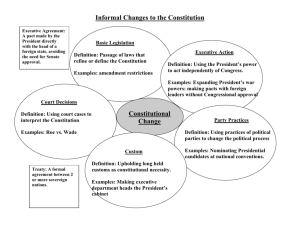

Constitutional Law 1 – Midterm Reviewer Political Law defined. That branch of public law which deals with the organization ,and operations of the governmental organs of the State and defines the relations of the State with the inhabitants of its territory [People v. Perfecto, 43 Phil. 887; Macariola v. Asuncion, 114 SCRA 77]. In case of doubt, the provisions should be considered self executing; mandatory rather than directory; and prospective rather than retroactive. Self-executing provisions. A provision which lays down a general principle is usually not self-executing. But a provision which is complete in itself and becomes operative without the aid of supplementary or enabling legislation, or that which supplies a sufficient rule by means of which the right it grants may be enjoyed or protected, is self-executing. Nature. That written instrument enacted by direct action of the people by which the fundamental powers of the government are established, limited and defined, and by which those powers are distributed among the several departments for their safe and useful exercise for the benefit of the body politic [Malcolm, Philippine Constitutional Law, p. 6]. a constitutional provision is self-executing if the nature and extent of the right conferred and the liability imposed are fixed by the Constitution itself, so that they can be determined by an examination and construction of its terms, and there is no language indicating that the subject is referred to the legislature for action Purpose. To prescribe the permanent framework of a system of government, to assign to the several departments their respective powers and duties, and to establish certain first principles on which the government is founded [11 Am. Jur. 606]. BRIEF CONSTITUTIONAL HISTORY. Classification 1. The Malolos Constitution. This was the first republican constitution in Asia. The Constitution recognized that sovereign power was vested in the people, provided for a parliamentary government, acknowledged separation of powers, and contained a bill of rights. 2. The American Regime and the Organic Acts a. The Treaty of Paris of December 10, 1898. It provided, among others, for the cession of the Philippine Islands by Spain to the US. b. US President McKinley’s Instructions of April 7, 1900, to transform the military into a civil government as rapidly as conditions would permit. c. The Spooner Amendment to the Army Appropriation Bill of March 2, 1901. for the establishment of a civil government and for maintaining and protecting the inhabitants in the free enjoyment of their liberty, property and religion. d. The Philippine Bill of July 1, 1902 continued the existing civil government, with the commitment from the US Congress to convene and organize in the Philippines a legislative body of their own representatives. 1. Written or unwritten 2. Enacted (Conventional) or Evolved (Cumulative) 3. Rigid or Flexible Qualities of a good written Constitution: 1. Broad 2. Brief 3. Definite Essential parts of a good written Constitution: 1. Constitution of Liberty 2. Constitution of Government 3. Constitution of Sovereignty Interpretation/Construction of the Constitution. verba leais - whenever possible, the words used in the Constitution must be given their ordinary meaning except where technical terms are employed. (Language) ratio leqis et anima - The words of the Constitution should be interpreted in accordance with the intent of the framers. ut maais valeat auam pereat - the Constitution has to be interpreted as a whole. 1 Constitutional Law 1 – Midterm Reviewer e. The Jones Law [Philippine Autonomy Act] of August 29, 1916. It was the principal organic act of the Philippines until November 15,1935, when the Philippine Commonwealth was inaugurated. f. The Tydings-McDuffie Act [Philippine Independence Act] of March 24, 1934 authorized the drafting of a Constitution for the Philippines, the establishment of a Commonwealth Government and, after ten years, independence. affects only the specific provision being amended. two-part test. 1. quantitative test asks whether the proposed change is so extensive in its provisions as to change directly the “substance entirety” of the Constitution by the deletion or alteration of numerous provisions. 2. qualitative test, which inquires into the qualitative effects of the proposed change in the Constitution. The main inquiry is whether the change will “accomplish such far-reaching changes in the nature of our basic governmental plan as to amount to a revision”. 3. The 1935 Constitution The Philippine Commonwealth established under the Constitution was inaugurated on November 15, 1935; full independence was attained with the inauguration of the (Third) Philippine Republic on July 4, 1946. 4. The Japanese (Belligerent) Occupation October 14, 1943, the (Second) Philippine Republic was inaugurated, with Jose P. Laurel as President. 5. The 1973 Constitution. Presidential Proclamation No. 1081, on September 21, 1972: Declaration of martial law by President Ferdinand E. Marcos. 