Innovation Activities and Integration through

Vertical Acquisitions

Laurent Frésard

Universita della Svizzera italiana (USI), Swiss Finance Institute

Downloaded from https://academic.oup.com/rfs/advance-article-abstract/doi/10.1093/rfs/hhz106/5571736 by guest on 15 October 2019

Gerard Hoberg

Marshall School of Business, University of Southern California

Gordon M. Phillips

Tuck School at Dartmouth College and National Bureau of Economic

Research

We examine the determinants of vertical acquisitions using product text linked to product

vocabulary from input-output tables. We find that the innovation stage is important in

understanding vertical integration. R&D-intensive firms are less likely to become targets

of vertical acquisitions. In contrast, firms with patented innovation are more likely to sell

to vertically related buyers. Firms’ R&D intensity is a more important deterrent to their

vertical acquisitions when the provision of innovation incentives by potential acquirers is

more difficult. The role of patents in fostering vertical acquisitions is more prevalent when

potential buyers face a higher risk of holdup. (JEL G32, G34, L22, L25, O34)

Received December 20, 2017; editorial decision July 7, 2019 by Editor Francesca Cornelli.

The scope of firm boundaries and whether to organize transactions within

the firm (integration) or by using external contracting is of major interest in

We are especially grateful to Francesca Cornelli (the editor) and two anonymous referees for extensive and

very thoughtful suggestions. We thank Yun Ling for excellent research assistance. For helpful comments, we

thank Kenneth Ahern, Jean-Noel Barrot, Thomas Bates, Nick Bloom, Giacinta Cestone, Francesca Cornelli,

Robert Gibbons, Oliver Hart, Thomas Hellmann, Ali Hortaçsu, Adrien Matray, Sébastien Michenaud, Chad

Syverson, Steve Tadelis, and Ivo Welch and seminar participants at the National Bureau of Economic Research

Organizational Economics Meetings, 2015 International Society for New Institutional Economics Meetings,

the American Finance Association Meetings, Arizona State University, Berkeley, Carnegie Mellon, Dartmouth

College, Humboldt University, IFN Stockholm, Harvard-MIT Organizational Economics joint seminar, Tsinghua

University, University of Alberta, University of British Columbia, University of California Los Angeles,

University of Chicago, Universidad de los Andes, University of Maryland, University of Washington, VU

Amsterdam, and Wharton. All authors contributed equally to this paper. Supplementary data can be found

on The Review of Financial Studies web site. Send correspondence to Gerard Hoberg, Marshall School of

Business, 701 Exposition Blvd, Hoffman Hall 231, Los Angeles, CA 90089; telephone: 213-740-2348. E-mail:

hoberg@marshall.usc.edu.

© The Author(s) 2019. Published by Oxford University Press on behalf of The Society for Financial Studies.

All rights reserved. For permissions, please e-mail: journals.permissions@oup.com.

doi:10.1093/rfs/hhz106

[20:39 28/9/2019 RFS-OP-REVF190113.tex]

Page: 1

1–40

The Review of Financial Studies / v 00 n 0 2019

Downloaded from https://academic.oup.com/rfs/advance-article-abstract/doi/10.1093/rfs/hhz106/5571736 by guest on 15 October 2019

understanding why firms exist. A large literature investigates the determinants

of vertical integration and, more recently, the relationship between firms’

vertical organization and innovation activities.1 Yet, existing research remains

largely silent on the role of firms’ innovation activities in explaining vertical

acquisitions. In this paper, we provide novel evidence that the stage of

development of innovative assets is a strong determinant of firms’ vertical

acquisitions and the boundaries of the firm.

Our analysis builds on the theories of the firm of Williamson (1971),

Grossman and Hart (1986), and Hart and Moore (1990) who emphasize that,

because of incomplete contracting and the inalienability of human capital, the

vertical boundaries between firms (separation or integration) are determined

by trading off their ex ante investment incentives and ex post opportunistic

behaviors. This trade-off is regulated by the allocation of control rights over the

assets that are specific to firms’ vertical relationships, as the firms that formally

control these assets have more incentives to invest ex ante due to increased

bargaining power ex post. Therefore, change in control – vertical acquisitions

– should occur when the relative importance of each party’s incentives to add

value to the overall relationship shifts.2

Early stage innovation activities (i.e., unrealized innovation) are particularly

sensitive to the allocation of control rights because investments in innovation

are typically not fully contractible, often unverifiable, heavily depend on human

capital, and are subject to holdup because of their specificities (e.g., Acemoglu

1996). When innovative assets require further investment and development, it

is optimal to leave control to the firms that perform the innovation, as their

incentives are most important for the value of the vertical relationship (e.g.,

Aghion and Tirole 1994), and because their employees may leave in case

of acquisition and take the unrealized innovation (i.e., their ideas) with them

(e.g., Hart and Moore 1994).3 Vertical separation preserves incentives for the

innovator (Grossman and Hart 1986). In contrast, when innovation is realized,

and protected by legally enforceable patents, incentives to invest in innovation

decline in importance and incentives to commercialize the innovation increase.

In this context, vertical acquisitions optimally reallocate control to the firms that

commercialize the innovation and thus integration reduces the risk of holdup by

the other party (Williamson 1971, 1979; Klein, Crawford, and Alchian 1978).

We thus predict that acquisitions by vertically related buyers are less likely

when firms’ innovation is still unrealized, but more likely when it is realized

and patented.

1 See Lafontaine and Slade (2007) and Bresnahan and Levin (2012) for recent surveys.

2 Holmstrom and Milgrom (1991) and Holmstrom and Milgrom (1994) also emphasize the role of incentives

in firm structure. Gibbons (2005) summarizes the large literature and highlights that the costs and benefits of

vertical integration depend on transactions costs, rent seeking, contractual incompleteness, and the specificity of

the assets involved in transactions.

3 For instance, the original innovating team could freely form a new firm and use the unrealized innovation to

compete against the purchasing firm.

2

[20:39 28/9/2019 RFS-OP-REVF190113.tex]

Page: 2

1–40

Innovation Activities and Integration through Vertical Acquisitions

Downloaded from https://academic.oup.com/rfs/advance-article-abstract/doi/10.1093/rfs/hhz106/5571736 by guest on 15 October 2019

To test this hypothesis, we construct a novel measure of vertical relatedness

between firm-pairs by linking product vocabularies from the Bureau of

Economic Analysis (BEA) input-output tables to firms’ 10-K product

descriptions filed with the Securities and Exchange Commission (SEC).

Because 10-Ks are updated annually, the result is a dynamic directed network of

vertical relatedness between all publicly traded firms between 1996 and 2013. In

this text-based network, we identify for instance that Tesla is vertically related

(downstream) to Honeywell, Goodyear, and Sun Hydraulics in 2010. This

pairwise network allows us to identify precisely which mergers and acquisitions

occur between firms offering vertically related products. We use the same

approach to also measure the degree of firms’ vertical integration based on

whether firms use product vocabulary that spans vertically related markets.

Using a large sample of more than 8,000 firms, we find a strong association

between the stage of development of firms’ innovation and vertical acquisitions.

Our main tests focus on targets in vertical deals since they are the party that

relinquishes control rights by selling, and for which the trade-off between ex

ante investment incentives and holdup is important. Consistent with vertical

separation being optimal when innovation is unrealized, we find that R&Dintensive firms are significantly less likely to be acquired in vertical transactions.

In contrast, when innovation is realized and protected by legally enforceable

patents, firms are more likely be acquired by a vertical buyer. The positive link

between firms’ patenting intensity and their vertical acquisitions is consistent

with patenting marking a shift away from incentives for further R&D and toward

incentives to commercialize the innovation.

The opposite roles of unrealized and realized innovation in vertical

acquisitions are highly robust across a host of alternative specifications,

including alternative measures of firms’ innovative efficiency and strict controls

for the potential multicollinearity between firms’ R&D and patenting intensity.

