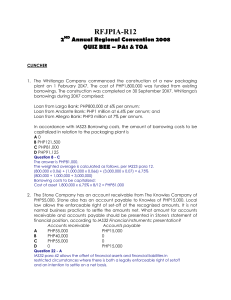

EASY ROUND 1. 2. 3. 4. 5. Which ONE of the following statements best describes the term 'liability'? A An excess of equity over current assets B Resources to meet financial commitments as they fall due C The residual interest in the assets of the entity after deducting all its liabilities D A present obligation of the entity arising from past events Question 1 - D The correct answer is "A present obligation of the entity arising from past events", as defined in para 49(b) of the Framework. Are the following statements true or false, according to IAS1 Presentation offinancial statements? (1) Dividends paid should be recognised in the statement of comprehensive income. (2) A loss on disposal of assets should be recognised in the statement of changes in equity. Statement (1) Statement (2) A False False B False True C True False D True True Question 3 - A A loss on disposal of assets is recognised in the statement of comprehensive income because IAS16 Property, plant and equipment does not permit otherwise (IAS1 para 88). Dividends paid are recognised in the statement of changes in equity (IAS1 para 106). The Oakes Company has a loan due for repayment in six months' time, but Oakes has the option to refinance for repayment two years later. Oakes plans to refinance this loan. In which section of its statement of financial position should this loan be presented, according to IAS1 Presentation of financial statements? (select one answer) A Current liabilities B Current assets C Non-current liabilities D Non-current assets Question 12 - C Because Oakes both has the right to roll over the loan beyond 12 months for the end of the reporting period and intends to roll it over, it should be presented as a non-current liability per para 73 of IAS1. Which TWO of the following should be taken into account when determining the cost of inventories per IAS2 Inventories? A Storage costs of part-finished goods B Trade discounts C Recoverable purchase taxes D Administrative costs Question 1 - A & B The correct answers are trade discounts (deduct these from purchase costs) and storage costs for part-finished (but not finished) goods. See IAS2 paras 11 and 16. Which ONE of the following statements best describes the carrying amount of an asset? A The cost (or an amount substituted for cost) of the asset less its residual value B The amount at which the asset is recognized in the statement of financial position after deducting any accumulated depreciation and accumulated impairment losses C The higher of the asset's net selling price and its value in use D The fair value of the asset at the date of a revaluation less any subsequent accumulated impairment losses 6. 7. 8. 9. 10. Question 3 - B The correct answer is "The amount … in the statement of financial position … after accumulated depreciation and … impairment losses". IAS16 para 6 defines the carrying amount. Which ONE of the following statements best describes the term 'depreciation'? A The systematic allocation of an asset's cost less residual value over its useful life B The removal of an asset from an entity's statement of financial position C The amount by which the recoverable amount of an asset exceeds its carrying amount D The amount by which the carrying amount of an asset exceeds its recoverable amount Question 5 - A "The systematic allocation of an asset's cost…" is the correct answer. See IAS16 para 6 for definitions. The Mirror Company classified a non-current asset accounted for under the cost model as held for sale on 31 December 20X6. Because no offers were received at an acceptable price, Mirror decided on 1 July 20X7 not to sell the asset, but to continue to use it. In accordance with IFRS5 Non-current assets held for sale and discontinued operations, the asset should be measured on 1 July 20X7 at (select one answer) A the lower of its carrying amount and its recoverable amount B the higher of its carrying amount and its recoverable amount C the lower of its carrying amount on the basis that it had never been classified as held for sale and its recoverable amount D the higher of its carrying amount on the basis that it had never been classified as held for sale and its recoverable amount Question 2 - C IFRS5 para 27 in effect requires an entity ceasing to classify an asset as held for sale to remeasure it as if it had never been held for sale, subject to an impairment test (the recoverable amount test) at that date. A brand name that was acquired separately should initially be recognized , according to IAS38 Intangible assets, at (select one answer) A recoverable amount B either cost or fair value at the choice of the acquirer C fair value D cost Question 5 - D IAS38 para 24 states that an intangible asset should be recognised initially at cost. The Naylor Company has determined that it needs to recognise an impairment loss on each of two noncurrent assets; plant and land. The relevant amounts are as follows: Plant Land Original cost CU700,000 CU1,400,000 Previous revaluations Nil CU450,000 Existing carrying amount CU700,000 CU1,850,000 Impairment loss to be recognised in year CU200,000 CU300,000 According to IAS36 Impairment of assets, how should each of the impairment losses be recognised? Plant Land A In profit or loss In profit or loss B In profit or loss In other comprehensive income C In other comprehensive income In profit or loss D In other comprehensive income In other comprehensive income Question 9 - B IAS36 paras 60-61 state that impairment losses on assets that have not been revalued are recognised in profit or loss. Impairment losses on revalued assets are treated as a revaluation decrease. The Snowfinch Company is closing one of its operating divisions, and the conditions for making restructuring provisions in IAS37 Provisions, contingent liabilities and contingent assets have been met. The closure will happen in the first quarter of the next financial year. At the current year end, the company has announced the formal plan publicly and is calculating the restructuring provision. Which ONE of the following costs should be included in the restructuring provision? A Retraining staff continuing to be employed B Relocation costs relating to staff moving to other divisions C Contractually required costs of retraining staff being made redundant from the division being closed D Future operating losses of the division being closed up to the date of closure Question 5 - C IAS37 paras 80-82 require provisions to be made for costs necessarily incurred by the restructuring, but not those relating to the future conduct of the business. AVERAGE ROUND 1. According to IAS29 Financial reporting in hyperinflationary economies, which TWO of the following are monetary items? a. Trade payables b. Inventories c. Administration costs paid in cash d. Loan repayable at par value Question 4 - A & D Monetary items are to be received (or settled) in fixed monetary terms (per IAS29 para 12). This includes trade payables and loans to be repaid at par value. 2. The Hopkins Company is a manufacturing company. The cost per unit of an item of inventory is shown on its card as follows: PHP Materials 30 Production labor costs 33 Production overheads 12 General administration costs 10 Marketing costs 5 According to IAS2 Inventories, what is the value of one completed item of inventory in Hopkins's statement of financial position? a. PHP63 b. PHP85 c. PHP75 d. PHP90 Question 11 - C PHP75 is the correct answer. IAS2 paras 10-12 define the cost of inventory. In this example the cost includes materials, production labor and production overheads, but not general administration or marketing costs. 3. On 1 January 20X8 The Ebro Company commenced trading to provide key skills education facilities in a region identified for technology development. Also on 1 January 20X8, the company received two grants from its government for setting up its operations in this location: Grant (a) – was paid to give financial assistance for start-up costs already incurred. Grant (b) – was paid to subsidize the costs of purchasing computer software over the five-year period. The company is almost certain to keep the facilities operational for the next five years. The company's accounting year end is 31 December. Are the following statements concerning recognition of the income from the two government grants true or false, according to IAS20 Government grants and government assistance? (1) Income from Grant (a) should be recognized in full on receipt in 20X8. (2) Income from Grant (b) should be recognized in full at the end of 5 years. Statement (1) Statement (2) a False False 4. 5. 6. 7. b False True c True False d True True Question 2 - C IAS20 para 20 requires grants for expenditure already incurred to be recognized immediately. Para 12 requires grants such as that for the software to be matched against the related costs, so that grant would be recognized over the five-year period. The Scandium Company is commencing a new construction project, which is to be financed by borrowing. The key dates are as follows: 15 May 20X8 Loan interest relating to the project starts to be incurred 3 June 20X8 Technical site planning commences 12 June 20X8 Expenditures on the project start to be incurred 18 July 20X8 Construction work commences According to IAS23 Borrowing costs, from what date can Scandium commence the capitalization of borrowing costs? a 15 May 20X8 b 3 June 20X8 c 12 June 20X8 d 18 July 20X8 Question 4 - C All relevant conditions in IAS23 para 17 are fulfilled by the date when expenditures on the project start to be incurred. The Palila Company purchased a varnishing machine for PHP150,000 on 1 January 20X7. The company received a government grant of PHP13,500 in respect of this asset. Company policy was to depreciate the asset over 4 years on a straight-line basis and to treat the grant as deferred income. Under IAS20 Government grants and government assistance, what should be the carrying amounts of the machine and the deferred income ("DI") balance at 31 December 20X8? Carrying amount DI balance a PHP75,000 PHP6,750 b PHP112,500 PHP10,125 c PHP81,750 PHP6,750 d PHP75,000 PHP13,500 Question 5 - A Carrying amount PHP75,000, Deferred income PHP6,750 is the correct answer. See IAS20 para 26, where the grant is recognized as income on a systematic and rational basis over the life of the asset. The deferred income in the statement of financial position is reduced each year by the amount credited to profit or loss. The asset is depreciated over its useful life per IAS16. The Coral Company accounts for non-current assets using the cost model. On 20 July 20X7 Coral classified a non-current asset as held for sale in accordance with IFRS5 Non-current assets held for sale and discontinued operations. At that date the asset's carrying amount was PHP14,500, its fair value was estimated at PHP21,500 and the costs to sell at PHP1,450. The asset was sold on 18 October 20X7 for PHP21,200. In accordance with IFRS5, at what amount should the asset be stated in Coral's statement of financial position at 30 September 20X7? A PHP20,050 B PHP21,500 C PHP21,200 D PHP14,500 Question 8 - D IFRS5 para 15 requires that a non-current asset held for sale should be stated at the lower of (i) the carrying amount and (ii) the fair value less costs to sell. The Markab Company has acquired a trademark relating to the introduction of 8. 9. 10. a new manufacturing process. The costs incurred were as follows: Cost of trademark PHP 3,500,000 Expenditure on promoting the new product PHP 50,000 Employee benefits relating to the testing of the proper functioning of the new process PHP 200,000 According to IAS38 Intangible assets, what is the total cost that should be capitalized as an intangible noncurrent asset in respect of the new process? A PHP3,750,000 B PHP3,700,000 C PHP3,500,000 D PHP3,550,000 Question 11 - B IAS38 paras 27-29 specify the costs attributable to a separately acquired intangible asset. This requires the trademark costs and costs of testing to be included. The Dipper Company operates chemical plants. Its published policies include a commitment to making good any damage caused to the environment by its operations. It has always honored this commitment. Which ONE of the following scenarios relating to Dipper would give rise to an environmental provision as defined by IAS37 Provisions, contingent liabilities and contingent assets? a. On past experience it is likely that a chemical spill which would result in Dipper having to pay fines and penalties will occur in the next year b. Recent research suggests there is a possibility that the company's actions may damage surrounding wildlife c. The government has outlined plans for a new law requiring all environmental damage to be rectified d. A chemical spill from one of the company's plants has caused harm to the surrounding area and wildlife Question 11 - D The published policy creates a constructive obligation as defined by IAS37 para 10. The spill is a past event which gives rise to a present obligation and the need for a provision under para 14. The government plans and any chemical spill relate to future events, while the "possible" damage to wildlife gives rise to a contingent liability which should be disclosed. The White Company set up a defined benefit post-employment plan with effect from 1 January 20X7. In the first year the expected return on plan assets was PHP5,000, the actual return on plan assets was PHP4,000, the current service cost was PHP12,000 and White's contributions paid into the plan were PHP7,500. What is the net expense to be recognized in profit or loss for the year ended 31 December 20X7, according to IAS19 Employee benefits? A PHP8,000 B PHP3,500 C PHP7,000 D PHP2,500 Question 11 - C The amounts to be recognized as an expense in profit or loss are the current service cost less the expected return on plan assets. See IAS19 para 61. Note that the difference between the expected and the actual return on plan assets is an actuarial loss, while the employer contributions increase plan assets. The Pinder Company is completing the preparation of its draft financial statements for the year ended 31 May 20X7. On 24 July 20X7, a dividend of PHP175,000 was declared and a contractual profit share payment of PHP35,000 was made, both based on the profits for the year to 31 May 20X7. On 20 June 20X7, a customer went into liquidation having owed the company PHP34,000 for the past 5 months. No allowance had been made against this debt in the draft financial statements. On 17 July 20X7, a manufacturing plant was destroyed by fire, resulting in a financial loss of PHP260,000. According to IAS10 Events after the reporting period, which TWO amounts should be recognized in Pinder's profit or loss for the year to 31 May 20X7 to reflect adjusting events after the end of reporting period? A PHP175,000 dividend B PHP35,000 bonus C PHP34,000 allowance for uncollectible trade receivables D PHP260,000 loss on manufacturing plant Question 7 - B & C The correct answers are PHP35,000 bonus and PHP34,000 allowance. See IAS10 paras 9, 12 and 22. Also, dividends are recognized in the statement of changes in equity, not profit or loss DIFFICULT ROUND 11. During the year ended 31 December 20X8 the following events occurred at The Gosling Company: (1) It was decided to write off PHP80,000 from inventory which was over two years old as it was obsolete. (2) Sales of PHP60,000 had been omitted from the financial statements for the year to 31 December 20X7. According to IAS8 Accounting policies, changes in accounting estimates and errors, how much should be shown as a prior period adjustment in Gosling's financial statements for the year to 31 December 20X8? A PHP60,000 B PHP140,000 C PHP80,000 D PHP20,000 Question 7 - A The correct answer is PHP60,000. IAS8 para 32's list of examples of changes in accounting estimates includes inventory obsolescence. 