lOMoARcPSD|14086013

Module 6 - Joint Arrangements

Advance Accounting (New Era University)

Studocu is not sponsored or endorsed by any college or university

Downloaded by mixx (kmixx.p@gmail.com)

lOMoARcPSD|14086013

1. Introduction/Overview

This module demonstrates an understanding about joint arrangement, essential elements of joint arrangement,

types of joint arrangement, accounting for joint operation transactions, and relevant provisions of the PRFS for

SMEs as well as Section 15 Investment in Joint Ventures.

Related standards:

PFRS 11 Joint Arrangements

PAS 28 Investments in Associates and Joint Ventures

Section 15 of the PFRS for SMEs

2. Learning Outcomes

1.

2.

3.

4.

Define a joint arrangement and state its characteristics.

Difference between a joint operation and joint venture.

Account for joint operations.

Describe the accounting requirements for joint ventures

3. Joint Arrangement

Definition of Joint arrangement

Joint arrangement is "an arrangement of which two or more parties have joint control." (PFRS 11.4)

Essential elements in the definition of joint arrangement:

a.

Contractual arrangement

b.

Joint control

Contractual arrangement

A contractual agreement for the sharing of joint control over an investee distinguishes an interest in a joint

arrangement from other types of investments, such as investment in equity securities measured at fair value

(PFRS 9), investment in associate (PAS 28), and investment in subsidiary (PFRS 3 and PFRS10). PFRS 11 is

not applicable without such an agreement.

The contractual arrangement may be evidenced in various ways, for example, by a contract, by minutes of

discussions between the parties, or by inclusion in the articles or by-laws of the joint arrangement. Whatever

its form, the contractual arrangement is usually in writing and deals with matters such as:

a.

the activity, duration and reporting obligations of the joint arrangement;

b.

the appointment of the board of directors (or its equivalent) and the voting rights of the

parties;

c.

capital contributions by the parties; and

d.

the sharing by the parties of the output, income, expenses or results of the joint arrangement.

Downloaded by mixx (kmixx.p@gmail.com)

lOMoARcPSD|14086013

The contractual arrangement establishes joint control over the joint arrangement. Such a requirement

ensures that no single party is in a position to control the activity unilaterally.

Joint control

Joint control is "the contractually agreed sharing of control of an arrangement, which exists only when decisions

about the relevant activities require the unanimous consent of the parties sharing control." (PFRS 11.7)

In contrast with significant influence and control, an investor obtains joint control over an investee through a

contractual agreement with fellow investors. Financial arid operating decisions relating to the joint

arrangement's activities require the consent of each of the parties sharing joint control. No single party obtains

leverage over another in respect of voting rights over financial and operating decisions.

Contrast joint control with the following:

•

Significant influence is the power to participate in the financial and

operating policy decisions of an investee but is not control or joint

control over those policies.

•

Control is the power to govern the financial and operating policies

of an investee so as to obtain benefits from it

Joint control exists when all the parties sharing joint control over the arrangement act collectively (together)

in directing the activities that significantly affect the returns of the arrangement.

An arrangement is considered a joint arrangement even if not all of the parties to the arrangement have

joint control. It is sufficient that at least two of those parties share joint control.

PFRS 11 distinguishes between:

a.

b.

parties that have joint control of a joint arrangement (referred to as joint operators or joint venturers — see

discussion below), and

parties that participate in, but do not have joint control of, a joint arrangement.

Downloaded by mixx (kmixx.p@gmail.com)

lOMoARcPSD|14086013

Ø Party to a joint arrangement is '"an entity that participates in a joint arrangement, regardless of whether that

entity has joint control of the arrangement." (PFRS 11. Appendix A)

However, in the separate financial statements, investments in associates, subsidiaries and joint ventures are

accounted for either: (a) at cost, (b) at fair value in accordance with PFRS 9, or (c) using the equality method.

