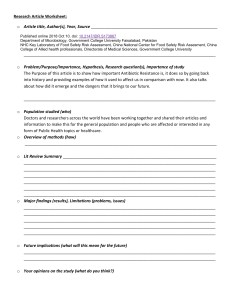

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by Journal of Business and Management JOURNAL OF BUSINESS AND MANAGEMENT Vol . 3, No.7, 20 14: 79 9-812 INVESTMENT DECISION BASED ON FINANCIAL PERFORMANCE ANALYSIS AND MARKET APPROACH VALUATION OF INDONESIAN CONSTRUCTION SECTOR Rahmat Faikar Makarim and Ana Noveria School of Business and Management Institut Teknologi Bandung, Indonesia rahmat.faikar@sbm-itb.ac.id Abstract- Investment is one of the tools for a company in gaining additional capital. This research will seeks the analysis of company financial performance and valuation as the fundamental tools in making investment decision on Indonesia construction sector, represented by 5 listed construction sector companies, which are PT Adhi Karya (ADHI), PT Wijaya Karya (WIKA), PT Nusa Konstruksi Enjiniring (DGIK), PT Total Bangun Persada (TOTL), and PT Surya Semesta Internusa (SSIA). By analyzing the financial performance, could be obtained the financial health condition of the company that will represent the company future to attract the investors. While the market approach valuation is used to see whether the company is undervalued or overvalued. Due to the development of Indonesia into a developed country, this sector has a high demand of work that make it always able to generate high net sales and profit for the past few years. This makes this sector one of the most secure stock to investing in. Moreover, the under value of their share price will give the investors possibilities of high return and probable increase of stock price on the future. Keywords: Construction sector, financial ratios, valuation, market approach, financial performance. Introduction Jakartaglobe.com stated that nowadays, construction stock sector is the market leader of Indonesian stock market gains. Along with the series of infrastructure and development projects in many big cities in Indonesia as the manifestation of the government’s multiyear Master Plan for the Acceleration and Expansion of Indonesia’s Economic Development (MP3EI) since 2012. World bank stated that on 2010 Indonesia is the 4th biggest population country, the population significantly rise from 37.7% in 2003 towards 56.5% in 2010. This figures indicates a high residential needs in Indonesia as a development country. With the increase of its populations, the numbers of construction work demand for the public-infrastructure will also growing. In this case the availability of construction sector business will be much needed, to facilitate the country growth. Despite of the bright future of the industry, the competition inside the sector is not easy. There were about 44 construction or infrastructure companies in Indonesia and 5 of them have been listed for more than 5 years in Indonesia, which are PT. Wijaya Karya Beton Tbk. (WIKA), PT Adhi Karya Tbk. (ADHI), PT. Nusa Konstruksi Enjiniring Tbk. (DGIK), PT. Total Bangun Persada Tbk. (TOTL), and PT. Surya Semesta Internusa Tbk. (SSIA), that make a though competition of the business. To estimate the success chance of the investment decision-making, there are many tools to analyze the stock return. Some of the tools to analyze the return of the companies are financial statement analysis and estimating firm’s value as part of the fundamental analysis. By financial statement analysis the investors should be able to see the company financial health from the financial performance track record, the rate return, financial risk involved, competitor’s position, market situation, and many other factors before making the decision. While from the firm’s value, the 799 Makarim and Noveria / Journal of Business and Management, Vol.3, No.7, 2014: 800-812 investors could see whether the firm is over value or under value compared to the current market situation to strengthen the research as the additional analysis in investing. The conclusions will shows the investor to be more informed about their investing decision, and it will also shows the worthiness of investing on this sector Literature Review Financial Statement Analysis Overview The main function of a financial statement is to provide financial information about a company to any interested parties. Generally, there is wide information about a company performance that could be obtained from the company financial statement. According to Ikatan Akuntan Indonesia (IAI) (2007) financial statement is part of financial reporting. It shows the company financial condition on a periods based from the historical company financial data. It shows the company’s wealth, capital, liability, profit, loss, operational, stockholders, and transactions. Mainly, a financial statement provides the company’s financial performance that will be used as the base for the user decision-making related with the company’s economic condition. A good financial statement consists of five principles. Which are, balance sheets, income statement, cash flow, Statement of Changes in equity, and footnotes. Common Size Financial