12. One of the conditions that must be satisfied in order to recognize revenue in a transaction involving the rendering of services is that the stage of completion of the transaction at the end of the reporting period can be measured reliably. Which TWO of the following methods for determining the stage of completion of a contract involving the rendering of services are specifically referred to in IAS18 Revenue, as being acceptable? A Costs incurred to date as a percentage of the estimated total costs of the transaction B Advances received to date as a percentage of the total amount receivable C Surveys of work performed D Revenue to date divided by total contract revenue Question 1 - A & C IAS18 para 24 permits surveys of work performed and costs incurred to date as methods of apportioning revenue on service contracts. 13. How should trade discounts be dealt with when valuing inventories at the lower of cost and net realizable value (NRV) according to IAS2 Inventories? (select one answer) A Added to cost B Ignored C Deducted in arriving at NRV D Deducted from cost Question 7 - D Trade discounts should be deducted from cost. See IAS2 para 11. 14. The Polyphony Company had 100,000 equity shares in issue on 1 January 20X7. On 1 July 20X7 it issued 20,000 new shares by way of a 1 for 5 bonus. On 1 October 20X7 it issued 28,000 new shares for cash at full market price. When calculating basic earnings per share, how many shares should be divided into the profit after tax, according to IAS33 Earnings per share? A 100,000 B 117,000 C 148,000 D 127,000 Question 9 - D The number of shares to be used is the weighted average in issue through the period. Bonus shares provide no additional consideration to the issuer, so 15. 16. 17. they are related back to the beginning of the earliest period presented. Shares issued for cash provide additional consideration, so they are time apportioned from the date the cash was receivable. See IAS33 paras 19 and 26. The weighted average is 100,000 + 20,000 + (28,000 × 3/12) = 127,000. On 1 July 20X7 The Otakamiro Company handed over to a client a new computer system. The contract price for the supply of the system and aftersales support for 12 months was PHP800,000. Otakamiro estimates the cost of the after-sales support at PHP120,000 and it normally marks up such costs by 50% when tendering for support contracts. Under IAS18 Revenue, the revenue Otakamiro should recognize in its financial year ended 31 December 20X7 is A PHP620,000 B PHP800,000 C PHP710,000 D Nil Question 10 - C Under IAS18 Appendix A para 11 a selling price which includes an amount for after-sales support should be split into two components: the support component (being the cost of such support plus a reasonable profit margin) and the sale of goods component (measured as the balance). The support component should be recognized as revenue over the service period. The support component is PHP180,000 (PHP120,000 plus 50%), of which half (PHP90,000) should be recognized in the year ended 31 December 20X7, along with the PHP620,000 (PHP800,000 – PHP180,000) sale of goods component. The Tanager Company purchased a boring machine on 1 January 20X1 for PHP81,000. The useful life of the machine is estimated at 3 years with a residual value at the end of this period of PHP6,000. During its useful life, the expected units of production from the machine are: 20X1 12,000 units 20X2 7,000 units 20X3 5,000 units What should be the depreciation expense for the year ended 31 December 20X2, using the most appropriate depreciation method permitted by IAS16 Property, plant and equipment? A PHP27,000 B PHP21,875 C PHP23,625 D PHP25,000 Question 17 - B The correct answer is PHP21,875. See IAS16 para 56, which indicates that assets are consumed principally through their use. In this example the answer is calculated as (the original cost less the residual value) divided by total units produced in 3 years multiplied by total units produced in 20X2. On 1 January 20X7 The Hamerkop Company borrowed PHP6 million at an annual interest rate of 10% to finance the costs of building an electricity generating plant. Construction commenced on 1 January 20X7 and cost PHP6 million. Not all the cash borrowed was used immediately, so interest income of PHP80,000 was generated by temporarily investing some of the borrowed funds prior to use. The project was completed on 30 November 20X7. What is the carrying amount of the plant at 30 November 20X7? A PHP6,000,000 B PHP6,470,000 C PHP6,520,000 D PHP6,550,000 Question 6 - B See IAS23 para 12. The asset's carrying amount in this example is the PHP6 million construction cost plus the interest charged on the loan for the 11 months of construction (PHP6 million x 10% x 11/12 = PHP550,000, less the 18. 19. 20. PHP80,000 interest earned prior to using the loan to finance construction. The Bentham Company purchased an investment property on 1 January 20X5 for a cost of PHP220,000. The property had a useful life of 40 years and at 31 December 20X7 had a fair value of PHP300,000. On 1 January 20X8 the property was sold for net proceeds of PHP290,000. Bentham uses the cost model to account for investment properties. What is the gain or loss to be recognized in profit or loss for the year ended 31 December 20X8 regarding the disposal of the property, according to IAS40 Investment property? A PHP86,500 gain B PHP81,000 gain C PHP10,000 loss D PHP70,000 gain Question 6 - A The correct answer is the PHP290,000 net disposal proceeds less the PHP203,500 (PHP220,000 less 3/40ths thereof) carrying amount. See IAS40 para 69. The Minor Company leased a freehold building for 20 years, the useful life of the building, with effect from 1 January 20X7. At that date the fair value of the leasehold interest was PHP7.5 million of which PHP6.0 million was attributable to the building. Annual rentals of PHP800,000 are payable in advance on 1 January. How much should Minor recognized as an operating lease expense in the year ended 31 December 20X7, according to IAS17 Leases? A Nil B PHP640,000 C PHP160,000 D PHP800,000 Question 5 - C A land and buildings lease should be separated into its two components: the land component which will usually be classified as an operating lease; and the buildings component which in this case extends to the end of the building's estimated useful life and should be classified as a finance lease. The annual rental is split between the two leases in proportion to the relative fair values of the two leasehold interests. 20% ((PHP7.5 million – PHP6.0 million) as a % of PHP7.5 million) of the rental is attributable to the land, so PHP160,000. See IAS17 paras 14-16. The Rattigan Company purchases PHP20,000 of bonds. The asset has been designated as one at fair value through profit and loss. One year later, 10% of the bonds are sold for PHP4,000. Total cumulative gains previously recognized in Rattigan's financial statements in respect of the asset are PHP1,000. In accordance with IAS39 Financial instruments: recognition and measurement, what is the amount of the gain on disposal to be recognized in profit or loss? A PHP1,900 B PHP900 C PHP2,000 D PHP1,000 Question 27 - A PHP1,900 (PHP4,000 – (10% × (PHP20,000 + PHP1,000))) is the correct answer. IAS39 para 27 states that on derecognition of part of a financial instrument: (a) there shall be an allocation of the carrying amount between the part derecognized and the part retained (b) the difference between the consideration received and the carrying amount allocated to the part derecognized shall be recognized in profit or loss. The previous gains had already been recognized in profit or loss and so are not included in the calculation. See IAS39 para 46 and AG67. CLINCHER 1. The Whitianga Company commenced the construction of a new packaging plant on 1 February 20X7. The cost of PHP1,800,000 was funded from existing borrowings. The construction was completed on 30 September 20X7. Whitianga's borrowings during 20X7 comprised: Loan from Largo Bank: PHP800,000 at 6% per annum; Loan from Andante Bank: PHP1 million at 6.6% per annum; and Loan from Allegro Bank: PHP3 million at 7% per annum. In accordance with IAS23 Borrowing costs, the amount of borrowing costs to be capitalized in relation to the packaging plant is A0 B PHP121,500 C PHP81,000 D PHP91,125 Question 8 - C The answer is PHP81,000. The weighted average is calculated as follows, per IAS23 para 12. (800,000 x 0.06) + (1,000,000 x 0.066) + (3,000,000 x 0.07) = 6.75% (800,000 + 1,000,000 + 3,000,000) Borrowing costs to be capitalized: Cost of asset 1,800,000 x 6.75% x 8/12 = PHP81,000 2. The Stone Company has an account receivable from The Knowles Company of PHP55,000. Stone also has an account payable to Knowles of PHP15,000. Local law allows the enforceable right of set-off of the recognized amounts. It is not normal business practice to settle the amounts net. What amount for accounts receivable and accounts payable should be presented in Stone's statement of financial position, according to IAS32 Financial instruments: presentation? Accounts receivable Accounts payable A PHP55,000 PHP15,000 B PHP40,000 0 C PHP55,000 0 D 0 PHP15,000 Question 22 - A IAS32 para 42 allows the offset of financial assets and financial liabilities in restricted circumstances where there is both a legally enforceable right of setoff and an intention to settle on a net basis. 3. In accordance with IAS7 Statement of cash flows, and treating it as a nonrecurring event, which classification of the cash flow arising from the proceeds from an earthquake disaster settlement would be most appropriate? (select one answer) A Cash flows from operating activities B Cash flows from investing activities C Cash flows from financing activities D Does not appear in the cash flow statement Question 6 - A The definition in IAS7 para 6 of operating activities includes "other activities that are not investing or financing", so will include disaster settlements. 4. Mackerel, a company listed on a recognized stock exchange, reports operating results from its North American activities to its chief operating decision maker. The segment information for the year is: Revenue PHP 3,675,000 Profit PHP 970,000 Assets PHP 1,700,000 Number of employees 2,500 Mackerel's results for all of its segments in total are: Revenue PHP39,250,000 Profit PHP 9,600,000 Assets PHP17,500,000 5. 1. Number of employees 18,500 According to IFRS8 Operating segments, which piece of information determines for Mackerel that the North American activities are a reportable segment? A Revenue B Profit C Assets D Number of employees Question 8 - B The correct answer is profit, because it is the only criterion out of profits, revenue and assets that exceeds 10% of the total for all segments. The number of employees is not one of the criteria. See IFRS8 para 13. According to IAS41 Agriculture, which TWO of the following items would be classified as biological assets? A Oranges B Chickens C Eggs D Trees Question 6 - B & D The correct answers are "Chickens" and "Trees". IAS41 para 5 defines a biological asset as a living animal or plant. EASY ROUND Which ONE of the following statements best describes the term 'liability'? A An excess of equity over current assets B Resources to meet financial commitments as they fall due C The residual interest in the assets of the entity after deducting all its liabilities D A present obligation of the entity arising from past events Question 1 - D The correct answer is "A present obligation of the entity arising from past events", as defined in para 49(b) of the Framework. 21. Are the following statements true or false, according to IAS1 Presentation offinancial statements? (1) Dividends paid should be recognised in the statement of comprehensive income. (2) A loss on disposal of assets should be recognised in the statement of changes in equity. Statement (1) Statement (2) A False False B False True C True False D True True Question 3 - A A loss on disposal of assets is recognised in the statement of comprehensive income because IAS16 Property, plant and equipment does not permit otherwise (IAS1 para 88). Dividends paid are recognised in the statement of changes in equity (IAS1 para 106). 22. The Oakes Company has a loan due for repayment in six months' time, but Oakes has the option to refinance for repayment two years later. Oakes plans to refinance this loan. In which section of its statement of financial position should this loan be presented, according to IAS1 Presentation of financial statements? (select one answer) A Current liabilities B Current assets C Non-current liabilities D Non-current assets Question 12 - C Because Oakes both has the right to roll over the loan beyond 12 months for the end of the reporting period and intends to roll it over, it should be presented as a non-current liability per para 73 of IAS1. 23. Which TWO of the following should be taken into account when determining the cost of inventories per IAS2 Inventories? A Storage costs of part-finished goods B Trade discounts C Recoverable purchase taxes D Administrative costs Question 1 - A & B The correct answers are trade discounts (deduct these from purchase costs) and storage costs for partfinished (but not finished) goods. See IAS2 paras 11 and 16. 