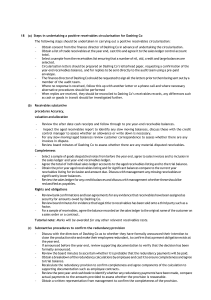

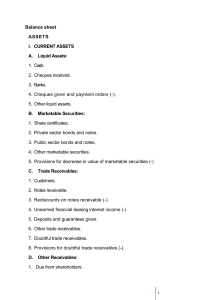

CASE : Comprehensive Limited: The following information is extracted from the balance sheet of Comprehensive ltd : Rs. In Crores FIXED ASSETS 290 NET WORTH 100 CURRENT ASSETS: TERM 220 LIABILITIES INVENTORIES 33 CURRENT LIABILITIES: EXPORT 5 TRADE CREDITORS 12 RECEIVABLES INDEGENOUS 10 BANK 5 RECEIVABLES BORROWINGS OTHER CURRENT 2 OTHER CURRENT 3 ASSETS LIABILITIES (SHORT TERM INVESTMENT IN SUBSIDIARIES AND ASSOCIATES) 340 340 Additional information : Term Loan installment due within one year- Rs 20 Inventory includes non moving inventories amounting to Rs 3 Receivables include receivables more than one year 5% Question: 1. Calculate MPBF under the modified MPBF method. 2. Deliver the credit as per Credit Delivery System 3. If the Financing Bank’s capital Funds is Rs 100 Crores, can it finance the entire requirement of the borrower. If Not, How the financing is to be made by Bankers. 4. Is there any RBI guidelines that puts a limit on a Bank’s exposure to individual borrower or group Borrowers? 5. How about creation of Charge on Securities? 6. How do you monitor the Borrowal Account?