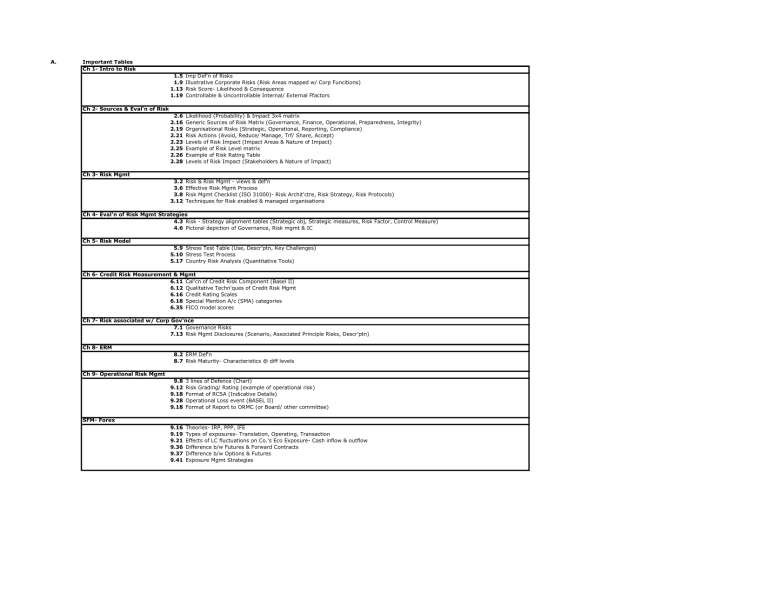

A. Important Tables Ch 1- Intro to Risk 1.5 1.9 1.13 1.19 Imp Def'n of Risks Illustrative Corporate Risks (Risk Areas mapped w/ Corp Funcitions) Risk Score- Likelihood & Consequence Controllable & Uncontrollable Internal/ External Ffactors 2.6 2.16 2.19 2.21 2.23 2.25 2.26 2.28 Likelihood (Probability) & Impact 3x4 matrix Generic Sources of Risk Matrix (Governance, Finance, Operational, Preparedness, Integrity) Organisational Risks (Strategic, Operational, Reporting, Compliance) Risk Actions (Avoid, Reduce/ Manage, Trf/ Share, Accept) Levels of Risk Impact (Impact Areas & Nature of Impact) Example of Risk Level matrix Example of Risk Rating Table Levels of Risk Impact (Stakeholders & Nature of Impact) 3.2 3.6 3.8 3.12 Risk & Risk Mgmt - views & def'n Effective Risk Mgmt Process Risk Mgmt Checklist (ISO 31000)- Risk Archit'ctre, Risk Strategy, Risk Protocols) Techniques for Risk enabled & managed organisations Ch 2- Sources & Eval'n of Risk Ch 3- Risk Mgmt Ch 4- Eval'n of Risk Mgmt Strategies 4.3 Risk - Strategy alignment tables (Strategic obj, Strategic measures, Risk Factor, Control Measure) 4.6 Pictoral depiction of Governance, Risk mgmt & IC Ch 5- Risk Model 5.9 Stress Test Table (Use, Descr'ptn, Key Challenges) 5.10 Stress Test Process 5.17 Country Risk Analysis (Quantitative Tools) Ch 6- Credit Risk Measurement & Mgmt 6.11 Cal'cn of Credit Risk Component (Basel II) 6.12 Qualitative Techn'ques of Credit Risk Mgmt 6.16 Credit Rating Scales 6.18 Special Mention A/c (SMA) categories 6.35 FICO model scores Ch 7- Risk associated w/ Corp Gov'nce 7.1 Governance Risks 7.13 Risk Mgmt Disclosures (Scenario, Associated Principle Risks, Descr'ptn) Ch 8- ERM 8.2 ERM Def'n 8.7 Risk Maturity- Characteristics @ diff levels Ch 9- Operational Risk Mgmt 9.8 9.12 9.18 9.28 9.18 3 lines of Defence (Chart) Risk Grading/ Rating (example of operational risk) Format of RCSA (Indicative Details) Operational Loss event (BASEL II) Format of Report to ORMC (or Board/ other committee) 9.16 9.19 9.21 9.36 9.37 9.41 Theories- IRP, PPP, IFE Types of exposures- Translation, Operating, Transaction Effects of LC fluctuations on Co.'s Eco Exposure- Cash inflow & outflow Difference b/w Futures & Forward Contracts Difference b/w Options & Futures Exposure Mgmt Strategies SFM- Forex B. ICAI Questions Source No. Rev Topic Covered Remarks ICAI(Web/ M18 MTP) CS-1 Design Risk Scenario (Bank Case Study) - 10 Identified Risks 1. Risk Scenario Title 2. Scenario description 3. Impact of scenario 4. Current measures to manage risks Deductive + Direct Answers from Ch 1 & Ch 3 ICAI risks differ from what you identified. Luckily, since only 5 risks are required to be stated → State only those risks which you have absolutely certainty over. Bucketing and Likelihood of above risks ← may come in handy CS-2 (i) Identify the Risks that may be possible and their nature. (ii) Scaling of these identified risks based on ICAI Guide on Risk Based Internal Audit. (iii) Any three to four approaches to identify and assess the risk. (iv) Course of action to be followed to treat these risks. (v) Matters on which Risk Governance Framework can define a policy statement. (vi) Risk Maturity Level and reasons for the same. Deductive Answer from Ch 1 (ICAI loves Operational Risk) Based on above (when in doubt→ use score 4) Direct Answer from Ch 2 Direct Answer from Ch 2 Direct Answer from Ch 7 Deductive Answer from Ch 8 CS-3 1. 2. 3. 