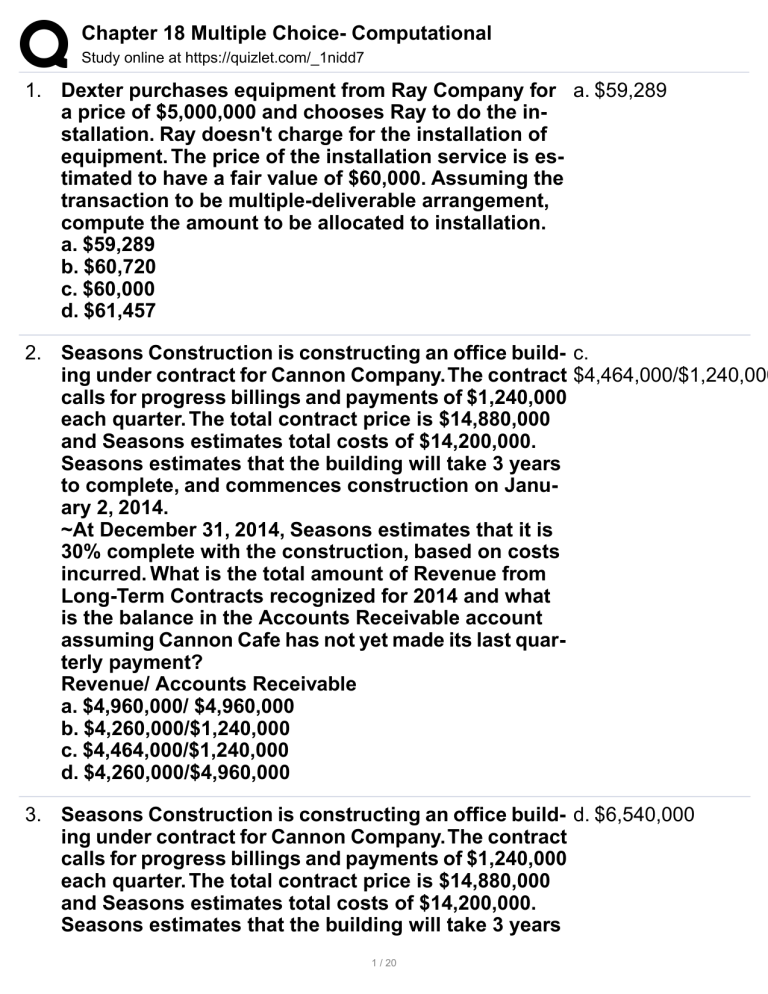

Chapter 18 Multiple Choice- Computational Study online at https://quizlet.com/_1nidd7 1. Dexter purchases equipment from Ray Company for a. $59,289 a price of $5,000,000 and chooses Ray to do the installation. Ray doesn't charge for the installation of equipment. The price of the installation service is estimated to have a fair value of $60,000. Assuming the transaction to be multiple-deliverable arrangement, compute the amount to be allocated to installation. a. $59,289 b. $60,720 c. $60,000 d. $61,457 2. Seasons Construction is constructing an office build- c. ing under contract for Cannon Company. The contract $4,464,000/$1,240,000 calls for progress billings and payments of $1,240,000 each quarter. The total contract price is $14,880,000 and Seasons estimates total costs of $14,200,000. Seasons estimates that the building will take 3 years to complete, and commences construction on January 2, 2014. ~At December 31, 2014, Seasons estimates that it is 30% complete with the construction, based on costs incurred. What is the total amount of Revenue from Long-Term Contracts recognized for 2014 and what is the balance in the Accounts Receivable account assuming Cannon Cafe has not yet made its last quarterly payment? Revenue/ Accounts Receivable a. $4,960,000/ $4,960,000 b. $4,260,000/$1,240,000 c. $4,464,000/$1,240,000 d. $4,260,000/$4,960,000 3. Seasons Construction is constructing an office build- d. $6,540,000 ing under contract for Cannon Company. The contract calls for progress billings and payments of $1,240,000 each quarter. The total contract price is $14,880,000 and Seasons estimates total costs of $14,200,000. Seasons estimates that the building will take 3 years 1 / 20 Chapter 18 Multiple Choice- Computational Study online at https://quizlet.com/_1nidd7 to complete, and commences construction on January 2, 2014. ~At December 31, 2015, Seasons Construction estimates that it is 75% complete with the building; however, the estimate of total costs to be incurred has risen to $14,400,000 due to unanticipated price increases. What is the total amount of Construction Expenses that Seasons will recognize for the year ended December 31, 2015? a. $10,800,000 b. $6,300,000 c. $6,390,000 d. $6,540,000 4. Seasons Construction is constructing an office build- b. ing under contract for Cannon Company. The contract $1,240,000/Debit calls for progress billings and payments of $1,240,000 each quarter. The total contract price is $14,880,000 and Seasons estimates total costs of $14,200,000. Seasons estimates that the building will take 3 years to complete, and commences construction on January 2, 2014. ~At December 31, 2015, Seasons Construction estimates that it is 75% complete with the building; however, the estimate of total costs to be incurred has risen to $14,400,000 due to unanticipated price increases. What is reported in the balance sheet at December 31, 2015 for Seasons as the difference between the Construction in Process and the Billings on Construction in Process accounts, and is it a debit or a credit? Difference between the accounts|Debit/Credit a. $3,380,000/Credit b. $1,240,000/Debit c. $880,000/Debit d. $1,240,000/Credit 5. Seasons Construction is constructing an office build- c. $3,720,000 $ ing under contract for Cannon Company. The contract 4,200,000 2 / 20 Chapter 18 Multiple Choice- Computational Study online at https://quizlet.com/_1nidd7 calls for progress billings and payments of $1,240,000 each quarter. The total contract price is $14,880,000 and Seasons estimates total costs of $14,200,000. Seasons