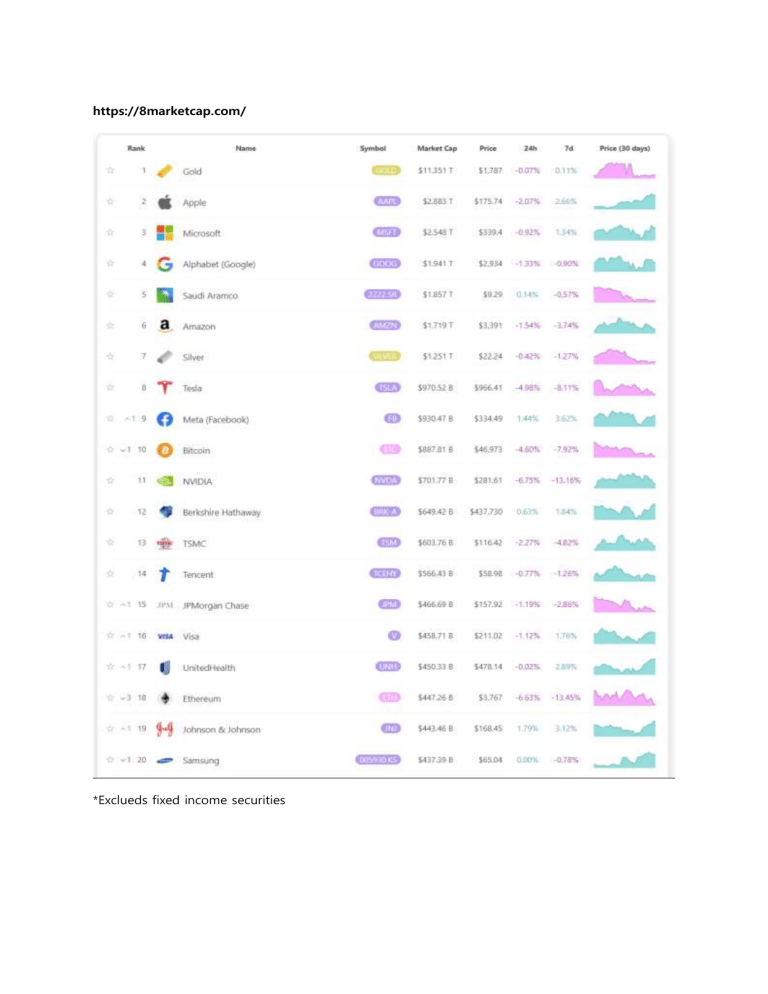

https://8marketcap.com/ *Exclueds fixed income securities https://coinmarketcap.com/ Today's Cryptocurrency Prices by Market Cap The global crypto market cap is $2.13T, a 5.67% decrease over the last day. The total crypto market volume over the last 24 hours is $98.24B, which makes a 39.46% increase. The total volume in DeFi is currently $12.62B, 12.85% of the total crypto market 24-hour volume. The volume of all stable coins is now $79.52B, which is 80.94% of the total crypto market 24-hour volume. Bitcoin's price is currently $46,973.43. Bitcoin’s dominance is currently 41.64%, an increase of 0.47% over the day. https://finviz.com/ Seigniorage/ MMT, modern monetary theory Blockchain technology; Distributed ledger – an immutable shared history (no double-spending) - Decentralization (no intermediary such as banks, exchanges, and brokers) - Anonymity -> no credit related financial services possible; over-collateralized loan only Valuation framework (not traditional DCF) - price of coin = no. of users in the network^2 / no. of coins issued - Plan B’s S2F model Store of value: 사용가치(use value) vs. 교환가치(exchange value) and 기호가치(sign value) The metaverse is a persistent online 3-D virtual space co-created and owned by its users. Layer 2 technology – a second layer of blockchain tech to bypass some of its existing bottlenecks Crypto is here to stay: 1) Institutionalization as an asset class: BTC(supply is limited to 21mil; 90%mined) as a hedge against inflation(fiat currency) 2) U.S. gov’s implicit approval: Chinese gov’s CBDC, Big Tech firms (Web 3.0) 3) Real life use case: smart contracts(programmable feature of blockchian), NTFs(digital art, collectibles, gaming assets, credential, metaverse) – acceleration of mainstream adoption, etc. Disclaimers - Not a trading but a management - Not regulated (yet); potential risks - Learning curve How to get an exposure - KRW market: 업비트(케이뱅크), 빗썸, 코인원, 코빗(신한은행) – 실명인증 필요 - (centralized exchanges) Binance, FTX, Bitmex etc. Wallet - (decentralized exchanges) MetaMask, Yoroi, Kaikas Portfolio construction Fungible Asset Weight Remark BTC 40% As per Bitcoin’s dominance ; to deposited ETH-related 30% Smart contract platforms Non-fungible Stablecoins 10% DeFi projects 10% NTF theme 5% ICO/IDO/IEO & etc. 5% w/ derivatives overlay Management fee - (2%)/20% p.a.(paid quarterly in arrears) Benchmark - N/A Report - Monthly asset management report - Ad hoc commentary Research - https://messari.io/ ($300 p.a.)