ 4.0 $10.0 million Total debt and equity........... $10.0 million Comparing all the ratios (LO2) Using the financial statements for the Snider Corporation, calculate the 13 basic ratios found in the chapter. SNIDER CORPORATION Balance Sheet December 31, 2010 Assets Current assets: Cash...................................................... Marketable securities ........................... Accounts receivable (net) .................... Inventory .............................................. Total current assets ........................... Investments ............................................. Plant and equipment................................ Less: Accumulated depreciation .......... Net plant and equipment ...................... Total assets .............................................. Liabilities and Stockholders’ Equity Current liabilities Account payable................................... Notes payable ....................................... Accrued taxes ....................................... Total current liabilities ...................... Long-term liabilities: 3-51 $ 50,000 20,000 160,000 200,000 $430,000 60,000 600,000 (190,000) 410,000 $900,000 $90,000 70,000 10,000 170,000 Chapter 03: Financial Analysis 3-52 Chapter 03: Financial Analysis Bonds payable ...................................... Total liabilities ..................................... Stockholders’ equity Preferred stock, $50 per value ............. Common stock, $1 par value ............... Capital paid in excess of par ................ Retained earnings ................................. Total stockholders’ equity................. Total liabilities and stockholders’ equity 150,000 $320,000 100,000 80,000 190,000 210,000 580,000 $900,000 SNIDER CORPORATION Income statement For the Year Ending December 31, 2010 Sales (on credit)................................................................................. Less: Cost of goods sold ............................................................... Gross profit ....................................................................................... Less: Selling and administrative expenses .................................... Operating profit (EBIT) .................................................................... Less: Interest expense ................................................................... Earnings before taxes (EBT) ............................................................. Less: Taxes.................................................................................... Earnings after taxes (EAT)................................................................ *Includes $35,000 in lease payments. $1,980,000 1,280,000 700,000 475,000* 225,000 25,000 200,000 80,000 $ 120,000 3-36. Solution: Snider Corporation Profitability ratios Profit margin = $120,000/$1,980,000 = 6.06% Return on assets (investment) = $120,000/$900,000 = 13.3% Return on equity = $120,000/$580,000 = 20.69% Assets utilization ratios 3-53 Chapter 03: Financial Analysis Receivable turnover = $1,980,000/$160,000 = 12.38x Average collection period = $160,000/$5,500 = 29.09 days Inventory turnover = $1,980,000/$200,000 = 9.9x Fixed asset turnover = $1,980,000/$410,000 = 4.83x Total asset turnover = $1,980,000/$900,000 = 2.2x Liquidity ratio Current ratio = $430,000/$170,000 = 2.53x Quick ratio = $230,000/$170,000 = 1.35x Debt utilization ratios Debt to total assets = $320,000/$900,000 = 35.56% Times interest earned = $225,000/$25,000 = 9x Fixed charge coverage = $260,000/$60,000 = 4.33x 37. Ratio computation and analysis (LO2) Given the financial statements for Jones Corporation and Smith Corporation shown here: a. To which one would you, as credit manager for a supplier, approve the extension of (short-term) trade credit? Why? Compute all ratios before answering. b. In which one would you buy stock? Why? JONES CORPORATION Current Assets Cash.............................................. Accounts receivable ..................... Inventory ...................................... Long-Term Assets Fixed assets .................................. Less: Accumulated depreciation Net fixed assets* .......................... Total assets ............................... $ 20,000 80,000 50,000 $500,000 (150,000) 350,000 $500,000 Liabilities Accounts payable .................. Bonds payable (long-term) .... Stockholders’ Equity Common stock ....................... $150,000 Paid-in capital ........................ 70,000 Retained earnings .................. 100,000 Total liab. and equity ........ $500,000 Sales (on credit) ....................................................................................... $1,250,000 Cost of goods sold ................................................................................... 