The estimated relations are also economically important as a 1-standarddeviation increase in firms’ R&D intensity is associated with a large 0.46%

percentage point reduction in their probability of being acquired in a vertical

transaction. This decrease represents roughly one-third of the unconditional

probability of being acquired by a vertical buyer. The economic magnitude of

firms’ patenting intensity in explaining vertical acquisitions are even larger.

Western Digital’s purchase of Komag in 2007 illustrates the logic of our

results. Komag specialized in developing thin-file disks of the sort used in hard

drives. Buying Komag transferred control of Komag’s realized innovation to

Western Digital, thus reducing ex post holdup and increasing Western Digital’s

commercialization incentives. Western Digital’s CEO John Coyne commented

that “the acquisition of Komag will enable Western Digital to optimize synergies

through the integration of heads and media” (Duncan 2007). Another example

is GE’s acquisition of Edwards Systems Technology in 2004, which gave GE

control of Edward’s fire detection technology, used in GE’s broad security

offering. Will Woodburn, CEO of GE Infrastructure, indicated that Edwards’

3

[20:39 28/9/2019 RFS-OP-REVF190113.tex]

Page: 3

1–40

The Review of Financial Studies / v 00 n 0 2019

Downloaded from https://academic.oup.com/rfs/advance-article-abstract/doi/10.1093/rfs/hhz106/5571736 by guest on 15 October 2019

technology will enable GE to offer an “integrated facility management solution

to partners and end users” (Buildings 2004).

Our hypothesis specifically points to the trade-off between maintaining

innovation incentives and limiting holdup risk. We thus examine whether the

negative relation between R&D and acquisition, and the positive association

between patenting and acquisition, is stronger when these trade-offs are most

salient. First, we show that the negative link between firms’ R&D intensity and

vertical acquisitions is significantly stronger when potential vertical buyers

likely find it difficult to maintain the innovation incentives of the target

and keep its key employees post-acquisition, as measured using inventor

mobility and the intensity of each firm’s 10-K disclosures relating to employee

incentives.4 Second, we show that the positive link between firms’ patenting

intensity and vertical acquisitions is significantly stronger when opportunistic

behaviors are more likely, which we measure using patent infringement

litigation, poor secondary market liquidity, and high product market

concentration.

Our tests are consistent with the idea that investment incentives and holdup

risk increase the sensitivity of vertical boundaries to the stage of innovation.

Nevertheless, our tests do not fully rule out some alternative explanations and

we further test two specific alternatives. First, our results could be driven

by potential vertical buyers relying on patent grants as signals of a target’s

innovation efficiency. Second, our findings might reflect firms responding

to the likelihood of vertical acquisitions by reducing their R&D intensity

and increasing their patenting intensity (reverse causality) to attract a better

offer. Several tests mitigate both concerns. For instance, inconsistent with

patent grants signaling innovative efficiency, our results are robust to including

controls for firms’ innovative efficiency (patents by dollar of R&D). We further

examine the timing of vertical acquisitions and find that patenting intensity

increases around the acquisition. The drop in firms’ R&D intensity occurs

mostly after control is transferred to the buyers, which is inconsistent with a

reverse causality explanation.

Inconsistent with many other alternatives, we show that our results are

unique to vertical acquisitions as we find opposite or insignificant results for

nonvertical acquisitions (in line with Bena and Li 2014). We recognize that part

of our results might arise because some acquirers might use patent grants as

an indication of the degree of the target’s success, triggering their acquisition.

This channel can be distinct from our explanation if no ex ante incentives

are required for the effort needed to achieve that degree of success. Yet, our

4 Note we do not study “acqui-hires,” where firms acquire a company to recruit its employees without necessarily

showing an interest in its current products and services. In many such cases, the product that these previously

separate employees were working on either has failed or is not significant enough to develop within the firm.

4

[20:39 28/9/2019 RFS-OP-REVF190113.tex]

Page: 4

1–40

Innovation Activities and Integration through Vertical Acquisitions

Downloaded from https://academic.oup.com/rfs/advance-article-abstract/doi/10.1093/rfs/hhz106/5571736 by guest on 15 October 2019

subsample tests based on proxies for incentive provision and holdup risk provide

specific support for our proposed incentive-based channel.

Finally, we show that our new measures of the degree of firms’ vertical

integration are also consistently related to the stage of innovation development.

In particular, firms operating in industries characterized by high levels of

R&D intensity display lower levels of vertical integration. In contrast, firms in

patenting intensive industries appear significantly more integrated vertically, in

line with vertical integration being more prevalent in sectors where innovation is

realized. Using within firm analysis, we uncover a positive relationship between

vertical integration and firms’ patenting intensity over time, but only for firms

that have been vertical acquirers. In contrast, changes in firms’ degree of vertical

integration is largely unrelated to their R&D intensity. These results support

our central hypothesis as these firms are specialized (i.e., nonintegrated) and

we predict and find that they tend to exit the sample via vertical acquisitions

once their innovation becomes realized.

Our findings contribute to the large literature examining the determinants

of firms’ vertical boundaries, and in particular to recent papers linking

vertical integration to innovation and intangible assets. Acemoglu et al. (2010)

show, in a sample of UK manufacturing firms, that backward integration

is positively (negatively) related to the R&D intensity of the downstream

(upstream) industry. Using Census data, Atalay, Hortacsu, and Syverson (2014)

report limited physical shipments within vertically integrated firms in the

United States, suggesting that innovation and intangible capital (which do

not require shipments) might be responsible for firms’ vertical organization.5

By showing that firms’ vertical boundaries are related to the stage of

innovative development, our paper provides direct evidence of the importance

of innovation for firms’ vertical boundaries.

Our paper also adds to the literature on the determinants and implications

of vertical acquisitions. Fan and Goyal (2006) and Kedia, Ravid, and Pons

(2011) examine stock market reactions to vertical deals, and Ahern (2012)

shows that the division of stock market gains is determined in part by customer

or supplier bargaining power. Ahern and Harford (2014) examine how supply

chain shocks translate into vertical merger waves. Our study is distinct and

focuses on the stage of innovation and a novel hypothesis linking this to the

choice of firms’ organizational form. Our results are consistent with the view

that vertical acquisitions emerge as an optimal way to transfer the residual

rights of control of relationship-specific intangible assets to the party whose

investment incentives are most important for the success of the relationship,

thus also reducing holdup risk. This motive is distinct from existing acquisition

5 The authors document a decline in nonproduction workers in vertically acquired establishments. They also find

a shift in production of the acquirer’s products toward the acquired firms’ establishments.

5

[20:39 28/9/2019 RFS-OP-REVF190113.tex]

Page: 5

1–40

The Review of Financial Studies / v 00 n 0 2019

Downloaded from https://academic.oup.com/rfs/advance-article-abstract/doi/10.1093/rfs/hhz106/5571736 by guest on 15 October 2019

motives emphasized in existing research including neoclassical theories, agency

theories, and horizontal theories.6

Our focus is on the motives for acquisitions of vertically related firms

who have actual products (i.e., publicly listed firms), and we do not directly

consider licensing or patent purchases, as they are outside the scope of

our study.7 We conjecture that licensing occurs when follow-on integration

or tailoring of the technology to a particular use after contracting is less

important. Patent sales occur when the scope of the patent is well defined

and the acquirer does not need resources or employees from the target to help

integrate the product or further develop the technology. Our hypothesis differs

from just purchasing patents or licensing because acquisitions among more

complex publicly traded firms typically involves additional needs beyond the

associated patents alone. For example, many innovation-driven acquisitions

require continued participation by the targets’ employees either regarding future

technological development or in adapting the technology to the purchaser.8

Thus, we expect to observe technology-driven vertical acquisitions despite the

possibility of patent purchases or licensing.

A key methodological contribution is that we can identify vertical relatedness

at the detailed firm-pair level. Existing measures are based on static NAICS

industry classifications and not only fail to provide firm-specific measures, but

are slow to update over time and are based on production processes and not the

products and services offered by firms.9 Our textual measures do not rely on the

quality of the Compustat segment tapes to delineate firms’ product markets, the

quality of the NAICS classification, or the links between NAICS codes and the

Input-Output tables, which are based on BEA classifications. This methodology

for measuring vertical linkages between firms extends the work of Hoberg and

Phillips (2016), who focus on horizontal links using 10-K text. Our approach

thus contributes to the growing literature that uses text as data in finance and

economics, recently surveyed by Gentzkow, Kelly, and Taddy (forthcoming).

