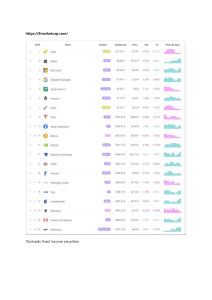

Introduction This final paper focuses on the marketing campaign of Crypto.com, a company in the FinTech category with the ambitious goal of delivering a better alternative to international banks, through a range of services powered by cryptocurrencies. This paper will provide a deep insight into their marketing strategy and implementation, foresee difficulties to achieve goals and prescribe solutions to mitigate them. 1. Company Background Crypto.com was founded in June 2016 by Kris Marszalek (CEO), Rafael Melo (CFO), Gary Orr (CTO) and Bobby Bao (Head Corporate Development): leaders with expertise in banking, technology, financial compliance and entrepreneurship. A recent interview revealed that the company operates with 130 employees, the majority being in engineering, product development, and security (Altcoin Buzz, 2019). Crypto.com is vocal about their mission to “accelerate the transition to cryptocurrency” and vision of “cryptocurrency in every wallet”. Their objective is to create a better alternative to international banking through a suite of financial services by operating a platform leveraging the power of cryptocurrency. 1.1 Line of Products Below is a summary of the financial products Crypto.com is offering to compete with Banks: • MCO VISA Prepaid Cards: Best rewards on the market. Full details in Appendix 1. • Crypto Wallet: Buy and sell crypto currencies with bank transfers and credit card support. • Crypto Invest: Simple investment portfolio built on top of Crypto.com trading engine. • Crypto PAY: Payment network adding cryptocurrency payments for merchants. • Crypto Credit: Borrow money using cryptocurrency as collateral (Coming Soon!) • Crypto Earn: Earn interests on your cryptocurrencies (Coming Soon!) All these products are similar to the ones offered by major banks. They are directly distributed to consumers using the Crypto.com Wallet App. Credit cards are currently restricted to Singapore, BUS 5112 – Final Paper 1 but the team is pushing hard for the major release to the USA and Europe. See product roadmap (Appendix 2). 1.2 Main Competition and Competitive Advantage The FinTech product category is described as financial services products developed by nonbank, noninsurance, online companies. The diversity of products developed by Crypto.com overlaps with several companies in the cryptocurrency space: • Cryptocurrency payment processors such as BitPay and CoinBase • Cryptocurrency Debit Cards such as TenX, Wirex, and CryptoPay • Exchanges for buying and selling cryptocurrencies such as Binance, Bittrex and Kraken There is a race to acquire the first mover advantage in the space in order to establish the company as a leader. Most of it depends on worldwide compliance with local regulations. With many companies focusing on a single service, Crypto.com has the advantage of offering all services under a single platform. Their VISA card product is also more attractive than anything else on the market. Competition with banks, a mature category, poses challenges since the alternative have to establish its value (Winer & Dhar, 2011). 2. Value Proposition, Marketing Strategy and Implementation For anyone with a bank account tired of paying high fees and getting bad service, Crypto.com offers a better alternative through financial services such as high reward VISA cards, investments & loans services, and a payment network giving great perks to buyers while decreasing fees to merchants. 2.1 Target Segment The most active crowd in the FinTech category is composed of young high-income technology professionals (Gulamhuseinwala et al., 2015). In its infancy, Crypto.com has focused its communications on social media platforms to reach this market segment. Today with over 400,000 adopters (Altcoin Buzz, 2019) and over 100,000 cards reserved (Topper, 2019), we observe a transition to mainstream consumers by advertising in travel magazines (Chan, 2019). 2.2 Community Building and Integrated Communication Mix (ICM) BUS 5112 – Final Paper 2 Crypto.com has embraced the concept of ICM, integrating the brand in the lifestyle of consumer through coordination between a diversity of communication channels. Passing information from one medium to another is cost effective and efficient (Pinegar, 2018). Consumers are exposed to the brand via their metal VISA cards, with each purchase they get instant cashback phone notifications. Moreover, all major social media platforms provide a constant flow of information regarding announcements, news and community discussions. An appointed officer delivers most important messages, improving overall consistency (Winer & Dhar, 2011). About once a month, the company organizes a Q&A session for the community to ask questions to Kris Marszalek, CEO of Crypto.com. A variety of platforms have been used such as Reddit, Slack, Discord and YouTube. Each time, the community gathers a list of questions that will be formally answered. This level of transparency increases trust in the brand, even though the community is often impatient for expected news such as shipping dates for upcoming new markets. 