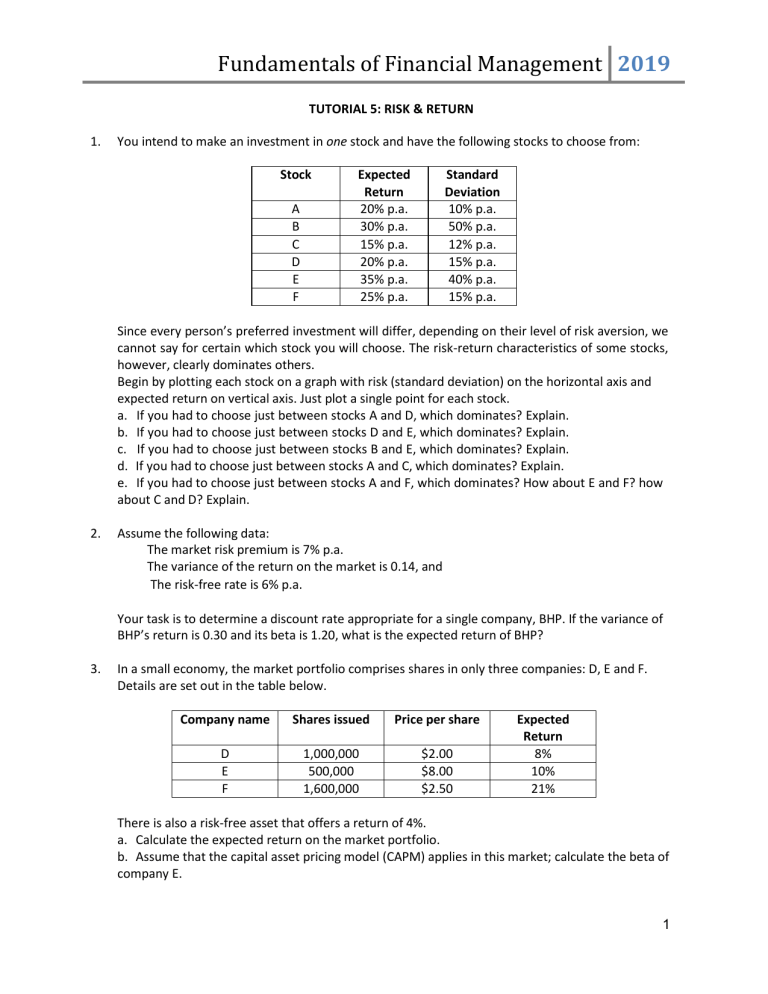

Fundamentals of Financial Management 2019 TUTORIAL 5: RISK & RETURN 1. You intend to make an investment in one stock and have the following stocks to choose from: Stock A B C D E F Expected Return 20% p.a. 30% p.a. 15% p.a. 20% p.a. 35% p.a. 25% p.a. Standard Deviation 10% p.a. 50% p.a. 12% p.a. 15% p.a. 40% p.a. 15% p.a. Since every person’s preferred investment will differ, depending on their level of risk aversion, we cannot say for certain which stock you will choose. The risk-return characteristics of some stocks, however, clearly dominates others. Begin by plotting each stock on a graph with risk (standard deviation) on the horizontal axis and expected return on vertical axis. Just plot a single point for each stock. a. If you had to choose just between stocks A and D, which dominates? Explain. b. If you had to choose just between stocks D and E, which dominates? Explain. c. If you had to choose just between stocks B and E, which dominates? Explain. d. If you had to choose just between stocks A and C, which dominates? Explain. e. If you had to choose just between stocks A and F, which dominates? How about E and F? how about C and D? Explain. 2. Assume the following data: The market risk premium is 7% p.a. The variance of the return on the market is 0.14, and The risk-free rate is 6% p.a. Your task is to determine a discount rate appropriate for a single company, BHP. If the variance of BHP’s return is 0.30 and its beta is 1.20, what is the expected return of BHP? 3. In a small economy, the market portfolio comprises shares in only three companies: D, E and F. Details are set out in the table below. Company name Shares issued Price per share D E F 1,000,000 500,000 1,600,000 $2.00 $8.00 $2.50 Expected Return 8% 10% 21% There is also a risk-free asset that offers a return of 4%. a. Calculate the expected return on the market portfolio. b. Assume that the capital asset pricing model (CAPM) applies in this market; calculate the beta of company E. 1 Fundamentals of Financial Management 2019 4. Sorbond Industries has a beta of 1.45. The risk-free rate is 8 percent and the expected return on the market portfolio is 13 percent. The company currently pays a dividend of $2 a share, and investors expect it to experience a growth in dividends of 10 percent per annum for many years to come. a. What is the stock’s required rate of return according to the CAPM? b. What is the stock’s present market price per share, assuming this required return? c. What would happen to the required return and to market price per share if the beta were 0.80? (Assume that all else stays the same.) 5. You want to create a portfolio that is equally risky to the market, and you have $1,000,000 to invest. Given this information, find the values of (a), (b) and (c) in the following table. Present your detailed calculations. Asset Stock A Stock B Stock C Risk-free asset 6. Investment $210,000 $320,000 (a) (b) Beta 0.85 1.20 1.35 (c) Consider the following information about Stocks I and II: State of Economy Recession Normal Boom Probability of State of Economy 0.25 0.50 0.25 Rate of Return if State occurs Stock I Stock II 0.11 -0.40 0.29 0.10 0.13 0.56 The market risk premium is 8 percent, and the risk-free rate is 4 percent. Which stock has the most systematic risk? Which one has the most unsystematic risk? Which stock is “riskier”? Explain. 