Accounting Principles & Business Organization Lecture Notes

advertisement

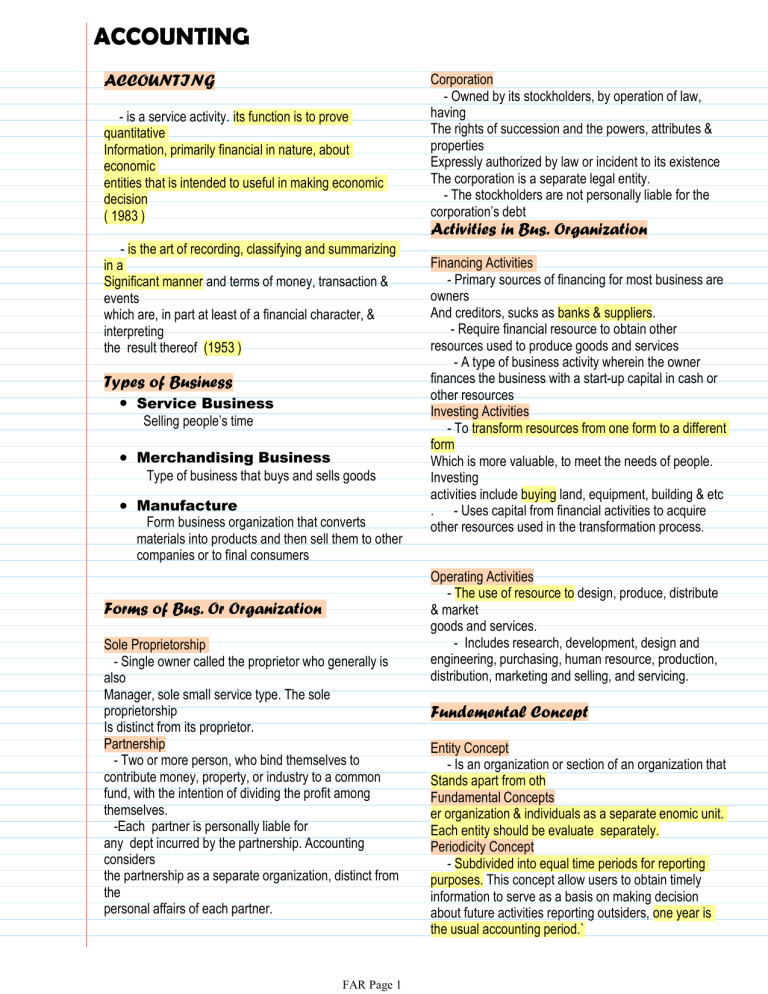

ACCOUNTING ACCOUNTING - is a service activity. its function is to prove quantitative Information, primarily financial in nature, about economic entities that is intended to useful in making economic decision ( 1983 ) - is the art of recording, classifying and summarizing in a Significant manner and terms of money, transaction & events which are, in part at least of a financial character, & interpreting the result thereof (1953 ) Types of Business • Service Business Selling people’s time • Merchandising Business Type of business that buys and sells goods • Manufacture Form business organization that converts materials into products and then sell them to other companies or to final consumers Forms of Bus. Or Organization Sole Proprietorship - Single owner called the proprietor who generally is also Manager, sole small service type. The sole proprietorship Is distinct from its proprietor. Partnership - Two or more person, who bind themselves to contribute money, property, or industry to a common fund, with the intention of dividing the profit among themselves. -Each partner is personally liable for any dept incurred by the partnership. Accounting considers the partnership as a separate organization, distinct from the personal affairs of each partner. FAR Page 1 Corporation - Owned by its stockholders, by operation of law, having The rights of succession and the powers, attributes & properties Expressly authorized by law or incident to its existence The corporation is a separate legal entity. - The stockholders are not personally liable for the corporation’s debt Activities in Bus. Organization Financing Activities - Primary sources of financing for most business are owners And creditors, sucks as banks & suppliers. - Require financial resource to obtain other resources used to produce goods and services - A type of business activity wherein the owner finances the business with a start-up capital in cash or other resources Investing Activities - To transform resources from one form to a different form Which is more valuable, to meet the needs of people. Investing activities include buying land, equipment, building & etc . - Uses capital from financial activities to acquire other resources used in the transformation process. Operating Activities - The use of resource to design, produce, distribute & market goods and services. - Includes research, development, design and engineering, purchasing, human resource, production, distribution, marketing and selling, and servicing. Fundemental Concept Entity Concept - Is an organization or section of an organization that Stands apart from oth Fundamental Concepts er organization & individuals as a separate enomic unit. Each entity should be evaluate separately. Periodicity Concept - Subdivided into equal time periods for reporting purposes. This concept allow users to obtain timely information to serve as a basis on making decision about future activities reporting outsiders, one year is the usual accounting period.` ACCOUNTING Tuesday, 6 September 2022 Stable Monetary Unit Concept - It allows accountants to add and subtract peso amounts as though each peso has the same purchasing power as any peso at any time. Going Concept - Financial statements are normally prepared on the assumption that the reporting entity is a going concern & will continue in operation for the foreseeable future. Depreciation of assets over their useful lives. USERS/ STOKEHOLDERS Basic Principle (MARCEHO) – This equation present the resources controlled by the enterprise, the present obligation of the enterprise and the residual interest in assets. Objectivity Principle - Accounting records and statements are based on the most reliable data available so that they will be as accurate and useful as possible. Historical Cost - That acquired assets should be recorded at their actual cost & not at what management thinks they worth as at reporting date. Revenue Recognition Principle - Revenue is to be recognized in the accounting period when goods are delivered or services are rendered or performed. Expense Recognition Principle - Expense should be recognized in the accounting period in which goods & services are used up to produce revenue and not when the entity pays for those good and services. Adequate Disclosure - Requires that all relevant information that would affect the user's understanding and assessment of the accounting entity be disclose in the financial statements. Materiality - Financial reporting is only concerned with information that is significant enough to affect evaluation and decision, depends on the size & nature of the item judged in the particular circumstances of its omission. Consistency Principle - The firms should use the same accounting method from period to period to archive comparability over time within a