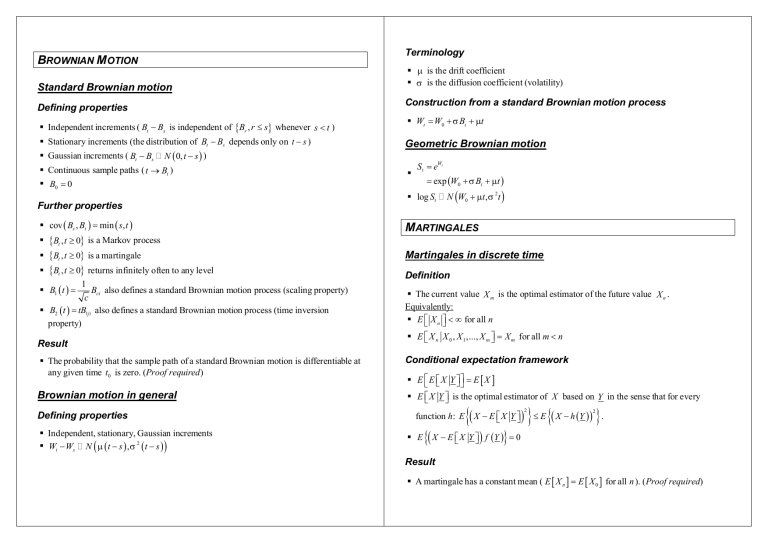

BROWNIAN M OTION

Standard Brownian motion

Defining properties

Terminology

§ µ is the drift coefficient

§ σ is the diffusion coefficient (volatility)

Construction from a standard Brownian motion process

§ Independent increments ( Bt − Bs is independent of {Br , r ≤ s} whenever s < t )

§ Wt = W0 + σ Bt + µt

§ Stationary increments (the distribution of Bt − Bs depends only on t − s )

Geometric Brownian motion

§ Continuous sample paths ( t → Bt )

§ B0 = 0

§

§ Gaussian increments ( Bt − Bs : N ( 0, t − s ) )

Further properties

§ cov ( Bs , Bt ) = min ( s, t )

§

§

§

{Bt , t ≥ 0} is a Markov process

{Bt , t ≥ 0} is a martingale

{Bt , t ≥ 0} returns infinitely often to any level

1

Bct also defines a standard Brownian motion process (scaling property)

§ B1 ( t ) =

c

§ B2 (t ) = tB1 t also defines a standard Brownian motion process (time inversion

property)

Result

§ The probability that the sample path of a standard Brownian motion is differentiable at

any given time t0 is zero. (Proof required)

Brownian motion in general

Defining properties

§ Independent, stationary, Gaussian increments

§ Wt − Ws : N ( µ ( t − s ) , σ 2 ( t − s ) )

St = eWt

= exp (W0 + σ Bt + µt )

§ log St : N (W0 + µt ,σ 2t )

MARTINGALES

Martingales in discrete time

Definition

§ The current value X m is the optimal estimator of the future value X n .

Equivalently:

§ E X n < ∞ for all n

§ E X n X 0 , X 1 ,..., X m = X m for all m < n

Conditional expectation framework

§ E E X Y = E [ X ]

§ E X Y is the optimal estimator of X based on Y in the sense that for every

function h: E

§ E

{( X − E X Y ) } ≤ E {( X − h (Y )) } . (Proof required)

2

2

{( X − E X Y ) f (Y )} = 0 (Proof required)

Result

§ A martingale has a constant mean ( E [ X n ] = E [ X 0 ] for all n ). (Proof required)

Martingales in continuous time

Properties

Definition

t

§ ∫ Ys dBs , t ≥ 0 is a martingale

0

t

§ E ∫ Ys dBs = 0

0

2

t

t

t

§ E ∫ Ys dBs = E ∫ Ys 2ds = ∫ E Ys 2 ds

0

0

0

§ E X t < ∞ for all t

§ E X t Fs = X s for all s < t

Filtration framework

§ The filtration of a stochastic process X t is denoted Ft , and is the set of all events in

the sample space that depend only on X s ,0 ≤ s ≤ t .

§ A random variable Y is Ft -measurable if the event {Y ≤ y} belongs to Ft for all

values of y.

§ A stochastic process Yt , t ≥ 0 is adapted to the filtration Ft if Yt is Ft -measurable for

all t.

0

Definition (general case)

{ }

§ If a sequence of step functions Ys( n) converges to the adapted integrand Ys , then the

t

sequence of integrals ∫ Ys ( n) dBs converges to the limit defined as ∫ Ys dBs .

0

0

t

§ This approach can be used for any Y satisfying E ∫ Ys 2 ds < ∞ .

