Capital Budgeting Tutorial: Financial Management Problems

advertisement

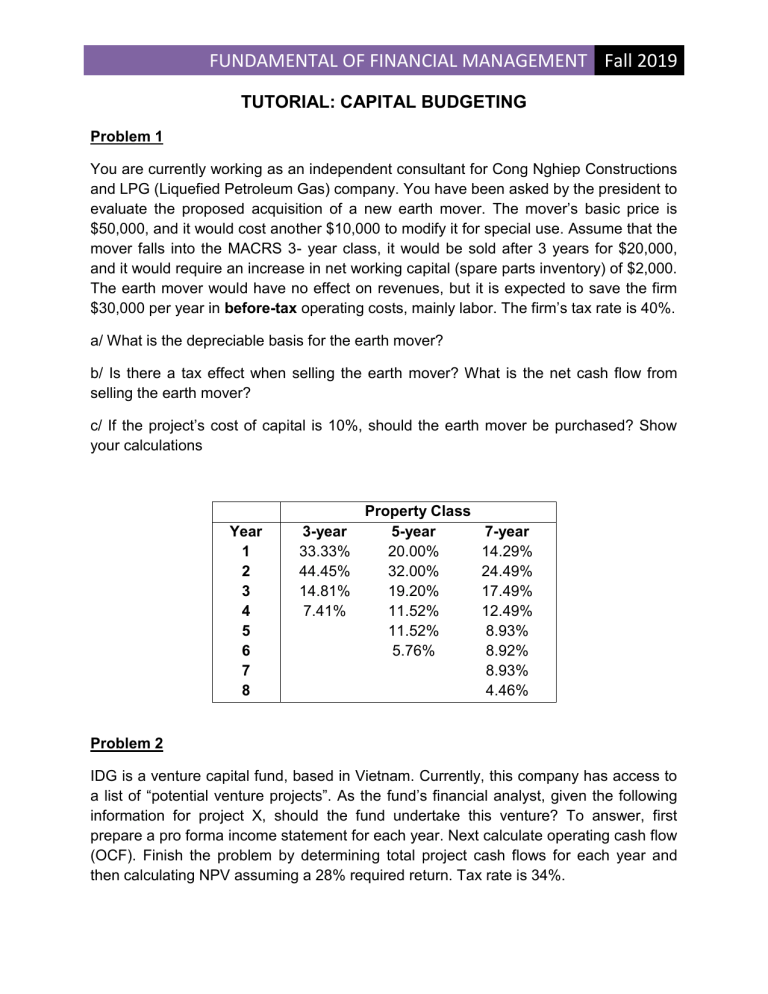

FUNDAMENTAL OF FINANCIAL MANAGEMENT Fall 2019 TUTORIAL: CAPITAL BUDGETING Problem 1 You are currently working as an independent consultant for Cong Nghiep Constructions and LPG (Liquefied Petroleum Gas) company. You have been asked by the president to evaluate the proposed acquisition of a new earth mover. The mover’s basic price is $50,000, and it would cost another $10,000 to modify it for special use. Assume that the mover falls into the MACRS 3- year class, it would be sold after 3 years for $20,000, and it would require an increase in net working capital (spare parts inventory) of $2,000. The earth mover would have no effect on revenues, but it is expected to save the firm $30,000 per year in before-tax operating costs, mainly labor. The firm’s tax rate is 40%. a/ What is the depreciable basis for the earth mover? b/ Is there a tax effect when selling the earth mover? What is the net cash flow from selling the earth mover? c/ If the project’s cost of capital is 10%, should the earth mover be purchased? Show your calculations Year 1 2 3 4 5 6 7 8 Property Class 3-year 5-year 33.33% 20.00% 44.45% 32.00% 14.81% 19.20% 7.41% 11.52% 11.52% 5.76% 7-year 14.29% 24.49% 17.49% 12.49% 8.93% 8.92% 8.93% 4.46% Problem 2 IDG is a venture capital fund, based in Vietnam. Currently, this company has access to a list of “potential venture projects”. As the fund’s financial analyst, given the following information for project X, should the fund undertake this venture? To answer, first prepare a pro forma income statement for each year. Next calculate operating cash flow (OCF). Finish the problem by determining total project cash flows for each year and then calculating NPV assuming a 28% required return. Tax rate is 34%. FUNDAMENTAL OF FINANCIAL MANAGEMENT Fall 2019 Project X involves a new type of graphite composite in-line skate wheel. Projected sales volume is 6,000 units per year at $1,000 each. Variable cost will run about $400 per unit, and the product should have a four year life. Fixed cost for the project will run $450,000 per year. Further, the project will need to invest a total of $1,250,000 in manufacturing equipment. This equipment is depreciated under seven-year MACRS property for tax purposes. By the end of the 4th year, the equipment would be sold on the market for half of its original price. Initial net working capital needed is $1,150,000. After that, net working capital requirements would be 25% of sales. Problem 3 Shrieves Casting Company is considering adding a new line to its product mix, and the capital budgeting analysis is being conducted by Sidney Johnson, a recently graduated MBA. The production line would be set up in unused space in Shrieves’ main plant. The machinery’s invoice price would be approximately $200,000, another $10,000 in shipping charges would be required, and it would cost an additional $30,000 to install the equipment. The machinery has an economic life of 4 years, and Shrieves has obtained a special tax ruling that places the equipment in the MACRS 3-year class. The machinery is expected to have a salvage value of $25,000 after 4 years of use. The new line would generate incremental sales of 1,250 units per year for 4 years at an incremental cost of $100 per unit in the first year, excluding depreciation. Each unit can be sold for $200 in the first year. The sales price and cost are expected to increase by 3% per year due to inflation. Further, to handle the new line, the firm’s net working capital for each year would have to equal to 12% of next year’s sales revenues. The firm’s tax rate is 40%,and its discount rate is 10%. Part A a. Define “incremental cash flow.” b. Should you subtract interest expense when calculating project cash flow? c. Suppose the firm had spent $100,000 last year to rehabilitate the production line site. Should this cost be included in the analysis? Explain. d. Now assume