24. Which ONE of the following statements best describes the carrying amount of an asset? A The cost (or an amount substituted for cost) of the asset less its residual value B The amount at which the asset is recognized in the statement of financial position after deducting any accumulated depreciation and accumulated impairment losses C The higher of the asset's net selling price and its value in use D The fair value of the asset at the date of a revaluation less any subsequent accumulated impairment losses Question 3 - B The correct answer is "The amount … in the statement of financial position after accumulated depreciation and impairment losses". IAS16 para 6 defines the carrying amount. 25. 26. 27. Which ONE of the following statements best describes the term 'depreciation'? A The systematic allocation of an asset's cost less residual value over its useful life B The removal of an asset from an entity's statement of financial position C The amount by which the recoverable amount of an asset exceeds its carrying amount D The amount by which the carrying amount of an asset exceeds its recoverable amount Question 5 – A "The systematic allocation of an asset's cost…" is the correct answer. See IAS16 para 6 for definitions. The Mirror Company classified a non-current asset accounted for under the cost model as held for sale on 31 December 20X6. Because no offers were received at an acceptable price, Mirror decided on 1 July 20X7 not to sell the asset, but to continue to use it. In accordance with IFRS5 Non-current assets held for sale and discontinued operations, the asset should be measured on 1 July 20X7 at (select one answer) A the lower of its carrying amount and its recoverable amount B the higher of its carrying amount and its recoverable amount C the lower of its carrying amount on the basis that it had never been classified as held for sale and its recoverable amount D the higher of its carrying amount on the basis that it had never been classified as held for sale and its recoverable amount Question 2 - C IFRS5 para 27 in effect requires an entity ceasing to classify an asset as held for sale to remeasure it as if it had never been held for sale, subject to an impairment test (the recoverable amount test) at that date. A brand name that was acquired separately should initially be recognized , according to IAS38 Intangible assets, at (select one answer) A recoverable amount B either cost or fair value at the choice of the acquirer C fair value D cost Question 5 – D IAS38 para 24 states that an intangible asset should be recognised initially at cost. 28. The Naylor Company has determined that it needs to recognise an impairment loss on each of two noncurrent assets; plant and land. The relevant amounts are as follows: Plant Land Original cost CU700,000 CU1,400,000 Previous revaluations Nil CU450,000 Existing carrying amount CU700,000 CU1,850,000 Impairment loss to be recognised in year CU200,000 CU300,000 According to IAS36 Impairment of assets, how should each of the impairment losses be recognised? Plant Land A In profit or loss In profit or loss B In profit or loss In other comprehensive income C In other comprehensive income In profit or loss D In other comprehensive income In other comprehensive income Question 9 - B IAS36 paras 60-61 state that impairment losses on assets that have not been revalued are recognised in profit or loss. Impairment losses on revalued assets are treated as a revaluation decrease. 29. The Snowfinch Company is closing one of its operating divisions, and the conditions for making restructuring provisions in IAS37 Provisions, contingent liabilities and contingent assets have been met. The closure will happen in the first quarter of the next financial year. At the current year end, the company has announced the formal plan publicly and is calculating the restructuring provision. Which ONE of the following costs should be included in the restructuring provision? A Retraining staff continuing to be employed B Relocation costs relating to staff moving to other divisions C Contractually required costs of retraining staff being made redundant from the division being closed D Future operating losses of the division being closed up to the date of closure Question 5 - C IAS37 paras 80-82 require provisions to be made for costs necessarily incurred by the restructuring, but not those relating to the future conduct of the business. AVERAGE ROUND 1. According to IAS29 Financial reporting in hyperinflationary economies, which TWO of the following are monetary items? a. Trade payables b. Inventories c. Administration costs paid in cash d. Loan repayable at par value Question 4 - A & D Monetary items are to be received (or settled) in fixed monetary terms (per IAS29 para 12). This includes trade payables and loans to be repaid at par value. 2. The Hopkins Company is a manufacturing company. The cost per unit of an item of inventory is shown on its card as follows: PHP Materials 30 Production labor costs 33 Production overheads 12 General administration costs 10 Marketing costs 5 According to IAS2 Inventories, what is the value of one completed item of inventory in Hopkins's statement of financial position? a. PHP63 b. PHP85 c. PHP75 d. PHP90 Question 11 - C PHP75 is the correct answer. IAS2 paras 10-12 define the cost of inventory. In this example the cost includes materials, production labor and production overheads, but not general administration or marketing costs. 3. On 1 January 20X8 The Ebro Company commenced trading to provide key skills education facilities in a region identified for technology development. Also on 1 January 20X8, the company received two grants from its government for setting up its operations in this location: Grant (a) – was paid to give financial assistance for start-up costs already incurred. Grant (b) – was paid to subsidize the costs of purchasing computer software over the five-year period. The company is almost certain to keep the facilities operational for the next five years. The company's accounting year end is 31 December. Are the following statements concerning recognition of the income from the two government grants true or false, according to IAS20 Government grants and government assistance? (1) Income from Grant (a) should be recognized in full on receipt in 20X8. (2) Income from Grant (b) should be recognized in full at the end of 5 years. Statement (1) Statement (2) a False False b False True c True False d True True Question 2 - C IAS20 para 20 requires grants for expenditure already incurred to be recognized immediately. Para 12 requires grants such as that for the software to be matched against the related costs, so that grant would be recognized over the five-year period. 4. 5. The Scandium Company is commencing a new construction project, which is to be financed by borrowing. The key dates are as follows: 15 May 20X8 Loan interest relating to the project starts to be incurred 3 June 20X8 Technical site planning commences 12 June 20X8 Expenditures on the project start to be incurred 18 July 20X8 Construction work commences According to IAS23 Borrowing costs, from what date can Scandium commence the capitalization of borrowing costs? a 15 May 20X8 b 3 June 20X8 c 12 June 20X8 d 18 July 20X8 Question 4 - C All relevant conditions in IAS23 para 17 are fulfilled by the date when expenditures on the project start to be incurred. The Palila Company purchased a varnishing machine for PHP150,000 on 1 January 20X7. The company received a government grant of PHP13,500 in respect of this asset. Company policy was to depreciate the asset over 4 years on a straight-line basis and to treat the grant as deferred income. Under IAS20 Government grants and government assistance, what should be the carrying amounts of the machine and the deferred income ("DI") balance at 31 December 20X8? Carrying amount DI balance a PHP75,000 PHP6,750 b PHP112,500 PHP10,125 c PHP81,750 PHP6,750 d PHP75,000 PHP13,500 Question 5 - A Carrying amount PHP75,000, Deferred income PHP6,750 is the correct answer. See IAS20 para 26, where the grant is recognized as income on a systematic and rational basis over the life of the asset. The deferred income in the statement of financial position is reduced each year by the amount credited to profit or loss. The asset is depreciated over its useful life per IAS16. 6. The Coral Company accounts for non-current assets using the cost model. On 20 July 20X7 Coral classified a non-current asset as held for sale in accordance with IFRS5 Non-current assets held for sale and discontinued operations. At that date the asset's carrying amount was PHP14,500, its fair value was estimated at PHP21,500 and the costs to sell at PHP1,450. The asset was sold on 18 October 20X7 for PHP21,200. In accordance with IFRS5, at what amount should the asset be stated in Coral's statement of financial position at 30 September 20X7? A PHP20,050 B PHP21,500 C PHP21,200 D PHP14,500 Question 8 - D IFRS5 para 15 requires that a non-current asset held for sale should be stated at the lower of (i) the carrying amount and (ii) the fair value less costs to sell. 7. The Markab Company has acquired a trademark relating to the introduction of a new manufacturing process. The costs incurred were as follows: Cost of trademark PHP 3,500,000 Expenditure on promoting the new product PHP 50,000 Employee benefits relating to the testing of the proper functioning of the new process PHP 200,000 According to IAS38 Intangible assets, what is the total cost that should be capitalized as an intangible noncurrent asset in respect of the new process? A PHP3,750,000 B PHP3,700,000 C PHP3,500,000 D PHP3,550,000 Question 11 - B IAS38 paras 27-29 specify the costs attributable to a separately acquired intangible asset. This requires the trademark costs and costs of testing to be included. 11. The Dipper Company operates chemical plants. Its published policies include a commitment to making good any damage caused to the environment by its operations. It has always honored this commitment. Which ONE of the following scenarios relating to Dipper would give rise to an environmental provision as defined by IAS37 Provisions, contingent liabilities and contingent assets? a. On past experience it is likely that a chemical spill which would result in Dipper having to pay fines and penalties will occur in the next year b. Recent research suggests there is a possibility that the company's actions may damage surrounding wildlife c. The government has outlined plans for a new law requiring all environmental damage to be rectified d. A chemical spill from one of the company's plants has caused harm to the surrounding area and wildlife Question 11 - D The published policy creates a constructive obligation as defined by IAS37 para 10. The spill is a past event which gives rise to a present obligation and the need for a provision under para 14. The government plans and any chemical spill relate to future events, while the "possible" damage to wildlife gives rise to a contingent liability which should be disclosed. The White Company set up a defined benefit post-employment plan with effect from 1 January 20X7. In the first year the expected return on plan assets was PHP5,000, the actual return on plan assets was PHP4,000, the current service cost was PHP12,000 and White's contributions paid into the plan were PHP7,500. 12. 13. What is the net expense to be recognized in profit or loss for the year ended 31 December 20X7, according to IAS19 Employee benefits? A PHP8,000 B PHP3,500 C PHP7,000 D PHP2,500 Question 11 - C The amounts to be recognized as an expense in profit or loss are the current service cost less the expected return on plan assets. See IAS19 para 61. Note that the difference between the expected and the actual return on plan assets is an actuarial loss, while the employer contributions increase plan assets. The Pinder Company is completing the preparation of its draft financial statements for the year ended 31 May 20X7. On 24 July 20X7, a dividend of PHP175,000 was declared and a contractual profit share payment of PHP35,000 was made, both based on the profits for the year to 31 May 20X7. On 20 June 20X7, a customer went into liquidation having owed the company PHP34,000 for the past 5 months. No allowance had been made against this debt in the draft financial statements. On 17 July 20X7, a manufacturing plant was destroyed by fire, resulting in a financial loss of PHP260,000. According to IAS10 Events after the reporting period, which TWO amounts should be recognized in Pinder's profit or loss for the year to 31 May 20X7 to reflect adjusting events after the end of reporting period? A PHP175,000 dividend B PHP35,000 bonus C PHP34,000 allowance for uncollectible trade receivables D PHP260,000 loss on manufacturing plant Question 7 - B & C The correct answers are PHP35,000 bonus and PHP34,000 allowance. See IAS10 paras 9, 12 and 22. Also, dividends are recognized in the statement of changes in equity, not profit or loss 33. 34. On 1 July 20X7 The Otakamiro Company handed over to a client a new computer system. The contract price for the supply of the system and aftersales support for 12 months was PHP800,000. Otakamiro estimates the cost of the after-sales support at PHP120,000 and it normally marks up such costs by 50% when tendering for support contracts. Under IAS18 Revenue, the revenue Otakamiro should recognize in its financial year ended 31 December 20X7 is A PHP620,000 B PHP800,000 C PHP710,000 D Nil Question 10 - C Under IAS18 Appendix A para 11 a selling price which includes an amount for after-sales support should be split into two components: the support component (being the cost of such support plus a reasonable profit margin) and the sale of goods component (measured as the balance). The support component should be recognized as revenue over the service period. The support component is PHP180,000 (PHP120,000 plus 50%), of which half (PHP90,000) should be recognized in the year ended 31 December 20X7, along with the PHP620,000 (PHP800,000 – PHP180,000) sale of goods component. 35. The Tanager Company purchased a boring machine on 1 January 20X1 for PHP81,000. The useful life of the machine is estimated at 3 years with a residual value at the end of this period of PHP6,000. During its useful life, the expected units of production from the machine are: 20X1 12,000 units 20X2 7,000 units 20X3 5,000 units What should be the depreciation expense for the year ended 31 December 20X2, using the most appropriate depreciation method permitted by IAS16 Property, plant and equipment? A PHP27,000 B PHP21,875 C PHP23,625 D PHP25,000 Question 17 - B The correct answer is PHP21,875. See IAS16 para 56, which indicates that assets are consumed principally through their use. In this example the answer is calculated as (the original cost less the residual value) divided by total units produced in 3 years multiplied by total units produced in 20X2. DIFFICULT ROUND 30. 