Statements Stephen A.Ross (2010) stated that to get the analysis of a financial statement is to compare it with similar companies. The problem may occur when comparing a company financial statement analysis is the difference size of financial statement. One useful way to standardize the size is by compare the value of it with percentage instead of using currencies. This method is usually called with common-size financial statements. The Common size financial statement analysis is divided into common size of balance sheet and common size of income statement, according to Sharma (2012) Common Size Statement is an ideal tool for comparing financial statement of different sizes companies. Financial Ratio Analysis Overview In accordance to (Horne, 2008) financial ratio is one of the tools used to assess the financial condition and performance. To get the valuable insight from a financial statement could be derived from the analysis of the numbers on the financial statement, which is analyzing the financial ratio of the company; it’s a major tool used for the investment decision based on a company financial report analysis, because it will evaluate various aspect of firm’s financial condition through the value on the financial statement. Furthermore, Gitman (2009) divides financial ratios into five basic categories, which are: liquidity, activity, debt, profitability, and market ratios. Liquidity, activity, and debt ratios primarily measure risk. Profitability ratios will measure the return. While, market ratios will capture both of risk and return on the company. The ratio gives valuable insight into the health of a firm, the financial condition and profitability. Financial ratio relates two pieces of financial data by dividing one quantity to another. The financial health could affect investor’s interest to invest on the company. The financial ratios growth on a period could be evaluated to predict the company’s financial trend. One of the tools used to measure of a company growth is calculating the company’s compound growth analysis rate (CAGR). Compound Annual Growth Rate By calculating CAGR the performance growth could be determined through dividing the ending value to the beginning value. Equation 1: CAGR Liquidity Ratio 800 Makarim and Noveria / Journal of Business and Management, Vol.3, No.7, 2014: 800-812 Current Ratio “A measure of liquidity calculated by dividing the firm’s current assets by its current liabilities. A higher current ratio indicates a greater degree of liquidity”. Equation 2: Current Ratio Quick Ratio “Quick ratio or acid test ratio is a measure of liquidity calculated by dividing the firm’s current assets minus inventory by its current liabilities”. Generally it is similar with current ratio, except it excludes inventory. Equation 3: Quick Ratio Activity Ratio Total Asset Turnover “Total Asset Turnover indicates the efficiency with which the firm uses its assets to generate sales”. Equation 4: Total Asset Turnover Inventory Turnover “Inventory turnover measures the activity, or liquidity, of a firm’s inventory”. Equation 5: Inventory Turnover Average Collection Period “The average amount of time needed to collect accounts receivable. It is useful in evaluating credit and collection policies”. Equation 6: Average Collection Period Debt/Leverage Ratio Debt Ratio “Measures the proportion of total assets financed by the firm’s creditors”. The higher this ratio, the greater the amount of other people’s money used to generate profits. Equation 7: Debt Ratio Long-Term Debt to Capital “Long-term debt to capital ratio is determining the degree of reliance by a company to finance its dayto-day operations”. Equation 8: Long-term debt to capital Time Interest Earned Ratio “Measures the firm’s ability to make contractual interest payments; sometimes called the interest coverage ratio” . Equation 9: Times Interest Earned Ratio Profitability Ratio Gross Profit Margin “Measures the percentage of each sales dollar remaining after the firm has paid for goods”. 801 Makarim and Noveria / Journal of Business and Management, Vol.3, No.7, 2014: 800-812 Equation 10: Gross Profit Margin Operating Profit Margin “Measures the percentage of each sales dollar remaining after all costs and expenses other than interest, taxes, and preferred stock dividends are deducted” . (“Pure profits” earned on each sales dollar). Equation 11: Operating Profit Margin Net Profit Margin “Measures the percentage of each sales dollar, remaining after all costs and expenses, including interest, taxes, and preferred stock dividends, have been deducted”. Equation 12: Net-Profit Margin Return on Asset “Return on Assets (ROA) measures the overall effectiveness of management in generating profits with its available assets”. Equation 13: ROA Return on Equity “Return on equity (ROE) Measures the return earned on the common stockholder’s investment in the firm”. Equation 14: ROE Earnings Per share “Earnings per share (EPS) represent the number of dollars earned during the period on behalf of each outstanding share of common stock” . Equation 15: EPS Market Ratio Price/Earnings (P/E) Ratio “P/E Ratio measures the amount that investors are willing to pay for each dollar of a firm’s earnings”. A high P/E ratio will increase the investor confidence to invest on the company Equation 16: P/E Ratio Comparing Company Financial Ratio On analyzing multi companies financial ratios, the ratios of each company should be differ one to each other. The different will be needed as the base to decide the lead company between the comparisons; it will ease the decision for investors to invest on a company among similar companies. Gitman (2009) states two main types of ratio comparisons, which are: cross-sectional analysis and time-series analysis. 