1. Vertical Acquisitions and the Stage of Innovation

In this section, we discuss a framework to motivate our tests based on

the analysis of Grossman and Hart (1986), Aghion and Tirole (1994),

and Williamson (1971). As an illustration of the contrasting effects of

6 See Maksimovic and Phillips (2001), Jovanovic and Rousseau (2002), and Harford (2005) for neoclassical and

q theories; see Morck, Shleifer, and Vishny (1990) for an agency motivation for acquisitions; and see Phillips

and Zhdanov (2013) for a recent horizontal theory of acquisitions.

7 For studies in these areas, see Teece (1986) and Arora and Fosfuri (2003) for licensing and Serrano (2010) for

patents sales and transfers.

8 Apple, for example, purchased Intrinsity for its technology and the engineers who developed low power fast

chips at Intrinsity further enhanced Apple’s mobile and iPad chips.

9 The Federal Register states “NAICS was developed to classify units according to their production function.

NAICS results in industries that group units undertaking similar activities using similar resources but does not

necessarily group all similar products or outputs” (Federal Register 2014).

6

[20:39 28/9/2019 RFS-OP-REVF190113.tex]

Page: 6

1–40

Innovation Activities and Integration through Vertical Acquisitions

Downloaded from https://academic.oup.com/rfs/advance-article-abstract/doi/10.1093/rfs/hhz106/5571736 by guest on 15 October 2019

realized and unrealized innovation on firms’ vertical boundaries, consider two

vertically related firms (e.g., upstream supplier and a downstream producer)

that cooperate to offer a product or service. These firms can operate as separate

entities or combine into a vertically integrated firm.10

The joint value of their vertical relationship and the price they

charge to consumers depends positively on R&D product investments and

commercialization investments, both of which are specific to the relationship.

Both upstream and downstream firms can conduct R&D. While both firms

conduct R&D, it is relatively more likely (but not a given as our examples later

show) that upstream firms conduct product R&D and downstream firms that

are closer to the end-consumer conduct investments and R&D that is useful

for commercialization. Either firm can have a differential mix of realized and

unrealized innovation.

As is standard in the literature (e.g., Aghion and Tirole 1994), the outcome

of the product innovation effort in each period is risky, succeeding only

probabilistically, and is noncontractible and unverifiable. The outcome of

innovation effort is protected by legally enforceable patents in case of success,

but remains intangible if unsuccessful. The commercialization investment in a

given period is less risky than the innovation effort, and occurs after its outcome

is realized. As the product (or service) resulting from firms’ relationship

matures over time, the marginal value of innovation effort to add new

technological features naturally decreases, whereas that of commercialization

effort marginally increases.

In our context, the optimal organizational form depends on the stage of

development of the innovation. First, consider the firms operating separately.

It is optimal for firms to stay separate when one firm’s product innovation

efforts have not succeeded yet and further innovation effort thus benefits

the relationship. In that case, separation optimally allocates control rights to

the party whose investment incentives are relatively more important. Indeed,

transferring control rights to the other firm when innovation is still unrealized

lowers innovation incentives, as innovative effort is not fully contractible.

In addition, integration does not guarantee the acquirer’s access to the other

firm’s unrealized innovation because of the absence of clearly defined property

rights. For instance, the value of unrealized innovation could be encapsulated in

employees’ knowledge, which is inalienable, as in Hart and Moore (1994), and

employees might freely leave in the case of integration. Intuitively, staying

separate is optimal when further incentives for R&D benefit the overall

relationship. In that case, individual ownership maintains ex ante incentives

for the firms to further invest. Separation optimally allocates residual rights of

control to the party who has unrealized innovation where incentives are more

important.

10 We included a simple model developing these ideas in an earlier version of this paper. This model is available

on the authors’ Web sites.

7

[20:39 28/9/2019 RFS-OP-REVF190113.tex]

Page: 7

1–40

The Review of Financial Studies / v 00 n 0 2019

Downloaded from https://academic.oup.com/rfs/advance-article-abstract/doi/10.1093/rfs/hhz106/5571736 by guest on 15 October 2019

Now consider the integration decision. At each point in time, the firms can

either operate as separate entities or decide to integrate through one party (either

upstream or downstream) buying the other.11 The party that sells its assets (the

target) loses control rights over the assets sold, and makes less new product

R&D investment, as this investment is noncontractible and the parties would

not be able to ensure payment ex post. The realization of R&D and the grants of

patents are thus key to determining whether firms integrate or remain separate.

When the innovation is successful and its features are protected by patents,

incentives for further innovation decline because of the decreasing marginal

value of innovation effort for the overall relationship. In contrast, the incentives

of the potential acquirer to invest in commercialization marginally increase.

However, the crucial tension is that without legal control rights on the outcome

of the realized innovation through the ownership of the patents, the user of the

innovation faces a risk of holdup, in the spirit of Williamson (1971), whereby

one firm can threaten to holdup the other firm after significant investment has

been made by both parties. The acquisition decision is made to encourage ex

post commercialization investments and to protect the two parties’ investments

in the relationship after more of the innovation becomes realized through

patents.

This holdup risk is likely in production when commercialization is more

important. Commercialization investments can include investments that lower

the cost of the product. Holdup risk can also include supply chain problems

that can persist when firms are separate and the quality of the engineers or

people involved in the production of the components supplied cannot be easily

contracted upon.12 To encourage commercialization incentives, the overall

relationship should optimally allocate the residual rights of control to one party

to reduce holdup costs. At this stage, vertical integration through acquisition is

optimal as it maximizes total surplus.

The trade-off between ex ante innovation incentives and ex post holdup risk

leads to our central prediction:

Central Prediction: Firms are less likely to be acquired by a vertically related

buyer when their innovation is unrealized. Firms are more likely to be acquired

by a vertically related buyer when their innovation is realized and protected by

patents.

11 Note that the overall framework is agnostic about whether the acquirer is the upstream firm or the downstream

firm closer to the customer. Several examples show that the acquirer can be either the upstream firm or the

downstream firm. Western Digital, a disk drive manufacturer, is an example of a downstream firm buying an

upstream firm. They purchased Komag Inc., a producer of thin-film discs used in hard drives. We also note

that Conexant, a semiconductor manufacturer, acquired an upstream firm, Globespan Virata Inc., a maker of

broadband communications products that use semiconductor chips. In both of these cases, the target was a high

R&D firm that, over time, realized more patents.

12 An example would be Boeing purchasing some of its previously separate suppliers and integrating them given

supply chain problems. For additional examples, see von Simson (2010).

8

[20:39 28/9/2019 RFS-OP-REVF190113.tex]

Page: 8

1–40

Innovation Activities and Integration through Vertical Acquisitions

We test this prediction using new text-based measures of vertical relatedness

between firms, and by examining the impact of firms’ R&D and patenting

intensity on their likelihood of being purchased in vertical transactions.

2. Measuring Vertical Relatedness

Downloaded from https://academic.oup.com/rfs/advance-article-abstract/doi/10.1093/rfs/hhz106/5571736 by guest on 15 October 2019

This section develops and validates our text-based measure of vertical

relatedness.

2.1 Data from 10-K business descriptions

We start with all firm-year observations in Compustat from 1996 to 2013 with

sales of at least $5 million and positive assets.13 We follow the same procedures

as Hoberg and Phillips (2016) to identify, extract, and parse 10-K annual firm

business descriptions from the SEC Edgar database. These 10-Ks are merged

with the Compustat-based sample using the central index key (CIK) mapping to

gvkey provided in the WRDS SEC Analytics package. Item 101 of Regulation

S-K requires business descriptions to accurately report (and update each year)

the significant products firms offer. We obtain 92,087 firm-years in the merged

Compustat/Edgar universe.