31. 32. During the year ended 31 December 20X8 the following events occurred at The Gosling Company: (1) It was decided to write off PHP80,000 from inventory which was over two years old as it was obsolete. (2) Sales of PHP60,000 had been omitted from the financial statements for the year to 31 December 20X7. According to IAS8 Accounting policies, changes in accounting estimates and errors, how much should be shown as a prior period adjustment in Gosling's financial statements for the year to 31 December 20X8? A PHP60,000 B PHP140,000 C PHP80,000 D PHP20,000 Question 7 - A The correct answer is PHP60,000. IAS8 para 32's list of examples of changes in accounting estimates includes inventory obsolescence. One of the conditions that must be satisfied in order to recognize revenue in a transaction involving the rendering of services is that the stage of completion of the transaction at the end of the reporting period can be measured reliably. Which TWO of the following methods for determining the stage of completion of a contract involving the rendering of services are specifically referred to in IAS18 Revenue, as being acceptable? A Costs incurred to date as a percentage of the estimated total costs of the transaction B Advances received to date as a percentage of the total amount receivable C Surveys of work performed D Revenue to date divided by total contract revenue Question 1 - A & C IAS18 para 24 permits surveys of work performed and costs incurred to date as methods of apportioning revenue on service contracts. How should trade discounts be dealt with when valuing inventories at the lower of cost and net realizable value (NRV) according to IAS2 Inventories? (select one answer) A Added to cost B Ignored C Deducted in arriving at NRV D Deducted from cost Question 7 - D Trade discounts should be deducted from cost. See IAS2 para 11. The Polyphony Company had 100,000 equity shares in issue on 1 January 20X7. On 1 July 20X7 it issued 20,000 new shares by way of a 1 for 5 bonus. On 1 October 20X7 it issued 28,000 new shares for cash at full market price. When calculating basic earnings per share, how many shares should be divided into the profit after tax, according to IAS33 Earnings per share? A 100,000 B 117,000 C 148,000 D 127,000 Question 9 - D The number of shares to be used is the weighted average in issue through the period. Bonus shares provide no additional consideration to the issuer, so they are related back to the beginning of the earliest period presented. Shares issued for cash provide additional consideration, so they are time apportioned from the date the cash was receivable. See IAS33 paras 19 and 26. The weighted average is 100,000 + 20,000 + (28,000 × 3/12) = 127,000. 36. On 1 January 20X7 The Hamerkop Company borrowed PHP6 million at an annual interest rate of 10% to finance the costs of building an electricity generating plant. Construction commenced on 1 January 20X7 and cost PHP6 million. Not all the cash borrowed was used immediately, so interest income of PHP80,000 was generated by temporarily investing some of the borrowed funds prior to use. The project was completed on 30 November 20X7. What is the carrying amount of the plant at 30 November 20X7? A PHP6,000,000 B PHP6,470,000 C PHP6,520,000 D PHP6,550,000 Question 6 - B See IAS23 para 12. The asset's carrying amount in this example is the PHP6 million construction cost plus the interest charged on the loan for the 11 months of construction (PHP6 million x 10% x 11/12 = PHP550,000, less the PHP80,000 interest earned prior to using the loan to finance construction. 37. The Bentham Company purchased an investment property on 1 January 20X5 for a cost of PHP220,000. The property had a useful life of 40 years and at 31 December 20X7 had a fair value of PHP300,000. On 1 January 20X8 the property was sold for net proceeds of PHP290,000. Bentham uses the cost model to account for investment properties. What is the gain or loss to be recognized in profit or loss for the year ended 31 December 20X8 regarding the disposal of the property, according to IAS40 Investment property? A PHP86,500 gain B PHP81,000 gain C PHP10,000 loss D PHP70,000 gain Question 6 - A The correct answer is the PHP290,000 net disposal proceeds less the PHP203,500 (PHP220,000 less 3/40ths thereof) carrying amount. See IAS40 para 69. 38. The Minor Company leased a freehold building for 20 years, the useful life of the building, with effect from 1 January 20X7. At that date the fair value of the leasehold interest was PHP7.5 million of which PHP6.0 million was attributable to the building. Annual rentals of PHP800,000 are payable in advance on 1 January. How much should Minor recognized as an operating lease expense in the year ended 31 December 20X7, according to IAS17 Leases? A Nil B PHP640,000 C PHP160,000 D PHP800,000 Question 5 - C A land and buildings lease should be separated into its two components: the land component which will usually be classified as an operating lease; and the buildings component which in this case extends to the end of the building's estimated useful life and should be classified as a finance lease. The annual rental is split between the two leases in proportion to the relative fair values of the two leasehold interests. 20% ((PHP7.5 million – PHP6.0 million) as a % of PHP7.5 million) of the rental is attributable to the land, so PHP160,000. See IAS17 paras 14-16. 39. The Rattigan Company purchases PHP20,000 of bonds. The asset has been designated as one at fair value through profit and loss. One year later, 10% of the bonds are sold for PHP4,000. Total cumulative gains previously recognized in Rattigan's financial statements in respect of the asset are PHP1,000. In accordance with IAS39 Financial instruments: recognition and measurement, what is the amount of the gain on disposal to be recognized in profit or loss? A PHP1,900 B PHP900 C PHP2,000 D PHP1,000 Question 27 - A PHP1,900 (PHP4,000 – (10% × (PHP20,000 + PHP1,000))) is the correct answer. IAS39 para 27 states that on derecognition of part of a financial instrument: (a) there shall be an allocation of the carrying amount between the part derecognized and the part retained (b) the difference between the consideration received and the carrying amount allocated to the part derecognized shall be recognized in profit or loss. The previous gains had already been recognized in profit or loss and so are not included in the calculation. See IAS39 para 46 and AG67. DySAS Level 1 EASY 1. If a transaction causes total liabilities to decrease but does not affect the owner’s equity, what change, if any, will occur in total assets? (a) assets will be increased (c) no change in total assets (b) assets will be decreased (d) none B 2. A company has assets of P45,000, no liabilities, and stockholders’ equity of P45,000. It buys store fixtures worth P5,000 on credit. What effect would this transaction have? (a) both assets and stockholders’ equity increase by P5,000 (b) both assets and stockholders’ equity decrease by P5,000 (c) assets remain the same and stockholders’ equity increases by P5,000 (d) both assets and liabilities increase by P5,000 D 3. In accounting parlance, the sequence of the arrangements of the accounts in a ledger – that is, assets first, followed by liabilities, owner’s equity accounts, revenues and expenses – is called: (a) financial statement order (c) double entry method (b) account balance (d) accounting cycle A 4. The recording phase of accounting covers the following steps, except: (a) business documents are received and prepared. (b) transactions are journalized. (c) transactions are posted to the ledger. (d) financial statements are prepared. D 5. An accrued expense is an expense: (a) incurred but not paid (c) paid but not incurred (b) incurred and paid (d) not reasonably estimable A 6. Balance sheet accounts that are not eliminated in the closing entries are called: (a) nominal (c) positive (b) private (d) real D 7. Entries prepared, as a step in the accounting process, to bring the books and accounts up-to-date, is known as: (a) opening entries (c) closing entries (b) adjusting entries (d) reversing entries B 8. If a general partnership, whose partnership contract provides for interest on partners' capital account balances, incurs a net loss, the interest provision of the contract: a. Must be enforced c. May be either enforced or disregarded b. Must be disregarded d. Must be rescinded by the partners A 9. A partner by estoppel: a. Ostensible partner c. Dormant b. Secret partner d. Nominal D 10. The theory which viewed the assets of a business as belonging to the owner or proprietor, the liabilities as debts of the owner, and the income of the business as an increase in the owner’s net worth or capital. a. Proprietary theory c. Entity theory b. Equity theory d. Funds theory A AVERAGE 11. The income summary account: (a) generally has a credit balance after all the accounts that should be closed have closed. (b) summarizes revenues, expenses, and net earnings or loss for the accounting period. (c) summarizes changes in assets, liabilities, and net earnings or loss for the accounting period. (d) is used to close the retained earnings account. B 12. Reversing entries apply to: (a) all adjusting entries. (c) all accruals. (b) all deferrals. (d) all closing entries. C 13. Which of the following combinations of trial balance totals does not indicate a transposition? (a) P65,470 debit and P64,570 credit (c) P25,670 debit and P26,670 credit (b) P32,540 debit and P35,420 credit (d) P14,517 debit and P15,471 credit C 14. Which of the following errors would cause unequal totals in the trial balance? (a) The company records a payment of P20,000 in advance of delivery of goods as a debit of P2,000 to purchases and a credit of P2,000 to cash. (b) The company fails to accrue salaries of P50,000 for the month of December. (c) Both a and b. (d) None of the above. D 15. Which of the following errors would cause unequal totals in the trial balance? (a) The firm records P21,000 received from a customer in advance of delivery of goods as a debit of P1,000 to cash and a credit of P21,000 to sales. (b) The firm fails to enter the cost of electric current used during the month as an expense and fails to recognize the P22,000 owed to DLPC. (c) All these errors will cause unequal trial balance totals. (d) None of these errors will cause unequal trial balance totals. A 16. Adjusting entries that should be reversed include those for prepaid or unearned items that: (a) create an asset or a liability account (b) were originally entered in a revenue or expense account (c) were originally entered in an asset or liability account (d) create an asset or a liability account and were originally entered in a revenue or expense account 17. The primary responsibility of an independent auditor who is a CPA is to: (a) Verify the accuracy of the amounts determined by the client. (b) Assess whether the management is honest. (c) Evaluate the “fair presentation” of the company’s eternal financial statements. (d) Prepare current financial reports for the client. C 18. Loka and Moko formed a partnership on July 1, 2007 and contributed the following assets: Loka Moko Cash P65,000 P100,000 Realty 300,000 The realty was subject to a mortgage of P25,000, which was assumed by the partnership. The partnership agreement provides that Loka and Moko will share profits and losses in the ratio of onethird and two-thirds respectively. Moko’s lcapital account at July 1, 2007 should be: a. P400,000 b. P391,667 c. P375,000 d. P310,000 C 19. A, B and C are partners in an accounting firm. Their capital account balances at year-end were: A, P90,000; B, P110,000; C, P50,000. They share profits and losses in a 4:4:2 ratio, after the following special terms: a. Partner C is to receive a bonus of 10% of the net income after the bonus. b. Interest of 10% shall be paid on that portion of a partner’s capital in excess of P100,000. c. Salaries of P10,000 and P12,000 shall be paid to partners A and C, respectively. 20. Assuming a net income of P44,000 for the year, the total profit share of partner C would be: a. P7,800 b. P16,800 c. P19,400 d. P19,800 C The basic components of financial statements include (choose the incorrect one): (a) statement of changes in equity (c) statement of retained earnings (b) statement of recognized gains and losses (d) cash flow statement C DIFFICULT 21. Accrued salaries payable of P5,000 were not recorded at December 31, 2006. Supplies on hand of P2,000 at December 31, 2007 were erroneously treated as expense instead of supplies inventory. Neither of these errors were discovered nor corrected. The effect of these two errors would cause: (a) 2007 net income to be understated by P7,000 and December 31, 2007 retained earnings to be understated by P2,000. (b) 2006 net income and December 31, 2006 retained earnings to be understated by P5,000 each. (c) 2006 net income to be overstated by P5,000 and 2007 net income to be understated by P2,000. (d) 2007 net income and December 31, 2007 retained earnings to be understated by P2,000 each. A 22. Nick and Carter are partners who share profits and losses in the ratio of 7:3, respectively. Their respective capital accounts are as follows: Nick P35,000 Carter P30,000 They agreed to admit Brian as a partner with a one-third interest in the capital and profits and losses, upon an investment of P25,000. The new partnership will begin with a total capital of P90,000. Immediately after Brian’s admission, what are the capital balances of Nick, Carter, and Brian, respectively? a. P30,000; P30,000; P30,000 c. P31,667; P28,333; P30,000 b. P31,500; P28,500; P30,000 d. P35,000; P30,000; P25,000 B 23. At December 31, Miga and Migo are partners with capital balances of P40,000 and P20,000, and they share profits and losses in the ratio of 2:1, respectively. On this date Ami invests P17,000 in cash for a one-fifth interest in the capital and profit of the new partnership. Assuming that goodwill is not recorded, how much should be credited to Ami’s capital account on December 31? a. P12,000 b. P15,000 c. P15,400 d. P17,000 C 24. If a bonus is traceable to the previous partners rather than an incoming partner, it is allocated among the partners according to the: a. Profit-sharing percentages of the previous partnership. b. Profit-sharing percentages of the new partnership. c. Capital percentages of the previous partners. d. Capital percentages of the new partnership. A 25. The essential characteristics of an asset include (choose the incorrect one): (a) The asset is the result of past transaction or event. (b) The asset provides future economic benefits. (c) The cost of the asset can be measured reliably. (d) The asset is tangible. D Immaterial amounts of similar nature and function should be grouped or condensed as one line item in the financial statements. (a) consistency (c) offsetting (b) aggregation (d) comparability B 27. The “accounting policies section” of the notes to financial statements should describe: (a) only the measurement basis used in preparing the financial statements. (b) only the specific accounting policies followed by the enterprise. (c) both the measurement basis and accounting policies followed. (d) nature of the enterprise’s operations and its principal activities. C 28. You are given the data as follows for CHIN UP CORPORATION: Net Assets at the beginning of the year P130,000 Net Assets at the end of the year 175,000 Dividends declared 8,000 Capital Stock Issued 70,000 The net income (loss) is: (a) Net loss – P107,000 (c) Net income – P107,000 (b) Net income – P17,000 (d) Net loss – P17,000 D 26. Net assets at the end of the year Net assets at the beginning of the year (130,000) P 175,000 29. 