Examples: (PFRS 11.B28)

Case 1

A, B and C has an arrangement whereby A has 50% voting rights, B has 30% and C has 20%. The parties

agreed that at least 75% of the voting rights are required to make decisions about the relevant activities of

the arrangement

Downloaded by mixx (kmixx.p@gmail.com)

lOMoARcPSD|14086013

Analysis:

The requirement that at least 75% voting rights is needed to make a decision imply that A and B have joint

control over the arrangement because decisions cannot be made without both A and B agreeing.

Case 2:

A, B, and C has an arrangement whereby A has 50% of the voting rights, B has 25% and C has 25%. The

parties agreed that at least 75% of the voting rights are required to make decisions about the relevant activities

of the arrangement.

Analysis:

A, B and C collectively control the arrangement because to reach the 75% vote either A and B or A and C

should agree. To be a joint arrangement, the parties would need to specify which combination of the parties

is required to agree unanimously on decisions about the relevant activities of the arrangement.

Case 3:

A and B each has 35% of the voting of an arrangement; the remaining 30% is widely dispersed.

Decision about relevant activities require a majority of the voting rights.

Analysis:

A and B have joint control only if the contractual arrangement specifies that decisions require both A and B

agreeing. This is because a majority vote can be reached either in the combination of A and other parties or B

and other parties, i.e., A's 35% + at least 16% held by other investors or B's 35% + at least 16% held by other

investors. ('Majority is 51% or more)

Downloaded by mixx (kmixx.p@gmail.com)

lOMoARcPSD|14086013

3.1. Types of Joint Arrangement

Types of joint arrangement

An entity is required to determine the type of joint arrangement in which it is involved. The types of joint

arrangement are:

Joint operation — is "a joint arrangement whereby the parties that have joint control of the

arrangement have rights to the assets and obligations for the liabilities of the arrangement. Those parties are

called joint operators.” (PFRS 11.15)

a.

Joint venture — is "a joint arrangement whereby the parties that have joint control of the arrangement

have rights to the net assets of the arrangement. Those parties are called joint venturers." (PFRS 11.16)

b.

An entity applies judgment when determining the type of joint arrangement in which it is involved by:

a.

Considering its rights and obligations arising from the arrangement.

b.

Assessing its rights and obligations in relation to the:

i.

structure and legal form of the arrangement,

ii.

terms of the contractual agreement, and

iii.

other facts and circumstances.

Rights and obligations arising from the arrangement

If the contractual arrangement confers to the parties that have joint control rights to the assets and obligations

for the liabilities of the joint arrangement, the joint arrangement is a joint operation. The parties that have

joint control are called joint operators.

If the contractual arrangement confers to the parties have joint control rights to the net assets of the joint

arrangement, the joint arrangement is a joint venture. The parties that have control are called joint venturers.

Assessment of rights and obligations Structure and legal form of the arrangement

a.

A joint arrangement that is not structured through a separate vehicle is a joint operation.

b.

A joint arrangement in which the assets and liabilities relating to the arrangement are held in a separate

vehicle can be either a joint venture or a joint operation.

Ø Separate vehicle — "a separately identifiable financial structure, including separate legal entities or entities

recognized by statute, regardless of whether those entities have a legal personality." (PFRS 11. Appendix A)

Downloaded by mixx (kmixx.p@gmail.com)

lOMoARcPSD|14086013

Examples:

Case 1:

A, B, and C, each engaged in the extraction of oil, agreed to acquired and jointly operate an oil pipeline. The

parties will share equally in the pipeline’s acquisition and operating costs.

Analysis:

The joint arrangement is a joint operation because it confers to the Parties rights to the assets and obligations

for the liabilities of the joint arrangement.

Case 2:

A and B agreed to jointly manufacture and distribute a particular product. Each party will carry out different

parts of the manufacturing process, bearing its own costs but will have an equal share on the revenues.

Analysis:

The joint arrangement is a joint operation because it is not Structured through a separate vehicle (i.e., each

party carries out a specific task using its own existing business).

Case 3:

A and B entered into a joint arrangement to form Alphabets Corporation, which will manufacture materials

required in A’s and B’s individual manufacturing processes. Each party will have 50% ownership interest in

Alphabets Corporation. Alphabets will have its own assets, liabilities, equity, income and expenses.

