Costing

System (1)

Dr/ Mostafa Ibrahim El-feky.

Lecturer of Accounting

Faculty of Commerce

Mansoura University

First Edition

2022/2023

Contents

Chapter (1)

Job Costing

Chapter (2)

Process Costing System

Chapter (3)

Spoilage, Scrap, and Rework

Chapter (4)

Cost-Volume-Profit (CVP) Relationships

References

2

3

58

97

145

174

Dr/Mostafa I. Elfeky

Chapter (1)

Job Costing

The

building blocks are cost object, direct costs, indirect

costs, cost pools, and cost-allocation bases.

1. Cost object

It is anything for which a measurement of costs is desired (or

anything that we want to determine its cost, such as product,

service, customer, activity, project, and Department.

2. Direct Costs of a Cost Object

They are costs that are related to the particular cost object and

that can be traced to it in an economically and conveniently

feasible way.

▪ Direct cost categories include direct materials (DM) and

direct manufacturing labor (DML). Direct materials are

materials that go into the production of the product. Direct

labor is the wages paid to workers who spend time working on

the product.

3. Indirect Costs of a Cost Object

They are costs that are related to the particular cost object but

cannot be traced to it in an economically and conveniently

feasible way.

▪ Indirect cost must be allocated to the cost object using a cost

allocation method.

▪ These costs are frequently referred to as factory overhead,

manufacturing overhead (MOH), or some similar term.

These costs include supervisor salaries, supplies, or other

costs incurred in the factory that are not direct materials or

direct labor.

3

Dr/Mostafa I. Elfeky

4. Cost Assignment

It is a general term that includes both:- Tracing accumulated costs that have a direct relationship to a

cost object.

- Allocating accumulated costs that have an indirect

relationship to a cost object.

Cost tracing

Cost Allocation

Direct

Relationship

Indirect

Relationship

Cost object.

Cost object.

Two new terms related to costing systems are introduced in

this chapter; they are cost pool, and cost-allocation base.

5. A cost pool is a grouping of individual indirect cost

items.

▪ A cost-allocation base is the driver or activity that is used

to allocate indirect costs from the cost pool to the cost

object.

For example,

(1) Direct Labor Hours.

(3) Machine Hours.

(2) Direct Material Cost.

(4) Direct Labor Cost.

Job Costing and Process

Costing Systems

Management uses two basic types of costing systems to

assign costs to products or services.

1) A job-costing system, or a job-order system, is used by a

company that makes a distinct (different) product or service

4

Dr/Mostafa I. Elfeky

called a job. The product or service is often a single unit. The

job is frequently the cost object. Costs are accumulated

separately for each job or service.

2) A process-costing system is used by a company that makes a

large number of identical (similar) products. Costs are

accumulated by department and divided by the number of

units produced to determine the cost per unit. It is an average

cost of all units produced during the period. The cost object is

masses of similar units of a product.

General Approach to Job Costing

A seven-step approach is used to assign costs to an

individual job.

This approach is used by manufacturers, merchandisers,

and companies in the service sector.

1. Identify the Job that is the Chosen Cost Object.

2. Identify the Direct Costs of the Job.

3. Select the Cost-Allocation base(s) to use for allocating

Indirect Costs to the Job.

4. Match Indirect Costs to their respective Cost-Allocation

base(s).

5. Calculate an Overhead Allocation Rate:• Actual OH Costs ÷ Actual OH Allocation Base

6. Allocate Overhead Costs to the Job:• OH Allocation Rate x Actual Base Activity For the Job

7. Compute Total Job Costs by adding all direct and indirect

costs together.

5

Dr/Mostafa I. Elfeky

Step 1:Identify the Job That Is the Chosen Cost Object.

The source documents such as the job-cost sheet, the

material-requisition record, and the labor-time record

assist managers in gathering information about the

costs incurred on a job.

Step 2: Identify the Direct Costs of the Job.

Most manufacturing operations have two direct cost

categories—direct materials and direct manufacturing

labor.

Step 3: Select the Cost-Allocation Bases to Use for

Allocating Indirect Costs to the Job.

Since these costs cannot be traced to the job, they must

be allocated in a systematic manner.

Step 4: Identify the Indirect Costs Associated with Each

Cost-Allocation Base.

Hopefully, a cause-and-effect relationship can be

established between the costs incurred and the costallocation base (or cost driver).

Step 5: Compute the Rate per Unit of Each Cost-Allocation

Base Used to Allocate Indirect Costs to the Job.

Actual manufacturing overhead rate = Actual

manufacturing overhead costs ÷ Actual total quantity

of cost allocation base.

Step 6: Compute the Indirect Costs Allocated to the Job.

Multiply the actual quantity of each different allocation

base by the indirect cost rate for each allocation base.

Step 7: Compute the Total Cost of the Job by Adding All

Direct and Indirect Costs Assigned to the Job.

6

Dr/Mostafa I. Elfeky

Distinguish actual costing from

normal costing

❖

Actual costing is a costing system that traces direct costs

to a cost object by using actual direct-cost rates times the

actual quantities of the direct-cost inputs. It allocates

indirect costs based on the actual indirect-cost rate times

the actual quantities of the cost-allocation bases.

❖ Normal costing is a costing system that:- Traces direct costs to a cost object by using actual directcost rates times the actual quantities of the direct-cost

inputs, and

- Allocates indirect costs based on the budgeted indirectcost rates time the actual quantities of the cost-allocation

bases.

Note that

(1) Both systems (Actual & Normal) allocates – Direct Costs to a

cost object: - by using Actual direct – cost rates times Actual

quantities of the direct-cost inputs.

(2) Under Actual costing system:-

(3) Under Normal costing system:-

7

Dr/Mostafa I. Elfeky

For Example

Anderson Construction uses a job–costing system with two

direct–cost categories (direct materials and direct

manufacturing labor) and one manufacturing overhead cost

pool. Anderson Construction allocates manufacturing overhead

costs using direct manufacturing labor hours. Anderson

Construction provides the following information:-

Budgeted for

2023

Direct material costs

$1,500,000

Direct manufacturing labor costs 1,000,000

Direct manufacturing labor hours

100,000

Manufacturing overhead costs

1,750,000

Actual results

for 2023

$1,450,000

980,000

98,000

1,862,000

Required

1. Compute the actual and budgeted manufacturing overhead

rates for 2023.

2. During March, the Job–cost record for job 626 contained

the following information:Direct materials used

Direct manufacturing labor costs

Direct manufacturing labor hours

$ 40,000

$ 30,000

3,000 hr

Compute the cost of Job 626 using (a) actual costing

system, and (b) normal costing system.

8

Dr/Mostafa I. Elfeky

3. At the end of 2023, compute the under– or overallocted

manufacturing under normal costing. Why is there no

under– or overallocted manufacturing under actual costing?

Answer

1) Budgeted and actual MOH rate:▪ Budgeted MOH rate

= $1,750,000 ÷100,000

= $ 17.5 per DLH

▪ Actual MOH rate

= $1,862,000 ÷ 98,000

= $ 19 per DLH

2) Cost of job 626 under actual and normal costing system:-

Note →

MOH under Normal costing system is called Allocated OH

Note →

MOH under actual costing system called actual OH

Direct material

Direct manufacturing labor cost

MOH costs

Total cost of job # 626

Normal costing

$40,000

30,000

Actual costing

$ 40,000

30,000

AQ × BR

3000 × $17.5

52,500

$ 122,500

AQ × AR

3000 × $19

57,000

$ 127,000

3) Computing under or over allocated MOH under normal

costing:-

✓ IF Allocated MOH <Actual → Underallocated MOH

✓ If Allocated MOH >Actual → Overallocated MOH

9

Dr/Mostafa I. Elfeky

▪

Total MOH allocated under normal costing system

= AQ × BR

= 98,000 × 17.5

= $ 1,715,000

▪ Under allocated MOH

= 1,862,000 – 1,715,000

= $ 147,000

❖ There are three methods to calculate the difference

between Actual and allocated OH.

(1) Total Cost under Normal costing – Total Cost under

Actual costing.

(2) Overhead under Normal costing – Overhead under

Actual costing.

(3) (Actual Rate – Budgeted Rate) × Actual Quantity.

Or (∆R × AQ).

➢ Over or under allocated MOH for job 626

(1) T.C. Under N. – T.C. under A = (122,500 – 127,000)

= $4,500 under-allocated.