30. 31. 32. 33. 1. 2. 3. Increase in net assets P 45,000 Dividends declared 8,000 Capital Stock issued ( 70,000) Net loss P 17,000 Kern and Pate are partners with capital balance of P60,000 and P20,000, respectively. Profits and losses are divided in the ratio of 60:40. Kern and Pate decided to form a new partnership with Grant, who invested land valued at P15,000 for a 20% capital interest in the new partnership. Grant’s cost of the land was P12,000. The partnership elected to use the bonus method to record the admission of Grant into the partnership. Grant's capital account should be credited for: a. P12,000 b. P15,000 c. P16,000 d. P19,000 Partners Dado, Etoy, Fapo, and Gaga share profits 50%, 30%, 10%,and 10%. Accounts maintained with partners just prior to liquidation follow: Advances (Dr) Loans (Cr) Capitals (Cr) Dado P 5,000 P40,000 Etoy 10,000 30,000 Fapo P4,500 15,000 Gaga 2,500 25,000 At this point P18,000 is available for distribution to the partners. How much cash is to be distributed to Gaga? a. P6,625 b. P0 c. P11,375 d. P12,375 Working capital is: (a) the group assets which enables the business to operate profitably. (b) capital which has been reinvested in the business. (c) unappropriated retained earnings. (d) current assets less current liabilities. John and Eddie form a partnership on March 1, 2002 with the following investments: John Eddie Cash P10,000 P 35,000 Land 105,000 Furniture and fixtures 35,000 John and Eddie agree to divide profits and losses in the ratio of 70:30, respectively, and to assume the P20,000 mortgage on the land of Eddie. If John is required to make his share in equity equal to 40% he must make an additional investment of: a. P48,000 b. P35,000 c. P80,000 d. P45,000 B It presents an indication in conformity with GAAP of the financial status of the enterprise at a particular point in time. (a) balance sheet (c) statement of retained earnings (b) statement of earnings (d) cash flow statement A THEORY OF ACCOUNTS Which of the following is not a qualitative characteristic of financial reporting? a. Reliability c. Comparability b. Going concern d. Relevance Which of the following statements about consistency is true? a. The method of accounting can never be changed the entity has to follow the accounting method consistently period after period. b. The method of accounting can be changed however, if the method is changed, it must be highlighted in the financial statement. c. Method of accounting can be changed if standards require. No disclosure is required in the financial statements. d. Companies must sell the same product consistently from one period to the next. An investment property should be measured initially at a. Cost b. Cost less accumulated impairment losses 4. 5. 6. 7. 8. 9. 10. c. Depreciable cost less accumulated impairment losses d. Fair value less accumulated impairment losses An asset is impaired when the carrying amount is a. Higher than fair value less costs to sell but lower than value in use. b. Lower than fair value less costs to sell but higher than value in use. c. Higher than fair value less costs to sell and value in use. d. Lower than fair value less costs to sell and value in use. When it is difficult to distinguish between a change of estimate and a change in accounting policy, then an entity should a. treat the entire change as a change in estimate with appropriate disclosure b. Apportion, on a reasonable basis, the relative amounts of change in estimate and the change in accounting policy and treat each one accordingly c. Treat the entire change as a change in accounting policy d. Since this change is a mixture of two types of changes, it is best if it is ignored in the year of the change; the entity should then wait for the following year to see how the change develops and then treat it accordingly Interim financial reports should include as a minimum a. A complete set of financial statements complying with PAS 1 b. A condensed set of financial statements and selected notes c. A balance sheet and income statement only d. A condensed balance sheet, income statement, and cash flow statement only XYZ Inc. owns a fleet of over 100 cars and 20 ships. It operates in a capital-intensive industry and thus has significant other property, plant, and equipment that it carries in its books. It decided to revalue its property, plant, and equipment. The company's accountant has suggested the alternatives that follow. Which one of the options should XYZ Inc. select in order to be in line with the provisions of PAS 16? a. Revalue only one-half of each class of property, plant, and equipment, as that method is less cumbersome and easy compared to revaluing all assets together b. Revalue an entire class of property, plant, and equipment c. Revalue one ship at a time, as it is easier than revaluing all ships together d. Since assets are being revalued regularly, there is no need to depreciate The following expenditures would qualify as an exploration and evaluation asset under PFRS 6 I. Expenditure for acquisition of rights to explore II. Expenditure for exploratory drilling III. Expenditures related to the development of mineral resources IV. Expenditure for activities in relation to evaluating the technical feasibility and commercial viability of extracting a mineral resource a. I and II c. I, II and IV b. III and IV d. I, II, III and IV Which statement is incorrect concerning internally generated intangible asset? a. To assess whether an internally generated intangible asset meets the criteria for recognition, an entity classifies the generation of the asset into a research phase and a development phase. b. The cost of an internally generated asset comprises all directly attributable costs necessary to create, produce and prepare the asset for its intended use. c. Internally generated brands, mastheads, publishing titles, customer lists and items similar in substance shall be recognized as intangible assets. d.Internally generated goodwill shall not be recognized as an intangible asset. Which of the following is true? a. Trading securities can be classified as current or noncurrent depending on management's intent. b. Held-to-maturity securities should not be classified as current under any circumstance. c. Trading securities should not be classified as current under any circumstance. d. Available-for-sale securities can be classified as current or noncurrent depending on management's intent. PRACTICAL ACCOUNTING 1 1. 2. Purchased materials Direct labor Supervision Design and planning costs 3. 4. 5. 12/31/07 On November 15, 2008, Socrates entered in to a commitment to purchase 200,000 units of raw material X for P8,000,000 on March 15, 2009. Socrates entered into this purchase commitment to protect itself against the volatility in the price of raw material X. By December 31, 2008, the purchase price of material X had fallen to P35 per unit. However, by March 15, 2009, when Socrates took delivery of the 200,000 units, the price of the material had risen to P42 per unit. How much will be recognized as gain on purchase commitment on March 15, 2009? a. P1,400,000 c. P400,000 b. P1,000,000 d. P 0 On September 30, 2008, the company completed the construction of a new warehouse. The construction was achieved using the company’s own resources as follows: P150,000 800,000 65,000 20,000 6. Included in the above figures are P10,000 for materials and P25,000 for labor costs that were effectively lost due to the foundations being too close to a neighboring property. All the above costs are included in cost of sales. The building was brought into immediate use upon completion and has an estimated useful life of 20 years (straight-line depreciation). The company’s policy for all depreciation is that it is charged to cost of sales and a full year’s charge is made in the year of acquisition or completion and none in the year of disposal. The carrying amount of the new warehouse as of December 31, 2008 is a. P1,000,000 c. P950,000 b. P 869,250 d. P987,500 On January 1, 2007, Citimart Inc. was granted 5,000 acres of land in a village, located near the slums outside the city limits, by a local government authority. The condition attached to this grant was that the company should clean up this land and lay roads by employing laborers from the village in which the land is located. The government has fixed the minimum wage payable to the workers. The entire operation will take three years and is initially estimated to cost P160 million. The fair value of this land on the date of grant was P240 million and is expected to increase by at least 20% annually because of the improvements to be done by the company. In relation to the attached condition, the company incurred costs of P80 million in 2007 and P70 million in 2008. On December 31, 2008, the company estimated that it will incur additional cost of P30 million in 2009. How much should be recognized as income from government grant for the year ended December 31, 2008? a. P120,000,000 c. P80,000,000 b. P105,000,000 d. P70,000,000 Worn Company had purchased equipment for P10,000,000, on January 1, 2006. The equipment had a 5-year life and a salvage value of 10%. Worn Company depreciated the equipment using the straight line method. On December 31, 2008, Worn had doubts on the recoverability of the carrying amount of this equipment. On December 31, 2008, the discounted expected net future cash inflows related to the continued use and eventual disposal of the equipment totaled P4,300,000. The equipment’s fair value less costs to sell on December 31, 2008 is P4,500,000. After any loss on impairment has been recognized, what is the carrying amount of the equipment? a. P4,000,000 c. P4,500,000 b. P4,300,000 d. P4,600,000 The draft balance sheet of JJ Rapids Corporation as of December 31, 2008 reported the net property, plant and equipment at P4,200,000. Details of the amount follow: Land at cost Building at cost Less accumulated depreciation at P4,000,000 P1,000,000 7. 8. 9. ( 800,000) 3,200,000 P4,200,000 At the beginning of the current year, the company had an open market basis valuation of its properties. Land was valued at P1.2 million and the building at P4.8 million. The directors wish these values to be incorporated into the financial statements. The building had an estimated remaining life of 20 years at the date of the valuation (straight-line depreciation is used). The company makes a transfer to retained earnings in respect of the excess depreciation on revalued assets. The revaluation surplus as of December 31, 2008 is a. P1,720,000 c. P1,800,000 b. P1,710,000 d. P 960,000 Jenus owns a company called Klassic Kars. Extracts from Jenus' consolidated balance sheet relating to Klassic Kars are: Goodwill P 80,000,000 Franchise costs 50,000,000 Restored vehicles (at cost) 90,000,000 Plant 100,000,000 Other net assets 50,000,000 P370,000,000 The restored vehicles have an estimated realizable value of P115 million. The franchise agreement contains a 'sell back’ clause, which allows Klassic Kars to relinquish the franchise and gain a repayment of P30 million from the franchisor. An impairment review at December 31, 2008 has estimated that the value of Klassic Kars as a going concern is only P240 million. How much is the carrying amount of Plant after impairment loss is recognized? a. P66,666,667 c. P80,000,000 b. P75,000,000 d. P82,800,000 Joy Corp. is engaged in a research and development project to produce a new product. In the year ended December 31, 2007, the company spent P1,200,000 on research and concluded that there were sufficient grounds to carry the project on to its development stage and a further P750,000 had been spent on development. At that date management had decided that they were not sufficiently confident in the ultimate profitability of the project and wrote off all the expenditure to date to the income statement. In 2008 further direct development costs have been incurred of P800,000 and the development work is now almost complete with only an estimated P100,000 of costs to be incurred in the future. Production is expected to commence within the next few months. Unfortunately the total trading profit from sales of the new product is not expected to be as good as market research data originally forecasted and is estimated at only P1,500,000. Assuming the other criteria given in PAS 38 are met, how much should be capitalized as of December 31, 2008? a. P1,650,000 c. P900,000 b. P1,550,000 d. P800,000 Sayong Company bought 20% of Yobo Corporation’s ordinary shares on January 1, 2008 for P11,400,000. Carrying amount of Yobo’s net assets at purchase date totaled P50,000,000. Fair value and carrying amounts were the same for all items except for plant and inventory, for which fair values exceed their carrying amounts by P10,000,000 and P2,000,000 respectively. The plant has a 5-year life. All inventory was sold during 2008. During 2007, Yobo reported net income of P30,000,000 and paid a P10,000,000 cash dividend. What amount should Sayong report as net income related to this investment in 2008? a. P5,200,000 c. P5,400,000 b. P6,200,000 d. P4,200,000 On January 2, 2008, Arjam Co. established a noncontributory defined benefit plan covering all employees and contributed P450,000 to the plan. At December 31, 2008, Arjam determined that the 2008 service and interest costs on the plan were P620,000. The expected and the actual rate of return on plan assets for 2008 was 10%. There are no other components of Arjam's pension 10. 