single enterprise. However changes are permitted if justifiable & disclosed in the financial statements. FAR Page 2 • • • • • • • Owners/ inventors Manager Lender/ creditor Supplies Regulatory Agencies Employees Customer Accounting equation The basic accounting model ASSETS = LIABILITIES + OWNWES' EQUITY ASSETS - Resources owned by the business. • CASH - Bank will accept for deposit at face value. Includes coin, currency, checks, money orders, drafts And, bank deposits. • NOTES REC- Written pledge that the Customer will pay the business a fixed amount of money on a Certain date. • ACCOUNT REC - Claims against customers arising From sale service or good on credit. types of less security Than a promissory note • INVENTORIES - .The form of materials or supplies To be consumed in the production process or in the regarding Of service. • PREPAID EXP - Paid for by the business in advance • PROPERTY, PLAN, & EQUIP - Use for in the Production or supply of good s or service. Includes items Land, building, machinery and equipment, furniture, fixture, Motor vehicles and equip. ACCOUNTING Tuesday, 6 September 2022 USERS/ STOKEHOLDERS • • • • • • • Owners/ inventors Manager Lender/ creditor Supplies Regulatory Agencies Employees Customer Accounting equation – This equation present the resources controlled by the enterprise, the present obligation of the enterprise and the residual interest in assets. The basic accounting model ASSETS = LIABILITIES + OWNWES' EQUITY ASSETS - Resources owned by the business. • CASH - Bank will accept for deposit at face value. Includes coin, currency, checks, money orders, drafts And, bank deposits. • NOTES REC- Written pledge that the Customer will pay the business a fixed amount of money on a Certain date. • ACCOUNT REC - Claims against customers arising From sale service or good on credit. types of less security Than a promissory note • INVENTORIES - .The form of materials or supplies To be consumed in the production process or in the regarding Of service. • PREPAID EXP - Paid for by the business in advance • PROPERTY, PLAN, & EQUIP - Use for in the Production or supply of good s or service. Includes items Land, building, machinery and equipment, furniture, fixture, Motor vehicles and equip. • ACCUMULATED DEPRECIATION - This acct. Deducted from the cost of the related asset- equip. or building To obtain book value. • INTANGIBLE ASSETS - Nonmonetary assets without Physical subs. These include good will, patents, copy right, Licenses, franchise, trademarks, brand names, secret process, Subscription list 7 noncompetition agreements. LIABILITIES - Right of the creditors over the asset. • ACCT. PAYABLE - Reverse relationship of the acct. receivable. • NOTES PAYABLE - Is like a notes receivable but reverse sense. • ACCRUED LIAB - To others for unpaid expenses. Includes salaries payable, utilities pay, interest pay and Taxes payable • UNEARNED REV - When the goods or service are Provided to the customer, the unearned rev is reduce and income is recognized. • MORTAGE PAYABLE - Records long term dept of The business entity for which the business entity has pledged Certain assets as security to the creditor. (SANLA) EQUITY - The owner over the assets under • INITIAL INVESTMENT • ADDITIONAL INVESTMENT • WITHDWALS • REVENUE - SALES AND SERVICE REV • EXPENSES 1 SALARIES EXP- Payment of an employer,13 month 2 SUPPLIES EXP- Conduct of daily business 3 UTILITIES EXP4 RENT EXP 5 ADDITIONAL EXP 6 TAXES EXP FAR Page 3 ACCOUNTING Tuesday, 6 September 2022 NAME OF THE COMPANY INCOME STATEMENT FOR THE MONTH ENDED SR > OE - NET INCOME SR < OE - NET LOSS • Performance report of revenues against cost and expenses NAME OF THE COMPANY STATEMENT OF CHANGE IN OE FOR THE MONTH ENDED • Show financial performance for the period showing separately the total amounts attributable to owners of the parent and to minority interest • A statement of change in equity (also referred to as statement of retained earnings) is a business' financial statement that measures the changes in owners' equity throughout a specific accounting period. It covers the following elements: Net profit or loss. Dividend payments. (google) NAME OF THE COMPANY STATEMENT OF FINANCIAL PISITION AS OF The statement of financial position is another term for the balance sheet. The statement lists the assets, liabilities, and equity of an organization as of the report date. As such, it provides a snapshot of the financial condition of a business as of a specific date. (google) NAME OF THE COMPANY STATEMENT OF CASH FLOW • Financial report that shows what happened to the cash by enumerating the activities of cash received and cash used by the business • Creditor – stakeholders assess the paying ability of the business • Capital – account to record the original and additional investment of the owner of the business entity • Service revenue – revenues earned by performing services for customer or client FAR Page 4