estimates that the building will take 3 years to complete, and commences construction on January 2, 2014. ~Seasons Construction completes the remaining 25% of the building construction on December 31, 2016, as scheduled. At that time the total costs of construction are $15,000,000. What is the total amount of Revenue from Long-Term Contracts and Construction Expenses that Seasons will recognize for the year ended December 31, 2016? Revenue Expenses a. $14,880,000 $15,000,000 b. $3,720,000 $ 3,750,000 c. $3,720,000 $ 4,200,000 d. $3,750,000 $ 3,750,000 6. Cooper Construction Company had a contract start- b. $690,000 ing April 2015, to construct a $18,000,000 building that is expected to be completed in September 2017, at an estimated cost of $16,500,000. At the end of 2015, the costs to date were $7,590,000 and the estimated total costs to complete had not changed. The progress billings during 2015 were $3,600,000 and the cash collected during 2015 was 2,400,000. ~For the year ended December 31, 2015, Cooper would recognize gross profit on the building of: a. $632,500 b. $690,000 c. $810,000 d. $0 7. Cooper Construction Company had a contract start- c. $8,280,000 ing April 2015, to construct a $18,000,000 building that is expected to be completed in September 2017, at an estimated cost of $16,500,000. At the end of 2015, the costs to date were $7,590,000 and the estimated 3 / 20 Chapter 18 Multiple Choice- Computational Study online at https://quizlet.com/_1nidd7 total costs to complete had not changed. The progress billings during 2015 were $3,600,000 and the cash collected during 2015 was 2,400,000. ~At December 31, 2015 Cooper would report Construction in Process in the amount of: a. $690,000 b. $7,590,000 c. $8,280,000 d. $7,080,000 8. Hayes Construction Corporation contracted to con- c. $900,000 and struct a building for $4,500,000. Construction began $450,000. in 2014 and was completed in 2015. Data relating to the contract are summarized below: Year ended December 31, 2014/ 2015 Costs incurred:$1,800,000/ $1,350,000 Estimated costs to complete:1,200,000/— Hayes uses the percentage-of-completion method as the basis for income recognition. For the years ended December 31, 2014, and 2015, respectively, Hayes should report gross profit of a. $810,000 and $540,000. b. $2,700,000 and $1,800,000. c. $900,000 and $450,000. d. $0 and $1,350,000. 9. Monroe Construction Company uses the percentage-of-completion method of accounting. In 2015, Monroe began work on a contract it had received which provided for a contract price of $25,000,000. Other details follow: 2015 Costs incurred during the year: $12,000,000 Estimated costs to complete as of December 31: 8,000,000 Billings during the year: 11,000,000 Collections during the year: 6,500,000 4 / 20 c. $3,000,000 Chapter 18 Multiple Choice- Computational Study online at https://quizlet.com/_1nidd7 What should be the gross profit recognized in 2015? a. $1,000,000 b. $13,000,000 c. $3,000,000 d. $5,000,000 10. In 2015, Fargo Corporation began construction work b. $280,000 under a three-year contract. The contract price is $4,800,000. Fargo uses the percentage-of-completion method for financial accounting purposes. The income to be recognized each year is based on the proportion of costs incurred to total estimated costs for completing the contract. The financial statement presentations relating to this contract at December 31, 2015, follow: Balance Sheet Accounts receivable—construction contract billings: $200,000 Construction in progress: $600,000 Less contract billings: 480,000 Costs and recognized