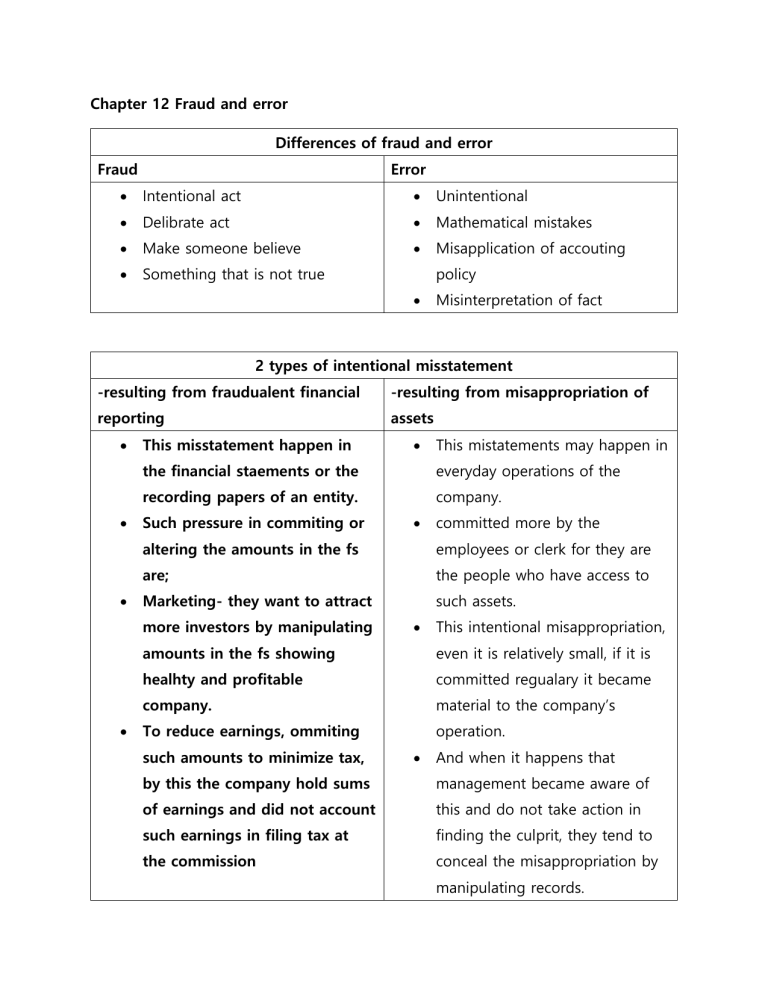

Chapter 12 Fraud and error Differences of fraud and error Fraud Error Intentional act Unintentional Delibrate act Mathematical mistakes Make someone believe Misapplication of accouting Something that is not true policy Misinterpretation of fact 2 types of intentional misstatement -resulting from fraudualent financial -resulting from misappropriation of reporting assets This misstatement happen in This mistatements may happen in the financial staements or the everyday operations of the recording papers of an entity. company. Such pressure in commiting or committed more by the altering the amounts in the fs employees or clerk for they are are; the people who have access to Marketing- they want to attract such assets. more investors by manipulating This intentional misappropriation, amounts in the fs showing even it is relatively small, if it is healhty and profitable committed regualary it became company. material to the company’s To reduce earnings, ommiting operation. such amounts to minimize tax, And when it happens that by this the company hold sums management became aware of of earnings and did not account this and do not take action in such earnings in filing tax at finding the culprit, they tend to the commission conceal the misappropriation by manipulating records. This type of misstatement are often done by higher ups or the executives. Video lecture 1 Fraud and error Why people committ fraud? Pressure What motivate someone to commit fraud Opportunity Has the access, Rationalization Fraudster, justifying itself, underpay or overwork Responsibilities of management - Take reasonable step - Intalling an effective, accounting system and internal control system - Establish committee - Ensuring has code of conduct Responsible of auditors - To express an opinion - True and fair view - Audit conducted in accordance with GAAS - Mainatain an attitude of professional skepticism o Reporting responisbilities In management, communicate factual finding User of FS Conclude that FS has material effect & properly conceaded Regulatory Duty of confidentiality, auditors must have legal advice Video lecture 2 Its management responsibility How long it occuring How many people are involve How much is in the fraudulent act Some company conceal such fraud because of reputation and credibility issue. Publishing such FS or accounting records signed and approved by the excecutive can affect their image in a bad way. -crime Adobe Gothic Std B