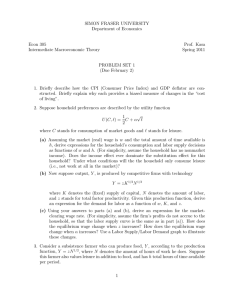

Homework 2 1. Consider a situation in which lump-sum tax is higher than dividend income and the consumer prefers an equal proportion of consumption and leisure. a. Suppose that h=16, w=0.5, π=0.6, and T=4. Use a diagram to show the consumer’s optimal choice of consumption and leisure. b. If the consumer likes a fixed proportion of 4 units of consumption and 1 unit of leisure, how will your answer to part (a) change? Use the diagram from your answer to part (a) to show the changes. c. Show the new optimal choice of consumption and leisure on the same diagram if w is now doubled. Explain this change in terms of income and substitution effects. 2. Suppose that a consumer can earn a higher wage rate for working overtime. That is for the first q hours the consumer works, he or she receives a real wage rate of w1, and for hours worked more than q he or she receives w2, where w2>w1. Suppose that the consumer pays no taxes and receives no nonwage income, and he or she is free to choose hours of work. a. Draw the consumer’s budget constraint, and show his or her optimal choice of consumption and leisure. b. Show that the consumer would never work q hours, or anything very close to q hours. Explain the intuition behind this. c. Determine what happens if the overtime wage rate w2 increases. Explain your results in terms of income and substitution effects. You must consider the case of a worker who initially works overtime, and a worker who initially does not work overtime. 3. Suppose that the government imposes a proportional income tax on the representative consumer’s wage income. That is, the consumer’s wage income is w(1-t)(h-l) where t is the tax rate. What effect does the income tax have on consumption and labor supply? Explain your results in terms of income and substitution effects. 4. Suppose that the government announces a ban on hiring foreign domestic helpers. The representative consumer now has to give up some of her leisure activities to spend more of her time doing housework. Her preference toward the consumption bundle changes and she is now willing to consume less for additional leisure time. Assuming that there has been no effect on real wage (w), taxes (T), and dividend income, how does this new policy affect the consumer’s choice of work and consumption? Draw a diagram to explain your answer. 5. Suppose a two-person household. Person 1 has h1 units of time and takes l1 units of leisure time, and person 2 has h2 units of time available and takes l2 units of leisure time. Collectively, the two persons in the household care about their total consumption c, and their total leisure l=l1+l2, and they have preferences over their total consumption and total leisure. But person 1 faces a market wage w1, and person 2 faces a market wage w2, with w1>w2. a. Draw the budget constraint faced by the two-person household. What will the household do, that is, how much does each household member work? b. What happens if the market wage of person 2 rises? 6. Suppose that the government imposes a lump-sum tax on goods produced by a firm. Determine the effect of this tax on the firm’s demand for labor. 7. An emerging economy changes its policy, attracting more foreign direct investment, which leads to the accumulation of a more productive capital stock. How does this policy affect the aggregate output, consumption, employment, and real wage? Explain your results with a diagram and illustrate the income and substitution effects.