802 Makarim and Noveria / Journal of Business and Management, Vol.3, No.7, 2014: 800-812 Cross Sectional Analysis is a comparison of different firms financial ratios at the same point in time. Frequently, it compares the firm’s ratios to those other firms in its industry or to the industry averages (Gitman, Principles of Managerial Finance, 2009). Time series analysis By using time series analysis could be obtained whether the company performance falling, rising, or stay constantly over a time period. Intra and intercompany comparison also could be done with time series technique. The use of DuPont System Analysis DuPont system analysis is the system used to analyze the firm’s financial statements and to assess its financial condition. (Gitman, 2009). Furthermore, DuPont system of analysis decomposes return on net operating assets into two multiplicative components: profit margin and asset turnover. Prior research has found that a change in asset turnover is positively related to future changes in earnings. The DuPont system analysis will merge the income statement and balance sheet of the company to two summary measures of profitability, which is Retun on Assets (ROA) and Return on Equity (ROE). This system identifies profitability as being impacted by three different methods, which are earnings, turnings, and leverage, or net profit margin, total asset turnover, and equity multiplier. Equation 17: ROA & ROE DuPont Formulation Company Valuation Analysis Theories Aswath Damodaran (2002) stated on his little book of valuation that valuation is one of the important things in financing. By knowing the value of an asset it may not be guarantee a success on investing. But it will help the investors to make more informed decision. Market Approach Based on the research of Robert F Reilly (2012), market approach is commonly operated because it used the real market value as it main indicator. Generally, the result of this approach will determine the firm’s share price, assigned by comparing numerous aspects of the company to similar aspect of other companies that the market value already has established. As stated by Damodaran (2002), the best comparable companies are the one who has the cash flow, growth potential, and risk similar to the valued company. Considerably stated that market ratios will be much used to value a company in relations to its risk and return condition on the real market. Equation 18: Estimating share Price using Market Approach Methodology Problem Identification Research Objective Literature Review Result & Conclusion Data Analysis Data Collection Figure 1: Research Methodology 803 Makarim and Noveria / Journal of Business and Management, Vol.3, No.7, 2014: 800-812 Problem Identification: Explain the problem identification and research scope and limitation based on the case background Research Objective: Explain the theories used to reach the main purpose of this research Data Collection: The data gathering process that related with the main research topic Data Analysis: The analyzed and calculated data as the core of this research Result & Conclusion: Shows the result of this research objective and conclude it to answer the entire research problem Data Collection & Analysis In this research, the author used the annual report data of PT Adhi Karya, PT Wijaya Karya, PT Nusa Konstruksi Enjiniring, PT Total Bangun Persada, and PT Surya Semesta Internusa from 2009 to 2013. The data was obtained from Indonesia Stock Exchange official website. There are several steps used on this research. For the company performance assessment, the methods used are financial ratios calculation; the author will only discussed the profitability and market ratios due to the relation with the return of the company. DuPont analysis is used to examine the companies’ financial statement to measure the profitability. The financial ratio comparison will be operated by time-series analysis to evaluate the trend situation of the companies and cross-sectional analysis or benchmarking to the industry average. The industry average data are gathered from (www.reuters.com) the author also used financial statement analysis, or common-size financial statement, and finding the CAGR of the company’s income statement. For the company valuation, market approach will be