2.2 Data from input-output tables

We then use the 2002 BEA input-output (IO) tables, which provide dollar

flows between producers and purchasers in the U.S. economy (including

households, government, and foreign buyers of U.S. exports). The IO tables

are based on two primitives: “commodity” outputs (any good or service)

defined by the Commodity IO Code, and producing “industries” defined by the

Industry IO Code. In 2002, there were 424 commodities and 426 industries

in the “Make table,” which reports the dollar value of each commodity

produced by each industry. There are 431 commodities purchased by 439

industries or end users in the “Use table,” which reports the dollar value of

each commodity purchased by each industry.14 We use these IO tables to

compute three items: (1) commodity-to-commodity (upstream to downstream)

correspondence matrix (V ), (2) commodity-to-word correspondence matrix

(CW ), and (3) commodity-to-“exit” correspondence matrix (E).

In addition to the numerical values in the BEA data, we use an often

overlooked resource: the “Detailed Item Output” table, which verbally

13 We show in the Online Appendix that our results are robust to any minimum sales thresholds ranging from $1

million to $10 million.

14 An industry can produce more than one commodity: in 2002, the average (median) number of commodities

produced per industry was 18 (13). Industry output is also concentrated as the average commodity concentration

ratio is 0.78. Costs are reported in both purchaser and producer prices. We use producer prices. Seven commodities

in the Use table are not in the Make table, for example, compensation to employees. Thirteen “industries” in the

Use table are not in the Make table. These correspond to “end users” and include personal consumption, exports

and imports, and government expenditures.

9

[20:39 28/9/2019 RFS-OP-REVF190113.tex]

Page: 9

1–40

The Review of Financial Studies / v 00 n 0 2019

Table 1

BEA vocabulary example: Photographic and photocopying equipment

Description of commodity subcategory

Value of production ($Mil.)

266.1

72.4

40.5

266.5

592.4

Downloaded from https://academic.oup.com/rfs/advance-article-abstract/doi/10.1093/rfs/hhz106/5571736 by guest on 15 October 2019

Still cameras (hand-type cameras, process cameras for photoengraving

and photolithography, and other still cameras)

Projectors

Still picture commercial-type processing equipment for film

All other still picture equipment, parts, attachments, and accessories

Photocopying equipment, including diffusion transfer, dye transfer,

electrostatic, light and heat sensitive types, etc.

Microfilming, blueprinting, and white-printing equipment

Motion picture equipment (all sizes 8 mm and greater)

Projection screens (for motion picture and/or still projection)

Motion picture processing equipment

20.7

149.0

204.9

23.0

Processed commodity vocabulary: microfilming, whiteprinting, blueprinting, interchangeable, film,

projectors, rear, viewers, screen, mm, photoengraving, photolithography, cameras, photographic, motion,

electrostatic, diffusion, dye, heat, projection, screens, picture, still, photocopying

This table provides an example of the BEA commodity “photographic and photocopying equipment” (IO

commodity code #333315). The table displays its subcommodities and their associated product text, along

with the value of production for each subcommodity.

describes each commodity and its subcommodities. The BEA also provides the

dollar value of each subcommodity’s total production and a commodity’s total

production is the sum of these subcommodity figures.15 Each subcommodity

textual description uses between 1 to 25 distinct words (the average is 8)

that summarizes the nature of the good or service provided. Table 1 contains

an example of product text corresponding to the BEA “photographic and

photocopying equipment” commodity (IO commodity code #333315). We label

the complete set of words associated with a commodity as “commodity words.”

We follow Hoberg and Phillips (2016) and only consider nouns and proper

nouns. We then apply four additional screens to ensure our identification of

vertical links is conservative. First, because commodity vocabularies identify

stand-alone product markets, we manually discard expressions that indicate

a vertical relation, such as “used in,” “made for,” or “sold to.” Second,

we remove expressions indicating exceptions (e.g, phrases beginning with

“except” or “excluding”). Third, we discard common words from commodity

vocabularies.16 Fourth and finally, we remove any words that do not frequently

coappear with the other words in a given commodity’s vocabulary. This

ensures that horizontal links are not mislabeled as vertical links. To do so,

we compute the fraction of times each focal word coappears with the same

peer words used in a given IO commodity when it appears in a 10-K business

description using all 10-Ks in 1997. For each commodity, we then discard

one-third of its words, specifically those in the bottom tercile by this measure

15 There were 5,459 subcommodities in 2002. The average number of subcommodities per commodity is 12; the

minimum is 1; and the maximum is 154.

16 There are 250 such words including “commercial” and “component.” The Internet Appendix provides a full list.

10

[20:39 28/9/2019 RFS-OP-REVF190113.tex]

Page: 10

1–40

Innovation Activities and Integration through Vertical Acquisitions

Downloaded from https://academic.oup.com/rfs/advance-article-abstract/doi/10.1093/rfs/hhz106/5571736 by guest on 15 October 2019

(the least specific words).17 Overall we consider 7,735 commodity words.

For instance, the last row of Table 1 illustrates that words such as film,

projectors, photoengraving, and microfilm characterize the BEA commodity

“photographic and photocopying equipment.”

The “Detailed Item Output” table also provides metrics of economic

importance. We compute the relative economic contribution of a given

subcommodity (ω) as the dollar value of its production relative to its

commodity’s total production (see the last column of Table 1). Each word in a

subcommodity’s textual description is assigned the same ω. Because a word can

appear in several subcommodities, we sum its ω’s within a commodity. A given

commodity word is important if this fraction is high. We define the commodityword correspondence matrix (CW ) as a three-column matrix containing: a

commodity, a commodity word, and its economic importance (e.g., {#333315,

projector, 0.044} or {#333315, photolithography, 0.162}.

Next, we compute the intensity of vertical relatedness between pairs of

commodities. We construct the sparse square matrix V based on the extent

to which a given commodity is vertically linked (upstream or downstream) to

another commodity. From the Make table, we create SH ARE, an I ×C matrix

(Industry × Commodity) that contains the percentage of commodity c produced

by a given industry i. The U SE matrix is a C ×I matrix that records the dollar

value of industry i’s purchase of commodity c as input. The CF LOW matrix

is then given by U SE ×SH ARE, and is the C ×C matrix of dollar flows from

an upstream commodity c to a downstream commodity d. Similar to Fan and

Goyal (2006), we define the SU P P matrix as CF LOW divided by the total

production of the downstream commodity d. SU P P records the fraction of

commodity c that is used as an input to produce commodity d. Similarly, the

matrix CU ST is given by CF LOW divided by the total production of the

upstream commodities c, and it records the fraction of commodity c’s total

production that is used to produce its commodity d. The V matrix is then

defined as the average of SU P P and CU ST . A larger element in V indicates

a stronger vertical relationship between commodities c and d.18 Note that V is

sparse (i.e., most commodities are not vertically related) and is nonsymmetric

as it features downstream (Vc,d ) and upstream (Vd,c ) directions.

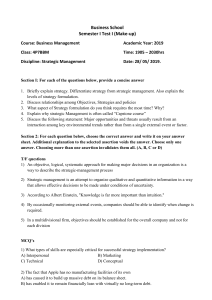

Figure 1 presents a snapshot of the direction and intensity of upstream

and downstream vertical relatedness associated with the “photographic

and photocopying equipment” commodity (#333315). As measured by

V , this commodity is downstream to “semiconductor and related device

manufacturing” (#334413) and “coated and laminated paper, packaging paper,

and plastics film manufacturing” commodities (#32222A), which supply 2.2%

and 1.4% of their respective production to the “photographic and photocopying

17 Hoberg and Phillips (2010) use a similar tercile approach to discard the most broad/vague words.

18 Alternatively, we consider in unreported tests the maximum between SU P P and CU ST , and also SU P P , or

CU ST alone, to define vertical relatedness. Our results are robust.

