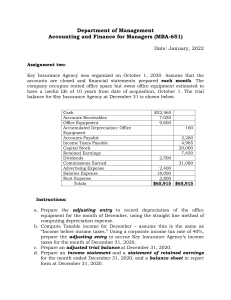

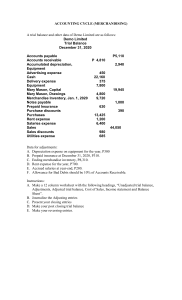

“ 2 Adjusting Entries Learning Objectives: At the end of the chapter, learners should be able to: 1. Enuemrate the common end of the period adjustments; 2. Prepare adjusting entries 4 Review of the Accounting Cycle 5 Definition 6 Adjusting Entries 7 Adjusting Entries 8 Adjusting Entries 9 Adjusting Entries 10 Accruals Income already earned but not yet collected. Accrued Income Expenses already incurred but not yet paid. Accrued Expense 11 Accrued Income ABC Company received a 12%, Php100,000.00 one year note on April 1, 2020. ABC uses a calendar year period. The principal and interest on note are due on April 1, 2021. Date Particular F Debit 2020 Interest Receivable 9,000.00 Dec. 31 Interest Income To accrue interest from April 1 to Dec. 31 (Php10,000.00 x 12% x 9/12) Credit 9,000.00 12 Accrued Income Angara Law Office received Php20,000.00, 10%, 3-month note from a client on Nov. 16, 2020. Date Particular F 2020 Interest Receivable Dec. 31 Interest Income To accrue interest from Nov. 16 to Dec. 31 (Php20,000.00 x 10% x 45/360) Debit 250.00 Credit 250.00 13 Accrued Income Topline Condominium Inc. leased one of their units to Diamond Corporation for Php15,000.00 per month. Diamond started to occupy the unit on Dec. 1. No payment was made by Diamond as at Dec. 31. Date Particular F 2020 Rent Receivable Dec. 31 Rent Income To accrue rent income for the month of Dec. Debit 15,000.00 Credit 15,000.00 14 Accrued Expense 15 Accrued Expense Vienna Company issued a 6month 10% promisory note to G Company on October 1, 2020. The amount of the note is Php60,000.00 Date Particular F Debit 2020 Interest Expense 1,500.00 Dec. 31 Interest Payable To accrue interest on note issued from Oct 1 to Dec. 31 (Php60,000.00 x 10% x 3/12) Credit 1,500.00 16 Accrued Expense JCP Tutorial Services hired the services of additional tutors during the last week of December. Payments for these tutors amounting to Php25,000.00 will be made on the first week of January next year. Date Particular 2020 Salaries Expense Dec. 31 Salaries Payable To record accrued salaries F Debit 25,000.00 Credit 25,000.00 17 Depreciation Expense 18 Depreciation Expense 19 Depreciation Expense 20 Depreciation Expense 21 Depreciation Expense Christian Company owns a building which was constructed five years ago. Total cost of the building was Php1,500,000.00. The building has a salvage value of Php50,000.00 and estimated useful life of 25 years. Date Particular 2020 Depreciation Expense - Building Dec. 31 Accumulated Depreciation – Building F To record depreciation for the year. Debit 58,000.00 Credit 58,000.00 22 Depreciation Expense Jed Company purchased a delivery truck three years ago at a cost of Php1,000,000.00. The truck has estimated salvage value of Php75,000.00 and has an estimated useful life of 10 years. Date Particular F 2020 Depreciation Expense – Delivery Truck Dec. 31 Accumulated Depreciation – Del. Truck To record depreciation for the year. Debit 92,500.00 Credit 92,500.00 23 Depreciation Expense Jessie Merchandising owns a machinery costing Php100,000.00 which the company acquired on March 1 of the current year. The machinery will have a salvage value of Php10,000.00 after its useful life of five years. Date Particular F Debit 2020 Depreciation Expense – Machinery 15,000.00 Dec. 31 Accumulated Depreciation – Machinery To record depreciation for the year. (100,00010000/5) = 18,000 18000 x 10/12 (March 1 – Dec. ) Credit 15,000.00 24 Depreciation Expense Char Company purchased office tables and chairs costing Php20,000.00 on July 31 of the current year. It was estimated that these assets will have a salvage value of Php2,000.00 after its estimated useful life of five years. Date Particular F Debit 2020 Depreciation Expense – Furniture 1,500.00 Dec. 