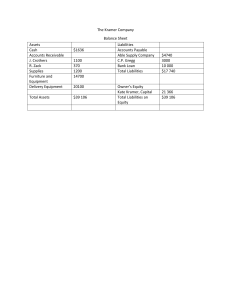

MINDA CORPORATION LIMITED Minda Corporation Limited is a listed public company incorporated on 11 March, 1985. It is classified as a public limited company and is located in New Delhi, Delhi. It’s authorized share capital is INR 157.70 cr and the total paid-up capital is INR 47.82 cr. Minda Corporation Limited’s operating revenues range is Over INR 500 cr for the financial year ending on 31 March, 2021. It’s EBITDA has decreased by -12.71 % over the previous year. At the same time, it’s book networth has increased by 18.51 %. Minda Corporation Ltd.: Die Casting Division is a leading manufacturer of Aluminium & Zinc die casted and machined components for Global Automotive & Non-Automotive Industry. We offer our customers End to End solutions ranging from Prototyping, Tool Designing & Manufacturing, Casting Simulation, Core Making, Die Casting, Shot Blasting, Powder Coating, Assembly & multi process Foundry services. With Three State of the Art Manufacturing facilities located in Pune & Greater Noida, India, the company delivers best-in-class Gravity Die Casting (GDC), Low Pressure Die Casting (LPDC), High Pressure Die Casting (HPDC) & Zinc Hot Chamber Casting products. VISION OF COMPANY ‘To be a Dynamic, Innovative and Profitable Global Automotive Organization for emerging market as the Preferred Supplier and Employer, to create value for all Stakeholders.’ ‘Dynamic’ As a player, the Group is sensitive to the rapidly changing business environment. The actions of all Group Companies are and will be geared towards meeting stringent benchmarks and norms that are required and will be required. Innovative -As a Group, we have been at the forefront of innovation. We intend to increase our focus on innovation in products and technologies, organizational structure, and optimizing efficiencies. We are also committed to change management as a way of life to enable us to meet the emerging challenges of the Industry. Profitable We want to emerge in the global arena as a leading automotive player and realize profitability in business so as to sustain and enhance our efforts towards emerging as a leader in the industry. Global We are already global and will continue to expand to meet the requirements of global OEMs and be a significant player globally, in our own domain. In spreading globally, we will not focus on any specific country or region but take decisions based on our core interests in the automotive sector. Mission of the company ‘Our mission is to be an Automotive System Solution provider and build a brand recognized by vehicle manufacturers progressively all over the world, as an organization providing products and systems, unparalleled in Quality and Price.’ Stakeholders We will ensure that our enterprise grows aggressively and earns adequate returns. Customers We will make customers for lifetime and always strive to exceed their expectations. Partners We will develop long term relationships with our partners based on mutual benefit, trust, support & transparency. Employees We will treat our employees as family members and would provide them a safe, healthy, stimulating and rewarding work environment. Society We will always be conscious of our responsibilities towards the society at large and undertake welfare activities for the community. Values of company Commitment to Stakeholders Demonstrate loyalty and dedication to the organization. Passion for Excellence Relentlessly improving and continuously raising the bar in everything we do. Open Communication Reasoning, knowledge, experience sharing, confronting fearlessly for the good of the organization. Integrity & Fairness Fair and upright in