11

[20:39 28/9/2019 RFS-OP-REVF190113.tex]

Page: 11

1–40

The Review of Financial Studies / v 00 n 0 2019

Semiconductor and related

device manufacturing

(#334413 – 2.2%)

Coated and laminated

paper, packaging paper and

plascs film manufacturing

(#32222A) – 1.4%

Paperboard container

manufacturing

(#3222210 – 1.1%)

Support acvies for

prinng

(#323120 – 1%)

Electronic and precision

equipment repair and

maintenance

(#33331A – 0.2%)

Downloaded from https://academic.oup.com/rfs/advance-article-abstract/doi/10.1093/rfs/hhz106/5571736 by guest on 15 October 2019

Photographic and

photocopying equipment

manufacturing

Vending, commercial,

industrial and office

machinery manufacturing

(#811200 – 0.3%)

Figure 1

Example of BEA commodity-commodity vertical relatedness (the V matrix)

This figure presents a snapshot of the direction and intensity of upstream and downstream vertical relatedness

between commodities based on the 2002 BEA input-output tables (the V matrix), focusing on the “Photographic

and photocopying equipment manufacturing” commodity (#333315). We display some upstream and downstream

commodities and the intensity of their vertical relatedness based on the elements of the matrix V .

equipment” commodity. This commodity is itself upstream to the “support

activities for printing” (#323120) and “electronic and precision equipment

repair and maintenance” (#33331A) commodities, supplying 1% and 0.2%

of its production to these commodities.

2.3 Text-based vertical relatedness

We combine the vocabulary in firm 10-Ks and the vocabulary defining the BEA

IO commodities to identify vertical relatedness between firms. The intuition is

as follows. Because vertical relatedness is observed from the IO tables at the IO

commodity level (see description of the matrix V above), we can score every

pair of firms i and j based on the extent to which they are located upstream or

downstream to each other by (1) mapping i’s and j ’s text to the subset of IO

commodities it provides, and (2) determining the intensity of i and j ’s vertical

relatedness using the vertical relatedness matrix V .

We proceed in three steps. First, we link each firm-year in the

Compustat/Edgar universe to BEA IO commodities by computing the similarity

between the given firm’s business description and the textual description of

each BEA commodity. We limit attention to words that appear in the Hoberg

and Phillips (2016) post-processed universe based on firms’ 10-Ks. Although

uncommon, a firm will sometimes mention its customers or suppliers in its

10-K’s product description. For example, a coal manufacturer might mention

that its products are “sold to” the steel industry. To ensure that vocabulary

from firms’ 10-K product descriptions is not contaminated by such vertical

12

[20:39 28/9/2019 RFS-OP-REVF190113.tex]

Page: 12

1–40

Innovation Activities and Integration through Vertical Acquisitions

U Pi,j = [B ·V ·B ]i,j ,

Downloaded from https://academic.oup.com/rfs/advance-article-abstract/doi/10.1093/rfs/hhz106/5571736 by guest on 15 October 2019

links, we remove any mentions of customers and suppliers using eightyone typical phrases listed in the Internet Appendix.19 We then represent

both firm vocabularies and BEA commodity vocabularies as vectors having

a length equal to the number of nouns and proper nouns appearing in 10-K

business descriptions in each year (63,367 in 1997, e.g.), with each element

corresponding to a single word. By representing BEA commodities and firm

vocabularies as vectors in the same space, we are able to assess firm and

commodity similarity.

Our next step is to compute the “firm to IO commodity correspondence

matrix” B. This matrix has dimension M ×C, where C is the number of IO

commodities, and M is the number of firms. An entry Bm,c (row m, column

c) is the cosine similarity of the text in the given IO commodity c, and the

text in firm m’s business description. In this cosine similarity calculation,

commodity word vector weights are assigned based on the words’ economic

importance from the CW matrix (see above), and firm word vectors are equallyweighted following Hoberg and Phillips (2016). We use cosine similarity

because it controls for document length, is bounded in [0,1], and is well

established in computational linguistics (see Sebastiani 2002). The matrix B

thus indicates which IO commodities a given firm’s products are most similar

to. Intuitively, the product description of a firm (say m) that manufactures and

sells photocopying equipment will appear largely similar to the text for the

“photographic and photocopying equipment” commodity (say c), so that the

element Bm,c will be large.

We then measure the extent to which firm i is located upstream relative to

firm j using the following triple product:

(1)

which results in an M ×M matrix of upstream-to-downstream relatedness

between firms i to firms j . Note that direction is important, and the U Pij

matrix is not symmetric. Upstream relatedness of i to j is thus the i’th row

and j ’th column of this matrix. Firm-pairs receiving the highest scores for

vertical relatedness are those having vocabulary that maps most strongly to

IO commodities that are vertically related to matrix V (constructed only using

BEA relatedness data). Thus, firm i is located upstream from firm j when i’s

business description is strongly associated with commodities used to produce

other commodities whose description resembles firm j ’s product description.

Downstream relatedness is simply the mirror image of upstream relatedness,

DOW Ni,j = U Pj,i . We repeat this procedure for every year and create a timevarying network of firm-pairwise vertical relatedness. In section 6, we also use

the diagonal entries of the triple product (U Pi,i ) to measure the extent to which

a given firm is “vertically integrated” based on whether its business description

contains many word pairs that are vertically related.

19 We think this step is important, but our results are robust if we exclude this step.

13

[20:39 28/9/2019 RFS-OP-REVF190113.tex]

Page: 13

1–40

The Review of Financial Studies / v 00 n 0 2019

film

laminate

plasc

gelan

semiconductor

resin

paper

wax

picture

photocopy

screen

blueprinng

periodical

microfilm

Downloaded from https://academic.oup.com/rfs/advance-article-abstract/doi/10.1093/rfs/hhz106/5571736 by guest on 15 October 2019

projector

Coated and laminated

paper, packaging paper and

plascs film manufacturing

(#32222A) – 1.4%

Photographic and

photocopying equipment

manufacturing

camera

library

edion

books

binding

Support acvies for

prinng

(#323120 – 1%)

lithography

Figure 2

Vertical relatedness between words based on BEA

This figure displays how we use vertical relatedness between commodities (on the right) to compute vertical

relatedness between words in the corresponding commodity vocabularies. For instance, the word “photocopy”

(part of the vocabulary of our previous example) is downstream of “plastic,” “semiconductor,” and “resin,”, but

upstream of “periodical,” “book,” and “library.”.

Figures 2 and 3 illustrate the intuition for the triple product B ·V ·B . Figure 2

depicts how we use vertical relatedness between commodities (on the right) to

compute vertical relatedness between words in the corresponding commodity

vocabularies. For instance, the word “photocopy” (part of the vocabulary of our

previous example) is downstream relative to “plastic,” “semiconductor,” and

“resin,” but upstream relative to “periodical,” “book,” and “library.” Figure 3

depicts some words extracted from the 10-K business description of two sample

firms, key to constructing the B matrices in Equation (1). Our measure of

vertical relatedness thus intuitively uses the vertical word mappings from the

BEA data (as in Figure 2), and the words in firm business descriptions to

map specific firm-pairs to the BEA vertically related vocabularies. The arrows

indicate vertical relatedness between words, highlighting that the firms A and

B have nontrivial vertical relatedness (U PA,B is large), as firm A’s business

description contains many words that are upstream relative to many words in

firm B’s business description.

As an illustration, Table 2 presents a snapshot of the U Pij pairwise vertical

network in 2010, focusing on two upstream and downstream companies. The

upper part of the table displays a representative set of companies that are

14

[20:39 28/9/2019 RFS-OP-REVF190113.tex]

Page: 14

1–40

Innovation Activities and Integration through Vertical Acquisitions

Firm A

photocopy

Firm B

projector

camera

screen

xxx

blueprinng

xxx

bindings

periodical

lythography

edion

library

xxx

books

xxx

xxx

Downloaded from https://academic.oup.com/rfs/advance-article-abstract/doi/10.1093/rfs/hhz106/5571736 by guest on 15 October 2019

Figure 3

Illustration of firm-pair vertical relatedness (U PA,B )

This figure illustrates some words extracted from the 10-K business description of two sample firms, key to

constructing the B matrices in Equation (1). Our measure of vertical relatedness uses the vertical word mappings

from the BEA data (as in Figure 2) and the words in firm business descriptions to map specific firm-pairs to the

BEA vertically related vocabularies. The arrows indicate vertical relatedness between words, highlighting that

the firms A and B have nontrivial vertical relatedness (U PA,B is large).

upstream to Tesla, an electric car manufacturer. These includes companies

selling auto parts (e.g., Sorl Auto Parts), metals (e.g., Titanium Metals),

electronic instruments (e.g., Cabot Microelectronics), or hydraulics products

(e.g., Sun Hydraulics). In the bottom part of the table, we display a set

of companies that are downstream from Encore Wire, a manufacturer of

copper and aluminum wires. Downstream-located companies includes firms

active in the car (e.g., General Motors), electronics (e.g., Pulse Electronics),

communication (e.g., Atheros Communications), energy (e.g., Massey Energy),

or pumps (e.g., Gorman-Rupp) business.