Analysis:

Alphabets Corporation (the 'separate vehicle') is a legal entity, separate and distinct from its owners.

Accordingly, Alphabets' assets and liabilities are its own, rather than of its owners. This indicates that the joint

arrangement confers A and B rights to the net assets of Alphabets, as opposed to specific assets and liabilities.

The joint arrangement, therefore, is a joint venture.

However, A and B can modify the features of the separate vehicle such that A and B will have rights to the

assets and obligations for the liabilities of the separate vehicle. Such modifications can cause an arrangement

to be a joint operation.

(See next case.)

Downloaded by mixx (kmixx.p@gmail.com)

lOMoARcPSD|14086013

Terms of the contractual agreement and Other facts and circumstances

Case 4 (adapted from PFRS 11.B32

Refers to case 3 above (Alphabets Corporation). In addition, it was further agreed that:

A and B shall purchased all of Alphabet’s output in the ratio od 50:50. Alphabets cannot sell to third

parties without A and B;s approval.

a.

Alphabets’ pricing policy is designed to cover only the operating costs. Thus Alphabets is intended to

operate at a break-even level.

b.

Analysis:

The exclusivity of Alphabets' output to A and B reflects the dependence of Alphabets on A and B in generating

cash flows. Therefore, A and B have an obligation to fund the settlement of Alphabets' liabilities. Moreover,

that exclusivity evidences A and B's rights to all the economic benefits of the assets of Alphabets. These

additional facts and circumstances indicate that the arrangement is a joint operation.

Case 5: (Adapted from PFRS 11.B32)

See Cases 3 & 4. A and B change the contractual arrangement so that Alphabets is able to sell its output to

third parties, resulting in Alphabets assuming demand, inventory and credit risks.

Analysis:

The change in the facts and circumstances requires a reassessment of the classification of the joint arrangement.

The change indicates that the arrangement is a joint venture.

3.2. Joint Operations

Joint operations

A joint operator recognizes its own. assets, liabilities, income and expenses plus its share in the joint

operation's assets, liabilities, income and expenses. These items are accounted for under other PFRSs applicable

to the particular assets, liabilities, income and expenses.

Illustration 1:

A and B agreed to combine their operations, resources and expertise to jointly manufacture and sell a particular

product. The joint operators will individually carry out different parts of the manufacturing process, bearing

their own costs but will share equally in the revenues. The joint operation was complete, and thus

terminated, during the year. The following were the transactions:

•

A had sales of P200 and expenses of PIOO.

Downloaded by mixx (kmixx.p@gmail.com)

lOMoARcPSD|14086013

•

B had sales of P150 and expenses of P80.

Ø Financial reporting:

The individual statement of comprehensive income of the entities will show the following:

Entity A

Entity B

Sales [(200 + 150) x 50%}]

175

Expenses

(100)

Profit

75

Sales [(200 + 150) x 50%}]

175

Expenses

(80)

Profit

95

Illustration 2:

A and B agreed to acquire and jointly operate an oil each will use to transport its own oil. The joint operators

will share equally in the pipeline's acquisition and operating costs. The acquisition cost was P100M and the

operating costs were P30M. A and B had total sales of P120M and P150M, respectively.

Ø Financial reporting:

The individual financial statement of the entities will show the following:

Entity A

Entity B

Statement of financial position

Statement of financial position

PPE (oil pipeline) 100M x 50%

50M

Statement of profit or loss

PPE (oil pipeline) 100M x 50%

50M

Statement of profit or loss

Sale

120M

Sale

150M

Expenses

Profit

(15M )

105M

Expenses

Profit

(15M )

135M

Accounting for joint operation transactions

Separate books of accounts (i.e., journal and ledger) may or may not be used for a joint operation.

No separate records are maintained

Separate books of accounts may not be used most especially when the joint operation is relatively short-lived.