intention and actions - always complying with conscience. Nurture Talent, Competency & Willingness Create challenging opportunities and provide support for development of self and team members. Encourage experimentation & willingness to accept challenges. Respect & Humility Must be Courteous, Compassionate, Caring, Humane and Humble in all our interpersonal exchanges. Innovation & Improvement Orientation Challenge status quo. Demonstrate creativity for improvement and breakthrough. Partnering Leverages interdependence, cooperative, readily provides support and assistance to others. Responsibility Take ownership for the consequences of ones decisions and actions. Cross Cultural Diversity Build a vibrant workforce with different ethnicity, cultural orientation with no prejudice due to sex / caste / creed / color and to cherish our diversity. BUSSINESS OF MINDA CORPORATION LIMITED Our manufacturing facilities include the following : High Pressure Die Casting – Cold Chamber State-of-the-Art PLC/CNC Controlled with vacuum system Capacity: 150 to 530 Tons Locking Force Machine make: Buhler, Toshiba, Zitai High Pressure Die Casting – Hot Chamber Complete Automatic Zinc PDC machines Cellular Concept Layout – Die Casting till packing in one single cell Capacity: 30 to 280 Tons locking force Make: Producer, Techmire, Frech, Jeng Fong Gravity Die Casting Machines Capacity: Casting weight range from 100 gms up to 15 Kg Technology: -45˚ to 90˚ Tilting with PLC Controlled with temperature locking system Quality Assurance Equipments X-Ray (GE-XCUBE 160KV) Contour Tracer: Mitutoyo Profile Projector Microscope with Particle Size Analyzer Millipore Test Rig Boroscope Salt Spray Tester DI Tester Roughness Tester Electronic Gauging Facility Hardness Tester: Rockwell B & C Scale, Brinell UTM: Fine Instruments Sand Testing Equipments: Sieve Shaker, Hot Tensile Strength, and Scratch Hardness Powder Coating/Plating/Surface treatment testing equipments: Micro sample moulding machine, Polishing machine, DFT meter, and Pencil Hardness tester etc. Management of MINDA corporation limited (BOD) The company has 8 directors and 3 reported key management personnel. The longest serving director currently on board is Ashok Minda who was appointed on 22 July, 1987. Ashok Minda has been on the board for more than 35 years. The most recently appointed director is Ravi Sud, who was appointed on 25 March, 2021. Ashok Minda has the largest number of other directorships with a seat at a total of 11 companies. In total, the company is connected to 40 other companies through its directors. Major competitiors of Minda Name Last Price Market Cap. UNO Minda 536.70 30,729.62 Sales Turnover 4,959.73 196.03 2,937.64 FIEM Ind Lumax Inds 1,596.90 1,646.10 2,101.49 1,538.73 1,572.26 1,751.31 95.26 35.43 668.61 786.71 15.50 17.33 86.74 -6.33 66.25 (Rs. cr.) Autolite India Balance Sheet Net Profit Total Assets ------------------- in Rs. Cr. ------------------UNO Minda FIEM Ind Lumax Inds Jagan Litech Autolite India Mar '22 Mar '22 Mar '22 Mar '22 Mar '20 57.12 57.12 27.61 0.00 13.16 13.16 0.00 0.00 9.35 9.35 0.00 0.00 7.16 7.16 0.00 0.00 11.19 11.19 0.00 0.00 Reserves 2,507.70 634.27 413.36 17.47 23.20 Revaluation Reserves Networth 0.00 2,592.43 0.00 647.43 0.00 422.71 0.00 24.63 0.00 34.39 Secured Loans Unsecured Loans Total Debt Total Liabilities 345.21 0.00 345.21 2,937.64 21.17 0.00 21.17 668.60 363.99 0.00 363.99 786.70 5.18 0.00 5.18 29.81 31.87 0.00 31.87 66.26 UNO Minda FIEM Ind Lumax Inds Jagan Litech Autolite India Mar '22 Mar '22 Mar '22 Mar '22 Mar '20 Gross Block Less: Accum. Depreciation Net Block 1,940.04 619.86 1,320.18 948.00 440.82 507.18 1,031.42 320.27 711.15 35.05 