1. 2. 3. 4. expense. What amount should Arjam report in its December 31, 2008 balance sheet as accrued pension expense? a. P575,000 c. P125,000 b. P170,000 d. P 80,000 The following facts relate to Mustafah Corporation for the year 2008: Accounting profit for the year, P500,000. Cumulative temporary difference at December 31, giving rise to future taxable amounts, P230,000. Cumulative temporary difference at December 31, giving rise to the future deductible amounts, P95,000. Deferred tax liability, January 1, P48,300. Deferred tax asset, January 1, P15,750. Tax rate for all years, 35%. No permanent differences exist. The company is expected to operate profitably in the future. What is the current tax expense? a. P160,300 c. P175,000 b. P127,750 d. P189,700 MANAGEMENT ADVISORY SERVICES What is a major disadvantage of using economic value added (EVA) alone as a performance measure? A. It fails to focus on creating shareholder value. B. It promotes the acceptance of unprofitable projects. C. It fails to reflect all of the ways that value may be created. D. It discourages cost cutting. Associated Supply, Inc. is considering introducing a new product that will require a P250,000 investment of capital. The necessary funds would be raised through a bank loan at an interest rate of 8%. The fixed operating costs associated with the product would be P122,500 while the contribution margin percentage would be 42%. Assuming a selling price of P15 per unit, determine the number of units (rounded to the nearest whole unit) Associated would have to sell to generate earnings before interest and taxes (EBIT) of 32% of the amount of capital invested in the new product. A. 35,318 units. C. 25,575 units. B. 32,143 units. D. 23,276 units Following are the operating results of the two segments of Parklin Corporation Sales P10,000 P15,000 P25,000 Variable cost of goods sold 4,000 8,500 12,500 Fixed cost of goods sold 1,500 2,500 4,000 Gross margin 4,500 4,000 8,500 Variable selling and administrative 2,000 3,000 5,000 Fixed selling and administrative 1,500 1,500 3,000 Operating income (loss) P1,000 P (500) P500 Fixed costs of goods sold are allocated to each segment based on the number of employees. Fixed selling and administrative expenses are allocated equally. If Segment B is eliminated, P1,500 of fixed costs of goods sold would be eliminated. Assuming Segment B is closed, the effect on operating income would be A. An increase of P500. C. A decrease of P2,000. B. An increase of P2,000. D. A decrease of P2,500. The balanced scorecard generally uses performance measures with four different perspectives. Which of the following performance measures would be part of those used for the internal business processes perspective? A. Cycle time. B. Employee satisfaction. C. Hours of training per employee. 5. D. Customer retention. Antlers, Inc. produces a single product that sells for P150 per unit. The product is processed through the Cutting and Finishing departments. Additional data for these departments are follows: Cutting Finishing Annual capacity (36,000 direct labor hours available in each department) 180,000 units 135,000 units Current production rate (annualized) 108,000 units 108,000 units Fixed manufacturing overhead P1,296,000 P1,944,000 Fixed selling and administrative expense P864,000 P1,296,000 Direct materials cost per unit. P45 P15 The current production rate is the budgeted rate for the entire year. Direct labor employees earn P20 per hour and the company has a “no layoff” policy in effect. What is the amount of the throughput contribution per unit as computed using the theory of constraints? A. p90.00 C. P46.67 B. P76.67 D. P26.6 6. Management of Russell Corporation is considering the following two potential capital structures for a newly acquired business. Alternative I Long-term debt, 6% interest Common equity Cost of common equity, 10% Marginal tax rate, 15% Alternative 2 Long-term debt, 7% interest Common equity Cost of common equity, 12% Marginal tax rate, 15% 7. 8. P3,000,000 P3,000,000 P5,000,000 P1,000,000 Which of the following statements is not true if management decides to accept Alternative 1? A. Alternative 1 is the more conservative capital structure. B. Alternative 1 provides the greatest amount of financial leverage. C. Net income will be less variable under Alternative 1. D. Total interest expense Para Co. is reviewing the following data relating to an energy saving investment proposal: Cost P50,000 Residual value at the end of 5 years 10,000 Present value of an annuity of 1 at 12% for 5 years 3.60 Present value of 1 due in 5 years at 12% 0.57 What would be the annual savings needed to make the investment realize a 12% yield? A. P 8,189 C. P12,306 B. P11,111 D. P13,889 Ethoy, Inc. has seasonal demand for its products and management is considering whether level production or sea-al production should be implemented. The firm’s short- term interest cost is 8%, and management has developed the following information to make the decision: Alternative 1 Alternative 2 Level production Seasonal production Average inventory P2,000,000 P1,500,000 Production costs P6,000,000 P6,050,000 At what rate of short-term interest rate would the two alternatives have the same cost? A. 6% C. 10% B. 9% D. 12% 9. 10. 1. 2. 3. 4. 5. 6. 7. Roy Macho Company is budgeting sales of 53,000 units of product Nous for October 2008. The manufacture of one unit of Nous requires four kilos of chemical Loire. During October 2008, Roy Macho plans to reduce the inventory of Loire by 50,000 kilos and increase the finished goods inventory of Nous by 6,000 units. There is no Nous work in process inventory. How many kilos of Loire is Roy Macho planning to purchase in October 2008? A. 138,000 C. 186,000 B. 162,000 D. 238,000 Anna Bonita Wheels purchases bicycle components in the month prior to assembling them into bicycles. Assembly is scheduled one month prior to budgeted sales. Anna pays 75% of component costs in the month of purchase and 25% of the costs in the following month. Component cost included in budgeted cost of sales are April May June July August P5,000 P6,000 P7,000 P8,000 P8,000 What is Anna’s budgeted cash payment for components in May? A. P5,750 C. P7,750 B. P6,750 D. P8,000 BUSINESS LAW Juan de la Cruz signs a promissory note payable to Pedro Lim or Bearer, and delivers it personally to Pedro Lim. The latter somehow misplaces the said note and Carlos Ros finds the note lying around the corridor of the building. Carlos Ros endorses the promissory note to Juana Bond, for value, by forging the signature of Pedro Lim. May Juana Bond hold Juan de la Cruz liable on the note? a. No, because forgery is a real defense b. Yes, because the forge signature is not necessary for the negotiation of the instrument. c. No, because Juana Bond cannot become a holder because the indorsement is forged. d. Yes, because forgery is just a personal defense. The term of office of Mr. Carlito as member of the board is about to expire on December 10, 2007. On December 12, 2007 a special meeting was called to fill up the vacancy in the board. Mr. Vladimir got the highest number of votes; however Mr. Vladimir is not a shareholder. a. Mr. Carlito is no longer a director because Mr. Vladimir is qualified to be a director b. Mr. Vladimir is the new director because he got the highest number of votes. c. Mr. Vladimir is entitled to office because he got the highest number of votes and the term of Mr. Carlito is already expired. d. Mr. Carlito is entitled to hold office despite that his term is already expired because Mr. Vladimir is not qualified to be a director not being a shareholder. Hence, the incumbent director Mr. Carlito shall serve until his successor is elected and qualified. Who among the following are liable for warranties as well as secondary liability? a. Drawer c. Qualified indorser b. Maker d. Unqualified indorser Which of the following transactions or contracts involving the sale or financing of real estate on installment payments is not covered by Maceda law: a. Residential c. Apartment b. Condominium d. Commercial Building These are adjudicated in order that a right of the plaintiff, which has been violated or invaded by the defendant, may be vindicated or recognized: a. Moral damages c. Nominal damages b. Temperate damages d. Actual damages And B are debtors of C for P2,000,000. A’s consent was obtained by C thru fraud. a. C can collect the entire P2,000,000 from B b. C can collect the entireP2,000,000 from B but the latter can recover from A P1,000,000. c. A is liable only to C for P1,000,000 because he can interpose his defense of fraud. d. B is liable to C for his share of P1,000,000. Which of the following is a consensual contract: a. Contract of partnership with capital contribution of real property amounting to P100,000. 8. 9. 10. 1. b. Oral donation of personal computer worth P15,000. c. Stipulation of interest in a contract of loan. d. Contract of agency. Which of these is not a conditional obligation? a. D is to pay C P1,000,000 if he finishes his LL.B. at the V.P. College of law. b. D will pay C P500,000 as soon as his financial means will permit him to do so. c. D is to pay C P2,000,000 ten days after his 80th birthday. d. D will pay C P1,000,000 twenty days after he passes the C.P.A. exams for October 2008. In the following cases, the debtor shall lose the benefit of the period – choose the exception. a. When after the contraction of the obligation the debtor becomes insolvent but he gives collateral security or guaranty. b. When the debtor fails to furnish the collateral securities which has promised. c. When the collateral security is impaired whether through the debtor’s fault or by fortuitous events. d. When the debtor attempts to abscond. A, B, & C obligated themselves to deliver to X a specific and determinate car valued at P600,000. Due to the fault of A, the car was not delivered to X causing the latter damages in the amount of P9,000. a. By specific performance. X can compel B & C to deliver 1/3 each of the car and H to pay damages. b. The action of X is converted into one for damages where he hold liable A, B & C for P203,000 each. c. The action of X is converted into one for damages where he can hold B & C liable for P200,000 each and A for P209,000. d. The action being solidary and indivisible only A can be held liable by X for P609,000. PRACTICAL ACCOUNTING 2 The condensed balance sheet of IVY Corporation as of December 31, 2007 is shown below: Book Values Fair Values Current assets P200,000 P225,000 Plant assets 300,000 400,000 Total assets P500,000 Liabilities Capital stock, P10 par Additional paid-in capital Retained earnings Total equities 2. P150,000 50,000 100,000 200,000 P500,000 On January 1, 2008, Vine Company issues 10,000 shares of its P10 par value stock with a market value of P50 per share for the net assets of IVY Corporation. How much is the increase in the stockholders' equity of Vine Company due to the business combination? A. P 100,000 C. P 350,000 B. P 150,000 D. P 500,000 The following amounts were taken from the statement of affairs for Bagsak Company Unsecured liabilities without priority Stockholders' equity Loss on realization of assets Estimated administrative expenses that have accounting records P90,000 36,000 45,000 not been entered in the 4,500 Unsecured liabilities with priority 3. 4. The estimated payment for the unsecured liabilities without priority will be A. P76,500 C. P81,000 B. P77,850 D. P90,000 Rose Company which began operations on January 2, 2007, appropriately uses the installment sales method of accounting. The following information is available for 2007: Installment accounts receivable, December 31, P800,000; Deferred gross profit, December 31, before recognition of realized gross profit for 2007, P560,000; gross profit rate on sales, 40% For the year ended December 31, 2007, cash collections and realized gross profit on sales should be: A. P400,000;P320,000 C. P600,000;P320,000 B. P400,000;P240,000 D. P600,000;P240,000 6. 7. Plant assets Total assets Liabilities Common stock- P10 par Additional paid-in capital Retained earnings Total equities 8. P 1,000,000 3,000,000 500,000 9. 200.000 P4,700,000 Estimated additional cost to complete the building P 5,500,000 Calculate the amount of profit to be recognized by Buildquick for the first year of construction activities. A. P 829,412 C. P1,350,000 B. P 900,000 D. P1,800,000 The home office in Alabang shipped merchandise costing P55,500 to Davao branch, prepaid, the freight amounting to P4,200. The home office transfers merchandise to the branch at a 20% markup above cost. Davao branch was subsequently instructed to transfer the merchandise to Cebu branch wherein the latter paid for P2,800 freight. If the shipment was made directly from Alabang to Cebu, the freight cost would have been P6,200. Which of the following is true as a result of the interbranch transfer of merchandise? A. The home office will debit Branch Current - Cebu, P73,600 B. Cebu branch will debit Home Office Current - P70,000 C. Davao branch credit Freight-in, P6,200 D. The home office will credit Branch Current - Davao, P70,800 Job No. 41 (consisting of 5,000 units) was started in September, 2008 and it is special in nature because of its strict specifications. Factory overhead is charged at P 0.85 per unit and includes a P.05 provision for defective work. The prime costs incurred in September are: Direct materials, P 9,000 and Direct labor, P 4,800. Upon inspection, 80 units were found with imperfections and required the following reprocessing costs, Direct materials, P 2,000 and direct labor, P 1,000. The unit cost of Job No. 41, upon completion, is: A. P 4.22 C. P 3.98 B. P4.17 D. P 3.69 Patter Corporation issues 500,000 shares of its own P10 par common stock for the net assets of Simpson Corporation in a merger consummated on July 1, 2007. On this date, Patter stock is quoted at P20 per share. Summary balance sheet data for the two companies at July 1, 2007, just before combination, are as follows: Patter Simpson Current assets P18,000,000 P1,500,000 22,000,000 40,000,000 12,000,000 20,000,000 3,000,000 5.000,000 P40,000,000 6,500,000 8,000,000 2,000,000 3,000,000 1,000,000 2.000.000 P8,000,000 Calculate the retained earnings Patter Corporation immediately after the combination: A. P5,000,000 C. P7,000,000 B. P6,000,000 D. P8,000,000 An entity purchases plant from a foreign supplier for 3 million foreign currency units on January 31, 2007, when the exchange rate was 2fc = PI. At the entity's year-end of March 31, 2007, the amount has not been paid. The closing exchange rate for the mentioned foreign currency was 1.5fc = PI. The entity's functional currency is the peso. Which of the following statements is correct? A. Cost of plant, P2 million, exchange loss P0.5 million, trade payable, PI.5 million. B. Cost of plant, PI.5 million, exchange loss P0.6 million, trade payable, P2 million. C. Cost of plant, PI.5 million, exchange loss P0.5 million, trade payable, P2 million. D. Cost of plant, P2 million, exchange loss P0.5 million, trade payable P2 million. On September 24, 2007 Bureau of Internal Revenue (BIR) collected taxes from individual taxpayers in the amount of P875,000 The BIR has no authority to use these collections in their operation and therefore deposited it to the Bureau of Treasury. What is the journal entry to record the collections in the National Government Books? A. Cash-National Treasury -MDS 875,000 Subsidy Income from NG 875,000 B. Cash-Collecting Officer 875,000 Income taxes-Individuals 875,000 C. Cash-Collecting Officer 875,000 Contributions Revenue 875,000 D. Cash-National Treasury - MDS 875,000 Income taxes-Individuals 875,000 Buildquick Construction Company has entered into a fixed price contract to construct an apartment building for P13,000,000. The details of the costs incurred to date in the first year are Site labor cost Cost of construction materials Depreciation of plant and equipment being used in project Marketing and selling costs to get the exposure needed Total 5. 