profit in excess of billings: 120,000 Income Statement Income (before tax) on the contract recognized in 2015 $120,000 ~How much cash was collected in 2015 on this contract? a. $200,000 b. $280,000 c. $40,000 d. $480,000 11. In 2015, Fargo Corporation began construction work d. $960,000 under a three-year contract. The contract price is $4,800,000. Fargo uses the percentage-of-completion method for financial accounting purposes. The income to be recognized each year is based on the proportion of costs incurred to total estimated costs 5 / 20 Chapter 18 Multiple Choice- Computational Study online at https://quizlet.com/_1nidd7 for completing the contract. The financial statement presentations relating to this contract at December 31, 2015, follow: Balance Sheet Accounts receivable—construction contract billings: $200,000 Construction in progress: $600,000 Less contract billings: 480,000 Costs and recognized profit in excess of billings: 120,000 Income Statement Income (before tax) on the contract recognized in 2015 $120,000 ~What was the initial estimated total income before tax on this contract? a. $600,000 b. $640,000 c. $800,000 d. $960,000 12. Adler Construction Co. uses the percentage-of-com- c. $1,620,000 pletion method. In 2014, Adler began work on a con- $960,000 tract for $6,600,000 and it was completed in 2015. Data on the costs are: Year Ended December 31 2014/ 2015 Costs incurred: $2,340,000/ $1,680,000 Estimated costs to complete: 1,560,000/— For the years 2014 and 2015, Adler should recognize gross profit in 2014 and 2015 of 2014 2015 a. $0 $2,580,000 b. $1,548,000 $1,032,000 c. $1,620,000 $960,000 d. $1,620,000 $2,580,000 13. Gomez, Inc. began work in 2014 on contract #3814, which provided for a contract price of $14,400,000. 6 / 20 b. $1,200,000. Chapter 18 Multiple Choice- Computational Study online at https://quizlet.com/_1nidd7 Other details follow: 2014/ 2015 Costs incurred during the year $2,400,000/ $7,350,000 Estimated costs to complete, as of December 31: 7,200,000/0 Billings during the year 2,700,000/ 10,800,000 Collections during the year 1,800,000/ 11,700,000 ~Assume that Gomez uses the percentage-of-completion method of accounting. The portion of the total gross profit to be recognized as income in 2014 is a. $900,000. b. $1,200,000. c. $3,600,000. d. $4,800,000. 14. Gomez, Inc. began work in 2014 on contract #3814, c. $4,650,000. which provided for a contract price of $14,400,000. Other details follow: 2014/ 2015 Costs incurred during the year $2,400,000/ $7,350,000 Estimated costs to complete, as of December 31: 7,200,000/0 Billings during the year 2,700,000/ 10,800,000 Collections during the year 1,800,000/ 11,700,000 ~Assume that Gomez uses the completed-contract method of accounting. The portion of the total gross profit to be recognized as income in 2015 is a. $1,800,000. b. $2,700,000. c. $4,650,000. d. $14,400,000. 15. Kiner, Inc. began work in 2014 on a contract for $16,800,000. Other data are as follows: 2014/ 2015 Costs incurred to date $7,200,000/ $11,200,000 Estimated costs to complete 4,800,000/ — Billings to date: 5,600,000/ 16,800,000 Collections to date 4,000,000/ 14,400,000 7 / 20 a. $2,880,000. Chapter 18 Multiple Choice- Computational Study online at https://quizlet.com/_1nidd7 ~If Kiner uses the percentage-of-completion method, the gross profit to be recognized in 2014 is a. $2,880,000. b. $3,200,000. c. $4,320,000. d. $4,800,000. 