operated. Trend Analysis Table 1. Financial ratio of PT Adhi Karya (Persero) Tbk PT ADHI KARYA (persero) Tbk. Liquidity Leverage / Solvency Activity Profitability Market Financial Ratios Current Ratio Quick Ratio Total Debt Ratio Times Interest Earned Ratio Long Term Debt to Capital Inventory Turnover 2009 1.20 1.17 0.87 4.98 0.10 57.37 2010 1.14 1.13 0.83 5.13 0.12 80.37 2011 1.10 1.09 0.84 4.74 0.04 86.94 2012 1.24 1.22 0.85 5.94 0.11 57.24 2013 1.39 1.37 0.84 7.62 0.17 53.27 Total Asset Turnover Average Collection Period (days) Gross Profit Margin Operating Profit Margin Net Profit Margin 1.37 85 9.75% 6.96% 2.11% 1.15 107 13.55% 9.71% 3.35% 1.10 90 11.93% 6.18% 2.73% 0.97 112 13.68% 6.71% 2.80% 1.01 101 Earnings per Share (EPS) Return on Assets (ROA) Return on Equity (ROE) P/E Ratio 94.20 2.89% 22.28% 4.35 107.83 103.64 117.46 225.38 3.86% 2.99% 2.71% 4.20% 22.09% 18.45% 18.06% 26.38% 8.44 5.60 14.98 6.70 12.73% 8.40% 4.17% Overall, in the trends of this company shows a positive trend, reflected by the increase from 2009 to 2013. In terms of profitability the company able to manage the increase mainly the success factor of the increased profitability-ratio on this company is because of the increasing net sales that affecting the net income of the company from many construction projects associated to the company’s expanded business line. Not only construction as the core business, but now the company also engages on the engineering Some of the company’s projects on 2013 are the construction of Ngurah Rai Airport, Terminal 3 Soekarno-Hatta Airport, power plant at Kalimantan & Lampung, port Tanjung Priok, and Gede Bage Stadion Bandung. The improvement of company’s earning turns the 804 Makarim and Noveria / Journal of Business and Management, Vol.3, No.7, 2014: 800-812 investors confidence to buy the company’s stock that will relate to the P/E ratio on the market side. Except on 2013 due to the instability of IDR value to the global currency. Table 2. Financial ratio of PT Wijaya Karya (Persero) Tbk PT Wijaya Karya (persero) Tbk. Liquidity Leverage / Solvency Activity Profitability Market Financial Ratios Current Ratio Quick Ratio Total Debt Ratio Times Interest Earned Ratio Long Term Debt to Capital Inventory Turnover Total Asset Turnover Average Collection Period (days) Gross Profit Margin Operating Profit Margin Net Profit Margin Earnings per Share (EPS) Return on Assets (ROA) Return on Equity (ROE) P/E Ratio 2009 2010 2011 2012 2013 1.44 1.41 1.14 1.10 1.10 1.14 1.17 0.97 0.93 0.94 0.73 0.71 0.73 0.74 0.74 9.37 49.69 41.65 23.34 18.99 0.11 0.12 0.12 0.15 0.16 5.71 6.32 8.00 7.82 9.44 1.16 0.96 0.93 0.90 0.94 75 86 88 74 49 9.80% 11.18% 11.17% 11.32% 13.32% 7.36% 7.93% 8.44% 8.61% 10.23% 3.13% 5.17% 5.05% 5.15% 5.25% 33.37 50.15 60.59 76.00 92.92 3.62% 4.95% 4.70% 4.62% 4.96% 13.47% 17.28% 17.62% 17.95% 19.35% 9.74 13.56 10.07 19.47 17.00 Generally, the financial ratio condition of PT Wijaya Karya (persero) Tbk shows some decent improvement from 2009 to 2013, in the terms of profitability and market ratio the company seems to have a steady growth for the past 5 years. Some of the strategies used on this company to keep the growth of its net income are carefully selecting market, by only select government and state owned enterprise (SOE) projects, maintaining the liquidity asset through centralized financing and the self-financing strategy project policy, and efficiency in all aspects. Also, The Company able to maintain a good relation with foreign investors and the main suppliers of the business. On the market side, The P/E ratio seems to be growing each year, except on 2011 and 2013 due to the decreasing market share price. It determine at that time, the investor is not confident enough to buy the stock because some factor like the decreasing company financial performance, economic issue related with the sector, or the instable IDR value to the global currency. Table 3. Financial ratio of PT Nusa Konstruksi Enjiniring Tbk PT Nusa Konstruksi Enjiniring Tbk. Liquidity Leverage / Solvency Activity Profitability Financial Ratios Current Ratio Quick Ratio Total Debt Ratio Times Interest Earned Ratio Long Term Debt to Capital Inventory Turnover Total Asset Turnover Average Collection Period (days) Gross Profit Margin Operating Profit Margin Net Profit Margin Earnings per Share (EPS) Return on Assets (ROA) 2009 2010 2.04 1.53 n/a 1.53 0.39 0.50 4.20 4.30 0.03 0.01 n/a 2142.40 0.86 0.69 21 57 13.78% 14.10% 9.83% 9.92% 5.18% 5.21% 12.09 12.78 4.47% 3.60% 805 2011 2012 2013 2.30 1.78 1.56 2.12 1.58 1.38 0.35 0.43 0.50 3.61 5.56 3.96 0.05 0.04 0.03 11.46 7.94 7.09 0.74 0.69 0.69 62 79 87 12.04% 13.48% 12.82% 5.54% 6.17% 5.55% 0.73% 3.90% 4.55% 1.45 8.60 11.97 0.54% 2.70% 3.15% Makarim and Noveria / Journal of Business and Management, Vol.3, No.7, 2014: 800-812 Market Return on Equity (ROE) P/E Ratio 7.28% 7.20 7.27% 11.43 0.83% 61.48 4.71% 16.75 6.23% 12.53 The financial ratio trend of PT Nusa Konstruksi Enjiniring Tbk, which formerly is PT Duta Graha Indah Tbk at 2010, shows some