It is important to note our text-based measure of pairwise vertical relatedness

is designed to capture the extent to which two firms operate in vertically related

product markets (e.g., Encore Wire and Caterpillar from Table 2). It does not

measure actual shipments (if any) between pairs of firms. This distinction is

important in light of the recent analysis of Atalay, Hortacsu, and Syverson

(2014) who document limited physical shipments within vertically integrated

firms in the United States, and suggest that intangible assets are important

drivers of vertical boundaries. Our new construct thus provides a broad measure

of vertical relatedness, which captures the “potential” for vertical integration

between firm pairs.

2.4 NAICS-based vertical relatedness

As a benchmark for evaluating our new text-based pairwise vertical network, we

also consider the NAICS-based vertical relatedness network used in previous

research (see, e.g., Fan and Goyal 2006). To compute firms’ pairwise vertical

relatedness based on NAICS, we follow the literature and construct a matrix Z,

which is analogous to the matrix V in the preceding section but is based on BEA

industries instead of commodities. Following common practice in the literature,

we map BEA industries to NAICS industries and use two numerical thresholds

to identify meaningful levels of vertical relatedness between industries: 1%

and 5%. A given industry i is deemed as upstream (downstream) relative to

15

[20:39 28/9/2019 RFS-OP-REVF190113.tex]

Page: 15

1–40

The Review of Financial Studies / v 00 n 0 2019

Table 2

Vertical relatedness examples: Tesla and Encore Wire

Firm i

(Upstream)

Year

Vertical Score

TESLA INC

TESLA INC

TESLA INC

TESLA INC

TESLA INC

TESLA INC

TESLA INC

TESLA INC

TESLA INC

TESLA INC

TESLA INC

TESLA INC

TESLA INC

TESLA INC

...

ALLIED MOTION TECHNOLOGIES

MASSEY ENERGY CO

BEACON ROOFING SUPPLY INC

GENERAL MOTORS CO

CATERPILLAR INC

TESLA INC

PULSE ELECTRONICS CORP

UNIVERSAL DISPLAY CORP

GORMAN-RUPP CO

HARLEY-DAVIDSON INC

ADVANCED BATTERY TECH INC

ATHEROS COMMUNICATIONS INC

STEEL DYNAMICS INC

...

2010

2010

2010

2010

2010

2010

2010

2010

2010

2010

2010

2010

2010

2010

...

2010

2010

2010

2010

2010

2010

2010

2010

2010

2010

2010

2010

2010

...

0.02294

0.01273

0.01276

0.02227

0.02293

0.01988

0.02070

0.02005

0.01567

0.01466

0.02239

0.01696

0.02560

0.01275

...

0.01425

0.01302

0.01452

0.01866

0.01692

0.01445

0.01945

0.01260

0.02346

0.01379

0.01695

0.01553

0.02823

...

Downloaded from https://academic.oup.com/rfs/advance-article-abstract/doi/10.1093/rfs/hhz106/5571736 by guest on 15 October 2019

MEASUREMENT SPECIALTIES INC

EDAC TECHNOLOGIES CORP

DIODES INC

FUEL SYSTEMS SOLUTIONS INC

SORL AUTO PARTS INC

CLEANTECH SOLUTIONS INTL INC

SUN HYDRAULICS CORP

ENCORE WIRE CORP

CABOT MICROELECTRONICS CORP

LITTELFUSE INC

TITANIUM METALS CORP

COOPER TIRE & RUBBER CO

HONEYWELL INTERNATIONAL INC

GENERAL ELECTRIC CO

...

ENCORE WIRE CORP

ENCORE WIRE CORP

ENCORE WIRE CORP

ENCORE WIRE CORP

ENCORE WIRE CORP

ENCORE WIRE CORP

ENCORE WIRE CORP

ENCORE WIRE CORP

ENCORE WIRE CORP

ENCORE WIRE CORP

ENCORE WIRE CORP

ENCORE WIRE CORP

ENCORE WIRE CORP

...

Firm j

(Downstream)

This table provides examples of vertical relatedness for two illustrative companies in 2010 based on the network

matrix U Pij , defined in Section 2. The table displays the upstream (i ) and downstream (j ) firms, the year, and

the vertical score for each firm-pairs.

industry j when the flow of goods Zij (Zj i ) is larger than this threshold. To

create a network of pairwise vertical relatedness between firms (henceforth

NAICS-based network), we simply assign firms into NAICS industry based on

the NAICS code reported by each firm in Compustat. Therefore, the degree

of vertical relatedness between firms corresponds to that of their respective

industries. We find that the 1% and 5% flow thresholds generate NAICS-based

vertical relatedness networks that have granularity of 1.32% and 9.17%, which

means that 9.17% of randomly chosen firm pairs are vertically related in this

network. For simplicity, we label these vertical networks as “NAICS-1%” and

“NAICS-10%”, respectively.

To ensure our textual networks are comparable, we choose two analogous

textual granularity levels: 10% and 1%. These two text-based vertical networks

define firm pairs as vertically related when they are among the top 10% and top

1% most vertically related firm-pairs using the textual scores. We label these

networks as “Vertical Text-10%” and “Vertical Text-1%.” Note that the NAICSbased networks rely not only on the quality of NAICS industries to delineate

product markets, but also on the mapping between NAICS and BEA industries.

16

[20:39 28/9/2019 RFS-OP-REVF190113.tex]

Page: 16

1–40

Innovation Activities and Integration through Vertical Acquisitions

Table 3

Vertical network statistics and validity tests

Network:

Vert. text-10%

Vert. text-1%

NAICS-10%

NAICS-1%

TNIC-3

10%

1.52%

0.77%

0.60%

0.85%

100%

10%

9.63%

100%

10%

1%

2.50%

1.01%

0.59%

1.07%

100%

100%

1.87%

100%

100%

9.17%

2.87%

0.36%

0.12%

0.36%

10.59%

1.17%

51.20%

20.42%

2.39%

1.32%

3.79%

0.20%

0.11%

0.20%

13.66%

1.17%

36.97%

21.03%

1.85%

2.36%

100%

36.61%

36.27%

39.55%

7.17%

1.18%

55.81%

11.63%

2.68%

21.49%

6.36%

14.47%

5.09%

14.09%

4.05%

0.76%

3.01%

0.35%

12.293

A: Networks’ statistics

Downloaded from https://academic.oup.com/rfs/advance-article-abstract/doi/10.1093/rfs/hhz106/5571736 by guest on 15 October 2019

Granularity

% of pairs in TNIC-3

% of pairs in the same SIC

% of pairs in the same NAICS

% of pairs in the same SIC or NAICS

% of pairs in Vert. Text-10%

% of pairs in Vert. Text-1%

% of pairs that include a financial firm

% of (no fin.) pairs in Vert. Text-10%

% of (no fin.) pairs in Vert. Text-1%

B: Actual supplier-customer relationships

Supp-cust pairs (Compustat)

(38,734 pairs)

Supp-cust pairs (CIQ)

(12,293 pairs)

This table presents the characteristics of our five distinct networks: Text-10% and Text-1% networks correspond

to vertical networks based on textual analysis set at a 10% and, respectively, 1% granularity level, NAICS-1% and

NAICS-5% correspond to vertical networks based in the 2002 BEA Input-Output Table with relatedness cutoffs

of 1% and 5%, respectively, and TNIC corresponds to the horizontal text-based Network Industry Classification

developed by Hoberg and Phillips (2010). Panel A presents the fraction of firm-pairs in each network that

are also present in other networks. Panel B presents the fraction of firm-pairs in each network that are also

present in the networks of actual customer-supplier linkages, based on Compustat segments and Capital IQ client

announcements.