16. Kiner, Inc. began work in 2014 on a contract for $16,800,000. Other data are as follows: 2014/ 2015 Costs incurred to date $7,200,000/ $11,200,000 Estimated costs to complete 4,800,000/ — Billings to date: 5,600,000/ 16,800,000 Collections to date 4,000,000/ 14,400,000 ~If Kiner uses the completed-contract method, the gross profit to be recognized in 2015 is a. $2,720,000. b. $5,600,000. c. $2,800,000. d. $11,200,000. b. $5,600,000. 17. Horner Construction Co. uses the percentage-of-com- a. $2,400,000. pletion method. In 2014, Horner began work on a contract for $16,500,000; it was completed in 2015. The following cost data pertain to this contract: Year Ended December 31 2014/ 2015 Cost incurred during the year $5,850,000/ $4,200,000 Estimated costs to complete at the end of year: 3,900,000/— ~The amount of gross profit to be recognized on the income statement for the year ended December 31, 2015 is a. $2,400,000. b. $2,580,000. c. $2,700,000. d. $6,450,000. 18. c. $0. $6,450,000 8 / 20 Chapter 18 Multiple Choice- Computational Study online at https://quizlet.com/_1nidd7 Horner Construction Co. uses the percentage-of-completion method. In 2014, Horner began work on a contract for $16,500,000; it was completed in 2015. The following cost data pertain to this contract: Year Ended December 31 2014/ 2015 Cost incurred during the year $5,850,000/ $4,200,000 Estimated costs to complete at the end of year: 3,900,000/— ~If the completed-contract method of accounting was used, the amount of gross profit to be recognized for years 2014 and 2015 would be 2014 2015 a. $6,750,000. $0. b. $6,450,000. $(300,000). c. $0. $6,450,000. d. $0. $6,750,000. 19. Remington Construction Company uses the percent- b. $7,500,000. age-of-completion method. During 2014, the company entered into a fixed-price contract to construct a building for Sherman Company for $24,000,000. The following details pertain to the contract: At December 31, 2014/ At December 31, 2015 Percentage of completion: 25%/ 60% Estimated total cost of contract: $18,000,000/ $20,000,000 Gross profit recognized to date: 1,500,000/ 2,400,000 The amount of construction costs incurred during 2015 was a. $12,000,000. b. $7,500,000. c. $4,500,000. d. $2,000,000. 20. Eilert Construction Company had a contract starting c. $805,000. April 2015, to construct a $21,000,000 building that is expected to be completed in September 2016, at an estimated cost of $19,250,000. At the end of 2015, 9 / 20 Chapter 18 Multiple Choice- Computational Study online at https://quizlet.com/_1nidd7 the costs to date were $8,855,000 and the estimated total costs to complete had not changed. The progress billings during 2015 were $4,200,000 and the cash collected during 2015 was $2,800,000. Eilert uses the percentage-of-completion method. ~For the year ended December 31, 2015, Eilert would recognize gross profit on the building of a. $0. b. $737,917. c. $805,000. d. $945,000. 21. Eilert Construction Company had a contract starting a. $9,660,000. April 2015, to construct a $21,000,000 building that is expected to be completed in September 2016, at an estimated cost of $19,250,000. At the end of 2015, the costs to date were $8,855,000 and the estimated total costs to complete had not changed. The progress billings during 2015 were $4,200,000 and the cash collected during 2015 was $2,800,000. Eilert uses the percentage-of-completion method. ~At December 31, 2015, Eilert would report Construction in Process in the amount of a. $9,660,000. b. $8,855,000. c. $8,260,000. d. $805,000. 22. Hiser Builders, Inc. is using the completed-contract b. a $420,000 loss. method for a $9,800,000 contract that will take two years to complete. Data at December 31, 2015, the end of the first year, are as follows: Costs incurred to date: $4,480,000 Estimated costs to complete: 5,740,000 Billings to date: 4,200,000 Collections to date: 3,500,000 The gross profit or loss that should be recognized for 2015 is a. $0. 