trend decline for the past 5 years. The net income was fluctuated a lot because of the high price of raw materials used or processing cost. While the price of the materials gone up, the net income could be decreased due to insignificant revenue growth of the company from the decreased project contracts when compared to its cost of sales or operating expenses. Though the company faced a decline trend from 2009 to 2013, the company still able to generate profit for the past 5 years by focused on building construction. On 2011, the company financial condition was critically affected by the financial crisis in Eurozone and the weakened United States economy at that period. Arisen from the hard time in 2011, PT Duta Graha Indah Tbk, rebranding the company’s name into PT Nusa Konstruksi Enjiniring Tbk. The company now more focused on private sector across the country due to the rapid development of private sector in Indonesia construction market at that time. By focusing on Private-sector Companies the company succeed to keep the profitability ratio growth increase until 2013. As for the market ratio, the financial crisis on 2011 affecting a high rising on price per earning ratio, it grown into 61.48 in 2011 compared to 11.43 on 2010. Even though the higher P/E ratio is better, the significant growth of P/E ratio in 2011 suspected to be a stock market bubble due to low net income at that time. Through the net income increase on 2012, the company finally able to manages the net income to be increasing on 2012 and 2013, so the P/E ratio able to back to its fair value. Table 4. Financial ratio of PT Total Bangun Persada (Persero) Tbk PT Total Bangun Persada (Persero) Tbk. Liquidity Leverage / Solvency Activity Profitability Market Financial Ratios Current Ratio Quick Ratio Total Debt Ratio Times Interest Earned Ratio Long Term Debt to Capital Inventory Turnover Total Asset Turnover Average Collection Period (days) Gross Profit Margin Operating Profit Margin Net Profit Margin Earnings per Share (EPS) Return on Assets (ROA) Return on Equity (ROE) P/E Ratio 2009 1.54 n/a 0.62 69.68 0.01 n/a 1.34 68 9.85% 5.32% 3.01% 19.15 4.04% 10.59% 7.83 2010 1.51 n/a 0.65 2011 1.40 1.40 0.64 2012 1.44 1.44 0.66 2013 1.58 1.43 0.63 174.51 314.63 346.76 568.26 0.05 0.04 0.06 0.08 n/a 2348.29 11.11 10.02 0.97 0.83 0.89 1.03 98 96 87 82 12.73% 16.12% 19.05% 19.26% 6.57% 10.97% 13.14% 12.68% 5.23% 7.87% 9.91% 9.32% 25.37 36.61 51.51 56.98 5.07% 6.51% 8.80% 9.57% 14.44% 18.33% 25.75% 26.03% 10.05 7.78 17.47 8.78 Overall, the financial ratio trend of PT Total Bangun Persada (persero) Tbk appears to be increased from 2009 to 2013. The profitability ratio shows a steady growth year by year. The components of the profitability ratio, which are net sales, gross profit, operation income, net income, total assets, and the equity of this company also increased every period on the past 5-year. The company focused on growing the net income to 15% per year by targeting on high-rise building construction. The company also maintains the net sales by prioritizing the repeated contract order from its satisfied current customers. For the market ratio, the Price per earning ratio seems to be fluctuated, it increased on 2010 and 2012, and decreased on 2011 and 2013. 806 Makarim and Noveria / Journal of Business and Management, Vol.3, No.7, 2014: 800-812 Table 5. Financial ratio of PT Surya Semesta Internusa Tbk SSIA Liquidity Leverage / Solvency Activity Profitability Market Financial Ratios Current Ratio Quick Ratio Total Debt Ratio Times Interest Earned Ratio Long Term Debt to Capital Inventory Turnover Total Asset Turnover Average Collection Period (days) Gross Profit Margin Operating Profit Margin Net Profit Margin Earnings per Share (EPS) Return on Assets (ROA) Return on Equity (ROE) P/E Ratio 2009 2010 1.08 1.02 1.07 1.01 0.66 0.64 2.07 3.75 0.33 0.28 212.04 187.45 0.66 0.71 88 98 23.43% 28.31% 5.81% 9.52% 3.65% 8.30% 14.96 98.26 2.42% 5.89% 7.15% 16.15% 4.68 2.37 2011 1.67 1.66 0.59 8.48 0.30 253.74 0.98 82 27.18% 15.84% 9.66% 54.72 9.47% 23.16% 13.16 2012 1.73 1.63 0.66 14.19 0.29 13.85 0.73 39 36.35% 26.35% 20.72% 150.31 15.21% 44.24% 7.19 2013 2.01 1.76 0.55 7.39 0.23 7.11 0.79 69 28.81% 21.24% 16.29% 147.41 12.84% 28.59% 3.80 For the last 5 years, the financial ratio trend of PT Surya Semesta Internusa Tbk, shows a positive trend. The company seems has a good capability in generating profit reflected on the increased profitability ratio. The growth of company’s profit was also because of the company focus on the sales of industrial land blocks and the construction of high-rise buildings. The company was selected to be the main contractor of Cikampek-Palimanan toll road project on 2012 that makes the company got a significant improvement in profitability ratio. On the market side, the P/E ratio of this company seems to fluctuate a lot, though the company shares always increasing for the past 5 years. The share’s price is also increasing until it hits it highest point on 2012 at IDR 1,080/share, but decreased