(2) O.H. under N. – O.H. under A= ( 52,500 – 57,000)

= $4,500 under-allocated.

(3) (A.R–B.R)×A.Q

= ($19 – $17.5) ×3,000

= $4,500 under-allocated.

▪ IF seven step were applied "Actual costing system"

1. Cost object = Job # 626

2. Direct costs = ( DM + DL ) → { 40,000 + 30,000} = $

70,000

3. Indirect costs = $ 1,862,000

4. Allocation base = "DMLHR" 98,000 hr

10

Dr/Mostafa I. Elfeky

5. Allocation rate = 1,862,000 / 98,000 = $ 19/DLHR

6. Indirect costs = AQ × AR

= 3,000 × 19 = $57,000

7. Total cost for job # 626 = 70,000 + 57,000 = $ 127,000

▪ IF seven step were applied "Normal costing system"

1) Cost object = Job # 626

2) Direct costs = ( DM + DL ) → { 40,000 + 30,000} = $

70,000

3) Indirect costs = $ 1,750,000

4) Allocation base = "DMLHR" 100,000 hr

5) Allocation rate = 1,750,000 / 100,000 = $ 17.5/DLHR

6) Indirect costs = AQ × BR

= 3,000 × 17.5 = $52,500

7) Total cost for job # 626 = 70,000 + 52,500 = $ 122,500

End of year adjustment

- This difference will be eliminated in the end-of-period

adjusting entry process, using one of three possible

methods

❖ The

three approach to adjust over (under)

allocated MOH:

1. Adjusted allocation rate approach.

2. Proration approach.

3. The write-off to cost of goods sold.

11

Dr/Mostafa I. Elfeky

- The choice of method should be based on such issues

as materiality, consistency and industry practice.

1. Adjusted allocation rate approach:

• All allocations are recalculated with the actual, rather

than budgeted cost rates.

• It's applied for individual job.

• The replacement of budgeted allocation rate by

actual allocation rate by using computerized

accounting system.

• Adjusted allocation rate = (Actual MOH – Allocated

MOH) ÷ Allocated MOH

2. Proration approach: Is the spreading of under

(over) allocated MOH among WIP, Finished

goods and cost of goods sold.

Under Proration we have two ways:

A. Proration based on MOH allocated end

balances of WIP, FG, COGS.

B. Proration based on the end balances of

WIP, FG, COGS.

3. Write off to cost of goods sold: In this case the

total under or over allocated overhead is included

in the cost of goods sold account.

12

Dr/Mostafa I. Elfeky

Ex

Assume that the MOH control balance is $1,215,000 and the

MOH allocated balance is $1,080,000.

Required

Use the three approaches to adjust over (under) allocated MOH.

Solution:

▪ Under (over) allocated OH = 1,215,000 – 1,080,000 =

$135,000 underallocated

(1)

Adjusted allocation rate approach:

Adjusted allocation rate = (1,215,000 – 1,080,000) / 1,080,000

= 12.5%

Assume that job 298 under normal costing has MOH allocated

is $3,520 so to adjust overhead allocated to be equal to actual

overhead. So to adjust allocated MOH to equal actual MOH;

increase MOH allocated by 12.5%.

Adjusted MOH for job 298 = 12.5% × 3,520 = $440. So; the

adjusted allocated MOH will equal to actual MOH

= 3,520 + 440 = $3,960

(2)

Proration approach:

Ex

In our previous example, end-of-year proration is made

to the ending balances in Work-in-Process Control, Finished

Goods Control, and Cost of Goods Sold. Assume the following

actual results for Robinson Company in 2022:

13

Dr/Mostafa I. Elfeky

WIP

FG

COGS

Total

Accounts Balance Allocated MOH

(Before Proration) (Before Proration)

$ 50,000

$ 16,200

75,000

31,320

2,375,000

1,032,480

$2,500,000

$ 1,080,000

How should the company prorate the underallocated

$135,000 of manufacturing overhead at the end of

2022?

A. Proration based on MOH allocated end balances.

Entry to record proration:

Work–In–Process (WIP)

Finished Goods (FG)

Cost Of Goods Sold (COGS)

Manufacturing Overhead control

14

2,025

3,915

129,060

135,000

Dr/Mostafa I. Elfeky

B. Proration based on the end balances of WIP, FG, &

COGS

Entry to record proration:

Work–In–Process (WIP)

Finished Goods (FG)

Cost Of Goods Sold (COGS)

Manufacturing Overhead control

2,700

4,050

128,250

135,000

(3) Write off to cost of goods sold:

Entry to record proration:

Cost Of Goods Sold (COGS)

Manufacturing Overhead control

135,000

135,000

Or

Cost Of Goods Sold (COGS)

Manufacturing Overhead allocated

Manufacturing Overhead control

135,000

1,080,000

1,215,000

▪ Ending Balance of COGS = 2,375,000 + 135,000 =

$ 2,510,000

15

Dr/Mostafa I. Elfeky

Accounting cycle

❖ The accounting cycle includes the following stages:

1. Purchase of materials and other manufacturing inputs.

"Materials control account".

2. Conversion into work in process inventory.

"Work in process control account".

3. Conversion into finished goods inventory.

"Finished goods control account".

4. Sale of finished goods.

"Cost of goods sold account".

Ex

1. Purchase of materials (direct and indirect), on credit $89,000.

2. Materials sent manufacturing plant floor: direct materials

$81,000 ($60,000 to job No 340 and $21,000 to job No. 341)

and indirect materials $4,000.

3. Total manufacturing payroll for Feb.: direct $39,000 ($30,000

to job no. 340 and $9,000 to job no. 341) and indirect

$15,000.

4. Payment of total manufacturing payroll for Feb. $54,000.

5. Additional manufacturing OH costs incurred during Feb.

$75,000. These costs consist of engineering and supervisory

salaries $44,000, Utilities and repairs $ 11,000, depreciation

$18,000 and insurance $2,000.

6. Allocation of manufacturing overhead to jobs $80,000.

7. Completion and transfer of individual jobs to finished goods,

$188,800.

8. Cost of goods sold $180,000.

9. Sales revenue on credit $270,000.

16

Dr/Mostafa I. Elfeky

Required

Prepare journal entries for the above transactions.

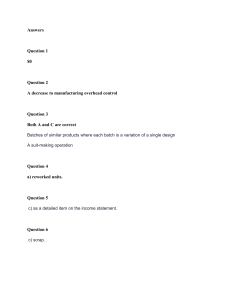

Answers

1

2

3

4

5

6

7

8

17

Material control

Accounts payable control

Work In Process Control

Job NO.340

Job NO.341

Manufacturing OH control

Material control

Work in process Control

Job no.340

Job no. 341

Manufacturing OH control

Wages payable control

Wages payable control

Cash control

Manufacturing OH control

Salaries payable control

Account payable control

Accumulated depreciation control

Prepaid insurance control

Work in process control

Manufacturing OH allocated

Finished goods

Work in process control

Cost of goods sold

Finished goods control

Dr.

89,000

Cr.

89,000

60,000

21,000

4,000

85,000

30,000

9,000

15,000

54,000

54,000

54,000

75,000

44,000

11,000

18,000

2,000

80,000

80,000

188,800

188,800

180,000

180,000

Dr/Mostafa I. Elfeky

9

Account receivable control

Revenues

End of year adjustment entry:

270,000

Manufacturing OH Allocated

Manufacturing OH underallocated

Manufacturing OH control

80,000

14,000

270,000

94,000

Material control

89,000

85,000

$ 4,000

Account payable

89,000

11,000

$100,000

Work In Process

81,000 188,800

39,000

80,000

$ 11,200

MOH control

4,000

15,000

75,000

$ 94,000

Wages Payable

54,000

54,000

Salaries Payable

44,000

$ 44,000

Prepaid insurance

2,000

18

Cash

54,000

$54,000

Accumulated depreciation

18,000

$ 18,000

MOH allocated

80,000

$ 80,000

Dr/Mostafa I. Elfeky

Finished goods

188,800 180,000

$8,800

Account Receivable

270,000

270,000

Cost of Goods sold

180,000

$180,000

Revenues

270,000

$ 270,000

Accounting for Overhead

Recall that two different overhead accounts were used in the

preceding journal entries: Manufacturing Overhead Control was debited for the actual

overhead costs incurred.