750,000 Gross profit .............................................................................................. 500,000 † Selling and administrative expense ..................................................... 257,000 Less: Depreciation expense .................................................................. 50,000 Operating profit ....................................................................................... 193,000 Interest expense ....................................................................................... 8,000 Earnings before taxes .............................................................................. 185,000 3-54 $100,000 80,000 Chapter 03: Financial Analysis Tax expense ............................................................................................. 92,500 Net income .............................................................................................. $ 92,500 *Use net fixed assets in computing fixed asset turnover. †Includes $7,000 in lease payments. SMITH CORPORATION Current Assets Cash ................................. $ 35,000 Marketable securities ...... 7,500 Accounts receivable ........ 70,000 Inventory ......................... 75,000 Liabilities Accounts payable .................. Bonds payable (long-term) .... Long-Term Assets Fixed assets ..................... $500,000 Less: Accum. dep.......... (250,000) Net fixed assets* ............. 250,000 Total assets ................. $437,500 Stockholders’ Equity Common stock....................... $ 75,000 Paid-in capital ........................ 30,000 Retained earnings .................. 47,500 Total liab. and equity ........... $437,500 $ 75,000 210,000 *Use net fixed assets in computing fixed asset turnover. SMITH CORPORATION Sales (on credit)....................................................................................... $1,000,000 Cost of goods sold ................................................................................... 600,000 Gross profit ............................................................................................. 400,000 Selling and administrative expense†..................................................... 224,000 Less: Depreciation expense .................................................................. 50,000 Operating profit ....................................................................................... 126,000 Interest expense ....................................................................................... 21,000 Earnings before taxes .............................................................................. 105,000 Tax expense............................................................................................. 52,500 Net income .............................................................................................. $ 52,500 †Includes $7,000 in lease payments. 3-37. Solution: Jones and Smith Comparison One way of analyzing the situation for each company is to compare the respective ratios for each. Examining those ratios which would be most important to a supplier or short-term lender and a stockholder. 3-55 Chapter 03: Financial Analysis Jones Corp. 7.4% 18.5% 28.9% 15.63x 23.04 days 25x 3.57x 2.5x 1.5x 1.0x 36% 24.13x 13.33x (200/15) Smith Corp. 5.25% 12.00% 34.4% 14.29x 25.2 days 13.3x 4x 2.29x 2.5x 1.5x 65.1% 6x 4.75x (133/28) Profit margin Return on assets (investments) Return on equity Receivable turnover Average collection period Inventory turnover Fixed asset turnover Total asset turnover Current ratio Quick ratio Debt to total assets Times interest earned Fixed charge coverage Fixed charge coverage calculation 3-37. (Continued) a. Since suppliers and short-term lenders are most concerned with liquidity ratios, Smith Corporation would get the nod as having the best ratios in this category. One could argue, however, that Smith had benefited from having its debt primarily long term rather than short term. Nevertheless, it appears to have better liquidity ratios. b. Stockholders are most concerned with profitability. In this category, Jones has much better ratios than Smith. Smith does have a higher return on equity than Jones, but this is due to its much larger use of debt. Its return on equity is higher than Jones’ because it has taken more financial risk. In terms of other ratios, Jones has its interest and fixed charges well covered and in general its long-term ratios and outlook are better than Smith’s. Jones has asset utilization ratios equal to or better than 3-56 Chapter 03: Financial Analysis Smith and its lower liquidity ratios could reflect better short-term asset management, and that point was covered in part a. Note: Remember that to make actual financial decisions more than one year’s comparative data is usually required. Industry comparisons should also be made. SMITH CORPORATION Sales (on credit) .......................................... Cost of goods sold ....................................... Gross profit .................................................. Selling and administrative expense.......... Less: Depreciation expense ....................... Operating profit ........................................... Interest expense ........................................... Earnings before taxes................................... Tax expense ................................................. Net income ................................................... $1,000,000 600,000 400,000 224,000 50,000 126,000 21,000 105,000 52,500 $ 52,500 Includes $7,000 in lease payments. COMPREHENSIVE PROBLEM Comprehensive Problem 1. Lamar Swimwear (trend analysis and industry comparisons)(LO3) Bob Adkins has recently been approached by his first cousin, Ed Lamar, with a proposal to buy a 15 percent interest in Lamar Swimwear. The firm manufactures stylish bathing suits and sunscreen products. Mr. Lamar is quick to point out the increase in sales that has taken place over the last three years as indicated in the income statement, Exhibit 1. The annual growth rate is 25 percent. A balance sheet for a similar time period is shown in Exhibit 2, and selected industry ratios are presented in Exhibit 3. Note the industry growth rate in sales is only 10 to 12 percent per year. There was a steady real growth of 3 to 4 percent in gross domestic product during the period under study. 3-57 Chapter 03: Financial Analysis Comprehensive Problem 1 (Continued) Exhibit 1 LAMAR SWIMWEAR Income Sheet 201X Sales (all on credit) ............................................. $1,200,000 Cost of goods sold............................................... 800,000 Gross profit ......................................................... $ 400,000 Selling and administrative expense* ................... 239,900 Operating profit (EBIT) ...................................... $ 160,100 Interest expense................................................... 35,000 Net income before taxes ..................................... $ 125,100 Taxes ................................................................... 36,900 Net income .......................................................... $ 88,200 Shares .................................................................. 30,000 $ 2.94 Earnings per share ............................................... * 201Y $1,500,000 1,040,000 $ 460,000 274,000 $ 186,000 45,000 $ 141,000 49,200 $ 91,800 30,000 $ 3.06 201Z $1,875,000 1,310,000 $ 565,000 304,700 $ 260,300 85,000 $ 175,300 55,600 $ 119,700 38,000 $ 3.15 Includes $15,000 in lease payments for each year. Exhibit 2 LAMAR SWIMWEAR Balance Sheet Assets 201X Cash.................................................................... $ 30,000 Marketable securities ......................................... 20,000 Accounts receivable ........................................... 170,000 Inventory ............................................................ 230,000 Total current assets ........................................ $ 450,000 Net plant and equipment .................................... 650,000 Total assets ......................................................... $1,100,000 Liabilities and Stockholders’ Equity Accounts payable ............................................... $ 200,000 Accrued expenses............................................... 20,400 Total current liabilities ................................... $ 220,400 Long-term liabilities........................................... 325,000 Total liabilities ............................................... $ 545,400 Common stock ($2 par) ..................................... 60,000 Capital paid in excess of par .............................. 190,000 Retained earnings ............................................... 304,600 Total stockholders’ equity.............................. $ 554,600 Total liabilities and stockholders’ equity ........... $1,100,000 3-58 201Y 40,000 25,000 259,000 261,000 $ 585,000 765,000 $1,350,000 201Z 30,000 30,000 360,000 290,000 $ 710,000 1,390,000 $ 2,100,000 $ $ $ 310,000 30,000 $ 340,000 363,600 $ 703,600 60,000 190,000 396,400 $ 646,400 $1,350,000 $ 505,000 35,000 $ 540,000 703,900 $ 1,243,900 76,000 264,000 516,100 $ 856,100 $2, 100,000 Chapter 03: Financial Analysis Exhibit 3 Selected Industry Ratios 201X Growth in sales .................................. — Profit margin ...................................... 