on 2013 at IDR 580 due to the internal problem of increased interest rate Growth Rate Comparison Table 6. Compound Annual Growth Rate Comparison Year 2009 - 2013 Net Sales Cost of Good Sold CAGR ADHI WIKA 6.16% 15.88% 5.08% 15.34% DGIK 3.05% 3.07% TOTL 7.22% 4.35% SSIA 32.56% 30.17% Gross Profit Total Operating Expense 13.50% 11.21% 25.14% 22.96% 1.19% 20.00% 26.79% 37.91% 39.58% 14.40% Operating Income 14.38% 25.84% -10.69% 19.26% 83.32% Other Income Profit Before Income Tax -2.19% 21.13% 7.81% 30.73% 34.60% 1.41% -21.72% 29.20% -23.85% 68.38% Income tax Net Income 16.02% 29.02% 25.94% 31.86% 4.15% -0.24% 10.24% 42.27% 28.58% 92.67% From the comparison, ADHI, WIKA, TOTL, and SSIA seems to managed generate positive growth rate of net income due to the good growth rate of the companies’ net sales compared to the COGS rate, operating expense, other income or expense, and the income tax. The good growth rate of net sales could be affected from the increase in work contract, in this case the construction work sales increase as the impact of the government MP3EI project to support the realization of Indonesia as a 807 Makarim and Noveria / Journal of Business and Management, Vol.3, No.7, 2014: 800-812 developed country and also as the rise of Indonesia population, which foresees a high demand for residential and any other infrastructures as well the commercials development due to the stability of economic growth recovered from the global economic crisis on 2009. The increasing net sales will impacted the material use to get the work done, that define the increase in cost of good sold (COGS) used. The companies cost of good sold also show a positive amount that nearly even to the net sales. The high amount of COGS may occur due to the increased price of raw materials as the instability of Indonesia Rupiah value to the global currency and the Eurozone and United States, which also impacted by the sharp rise on oil prices, the raw materials like asphalt, glass, and cement rise up to 20% at 2011. The COGS use will affecting the operating expense in which the companies show the positive amount due to the high COGS price. In managing the operating income and net income from the expenses and tax, the companies succeed to generate profit as shown on the positive value of the income growth rate, except for DGIK. The minus income shown on DGIK occurred due to the higher price of COGS compared to the net sales of the company and high operating expense compared to the gross profit. Overall, a good growth rate of companies’ net sales will result in a good profit if the company able to manage the use of COGS and operating expense for the sales production. Cross-Section Analysis Table 7. Cross-Section Comparison (2013) CROSS-SECTION (Year of 2013) Financial Ratios Liquidity Leverage / Solvency Activity Profitability Market Industry Average ADHI WIKA DGIK TOTL SSIA Current Ratio 1.95 1.39 1.10 1.56 1.58 2.01 Quick Ratio 1.52 1.37 0.94 1.38 1.43 1.76 Total Debt Ratio n/a 0.84 0.74 0.50 0.63 0.55 Times Interest Earned Ratio 20.16 7.62 18.99 3.96 568.26 7.39 Long Term Debt to Capital n/a 0.17 0.16 0.03 0.08 0.23 Inventory Turnover 14.59 53.27 9.44 7.09 10.02 7.11 Total Asset Turnover 0.74 1.01 0.94 0.69 1.03 0.79 Average Collection Period n/a 101 49 87 82 69 Gross Profit Margin 32.58 12.73% 13.32% 12.82% 19.26% 28.81% Operating Profit Margin 13.85 8.40% 10.23% 5.55% 12.68% 21.24% Net Profit Margin 8.85 4.17% 5.25% 4.55% 9.32% 16.29% Earningsper Share (EPS) 103.23 225.38 92.92 11.97 56.98 147.41 Return on Assets (ROA) 5.42 4.20% 4.96% 3.15% 9.57% 12.84% Return on Equity (ROE) 11.13 26.38% 19.35% 6.23% 26.03% 28.59% P/E Ratio 28.22 6.70 17.00 12.53 8.78 3.80 = Industry average value = Highest value of the group and higher than the industry average value = Highest value of the group, lower than the industry average value = Lowest value of the group Overall, though each company has a different capability in control the financial condition of the company, Indonesian construction Sector Company on 2013 has a well performance in managing the 10 from 15 aspects of the financial ratios performed above the industry average. SSIA seems to be the lead of the competitors through 6 of the 10 ratio performed above the industry average is on 808 Makarim and Noveria / Journal of Business and Management, Vol.3, No.7, 2014: 800-812 this company, followed by ADHI and TOTL with each 2 ratio performed above the industry average, WIKA also lead in 2 ratio though it still under the industry average. On the other side, even DGIK is the leader of the total debt ratio; the company still has the lowest value of ratios compared to its competitors that indicates that the company did not performed well during the period. DuPont System of Analysis Table 8. DuPont System Analysis (2009-2013) Net Profit Margin Total Asset Turnover Equity Multiplier ROA ROE Net Profit Margin Total Asset Turnover Equity Multiplier ROA ROE Net Profit Margin Total Asset Turnover Equity Multiplier ROA ROE Net Profit Margin Total Asset Turnover