When separate records are not maintained, joint operation transactions involving income and expenses are

recorded in each of the joint operators' individual books using the "Joint Operation " account (which is

like the 'income summary' account). Joint Operation

Downloaded by mixx (kmixx.p@gmail.com)

lOMoARcPSD|14086013

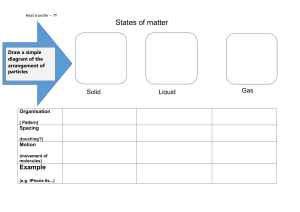

·

Merchandise contribution

xx

xx

Merchandise withdrawals

·

Purchased & freight- in

xx

xx

Purchase returns & discount

·

Sales return & discount

xx

xx

Sales and other income

·

Expenses

xx

xx

Unsold merchandise, if any

Nominal accounts with normal debits balances are placed on the debit side; those with normal credit balances

are placed on the credit side. A credit balance in the T- account represent profit; a debit balance represent

loss.

Unsold merchandise (ending inventory) is placed on the credit side to reflect ‘cost of goods sold’ (i.e.,

mdse. Contribution/beg. + purchased + freight-in on the debit side less ending inventory on the credit side

equals cost of goods sold).

In addition, personal accounts are used. A personal account is a receivable from, or a payable to, a joint

operator.

Example: A and B's joint operation has no separate records. To record the transactions of the joint operation,

A and B will each open a Joint Operation account in their respective books. In addition, A will open a

"Receivable from B" and/or a "Payable to B " account. B will do the same his books. Alternatively, account

titles such as "Account with A" or "Account with B" or simply "A co." or "B Co. " may also be used. A credit

balance in such account represents a payable; a debit balance represents a receivable. At any point of time, the

Joint Operation accounts in A's and B's books should tally. If not, reconciliation shall be made.

One or more joint operators may act as the manager who will oversee the day-to-day operations of the joint

operation. Managers are usually paid a fee for such duties. Management fees are treated as expense by the joint

operation and as income by the manager.

The manager records any asset (other than merchandise) and any liability he receives/incurs on behalf of

the joint operation using regular accounts but labeled as 'JO', e.g., "Joint operation Cash" ('JO-Cash'), 'JOaccounts receivable', and 'JO-accounts payable', The manager maintains these accounts in his 'own books in

addition to the Joint Operation and personal accounts.

The Joint Operation, personal accounts, and other JO accounts are maintained alongside a joint operator’s

regular accounts, but these are closed when the joint operator prepares its general-purpose financial statements.

Downloaded by mixx (kmixx.p@gmail.com)

lOMoARcPSD|14086013

Illustration: Joint operation profit & Cash settlement

A, B and C’s joint operation had the following transaction;

a.

A contributed cash P100 and inventory costing P200

b.

B contributed inventory costing P400. B paid freight of P20 on the transfer;

c.

C made purchased of P100 using A’s cash contribution.

d.

C paid expenses of P200 using his own cash.

e.

C made total sales of P800. All inventories were sold expect one-half of those contributed by B. the unsold

inventory was charged to C on the settlement of the joint operation.

The joint operators agreed on the following:

a.

C, the appointed manager, is entitled to a salary of P30 and a bonus of 25% of profit after salary and bonus.

b.

Interest of 10% is allowed on A’s and B’s capital contributions.

c.

Any remaining profit or loss is shared equally,

Solutions:

Requirements (a): Profit or loss after salary and bonus

Joint operation

Mdse. Contribution of A & B (a)

Purchased

Expenses

620

100 800 Sales

200 210 Unsold merchandise 9b0

90

Profit before salary and bonus

(a)

A: 200+ B: 400 + 20 freight = 620

(b)

(B: 400 + 20 freight) x 1/2 = 210

Profit before salary and bonus

90

C’s salary

(30)

C’s bonus

(12)

Profit after salary and bonus

•

48

Alternative solution: (90 — 30) + 125% = 48

Recall that a joint operation recognizes management fees as expenses. Thus, even if the requirement in the

problem is stated differently, say "profit for the year,' the answer would still be P48. The interests on capital

contributions, however, are used only for P/L allocation and are not expenses. Why?......because capital

Downloaded by mixx (kmixx.p@gmail.com)

lOMoARcPSD|14086013

contributions are considered equity, only interests on liabilities are recognized as interest expenses.

