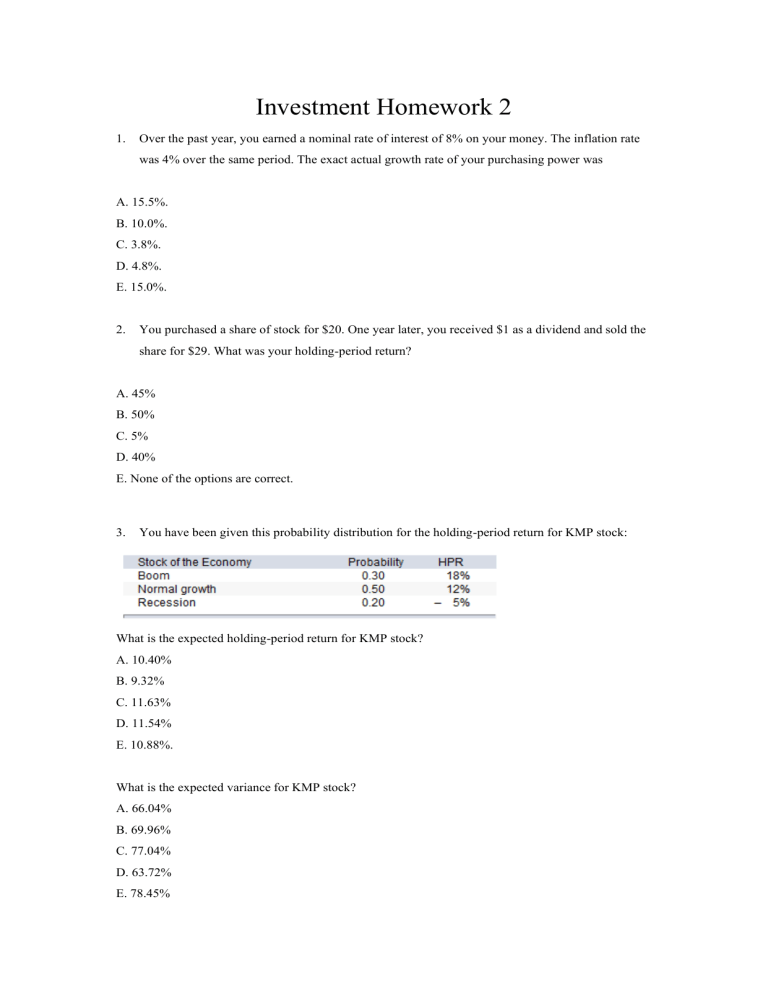

Investment Homework 2 1. Over the past year, you earned a nominal rate of interest of 8% on your money. The inflation rate was 4% over the same period. The exact actual growth rate of your purchasing power was A. 15.5%. B. 10.0%. C. 3.8%. D. 4.8%. E. 15.0%. 2. You purchased a share of stock for $20. One year later, you received $1 as a dividend and sold the share for $29. What was your holding-period return? A. 45% B. 50% C. 5% D. 40% E. None of the options are correct. 3. You have been given this probability distribution for the holding-period return for KMP stock: What is the expected holding-period return for KMP stock? A. 10.40% B. 9.32% C. 11.63% D. 11.54% E. 10.88%. What is the expected variance for KMP stock? A. 66.04% B. 69.96% C. 77.04% D. 63.72% E. 78.45% 4. If a portfolio had a return of 18%, the risk-free asset return was 5%, and the standard deviation of the portfolio's excess returns was 34%, the risk premium would be A. 13%. B. 18%. C. 49%. D. 12%. E. 29%. 5. If an investment provides a 1.25% return quarterly, its effective annual rate is A. 5.23%. B. 5.09%. C. 4.02%. D. 4.04%. 6. When assessing tail risk by looking at the 5% worst-case scenario, the most realistic view of downside exposure would be A. expected shortfall. B. value at risk. C. conditional tail expectation. D. expected shortfall and value at risk. E. expected shortfall and conditional tail expectation. 7. According to the mean-variance criterion, which one of the following investments dominates all others? A. E(r) = 0.15; Variance = 0.20 B. E(r) = 0.10; Variance = 0.20 C. E(r) = 0.10; Variance = 0.25 D. E(r) = 0.15; Variance = 0.25 E. None of these options dominates the other alternatives. 8. Use the below information to answer the following question. U = E(r ) – (A/2)Var(r), where A = 4.0. Based on the utility function above, which investment would you select? A. 1 B. 2 C. 3 D. 4 E. Cannot be determined from the information given. 9. According to the mean-variance criterion, which of the statements below is correct? A. Investment B dominates investment A. B. Investment B dominates investment C. C. Investment D dominates all of the other investments. D. Investment D dominates only investment B. E. Investment C dominates investment A. 10. The capital allocation line can be described as the A. investment opportunity set formed with a risky asset and a risk-free asset. B. investment opportunity set formed with two risky assets. C. line on which lie all portfolios that offer the same utility to a particular investor. D. line on which lie all portfolios with the same expected rate of return and different standard deviations. 11. An investor invests 30% of his wealth in a risky asset with an expected rate of return of 0.15 and a variance of 0.04 and 70% in a T-bill that pays 6%. His portfolio's expected return and standard deviation are __________ and __________, respectively. A. 0.114; 0.12 B. 0.087; 0.06 C. 0.295; 0.06 D. 0.087; 0.12 E. None of the options are correct. 12. You invest $100 in a risky asset with an expected rate of return of 0.12 and a standard deviation of 0.15 and a T-bill with a rate of return of 0.05. What percentages of your money must be invested in the risky asset and the risk-free asset, respectively, to form a portfolio with an expected return of 0.09? A. 85% and 15% B. 75% and 25% C. 67% and 33% D. 57% and 43% E. Cannot be determined. 13. You invest $100 in a risky asset with an expected rate of return of 0.12 and a standard deviation of 0.15 and a T-bill with a rate of return of 0.05. What percentages of your money must be invested in the risk-free asset and the risky asset, respectively, to form a portfolio with a standard deviation of 0.06? A. 30% and 70% B. 50% and 50% C. 60% and 40% D. 40% and 60% E. Cannot be determined. 14. You invest $100 in a risky asset with an expected rate of return of 0.11 and a standard deviation of 0.20 and a T-bill with a rate of return of 0.03. The slope of the capital allocation line formed with the risky asset and the risk-free asset is equal to A. 0.47. B. 0.80. C. 2.14. D. 0.40. E. Cannot be determined. 