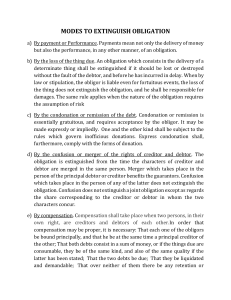

Obligations: Legal Definition & Essential Elements

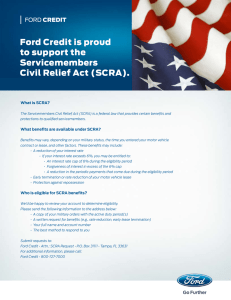

advertisement