4. Direct Answer from Ch 2 Deductive Answer from Ch 5 Direct Answer from Ch 9 of SFM CS Based SWOT Analysis Risk Definitions & Explanations Tackle the exposure of difference in exchange rates b/w sale and invoice collection Efficacy Internal Financial Control (IFC) May 18 Exam Paper CS-1 Financial Ratios Formulae based computations CS-2 Bayes Theorem,NPV,GM Big Data Analytics w.r.t Money Laundering Operations VaR and Expected Shortfall,Monte carlo Simulation CDS v/s Credit Insurance, Five Cs of Credit Old Ch 4 of RM Direct Answer from Ch 9 Direct Answers from Ch 5 & Ch 2 Direct Answer from Ch 6 Direct Answer from Ch 6 CS-3 Key Risks and Measure to Mitigate Risks in CS Deducitve + Direct Answers from Ch 1 & Ch 3 (2 Alt Presentations given) Portfolio Risks Deductive (Conceptual) + Ch 6 for reference CS-2 A. Types of risk faced by XYZ Co, steps to mitigate B. Cyber Risks & Cyber Crimes Deductive Answer from Ch 1 Deducitve + Direct Answers from Ch 9 CS-3 A. Country Risk & Qualitative tools to assess same B. Credit risk mitigation C. Risk Governance (Sound Practices by BoD & AC) D. Probability Computation (Bayes Theorem) Direct Answers from Ch 1 & Ch 9 Direct Answer from Ch 6 Direct Answer from Ch 7 Old Ch 4 of RM August 18 MTP CS-1 Nov 18 Exam Paper CS-1 CS-2 Report to Board 1. Type of Risk ,Impact of Risk, Mitigation of Risk 2. Preventive measures while engaging Professionals for Stat Compliances Deductive + Direct Answers from Ch 1 & 3 ← May come in handy. Purely Conceptual. 1. 2. 3. 4. 5. 6. Direct Answer from Ch 2 Old Ch 4 of RM Direct Answer from Ch 7 Direct Answers (Refer KL index + AS) Direct Answer from Ch 6 Direct Answer from Ch 3 OECD Principles for effective implementation of risk management. Variance & Std Deviation Functions of Risk Mgmt Definitions Basic principles for assessment of Credit Risk Holistic Risk Mgmt Framework CS-3 Risk Grading/Rating, Classify Risk& Report(EVEN THOUGH TERM IS "RISK RATING"→ USED RISK BUCKETING) → Stagnant business growth resulting from competition from other airlines → Aggressive fleet expansion leading to over-capacities → Safety Standards resulting in Crash/ disastrous hijacking → Volatile Oil Prices Deductive (Highly Judgmental) from Ch 9 High Impact – Low Probability High Impact – High Probability Low Probability – High Impact Low Probability – Low Impact CS-1 Key Risks Identification & Report while AC reviews RMF Highly Judgmental from Ch 1 Risks Covered: (Some new/ not easily spotted from SM) - Economic Risk - Competitor Risk - Project Execution Risk - Human Resource Risk - Foreign Exchange Risk - Interest Rate Risk - Commodity Price Risk CS-2 Stakeholders and impact Impact areas and nature of impact Risk Treatment Options Assess Risk Maturity Levels of Co Techniques to track the process of Risk Mgmt Types of Political Risk exposure Benefits from Distributed Ledger Technology Quantitative tools for Country Risk Assessment Direct Answer from Ch 2 Direct Answer from Ch 2 Direct Answer from Ch 2 Deductive Answer from Ch 8 Direct Answer from Ch 3 Direct Answer from Ch 5 Direct Answer from Ch 9 Direct Answer from Ch 5 CS-3 Key Risks and Measure to Mitigate Deducitve + Direct Answers from Ch 1 & Ch 3 (2 Alt Presentations given) CS-1 Measures to Mitigate Risks & Sound Practices "Loss would occur, or no loss would occur" - Explain this risk & other such types Qualitative tools for Country Risk Assessment Challenges while developing the risk management and oversight practices Analysis of Cash Flows (2 Types) Expected Monetary Value Direct Answer from Direct Answer from Direct Answer from Direct Answer from Direct Answer from Simple Calculation CS-2 Key principle that would underpin risk appetite Credit Rating meaning. List 6 CRA in India. Describe Credit Rating Process. How much risk to take. What risks arise in Risk Assessment w.r.t data furnished in the Peer Group Analysis Direct Answer from Ch 3 Direct Answer from Ch 6 Direct Answer from Ch 7 (PFATRAGIC) "w.r.t Data" → Psych! CS-3 Points considered w.r.t data migration