Requirement (b): Cash settlement

A

B

C

Profit before salary and bonus

Total

90

Allocation

1.

Salary

30

30

2.

Bonus (see requirement ‘a’

12

12

3.

Interest (300 x 10%) and (420 x 10%)

4.

Allocation of remaining profit

30

42

72

(90 – 30 – 12 – 72) = -24; (-24/3)

(8)

(8)

(8)

(24)

As allocated

22

34

34

90

Interest in Joint Operation whose activity constitutes a business

An entity that acquires an interest in a joint operation whose activity constitutes a business shall account for its

share as a business combination.

A business "is an integrated set of activities and assets that is capable of being conducted and managed for

the purpose of providing a return in the form of dividends, lower costs or other economic benefits directly to

investors or other owners, members or participants." (PFRS 3. Appendix A)

Financial Reporting:

C Co.'s statement of financial position will include C Co.'s shares in JO X's assets and liabilities and the

computed goodwill.

Downloaded by mixx (kmixx.p@gmail.com)

lOMoARcPSD|14086013

3.3. Joint Venture

Joint ventures

An entity first applies PFRS 11 to determine the type of arrangement it is involved in. If the arrangement is

a joint venture, the entity recognizes its interest as an investment and account for it using the equity method

under PAS 28 Investments in Associates and Joint Ventures.

Under the equity method, the investment is initially recognized at cost and subsequently adjusted for the

investor's share in the investee's changes in the equity, such as (1) profit or loss, (2) other comprehensive

income, (3) dividends, and (4) results of discontinued operations.

Illustration: Equity method

On Jan. 1, 20x1, ABC Co. entered into a joint arrangement classified as a joint venture. ABC acquired its 30%

interest in Joint Venture, Inc. (JV, Inc.) for P500,000. During the year, JV, Inc. reported P1,000,000 profit and

P200,000 other comprehensive income, i.e., a total comprehensive income of 1,200,000 JV, Inc, declared

dividends of P600,000.

Requirement: Compute for the carrying amount of ABC's investment on Dec. 31, 20x1?

Solution:

The equity method is discussed exhaustively in Intermediate Accounting Part 1B. The various illustrations

in that book also apply to investments in joint ventures.

Presentation in statement of financial position

Investments accounted for under the equity method (i.e., investments in associates and joint ventures) are

presented in the statement of financial position as non-current assets, except when they are classified as held

for sale under PFRS 5 Non-current Assets Held for Sale and Discontinued Operations.

4. Summary

•

•

The essential elements of a joint arrangement are (1) contractual arrangement and (2) joint control.

Joint control is the contractually agreed sharing of control, such that decisions require the unanimous

consent of the parties sharing control.

Downloaded by mixx (kmixx.p@gmail.com)

lOMoARcPSD|14086013

•

•

•

•

•

•

•

A joint arrangement can exist even if not all of the parties have joint control. It is sufficient that at least

two parties have joint control.

A joint arrangement is either (a) joint operation or (b) joint venture.

A joint arrangement is a joint operation if the parties with joint control have rights to the assets and

obligations for the liabilities of the arrangement.

A joint arrangement is a joint venture if the parties with joint control have rights to the net assets of the

arrangement.

Separate records may or may not be used for a joint operation.

If no separate records are maintained, the joint operation transactions are recorded in each of the joint

operators' individual books.

If separate records are maintained, the joint operation transactions are recorded in the separate records

in the regular manner. The joint operators record only their own transactions in their respective books.

Joint Operation

·

Merchandise contributions

xx

·

Merchandise withdrawals

xx

·

Purchases & freight in

xx

·

Purchases & discounts

xx

·

Sales returns & discounts

xx

·

Sales returns & other income

xx

·

Expenses

xx

·

Unsold merchandise, if any

xx

•

A joint venture accounts for its interest in a joint venture similar to an investment in associate, i.e., using

the equity method

Relevant provisions of the PFRS for SMEs

Section 15 Investments in Joint Ventures

A joint venture is ''a contractual arrangement whereby two or more parties undertake an economic activity that

is subject to joint control."