0

§ The properties of the simple case (above) are preserved.

t

Results

§ E

t

§ The sample paths of ∫ Ys dBs are continuous

{( X − E X F )Y } = 0 for all F -measurable bounded Y

t

t

§ E E X Ft = E [ X ]

§ If X is Ft -measurable, then E X Ft = X

§ If Y is Ft -measurable and bounded, then E XY Ft = Y .E X Ft

§ If X is independent of Ft , then E X Ft = E [ X ]

STOCHASTIC CALCULUS

Ito integrals

Definition (simple case)

Y 0 ≤ s < t1

§ If Ys = 0

, where Y0 is F0 -measurable and Y1 is Ft1 -measurable, then:

Y1 t1 ≤ s ≤ T

t

if t < t1

Y0 Bt

§ ∫ Ys dBs =

0

Y0 Bt1 + Y1 ( Bt − Bt1 ) if t ≥ t1

Ito processes

Definition

A time-homogeneous diffusion (Ito) process has the following defining properties:

§ It is a Markov process

§ It has continuous sample paths

§ There exist functions µ ( x ) and σ 2 ( x ) > 0 such that as h → 0+

E X t +h − X t X t = x = hµ ( x ) + o ( h)

2

E ( X t +h − X t ) X t = x = hσ 2 ( x ) + o ( h )

3

E X t+h − X t X t = x = o (h )

§ Similar to a general Brownian motion, but with variable drift and diffusion

coefficients.

General results

Notation

t

t

0

0

§ An Ito process can be defined in integral notation as: X t = X 0 + ∫ Ys dBs + ∫ Z s ds

§ A shorthand form is to use differential notation: dX t = Yt dBt + Zt dt

t

t

§ M t = exp ∫ f ( s ) dBs − 12 ∫ f 2 ( s ) ds is a martingale

0

0

t

t 2

§ ∫ f ( s ) dBs : N 0, ∫ f ( s ) ds

0

0

Ito’s Lemma

Ornstein-Uhlenbeck process

Lemma for a function of standard Brownian motion

Stochastic differential equation

§ df ( Bt ) = f ′ ( Bt ) dBt + 12 f ′′ ( Bt ) dt

dX t = −γ X t dt + σ dBt

Lemma for a function of a diffusion process and time

∂f ∂f

∂f

∂2 f

§ df ( t , X t ) = Yt dBt + + Zt + 12 2 Yt 2 dt

∂x

∂x

∂t ∂x

§ Define U t = f ( t , X t ) = e γ t X t and use Ito’s lemma to calculate

§ Substitute for dX t and simplify

§ Express in integral form and then convert back to X t

Derivation

§ Taylor’s formula gives: df ( t , X t ) =

§ Substitute dX t = Yt dBt + Zt dt

∂f

∂f

∂2 f

2

dt + dX t + 12 2 ( dX t )

∂t

∂x

∂x

§ Use the fact that ( dt ) = dtdBt = dBt dt = 0 and ( dBt ) = dt

2

2

Geometric Brownian motion

Stochastic differential equation

§ dSt = σ St dBt + α St dt

Process to solve

§ Use Ito’s lemma to calculate d log St

§ Substitute for dSt and simplify

§ Express in integral form and then convert back from logs

Solution

§ St = S0 exp (α − 12 σ 2 ) t + σ Bt

§

(

St

: lognormal (α − 12 σ 2 ) t , σ 2t

S0

)

Process to solve

Solution

t

§ X t = X 0e −γ t + σ ∫ e −γ ( t − s) dBs

0

Properties

σ2

§ X t : N X 0e −γ t , (1 − e −2γ t )

2

γ

§ This process is the continuous equivalent of an AR(1) process.

THE CONTINUOUS TIME LOGNORMAL M ODEL

Definition

§ log Su − log St : N µ ( u − t ) , σ 2 ( u − t ) for u > t

Where:

§ St is the security price at time t

§ µ is the drift

§ σ is the volatility

Equivalently:

§ St = exp (W0 + σ Bt + µ t )

§ log Su = log St + µ ( u − t ) + ε uσ u − t

Momentum effects

§ Evidence of momentum effects is inconsistent with the independent increments

assumption

Non-normality of returns

§ Evidence suggests that there are more days with little or no movement in prices than

would be expected if log returns were normally distributed (higher peak)

§ Evidence suggests that there are more days with very large price movements than

would be expected if log returns were normally distributed (fatter tails)

STOCHASTIC MODELS OF ASSET PRICES ( CONTINUED)

Cross-sectional and longitudinal properties

Properties

Cross-sectional properties

§ Mean and variance of the log returns are proportional to u − t

§ Returns over non-overlapping intervals are assumed to be independent

§ E [ Su ] = St exp ( µ (u − t ) + 12 σ 2 ( u − t ))

§ Looks at the distribution over all simulations at a particular point in time

§ Dependent on the initial conditions

§ var [ Su ] = St2 exp ( 2µ ( u − t ) + σ 2 (u − t ) ) exp (σ 2 ( u − t ) ) − 1

Reasons why it may be inappropriate

Volatility

§ A constant σ is inconsistent with historically observed market volatility

§ Implied volatility in option prices has fluctuated significantly over time

Drift

§ It can be argued that µ should vary over time, particularly with interest rate changes

Mean reversion

§ Evidence of mean-reverting behaviour is inconsistent with the independent increments

assumption

Longitudinal properties

§ Looks at a statistic sampled from a single simulation over a long period of time

§ Based on an average over varying market conditions, not those at a particular date

Random walk

§ Because of the independent increments property, returns are independent over time

§ Cross-sectional and longitudinal simulations coincide (not true of other models)