in new ERP Deployment BOD- Issues Considered & Questions asked in addressing Present/ Future Risks Role of Risk Assessment w.r.t. Financial Reporting Invoicing in Domestic Currency to hedge exposure risk Indirect Risks Company may be facing Types of countermeasures for vulnerabilities faced while assessing/ evaluating Risks Country Risks w.r.t Polticial Changes Risk Mitigation Process w.r.t Letter of Credit Facility Direct Answer from Ch 9 (Migration Risk) Direct Answer from Ch 7 Direct Answer from Ch 7 Direct Answer from Ch 9 of SFM (FOREX) Judgemental- Related to Case Study Direct Answer from Ch 2 Direct Answer from Ch 5 This is Funded Credit. Direct Answer from Ch 6 March 19 MTP May 19 Exam Paper Ch Ch Ch Ch Ch 7 (Focused on Risk Mgmt Committee) 1 5 7 6 October 19 MTP CS-1 Financial Ratios Formulae based computations Risk Grading/Rating, Classify Risk & Report Deductive (Highly Judgmental) from Ch 9 Key Risks affecting Company Highly Judgmental. Ch 1. NEW RISKS GIVEN IN SUGGESTED. CS-4 Report to Board - Type of Risk ,Impact of Risk Deductive + Direct Answers from Ch 1 & 3 (ICAI Answer is extremely short) CS-5 Ques on RBI- Credit Default Swaps ,Diff b/w credit insurance and CDS, Estimating Credit Default probability Direct Answer from Ch 6 CS-1 Methodology that you would suggest for analyzing the data on Vehicular Movement NPV,Profitability Index calculation Explain areas of improvements suggested by the consultant in Case Study Indirect Answer from Ch 9 (Needed to link Machine Learning) Forumulae based - IPCC Chapters Conceptual Based → Needed to explain data Type of Risks Faced Sample Risk Register Benefits of ‘Improved risk measurement and Management' to Mgmt Deductive Answer from Ch 1 ICAI FORMAT IS IMPORTANT Direct Answer from Ch 8 Bayes Theorem (Probability) Risk Maturity Levels and their Key Characteristics Economic risks that could be faced Old Ch 4 of RM Direct Answer from Ch 8 Concept based Corporate Governance referring to OECD guidelines Risk mgmt initiated by the Board/Mgmt to prevent frauds and financial crimes How can Credit Risk Mgmt be upgraded to ensure risk of default is kept to the minimum. Deductive Answer from Ch 7 Deductive Answer from Ch 9 Deductive Answer from Ch 6 Define Pure Risk & Insurance's Importance Why operational risk mgmt is important Role and responsibility of the Risk Manager Direct Answer from Ch 1 Direct Answer from Ch 9 Direct Answer from Ch 2 Inputs on Issues raised by Risk Manager (points) Highly Judgemental- Concept Based Main Risks + Components while Lending Amount of Loan that's justified keeping the various factors Expected Loss (Loss Given Default) MPBF Calculation as per Tandon Committee (Current Ratio = 1.33) Deductive Answer from Ch 6 Case Study based. As per individual judgement. Simple Calculation Formula Based from Ch 6 Type of Risks Faced Sample Risk Register Benefits of ‘Improved risk measurement and Management' to Mgmt Deductive Answer from Ch 1 ICAI FORMAT IS IMPORTANT Direct Answer from Ch 8 Corporate Governance referring to OECD guidelines Risk mgmt initiated by the Board/Mgmt to prevent frauds and financial crimes How can Credit Risk Mgmt be upgraded to ensure risk of default is kept to the minimum. Deductive Answer from Ch 7 Deductive Answer from Ch 9 Deductive Answer from Ch 6 Define Pure Risk & Insurance's Importance Why operational risk management is important Role and responsibility of the Risk Manager Direct Answer from Ch 1 Direct Answer from Ch 9 Direct Answer from Ch 2 CS-2 CS-3 Nov 19 Exam Paper CS-2 CS-3 CS-4 CS-5 May 20 MTP CS-1 CS-2 CS-3 CS-4 CS-5 October-20 MTP CS-1 Credit Due Diligence for recommending the subscription of the debenture issue Market interest rate increased, action by investor. Risks faced. Debt