10 / 20 Chapter 18 Multiple Choice- Computational Study online at https://quizlet.com/_1nidd7 b. a $420,000 loss. c. a $210,000 loss. d. a $184,800 loss. 23. Gorman Construction Co. began operations in 2015. c. Gross profit, Construction activity for 2015 is shown below. Gor- $1,575,000 man uses the completed-contract method. Contract/Contract Price/Billings thru 12/31/15/Collectings thru 12/31/15/Costs to 12/31/15/EstCost to complete 1 /$4,800,000/ $4,725,000/$3,900,000/$3,225,000/— 2 /3,600,000/ 1,500,000/ 1,000,000/ 820,000/ $1,880,000 3 3,300,000/1,900,000/ 1,800,000/ 2,250,000/ 1,200,000 ~Which of the following should be shown on the income statement for 2015 related to Contract 1? a. Gross profit, $675,000 b. Gross profit, $1,500,000 c. Gross profit, $1,575,000 d. Gross profit, $900,000 24. Gorman Construction Co. began operations in 2015. c. Current liability, Construction activity for 2015 is shown below. Gor- $680,000 man uses the completed-contract method. Contract/Contract Price/Billings thru 12/31/15/Collectings thru 12/31/15/Costs to 12/31/15/EstCost to complete 1 /$4,800,000/ $4,725,000/$3,900,000/$3,225,000/— 2 /3,600,000/ 1,500,000/ 1,000,000/ 820,000/ $1,880,000 3 3,300,000/1,900,000/ 1,800,000/ 2,250,000/ 1,200,000 ~Which of the following should be shown on the balance sheet at December 31, 2015 related to Contract 2? a. Inventory, $680,000 b. Inventory, $820,000 c. Current liability, $680,000 d. Current liability, $1,500,000 25. Gorman Construction Co. began operations in 2015. a. Inventory, Construction activity for 2015 is shown below. Gor- $200,000 11 / 20 Chapter 18 Multiple Choice- Computational Study online at https://quizlet.com/_1nidd7 man uses the completed-contract method. Contract/Contract Price/Billings thru 12/31/15/Collectings thru 12/31/15/Costs to 12/31/15/EstCost to complete 1 /$4,800,000/ $4,725,000/$3,900,000/$3,225,000/— 2 /3,600,000/ 1,500,000/ 1,000,000/ 820,000/ $1,880,000 3 3,300,000/1,900,000/ 1,800,000/ 2,250,000/ 1,200,000 ~Which of the following should be shown on the balance sheet at December 31, 2015 related to Contract 3? a. Inventory, $200,000 b. Inventory, $350,000 c. Inventory, $2,100,000 d. Inventory, $2,250,000 26. Oliver Co. uses the installment-sales method to d. $300 gain. record the sale of dining room sets. When an account had a balance of $14,000, no further collections could be made and the dining room set was repossessed. At that time, it was estimated that the dining room set could be sold for $4,000 as repossessed, or for $5,000 if the company spent $500 reconditioning it. The gross profit rate on this sale was 70%. The gain or loss on repossession was a a. $9,800 loss. b. $10,000 loss. c. $1,000 gain. d. $300 gain. 27. Spicer Corporation has a normal gross profit on in- b. a $4,400 loss. stallment sales of 30%. A 2013 sale resulted in a default early in 2015. At the date of default, the balance of the installment receivable was $32,000, and the repossessed merchandise had a fair value of $18,000. Assuming the repossessed merchandise is to be recorded at fair value, the gain or loss on repossession should be a. $0. b. a $4,400 loss. 12 / 20 Chapter 18 Multiple Choice- Computational Study online at https://quizlet.com/_1nidd7 c. a $4,400 gain. d. a $10,000 loss. 28. Fryman Furniture uses the installment-sales method. a. $6,400. No further collections could be made on an account with a balance of $24,000. It was estimated that the repossessed furniture could be sold as is for $7,200, or for $8,400 if $400 were spent reconditioning it. The gross profit rate on the original sale was 40%. The loss on repossession was a. $6,400. b. $6,000. c. $16,000. d. $16,800. 