7.71% Return on assets (investment) ............ 7.94% Return on equity................................. 14.31% Receivable turnover ........................... 9.02X Average collection period .................. 39.9 days Inventory turnover ............................. 4.24X Fixed asset turnover ........................... 1.60X Total asset turnover ............................ 1.05X Current ratio ....................................... 1.96X Quick ratio ......................................... 1.37X Debt to total assets ............................. 43.47% Times interest earned ......................... 6.50X Fixed charge coverage ....................... 4.70X Growth in EPS ................................... — 201Y 10.00% 7.82% 8.86% 15.26% 8.86X 40.6 days 5.10X 1.64X 1.10X 2.25X 1.41X 43.11% 5.99X 4.69X 10.10% 201Z 12.00% 7.96% 8.95% 16.01% 9.31X 38.7 days 5.11X 1.75X 1.12X 2.40X 1.38X 44.10% 6.61X 4.73X 13.30% The stock in the corporation has become available due to the ill health of a current stockholder, who is in need of cash. The issue here is not to determine the exact price for the stock, but rather whether Lamar Swimwear represents an attractive investment situation. Although Mr. Adkins has a primary interest in the profitability ratios, he will take a close look at all the ratios. He has no fast and firm rules about required return on investment, but rather wishes to analyze the overall condition of the firm. The firm does not currently pay a cash dividend, and return to the investor must come from selling the stock in the future. After doing a thorough analysis (including ratios for each year and comparisons to the industry), what comments and recommendations do you offer to Mr. Adkins? 3-59 Chapter 03: Financial Analysis CP 3-1. Solution: Lamar Swimwear 201X Growth in sales (Company) (Industry) Profit margin (Company) 7.35% (Industry) 7.71% Return on assets (Company) 8.02% (Industry) 7.94% Return on equity (Company) 15.90% (Industry) 14.31% Receivable turnover (Company) 7.06x (Industry) 9.02x Average collection (Company) 51.0 days period (Industry) 39.9 days Inventory turnover (Company) 5.22x (Industry) 4.24x Fixed asset turnover (Company) 1.85x (Industry) 1.60x Total asset turnover (Company) 1.09x (Industry) 1.05x Current ratio (Company) 2.04x (Industry) 1.96x Quick ratio (Company) 1.00x (Industry) 1.37x Debt to total assets (Company) 49.58% (Industry) 43.47% Times interest (Company) 4.57x earned (Industry) 6.50x Fixed charge (Company) 3.50x coverage (Industry) 4.70x Growth in E.P.S. (Company) ---(Industry) ---- 3-60 201Y 25% 10% 6.12% 7.82% 6.80% 8.68% 14.20% 15.26% 5.79x 8.86x 62.2 days 40.6 days 5.75x 5.10x 1.96x 1.64 1.11x 1.10x 1.72x 2.25x .95x 1.41x 52.12% 43.11% 4.13x 5.99x 3.35x 4.69x 4.1% 10.1% 201Z 25% 12% 6.38% 7.96% 5.70% 8.95% 13.98% 16.01% 5.21x 9.31x 69.1 days 38.7 days 6.47x 5.11x 1.35x 1.75x 0.89x 1.12x 1.31x 2.40x 0.78x 1.38x 59.23% 44.10% 3.06x 6.61x 2.75x 4.73x 2.9% 13.3% Chapter 03: Financial Analysis CP 3-1. (Continued) Discussion of Ratios While Lamar Swimwear is expanding its sales much more rapidly than others in the industry, there are some clear deficiencies in their performance. These can be seen in terms of a trend analysis over time as well as a comparative analysis with industry data. In terms of profitability, the profit margin is declining over time. This is surprising in light of the 56.25 percent increase in sales over two years (25 percent per year). There obviously are no economies of scale for this firm. Higher costs of goods sold and interest expense appear to be causing the problem. The return-on-asset ratio starts out in 201X above the industry average (8.02 percent versus 7.94 percent) and ends up well below it (5.70 percent versus 8.95 percent) in 201Z. The decline of 2.32 percent for return on assets is serious, and can be attributed to the previously mentioned declining profit margin as well as a slowing total asset turnover (going from 1.09x to 0.89x). Return on equity is higher than the industry average the first year, and then also falls far below it. This decline is particularly significant in light of the progressively larger debt that the firm is using. High debt utilization tends to contribute to high return on equity, but not in this case. There is simply too much deterioration in return on assets translating into low return on equity. The previously mentioned slower turnover of assets can be analyzed through the turnover ratios. A problem can be found in accounts receivable