10,000 10. Darlin Hospital, a private not-for-profit hospital, had the following cash receipts for the year ended December 31, 2007: Patient service revenue P300,000 Gift shop revenue 25,000 Interest revenue restricted by donor stipulation for acquisition of equipment 50,000 As a result of these cash receipts, the hospital's statement of cash flows for the year ended December 31, 2007, would report an increase in operating activities of a. P325,000 b. P375,000 c. P350,000 d. P300,000 THEORY OF ACCOUNTS 1. Which of the following statements is (are) true, for purposes of financial reporting in the Philippines? I. Philippine practice is to present in the balance sheet current assets before non-current assets, current liabilities before non-current liabilities; and equity accounts before liabilities II. Notes are normally presented in the following order: Significant accounting policies; statement of compliance of PRFSs; supporting information on items presented on the face of the financial statements; and lastly, other disclosures 2. 3. 4. 5. 6. 7. 8. 9. III. The IAS term ”Reserves” in present Philippine practice, may refer to revaluation increment, translation adjustments recognized in equity; unrealized gains and losses from available for sale securities recognized in equity. a. I and II only b. I and III only c. II and III only d. I, II and III An entity purchases a building and the seller accepts payment partly in equity shares and partly in debentures of the entity. This transaction should be treated in the cash flow statement as follows: a. The purchase of the building should be investing cash outflow and the issuance of shares and the debentures financing cash outflows. b. The purchase of the building should be investing cash outflow and the issuance of debentures financing cash outflows while the issuance of shares investing cash outflow. c. This does not belong in a cash flow statement and should be disclosed only in the notes to the financial statements. d. Ignore the transaction totally since it is a non-cash transaction. No mention is required in either the cash flow statement or anywhere else in the financial statements The scope of PAS 39 includes all of the following except a. Financial instruments that meet the definition of a financial asset b. Financial instrument that meet the definition of a financial liability c. Financial instruments issued by the entity that meet the definition of an equity instrument d. Contracts to buy or sell non-financial items that can be settled net. Deposits in foreign countries which are subject to a foreign exchange restrictions should be a. Valued at current exchange rates and shown as current assets b. Valued at historical exchange rates and presented as noncurrent assets c. Valued at current exchange rates and presented as noncurrent assets / d. Valued at historical exchange rates and presented as current assets What is the proper accounting for credit card sales if the credit card company is Affiliated with a bank Not affiliated with a bank a. Sale on account Cash sales b. Sale on account Sale on account c. Cash sale Cash sale d. Cash sale Sale on account Losses which are expected to arise from firm and non-cancellable commitments for the future purchase of inventory items, if material should be a. Recognized in the accounts by debiting loss on purchase commitments and crediting estimated liability for loss on purchase commitments b. Disclosed in the notes c. Ignored d. Charged to retained earnings Delta Corp. purchased 7,400 shares of Maiden Company’s common stock and classified it as available-for-sale. The purchase price was P362,000, which is equal to 50% of Maiden Company’s retained earnings balance. Maiden Company’s 46,000 shares of common stock are actively traded. Delta should account for this using the a. Cost method b. Equity method c. Cost method subject to fair value valuation in the balance sheet d. Market value method subject to fair value valuation in the balance sheet Which of the following statements regarding Investment Property is (are) true I. An investment property shall be measured initially at its cost II. Transaction cost shall be included in the initial measurement of investment property III. With certain exceptions, an entity shall choose as its accounting policy either the fair value model or the cost model and shall apply such policy to all its investment property a. I and II only b. I and III only c. II and III only d. I, II and III In determining the fair value of a biological asset for balance sheet purposes, which of the following should be considered? a. Price change b. Physical change c. Both price change and physical change d. Neither price change nor physical change 10. A company acquired some of its own common shares at a price greater than both their par value and original issue price but less than their book value. The company uses the cost method of accounting for treasury stock. What is the impact of this acquisition on total stockholders’ equity (TSE), and the net book value (NBV) per common share? a. SE – decrease ; NBV – increase c. SE – decrease; NBV – decrease b. SE – increase ; NBV – decrease d. SE – increase; NBV - increase 11. What is the measurement basis of an asset that is acquired in non-monetary exchange With commercial substance With no commercial substance a. Fair value of asset given up Carrying amount of asset given up b. Carrying amount of asset given up Carrying amount of asset received c. Carrying amount of asset received Fair value of asset received d. Fair value of asset given up Fair value of asset given up 12. Which of the following statements concerning borrowing costs is false? a. Borrowing costs generally include interest costs, bank overdrafts, amortization of discounts or premiums related to borrowings, finance charges with respect to finance leases. b. Borrowing costs are interest and other costs incurred by an enterprise in relation to borrowed funds. c. Per PAS 23, the benchmark treatment for borrowing costs is to capitalize it as part of the cost of the asset to which it relates. d. Borrowing costs include amortization of ancillary costs incurred in connection with the arrangement of borrowings, as well as exchange differences arising from foreign currency borrowings to the extent that they are regarded as an adjustment to interest cost. 13. Easy Builders Inc. is in the middle of a two-year construction contract when it receives a letter from the customer extending the contract by a year and requiring the construction company to increase its output in proportion of the number of years of the new contract to the previous contract period. This is allowed in recognizing additional revenue according to PAS 11 if a. Negotiations have reached an advanced stage and it is probable that the customer will accept the claim b. The contract is sufficiently advanced and it is probable that the specified performance standards will be exceeded or met. c. It is probable that the customer will approve the variation and the amount of revenue arising from the variation, and the amount of revenue can be reliably measured. d. It is probable that the customer will approve the variation and the amount of revenue arising from the variation, whether the amount of revenue can be reliably measured or not. 14. Under IAS 20, which of the following is permitted in recognizing an intangible asset acquired free of charge, or for nominal consideration, by way of a government grant? I. Recognize both the intangible asset and the grant initially at fair value. II. Recognize the asset initially at a nominal amount plus any expenditure that is directly attributable to preparing the asset for its intended use a. I only b. Either I or II, at the option of the acquiring enterprise c. II only d. Neither I nor II 15. PAS 20, Government Grants provide two approaches to accounting for government grants : (1) capitalization approach and (2) income approach. Arguments in support of the income approach include the following except: a. Government grants are considered earned through compliance with the condition and meeting envisaged obligations b. c. d. Government grants are receipts from a source other than shareholders or capital providers Government grants represent an incentive provided by the government without related costs. Government grants are considered as extension of fiscal policies similar to income and other taxes 22. In January 2008, Jenks Mining Corporation purchased a mineral mine for P4,200,000 with removable ore estimated by geological surveys at 3,000,000 tons. The property has an estimated value of P400,000 after the ore has been extracted. Jenks incurred P1,150,000 of development costs preparing the property for the extraction of ore. During 2008, 340,000 tons were removed and 300,000 tons were sold. For the year ended December 31, 2008, Jenks should include what amount of depletion in its cost of goods sold? a. P430,667 b. P380,000 c. P495,000 d. P561,000 23. Down Co. bought a trademark from Cater Corp. on January 1, 2008, for P112,000. An independent consultant retained by Down estimated that the remaining useful life is 50 years. Its unamortized cost on Cater's accounting records was P56,000. Down decided to write off the trademark over the maximum period allowed. How much should be amortized for the year ended December 31, 2008? a. P1,120. b. P1,400. c. P2,240. d. P2,800. PRACTICAL ACCOUNTING 1 16. In 2008, Paul Hypermarket awards loyalty points to customers who use Paul Hypermarket’s own credit card to pay for purchases. The award is at the rate of one point for every P250 charged to the card and each point entitles the customer to a certain credit against future purchases, without time limit. Paul Hypermarket estimates the fair value of each point at P4 and in 2008, P250,000,000 is charged to the Paul Hypermarket’s credit card. None of the customers have claimed their corresponding credit points during 2008. The amount to be reported as revenue for 2008 by Paul Hypermarket is a. P250,000,000 b. P249,000,000 c. P246,000,000 d. P245,000,000 Use the following information for numbers 74 and 75 On January 1, 2006 Luke Company, a financial services entity which is also involved in real estate development, has purchased a plot of land in Makati City for P2,000,000 which it intends to develop and eventually sell. On July 1, 2006, Luke Company purchased 10 passenger vehicles for a total consideration of P2,500,000. Luke Company’s intention was to use the passenger vehicles to transport Luke Company’s employees. Luke Company uses the straight-line depreciation method for the passenger vehicles with no expected salvage value and an estimated useful life of 8 years. On December 31, 2007, Luke Company entered in a lease agreement with John Company for its land in Makati City and its passenger vehicles. Development cost incurred until December 31, 2007 was P700,000. The fair values of the land in Makati City and the 10 passenger vehicles were P2,950,000 and P2,181,250 respectively. Assets classified by Luke Company as investment properties are presented at fair value. At the end of 2008, the fair values of land and 10 passenger vehicles were 3,100,000 and P2,201,250 respectively. 17. The gain (loss) to be reported in 2007 in relation to the reclassification to investment property is a. 18. 0 b. 150,000 c. 250,000 The revaluation surplus balance at December 31, 2008 is a. 0 b. 0,000 15 c. 5,577 d. 35 d. Use the following information for questions 80 and 81 On January 2, 2008, Hernandez, Inc. signed a ten-year non-cancelable lease for a heavy duty drill press. The lease stipulated annual payments of P70,000 starting at the end of the first year, with title passing to Hernandez at the expiration of the lease. Hernandez treated this transaction as a capital lease. The drill press has an estimated useful life of 15 years, with no salvage value. Hernandez uses straight-line depreciation for all of its plant assets. Aggregate lease payments were determined to have a present value of P420,000, based on implicit interest of 10%. 24. In its 2008 income statement, what amount of interest expense should Hernandez report from this lease transaction? a. P0. b. P26,250 c. P35,000. d. P42,000. 25. In its 2008 income statement, what amount of depreciation expense should Hernandez report from this lease transaction? a. P70,000. b. P46,667. c. P42,000. d. P28,000. 26. 400,000 2,500 48 Before year-end adjusting entries, Bass Company's account balances at December 31, 2001, for accounts receivable and the related allowance for uncollectible accounts were P500,000 and P45,000, respectively. An aging of accounts receivable indicated that P62,500 of the December 31 receivables are expected to be uncollectible. The net realizable value of accounts receivable after adjustment is a.P482,500. b. P437,500. c. P392,500. d. P455,000. 