31 Accumulated Depreciation – Furniture To record depreciation for the year. (Php20,000-2000/5) = 3600 x 5/12 (Aug 1 – Dec 31) Credit 1,500.00 25 Bad Debts Expense 26 Allowance for Doubtful Accounts 27 Bad Debts Expense E and E Co. has a total accounts receivable of Php20,000.00 on December 31, 2020 before any adjustments. Of the total amount, it was estimated that Php1,500.00 is doubtful of collection. Date Particular 2020 Bad Debts Expense Allowance for Doubtful Accounts Dec. 31 F Debit 1,500.00 To record bad debts expense for the year. Credit 1,500.00 28 Bad Debts Expense On December 31, current year, the following are the the unadjusted ledger balance of Accounts Receivable, Php180,000.00 Allowance for bad debts, Php5,500.00 Compute the bad debts expense for the year if Allowance for Bad Debts is to be increased by 10% Date Particular F Debit 2020 Bad Debts Expense 18,000.00 Allowance for Bad Debts Dec. 31 To record bad debts expense for the year. (Php180,000.00 x 10%) because of INCREASE BY Credit 18,000.00 29 Bad Debts Expense On December 31, current year, the following are the the unadjusted ledger balance of Accounts Receivable, Php180,000.00 Allowance for bad debts, Php5,500.00 Compute the bad debts expense for the year if Allowance for Bad Debts is to be increased to 10% Date Particular F Debit 2020 Bad Debts Expense 12,500.00 Allowance for Bad Debts Dec. 31 To record bad debts expense for the year. (Php180,000.00 x 10%) – (Php5,500.00) Credit 12,500.00 30 Bad Debts Expense The ledger balance for accounts receivable of Raffy Company showed a balance of Php94,000.00 at Dec. 31. The company estimated that 12% of outstanding customers’ account will be doubtful of collection. The Allowance for doubtful accounts showed a credit balance of Php9,150.00 before adjustments. Date Particular 2020 Bad Debts Expense Allowance for Doubtful Accounts Dec. 31 F Debit 2,130.00 To record bad debts expense for the year. Credit 2,130.00 31 Prepaid Expense 32 Prepaid Expense – Methods of Recording Asset Method – an asset account is debited upon the payment of expense. Expense Method – an expense account is debited upon the payment of expense. 33 Prepaid Expense – Methods of Recording – Asset Method On Sept 1, 2020, Angara Law Office paid Php4,500.00 for six month rent of a special printer used in the office Sept. 1, 2020 Prepaid Rent Expense Cash 4,500.00 4,500.00 Rental on printer from Sept.1 to Feb. 28 Dec. 31 Rent Expense 3,000.00 Prepaid Rent Expense To set-used part of the prepaid rent (Php4,500.00 x 4/6) Sept 1 to Dec. 31 3,000.00 34 Prepaid Expense – Methods of Recording – Asset Method On August 1, 2020, Angara Law Office paid Php120,000.00 for insurance premium covering for one year. Aug. 1, 2020 Prepaid Insurance Expense Cash 120,000.00 120,000.00 Insurance premium from Aug. 1 2020 to July 31, 2021 Dec. 31, 2020 Insurance Expense Prepaid Insurance Expense To set-used part of the prepaid insurance (Php120,000.00 x 5/12) Aug. 1 to Dec 31 50,000.00 50,000.00 35 Prepaid Expense – Methods of Recording – Asset Method Angara Law Office paid a one-year advertising contracts amounting to Php8,400.00 on June 1, 2020. June 1, 2020 Prepaid Advertising Expense 8,400.00 Cash Advertising from June 1 to May 31 Dec. 31, 2020 Advertising Expense 8,400.00 4,900.00 Prepaid Advertising Expense To set up used part of the prepaid advertising (Php8,400.00 x 7/12 ) June 1 to Dec. 31 4,900.00 36 Prepaid Expense – Methods of Recording – Expense Method On Sept 1, 2020, Angara Law Office paid Php4,500.00 for six month rent of a special printer used in the office Sept. 1, 2020 Rent Expense Cash 4,500.00 4,500.00 Rental on printer from Sept.1 to Feb. 28 Dec. 31 Prepaid Rent Expense 1,500.00 Rent Expense To set-unused part of the rent expense (Php4,500.00 x 2/6 Jan. 1 –Feb. 28) 1,500.00 37 Prepaid Expense – Methods of