Manufacturing Overhead Allocated was credited for

estimated (budgeted) overhead applied to production through

the Work-in-Process account.

Under-allocated & Over-allocated OH Costs

▪ Under-allocated indirect costs: Occurs when the allocated

(Budgeted) amount of the indirect costs in an accounting

period is less than the actual "incurred" amount in that period.

✓ Allocated MOH (<) Actual → Under-allocated MOH

19

Dr/Mostafa I. Elfeky

▪ Over-allocated indirect costs: Occurs when the allocated

(Budgeted) amount of the indirect costs in an accounting

period is higher than the actual "incurred" amount in that

period.

✓ If Allocated MOH (>) Actual → Over-allocated MOH

Actual MOH control – MOH allocated = Over (under)

allocated MOH

General Ledger Relationships

Ex

1. Purchase of materials (direct and indirect), on credit $89,000.

2. Materials sent manufacturing plant floor: direct materials

$81,000 ($60,000 to job No 340 and $21,000 to job No. 341)

and indirect materials $4,000.

3. Total manufacturing payroll for Feb.: direct $39,000 ($30,000

to job no. 340 and $9,000 to job no. 341) and indirect

$15,000.

4. Payment of total manufacturing payroll for Feb. $54,000.

5. Additional manufacturing OH costs incurred during Feb.

$75,000. These costs consist of engineering and supervisory

salaries $44,000, Utilities and repairs $ 11,000, depreciation

$18,000 and insurance $2,000.

6. Allocation of manufacturing overhead to jobs $80,000.

7. Completion and transfer of individual jobs to finished goods,

$188,800.

8. Cost of goods sold $180,000.

9. Sales revenue on credit $270,000.

20

Dr/Mostafa I. Elfeky

Required

Prepare journal entries for the above transactions.

Answers

1

2

3

4

5

6

7

8

9

21

Material control

Accounts payable control

Work In Process Control

Job NO.340

Job NO.341

Manufacturing OH control

Material control

Work in process Control

Job no.340

Job no. 341

Manufacturing OH control

Wages payable control

Wages payable control

Cash control

Manufacturing OH control

Salaries payable control

Account payable control

Accumulated depreciation control

Prepaid insurance control

Work in process control

Manufacturing OH allocated

Finished goods

Work in process control

Cost of goods sold

Finished goods control

Account receivable control

Revenues

Dr.

89,000

Cr.

89,000

60,000

21,000

4,000

85,000

30,000

9,000

15,000

54,000

54,000

54,000

75,000

44,000

11,000

18,000

2,000

80,000

80,000

188,800

188,800

180,000

180,000

270,000

270,000

Dr/Mostafa I. Elfeky

22

Dr/Mostafa I. Elfeky

MCQs

(1) Which of the following accounts would be debited in the journal

entry to record the requisition of direct materials?

A) Cost of Goods Sold

B) Work-in-Process Inventory

C) Finished Goods Inventory

D) Raw Materials Inventory

(2) The journal entry to record direct labor costs actually incurred

involves a debit to the:

A) Work-in-Process Inventory account.

B) Wages Payable account.

C) Manufacturing Overhead account.

D) Raw Materials Inventory account.

(3) The journal entry to record indirect labor costs incurred involves a

debit to the:

A) Manufacturing Overhead account.

B) Wages Payable account.

C) Finished Goods Inventory account.

D) Work-in-Process Inventory account.

(4) Manufacturing Overhead is a temporary account used to ________

indirect production costs during the accounting period.

A) Allocate

B) Assign

C) Accumulate

D) Approximate

(5) The journal entry to issue indirect materials to production should

include a debit to the:

A) Finished Goods Inventory account.

B) Raw Materials Inventory account.

C) Manufacturing Overhead account.

D) Work-in-Process Inventory account.

(6) The journal entry to issue $500 of direct materials and $30 of indirect

materials to production involves debit(s) to the:

A) Work-in-Process Inventory account for $500 and Finished Goods

Inventory account for $30.

B) Manufacturing Overhead account for $530.

23

Dr/Mostafa I. Elfeky

C) Work-in-Process Inventory account for $500 and Manufacturing

Overhead account for $30.

D) Work-in-Process Inventory account for $530.

(7) The journal entry to record $1,500 of direct labor and $200 of

indirect labor incurred will include debit(s) to the:

A) Manufacturing Overhead account for $1,700.

B) Work-in-Process Inventory account for $1,500 and Finished

Goods Inventory account for $200.

C) Finished Goods Inventory account for $1,700.

D) Work-in-Process Inventory account for $1,500 and Manufacturing

Overhead account for $200.

(8) Alexandra's Designs, a fashion boutique, incurred the following in

the month of September:

Salaries paid to designers

$140,000

Wages paid to tailors

30,000

Indirect wages

10,000

What is the journal entry to record the total labor charges incurred during

September?

A)

Work-in-Process Inventory (direct labor)

Manufacturing Overhead (indirect labor)

Wages payable

B)

Work-in-Process Inventory (direct labor)

Wages Payable

C)

Wages Payable

Finished Goods Inventory

Work-in-Process Inventory (direct labor)

D)

Manufacturing Overhead (indirect labor)

Wages Payable

170,000

10,000

180,000

180,000

180,000

180,000

150,000

30,000

180,000

180,000

(9) Adelphia Manufacturing issued $80,000 of direct materials and

$10,000 of indirect materials for production. Which of the following

journal entries would correctly record the transaction?

24

Dr/Mostafa I. Elfeky

A)

Raw Materials Inventory

Finished Goods Inventory

Work-in-Process Inventory (direct materials)

B)

Work-in-Process Inventory (direct & indirect materials)

Raw Materials Inventory

C)

Work-in-Process Inventory (direct materials)

Manufacturing Overhead (indirect materials)

Raw Materials Inventory

D)

Manufacturing Overhead (direct & indirect materials)

Raw Materials Inventory

90,000

80,000

10,000

90,000

90,000

80,000

10,000

90,000

90,000

90,000

(10) Uniq Works purchased raw materials amounting to $125,000 on

account and $15,000 for cash. The materials will be used to

manufacture upholstery for furniture manufacturers on a contract

basis. Which of the following journal entries correctly records this

transaction?

A)

Accounts Payable

125,000

Cash

15,000

Raw Materials Inventory

140,000

B)

Finished Goods Inventory

140,000

Accounts Payable

140,000

C)

Work-in-Process Inventory

140,000

Accounts Payable

140,000

D)

Raw Materials Inventory

140,000

Cash

15,000

Accounts Payable

125,000

25

Dr/Mostafa I. Elfeky

(11) The accounts of Delphinia Dreams Inc. showed the following

balances at the beginning of October:

Account

Debit

Raw Materials Inventory

$30,000

Work-in-Process Inventory

40,000

Finished Goods Inventory

50,000

Manufacturing Overhead

20,000

During the month, direct materials amounting to $20,000 and indirect

materials amounting to $5,000 was issued to production. What is the

ending balance in the Work-in-Process Inventory account for the

month of October?

A) $40,000

B) $60,000

C) $20,000

D) $25,000

(12) The accounts of Melissa Manufacturing showed the following

balances at the beginning of December:

Account

Debit

Raw Materials Inventory

$50,000

Work-in-Process Inventory

80,000

Finished Goods Inventory

30,000

Manufacturing Overhead

15,000

The following transactions took place during the month:

Dec. 2: Issued direct materials $25,000 and indirect materials $4,000

to production.

Dec.15: Paid $6,000 and $3,000 toward factory's direct labor cost and

indirect labor cost, respectively.

What should be the balance in the Work-in-Process Inventory account

at the end of December?

A) $111,000

B) $86,000

C) $105,000

D) $81,000

(13) On June 1, 2014, Dalton Productions had beginning balances as

shown in the T-accounts below.

26

Dr/Mostafa I. Elfeky

During June, the following transactions took place:

June 2: Issued $2,400 of direct materials and $200 of indirect

materials to production

Following this transaction, what was the balance in the Manufacturing

Overhead account?

A) $43,600

B) $43,400

C) $41,200

D) $41,000

(14) On June 1, 2014, Dalton Productions had beginning balances as

shown in the T-accounts below.

