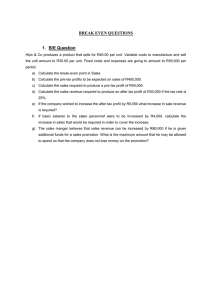

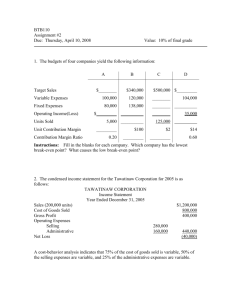

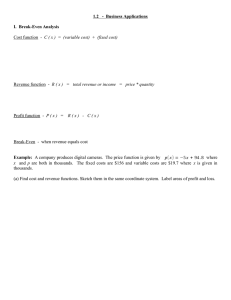

FACULTY OF BUSINESS, ECONOMICS AND SOCIAL DEVELOPMENT MARKETING PLAN TRIPLE H FRIED CHICKEN SEMESTER 1 2021/2022 MARKETING MANAGEMENT - MGM5143 1) MUHAMMAD GROUP MEMBERS: FIRDAUS BIN ABDUL SAMAD (P4980) 2) MOHD HASBI KYAIRI BIN AHMAD FUAD (P4984) DATE OF SUBMISSION: TBD TABLE OF CONTENT NO. CONTENT 1. EXECUTIVE SUMMARY 2. INTRODUCTION 3. MISSION STATEMENT AND VISION STATEMENT 4. SITUATIONAL ANALYSIS 4.1 4C ANALYSIS 4.1.1 COMPANY 4.1.2 COLLABORATORS 4.1.3 CUSTOMERS 4.1.4 COMPETITORS 4.2 SWOT ANALYSIS 4.3 PESTEL ANALYSIS 5. CORE CAPABILITIES 6. GOALS 7. TARGET MARKET 8. MARKETING STRATEGY 9. FINANCIAL SUMMARY 10. IMPLIMENTATION, EVALUATION AND CONTROL PAGE NUMBER 9. FINANCIAL SUMMARY 9.1 Financial Forecasts Financial forecast is crucial in a start-up business. Business needs to do the financial forecast in order to ensure the business is performing well. Financial forecast may allow business to anticipate the revenues and expenses over period of time (Brouster, 2021). By having financial forecast, business can estimate and predict its future revenues and expenses so that business could survive in any unforeseen circumstances. Business is relying on these data because numbers cannot lie, hence we can rely on the projection of financial forecast. In financial forecast, we need to look at a few key indicators to make sure financial forecast can be done successfully. The key indicators are sales and expenses forecast, Profit & Loss (P&L) Statement and Balance Sheet. These key indicators can aid business in ensuring the business plan succeed. 9.1.2 Sales and Expenses Forecast Sales forecast is a process of estimating future sales with combination of past data, industry benchmark or economic trends (Parsons, 2021). While expenses forecast refers to estimated future expenses involved in selling products. Expenses can be break down into two; fixed costs or variable costs. Both, sales and expenses forecast are essential in generating P&L statement, balance sheet and cash flow statement. Sales forecast may determine how much you should spend so that business can generate profit. For example, our business might want to know which menu has a higher sale. Then, we can use historical data on menu sold to estimate how much sales we can achieve each week or month. On the other hand, expenses forecast involves the costs to the business including overhead costs, variable costs and fixed costs. 9.1.3 Profit & Loss Statement Profit and Loss Statement (P&L) which also known as Income Statement shows the business performance over time in relation to incomes and expenses. It assists business to calculate profit and overview the business’s financial health (Johnson, 2021). Business could pay attention to increase sales or reduce expenses to enhance business performance. The P&L comprises of items as below: i. Revenues / sales ii. Cost of goods sold (COGS) iii. Gross profit iv. Selling, general and administrative expense (SG&A) v. Interest expense vi. Taxes vii. Net profit For a small, start-up business like Triple H Fried Chicken, the data or figure obtained can be used in calculating net profit. First, we must find what is the gross profit (revenues – COGS). Then, we need to take into consideration any other expenses incurred such as SG&A expense and interest expense. Finally, if there is any tax imposed, we must deduct that amount so that we can get the final figure which is net profit. Table below is an example of P&L for small business. Triple H Fried Chicken Profit & Loss Statement (For The Year Ended 20xx) RM Revenues / Sales Cost of Goods Sold Gross Profit Selling, General & Administrative Expenses xxx (xxx) xxx (xxx) Profit Before Tax Tax Expense Net Profit xxx (xxx) xxx 9.1.4 Balance Sheet Meanwhile, balance sheet is also important as it monitors our financial performance as a whole. This is because balance sheet shows the breakdown of assets and liabilities as well as equity of our business (The Art and Science of Financial Projections, 2021). Balance sheet provides details such as how much we owe our creditors or how many inventories we own. Balance sheet may help us in analysing the stability of business, whether to expand or invest. Balance sheet consists of three main categories which are assets, liabilities and equity. Each categories are breaking down into sub-categories as below: i. Assets: a. Current assets – Cash, Inventories & Account Receivables. b. Non-current