Recording – Expense Method On August 1, 2020, Angara Law Office paid Php120,000.00 for insurance premium covering for one year. Aug. 1, 2020 Insurance Expense Cash 120,000.00 120,000.00 Insurance premium from Aug. 1 2020 to July 31, 2021 Dec. 31, 2020 Prepaid Insurance Expense 70,000.00 Insurance Expense To set-unused part of the insurance expense (Php120,000 x7/12 Jan. 1 to July 31 2021) 70,000.00 38 Prepaid Expense – Methods of Recording – Expense Method Angara Law Office paid a one-year advertising contracts amounting to Php8,400.00 on June 1, 2020. June 1, 2020 Advertising Expense 8,400.00 Cash Advertising from June 1 to May 31 Dec. 31, 2020 8,400.00 Prepaid Advertising Expense 3,500.00 Advertising Expense 3,500.00 To set up unused part of the advertising expense (Php8,400.00 x 5/12 Jan 1 – May 31 2021) 39 Unearned Revenue 40 Unearned Income – Methods of Recording Liability Method – a liability account is credited upon the receipt of cash. Income Method – an income account is credited upon the receipt of cash. 41 Unearned Income – Methods of Recording – Liability Method Angara Law Office received from a lessor, on May 1, 2020, Php6,000.00 for a one year rent of a space owned by Angara. May 1, 2020 Cash 6,000.00 Unearned Rent Income 6,000.00 Rental payment received covering May 1 -April 30 Dec. 31, 2020 Unearned Rent Income 4,000.00 Rent Income 4,000.00 To set-up earned portion of the unearned income (Php6,000.00 x 8/12 ) May 1 to Dec. 31 2020 42 Unearned Income – Methods of Recording – Liability Method Vienna Company collected a one-year advertising contract from Emily Enterprise amounting to Php7,200.00 on June 1, 2020. June 1, 2020 Cash 7,200.00 Unearned Advertising Income 7,200.00 Advertising income collected (June 1 to May 31) Dec. 31, 2020 Unearned Advertising Income 4,200.00 Advertising Income 4,200.00 To set-up earned portion of the unearned advertising (Php7,200.00 x 7/12) June 1 to Dec. 31, 2020 43 Unearned Income – Methods of Recording – Liability Method Char Trading received interest payment from Mr. A, a client on October 1, 2020 amouting to Php4,000.00. This interest payment is good for 8 months starting Oct. 1, 2020. Oct. 1, 2020 Cash 4,000.00 Unearned Interest Income 4,000.00 Interest payment received covering Oct. 1 to May 31 Dec. 31, 2020 Unearned Interest Income 1,500.00 Interest Income 1,500.00 To set-up earned portion of the unearned interest income (Php4,000.00 x 3/8) Oct 1 to Dec. 31, 2020 44 Unearned Income – Methods of Recording – Income Method Angara Law Office received from a lessor, on May 1, 2020, Php6,000.00 for a one year rent of a space owned by Angara. May 1, 2020 Cash 6,000.00 Rent Income 6,000.00 Rental payment received covering May 1 -April 30 Dec. 31, 2020 Rent Income 2,000.00 Unearned Rent Income 2,000.00 To set-up unearned portion of the rent income (Php6,000.00 x 4/12) Jan. 1 to April 30, 2021 45 Unearned Income – Methods of Recording – Income Method Vienna Company collected a one-year advertising contract from Emily Enterprise amounting to Php7,200.00 on June 1, 2020. June 1, 2020 Cash 7,200.00 Advertising Income 7,200.00 Advertising income collected (June 1 to May 31) Dec. 31, 2020 Advertising Income 3,000.00 Unearned Advertising Income 3,000.00 To set-up unearned portion of the advertising income (Php7,200.00 x 5/12) Jan. 1 to May 31, 2021) 46 Unearned Income – Methods of Recording – Income Method Char Trading received interest payment from Mr. A, a client on October 1, 2020 amouting to Php4,000.00. This interest payment is good for 8 months starting Oct. 1, 2020. Oct. 1, 2020 Cash 4,000.00 Interest Income 4,000.00 Interest payment received covering Oct. 1 to May 31 Dec. 31, 2020 Interest Income 2,500.00 Unearned Interest Income 2,500.00 To set-up unearned portion of the interest income (Php4,000.00 x 5/8) Jan. 1 to May 31, 2021) 47 48 49 50 51