29. Melton Company sold some machinery to Addison b. $79,247 Company on January 1, 2014. The cash selling price would have been $947,700. Addison entered into an installment sales contract which required annual payments of $250,000, including interest at 10%, over five years. The first payment was due on December 31, 2014. What amount of interest income should be included in Melton's 2015 income statement (the second year of the contract)? a. $25,000 b. $79,247 c. $50,000 d. $69,770 30. Carperter Company has used the installment method b. $ 504,000. of accounting since it began operations at the beginning of 2015. The following information pertains to its operations for 2015: Installment sales: $ 2,800,000 Cost of installment sales: 1,960,000 Collections of installment sales: 1,120,000 General and administrative expenses: 280,000 The amount to be reported on the December 31, 2015 balance sheet as Deferred Gross Profit should be 13 / 20 Chapter 18 Multiple Choice- Computational Study online at https://quizlet.com/_1nidd7 a. $ 336,000. b. $ 504,000. c. $ 672,000. d. $1,680,000. 31. Daily, Inc. appropriately used the installment method b. $152,000 of accounting to recognize income in its financial statement. Some pertinent data relating to this method of accounting include: 2014/2015 Installment sales: $750,000/ $900,000 Cost of sales: 450,000/ 630,000 Gross profit:$300,000/ $270,000 Collections during year: On 2014 sales: 200,000/ 200,000 On 2015 sales: 240,000 What amount to be realized gross profit should be reported on Daily's income statement for 2015? a. $132,000 b. $152,000 c. $176,000 d. $216,000 32. Sutton Company sells plasma-screen televisions on d. $ 600. an installment basis and appropriately uses the installment-sales method of accounting. A customer with an account balance of $2,400 refuses to make any more payments and the merchandise is repossessed. The gross profit rate on the original sale is 40%. Sutton estimates that the television can be sold as is for $750, or for $900 if $60 is spent to refurbish it. The loss on repossession is a. $1,650. b. $960. c. $ 690. d. $ 600. 33. During 2014, Vaughn Corporation sold merchandise costing $2,250,000 on an installment basis for 14 / 20 d. 25% Chapter 18 Multiple Choice- Computational Study online at https://quizlet.com/_1nidd7 $3,000,000. The cash receipts related to these sales were collected as follows: 2014, $1,200,000; 2015, $1,050,000; 2016, $750,000. ~What is the rate of gross profit on the installment sales made by Vaughn Corporation during 2014? a. 75% b. 60% c. 40% d. 25% 34. During 2014, Vaughn Corporation sold merchana. $ 165,000 dise costing $2,250,000 on an installment basis for $3,000,000. The cash receipts related to these sales were collected as follows: 2014, $1,200,000; 2015, $1,050,000; 2016, $750,000. ~If expenses, other than the cost of the merchandise sold, related to the 2014 installment sales amounted to $135,000, by what amount would Vaughn's net income for 2014 increase as a result of installment sales? a. $ 165,000 b. $ 266,250 c. $ 300,000 d. $1,065,000 35. During 2014, Vaughn Corporation sold merchand. $262,500 and dise costing $2,250,000 on an installment basis for $187,500 $3,000,000. The cash receipts related to these sales were collected as follows: 2014, $1,200,000; 2015, $1,050,000; 2016, $750,000. ~What