During June, the following transactions took place:

June 2: Issued $2,400 of direct materials and $200 of indirect

materials to production

June 13: Paid $7,500 of direct factory labor cost and $14,100 of

indirect factory labor cost

Following these transactions, what was the balance in the

Manufacturing Overhead account?

A) $50,900

B) $55,300

C) $44,200

D) $65,200

(15) Which of the following describes the allocation base for allocating

manufacturing overhead costs?

A) The primary cost driver of indirect manufacturing costs

B) Estimated base amount of manufacturing overhead costs in a year

C) The percentage used to allocate direct labor to Work in Process

D) The main element that causes direct costs

(16) Which of the following correctly describes the term cost driver?

A) The inflation rate that causes costs to rise

B) The average inventory costs incurred at any point of time

C) The primary factor that causes a cost to be incurred

D) The total material, labor, and overhead cost of a completed job

27

Dr/Mostafa I. Elfeky

(17) Which of the following will be categorized as a manufacturing

overhead cost?

A) Depreciation on factory plant and equipment

B) Salaries paid to assembly line workers

C) Administration charges of showroom

D) Cost of direct materials used

(18) Which of the following will be debited to the Manufacturing

Overhead account of a watch manufacturer?

A) Office telephone expenses

B) Salaries paid to accountants

C) Factory electricity expense

D) Cost of printing brochures

(19) The predetermined overhead allocation rate is the rate:

A) Used to assign direct material costs to jobs.

B) Used to allocate actual manufacturing overhead costs incurred

during a period.

C) Used to allocate estimated manufacturing overhead costs to jobs.

D) Used to trace manufacturing and non-manufacturing costs to jobs.

(20) The predetermined overhead allocation rate is calculated by dividing:

A) The total estimated overhead costs by total number of days in a

year.

B) The estimated amount of cost driver by actual total overhead

costs.

C) The actual overhead costs by actual amount of the cost driver or

allocation base.

D) The estimated overhead costs by total estimated quantity of the

overhead allocation base

(21) The predetermined overhead allocation rate for a given production

year is calculated:

A) At the end of the production year.

B) Before the production year begins.

C) After completion of each job.

D) After the preparation of financial statements for the year.

(22) Aaron Company estimates direct labor costs and manufacturing

overhead costs for the coming year to be $800,000 and $500,000,

28

Dr/Mostafa I. Elfeky

respectively. Aaron allocates overhead costs based on machine hours.

The estimated total labor hours and machine hours for the coming

year are 16,000 hours and 10,000 hours, respectively. What is the

predetermined overhead allocation rate?

A) $80.00 per machine hour

B) $31.25 per labor hour

C) $81.25 per labor hour

D) $50.00 per machine hour

(23) Zephyros Corporation had estimated manufacturing overhead costs

for the coming year to be $316,000. The total estimated direct labor

hours and machine hours for the coming year are 6,000 and 10,000,

respectively. Manufacturing overhead costs are allocated based on

direct labor hours. What is the predetermined overhead allocation

rate?

A) $31.60 per machine hour

B) $19.75 per direct labor hour

C) $52.67 per direct labor hour

D) $39.50 per machine hour

(24) Sybil Inc. uses a predetermined overhead allocation rate to allocate

manufacturing overhead costs to jobs. The company recently

completed Job 300X. This job used 12 machine hours and 3 direct

labor hours. The predetermined overhead allocation rate is calculated

to be $45 per machine hour. What is the amount of manufacturing

overhead allocated to Job 300X using machine hours as the allocation

base?

A) $540

B) $135

C) $675

D) $405

(25) Jeremy Corporation estimated manufacturing overhead costs for the

year to be $500,000. Jeremy also estimated 8,000 machine hours and

2,000 direct labor hours for the year. It bases the predetermined

overhead allocation rate on machine hours. On January 31, Job 25

was completed. It required 6 machine hours and 1 direct labor hour.

What is the amount of manufacturing overhead allocated to the

completed job? (Round your intermediate calculations to one decimal

place)

29

Dr/Mostafa I. Elfeky

A)

B)

C)

D)

$1,500.00

$437.50

$375.00

$350.00

(26) The journal entry to record allocation of manufacturing overhead to a

particular job includes a:

A) Debit to the Finished Goods Inventory account and credit to the

Manufacturing Overhead account.

B) Debit to the Work-in-Process Inventory account and credit to the

Cash account.

C) Debit to the Manufacturing Overhead account and credit to the

Finished Goods Inventory account.

D) Debit to the Work-in-Process Inventory account and credit to the

Manufacturing Overhead account.

(27) Iglesias Company completed Job 12 on November 30. The details of

Job 12 are given below:

Direct labor cost

$840

Direct materials cost

$1,100

Machine hours

7

Direct labor hours

22

Predetermined overhead allocation rate

$90 per machine hour

What is the total cost of Job 12?

A) $2,570

B) $1,940

C) $1,947

D) $3,920

(28) Gardner Machine Shop estimates manufacturing overhead costs for

the coming year at $316,000. The manufacturing overhead costs will

be allocated based on direct labor hours. Gardner estimates 5,000

direct labor hours for the coming year. In January, Gardener

completed Job A33, which used 60 machine hours and 15 direct labor

hours. What was the amount of manufacturing overhead allocated to

job A33?

A) $948

B) $4,740

C) $3,792

D) $990

30

Dr/Mostafa I. Elfeky

(29) Gia Machine Shop uses a predetermined overhead allocation rate of

$63.20 per direct labor hour. In January, Gia completed Job A23

which utilized 15 direct labor hours. Which of the following correctly

describes the journal entry to allocate overhead to the job?

A) Debit Finished Goods Inventory $948, credit Manufacturing

Overhead $948

B) Debit Manufacturing Overhead $63.20, credit Work-in-Process

Inventory $63.20

C) Debit Work-in-Process Inventory $948, credit Manufacturing

Overhead $948

D) Debit Cost of Goods Sold $63.20, credit Finished Goods Inventory

$63.20

(30) Halcyon Company completed Job 10B last month. The cost details of

Job 10B are shown below:

Direct labor cost

$2,040

Direct materials cost

$90

Machine hours used

5

Direct labor hours

75

Predetermined overhead allocation rate per direct labor

hour

$34

Calculate the total job cost for Job 10B.

A) $2,640

B) $4,680

C) $2,550

D) $4,590

(31) Hermione Company completed Job GH6 last month. The cost details

of GH6 are shown below:

Direct labor cost

$2,040

Direct materials cost

$90

Direct labor hours

75

Predetermined overhead allocation rate per direct labor hour

$34

Number of units of finished product

200

Calculate the cost per unit of finished product of Job GH6.

A) $26.40

B) $46.80

C) $25.50

D) $23.40

31

Dr/Mostafa I. Elfeky

(32) Jezebel Company completed Job 12 and several other jobs in the last

week. The cost details of Job 12 are shown below:

Direct labor cost

$840

Direct materials cost

$1,100

Machine hours

7 hours

Direct labor hours

22 hours

Predetermined overhead allocation rate per machine hour

$90

What is the cost per unit of finished product produced under Job 12?

A) $77.88

B) $102.80

C) $12.40

D) $156.80

(33) Arabica Manufacturing uses a predetermined overhead allocation rate

based on the number of machine hours. At the beginning of 2015,

they estimated total manufacturing overhead costs to be $1,050,000,

total number of direct labor hours to be 5,000, and total number of

machine hours to be 25,000 hours. What was the predetermined

overhead allocation rate?

A) $35 per machine hour

B) $210 per direct labor hour

C) $42 per machine hour

D) $35 per direct labor hour

(34) Olympia Manufacturing uses a predetermined overhead allocation

rate based on a percentage of direct labor cost. At the beginning of

2014, Olympia estimated total manufacturing overhead costs at

$1,050,000 and total direct labor costs at $840,000. In June, 2014,

Job 511 was completed. Job stats are as follows:

Direct materials cost

$27,500

Direct labor cost

$13,000

Direct labor hours

400 hours

Units of product produced

200

What is the amount of manufacturing overhead costs allocated to Job

511?

A) $16,250

B) $10,400

C) $5,000

D) $34,375

32

Dr/Mostafa I. Elfeky

(35) Arabica Manufacturing uses a predetermined overhead allocation rate

based on a percentage of direct labor cost. At the beginning of 2015,

Arabica estimated total manufacturing overhead costs at $1,050,000

and total direct labor costs at $840,000. In June, 2015, Arabica

completed Job 511. Job stats are as follows:

Direct materials cost

$27,500

Direct labor cost

$13,000

Direct labor hours

400 hours

Units of product produced

200

How much was the total job cost of Job 511?