(PFRS for SMEs 15.13)

An entity considers any potential voting rights that are currently exercisable and held by the entity and/or its

co-venturers when determining the existence of joint control.

A joint venture is classified in one of the following:

a.

Jointly controlled operation

b.

Jointly controlled asset

c.

Jointly controlled entity

Downloaded by mixx (kmixx.p@gmail.com)

lOMoARcPSD|14086013

Jointly controlled operations

A jointly controlled operation is one whereby:

a.

b.

c.

The joint venture's operation involves the use of the venturers’ assets and other resources rather than the

establishment of a separate entity.

Each venturer uses its own assets and incurs its own liabilities and expenses, but takes a share in the joint

venture's income and expenses incurred in common.

The joint venture's activities may be carried out by the venturer’s employees alongside the venturer's

similar activities.

A venturer recognizes the assets it controls, the liabilitie and expenses that it incurs and its share in the joint

venture’s income,

Jointly controlled assets

A jointly controlled asset involves joint ownership over the assets contributed to, or acquired for the purpose

of, the joint venture and dedicated to the purposes of the joint venture, rather than the establishment of a

separate entity.

A venturer recognizes the assets that it controls plus its share in the jointly controlled assets classified

according the nature of the assets, the liabilities and expenses it incurs plus its share in any liabilities and

expenses incurred jointly with the other venturers, and its share in the joint venture's income or output.

Jointly controlled entities

A jointly controlled entity involves the establishment of a separate entity (e.g., a corporation) in which each

venturer has an interest. The separate entity operates in the same way as other entities, except that a contractual

arrangement between the venturers establishes joint control over the economic activity of the entity.

A venturer accounts for all its investments in jointly controlled entities using

one of the following:

a.

Cost model

b.

Equity method

c.

Fair value model

Under the Cost model, the investment is measured at cost, including transaction costs, and subsequently tested

for impairment (e.g., by comparing the carrying amount and fair value less costs to sell). Any impairment

loss.is recognized in profit or loss. Gain on reversal of impairment is recognized only up to the extent of

previously recognized impairment losses.

Downloaded by mixx (kmixx.p@gmail.com)

lOMoARcPSD|14086013

Investments measured under the Equity method are also tested for impairment.

Under the Fair value model, the investment is initially and subsequently measured at fair value, without

deductions for transaction costs and estimated costs to sell. Changes in fair values are recognized in profit or

loss.

Transactions between a venture and a joint venture

a.

sells to a joint venture recognizes only the portion of the gain or loss that is attributable to the interests of

the other venturers.

b.

Purchases from a joint venture recognizes gain or loss only when it resells the purchased assets to an

independent party.

In both cases, a venturer recognizes immediately a loss in full if it represents an impairment loss.

Investor does not have joint control

An investor that does not have joint control accounts for its investment at (a) FVPL, (b) cost less impairment,

or (c) as investment in associate, if it has significant influence.

Notable differences between the provisions of the full PFRS and the PFRS for SMEs:

Full PFRSs

PFRS for SMEs

Definition of terms

PFRS 11 uses the term joint arrangement and PFRS for SMEs uses the term joint venture and

classifies it into:

classifies it into:

a.

Joint operation

a.

Jointly controlled operation

b.

Joint venture

b.

Jointly controlled asset

c.

Jointly controlled entity

Choice of accounting policy on investments in joint venture

PAS 28 required the use of the equity method in PFRS for SMEs provides the following choices for

accounting for investments in joint ventures.

jointly controlled entities:

However, PAS 27 provides the following choices in a.

separate financial statements:

a.

Cost

b.

Equity method

c.

Fair value

Cost model

b.

Equity method

c.

Fair value method

Downloaded by mixx (kmixx.p@gmail.com)