20. Isaac Co. assigned P500,000 of accounts receivable to Dixon Finance Co. as security for a loan of P420,000. Dixon charged a 2% commission on the amount of the loan; the interest rate on the note was 10%. During the first month, Isaac collected P110,000 on assigned accounts after deducting P380 of discounts. Isaac accepted returns worth P1,350 and wrote off assigned accounts totaling P3,700. The amount of cash Isaac received from Dixon at the time of the transfer was a. P378,000. b. P410,000. c. P411,600. d. P420,000. 27. 19. 21. On June 1, 2008, Oslo Corp. sold merchandise with a list price of P15,000 to Mead on account. Oslo allowed trade discounts of 30% and 20%. Credit terms were 2/15, n/40 and the sale was made f.o.b. shipping point. Oslo prepaid P300 of delivery costs for Mead as an accommodation. On June 12, 2008, Oslo received from Mead a remittance in full payment amounting to a. P8,232 b. P8,526. c. P8,532. d P8,397. 28. On October 31, 2008, Beta Company engaged in the following transactions: Obtained a P500,000, six-month loan from City Bank, discounted at 12%. The company pledged P500,000 of accounts receivable as security for the loan. Factored P1,000,000 of accounts receivable without recourse on a non notification basis with Hype Company. Hype charged a factoring fee of 2% of the amount of receivables factored and withheld 10% of the amount factored. What is the total cash received from the financing of receivables? a. P1,320,000 b. P1,350,000 c. P1,380,000 d. P1,470,000 The closing inventory of Gandhi Company amounted to P284,000 at December 31, 2008. This total includes two inventory lines about which the inventory taker is uncertain. Item 1 - 500 items which had cost P15 each and which were included at P7,500. These items were found to have been defective at the balance sheet date. Remedial work after the balance sheet date cost P1,800 and they were then sold for P20 each. Selling expenses were P400. Item 2 - 100 items that had cost P10 each but after the balance sheet date, these were sold for P8 each with selling expenses of P150. What figure should appear in Gandhi’s balance sheet for inventory? a. P283,650 b. P283,950 c. P284,000 d. P284,300 In reconciling the Cash in bank of Yna Company with the bank statement balance for the month of November 2008, the following data are summarized: Book debits for November, including October CM for note collected, P60,000 Book credits for November, including NSF of P20,000 and service charge of P800 for October Bank credits for November including CM for November for bank loan of P100,000 and October deposit in transit for P80,000 Bank debits for November including October outstanding checks of P170,800 and P 800,000 620,000 700,000 November service charge of P200 What is the amount of outstanding checks for November ? a. P 20,000 b. P170,200 c. P171,000 600,000 d. P191,000 PRACTICAL ACCOUNTING 2 29. Roel, Jekell and Mike, CPAs, decide to form a partnership and agree to distribute profits in the ratio 5:3:2. It is agreed, however, that Roel and Jekell shall guarantee fees from their own clients of P600,000 and P500,000 respectively, that any deficiency is to be charged directly against the account of the partner failing to meet the guarantee, and that any excess is to be credited directly to the account of the partner with fees exceeding the guarantee. Fees earned during 20x4 are classified as follows: From clients of Roel P1,000,000 From clients of Jekell 400,000 From clients of Mike 100,000 Operating expenses for 20x4 are P200,000. Determine the share of Roel on the operating results for the year 20x4. a. P900,000 b. P500,000 c. P200,000 d. P300,000 30. Caine, Osman, and Roberts formed a partnership on January 1, 20x4, agreeing to distribute profits and losses in the ratio of original capitals. Original investments were P625,000, P250,000 and P125,000 respectively. Earnings of the firm and drawings by each partner for the period 20x4-20x6 follows: Drawings . Net income (loss) Caine Osman Roberts 20x4 P440,000 P150,000 P78,000 P52,000 20x5 185,000 150,000 78,000 52,000 20x6 ( 105,000) 100,000 52,000 52,000 At the beginning of 20x7, Caine and Osman agreed to permit Roberts to withdraw from the firm. Since the books for the firm had never been audited, the partners agreed to an audit in arriving at the settlement amount. In withdrawing, Roberts was allowed to take certain furniture and was charged P15,000, although the book value was P45,000; the balance of Roberts’ interest was paid in cash. The following items were revealed in the course of the audit. End of 20x4 End of 20x5 End of 20x6 Understatement of accrued expenses P 4,000 P 5,000 P 6,500 Understatement of accrued revenue 2,500 1,000 1,500 Overstatement of inventories 15,000 20,000 20,000 Understatement of depreciation expense On assets still held 1,500 3,500 2,000 How much must Roberts received from the partnership? a. P511,250 b. P156,500 c. P15,250 d. P11,250 31. The year-end balances in the home office account’s allowance for unrealized gross margin in branch inventory are P 48,750 for the QC Branch and P58,500 for the MC branch. The income from Branch, home office should record is: a. P171,750 b. P97,500 c. P130,500 d. P74,250 At the beginning of 2008, S Video established a QC Branch and a MC Branch in order to provide wider distribution of its merchandise. Merchandise is transferred to the branches at a pricd 30% above cost. All branch merchandise is acquired from the home office. At the end of 2008, the QC Branch and the MC Branch reported net income and ending inventory balances as follows: Net income Ending inventory QC Branch P45,500 P65,000 MC Branch 52,000 78,000 32. On January 1, 2008, Ashley Corp. purchased 75% of the common stock of Racks Corp. Separate balance sheet data for the companies at the combination date are given below: Cash Trade Receivable Merchandise Inventory Land Plant Assets Accumulated Depreciation Investment in Racks Total Assets Ashley P 84,000 504,000 462,000 273,000 2,450,000 (840,000) 1,372,000 P4,305,000 Racks P 721,000 91,000 133,000 112,000 1,050,000 (210,000) P1,897,000 Accounts Payable P 721,000 P 497,000 Capital Stock 2,800,000 1,050,000 Retained Earnings 784,000 350,000 Total Equities P4,305,000 P 1,897,000 At the date of combination the book values of Racks net assets was equal to the fair value of the net assets except for Rack’s inventory which has a fair value of P210,000. On the date of acquisition in the consolidated balance sheet: How much is the total assets? a. P 3,533,250 b. P4,984,000 c. P 6,543,250 d. P 5,171,250 33. The following data pertained to Pogi Company’s construction jobs, which commenced during 2008: PROJECT 1 PROJECT 2 Contract Price P420,000 P300,000 Cost incurred during 2008 240,000 280,000 Estimated cost to complete 120,000 40,000 Billed to customers during 2008 150,000 270,000 Received from customers during 2008 90,000 250,000 If Pogi company used the percentage of completion method, what amount of profit (loss) would Pogi Company report in its 2008 income statement? a. P(20,000) c. P22,500 b. P20,000 d. P40,000 34. On April 1, 2008, Ringo Corp. entered into franchise agreement with Quart Corp. to sell their products. The agreement provides for an initial franchise fee of P4,218,750 payable as follows: P1,181,250 cash to be paid upon signing of the contract and the balance in five equal annual payment every December 31, starting at the end of 2008. Ringo signs 12% interest learning note for the balance. The agreement further provides that the franchise must pay a continuing franchise fee equal to 5% of its monthly gross sales. On August 30 the franchisor completed the initial services required n the contract at a cost of P1,350,000 and incurred indirect costs of P232,500. The franchise commenced business operations on September 3, 2008. The gross sales reported to the franchisor are September sales, P110,000; October sales, P125,000; November sales P138,000; and December sales, P159,000. The first installment payment was made on due date. Assume the collectivity of the note is reasonably assured. In its income statement for the year ended December 31, 2008 how much is the realized gross profit? a. P2,868,750 b. P2,936,225 c. P2,895,350 d. P3,168,725 35. 36. The trustee for John Corp. prepares a statement of affairs which shows that unsecured creditors whose claims total P 540,000 may expect to receive approximately P 405,000 if assets are sold for the benefit of creditors. a. Danielle Corp. holds a note for P22,500 on which interest of P1,350 is accrued, property with a book value of P18,000 and a realizable amount of P 27,000 is pledged on the note. b. Randolph, an employee is owed P6,750 for his salary. c. Baltimore Corp. holds a note of P54,000 on which interest of P2,700 is accrued, securities with a book value of P 58,500 and a realizable amount of P45,000 is pledged on the note. d. Nick Corp. holds a note for P9,000 on which interest of P500 is accrued, nothing has been pledged for the note. How much may each of the following creditors receive? Danielle Corp; Randolph Corp; Baltimore Corp.; Nick Corp., respectively. a. P 27,000 ; P5,063; P53,775 ; P 0 c. P27,000 ; P6,750; P56,700 ; P 0 b. P 23,850; P 6,750; P56,700; P7,125 d, P23,850; P6,750; P53,775 ; P 7,125 Under Violeta’s accounting system, the cost of normal spoilage are treated as part of the cost of good units produced. However, the cost of abnormal spoilage is charged to factory overhead. Using weighted average method, what are the equivalent units for the materials unit cost calculation for the month of April? a. 47,000 b. 52,000 c. 55,000 d. 57,000 39. 40. The following information was taken from H Company’s accounting records for the year December 31, 2008: Increase in raw materials inventory Decrease in finished goods inventory Raw materials purchased Direct labor cost Factory overhead control Freight-in P 15,000 35,000 430,000 200,000 260,000 45,000 41. There was no work in process inventory at the beginning or end of the year. H’s 2008 cost of goods sold is if FOH is applied at 140% of labor costs: a. P950,000 37. b. P965,000 c. P975,000 d. P995,000 C Company has underapplied factory overhead of P45,000 for the year ended December 31, 2008. Before disposition of the underapplied overhead, selected December 31, 2008, balances from C’s accounting records are as follows: Sales Cost of goods sold P1,200,000 720,000 Inventories: Direct materials Work in process Finished goods 42. P Company owns controlling interests in S and T Corporations, having acquired an 80 percent interest in S in 20x1 and a 90 percent interest in T on January 1, 20x2. P’s investments in S and T were at book value equal to fair value. Inventories of the affiliated companies at December 31, 20x2 and December 31, 20x3 were as follows: December 31, 20x2 December 31, 20x3 P inventories P60,000 P54,000 S inventories 38,750 31,250 T inventories 24,000 36,000 P sells to S at a 25 percent markup based on cost, and T sells to P at a markup of 20 percent. P’s beginning and ending inventories for 20x3 consisted of 40% and 50%, respectively, of goods acquired from T. All of S inventories consisted of merchandise acquired from P. The inventory that should appear in the December 31, 20x3 consolidated balance sheet should amount to: a. P109,600 b. P106,000 c. P110,500 d. P121,250 43. In year 20x8, a 90 percent-owned subsidiary sold land to its parent at a gain. The parent still owns the land. In the consolidated balance sheet at December 31, 20x9, the minority interest in the subsidiary should be shown at: a. 10 percent of the subsidiary’s total equity. 36,000 54,000 90,000 Under C’s cost accounting system, over – or underapplied overhead is allocated to appropriate inventories and cost of goods sold based on year – end balances. In its 2008 income statement, C should report cost of goods sold of a. P682,500 38. b. P684,000 c. P756,000 d. P757,500 Violeta company adds materials at the beginning of the process in Department A. Information concerning the materials used in April 2008 is as follows: Units Work in process April ………………………………………………............... P10,000 Started during April……………………………………………………………….. 50,000 Completed & Transferred to the next department during April…………. 36,000 Normal spoilage incurred………………………………………………………… 3,000 Abnormal spoilage incurred……………………………………………………… 5,000 Work in process at April 30………………………………………………………. 16,000 Agency Makabayan received Notice of Cash Allocation (NCA) – P45,000,000 for the year 2008, the entry would be: a. No entry b. Memorandum entry in Registry of Allotments c. National Clearing Account 45,000,000 Appropriation Alloted 45,000,000 d. Cash-National Treasury, MDS 45,000,000 Subsidy Income from National government 45,000,000 Save the Planet, a private nonprofit research organization, received a $500,000 contribution from Ms. Susan Clark. Ms. Clark stipulated that her donation be used to purchase new computer equipment for Save the Planet’s research staff. The contribution was received in August of 2001, and the computers were acquired in January of 2002. For the year ended December 31, 2001, the $500,000 contribution should be reported by Save the Planet on its a. Statement of activities as unrestricted revenue. b. Statement of activities as deferred revenue. c. Statement of activities as temporarily restricted revenue. d. Statement of financial position as deferred revenue. On January 1, 20x3, Pike Company purchased 80% of the outstanding voting shares of Sword company for P800,000. On that date, Sword had P300,000 of capital stock and P600,000 of retained earnings. All assets and liabilities of Sword had book values approximately equal to their fair market values. Goodwill, if any, is not amortized. Pike uses the complete equity method to account for its investment in Sword. On April 1, 20x3, Pike sold equipment with a book value of P40,000 to Sword for P60,000. The equipment is expected to have a useful life of five years from the date of the sale and no salvage value. Sword will use straight-line depreciation. For year 20x3, Sword reported net income of P200,000 and paid dividends of P40,000. Determine the income from investment under the complete equity method. a. P143,000 b. P144,000 c. P163,00 d. P111,000 b. 10 percent of the subsidiary’s total equity less 10 percent of the gain on the land sale. c. 10 percent of the subsidiary’s total equity plus 10 percent of the gain on the land sale. d. 10 percent of the subsidiary’s total equity less 100 percent of the gain on the land sale.