A) $40,500

B) $56,750

C) $50,900

D) $74,875

(36) Irene Manufacturing uses a predetermined overhead allocation rate

based on percentage of direct labor cost. At the beginning of 2014,

Irene estimated total manufacturing overhead costs at $1,050,000 and

total direct labor costs at $840,000. In June, 2014, Job 711 was

completed. Job stats are as follows:

Direct materials cost

$27,500

Direct labor cost

$13,000

Direct labor hours

400 hours

Units of product produced

200

How much was the cost per unit of finished product?

A) $374.38

B) $202.50

C) $254.50

D) $283.75

(37) Venus Manufacturing uses a predetermined overhead allocation rate

based on percentage of direct labor cost. At the beginning of the year,

they fixed the manufacturing overhead rate at 20% of the direct labor

cost. In the month of June, Venus completed Job 13C the costs of

which are as follows:

Direct materials cost

$6,220

Direct labor cost

$900

Direct labor hours

32 hours

Units of product produced

250 units

What is the total cost incurred for Job 13C?

33

Dr/Mostafa I. Elfeky

A)

B)

C)

D)

$8,364

$6,400

$7,120

$7,300

(38) Venus Manufacturing uses a predetermined overhead allocation rate

based on percentage of direct labor cost. At the beginning of the year,

they fixed the manufacturing overhead rate at 20% times the direct

labor cost. In the month of June, Venus completed Job 13C the costs

of which are as follows:

Direct materials cost

$6,220

Direct labor cost

$900

Direct labor hours

32 hours

Units of product produced

250 units

What is the cost per unit of finished product of Job 13C?

A) $29.20

B) $33.46

C) $28.48

D) $36.70

(39) Happy Clicks Inc. uses a predetermined overhead allocation rate of

$4.75 per machine hour. Actual overhead costs incurred during the

year are as follows:

Indirect materials

$5,200

Indirect labor

$3,750

Plant depreciation

$4,800

Plant utilities and insurance

$9,530

Other plant overhead costs

$12,700

Total machine hours used during the year

7,520 hours

What is the amount of manufacturing overhead cost allocated to

Work-in-Process Inventory during the year?

A) $35,980

B) $8,950

C) $27,030

D) $35,720

(40) Doric Agricultural Products uses a predetermined overhead allocation

rate based on direct labor cost. The predetermined overhead allocated

during the year is $270,000. The details of production and costs

incurred during the year are as follows:

34

Dr/Mostafa I. Elfeky

Actual direct materials cost

$812,500

Actual direct labor cost

$180,000

Actual overhead costs incurred:

$264,000

Total direct labor hours

5,520 hours

What is the predetermined overhead allocation rate applied by Doric?

A) 50%

B) 67%

C) 150%

D) 33%

(41) Equinox Fabrication Plant suffered a fire incident in August due to

which most of the records for the year were destroyed. The following

accounting data for the year that were recovered:

Total manufacturing overhead estimated at the beginning

of the year

$105,840

Total direct labor costs estimated at the beginning of the

year

$186,000

Total direct labor hours estimated at the beginning of the

3,600 direct labor

year

hours

Actual manufacturing overhead costs for the year

$99,760

Actual direct labor costs for the year

$142,000

2,950 direct labor

Actual direct labor hours for the year

hours

The company bases its manufacturing overhead allocation on direct

labor hours. What was the predetermined overhead allocation rate for

the year?

A) $35.87

B) $33.82

C) $29.40

D) $27.71

(42) The Quadrangle Fabrication Plant suffered a fire incident at the

beginning of the year which resulted in loss of property including the

accounting records. Some data for the year were retrieved and

extracts from it are shown below:

Total manufacturing overhead estimated at the beginning of the

year

$105,840

Total direct labor costs estimated at the beginning of the year

$186,000

3,600 direct labor

Total direct labor hours estimated at the beginning of the year

hours

35

Dr/Mostafa I. Elfeky

Actual manufacturing overhead costs for the year

Actual direct labor costs for the year

$99,760

$142,000

2,950 direct labor

Actual direct labor hours for the year

hours

The company bases its manufacturing overhead allocation on direct

labor hours. How much manufacturing overhead was allocated to

production during the year?

A) $105,840

B) $86,730

C) $152,417

D) $186,000

(43) The Quadrangle Fabrication Plant suffered a fire incident at the

beginning of the year which resulted in loss of property including the

accounting records. Some data for the year were retrieved and

extracts from it are shown below:

Total manufacturing overhead estimated at the beginning of the

year

$105,840

Total direct labor costs estimated at the beginning of the year

$186,000

3,600 direct labor

Total direct labor hours estimated at the beginning of the year

hours

Total machine hours estimated at the beginning of the year

9,000 machine hours

Actual manufacturing overhead costs for the year

$99,760

Actual direct labor costs for the year

$142,000

2,950 direct labor

Actual direct labor hours for the year

hours

Actual machine hours for the year

10,000 machine hours

The company bases its manufacturing overhead allocation on number

of machine hours. What is the amount of manufacturing overhead cost

allocated to Work-in-Process Inventory during the year?

A) $86,730

B) $60,977

C) $152,417

D) $117,600

(44) Archangel Manufacturing calculated a predetermined overhead

allocation rate at the beginning of the year based on a percentage of

direct labor costs. The production details for the year are given

below:

36

Dr/Mostafa I. Elfeky

Total manufacturing overhead estimated at the beginning of the

year

Total direct labor costs estimated at the beginning of the year

$140,000

$350,000

12,000 direct labor

Total direct labor hours estimated at the beginning of the year

hours

Actual manufacturing overhead costs for the year

$159,000

Actual direct labor costs for the year

$362,000

12,400 direct labor

Actual direct labor hours for the year

hours

Calculate the allocation rate for the year based on the above data.

A) 40%

B) 44%

C) 250%

D) 228%

(45) Archangel Manufacturing uses a predetermined overhead allocation

rate based on a percentage of direct labor costs. The following are the

details of production during the year:

Total manufacturing overhead estimated at the beginning of the

year

$140,000

Total direct labor costs estimated at the beginning of the year

$350,000

12,000 direct labor

Total direct labor hours estimated at the beginning of the year

hours

Actual manufacturing overhead costs for the year

$159,000

Actual direct labor costs for the year

$362,000

12,400 direct labor

Actual direct labor hours for the year

hours

Calculate the amount of manufacturing overhead costs allocated to

production.

A) $140,000

B) $164,452

C) $144,800

D) $159,280

(46) Q-dot Manufacturing uses a predetermined overhead allocation rate

based on direct labor hours. It has provided the following information

for the year 2014:

Manufacturing overhead costs allocated to production

$189,000

Actual direct materials cost

$560,000

Actual direct labor cost

$250,000

37

Dr/Mostafa I. Elfeky

9,450 direct labor

Actual direct labor hours

hours

Estimated machine hours

180,000 machine hours

Based on the above information, calculate Q-dot's predetermined

overhead allocation rate.

A) $5.43 per machine hour

B) 76% of direct labor cost

C) 34% of direct materials cost

D) $20 per direct labor hour

(47) Felton Quality Productions uses a predetermined overhead allocation

rate based on machine hours. It has provided the following

information for the year 2014:

Actual manufacturing overhead costs incurred

$90,000

Manufacturing overhead costs allocated to

production

$42,500

Actual direct materials cost

$220,000

Actual direct labor cost

$46,000

Actual direct labor hours

2,000

Actual machine hours

30,000

Based on the above information, calculate the manufacturing

overhead rate applied by Felton.

A) $1.42 per machine hour

B) $1.53 per machine hour

C) $7.33 per machine hour

D) $3.00 per machine hour

(48) Davie Company used estimated direct labor hours of 250,000 and

estimated manufacturing overhead costs of $1,000,000 in establishing

its 2015 predetermined overhead allocation rate. Actual results

showed:

Actual manufacturing overhead

$900,000

Allocated manufacturing overhead

$875,000

What was the number of direct labor hours worked during 2015?