Both industry classifications suffer from the same time-fixed and all-or-nothing

limitations of SIC codes noted in Hoberg and Phillips (2016). A key advantage

of the textual vertical network is that it relies on neither, and instead relies on

the more detailed BEA commodity space. Unlike existing measures, our textbased measure of vertical relatedness generates a set of vertically related peers

that is customized to each firm’s unique product offerings, and varies over time

as firms dynamically update their product descriptions.

2.5 Vertical network statistics and validation

Panel A of Table 3 presents comparative statistics for four vertical and one

horizontal relatedness networks: Vertical Text-10%, Vertical Text-1%, NAICS10%, NAICS-1%, and the TNIC-3 network developed by Hoberg and Phillips

(2016). The first four capture pairwise vertical relatedness, and the TNIC-3

network captures pairwise horizontal relatedness. The first row shows that the

NAICS-10% and NAICS-1% networks have granularity levels of 9.17% and

1.32%, respectively. These levels, by design, are comparable to the 10% and

1% levels for the “Vertical Text-10%” and “Vertical Text-1%” networks.

Reassuringly, the second to fourth rows show that the four vertical networks

overlap little with the horizontal TNIC-3 network, and horizontal networks

based on firms’ classified in the same SIC or NAICS industries. Thus, horizontal

contamination is low. However, the fifth and sixth rows illustrate that the vertical

17

[20:39 28/9/2019 RFS-OP-REVF190113.tex]

Page: 17

1–40

The Review of Financial Studies / v 00 n 0 2019

Downloaded from https://academic.oup.com/rfs/advance-article-abstract/doi/10.1093/rfs/hhz106/5571736 by guest on 15 October 2019

networks are also quite different. Only 10.59% of firm-pairs in the NAICS10% network overlap with the Vertical Text-10% network, and only 1.17% of

firm-pairs overlap for the Vertical Text-1% and NAICS-1% networks.

A key reason for this difference relates to financial firms. The eighth row

shows that financial firm pairs are rarely classified as vertical by the textbased vertical networks (9.63% and 1.87% of linked pairs for the 10% and

1% networks). In contrast, financial firms account for a surprisingly large

51.20% and 39.97% of firm-pairs in the NAICS-based vertical networks.

When we discard financials, the last two rows show that overlap between

our text-based and NAICS-based networks roughly doubles. Because theories

of vertical integration are based on nonfinancial issues, such as relationshipspecific investment and ownership rights, these results further validate the use

of our text-based network.

We perform several analyses to assess the external validity of our vertical

relatedness network. First, we examine the extent to which our measure predicts

actual vertical relationships between firm pairs. Similar to Barrot and Sauvagnat

(2016) we rely on Compustat segment files to identify customer representing

more than 10% of firms’ sales. For our sample period, we obtain 38,734

supplier-customer pairs (excluding financials and utilities), corresponding to

4,689 unique suppliers and 2,306 customers.20 Alternatively, we use new

client announcements from Capital IQ’s “Key Developments” database and

obtain 12,293 announced supplier-customer pairs (4,474 suppliers and 4,459

customers) where both partners have available links to Compustat in our sample

period.21 Panel B of Table 3 indicates that our Vertical Text-10% network

captures more than 21% of the Compustat customer-supplier pairs, whereas

only 14% are classified as vertically related using the NAICS-10% network. The

text-based network is thus 50% more effective. A similar picture emerges when

we focus on the Capital IQ new client announcements, where our text-based

measure performs 34% better than the NAICS-based measure.

Second, we study how firms that are related vertically respond to trade

credit shocks. Intuitively, firms operating in vertically related markets should

experience negatively correlated shocks in accounts payables versus accounts

receivables due to their supply chain adjacency. For example, a shock to an

upstream market’s receivables should be associated with a similar shock to

the downstream market’s payables. In contrast, firms operating in horizontally

related markets should experience trade-credit shocks that are positively

correlated. For brevity, we present the details of the test and results verifying

20 Regulation SFAS No. 131 requires that firms disclose information about larger customers. We obtain customer-

suppliers links using the replication kit of Barrot and Sauvagnat (2016) posted on the Quarterly Journal of

Economics Web site.

21 Capital IQ records corporate announcements from over 20,000 sources including public news announcements,

company press releases, regulatory filings, call transcripts, and company Web sites and filters these data to

eliminate duplicates, identify the companies involved, and categorize each announcement into event categories

(we focus on new clients). These data are available starting from 2002.

18

[20:39 28/9/2019 RFS-OP-REVF190113.tex]

Page: 18

1–40

Innovation Activities and Integration through Vertical Acquisitions

that these properties hold significantly for our text-based measures of vertical

relatedness in the Internet Appendix. In contrast, these properties do not hold

for the NAICS-based measure.

3. Innovation and Vertical Acquisitions

Downloaded from https://academic.oup.com/rfs/advance-article-abstract/doi/10.1093/rfs/hhz106/5571736 by guest on 15 October 2019

To test our main hypothesis, we study the determinants of vertical acquisitions.

We focus on targets (i.e., the sellers of assets) as they are the party that loses

control rights due to the transaction. Our baseline test focuses on the distinction

between unrealized and realized innovation, and how both affect the likelihood

of becoming a target in a vertical acquisition.

3.1 Sample and definition

We gather data on mergers and acquisitions from the Securities Data

Corporation SDC Platinum database. We consider all announced and completed

U.S. transactions with announcement dates between January 1, 1996 and

December 31, 2013, that are coded as a merger, an acquisition of majority

interest, or an acquisition of assets. As we are interested in situations where

the ownership of assets changes hands, we only consider acquisitions that give

acquirers majority stakes. Following the convention in the literature, we limit

attention to publicly traded acquirers and targets, and we exclude transactions

that involve financial firms and utilities (SIC codes between 6000 and 6999

and between 4000 and 4999). To distinguish between vertical and nonvertical

transactions, we require that the acquirer and the target have available data in

the merged Compustat/Edgar universe (see Section 2.2.1).

Panel A of Table 4 indicates that the sample consists of 4,974 transactions

and tabulates how many of these transactions are classified as vertical using

various networks. We find that 39% are vertically related using the Vertical

Text-10% network, whereas just 13% are vertical according to the NAICS-10%

network. Because both networks have similar granularity levels, it is perhaps

surprising that the networks disagree sharply on the raw intensity of vertical

acquisitions. Also, given the granularity of 10%, if transactions are random,

we would expect to classify 10% of transactions as vertical. The fact that we

find 39% is evidence that vertically acquisitions are relatively common. We

also find that with both networks, vertical deals are almost evenly split between

upstream and downstream transactions.

To further highlight differences between vertical networks, we examine

whether transactions classified as vertical lead to actual increases in acquirers’

vertical integration. We do so by searching for the terms “vertical integration”

and “vertically integrated” in each firm’s 10-K (excluding cases where the

firm indicates that it is not integrated or lacks integration), and define a binary

variable identifying when a firm indicates that it is vertically integrated (V I10k ).

We then regress it on binary variables indicating whether a firm was a vertical

or nonvertical acquirer in the last 3 years (as well as firm and year fixed effects).

19

[20:39 28/9/2019 RFS-OP-REVF190113.tex]

Page: 19

1–40

The Review of Financial Studies / v 00 n 0 2019

Table 4

Mergers and acquisitions: Sample description

Measure:

All

Deal type:

(N )

Vertical

Text-based

Nonvert.

Vertical

NAICS-based

Nonvert.

4,974

1,919

38.58%

3,055

61.42%

626

12.59%

4,348

87.41%

A: Sample description

# Transactions

% Vertical (Nonvert.)