that the plant space could be leased out to another firm at $25,000per year. Should this be included in the analysis? If so, how? e. Finally, assume that the new product line is expected to decrease sales of the firm’s other lines by $50,000 per year. Should this be considered in the analysis? Part B a. Disregard the assumptions in part A. What is Shrieves’ depreciable basis? What are the annual depreciation expenses? FUNDAMENTAL OF FINANCIAL MANAGEMENT Fall 2019 b. Calculate the annual sales revenues and costs (other than depreciation) c. Construct annual incremental operating cash flow statements. d. Estimate the required net working capital for each year, and the cash flow due to investments in net working capital. e. Calculate the after-tax salvage cash flow f. Calculate the project cash flows for each year. Based on these cash flows, what is the project’s NPV? Should we undertake the project? Problem 4 Basket Wonders (BW) is considering the purchase of a new basket weaving machine. This machine will cost $50,000 while shipping and installation costs another $20,000. The machine, under IRS’s regulations, falls under the three-yearMACRS class. Initial net working capital requirement is $5,000, and is expected to be fully recovered by the end of the project’s life. Lisa Miller is the firm’s newly hired expert who currently works in the Purchasing Division. The company pays her a fixed salary of $7,500 per month to take care of the company’s purchasing activities. Lisa forecasts that with the purchase of this basket weaving machine, Basket Wonders’ revenues will increase by $110,000 for each of the next four years while operating costs will rise by $70,000 for each of the next four years. This machine will then be sold (scrapped) for $10,000 at the end of the 4 thyear, when the project ends. This company is in the 40% tax bracket. a/ What is the depreciable basis for this new basket weaving machine? b/ Why net working capital is fully recovered at the end of project’s life? c/ Given a discount rate of 20% , calculate the NPV of this project. What should Lisa say about this project? Problem 5 Golden Gate Windsurfing Inc. is considering a project to expand its current operation. Given the following information and assuming straight-line depreciation to zero: What is the net present value of this project? Should Golden Gate Windsurfing Inc. accept the project and why? Market research study = $15,000 Project life = 5 years FUNDAMENTAL OF FINANCIAL MANAGEMENT Fall 2019 Initial investment on fixed assets = $320,000; the fixed assets will be sold for $30,000 at the end of year 5. Initial working capital = $25,000 (the money will be recovered on closure of the project) Operating income = (sales – costs) = $150,000 per year; Losses in current sales if proceed the project: $20,000 in year 1 and $16,000 in year 2. Corporate tax rate = 25% Discount rate 13.45% Problem 6 Pegasus Telecommunications Ltd (PTL) is considering rolling out a new cable Internet service, PTL is a taxable publicly listed corporation operating in Australia. PTL’s management is in the process of analyzing the project using the NPV method, and as a junior analyst you have been asked to gather the relevant information. For each of the following items explain briefly (no more than 1 sentence) why that item is or is not relevant to the NPV computation: a. Last month, the marketing department ran a focus group to determine consumer interest in the new service. An invoice for $2,500 has just arrived from the consultants involved in running the focus group. b. PTL headquarters allocate central company costs to departments at a rate of $5,000 per employee per year. c. PTL’s bank will charge an interest of 12% p.a. compounded monthly on the loan required to purchase the necessary hardware. d. Equipment purchased will be depreciated straight line over 5 years. e. The Project will require the use of warehouse space already owned by PTL. The company estimates that the warehouse is worth $450,000.