6. The 1987 Constitution. Effectivity of the 1987 Constitution: February 2, 1987, the date of the plebiscite when the people ratified the Constitution [De Leon v. Esguerra, 153 SCRA 602]. Lambino vs Comelec The essence of amendments directly proposed by the people through initiative upon a petition is that the entire proposal on its face is a petition of the people. Thus, two essential elements must be present: (1) The people must author and sign the entire proposal; no agent or representative can sign in their behalf. (2) As an initiative upon a petition, the proposal must be embodied in the petition. People’s initiative applies only to an amendment, not a revision, of the Constitution Judicial Review: The power of the courts to test the validity of executive and legislative acts in light of their conformity with the Constitution. This is not an assertion of superiority by the courts over the other departments, but merely an expression of the supremacy of the Constitution. The power is inherent in the Judicial Department, by virtue of the doctrine of separation of powers. AMENDMENT VS. REVISION. Lambino v. Comelec, G.R. No. 174153, October 25, 2006 Revision broadly implies a change that alters a basic principle in the Constitution, like altering the principle of separation of powers or the system of checks and balances. There is also revision if the change alters the substantial entirety of the Constitution Amendment broadly refers to a change that adds, reduces, deletes, without altering the basic principle involved. Revision generally affects several provisions of the Constitution; while amendment generally Who may exercise the power. Sec. 4(2), Art. VIII of the Constitution recognizes the power of the Supreme Court to decide constitutional questions. Sec. 5(2), Art. VIII, which prescribes the constitutional appellate jurisdiction of the Supreme Court, and implicitly recognizes the authority of lower courts to decide questions involving the constitutionality of laws, treaties, international agreements. 2 Constitutional Law 1 – Midterm Reviewer Functions of Judicial Review Checking Legitimating Symbolic [See: Salonga v. Pano, 134 SCRA 438] IV. Requisites of Judicial Review/lnquiry: a. Actual case or controversy. b. The constitutional question must be raised by the proper party. ELEMENTS OF A STATE. I. II. People Also known in the constitution as: Inhabitants, Citizens, Electors. Territory a. National Territory – Article 1 UN Convention on the Law of the Sea (UNCLOS) [April 30,1982; ratified by the Philippines in August, 1983] provides (i) Contiguous Zone of 12 miles; (ii) Exclusive Economic Zone of 200 miles. Although the contiguous zone and most of the exclusive economic zone may not, technically, be part of the territory of the .State, nonetheless, the coastal State enjoys preferential rights over the marine resources found within these zones. III. Government may act as guardian of the rights of people who may be disadvantaged or suffering from some disability or misfortune. Sovereignty - The supreme and uncontrollable power inherent in a State by which that State is governed Characteristics: permanence, exclusiveness, comprehensiveness, absoluteness, indivisibility, inalienability, imprescriptibility. Dominium refers to the capacity to own or acquire property, including lands held by the State in its proprietary capacity; while Imperium is the authority possessed by the State embraced in the concept of sovereignty. STATE IMMUNITY FROM SUIT. “The State cannot be sued without its consent” [Sec. 3, Art. XVI]. There can be no legal right against the authority which makes the law on which the right depends. However, it may be sued if it gives consent, whether express or implied. Government - The agency or instrumentality through which the will of the State is formulated, expressed and realized. Government of the Philippines is “the corporate governmental entity through which the functions of government are exercised throughout the Philippines, including, save as the contrary appears from the context, the various arms through which political authority is made effective in the Philippines, whether pertaining to the autonomous regions, the provincial, city, municipal or barangay subdivisions or other forms of local government" [Sec. 2 (1), Administrative Code of 1987] Doctrine of Parens Patriae. Literally, parent of the people. As such, the A foreign agent, operating within a territory, can be cloaked with immunity from suit but only as long as it can be established that he is acting within the directives of the sending State. The cloak of protection is removed the moment the foreign agent is sued in his individual capacity, The United Nations, as well as its organs and specialized agencies, are likewise beyond the jurisdiction of local courts Even other international organizations or international agencies may be immune from the jurisdiction of local courts and local administrative tribunals Test to determine if suit is against the State: On the assumption that decision is rendered against the public officer or agency impleaded “will the enforcement thereof require an affirmative act from the State, such as the appropriation of the needed amount to satisfy the judgment?” 