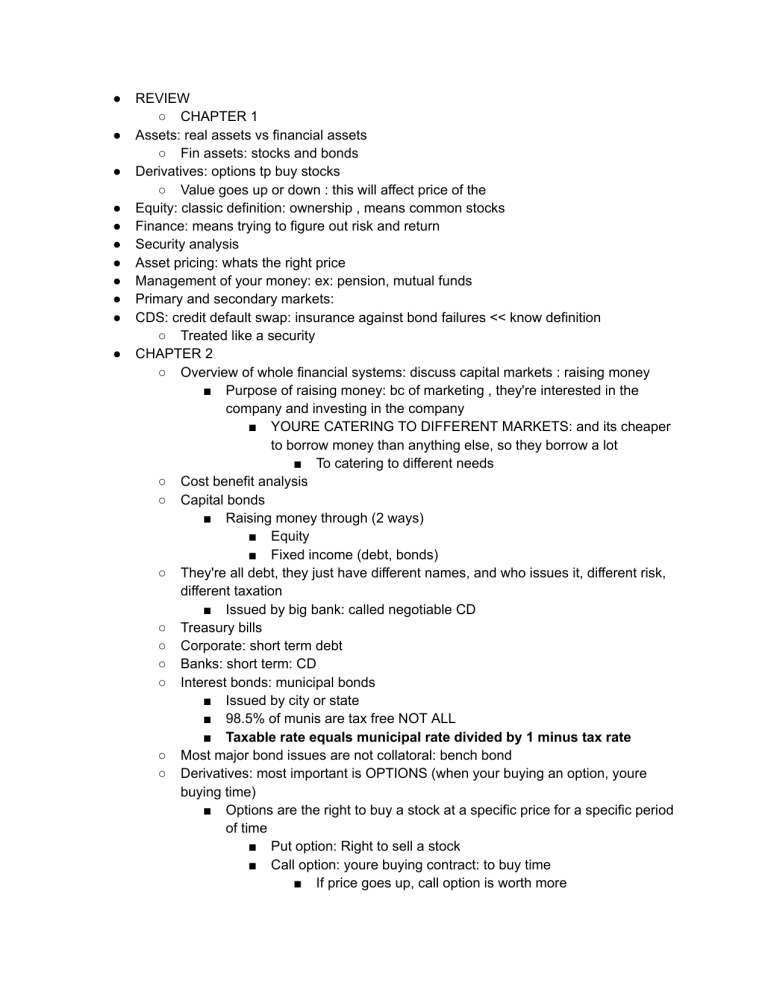

● ● ● ● ● ● ● ● ● ● ● REVIEW ○ CHAPTER 1 Assets: real assets vs financial assets ○ Fin assets: stocks and bonds Derivatives: options tp buy stocks ○ Value goes up or down : this will affect price of the Equity: classic definition: ownership , means common stocks Finance: means trying to figure out risk and return Security analysis Asset pricing: whats the right price Management of your money: ex: pension, mutual funds Primary and secondary markets: CDS: credit default swap: insurance against bond failures << know definition ○ Treated like a security CHAPTER 2 ○ Overview of whole financial systems: discuss capital markets : raising money ■ Purpose of raising money: bc of marketing , they're interested in the company and investing in the company ■ YOURE CATERING TO DIFFERENT MARKETS: and its cheaper to borrow money than anything else, so they borrow a lot ■ To catering to different needs ○ Cost benefit analysis ○ Capital bonds ■ Raising money through (2 ways) ■ Equity ■ Fixed income (debt, bonds) ○ They're all debt, they just have different names, and who issues it, different risk, different taxation ■ Issued by big bank: called negotiable CD ○ Treasury bills ○ Corporate: short term debt ○ Banks: short term: CD ○ Interest bonds: municipal bonds ■ Issued by city or state ■ 98.5% of munis are tax free NOT ALL ■ Taxable rate equals municipal rate divided by 1 minus tax rate ○ Most major bond issues are not collatoral: bench bond ○ Derivatives: most important is OPTIONS (when your buying an option, youre buying time) ■ Options are the right to buy a stock at a specific price for a specific period of time ■ Put option: Right to sell a stock ■ Call option: youre buying contract: to buy time ■ If price goes up, call option is worth more ○ ○ ○ ○ ○ Another way to raise money: equity ■ Stocks are equity Margins: what you put up, not what you bought: no margins? Short sale Inside trading is illegal: information that is not publicly known TIPS: treasury inflation asset protection security ■ Just for inflation, ■ Theres 5 yr tips, 10 yr tips, 2 yr tips, etc ■ 10 yr tip pays close to 1% ■ Difference btwn 10 year conventional and a tip: 1% (see above) plus whatever the inflation rate ● ● ● ● ● ● ○ Net asset value Closed end: limited number of shares, usually sell at discount Turnable rate Zero coupon bonds Catastrophe bonds: high interest rate Index bonds ● 9: ○ ○ ● 10 ● 11 Initial margin of 65% C ○ ● 13 ● 16 ● 17 ● D ○ A ○ 225-liabilities: D ○ A ○ After tax so A ○ 300-5 divided 9 million: ■ D ○ Small premium: false ○ False ○ False 12 ● ● ○ 18 31 ● 32 ● 33 PE ratio: about safety Yield on 10 yr treasury bond is 2.4%, next year rates are much higher This means that most long term bond prices increased: FALSE Short term rates go up, this tends to decrease value of the __: TRUE 10 yr TIP has .4%, and regular 10 yr convential: 2.6%, this means expected inflation is 3%: FALSE Index funds v popular today bc they almost never lose money: FALSE Coupon for zero copon: usually $10 a year: Bring calculator