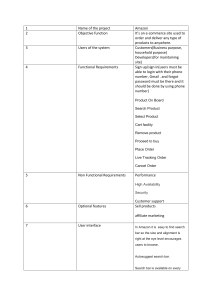

Analyzing the BCG Matrix of Amazon 2018-10921 전우재 Amazon has grown up from a small online bookstore to a global retailer market that provides thousands of goods to consumers. And their growth just doesn’t stop at selling things online. 64% of US households have amazon prime, half of all online growth and 21% percent of retail growth in the US can be attributed to Amazon, and one in four consumer check reviews on Amazon before buying stuff offline. It is meaningful to analyze what the focal business units of Amazon is to get a better understanding of which direction the online retail giant is heading. High market growth Low market growth Star Alexa Amazon Prime Question Mark Whole Foods Market Cash Cow AWS Dog High market share Amazon Retail Low market share Amazon’s business units can be divided into 5 main categories. Starting from the global marketplace amazon.com, their cloud service AWS, the ai software Alexa, Whole Foods market, and Amazon Prime. Below is how the 5 business units can be categorized. 1. Amazon Retail: A Cash Cow or a Dog? Amazon’s online store is what Jeff Bezos likes to call “the Everything Store” where you can buy anything you want. Last year the revenue for the e-commerce marketplace alone was 136 billion dollars, with double digit growth every year. This statistics is about to grow with upcoming days as they expand their delivery services to Japan, China, and India. However, in terms of profit, the global retail giant isn’t doing that well. In fact, we might as well not call the marketplace a cash cow, considering the fact that the company is losing billions of dollars each year. In 2018, it lost 2.1 billion dollars in international sales and the company wasn’t making net profits until recently: Q1 of 2016. The e-commerce marketplace is indeed controversial. Other business experts say that the reason the marketplace looks as if they are having negative profit is because Amazon hates free cash flow. They invest their free money right into other business units or products. That’s why they still make the Fire product line(their own brand that makes TV, phones and etc.) even though they lose competition to other companies today. What Amazon seeks to do with all their investment is to forge all their business network into one huge flywheel. In the near future, if you ask Alexa that you want to buy certain products, she will only answer Amazon Fire products, and that’s what Amazon aims to do. Which is why the retail store is somewhat in the middle of a Cash Cow and a Dog. If Amazon fails to integrate all their product line to capture consumers into the “Amazon ecosystem”, the marketplace will indeed become a dog, but if they do succeed, it will be a mighty cash cow that generates huge profits for the company. 2. AWS: The actual cash cow for the company Many consumers think amazon as a company that only sells products online. In fact, probably most of the actual profit comes from their online cloud service, AWS. Launched in 2006, the service has accelerated income and posted high margins over the past 3 years. It has grown an average of 48% over the last 3 years, generating nearly 26 billion dollars in sales last year. What’s more surprising is that AWS is pretty much a monopoly in the cloud business. Although there are competitors like the Microsoft Azure or Alphabet, AWS holds as the dominant cloud service for business and startups. 3. Alexa: Alexa please kill Siri for me. Global tech giants are investing huge amounts of money into artificial intelligence. Their first war with AI came when Google, Apple, and Amazon produced their smart speakers. The winner? Alexa for now. More than 100 million Alexa devices have been sold, and that’s more than what Apple Speakers and Google Speaker have managed. What Amazon has that other tech giants don’t have, is the global marketplace. Linking the two business units enabled Amazon to integrate Alexa into normal people’s lives. You can just ask her what to buy and when to deliver by just asking simple questions. As the ratio of people who use voice as a means of searching increased steadily over the years, it’s clear that Amazon is trying to drive commerce through Alexa. One study found that in key categories without much differentiation (such as batteries, water, toilet paper and etc.) Alexa will suggest Amazon Basics or Amazon Fire. If asking for a specific brand they will play dumb about other choices (“Sorry, that’s all I found!”) 4. Amazon Prime: What the retail giant really wants their customer to do 55% of people in the US have voted in 2016, 51% of US citizens go to church, only 49% of households own a landline phone nowadays, but 64% of the entire US citizens own Amazon Prime. The retail giant has managed to successfully lure people into subscribing to their Prime service. It delivers the products you buy in less than two days with free returns, and it gives exclusive content through their music and TV streaming service. Prime members represent recurring revenue, loyalty and annual purchase that are 40% greater than non-Prime members. Prime member on average, spend 193 dollars monthly, while non Prime members spend 138 dollars. If Prime continues to grow at its current rate, more people will have Amazon Prime than cable television. What’s more promising for Prime is that wealthy people are more likely to subscribe. 82% of US high-income households have Prime. This means that even if the acquisition cost for one extra Prime member may seem a losing fight, in the long run, it will mean steady sales with full customer loyalty. 5. Whole Foods Market: A new attempt for market dominance What Amazon is famous for in the business world is that it likes to monopolize. It the startup community there is a saying that if you try to compete with Amazon, you are either merged or go out of business. Among several surprising acquisitions Amazon made over the past few years, the acquisition of Whole Foods Market probably surprised most consumers. Amazon is now expanding their business into offline markets through Amazon Go. The Whole Foods Market was established to deliver the most fresh and ripe vegetables and other eateries to consumers. Previously they failed to deliver the food through online, since consumers liked to feel the food, and doubted the quality of the food considering the long delivery time. Although Whole Foods Market seemed to promise a successful offline business entry, it was highly criticized due to their high prices, and its stock price had fallen preacquisition. But the firm managed to lower their price by 2.8 percent in just 5 weeks. The problem with this business unit though is not about the price, but the consumer habits. It is known that consumers like to shop offline where they usually shop, because every other store sell the same products from the same brands. What Amazon really has to do is to provide a new value to consumers so that shopping on Amazon offline stores are more attractive than shopping at their usual stores. It’s true that Amazon is implementing automatic purchase tech through Amazon Go stores, but it’s still a blurry competition whether the company will be able to dominate the offline market as well.