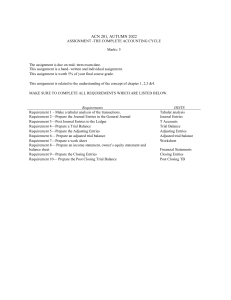

ACN 201, AUTUMN 2022 ASSIGNMENT -THE COMPLETE ACCOUNTING CYCLE Marks: 5 The assignment is due on mid- term exam date. This assignment is a hand- written and individual assignment. This assignment is worth 5% of your final course grade. This assignment is related to the understanding of the concept of chapter 1, 2,3 &4. MAKE SURE TO COMPLETE ALL REQUIREMENTS WHICH ARE LISTED BELOW. Requirements Requirement 1 – Make a tabular analysis of the transactions. Requirement 2—Prepare the Journal Entries in the General Journal Requirement 3—Post Journal Entries to the Ledger Requirement 4—Prepare a Trial Balance Requirement 5—Prepare the Adjusting Entries Requirement 6— Prepare an adjusted trial balance Requirement 7—Prepare a work sheet Requirement 8— Prepare an income statement, owner’s equity statement and balance sheet Requirement 9—Prepare the Closing Entries Requirement 10— Prepare the Post Closing Trial Balance HINTS Tabular analysis Journal Entries T Accounts Trial Balance Adjusting Entries Adjusted trial balance Worksheet Financial Statements Closing Entries Post Closing TB During its first month of operation, the Flower Landscaping Corporation, which specializes in residential landscaping, completed the following transactions. March 1 Owner invested $72000 cash in the business. March 2 Paid the current month's rent, $4,500. March 3 Paid the premium on a 1-year insurance policy, $3,300. March 7 Purchased supplies on account from Parkview Company, $900. March 10 Paid employee salaries, $2,200. March 14 Purchased equipment from Hammond Company, $9,000. Paid $1,500 down and the balance was placed on account. Note: Use accounts payable for the balance due. March 15 Received cash for landscaping revenue for the first half of March, $4,896. March 19 Made payment on account to Parkview Company, $450. March 31 Received cash for landscaping revenue for the last half of March, $5,304. Requirements: 1. Make a tabular analysis of the transactions using the following column headings: cash, prepaid insurance, supplies, equipment, accounts payable, owner’s capital, owner’s drawings, revenue and expense. 2. Prepare journal entries to record the March transactions. 3. Prepare necessary T Accounts 4. Prepare a trial balance on March 31 Other data: a) One month's insurance has expired. b) The remaining inventory of supplies is $475. c) The estimated depreciation on equipment is $150. Requirements: 5. 6. 7. 8. 9. 10. Prepare appropriate adjusting entries on March 31. Prepare an adjusted trial balance on March 31. Enter the adjusted trial balance on the worksheet and complete the worksheet Prepare an income statement, owner’s equity statement for March and a balance sheet on March 31. Prepare the closing entries. Prepare a post -closing trial balance.