Uploaded by

Redgine Domingo

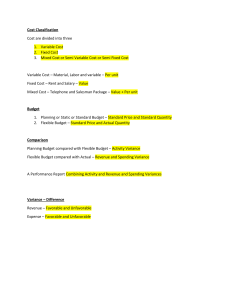

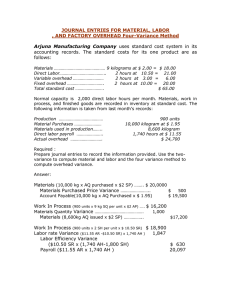

Cost Accounting Overhead Variance Exam Questions