3 Constitutional Law 1 – Midterm Reviewer the suit really affects the property, rights or interests of the State and not merely those of the officers nominally made party defendants. Suits against Government Agencies a. Incorporated: If the charter provides that the agency can sue and be sued, then suit will lie, including one for tort Municipal corporations are agencies of the State when they are engaged in governmental functions and, therefore, should enjoy the sovereign immunity from suit. However, they are subject to suit even in the performance of such functions because their respective charters provide that they can sue and be sued. Sec. 22, Local Government Code, is the power to sue and be sued. b. Unincorporated: Inquire into principal functions of the agency. If governmental: NO suit without consent If proprietary: suit will lie (to be sustainable or admissible as an action or appeal) because when the State engages in principally proprietary functions, then it descends to the level of a private individual, and may, therefore, be vulnerable to suit. immunity “cannot be used to perpetrate an injustice”. The unauthorized acts of government officials are not acts of state; thus, the public officer may be sued and held personally liable in damages for such acts Where the public official is sued in his personal capacity, the doctrine of state immunity will not apply, even if the acts complained of were committed while the public official was occupying a'public position. Need for consent. In order that suit may lie against the state, there must be consent, either express or implied. Express consent can be given only by an act of the legislative body, in a general or a special law. Implied Consent. When the State commences litigation, it becomes vulnerable to a counterclaim. except when the State intervenes not for the purpose of asking for any affirmative relief, but only for the purpose of resisting the claim precisely because of immunity from suit When the State enters into a business contract. jure imperii (sovereign acts) and in jure gestionis (commercial or proprietary acts). Suit against Public Officers The doctrine of State immunity also applies to complaints filed against officials of the State for acts performed by them in the discharge of their duties within the scope of their authority. Where the contract is in pursuit of a sovereign activity, there is no waiver of immunity, and no implied consent may be derived therefrom. exceptions when a public officer may be sued without the prior consent of the State Scope of Consent. Consent to be sued does not include consent to the execution of judgment against it. 1. to compel him to do an act required by law; 2. to restrain him from enforcing an act claimed to be unconstitutional; 3. to compel the payment of damages from an already appropriated assurance fund or to refund tax over-payments from a fund already available for the purpose; 4. to secure a judgment that the officer impleaded may satisfy by himself without the State having to do a positive act to assist him; and 5. where the government itself has violated its own laws, because the doctrine of state Such execution will require another waiver, because the power of the court ends when the judgment is rendered, since government funds and properties may not be seized under writs of execution or garnishment, unless such disbursement is covered by the corresponding appropriation as required by law 4 But funds belonging to government corporations (whose charters provide that they can sue and be sued) that are deposited Constitutional Law 1 – Midterm Reviewer with a bank are not exempt from garnishment Limitations: Generally, the Bill of Rights, although in some cases the exercise of the power prevails over specific constitutional guarantees. The courts may annul the improvident exercise of police power Suability not equated with outright liability. Liability will have to be determined by the Court on the basis of the evidence and the applicable law. POLICE POWER The power of promoting public welfare by restraining and regulating the use of liberty and property. FUNDAMENTAL POWERS OF THE STATE The inherent powers of the State are: Police power is the most pervasive, the least limitable, and the most demanding of the three powers. (a) Police Power; (b) Power of Eminent Domain; and (c) Power of Taxation salus populi est suprema lex - The welfare of the people is the supreme law sic utere tuo ut alienum non laedas - use your property in such a way that you do not damage others' Similarities: Inherent in the State, exercised even without need of express constitutional grant. Necessary and indispensable; State cannot be effective without them. Methods by which State interferes with private property. Presuppose equivalent compensation Exercised primarily by the Legislature. Who may exercise the power. The power is inherently vested in the Legislature. However, Congress may validly delegate this power to the President, to administrative bodies and to lawmaking bodies of local government units. Local government units exercise the power under the general welfare clause. Distinctions The taxing power may be used as an implement of police power Eminent domain may be used as an implement to attain the police objective Police power regulates both liberty and property; eminent domain and taxation affect only property rights. Police power and taxation are exercised only by government; eminent domain may be exercised by private entities. Property taken in police power is usually noxious or intended for a noxious purpose and may thus be destroyed; while in eminent domain and taxation, the property is wholesome and devoted to public use or purpose. Compensation in police power is the intangible, altruistic feeling that the individual has contributed to the public good; in eminent domain, it is the full and fair equivalent of the property taken; while in taxation, it