Service Coverage Ratio (DSCR) considering opening Cash Balance and Free Cash Flow Deductive from Ch 6 Deductive from Ch 6 Formulae based (2G) CS-2 Type of risks which Airplane Co is facing apart from Pandemic situation In what ways Enterprise Risk Management can be classified. Explain linking to Case Study. Paul Hopkins, risk is divided in what categories- Explain w.r.t Case Study Deductive Answer from Ch 1 ICAI has given advantages of ERM here (from Ch 8) Direct Answer from Ch 1 → Linking w/ Case Study req'd CS-3 Major types of Country Risks which an MNC is exposed to → Link with Co, Grading/Bucketing of Risks Identified Explain and map SWOT Direct Answer from Ch 5 → Linking w/ Case Study req'd Deductive Answer from Ch 9 (ICAI treats exch fluct as L-L) Direct Answer from Ch 2 → Linking w/ Case Study req'd Explain circumstances → cause risk for reliable FR to the Co. + Enlist the stat prov w.r.t risk mgmt disclosures Car Proposal Eval'n (Diesel or Petrol) + Non-Fin Considerations Direct Answers from Ch 2 & Ch 7 → Linking w/ CS req'd Concept based Identify Risks + Risk Mgmt F/w Risk Appetite + Risk Capacity Identify (Country Risk) + Process to Manage same Risk Mgmt F/W ICAI FORMAT IS IMPORTANT Needed to identiify → Module coverage is req'd Direct Answer from Ch 5 Specific Internal Controls for identified risks Sensitivity Analysis for 10% adverse Δ in variables Risk Actions and Risk Responses as per Risk And Control Matrix Deductive Answer from Ch 9 Simple Calculation (IPCC) Deductive Answer from Ch 2 Strategic Risks and Key Drivers for assessing risks in CS Purpose of Risk Management Framework. Steps in Developing RMF Analyze Country Risk Case Study based → Conceptual Direct Answer from Ch 2. (For Steps → ICAI has just modified DIAMA to incorporate Reputational Risk) Combined Answer from Ch 3 & 7 (Classic eg of mixing ans ) Direct Answer from Ch 5 Responsibility of CRO who is leader in implementing ERM Challenges in implementing ERM faced by Co. Relationship of ERM and BCP VaR + Computation Stress Testing + Linking with VAR Direct Answer from Ch 7 Case Study based Unique Answer Simple Calculation Direct Answer (Diagram) from Ch 5 + Conceptual Linking RCSA Register Altman Z score Practical Question Importance of Risk Management Deductive Answer from Ch 9 Simple Calculation (Ch 6) Direct Answer from Ch 3 Difference between AI and ML Challenges in implementing AI Areas where AI and ML can be applied KRI and RCSA RCSA Owner and methods to implement RCSA Processes to be followed before launching new products to address operational risk Level of Defence identification How to strengthen Operational Risk Direct Answer from Ch 3 Conceptual + Case Study based Conceptual + Case Study based Conceptual with help from Ch 9 Direct Answer from Ch 9 (Language changed & structured) Conceptual with help from Ch 9 Conceptual with help from Ch 9 Conceptual with help from Ch 9 CS-4 CS-5 Nov 20 Exam Paper CS-1 CS-2 CS-3 CS-4 CS-5 Reputational Risk and Steps to Assess Reputational Risk Jan 21 Exam Paper CS-1 Best practices to address the data privacy and cyber-security risks Risk management techniques Integrating of risks in the strategic planning process Direct Answer from Ch 9 Direct Answer from Ch 3 Direct Answer from Ch 9 (Language structured to link w/ CS) CS-2 Risks faced by Co. in Pandemic (COVID 19) Credit risk components Diff b/w Scenario Analysis and Sensitivity Analysis Deductive Answer from Ch 1 Direct Answer from Ch 6 Direct Answer from IPCC Ch 8 Recommending selection of individuals in ERC - 3 broad parameters to consider Is there difference between ERM and BCP? Narrative approach for risks that aren't easily quantified 5 key issues w.r.t outsourcing Direct Answer from Ch 7 Conceptual (ICAI has given 2 alternatives) Conceptual (ICAI has given 2 alternatives) Direct Answer from Ch 9 Conceptual Conditions where exchange rate changes may actually ↓ the risk of foreign investment 2 determinants of forex operating exposure + identify activity likely to address exposure + Implications of PPT w.r.t forex operating exposure Advant'gs & disadvant'ges of "financial hedging vis-à-vis operational hedges" and "Options contract vs Fwds" Risk register- Purpose, coverage, & disadvantages What are: risk capacity and risk exposure. Conceptual + Reference from SM Direct Answer from Ch 9 (ICAI has used key aspects in consideration for cyber risk as answer) Conceptual Conceptual CS-3 CS-4 CS-5 + Explain diff b/w risk exposure, risk tolerance and risk appetite Cyber-resilient organization: 2 definitive characteristics + reverse stress testing Diff b/w performing the capital budgeting analysis from parent & project perspective 4 types of direct pay out cost if Co. suffers Cyber-Attack Conceptual Conceptual w/ help of SFM Ch 9 Conceptual + Direct from Ch 8 (2 Alternatives given by ICAI) May 21 MTP CS-1 w.r.t Consortium loan, give opinion on: (i) Quantum of Liquid Assets in relation to the size of the company. (ii) Profitability of the company reflecting the company’s age and earning power. (iii) Operating Efficiency apart from tax and leveraging factors. (iv) Market dimensions that can show up security price fluctuations as a possible red flag. (v) Total Asset Turnover. Simple computation of Altman Z score. Needed to know the components to link the formula. CS-2 Grading/ Bucketing of Various Risks Deductive (Highly Judgmental) from Ch 9 CS-3 Key Risks affecting Company Highly Judgmental. Ch 1. NEW RISKS GIVEN IN SUGGESTED. CS-4 Aspects to consider before outsourcing biz Main issues that surface from technology risk from an Auditor’s /Operational Risk Professional’s perspective Direct Answer from Ch 9 Direct Answer from Ch 9 CS-5 What should chairman & BoD do Circumstances in which risk can arise or changed Direct Answer from Ch 7 (7.3, ICAI didn't relate to CS) Direct Answer from Ch 2 CS-5 How big data analytics help improve existing processes in Anti- Money Laundering operations Diff b/w CDS & credit insurance. 5 C’s of Credit which bank will review while giving loan Direct Answer from Ch 9 Direct Answer from Ch 6 Direct Answer from Ch 6 CS-6 What should chairman & BoD do Direct Answer from Ch 7 (7.3, ICAI didn't relate to CS) Case Study based (They have already identified risk- you just need to map it to situation in Q) Direct Answer from Ch 5 Case Studies Digest Governance Risk involved in CS Shareholding of FII is 10.4 % - identify risk & tools to mitigate CS-15 CS-16 Design Risk Scenario (Video Content Platform Startup CaseStudy) Type of Risks Faced Establishing an IT enabled OS including cyber crime prevention & Risk Mgmt and Governance system. Deductive + Direct Answers from Ch 1 & Ch 3 ICAI risks differ from what you identified. Luckily, since only 4 risks are required to be stated → State only those risks which you have absolutely certainty over. Highly Judgmental. Ch 1. NEW RISKS GIVEN IN SUGGESTED. Mashed up Direct Answers from Ch 9 & 7 (Structured a bit differently) CS-17 (i) Identify the Risks that may be possible and their nature. (ii) Scaling of these identified risks based on ICAI Guide on Risk Based Internal Audit. (iii) Action plan to treat the risks including monitoring mechanism. Deductive Answer from Ch 1 (ICAI loves Operational Risk) Based on above (when in doubt→ use score 4) Highly Judgmental. Unique Answer. CS-18 Potential risk associated with the project (EOU) Suggest Risk management framework Deductive Answer from Ch 1 (ICAI loves Operational Risk) Unique Answer