Equity Multiplier ROA ADHI 2.11% 1.37 7.70 2.89% 22.28% ADHI 3.35% 1.15 5.72 3.86% 2009 WIKA 3.13% 1.16 3.72 3.62% 13.47% 2010 WIKA 5.17% 0.96 3.49 4.95% DGIK 5.18% 0.86 1.63 4.47% TOTL 3.01% 1.34 2.62 4.04% SSIA 3.65% 0.66 2.95 2.42% 7.28% 10.59% 7.15% DGIK 5.21% 0.69 2.02 3.60% TOTL 5.23% 0.97 2.85 5.07% SSIA 8.30% 0.71 2.74 5.89% 22.09% 17.28% 2011 7.27% 14.44% 16.15% ADHI 2.73% 1.10 6.17 WIKA 5.05% 0.93 3.75 DGIK 0.73% 0.74 1.55 TOTL 7.87% 0.83 2.82 SSIA 9.66% 0.98 2.95 2.99% 18.45% 4.70% 17.62% 2012 WIKA 5.15% 0.90 3.89 4.62% 0.54% 0.83% 6.51% 18.33% 9.47% 27.92% DGIK 3.90% 0.69 1.75 2.70% TOTL 9.91% 0.89 2.92 8.80% SSIA 20.72% 0.73 2.91 15.21% 44.24% ADHI 2.80% 0.97 6.67 2.71% ROE 18.06% 17.95% 2013 4.71% 25.75% Net Profit Margin Total Asset Turnover Equity Multiplier ROA ROE ADHI 4.17% 1.01 6.28 4.20% 26.38% WIKA 5.25% 0.94 3.90 4.96% 19.35% DGIK 4.55% 0.69 1.98 3.15% 6.23% TOTL SSIA 9.32% 16.29% 1.03 0.79 2.72 2.23 9.57% 12.84% 26.03% 28.59% From the analyzed DuPont formulation system could be stated that the calculation of the company’s net profit margin has the highest impact to the changes of ROA and ROE. It will then indicate the return from the companies. On 2011, when the net profit margin of ADHI, WIKA, and DGIK decrease means that 2011 is not a good year to invest on the companies in risk of lower return, while afterward when the companies experienced an increase until 2013 is good time to reinvest on 809 Makarim and Noveria / Journal of Business and Management, Vol.3, No.7, 2014: 800-812 the companies. For TOTL and SSIA 2009 to 2012 is a good times to invest on the companies due to the high return from the increased net profit margin. While, 2013 is time to sell the stock in case of a bit decrease. Though, in 2013 SSIA has more capability in return on investment due to the significant amount differences among the other companies. Common Size Financial Statement Analysis Overall, in terms of common size income statement, all of the companies seems to experienced a growth on net sales for the past 5 years due to the increase of construction work needed. The increased net sales will impact to the increased production cost or the cost of goods sold (COGS), from the calculation, the COGS of the companies take a high proportion in minimum of 80% to the net sales indicating a high needs of COGS to finish the project contracts. The high amount of COGS could also be affected from the rose of construction materials price. High COGS will affect an increase in operating expense that later resulting on the operating income. As for the net income SSIA able to get a big proportion from the net sales compared to other companies as the company have many business lines other than construction service. While, ADHI, WIKA, and TOTL were able to achieve the net income growth every year, except on 2013 when the instability of macroeconomic condition in Indonesia occurred. Unfortunately DGIK appears to be the least company in terms of generating profit, the net income proportion never gone higher than 5% from the net sales. In the terms of common size balance sheet, the totals assets and total liabilities plus equity will be the benchmark base of other balance sheet aspect, included in total assets are total current assets and total non-currents assets, while the total liabilities plus equity containing total current liabilities and total non-current liabilities plus the total equity. All of the companies have more percentage number on their total current assets that indicates the companies’ cash and cash equivalent rising due to the high net sales as the high demand of construction service, also because of the companies have high inventories. On the proportion of total liabilities all of the companies have a high amount of total current liabilities that driven from the increase of tax payable as the increase of net income. The companies shows a stable growth on the equity proportion of common size balance sheet, that indicates this sector still have the investors attention to buy the company’s share price or market stocks as all of the companies are listed company. Market Approach Valuation Table 9. Market Approach Valuation PT. SURYA SEMESTA INTERNUSA Tbk. P/E Industry IDR 28.2 Net Income IDR 746,615,828 Equity Value IDR 21,069,498,666 Share Outstanding 4,688,521 Share Price IDR 4,494 Current Price IDR560 PT. NUSA KONSTRUKSI ENJINIRING Tbk. P/E Industry IDR 28.2 Net Income IDR 66,105,835 Equity Value IDR 1,865,506,664 Share Outstanding 5,521,729 Share Price IDR 338 Current Price 150 PT. ADHI KARYA Tbk. P/E Industry IDR 28.2 Net Income IDR 408,437,913 Equity Value IDR 11,526,117,905 PT. WIJAYA KARYA Tbk. P/E Industry IDR 28.2 Net Income IDR 624,371,679 Equity Value IDR 17,619,768,781 Share Outstanding 6,133,950 Share Price IDR 2,872 Current Price IDR1,580 Share Outstanding Share Price Current Price 1,801,320 IDR 6,399 IDR1,510 PT. TOTAL BANGUN PERSADA Tbk. P/E Industry IDR 28.2 810 Makarim and Noveria / Journal of Business and Management, Vol.3, No.7, 2014: 800-812 Net Income