assets – Property, Plant & Equipment (PPE) & Intangible Assets. ii. Liabilities: a. Current liabilities – Account Payables, Accrued Expenses. b. Non-current liabilities – Long-term Debt. iii. Equity: a. Share Capital. b. Retained Earnings. According to Corporate Finance Institute (2021), preparing balance sheet is important in order to have an overview of the business’s health. We can analyse business performance metrices such as liquidity, leverage, efficiency and rate of return. i. Liquidity – assess the ability of business to cover its short-term debts by comparing current assets and current liabilities. If current assets are higher than current liabilities, business can survive its short-term debts. ii. Leverage – assess the financial risk taken by business by comparing debt to equity. iii. Efficiency – assess how efficient business manage their asset by examining how well business manage its cash and how well the business turns assets into revenue. iv. Rate of return – assess how business generates return such as Return on Equity, Return on Assets and also Return on Investment. 9.2 Break-even Analysis In business, break-even is important in order to survive in short term run. Break-even is the level of output where total revenues equal to total costs. Thus, it simply means the revenues of the business must cover all the related costs of business. We, at Triple H Fried Chicken realise we need to know how much sales needed to ensure it can cover our fixed and variable costs. We need to focus on the fixed and variable costs. Fixed costs comprise of rent, insurance expense, utilities expenses and also marketing expenses. While variable costs may consist of costs that related to the production. They could be food and drink cost, labour cost and cleaning supplies cost. All these costs must take into consideration in calculating break-even point. Formula to calculate break-even point is as follow: Break-even Point = Total Fixed Costs / (Total Sales – Total Variable Costs / Total Sales) For example, with the data below we can calculate break-even point. i. Monthly sales – RM 50,000 ii. Monthly variable cost – RM 20,000 iii. Monthly fixed cost – RM 20,000 Break-even point = RM20,000 / ((RM50,000 – RM20,000) / RM50,000) Break-even point = RM20,000 / (RM30,000 / RM50,000) Break-even point = RM20,000 / 0.6 Break-even point = RM33,333 **This means we need to achieve sales of RM33,333 per month to break-even. As we already know the break-even point of sales. We can also target how many customers we need to achieve per month or per day. We discover that each customer spent about RM33 on average. Hence, we need to divide break-even sale with average amount spent. Break-even point (customer) = RM33,333 / RM33 Break-even point (customer) = 1,010 customers per month @ 34 customers per day 9.3 Cash Flow Projection Cash flow projection is the amount of money or cash that is expected to flow in and out of the business (David, 2020). In managing a start-up business, cash flow projection is needed as business is vulnerable to cash flow problem. Start-up business requires good cash flow so that suppliers are confident to deal with since there is no payment track record yet. Besides, in early stage of starting a business, we might want to spend more on marketing and R&D. Hence, business need to have proper cash flow projection to avoid running out of cash. This is one of the challenge faced by start-up business that may result in business failure. Therefore, we, Triple H Fried Chicken need to construct an accurate cash flow projection either for short term or long term period so that we can foresee any possible cash problem. First of all, we need to identify the importance of having cash flow projection. It helps business to identify potential shortfall in cash. When we do cash flow projection, we may know how much cash we have and we also know when we are going to have a shortfall in cash so that we can have alternative plans to overcome the shortfall. In addition, we do need the cash flow projection to monitor our ability to pay our suppliers as well as our employees. We need to manage suppliers’ payment term with the future cash flow projection so that the payment can be done within the agreeable period. Items needed to create a proper cash flow projection are as below: i. Opening cash balance – amount of cash at the start of period ii. Cash inflow – projection of expected sales iii. Cash outflow – projection of expected expenses iv. Net cash flow – cash inflow minus cash outflow