15.71 19.34 35.43 0.00 35.43 Capital Work in Progress Investments 93.58 1,204.10 0.71 86.01 48.03 7.89 0.00 0.00 0.00 1.60 472.00 877.98 62.83 184.74 174.60 66.88 264.35 232.14 15.70 6.46 8.79 0.12 13.71 36.14 0.37 1,412.81 225.66 0.00 1,638.47 426.22 34.09 0.00 460.31 512.19 173.24 0.00 685.43 15.37 2.48 0.00 17.85 50.22 20.76 0.00 70.98 Sources Of Funds Total Share Capital Equity Share Capital Share Application Money Preference Share Capital Application Of Funds Inventories Sundry Debtors Cash and Bank Balance Total Current Assets Loans and Advances Fixed Deposits Total CA, Loans & Advances Deffered Credit Current Liabilities Provisions 0.00 1,202.66 116.03 0.00 375.49 10.11 0.00 620.75 45.04 0.00 7.05 0.31 0.00 38.37 3.39 Total CL & Provisions Net Current Assets 1,318.69 319.78 385.60 74.71 665.79 19.64 7.36 10.49 41.76 29.22 Miscellaneous Expenses Total Assets 0.00 2,937.64 0.00 668.61 0.00 786.71 0.00 29.83 0.00 66.25 91.08 89.80 75.04 491.97 129.87 452.20 0.00 34.38 0.00 30.74 Contingent Liabilities Book Value (Rs) Source : Dion Global Solutions Limited PART – 02 COMPARATIVE BALANCESHEET Comparative Balance sheet of Minda Industries 31-Mar Particulars 2020 2021 (amount in cr) (amount in cr) Increase or Decrease % Change Absolute change (amount in ₹ cr) (amount in cr) Equity and Liabililites Equity Equity share capital other equity Equity attributable to owners of the Company Non-controlling interest Total Equity 52.44 1763.28 54.39 2202.18 1.95 438.9 3.72 24.89 1815.72 282.84 2098.56 2256.18 306.45 2563.02 440.46 23.61 464.46 24.26 8.35 22.13 Liabilities Non-current liabilities Financial liabilities (i) Borrowings (ii) Lease liabilities (iii) Other financial liabilities Provisions Deferred tax liabilities (net) Total non-current liabilities 780.33 97.93 75.14 117.45 13.53 1084.38 539.12 90.55 89.7 135.07 29.93 884.24 (241.21) (7.38) 14.56 17.62 16.4 (200.14) (30.91) (7.54) 19.38 15.00 121.21 (18.46) Current liabilities Financial liabilities (i) Borrowings ii) Lease liabilities (iii) Trade payables (a) total outstanding dues of micro and small enterprises (b) total outstanding dues of creditors other than micro and small enterprises (iv) Other financial liabilities Other current liabilities Provisions Total current liabilities Liabilities related to assets held for sale total equity and liability ASSETS Non-current assets Property, plant and equipment Capital work-in-progress Right-of-use assets Intangible assets Intangible assets under development Goodwill on Consolidation Financial assets (i) Investments ii) Loans (iii) Other financial assets Other tax assets Other non-current assets Total non-current assets Current assets Inventories Financial assets i) Trade receivables ii) Cash and cash equivalents (iii) Bank balances other than those included in cash and cash equivalents (iv) Loans v) Other financial assets Other current assets Total current assets Assets held for sale Total assets 217.14 18.29 313.78 20.16 96.64 1.87 44.51 10.22 87.97 181.68 93.71 106.52 874.82 312.13 108.83 32.39 1651.57 1,108.11 757.37 110.03 39.04 2,530.17 233.29 445.24 1.2 6.65 878.6 26.67 142.65 1.10 20.53 53.20 (4.34) (100.00) 4.34 4838.85 5,977.43 1138.58 23.53 1643.36 337.05 135.82 214.72 20 202.06 2,050.65 111.94 174.93 289.47 22.36 281.72 407.29 (225.11) 39.11 74.75 2.36 79.66 24.78 (66.79) 28.80 34.81 11.80 39.42 372.16 13.34 10.27 42.52 50.6 3041.9 528.61 27.26 3.7 26.17 39.27 3,556.08 156.45 13.92 (6.57) (16.35) (11.33) 514.18 42.04 104.35 (63.97) (38.45) (22.39) 16.90 555.26 750.56 195.3 35.17 726.41 250.98 1,198.82 205.61 472.41 (45.37) 65.03 (18.08) 76.86 5.7 34.89 139.36 1789.46 7.49 4838.85 32.57 2.94 27.28 202.01 2,421.35 (44.29) (2.76) (7.61) 62.65 631.89 (7.49) 1138.58 (57.62) (48.42) (21.81) 44.96 35.31 (100.00) 23.53 5,977.43 SCREENSHOT OF YEAR 2020 SCREENSHOT OF YEAR 2021 ANALYSIS OF THE MAJOR FACTORS In 2020 Deferred tax liabilities is 13.53(cr) and in 2021 it is increased by 121.21 % Borrowings is decreased by 30.91 % , In 2020 it was 780.33(cr.) and in 2021 it was 539.12(cr.) Total current liabilities increased by 53.20%, In 2020 the current liability was 1651.57(cr.) and in 2021 it was 2530.17 (cr.) Company able to increase there property, plant and equipment in 2020, 1643.36(cr.) and in 2021 they increased it by 24.78% Company able to achieve to good results in 2020 they have 1789.46cr. of total assets and in 2021 it was 2421.35 cr. Comparative balance sheet of the year 2021 & 2022 Comparative Balance sheet of Minda Industries 31-Mar Particulars 2020 21 202122 Increase or Decrease Absolute change % (amont Change in ₹ ) Equity and Liabililites Equity Equity share capital 54.39 57.12 other equity 2202.18 3381.33 Equity attributable to owners of the Company 2256.57 3438.45 Non-controlling interest 306.45 326.3 Total Equity 2563.02 3764.75 2.73 1179.15 1181.88 19.85 1201.73 Liabilities Non-current liabilities Financial liabilities (i) Borrowings (ii) Lease liabilities (iii) Other financial liabilities Provisions Deferred tax liabilities (net) Other non current liabilities Total non-current liabilities -164.42 -30.498 20.46 22.595 17.11 105.357 -49.97 -36.996 20.04 47.264 -15.22 -20.755 -172 -19.181 539.12 90.55 16.24 135.07 42.4 73.33 896.71 374.7 111.01 33.35 85.1 62.44 58.11 724.71 5.019 53.545 52.375 6.477 46.887 Current liabilities Contract libilities 48.01 116.29 Financial liabilities (i) Borrowings 509.4 441.18 ii) Lease liabilities 20.16 16.9 (iii) Trade payables (a) total outstanding dues of micro and small enterprises 181.68 179.1 (b) total outstanding dues of creditors other than micro and small enterprises 1108.11 1232.58 (iv) Other financial liabilities 560.81 177.29 Current tax libilities 27.57 Other current liabilities 62.88 86.83 Provisions 39.04 64.49 Total current liabilities 2530.17 2342.23 Total liability 3426.88 3066.94 Total equity and liability ASSETS Non current assets Property, plant and equipment Capital work-in-progress Right-of-use assets Intangible assets Intangible assets under development Goodwill on Consolidation investment in associate, joint ventures Financial assets (i)other financial assets defered tax assets non current tax assets Other non-current assets Total non-current assets Current assets Inventories Financial assets i) Trade receivables ii) Cash and cash equivalents (iii) Bank balances other than those included in cash and cash equivalents (iv) investment v) Other financial assets Other current assets Total current assets Assets held for sale Total assets 5989.9 6831.69 68.28 142.220 -68.22 -3.26 -13.392 -16.171 -2.58 -1.420 124.47 -383.52 27.57 23.95 25.45 -187.94 -359.94 11.233 -68.387 #DIV/0! 38.088 65.190 -7.428 -10.503 841.79 14.053 2050.65 2052.71 111.94 335.26 174.93 183.16 289.47 284.78 22.36 11.26 281.72 284.03 528.61 594.62 2.06 0.100 223.32 199.500 8.23 4.705 -4.69 -1.620 -11.1 -49.642 2.31 0.820 66.01 12.487 30.96 25.96 12.47 33.82 26.17 31.47 39.27 38.69 3568.55 3875.76 -5 -16.150 21.35 171.211 5.3 20.252 -0.58 -1.477 307.21 8.609 750.56 1046.43 295.87 39.420 1198.82 1376.65 205.61 202.27 177.83 -3.34 14.834 -1.624 32.57 31.93 1.56 12.09 30.22 46.17 202.01 240.39 2421.35 2955.93 -0.64 -1.965 10.53 675.000 15.95 52.780 38.38 18.999 534.58 22.078 5989.9 6831.69 841.79 14.053 SCREENSHOT OF YEAR 2021 SCREENSHOT OF YEAR 2022 00012he Preferred Supplier and Employer, to create value for all Stakeholders