952

967

229

320

Downloaded from https://academic.oup.com/rfs/advance-article-abstract/doi/10.1093/rfs/hhz106/5571736 by guest on 15 October 2019

# Upstream

# Downstream

B: Mentions of vertical integration after transactions

0.037∗∗

(0.018)

(dep.var :) V I10k

(firm and year FE)

(dep.var :) V I10k

(firm and year FE)

-0.014

(0.011)

0.033

(0.026)

0.006

(0.011)

0.41%

0.40%

580

0.55%

0.91%

4,049

C: Combined acquirers and targets returns

CAR(0)

CAR(-1,1)

# Transactions

0.54%

0.86%

4,629

0.61%

0.94%

1,807

0.49%

0.79%

2,822

Vert. score

Year

Value ($ mio)

Type

0.0059

0.0042

0.0241

0.0053

0.0290

0.0084

2007

2003

2004

2005

1999

2006

985

1,005

1,395

1,612

4,408

10,291

Upstream

Downstream

Upstream

Upstream

Upstream

Downstream

D: Examples of vertical deals

Acquirer

Target

Western Digital

Conexant

General Electic

3M Co

United Technologies

Thermo Electron

Komag

GlobeSpanVirata

Edwards Systems

Cuno

Sundstrand

Fischer Scientific

This table presents the characteristics of the transaction sample. Panel A displays statistics for vertical and

nonvertical transactions (nonfinancial firms only). A transaction is classified as vertical if the acquirer and target

are pairs in the Vertical Text-10% network or the NAICS-10% network. Panel B displays regression coefficients

(and standard errors) from specifications regressing a binary variable indicating mentions of vertical integration

in firms’ 10-K (V I10k ) on binary variables indicating whether firms were vertical or nonvertical acquirers in

the last 3 years, based on our the text-based or NAICS-based vertical networks. Specifications include firm and

year fixed effects. Panel C displays the average cumulated abnormal announcement returns (CARs) of combined

acquirers and targets, obtained from a market model estimated on 250 days prior to events. Panel D displays

examples of large vertical deals (both upstream and downstream acquisitions), together with the vertical score

between parties measures on the year of transaction. ∗ p > .1; ∗∗ p > .05; ∗∗∗ p > .01.

Panel B of Table 4 indicates that vertical acquisitions identified using our textbased measure are followed by a significant increases in mentions of vertical

integration (with a t-statistic of 2.04), while we detect no significant changes

in the language associated with integration after vertical transactions identified

using the NAICS-based measure (t-statistic of 1.27). These results suggest

that the accumulated noise associated with NAICS-based vertical measure is

substantial.

Panel C also displays the average abnormal announcement return (expressed

as a percentage) of combined acquirers and targets in vertical and nonvertical

transactions. We present these results mainly to compare with previous research

(based on SIC or NAICS codes). Confirming existing evidence, combined

returns across all transactions are positive and range from 0.54% to 0.86%.

We also find that when vertical transactions are identified using our text-based

measure, the combined returns are larger for vertical relative to nonvertical

20

[20:39 28/9/2019 RFS-OP-REVF190113.tex]

Page: 20

1–40

Innovation Activities and Integration through Vertical Acquisitions

Table 5

Summary statistics

Mean

SD

Min

Max

#Obs.

R&D/sales

Patents/assets

log(assets)

log(age)

PPE/assets

Segments

MB

CF/assets

OI/sales

Sales growth

HHI

End users

Target

Vertical target

Nonvertical target

corr(R&D/sales,Patents/assets)

0.108

0.009

5.680

2.896

0.259

1.477

1.982

0.023

0.047

0.169

0.237

0.470

0.065

0.024

0.041

0.321

0.277

0.028

1.913

1.108

0.225

0.936

1.491

0.204

0.359

0.412

0.198

0.077

0.246

0.153

0.198

—

0.000

0.000

1.780

0.000

0.006

1.000

0.561

−1.048

−2.236

−0.545

0.016

0.034

0.000

0.000

0.000

—

2.373

0.186

10.338

4.984

0.898

12.000

9.521

0.366

0.628

2.324

1.000

0.985

1.000

1.000

1.000

—

61,463

61,463

61,463

61,463

61,463

61,463

61,463

61,463

61,463

61,463

61,463

61,463

61,463

61,463

61,463

61,436

Downloaded from https://academic.oup.com/rfs/advance-article-abstract/doi/10.1093/rfs/hhz106/5571736 by guest on 15 October 2019

Variable:

This table displays summary statistics for the main variables used in the analysis. Appendix defines the variables.

transactions. This supports the idea that vertical deals are value creating as in

Fan and Goyal (2006).

Finally, panel D presents six examples of large vertical acquisitions in

our sample, representing both upstream and downstream purchases. Western

Digital, a disk drive manufacturer, is an example of a downstream firm buying

an upstream firm. They purchased Komag Inc. in 2007, a producer of thin-film

discs used in hard drives. Another example of upstream integration is GE’s

acquisition of Edwards Systems Technology in 2004, which gave GE control

of Edward’s fire detection technology, used in GE’s broad security offering.22

In contrast, Conexant, a semiconductor manufacturer, integrated downstream

through the acquisition in 2003 of Globespan Virata Inc., a maker of broadband

communications products that use semiconductor chips.

3.2 Measuring unrealized and realized innovation

To measure unrealized and realized innovation and map them to transactions,

we merge the SDC transaction data with our merged Compustat/SEC EDGAR

firm-year database. We discard financial firms and utilities, and firm-year

observations with sales lower than $5 million.23 The resultant sample includes

61,463 firm-year observations over the period 1996-2013, corresponding to

8,283 distinct firms.

We empirically characterize firms’ R&D intensity as unrealized innovation

and patenting intensity as realized innovation. A firm’s R&D intensity is the

22 Will Woodburn, CEO of GE Infrastructure, indicated that Edwards’ technology will enable GE to offer an

“integrated facility management solution to partners and end users.” See Buildings (2004).

23 The Internet Appendix shows that such a size threshold does not affect our conclusions.

21

[20:39 28/9/2019 RFS-OP-REVF190113.tex]

Page: 21

1–40

The Review of Financial Studies / v 00 n 0 2019

Downloaded from https://academic.oup.com/rfs/advance-article-abstract/doi/10.1093/rfs/hhz106/5571736 by guest on 15 October 2019

dollar amount spent on R&D in a given year divided by sales.24 A firm’s

patenting intensity is the number of patents granted in a given year divided

by assets.25 We obtain information on patent grants from the United States

Patent and Trademark Office (USPTO) for each firm in our sample between

1996 and 2010 by combining information from the NBER patent data set and

the recent data compiled by Kogan et al. (2017). We extend these data by

manually matching all patent grants to firms in our sample between 2011 and

2013 using assignee names. We winsorize both variables (and all continuous

variables used in the analysis) at the 1% and the 99% level, and the appendix

defines the variables.

Table 5 presents summary statistics. The average R&D intensity is 0.108 with

a standard deviation of 0.277. The average patenting intensity is 0.009 (i.e., one

patent per year for each $110 million of assets) with a standard deviation of

0.028. We also note that the correlation between firms’ R&D and patenting

intensity is 0.321. Finally, the odds of being purchased by a vertically related

buyer in a given year is 2.4%, whereas the odds of a nonvertical acquisition is

4.1%. The other variables (e.g., size, age, or cash flow) are in line with existing

research.

3.3 Main results

To explore the link between the stage of development of firms’ innovation

and vertical acquisitions, we begin by reporting summary statistics in Table 6

and find a large difference in the innovation characteristics of firms purchased

in vertical and nonvertical deals. When compared to firms that participate in

no acquisitions over our sample period (nonmerging firms), targets in vertical

transactions spend significantly less on R&D and are granted more patents. In

contrast, targets in nonvertical acquisitions spend more on R&D and are granted

fewer patents. In panel B, each target (vertical and nonvertical) is directly

compared to a matched firm with similar characteristics that did not transact in

the past 3 years.26 We find similar results.

We confirm these univariate results by estimating probit models in which

the dependent variable is a binary variable indicating whether a given firm is a