v. Closing cash balance – amount of cash at the end of period 10. IMPLEMENTATION, EVALUATION AND CONTROL The last element of marketing plan of business is to implement the plan, evaluate its performance and control needed to monitor the plan. These three processes are important to assess the effectiveness of marketing plan in business. They are inter-related, if one of the elements fails, our marketing plan would fail. 10.1 Implementation Implementation is a stage where we need to execute the actual marketing plan in business. The implementation needs to be completed according to the plan so that it happens within suggested time and follow the correct sequence (Grunert, 2019). A good manager must think of an effective and faster execution of marketing plan. According to (Click, 2016), there are eight (8) steps on how to implement successful marketing plan: i. Setting the right expectations – marketing plan may take some time. Once we get going, the momentum builds and it will be easier to achieve. ii. Building teams and securing resources – we need to have the best team to implement the marketing plan and also take a look at resources so that we can fully utilize it. iii. Communicating the plan – as we already have the team, we need to ensure team members understand their roles in implementing marketing plan. iv. Building up timeline and tasks – the best way to implement the marketing plan, we need to have project timeline. We can keeping eye on the project and do necessary adjustment when required. v. Setting up dashboard for tracking success – we need to develop a tool or template to measure overall performance of implementation. vi. Regular monitoring – once we have the tracking tool or template, we will vii. check and monitor the results. Be willing to adapt – sometimes, it is not occurred according to the plan. So we need to prepare ourselves to adapt the to the current situation or circumstance. viii. Communicating the results and celebrating success – we recognise our team’s effort by rewarding the team members. It can boost their morale and ensure them to contribute more towards the business. 10.2 Evaluation The evaluation of marketing plan is to do determine whether the business achieves its goals or objectives from implementation stage. If business can achieve their goals, those steps can be used for different situation. Otherwise, we need to revise our steps to improve business performance. Without having evaluation process, business does not know whether its marketing plan is effective or not. When evaluation process is done correctly, any marketing plan that does not fit the purpose can be change to more effective strategies. Therefore, our business identifies a few ways to evaluate our marketing plan as follows: i. Return on investment – we will measure the spending amount on marketing plan versus the sales that be brought in. We can examine whether the investment in marketing plan results in a profit. ii. Sales number – sales could be an indicator when our monthly sales is increasing compared to previous month. This shows that our marketing plan is perfectly working. iii. Customer response – when we conduct surveys or questionnaires to our customers, we may get feedbacks and responses from them. From the feedbacks, we can know whether our marketing plan is on track or not. iv. Competitors response to marketing plan – we can identify the success of our marketing plan when we observe our competitors are duplicating our marketing plan. So sometimes we need to always check on our competitors’ performance too. 10.3 Control Last but not least, control is important in evaluation stage as it sets the standards for the performance. Marketing control process involves establishing standards and reducing the difference between desired performance and actual performance (iEduNote.com, 2020). Control is related to evaluation stage as evaluation need to be done using the controls that being set by business. For example, above mentioned about return on investment and sales number. In order to evaluate, we need to identify the approaches to control which is market ratios. The calculation of those ratios needs to focus on sales analysis, expenses analysis and others. While other control which is market research also needed when we try to observe competitors’ response to marketing plan. Control is going to be the benchmark for us to assess the success of our marketing plan. We can evaluate the progress of current marketing plans and at the same time, we can plan for future.