Equity Value Share Outstanding Share Price Current Price IDR 213,168,653 IDR 6,015,619,388 3,410,000 IDR 1,764 IDR500 In accordance to (www.quotes.wsj.com.2014) the current share price of the companies are: PT Adhi Karya Tbk, amounted to IDR 1,510/share. While, the market value share price calculation of the company is IDR 6,399/share. The current share price of PT Wijaya Karya Tbk, amounted to IDR 1,580/share. Meanwhile, the market value share price calculation of the company is IDR 2,872/share. The current share price of PT Nusa Konstruksi Enjiniring Tbk, amounted to IDR 150/share, while, the market value share price calculation of the company is IDR 338/share. The current share price of PT Nusa Konstruksi Enjiniring Tbk, amounted to IDR 500/share. Meanwhile, the market value share price calculation of the company is IDR 1,764/share. Last, the current share price of PT Nusa Konstruksi Enjiniring Tbk, amounted to IDR 560/share. Meanwhile, the market value share price calculation of the company is IDR 4,494/share. The different value of both prices in all companies indicates that the current share price of the company is undervalued due to the higher amount of the calculated share price using market approach as the expected company value. This means the company’s share price has the possibilities to increase in the future. The high calculated share price could be indicated from the high equity value that related with the high net income. As for the company’s net income experienced an increase from 2012 due to the high project contract received Conclusions Based this research could be considered that by analyzing a company’s financial performance, and calculating the market-valuation of the companies, could be used as the fundamental analysis for the investors to make an investment decision, because we might see the healthiness of a company financial condition to predict the future of the company and build the investor confidence to invest on the company to gain optimal return. And from the analysis, the construction sector in Indonesia shows a good financial health and undervalued share price. The construction sector net income really depended on the net sales of the company. Construction sector in Indonesia has nothing to fear in lose a work contract, because as a development country, Indonesia will keep developing through many construction project to reach the realization of Indonesia as a developed country, and also as long as the number of population in Indonesia still rising, the demand of construction service like residential & hospitality, commercial-development, and any other public infrastructure will be grown high. The author suggested that the construction sector is the one of the most secure industry with the condition stated above for the investors to keep investing in. The sector also has the worthiness to keep investing, as the low share price will give the investors the opportunity of solid return with the high possibilities of growing up in the future. WIKA, ADHI, and SSIA could be prioritized as the stock choice for the investors. WIKA with its highest P/E-ratio, ADHI with the highest earning per share, and SSIA has the steadiest net income. References Badan Pusat Statistik (BPS). 2014. Berita Resmi Statistik. Retrieved from http://www.bps.go.id/brs_file/pdb_banner1.pdf Badan Pusat Statistik (BPS). 2014. Nilai Konstruksi Yang Diselesaikan Menurut Jenis Pekerjaan. Retrieved from http://www.bps.go.id/tab_sub/view.php?kat=2&tabel=1&daftar=1&id_subyek=04&notab=2 Damodaran, A. 2002. Investment Valuation: Tools and Techniques for Determining the Value of Any Assets. Wiley Finance Damodaran, A. 2010. The Little Book of Valuation. Retrieved from http://people.stern.nyu.edu/adamodar/pdfiles/papers/littlebookvaln.pdf 811 Makarim and Noveria / Journal of Business and Management, Vol.3, No.7, 2014: 800-812 Gitman L.J. 2009. Principles of Managerial Finance 12th Edition. Pearson GlobalBusinessGuide Indonesia. 2014. Overview Property Sector in Indonesia. Retrieved from http://www.gbgindonesia.com/en/property/article/2011/property_in_indonesia_overview.php Horne, James C. 2008. Wachowiz Jr, John M. Fundamental of Financial Management 13th Edition. Pearson Ikatan Akuntan Indonesia. 2007. Standar Akuntansi Keuangan Edisi 2007. Salemba Empat. Indonesia-Investment. 2014. Masterplan for Acceleration and Expansion of Indonesia’s Economic Development (MP3EI). Retrieved from http://www.indonesia-investments.com/projects/government-development-plans/masterplan-foracceleration-and-expansion-of-indonesias-economic-development-mp3ei/item306 Reuters. 2014. Indonesia Construction Sector Growth. Retrieved from http://www.reuters.com/article/2013/07/11/research-and-markets-idUSnBw116237a+100+BSW20130711 Ross, Stephen A. 2010. Corporate Finance 9th Edition. McGrawHill TheJakartaGlobe. 2014. Construction Sector Lead Indonesia Stock Market’s Gain This Year. Retrieved from http://www.thejakartaglobe.com/business/property-construction-lead-indonesian-stock-markets-gainsthis-year/ 812