is the protection given and/or public improvements instituted by government for the taxes paid. Limitations (Tests for Valid Exercise): a. Lawful subject - The interests of the public in general as distinguished from those of a particular class, require the exercise of the power. This means that the activity or property sought to be regulated affects the general welfare; b. Lawful Means: The means employed are reasonably necessary for the accomplishment of the purpose, and not unduly oppressive on individuals. The proper exercise of the police power requires compliance with the following requisites: (a) the interests of the public generally, as distinguished from those of a particular class, require the intereference by the State; and (b) the means employed are reasonably necessary for the attainment of the object sought and not unduly oppressive upon individuals. 5 Constitutional Law 1 – Midterm Reviewer Additional Limitations [When exercised by delegate]: 2. Private Property - Private property already devoted to public use cannot be expropriated by a delegate of legislature acting under a general grant of authority 3. Taking in the constitutional sense. 4. Public use - The term “public use” has now been held to be synonymous with “public interest”, “public benefit”, “public welfare”, and “public convenience” 5. Just compensation. - The full and fair equivalent of the property taken; it is the fair market value of the property. It is settled that the market value of the property is “that sum of money which a person, desirous but not compelled to buy, and an owner, willing but not compelled to sell, would agree on as a price to be given and received therefor”. 6. Due process of law. The defendant must be given an opportunity to be heard. a. Express grant by law b. Within territorial limits c. Must not be contrary to law the Supreme Court declared that for municipal ordinances to be valid, they: [a] must not contravene the Constitution or any statute; [b] must not be unfair or oppressive; [c] must not be partial or discriminatory; [d] must not prohibit, but may regulate, trade; [e] must not be unreasonable; and [f] must be general in application and consistent with public policy. POWER OF EMINENT DOMAIN Also known as the power of expropriation, POWER OF TAXATION Who may exercise. Primarily, the legislature; also: local legislative bodies [Sec. 5, Art. X, Constitution]; and to a limited extent, the President when granted delegated tariff powers [Sec. 28 (2), Art. VI], Police power is the power of the State to promote public welfare by restraining and regulating the use of liberty and property. The power of eminent domain is the inherent right of the State to condemn private property to public use upon payment of just compensation. - Limitations on the exercise. a. Due process of law: tax should not be confiscatory. With the legislature primarily lies the discretion to determine the nature, object, extent, coverage and situs of taxation. b. Equal protection clause: Taxes should be uniform and equitable [Sec. 28 (1), Art. VI]. c. Public purpose. Treated as a special fund and paid out for such purpose only; when purpose is fulfilled, the balance, if any, shall be transferred to the general funds of the Government. Sec. 9, Art. Ill of the Constitution, in mandating that “private property shall not be taken for public use without just compensation”, merely imposes a limit on the government’s exercise of this power and provides a measure of protection to the individual’s right to property. Who may exercise the power. Congress and, by delegation, the President, administrative bodies, local government units, and even private enterprises performing public services. Local government units have no inherent power of eminent domain; they can exercise the power only when expressly authorized by the Legislature. Double Taxation Additional taxes are laid on the same subject by the same taxing jurisdiction during the same taxing period and for the same purpose. Requisites for exercise: 1. Necessity - The issue of the necessity of the expropriation is a matter properly addressed to the Regional Trial Court in the course of the expropriation proceedings. Direct – Not allowed Indirect – allowed 6 Constitutional Law 1 – Midterm Reviewer Tax Exemptions. Requisite: No law granting any tax exemption shall be passed without the concurrence of a majority of all the Members of Congress a. Sec. 28 (31 Art. VI: Charitable institutions, churches and parsonages or convents appurtenant thereto, mosques, non-profit cemeteries, and all lands, buildings and improvements, actually, directly and exclusively used for religious, charitable or educational purposes shall be exempt from taxation. b. Sec. 4 (3) Art. XIV: All revenues and assets of non-stock, non-profit educational institutions used actually, directly and exclusively for educational purposes shall be exempt from taxes and duties, x x x Proprietary educational institutions, including those co-operatively owned, may likewise be entitled to such exemptions subject to the limitations provided by law including restrictions on dividends and provisions for reinvestment. c. Sec. 4 (41 Art. XIV: Subject to conditions prescribed by law, ail grants, endowments, donations, or contributions used actually, directly and exclusively for educational purposes shall be exempt from tax. d. Where tax exemption is granted gratuitously, it may be revoked at will; but not if granted for a valuable consideration. License fee is a police measure; tax is a revenue measure. License fee is paid for the privilege of doing something, and may be revoked when public interest so requires; Tax is imposed on persons or property for revenue. 