A) 225,000 hours

B) 243,056 hours

C) 250,000 hours

D) 218,750 hours

38

Dr/Mostafa I. Elfeky

(49) Forsyth Company uses estimated direct labor hours of 175,000 and

estimated manufacturing overhead costs of $350,000 in establishing

its 2014 predetermined overhead allocation rate. Actual results

showed:

Actual manufacturing overhead

$346,500

Allocated manufacturing overhead

$320,000

The number of direct labor hours worked during the period was:

A) 175,000 hours.

B) 160,000 hours.

C) 173,250 hours.

D) 191,406 hours.

(50) The records at Smith and Jones Company show that Job 110 is

charged with $11,000 of direct materials and $12,500 of direct labor.

Smith and Jones Company allocate manufacturing overhead at 85%

of direct labor cost. What is the total cost of Job No. 110?

A) $20,625

B) $34,125

C) $22,500

D) $21,625

(51) On January 1, 2015, Jackson Company's Work-in-Process Inventory

account showed a balance of $65,000. During 2015, materials

requisitioned for use in production amounted to $70,000 of which

$66,000 represented direct materials. Factory wages for the period

were $209,000 of which $186,400 were for direct labor.

Manufacturing overhead is allocated on the basis of 60% of direct

labor cost. Actual overhead was $116,440. Jobs costing $353,240

were completed during 2015. The December 31, 2015, balance in

Work-in-Process Inventory is:

A) $80,000.

B) $72,800.

C) $107,200.

D) $76,000.

(52) Caltran Company completed manufacturing Job 445. It included

$320 of direct materials cost, $1,240 of direct labor cost, and $560 of

allocated overhead. Which of the following is the correct journal

entry needed to record the completed job?

39

Dr/Mostafa I. Elfeky

A)

Work-in-Process Inventory

Finished Goods Inventory

B)

Finished Goods Inventory

Materials Inventory

C)

Work-in-Process Inventory

Cost of Goods Sold

D)

Finished Goods Inventory

Work-in-Process Inventory

2,120

2,120

2,120

2,120

40,000

40,000

2,120

2,120

(53) Altima Company finished Job A40 on the last working day of the

year. It utilized $400 of direct materials and $3,600 of direct labor.

Altima uses a predetermined overhead allocation rate based on

percentage of direct labor costs which has been fixed at 40%. The

entry to record the completion of the job should involve a:

A) Debit to Finished Goods Inventory $5,440 and a credit to

Materials Inventory $5,440.

B) Debit to Cost of Goods Sold $5,440 and a credit to Finished

Goods Inventory $5,440.

C) Debit to Finished Goods Inventory $5,440 and a credit to Workin-Process Inventory $5,440.

D) Debit to Work-in-Process Inventory $5,440 and a credit to

Finished Goods Inventory $5,440.

(54) On June 30, Caroline Company finished Job 750 with total job costs

of $4,600 and transferred the costs to Finished Goods Inventory. On

July 6, Caroline completed sale of the goods from Job 750 to a

customer for $5,100 cash. In order to record the sale, two entries are

necessary, one to record revenue, and one to record cost of goods

sold. Which of the following is the correct entry needed to record the

revenues?

A) Debit Finished Goods Inventory $4,600, credit Sales Revenue

$4,600

B) Debit Cash $5,100, credit Sales Revenue $5,100

C) Debit Sales Revenue $5,100, credit Cash $5,100

D) Debit Cost of Goods Sold $4,600, credit Sales Revenue $4,600

40

Dr/Mostafa I. Elfeky

(55) On June 30, Coral Company finished Job 750, with total job costs of

$4,600, and transferred the costs to Finished Goods Inventory. On

July 6, they completed the sale of the goods to a customer for $5,100

cash. In order to record the sale, two entries are necessary, one to

record revenue, and one to record cost of goods sold. Which of the

following is the correct journal entry to record the cost of goods sold?

A) Debit Finished Goods Inventory $4,600, credit Cost of Goods Sold

$4,600

B) Debit Cost of Goods Sold $4,600, credit Work-in-Process

Inventory $4,600

C) Debit Work-in-Process Inventory $4,600, credit Cost of Goods

Sold $4,600

D) Debit Cost of Goods Sold $4,600, credit Finished Goods Inventory

$4,600

(56) At the beginning of 2015, Conway Manufacturing had the following

account balances:

Following additional details are provided for the year:

Direct materials placed in production

$80,000

Direct labor incurred

190,000

Manufacturing overhead incurred

300,000

Manufacturing overhead allocated to production

295,000

Cost of jobs completed and transferred

500,000

The ending balance in the Work-in-Process Inventory account is a:

A) Credit of $67,000.

B) Debit of $65,000.

C) Credit of $65,000.

D) Debit of $67,000.

(57) At the beginning of 2015, Conway Manufacturing had the following

account balances:

41

Dr/Mostafa I. Elfeky

Following additional details are provided for the year:

Direct materials placed in production

$80,000

Direct labor incurred

190,000

Manufacturing overhead incurred

300,000

Manufacturing overhead allocated to production

295,000

Cost of jobs completed and transferred

500,000

The ending balance in the Finished Goods Inventory account is a:

A) Debit of $508,000.

B) Debit of $500,000.

C) Debit of $573,000.

D) Debit of $65,000.

(58) At the beginning of 2015, Conway Manufacturing had the following

account balances:

Following additional details are provided for the year:

Direct materials placed in production

$80,000

Direct labor incurred

190,000

Manufacturing overhead incurred

300,000

Manufacturing overhead allocated to production

295,000

Cost of jobs completed and transferred

500,000

The unadjusted balance in the Manufacturing Overhead account is a:

A) Credit of $295,000.

B) Credit of $5,000.

C) Debit of $5,000.

D) Debit of $13,000.

(59) When goods are transferred from the Work-in-Process Inventory

account to the Finished Goods Inventory account:

A) Total assets and total liabilities increase by the same amount.

B) Total assets of the company remain constant.

C) Total equity and total assets increase with the same amount.

D) Total liabilities increases and total equity decreases by the same

amount.

42

Dr/Mostafa I. Elfeky

(60) At January 1, 2015, Feldstein Manufacturing had a beginning balance

in Work-in-Process Inventory of $80,000 and a beginning balance in

Finished Goods Inventory of $20,000. During the year, Feldstein

incurred manufacturing costs of $350,000.

During the year, the following transactions occurred:

Job A-12 was completed for a total cost of $120,000 and was sold for

$125,000.

Job A-13 was completed for a total cost of $200,000 and was sold for

$210,000.

Job A-15 was completed for a total cost $60,000, but was not sold as

of year-end.

At the end of the year, what was the balance in Finished Goods

Inventory?

A) $60,000 debit balance

B) $40,000 credit balance

C) $80,000 debit balance

D) $30,000 debit balance

(61) Jorst Manufacturing began business on January

first year of operation, Jorst worked on five

reported the following information at year-end:

Job 1

Job 2

Job 3

Direct Materials

1,000

7,500

4,000

Direct Labor

12,000 20,000 13,000

Allocated Mfg.

Overhead

1,500

6,000

2,500

1, 2015. During its

industrial jobs and

Job 4

3,500

12,000

Job 5

1,500

800

7,500

200

Not

Job completed:

Jun 30

Sep 1

Oct 15

Nov 1

completed

Job sold:

Jul 10

Sep 12 Not sold Not sold

N/A

Revenues:

25,000 39,000

N/A

N/A

N/A

At year-end, what was the balance in Work-in-Process Inventory?

A) $2,500

B) $25,500

C) $45,000

D) $15,500

(62) Jorst Manufacturing began business on January 1, 2015. During its

first year of operation, Jorst worked on five industrial jobs, and

reported the following information at year-end:

43

Dr/Mostafa I. Elfeky

Direct Materials

Direct Labor

Allocated Mfg.

Overhead

Job 1

1,000

12,000

Job 2

7,500

20,000

Job 3

4,000

13,000

Job 4

3,500

12,000

1,500

6,000

2,500

7,500

Job 5

1,500

800

200

Not

Job completed:

Jun 30

Sep 1

Oct 15

Nov 1

completed

Job sold:

Jul 10

Sep 12 Not sold Not sold

N/A

Revenues:

25,000 39,000

N/A

N/A

N/A

At year-end, what was the balance in Finished Goods Inventory?

A) $90,500

B) $19,500

C) $42,500

D) $45,000

(63) The journal entry for adjustment of overallocated manufacturing

overhead includes

A) Credit to Finished Goods Inventory.