amount would be shown in the December 31, 2015 financial statement for realized gross profit on 2014 installment sales, and deferred gross profit on 2014 installment sales, respectively? a. $262,500 and $562,500 b. $487,500 and $262,500 c. $562,500 and $187,500 d. $262,500 and $187,500 15 / 20 Chapter 18 Multiple Choice- Computational Study online at https://quizlet.com/_1nidd7 36. During 2014, Martin Corporation sold merchandise costing $3,500,000 on an installment basis for $5,000,000. The cash receipts related to these sales were collected as follows: 2014, $2,000,000; 2015, $1,750,000; 2016, $1,250,000. ~What is the rate of gross profit on the installment sales made by Martin Corporation during 2014? a. 30% b. 40% c. 60% d. 70% a. 30% 37. During 2014, Martin Corporation sold merchandise d. $ 400,000 costing $3,500,000 on an installment basis for $5,000,000. The cash receipts related to these sales were collected as follows: 2014, $2,000,000; 2015, $1,750,000; 2016, $1,250,000. ~If expenses, other than the cost of the merchandise sold, related to the 2014 installment sales amounted to $200,000, by what amount would Martin's net income for 2014 increase as a result of installment sales? a. $1,800,000 b. $ 600,000 c. $ 450,000 d. $ 400,000 38. During 2014, Martin Corporation sold merchandise a. $525,000 and costing $3,500,000 on an installment basis for $375,000 $5,000,000. The cash receipts related to these sales were collected as follows: 2014, $2,000,000; 2015, $1,750,000; 2016, $1,250,000. ~What amount would be shown in the December 31, 2015 financial statements for realized gross profit on 2014 installment sales, and deferred gross profit on 2014 installment sales, respectively? a. $525,000 and $375,000 b. $975,000 and $525,000 16 / 20 Chapter 18 Multiple Choice- Computational Study online at https://quizlet.com/_1nidd7 c. $375,000 and $1,125,000 d. $525,000 and $1,125,000 39. Coaster manufactures and sells logging equipment. c. $1,120,000 Due to the nature of its business, Coaster is unable to reliably predict bad debts. During 2014, Coaster sold equipment costing $4,800,000 for $7,200,000. The terms of the sale were 20% down, with equal payments due quarterly over the next 3 years. All payments for 2014 were made on schedule. Round answers to two places. ~Assuming that Coaster uses the installment-sales method of accounting for its installment sales, what amount of realized gross profit will Coaster report in its income statement for the year ended December 31, 2014? a. $3,360,000 b. $2,240,000 c. $1,120,000 d. $ 739,200 40. Coaster manufactures and sells logging equipment. b. $ 480,000 Due to the nature of its business, Coaster is unable to reliably predict bad debts. During 2014, Coaster sold equipment costing $4,800,000 for $7,200,000. The terms of the sale were 20% down, with equal payments due quarterly over the next 3 years. All payments for 2014 were made on schedule. Round answers to two places. ~Assuming that Coaster uses the cost-recovery method of accounting for its installment sales, what amount of realized gross profit will Coaster report in its income statement for the year ended December 31, 2015? a. $0 b. $ 480,000 c. $ 633,600 d. $1,920,000 17 / 20 Chapter 18 Multiple Choice- Computational Study online at https://quizlet.com/_1nidd7 41. On January 1, 2015, Shaw Co. sold land that cost a. $0 $840,000 for $1,120,000, receiving a note bearing interest at 10%. The note will be paid in three annual installments of $450,380 starting on December 31, 2015. Because collection of the note is very uncertain, Shaw will use the cost-recovery