7 Constitutional Law 1 – Midterm Reviewer PRINCIPLES AND STATE POLICIES been delegated to the legislative or executive branch of government. It is concerned with issues dependent upon the wisdom, not legality, of a particular measure Republicanism [Sec. 1. Art. II] Separation of powers - To prevent concentration of authority in one person or group of persons that might lead to an irreversible error or abuse in its exercise to the detriment of republican institutions. Delegation of Powers Potestas delegata non potest delegare Permissible delegation Principle of Blending of Powers. Instances when powers are not confined exclusively within one department but are assigned to or shared by several departments, e.g., enactment of general appropriations law. PETAL People - Under the 1987 Constitution, there are specific provisions where the people have reserved to themselves the function of legislation. Principle of Checks and Balances. This allows one department to resist encroachments upon its prerogatives or to rectify mistakes or excesses committed by the other departments, e.g., veto power of the President as check on improvident legislation, etc.. Emergency Powers to the President - Sec. 23(2), Art. VI The exercise of emergency powers, such as the taking over of privately-owned public utilities or businesses affected with public interest, requires a delegation from Congress. - Sec. 17, Art. XII, Role of the Judiciary. The judicial power, as defined in Sec. 1, Art. VIII, “includes the duty of the courts of justice to settle actual controversies involving rights which are legally demandable and enforceable, and to determine whether or not there has been a grave abuse, of discretion amounting to lack or excess of jurisdiction on the part of any branch or instrumentality of the Government. (Judicial review) Tariff Powers to the President - Sec. 28(2), Art. VI The Tariff and Customs Code grants such stand-by powers to the President. Administrative Bodies - “The power of subordinate legislation.” Local Government Unit - “Such legislation (by local governments) is not regarded as a transfer of general legislative power, but rather as the grant of the authority to prescribe local regulations, according to immemorial practice, subject, of course, to the interposition of the superior in cases of necessity” [Peopje v. Vera, supra.]. first and safest criterion to determine whether a given power has been validly exercised by a particular department whether or not the power has been constitutionally conferred upon the department claiming its exercise — since the conferment is usually done expressly. This recognizes the fact that local legislatures are more knowledgeable than the national lawmaking body on matters of purely local concern, and are in a better position to enact appropriate legislative measures thereon. Political and justiciable questions justiciable question implies a given right, legally demandable and enforceable, an act or omission violative of such right, and a remedy granted and sanctioned by law for said breach of right. Tests for valid delegation 1. Completeness Test. The law must be complete in all its essential terms and conditions when it leaves the legislature so that there will be nothing left for the delegate to do when it reaches him except to enforce it. Political question’ connotes what it means in ordinary parlance, namely a question of policy. It refers to those questions which, under the Constitution, are to be decided by the people in their sovereign capacity, or in regard to which full discretionary authority has 8 Constitutional Law 1 – Midterm Reviewer 2. Sufficient standard test. A sufficient standard is intended to map out the boundaries of the delegate’s authority by defining the legislative policy and indicating the circumstances under which it is to be pursued and effected. The Incorporation Clause [Sec. 2. Art. II] 1. Renunciation of war Defensive – yes Offensive – no The congress declare state of war Doctrine of incorporation. By virtue of this clause, our Courts have applied the rules of international law in a number of cases even if such rules had not previously been subject of statutory enactments, because these generally accepted principles of international law are automatically part of our own laws. international law can become part of the sphere of domestic law by: 1. transformation method requires that an international law principle be transformed into domestic law through a constitutional mechanism, such as local legislation. 2. incorporation method applies when, by mere constitutional declaration, international law is deemed to have the force of domestic law with situations in which there appears to be a conflict between a rule of international law and the provisions of the constitution or statute of the local state. Efforts should first be exerted to harmonize them, so as to give effect to both. In a situation, however, where the conflict is irreconcilable and a choice has to be made between a rule of international law and municipal law, jurisprudence dictates that municipal law should be upheld by the municipal courts. 9