B) Credit to Manufacturing Overhead.

C) Debit to Work-in-Process Inventory.

D) Credit to Cost of Goods Sold.

(64) The journal entry for adjustment of underallocated manufacturing

overhead includes

A) Credit to Finished Goods Inventory.

B) Credit to Manufacturing Overhead.

C) Debit to Work-in-Process Inventory.

D) Credit to Cost of Goods Sold.

(65) Underallocated overhead occurs when:

A) Allocated overhead costs are less than actual overhead costs.

B) Actual overhead costs are less than allocated overhead costs.

C) Estimated overhead costs are greater than budgeted overhead

costs.

D) Estimated overhead costs are greater than actual overhead costs.

(66) Neptune Fabrication Plant has provided you with the following

information.

Total manufacturing overhead estimated at the beginning of the

year

$250,000

44

Dr/Mostafa I. Elfeky

Total direct labor costs estimated at the beginning of the year

$125,000

5,000 direct labor

Total direct labor hours estimated at the beginning of the year

hours

Actual manufacturing overhead costs for the year

$240,000

Actual direct labor costs for the year

$135,000

4,500 direct labor

Actual direct labor hours for the year

hours

The company bases its manufacturing overhead allocation on direct

labor hours. What was the unadjusted ending balance in the

manufacturing overhead account?

A) $10,000 credit balance

B) $10,000 debit balance

C) $15,000 credit balance

D) $15,000 debit balance

(67) Lakeside Company estimated manufacturing overhead costs for 2014

at $378,000, based on 180,000 estimated direct labor hours. Actual

direct labor hours for 2014 totaled 195,000. The manufacturing

overhead account contains debit entries totaling $391,500. The

manufacturing overhead for 2014 was:

A) $31,500 underallocated.

B) $31,500 overallocated.

C) $18,000 underallocated.

D) $18,000 overallocated.

(68) At the end of the year, Beta Company has an unadjusted debit

balance in the Manufacturing Overhead account of $3,950. The

adjusting journal entry needed to clear the balance to zero will

include a:

A) Debit to Cost of Goods Sold $3,950 and credit to Manufacturing

Overhead $3,950.

B) Debit to Manufacturing Overhead $3,950 and credit to Cost of

Goods Sold.

C) Debit to Work-in-Process Inventory $3,950 and credit to

Manufacturing Overhead $3,950.

D) Debit to Gross Profit $3,950 and credit to Cost of Goods Sold

$3,950.

(69) At the beginning of 2015, Conway Manufacturing had the following

account balances:

45

Dr/Mostafa I. Elfeky

Following additional details are provided for the year:

Direct materials placed in production

$80,000

Direct labor incurred

190,000

Manufacturing overhead incurred

300,000

Manufacturing overhead allocated to production

295,000

Cost of jobs completed and transferred

500,000

Total revenue

750,000

Cost of goods sold

440,000

After adjusting the balance in Manufacturing Overhead, the ending

balance in the Finished Goods Inventory account is a:

A) Credit of $52,000.

B) Debit of $60,000.

C) Credit of $432,000.

D) Debit of $68,000.

(70) At the end of the year, Metro Company has an unadjusted credit

balance in the Manufacturing Overhead account of $950. Which of

the following is the year-end adjusting entry needed to clear the

balance to zero?

A) Debit Cost of Goods Sold $950, credit Finished Goods Inventory

$950

B) Debit Manufacturing Overhead $950, credit Finished Goods

Inventory $950

C) Debit Manufacturing Overhead $950, credit Cost of Goods Sold

$950

D) Debit Cost of Goods Sold $950, credit Manufacturing Overhead

$950

(71) At the beginning of 2015, Conway Manufacturing had the following

account balances:

Following additional details are provided for the year:

Direct materials placed in production

Direct labor incurred

46

$80,000

190,000

Dr/Mostafa I. Elfeky

Manufacturing overhead incurred

300,000

Manufacturing overhead allocated to production

295,000

Cost of jobs completed and transferred

500,000

Total revenue

750,000

Cost of goods sold

440,000

After recording all these transactions and adjusting for the

over/underallocated overhead, the ending balance in the Cost of

Goods Sold account is a:

A) debit of $435,000.

B) Debit of $445,000.

C) Credit of $445,000.

D) Debit of $440,000.

(72) At the beginning of 2015, Conway Manufacturing had the following

account balances:

Following additional details are provided for the year:

Direct materials placed in production

$80,000

Direct labor incurred

190,000

Manufacturing overhead incurred

300,000

Manufacturing overhead allocated to production

295,000

Cost of jobs completed and transferred

500,000

Total revenue

750,000

Cost of goods sold

440,000

Calculate the gross profit will Conway report for the year 2015.

A) $315,000

B) $305,000

C) $310,000

D) $345,000

(73) On January 1, 2014 Feldstein Manufacturing had a beginning balance

in Work-in-Process Inventory of $80,000 and a beginning balance in

Finished Goods Inventory of $20,000. During the year, Feldstein

incurred manufacturing costs of $350,000.

Additionally, the following transactions occurred during the year:

Job A-12 was completed for a total cost of $120,000 and was sold for

$125,000

47

Dr/Mostafa I. Elfeky

Job A-13 was completed for a total cost of $200,000 and was sold for

$210,000

Job A-15 was completed for a total cost $60,000 but was not sold as

of year-end

The Manufacturing Overhead account had an unadjusted credit balance of

$12,000, and was cleared to zero at year-end.

What was the final balance in the Cost of Goods Sold account?

A) $308,000 debit balance

B) $332,000 debit balance

C) $320,000 debit balance

D) $12,000 credit balance

(74) At January 1, 2015, Feldstein Manufacturing had a beginning balance

in Work-in-Process Inventory of $80,000 and a beginning balance in

Finished Goods Inventory of $20,000. During the year, Feldstein

incurred manufacturing costs of $350,000.

During the year, the following transactions occurred:

Job A-12, was completed for a total cost of $120,000, and was sold

for $125,000.

Job A-13, was completed for a total cost of $200,000, and was sold

for $210,000.

Job A-15, was completed for a total cost $60,000, but was not sold as

of year-end.

The Manufacturing Overhead account had an unadjusted credit

balance of $12,000, and was cleared to zero at year-end.

What was the amount of gross profit reported by Feldstein at the end

of the year?

A) $2,000

B) $27,000

C) $3,000

D) $15,000

(75) Archangel Manufacturing has finished production activities for the

year 2015. The company allocates manufacturing overhead based on

a percentage of direct labor costs. The company has provided the

following information:

Total manufacturing overhead estimated at the beginning of the

year

$140,000

Total direct labor costs estimated at the beginning of the year

$350,000

Total direct labor hours estimated at the beginning of the year 12,000 direct labor hours

48

Dr/Mostafa I. Elfeky

Actual manufacturing overhead costs for the year

Actual direct labor costs for the year

Actual direct labor hours for the year

$159,000

$362,000

12,400 direct labor hours

Based on the above data, calculate the unadjusted ending balance in

the Manufacturing Overhead account.

A) $19,000 credit balance

B) $19,000 debit balance

C) $14,200 credit balance

D) $14,200 debit balance

(76) On January 1, 2015, Frederic Manufacturing had a beginning balance

in Work-in-Process Inventory of $160,000 and a beginning balance

in Finished Goods Inventory of $20,000. During the year, Frederic

incurred manufacturing costs of $200,000.

During the year, the following transactions occurred:

Job C-62 was completed for a total cost of $140,000 and was sold for

$155,000.

Job C-63 was completed for a total cost of $180,000 and was sold for

$210,000.

Job C-64 was completed for a total cost $80,000 but was not sold as

of year-end.

The Manufacturing Overhead account had an unadjusted credit balance

of $24,000, and was cleared to zero at year-end.

What was the final balance in the Cost of Goods Sold account?

A) $296,000 debit balance

B) $341,000 debit balance

C) $341,000 credit balance

D) $296,000 credit balance

(77) On January 1, 2015, Frederic Manufacturing had a beginning balance

in Work-in-Process Inventory of $160,000 and a beginning balance

in Finished Goods Inventory of $20,000. During the year, Frederic

incurred manufacturing costs of $200,000.

During the year, the following transactions occurred:

Job C-62 was completed for a total cost of $140,000 and was sold for

$155,000.