where turnover has gone from 7.06x to 5.21x. This can also be stated in terms of an average collection period that has increased from 51 days to 69.1 days. While inventory turnover has been and remains superior to the industry, the same cannot be said for fixed asset turnover. A decline from 1.85x to 1.35x was caused by an increase in 113.8 percent in fixed assets (representing $740,000). We can summarize the discussion of the turnover ratios by saying that despite a 56.25 percent increase in sales, assets grew even more rapidly causing a decline in total asset turnover from 1.09x to 0.89x. 3-61 Chapter 03: Financial Analysis CP 3-1. (Continued) The liquidity ratios also are not encouraging. Both the current and quick ratios are falling against a stable industry norm of approximately two to one and one to one respectively. The debt to total assets ratio is particularly noticeable in regard to industry comparisons. Lamar Swimwear has gone from being only 6.11 percent over the industry average to 15.13 percent above the norm (59.23 percent versus 44.10 percent). Their heavy debt position is clearly out of line with their competitors. Their downtrend in times interest earned and fixed charge coverage confirms the heavy debt burden on the company. Finally, we see that the firm has a slower growth rate in earnings per share than the industry. This is a function of less rapid growth in earnings as well as an increase in shares outstanding (with the sale of 8,000 shares in 201Z). Once again, we see that the rapid growth in sales is not being translated down into significant earnings gains. This is true in spite of the fact that there is a very stable economic environment. Investment Comments: He would probably have difficulty justifying such an investment based on the performance of the firm. There are no dividend payouts, so return to the investor would have to come in the form of capital appreciation if and when he was able to resell the shares. The prospects, at this point, would not appear to justify the purchase. This is particularly true when one considers that Mr. Adkins would be buying a minority interest (15%) and would not have control of the firm. 3-62 Chapter 03: Financial Analysis Comprehensive Problem 2 Sun Microsystems (trends, ratios stock performance) (LO3) Sun Microsystems is a leading supplier of computer related products, including servers, workstations, storage devices, and network switches. In the letter to stockholders as part of the 2001 annual report, President and CEO Scott G. McNealy offered the following remarks: Fiscal 2001 was clearly a mixed bag for Sun, the industry, and the economy as a whole. Still, we finished with revenue growth of 16 percent—and that’s significant. We believe it’s a good indication that Sun continued to pull away from the pack and gain market share. For that, we owe a debt of gratitude to our employees worldwide, who aggressively brought costs down— even as they continued to bring exciting new products to market. The statement would not appear to be telling you enough. For example, McNealy says the year was a mixed bag with revenue growth of 16 percent. But what about earnings? You can delve further by examining the income statement in Exhibit 1. Also, for additional analysis of other factors, consolidated balance sheet(s) are presented in Exhibit 2 on page 92. 1. Referring to Exhibit 1, compute the annual percentage change in net income per common share-diluted (second numerical line from the bottom) for 1998–1999, 1999–2000, and 2000–2001. 2. Also in Exhibit 1, compute net income/net revenue (sales) for each of the four years. Begin with 1998. 3. What is the major reason for the change in the answer for Question 2 between 2000 and 2001? To answer this question for each of the two years, take the ratio of the major income statement accounts to net revenues (sales). Cost of sales Research and development Selling, general and administrative expense Provision for income tax 4. Compute return on stockholders’ equity for 2000 and 2001 using data from Exhibits 1 and 2. In 2009, Sun Microsystems was acquired by Oracle Corporation. 3-63 Chapter 03: Financial Analysis Comprehensive Problem 2 (Continued) Exhibit 1 SUN MICROSYSTEMS, INC. Summary Consolidated Statement of Income (in millions) 2001 2000 1999 Dollars Dollars Dollars Net revenues ............................................... $18,250 $15,721 $11,806 Costs and expenses: Cost of sales ......................................... 10,041 7,549 5,670 Research and development .................. 2,016 1,630 1,280 Selling, general and administrative ...... 4,544 4,072 3,196 Goodwill amortization ......................... 