method. How much revenue from this sale should Shaw recognize in 2015? a. $0 b. $84,000 c. $112,000 d. $280,000 42. In 2012, Concord Inc. sells inventory with a cost of $32,000 for $50,000. Concord will receive payments of $14,000 in 2012, $26,000 in 2013, and $10,000 in 2014. If the cost-recovery method applies to this transaction, what would be the journal entry to recognize gross profit at the end of 2013? a.Deferred Gross Profit:10,000 Realized Gross Profit: 10,000 b.Realized Gross Profit:18,000 Deferred Gross Profit: 18,000 c.Sales Revenue 50,000 Cost of sales 32,000 Deferred Gross Profit 18,000 d.Deferred Gross Profit8,000 Realized Gross Profit8,000 d.Deferred Gross Profit8,000 Realized Gross Profit8,000 43. On January 1, 2015 Dairy Treats, Inc. entered into c.Cash 912,000 a franchise agreement with a company allowing the Franchise Fee company to do business under Dairy Treats's name. Revenue 840,000 Dairy Treats had performed substantially all required Revenue from services by January 1, 2015, and the franchisee paid Franchise Fees the initial franchise fee of $840,000 in full on that date. 57,600 The franchise agreement specifies that the franchisee Unearned Franmust pay a continuing franchise fee of $72,000 annual- chise Fees 14,400 ly, of which 20% must be spent on advertising by Dairy Treats. What entry should Dairy Treats make on January 1, 2015 to record receipt of the initial franchise fee 18 / 20 Chapter 18 Multiple Choice- Computational Study online at https://quizlet.com/_1nidd7 and the continuing franchise fee for 2015? a.Cash 912,000 Franchise Fee Revenue 840,000 Revenue from Franchise Fees 72,000 b.Cash 912,000 Unearned Franchise Fees 912,000 c.Cash 912,000 Franchise Fee Revenue 840,000 Revenue from Franchise Fees 57,600 Unearned Franchise Fees 14,400 d.Prepaid Advertising 14,400 Cash 912,000 Franchise Fee Revenue 840,000 Revenue from Franchise Fees 72,000 Unearned Franchise Fees 14,400 44. Wynne Inc. charges an initial franchise fee of b. $1,443,744. $1,840,000, with $400,000 paid when the agreement is signed and the balance in five annual payments. The present value of the future payments, discounted at 10%, is $1,091,744. The franchisee has the option to purchase $240,000 of equipment for $192,000. Wynne has substantially provided all initial services required and collectibility of the payments is reasonably assured. The amount of revenue from franchise fees is a. $ 400,000. b. $1,443,744. c. $1,491,744. d. $1,840,000. 45. On May 1, 2015, TV Inc. consigned 80 TVs to Ed's TV. d. $29,375. The TVs cost $450. Freight on the shipment paid by Ed's TV was $1,000. On July 10, TV Inc. received an account sales and $21,500 from Ed's TV. Thirty TVs had been sold and the following expenses were deducted: Freight $1,000 Commission (20% of sales price) ? Advertising 650 Delivery 350 19 / 20 Chapter 18 Multiple Choice- Computational Study online at https://quizlet.com/_1nidd7 ~The total sales price of the TVs sold by Ed's TV was a. $25,625. b. $26,875. c. $27,313. d. $29,375. 46. On May 1, 2015, TV Inc. consigned 80 TVs to Ed's TV. a. TV Inc./ $23,125 The TVs cost $450. Freight on the shipment paid by Ed's TV was $1,000. On July 10, TV Inc. received an account sales and $21,500 from Ed's TV. Thirty TVs had been sold and the following expenses were deducted: Freight $1,000 Commission (20% of sales price) ? Advertising 650 Delivery 350 ~The inventory of TVs will be reported on whose balance sheet and at what amount? Balance Sheet of / Amount of Inventory a. TV Inc./ $23,125 b. TV Inc./ $22,500 c. Ed's TV/ $23,125 d. Ed's TV/ $22,500 20 / 20