2.3 Consumer Acquisition, Branding, and Loyalty Incentives The company has promised to deliver an aggressive advertisement campaign after it establishes its presence in the USA and Europe. In the meantime, the company relies on word-ofmouth to acquire consumers through referral incentives beneficial for both the referral and referee. Crypto.com currently ships his cards in Singapore in an original packaging. It leads to consumers publishing unboxing videos on YouTube, directly advertising to friends and family. This phenomenon is ideal for establishing value for the brand (Winer & Dhar, 2011). To reserve premium credit cards, consumer must purchase and stake in the wallet app MCO tokens, a cryptocurrency issued by the company. After the six-months lockup period, these tokens can be redeemed and resold. VISA card holders can keep their MCO locked-up indefinitely, an incentive to enjoy enhanced rewards such as airdrops (free tokens), free Netflix, free Spotify, Rebates on Expedia and AirBNB. Not only this is a loyalty incentive to prevent users selling out their tokens, it also increases the scarcity and value of the MCO tokens. 3. Strengths and Challenges with the Marketing Mix BUS 5112 – Final Paper 3 Nowadays, every category of consumers trusts digital distribution channels for shopping and other services (Su, 2017). This is an opportunity for FinTech to disrupt financial services. Crypto.com seems to be doing a lot of great things so far by delivering a consistent message on social media, implementing an ICM, directly connecting to consumers and creating a product the people want, in a format they want to share with the world. With 400,000 active users and minimal visibility, their ICM strategy pays off. The main challenges for a marketing manager would be to create trust and comply with local regulations in order to distribute the products globally. For financial services, people tend to trust organizations with a physical presence, such as banks and government-linked organizations (Stewart, 2003) and keeping everything online may devalue the products. Another consideration is the image of cryptocurrencies associated with scams, money laundering, and drugs (Monaghan, 2017). Many people have lost money and faith with this type of investment, while others got a terrific return on their investment. Time should help mitigate people’s fear in adopting this type of technology. In the past, there have been bank runs, but over time, banks became trusted. 4. Recommendations for improving the Marketing Effectiveness Seeing the brand on physical establishments will help increase trust in the brand. Crypto.com must be aggressive in penetrating the market with their Crypto PAY network. By having stickers similar to VISA/Mastercard in everyday establishments such as groceries and restaurants, more people will be tempted to reserve their VISA card and enroll other products. As the product is only a few weeks old, I trust the company will come up with great ideas to speedup Crypto PAY adoption. Another challenge is the perceived complexity of buying MCO tokens, stake them and unlock them six-months later. I think the company should publish the USD cost of reserving the different types of cards and buy the equivalent MCO tokens. That would simplify the process and help the product appeal to more people. Conclusion BUS 5112 – Final Paper 4 With the knowledge acquired in this course, I realize that Crypto.com does a lot of good moves in their marketing strategy. Their main advantage over traditional banking is to limit the overhead costs in their operations, giving back these savings in offering a suite of compelling financial products. They are very early in their lifecycle, but their marketing strategy is lean and efficient. They have been successful in crafting products that people want, leveraging social media to build a community and implementing strong incentives to maintain consumer loyalty. Time will tell if they will achieve their big plans to deploy their services worldwide and create a better alternative to international banks. References Altcoin Buzz (2019), Why will the Crypto Bear Market End? with Kris Marszalek, CEO of crypto.com, YouTube. Retrieved from https://www.youtube.com/watch?v=ORx37RKme10 Chan, T. (2019), This New Lifestyle Card is Changing the Way We Travel — MCO Card, Travel Intern. Retrieved from https://thetravelintern.com/mco-card Gulamhuseinwala, I., Bull, T. & Lewis, S. (2015), “FinTech is Gaining Traction and Young, High-Income Users are the Early Adopters”, Journal of Financial Perspectives, Vol. 3, No. 3. Monaghan, A. (2017), “Bitcoin is a fraud that will blow up, says JP Morgan boss”, The Guardian, Retrieved from https://www.theguardian.com/technology/2017/sep/13/bitcoinfraud-jp-morgan-cryptocurrency-drug-dealers Pinegar, G. (2018), What is IMC? A Beginner's Guide to Integrated Marketing Communications, G2 Crowd. Retrieved from https://learn.g2crowd.com/integrated-marketingcommunications Rooke, K. (2019), Apple Pay Will Process 10 Billion Payments in 2019, The Spring. Retrieved from https://thespring.io/investing/apple-pay-will-process-10-billion-payments-in-2019 Stewart, C. (2003), Trust Transfer on the World Wide Web, Organization Science, Vol. 14, No. 1. Su, B. (2017). The evolution of consumer behavior in the digital age. Retrieved from https://medium.com/analytics-for-humans/the-evolution-of-consumer-behavior-in- thedigital-age-917a93c15888 BUS 5112 – Final Paper Topper, C. (2018), Hong Kong-based Crypto.com Plans To Issue More Than 100,000 Crypto Visa Debit Cards, Medium. Retrieved from https://medium.com/@cointopper/hongkong-based-crypto-com-plans-to-issue-more-than-100-000-crypto-visa-debit-cardsd92e141195d0 Winer, R., & Dhar, R. (2011). Marketing management (4th ed.). Boston: Prentice Hall. 5 BUS 5112 – Final Paper Appendix 1 Crypto.com Credit Card Benefits From https://crypto.com/en/cards.html BUS 5112 – Final Paper Product Roadmap (Updated March 19, 2019) From https://blog.crypto.com/crypto-com-roadmap-marching-to-mars Appendix 2