261 65 19 In-process research and development .. 77 12 121 Total costs and expenses ............................. 16,939 13,328 10,286 Operating Income ....................................... 1,311 2,393 1,520 Gain (loss) on strategic investments ........... (90) 208 – Interest income, net ..................................... 363 170 85 Litigation settlement ................................... – – – Income before taxes .................................... 1,584 2,771 1,605 Provision for income taxes ......................... 603 917 575 Cumulative effect of change in accounting principle, net ..................... (54) – – Net income .................................................. $ 927 $ 1,854 $ 1,030 Net income per common share—diluted .... $ 0.27 $ 0.55 $ 0.31 Shares used in the calculation of net income per common share—diluted ........... 3,417 3,379 3,282 1998 Dollars $9,862 4,713 1,029 2,826 .4 176 8,748 1,114 – 48 – 1,162 407 – $ 755 $ 0.24 3,180 5. Analyze your results to Question 4 more completely by computing ratios 1, 2a, 2b, and 3b (all from this chapter) for 2000 and 2001. Actually the answer to ratio 1 can be found as part of the answer to question 2, but it is helpful to look at it again. What do you think was the main contributing factor to the change in return on stockholders’ equity between 2000 and 2001? Think in terms of the Du Pont system of analysis. 6. The average stock prices for each of the four years shown in Exhibit 1 were as follows: 1998 11 1/4 1999 16 3/4 2000 28 1/2 2001 9 1/2 a. Computer the price/earnings (P/E) ratio for each year. That is, take the stock price shown above and divide by net income per common stock-dilution from Exhibit 1. b. Why do you think the P/E has changed from its 2000 level to its 2001 level? A brief review of P/E ratios can be found under the topic of Price-Earnings Ratio Applied to Earnings per Share in Chapter 2. 3-64 Chapter 03: Financial Analysis Comprehensive Problem 2 (Continued) Exhibit 2 SUN MICROSYSTEMS, INC Consolidated Balance Sheets (in millions) Assets Current assets: Cash and cash equivalents ..................................................................... Short-term investments .......................................................................... Accounts receivable, net allowances of $410 in 2001 and $534 in 2000 ....................................................................................... Inventories.............................................................................................. Deferred tax assets ................................................................................. Prepaids and other current assets ........................................................... Total current assets ............................................................................. Property, plant and equipment, net ............................................................ Long-term investments .............................................................................. Goodwill, net of accumulated amortization of $349 in 2001 and $88 in 2000 ............................................................................................ Other assets, net ......................................................................................... Liabilities and Stockholders’ Equity Current liabilities: Short-term borrowings ........................................................................... Accounts payable ................................................................................... Accrued payroll-related liabilities.......................................................... Accrued liabilities and other .................................................................. Deferred revenues and customer deposits.............................................. Warranty reserve .................................................................................... Income taxes payable ............................................................................. Total current liabilities ........................................................................ Deferred income taxes ............................................................................... Long-term debt and other obligations........................................................ Total debt ............................................................................................ Commitments and contingencies Stockholders’ equity: Preferred stock, $0.001 par value, 10 shares authorized (1 share which has been designated as Series A Preferred participating stock): no shares issued and outstanding ............................................................. Common stock and additional paid-in-capital, $0.00067 par value, 7,200 shares authorized; issued: 3,536 shares in 2001 and 3,495 shares in 2000 ... Treasury stock, at cost: 288 shares in 2001 and 301 shares in 2000 ......... Deferred equity compensation ................................................................... Retained earnings....................................................................................... Accumulated other comprehensive income (loss) ..................................... Total stockholders’ equity ....................................................................... 3-65 2001 2000 $ 1,472 387 $ 1,849 626 2,955 1,049 1,102 969 7,934 2,697 4,677 2,690 557 673 482 6,877 2,095 4,496 2,041 832 $18,181 163 521 $14,152 $ $ 3 1,050 488 1,374 1,827 314 90 5,146 744 1,705 $ 7,595 7 924 751 1,155 1,289 211 209 4,546 577 1,720 $ 6,843 – – 6,238 (2,435) (73) 6,885 (29) 10,586 2,728 (1,438) (15) 5,959 75 7,309 Chapter 03: Financial Analysis $18,181 $14,152 7. The book values per share for the same four years discussed in the preceding question were: 1998 $1.18 1999 $1.55 2000 $2.29 2001 $3.26 a. Compute the ratio of price to book value for each year. b. Is there any dramatic shift in the ratios worthy of note? CP 3-2. Solution Sun Microsystems 1. Percentage change in net income per common share-diluted 1999 1998 $ .31 $ .24 $ .07 +29.2% 2000 1999 $ .55 $ .31 $ .24 +77.4% 2001 2000 $ .27 $ .55 $–.28 –50.9% 2. Profit margin 1998 Net income $755 = Net revenues 9,862 7.66% 1999 2000 2001 $1,030 11,806 $1,854 15,721 $927 18,250 8.72% 11.79% 5.08% 3. Percent of net revenue 2000 Net revenues Cost of sales Research and development S, G, and A Provision for income taxes $15,721 7,549 2001 48.02% $18,250 10,041 55.02% 1,630 4,072 10.37 25.90 2,016 4,544 11.05 24.90 917 5.83 603 3.30 3-66 Chapter 03: Financial Analysis 3-67 Chapter 03: Financial Analysis The main problem between 2000 and 2001 was the increase in cost of sales as a percentage of net revenue (48.02% to 55.02%). CP 3-2. (Continued) 4. Return on stockholders’ equity Net income Stockholders' equity 2000 2001 $1,854 7,309 $ 927 10,586 25.37% 8.76% 2000 2001 5. 1. Net income Net revenues (sales) 11.79% 5.08% 2.a. Net income Total assets 13.1% 5.10% 2.b. Net income Sales Sales Total assets 11.79% 1.11 5.08% 1.00 13.09% 3.b. Return on assets 1 Debt/Assets 13.09% 1 .484 25.37% 3-68 5.08% 5.08% 1 .418 8.73% Chapter 03: Financial Analysis The main contributing factor to the decline in the return on stockholders’ equity (25.37% to 8.73%) was the decline in the profit margin (11.79% vs. 5.08%). The decrease in asset turnover (1.11 to 1.00) made a small contribution to the decline as did the decline in the debt ratio (48.4% to 41.8%). CP 3-2. (Continued) 6.a. P/E = Stock price/net income per common share-diluted (EPS) 1998 1999 2000 2001 Shares prices EPS $11.25 .24 $16.75 .31 $28.50 .55 $9.50 .27 P/E 46.9 51.8 35.2 54.0 b. The sharp decline in performance caused investors to pay a lower multiple for the stock. 7.a. Price to book value = Stock price/book value 1998 1999 2000 2001 Shares prices Book value $11.25 1.18 $16.75 1.55 $28.50 2.29 $9.50 3.26 P/BV 9.53 12.45 2.91 10.81 b. Once again, the sharp fall off in price to book value between 2000 and 2001 can be attributed to the decline in performance (and the impact on the stock prices). Book value was going up, but the ratio declined sharply due to the declining stock prices. 3-69 Chapter 03: Financial Analysis WEB EXERCISE 1. IBM was mentioned in the chapter as having an uneven performance. Let’s check this out. Go to its Web site www.ibm.com, and follow the following steps. Select ―About IBM‖ on the bottom of the page. Select ―Investors‖ (US) on the next page on the right side. Select ―Financial Snapshot‖ on the next page. 2. Click on ―Stock Chart.‖ How has IBM’s stock been doing currently? 3. Click on ―Financial Snapshot.‖ Assuming IBM’s historical Price/Earnings Ratio is 15, how does it currently stand? 4. Assuming its annual dividend yield is 2.5 percent, how does it currently stand? 5. Assuming IBM’s historical ―LT (Long-term Debt/Equity) is 100 percent, how does it currently stand? Generally speaking, is that good or bad? 6. Assuming its historical return on assets is 10 percent, how does it currently stand? Generally speaking, is that good or bad? Note: Occasionally a topic we have listed may have been deleted, updated, or moved into a different location on a Web site. If you click on the site map or site index, you will be introduced to a table of contents which should aid you in finding the topic you are looking for. 3-70