15. You invest $1,000 in a risky asset with an expected rate of return of 0.17 and a standard deviation of 0.40 and a T-bill with a rate of return of 0.04. What percentages of your money must be invested in the risk-free asset and the risky asset, respectively, to form a portfolio with a standard deviation of 0.20? A. 30% and 70% B. 50% and 50% C. 60% and 40% D. 40% and 60% E. Cannot be determined. 16. You invest $100 in a risky asset with an expected rate of return of 0.11 and a standard deviation of 0.21 and a T-bill with a rate of return of 0.045. The slope of the capital allocation line formed with the risky asset and the risk-free asset is equal to A. 0.4667. B. 0.8000. C. 0.3095. D. 0.41667. E. Cannot be determined. 17. Market risk is also referred to as A. systematic risk or diversifiable risk. B. systematic risk or nondiversifiable risk. C. unique risk or nondiversifiable risk. D. unique risk or diversifiable risk. 18. An investor who wishes to form a portfolio that lies to the right of the optimal risky portfolio on the capital allocation line must A. lend some of her money at the risk-free rate. B. borrow some money at the risk-free rate and invest in the optimal risky portfolio. C. invest only in risky securities. D. borrow some money at the risk-free rate, invest in the optimal risky portfolio, and invest only in risky securities E. Such a portfolio cannot be formed. 19. Which one of the following portfolios cannot lie on the efficient frontier as described by Markowitz? A. Only portfolio W cannot lie on the efficient frontier. B. Only portfolio X cannot lie on the efficient frontier. C. Only portfolio Y cannot lie on the efficient frontier. D. Only portfolio Z cannot lie on the efficient frontier. E. Cannot be determined from the information given. 20. The individual investor's optimal portfolio is designated by A. the point of tangency with the indifference curve and the capital allocation line. B. the point of highest reward to variability ratio in the opportunity set. C. the point of tangency with the opportunity set and the capital allocation line. D. the point of the highest reward to variability ratio in the indifference curve. E. None of the options are correct. 21. For a two-stock portfolio, what would be the preferred correlation coefficient between the two stocks? A. +1.00 B. +0.50 C. 0.00 D. –1.00 E. None of the options are correct. 22. Security X has expected return of 12% and standard deviation of 18%. Security Y has expected return of 15% and standard deviation of 26%. If the two securities have a correlation coefficient of 0.7, what is their covariance? A. 0.038 B. 0.070 C. 0.018 D. 0.033 E. 0.054 23. When two risky securities that are positively correlated but not perfectly correlated are held in a portfolio, A. the portfolio standard deviation will be greater than the weighted average of the individual security standard deviations. B. the portfolio standard deviation will be less than the weighted average of the individual security standard deviations. C. the portfolio standard deviation will be equal to the weighted average of the individual security standard deviations. D. the portfolio standard deviation will always be equal to the securities' covariance. 24. Given an optimal risky portfolio with expected return of 20%, standard deviation of 24%, and a risk free rate of 7%, what is the slope of the best feasible CAL? A. 0.64 B. 0.14 C. 0.62 D. 0.33 E. 0.54 25. As diversification increases, the standard deviation of a portfolio approaches A. 0 B. 1. C. infinity. D. the standard deviation of the market portfolio. E. None of the options are correct. 26. As diversification increases, the firm-specific risk of a portfolio approaches A. 0. B. 1. C. infinity. D. (n – 1) × n. 27. The index model has been estimated for stocks A and B with the following results: RA = 0.03 + 0.7RM + eA. RB = 0.01 + 0.9RM + eB. σM = 0.35; σ(eA) = 0.20; σ(eB) = 0.10. The covariance between the returns on stocks A and B is A. 0.0384. B. 0.0406. C. 0.1920. D. 0.0772. E. 0.4000. 