Job C-63 was completed for a total cost of $180,000 and was sold for

$210,000.

Job C-64 was completed for a total cost $80,000 but was not sold as

of year-end.

49

Dr/Mostafa I. Elfeky

The Manufacturing Overhead account had an unadjusted credit balance

of $24,000, and was cleared to zero at year-end.

What was the amount of gross profit reported by Frederic at the end of

the year?

A) $21,000

B) $69,000

C) $201,000

D) $161,000

(78) Jorst Manufacturing began business on January 1, 2014. During its

first year of operation, Jorst worked on 5 industrial jobs, and reported

the following information at year-end:

Job 1

Job 2

Job 3

Job 4

Job 5

Direct Materials

1,000

7,500

4,000

3,500

1,500

Direct Labor

12,000 20,000 13,000 12,000

800

Allocated Mfg.

Overhead

1,500

6,000

2,500

7,500

200

Not

Job completed:

Jun 30

Sep 1 Oct 15

Nov 1

completed

Job sold:

Jul 10 Sep 12 Not sold Not sold

N/A

Revenues:

25,000 39,000

N/A

N/A

N/A

Jorst's allocation of overhead costs left a debit balance of $1,200 in

the Manufacturing Overhead account which was adjusted to zero at

year-end. What was the final balance in Cost of goods sold?

A) $48,000

B) $49,200

C) $46,800

D) $91,700

(79) Jorst Manufacturing began business on January 1, 2014. During its

first year of operation, Jorst worked on 5 industrial jobs, and reported

the following information at year-end:

Job 1

Job 2

Job 3

Job 4

Job 5

Direct Materials

1,000

7,500

4,000

3,500

1,500

Direct Labor

12,000 20,000 13,000 12,000

800

Allocated Mfg.

Overhead

1,500

6,000

2,500

7,500

200

Not

Job completed:

Jun 30

Sep 1 Oct 15

Nov 1

completed

Job sold:

Jul 10 Sep 12 Not sold Not sold

N/A

Revenues:

25,000 39,000

N/A

N/A

N/A

50

Dr/Mostafa I. Elfeky

Jorst's allocation of overhead costs left a debit balance of $1,200 in

the Manufacturing Overhead account which was adjusted to zero at

year-end. What was the amount of gross profit earned in 2014?

A) $14,800

B) $16,000

C) $17,200

D) $1,700

(80) The budgeted indirect-cost rate is calculated:

A) At the beginning of the year

B) During the year

C) At the end of each quarter

D) At the end of the year

(81) The difference between actual costing and normal costing is:

A) Normal costing uses actual quantities of direct-costs

B) Actual costing uses actual quantities of direct-costs

C) Normal costing uses budgeted indirect-costs

D) Actual costing uses actual quantities of cost-allocation bases

(82) Which of the following statements about normal costing is true?

A) Direct costs and indirect costs are traced using an actual rate.

B) Direct costs and indirect costs are traced using budgeted rates.

C) Direct costs are traced using a budgeted rate, and indirect costs are

allocated using an actual rate.

D) Direct costs are traced using an actual rate, and indirect costs are

allocated using a budgeted rate.

(83) When using a normal costing system, manufacturing overhead is

allocated using the ________ manufacturing overhead rate and the

________ quantity of the allocation base.

A) Budgeted; actual

B) Budgeted; budgeted

C) Actual; budgeted

D) Actual; actual

(84) Which of the following statements about actual costing and normal

costing is true?

A) Manufacturing costs of a job are available earlier under actual

costing.

B) Corrective actions can be implemented sooner under normal

costing.

51

Dr/Mostafa I. Elfeky

C) Manufacturing costs are available earlier under normal costing.

D) Both B and C are correct.

Answer the following questions using the information below:

For 2010, Jake's Dog Supply Manufacturing uses machine-hours as the

only overhead cost-allocation base. The accounting records contain the

following information:

Estimated

Actual

Manufacturing overhead costs

$200,000

$240,000

Machine-hours

40,000

50,000

(85) Using job costing, the 2010 budgeted manufacturing overhead rate is:

A) $4.00 per machine-hour

B) $4.80 per machine-hour

C) $5.00 per machine-hour

D) $6.00 per machine-hour

(86) Using normal costing, the amount of manufacturing overhead costs

allocated to jobs during 2010 is:

A) $300,000

B) $250,000

C) $240,000

D) $200,000

Answer the following questions using the information below:

Rhett Company has two departments, Machining and Assembly. The

following estimates are for the coming year:

Machining

Assembly

Direct manufacturing labor-hours

10,000

50,000

Machine-hours

40,000

20,000

Manufacturing overhead

$200,000

$400,000

(87) A single indirect-cost rate based on direct manufacturing labor-hours

for the entire plant is:

A) $ 8 per direct labor-hour

B) $10 per direct labor-hour

C) $20 per direct labor-hour

D) None of these answers is correct.

52

Dr/Mostafa I. Elfeky

(88) The budgeted indirect-cost driver rate for the Machining Department

based on the number of machine-hours in that department is:

A) $5 per machine-hour

B) $10 per machine-hour

C) $20 per machine-hour

D) None of these answers is correct.

Answer the following questions using the information below:

Joni's Kitty Supplies applies manufacturing overhead costs to products at

a budgeted indirect-cost rate of $60 per direct manufacturing labor-hour.

A retail outlet has requested a bid on a special order of the Toy Mouse

product. Estimates for this order include: Direct materials $40,000; 500

direct manufacturing labor-hours at $20 per hour; and a 20% markup rate

on total manufacturing costs.

(89) Manufacturing overhead cost estimates for this special order total:

A) $10,000

B) $30,000

C) $36,000

D) None of these answers is correct.

Answer the following questions using the information below:

Roiann and Dennett Law Office employs 12 full-time attorneys and 10

paraprofessionals. Direct and indirect costs are applied on a professional

labor-hour basis that includes both attorney and paraprofessional hours.

Following is information for 20X3:

Budget

Actual

Indirect costs

$270,000

$300,000

Annual salary of each attorney

$100,000

$110,000

Annual salary of each paraprofessional $ 29,000

$ 30,000

Total professional labor-hours

50,000

60,000

(90) What are the budgeted direct-cost rate and the budgeted indirect-cost

rate, respectively, per professional labor-hour?

A) $27.00; $4.17

B) $29.80; $5.40

C) $32.40; $5.00

D) $27.00; $5.00

53

Dr/Mostafa I. Elfeky

(91) How much should a client be billed in a normal costing system when

1,000 professional labor-hours are used?

A) $32,000

B) $29,800

C) $35,200

D) $27,000

(92) When a normal costing system is used, clients using proportionately

more attorney time than paraprofessional time will:

A) Be overbilled for actual resources used

B) Be underbilled for actual resources used

C) Be billed accurately for actual resources used

D) Result in an underallocation of direct costs

(93) When the allocated amount of indirect costs are less than the actual

amount, indirect costs have been:

A) Overabsorbed

B) Underapplied

C) Underallocated

D) Both underapplied and underallocated are correct.

(94) One reason indirect costs may be overapplied is because:

A) The actual allocation base quantity exceeds the budgeted quantity

B) Budgeted indirect costs exceed actual indirect costs

C) Requisitioned direct materials exceed budgeted material costs

D) Both A and B are correct.

(95) The ________ approach adjusts individual job-cost records to

account for underallocated or overallocated overhead.

A) Adjusted allocation-rate

B) Proration

C) Write-off to cost of goods sold

D) Both A and B are correct.

(96) The adjusted allocation approach yields the benefits of:

A) Timeliness and convenience of normal costing

B) Allocation of of actual manufacturing overhead costs at the end of

the year

C) Both a and b are correct.

D) Neither a nor b are correct.

54

Dr/Mostafa I. Elfeky

(97) The approach often used when dealing with small amounts of

underallocated or overallocated overhead is the ________ approach.

A) Adjusted allocation-rate

B) Proration

C) Write-off to cost of goods sold

D) Both A and B are correct.

(98) The ________ approach carries the underallocated or overallocated

amounts to overhead accounts in the following year.

A) Adjusted allocation-rate

B) Proration

C) Write-off to cost of goods sold

D) None of these answers are correct.

(99) A company would use multiple cost-allocation bases:

A) If managers believed the benefits exceeded the additional costs of

that costing system