7. Suppose Intel stock has a beta of 1.6, whereas Boeing stock has a beta of 1. If the risk-free rate is 4% and the expected return of the market portfolio is 10%, according to the CAPM: a. What is the expected return of Intel stock? b. What is the expected return of Boeing stock? c. What is the beta of a portfolio that consists of 60% Intel stock and 40% Boeing stock? d. What is the expected return of a portfolio that consists of 60% Intel stock and 40% Boeing stock? 8. Suppose you observe the following situation: Security Pete Corp. Repete Co. Beta 1.35 0.80 Expected Return 0.132 0.101 Assume these securities are correctly priced. Based on the CAPM, what is the expected return on the market? What is the risk-free rate? 9. You have recently become very interested in real estate. To gain some experience as a real estate investor, you have decided to get together with nine of your friends to buy three small cottages near campus. If you and your friends pool your money, you will have just enough to buy the three properties. Since each investment requires the same amount of money and you will have a 10 2 Fundamentals of Financial Management 2019 percent interest in each, you will effectively haveone-third of your portfolio invested in each cottage. While the cottages cost the same, they are different distances from campus and in different neighborhoods. You believe that this causes them to have different levels of systematic risk, and you estimate that the betas for the individual cottages are 1.2, 1.3, and 1.5. If the risk-free rate is 4 percent and the market risk premium is 6 percent, what will be the expected return on your real estate portfolio after you make all three investments? 10. You have become concerned that you have too much of your money invested in your pizza restaurant and have decided to diversify your personal portfolio. Right now the pizza restaurant is your only investment. To diversify, you plan to sell 45 percent of your restaurant and invest the proceeds from the sale, in equal proportions, into a stock and a bond. Over the next year, you expect to earn a return of 15 percent on your remaining investment in the pizza restaurant,12 percent on your investment in the stock, and 8 percent on your investment in the bond. What return will you expect from your diversified portfolio over the next year? 11. You have $100,000 to invest in a portfolio containing Stock X, Stock Y, and a risk-free asset. You must invest all of your money. Your goal is to create a portfolio that has an expected return of 16.8% and that has only 80% of the risk of the overall market. If X has an expected return of 31% and a beta of 1.8, Y has an expected return of 20% and a beta of 1.3, and the risk-free rate is 7%, how much money will you invest in Stock X? 3