28. The index model has been estimated for stock A with the following results: RA = 0.01 + 0.8RM + eA. σM = 0.20; σ(eA) = 0.10. The standard deviation of the return for stock A is A. 0.0356. B. 0.1887. C. 0.1600. D. 0.6400. 29. In the context of the Capital Asset Pricing Model (CAPM), the relevant measure of risk is A. unique risk. B. beta. C. standard deviation of returns. D. variance of returns. 30. The risk-free rate and the expected market rate of return are 0.06 and 0.12, respectively. According to the capital asset pricing model (CAPM), the expected rate of return on security X with a beta of 1.2 is equal to A. 0.06. B. 0.144. C. 0.12. D. 0.132. E. 0.18. 31. Which statement is not true regarding the market portfolio? A. It includes all publicly-traded financial assets. B. It lies on the efficient frontier. C. All securities in the market portfolio are held in proportion to their market values. D. It is the tangency point between the capital market line and the indifference curve. E. All of the options are true. 32. According to the Capital Asset Pricing Model (CAPM), underpriced securities have A. positive betas. B. zero alphas. C. negative betas. D. positive alphas. E. None of the options are correct. 33. Your personal opinion is that a security has an expected rate of return of 0.11. It has a beta of 1.5. The risk-free rate is 0.05 and the market expected rate of return is 0.09. According to the Capital Asset Pricing Model, this security is A. underpriced. B. overpriced. C. fairly priced. D. Cannot be determined from data provided. 34. You invest $600 in a security with a beta of 1.2 and $400 in another security with a beta of 0.90. The beta of the resulting portfolio is A. 1.40. B. 1.00. C. 0.36. D. 1.08. E. 0.80. 35. A security has an expected rate of return of 0.10 and a beta of 1.1. The market expected rate of return is 0.08, and the risk-free rate is 0.05. The alpha of the stock is A. 1.7%. B. –1.7%. C. 8.3%. D. 5.5%. 36. As a financial analyst, you are tasked with evaluating a capital-budgeting project. You were instructed to use the IRR method, and you need to determine an appropriate hurdle rate. The risk-free rate is 4%, and the expected market rate of return is 11%. Your company has a beta of 0.67, and the project that you are evaluating is considered to have risk equal to the average project that the company has accepted in the past. According to CAPM, the appropriate hurdle rate would be A. 4%. B. 8.69%. C. 15%. D. 11%. E. 0.75%. 37. You invest 55% of your money in security A with a beta of 1.4 and the rest of your money in security B with a beta of 0.9. The beta of the resulting portfolio is A. 1.466. B. 1.157. C. 0.968. D. 1.082. E. 1.175. 38. Given are the following two stocks A and B: If the expected market rate of return is 0.09, and the risk-free rate is 0.05, which security would be considered the better buy, and why? A. A because it offers an expected excess return of 1.2%. B. B because it offers an expected excess return of 1.8%. C. A because it offers an expected excess return of 2.2%. D. B because it offers an expected return of 14%. E. B because it has a higher beta. 39. The capital asset pricing model assumes A. all investors are price takers. B. all investors have the same holding period. C. investors pay taxes on capital gains. D. all investors are price takers and have the same holding period. E. all investors are price takers, have the same holding period, and pay taxes on capital gains. 40. The amount that an investor allocates to the market portfolio is negatively related to I) the expected return on the market portfolio. II) the investor's risk aversion coefficient. III) the risk-free rate of return. IV) the variance of the market portfolio. A. I and II. B. II and III. C. II and IV. D. II, III, and IV. E. I, III, and IV. 41. Assume that a security is fairly priced and has an expected rate of return of 0.13. The market expected rate of return is 0.13, and the risk-free rate is 0.04. The beta of the stock is A. 1.25. B. 1.7. C. 1. D. 0.95.