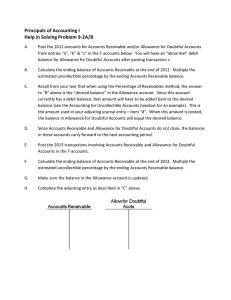

Audit problem The Vigan Company included the following in its notes receivable as of December 31, 2010: Note receivable from sale of land P 880,000 Note receivable from consultation 1,600,000 1,200,000 Note receivable from sale of equipment In connection with your audit, you were able to gather the following transactions during 2010 and other information pertaining to the company’s notes receivable: • On January 1, 2010, Vigan Company sold a tract of land. The land, purchased 10 years ago, was carried on Vigan Company’s books at a value of P500,000. Vigan received a noninterest – bearing note for P880,000. The note is due on December 31, 2011. There is no readily available market value for the land, but the current market rate of interest for comparable notes is 10%. • On January 1, 2010, Vigan Company finished consultation services and accepted in exchange a promissory note with a face value of P1,200,000, a due date of December 31, 2012, and a stated rate of 5% with interest receivable at the end of each year. The fair value of the services is not readily determinable and the note is not readily marketable. Under the circumstances, the note is considered to have an appropriate imputed rate of interest of 10%. • On January 1, 2010, Vigan Company sold equipment with a carrying amount of P1,600,000 to X company. As payment, X gave Vigan Company a P2,400,000 note. The note bears an interest rate of 4% and is to be repaid in three annual installments of P800,000 (plus interest on outstanding balance). The first payment was received on December 31, 2010. The market price of the equipment is not reliably determinable. The prevailing rate of interest for notes of this type is 14%. Questions: (Round off present value factors to four decimal places and final answers to nearest hundred) 1. The consultation service fee revenue that should be recognized in 2010 is a. P1,050,800 c. P 901,600 b. P1,095,800 d. P1,200,000 2. The gain on sale of equipment that should be recognized in 2010 is a. P331,600 c. P412,400 b. P257,280 3. d. P800,000 The noncurrent notes receivable as of December 31, 2010 is a. P2,605,706 This study source was downloaded by 100000828756128 from CourseHero.com on 09-24-2022 22:49:08 GMT -05:00 https://www.coursehero.com/file/86590317/Audit-problem-11docx/ c. P2,494,000 b. P1,825,800 d. P2,625,700 4. The current portion of long term notes receivables as of December 31, 2010 is a. P1,600,000 c. P1,468,200 b. P1,680,000 d. P 800,000 5. The interest income to be recognized in 2010 is a. P464,000 b. P435,800 c. P459,500 d. P156,000 EASY 1. Orr Company prepared an aging of accounts receivable on December 31, 2018 and determined that the net realizable value of the accounts receivable was ₱ 2,500,000. Allowance for doubtful accounts on January 1 280,000 Accounts written off as uncollectible 230,000 Accounts receivable on December 31 2,700,000 Uncollectible accounts recovery 50,000 What amount should recognized as doubtful accounts expense for the current year? (Problem 19-1, Practical Accounting 1, Valix, 2016) 2. At the first year of operations, Water Company had a net realizable value of accounts receivable of ₱ 5,000,000. During the year, the entity recorded charges to bed debt expense of ₱ 800,000 and wrote of as uncollectible accounts receivable of ₱ 200,000. What is the year-end accounts receivable balance before the allowance for doubtful account? (Problem 19-5, Practical Accounting 1, Valix, 2016) This study source was downloaded by 100000828756128 from CourseHero.com on 09-24-2022 22:49:08 GMT -05:00 https://www.coursehero.com/file/86590317/Audit-problem-11docx/ 3. Seiko Company reported the following balances after adjustments at year-end: 2018 2017 Accounts Receivable 5,250,000 4,800,000 Net Realizable Value 5,100,000 4,725,000 During 2018, the entity wrote off accounts totalling ₱ 160,000 and collected ₱ 40,000 on accounts written off in previous year. What amount should be recognized as doubtful accounts expense for the year ended December 31, 2018? (Problem 19-2, Practical Accounting 1, Valix, 2016) MODERATE 1. Tara Company provided the following information pertaining to accounts receivable on December 31, 2018: Days Outstanding Estimated Amount 0-60 1% 1,200,000 61-120 900,000 Over 121 Estimated Uncollectible 2% 1,000,000 60,000 During the current year, the entity wrote off ₱ 70,000 in accounts receivable and recovered ₱ 40,000 that had been written off in prior years. On January 1, 2018, the allowance for uncollectible accounts was ₱ 100,000. Under the aging method, what amount of allowance for uncollectible accounts should be reported on December 31, 2018? (Problem 19-6, Practical Accounting 1, Valix, 2016) This study source was downloaded by 100000828756128 from CourseHero.com on 09-24-2022 22:49:08 GMT -05:00 https://www.coursehero.com/file/86590317/Audit-problem-11docx/ 2. Beach Bank loaned Boracay Company ₱ 7,500,000 on January 1, 2014. The terms of the loan were payment in full on January 1, 2018 plus annual interest payment at 11%. The interest payment was made as scheduled in January 1, 2015. However, due to financial setbacks, Boracay Company was unable to make the 2016 interest payment. Beach Bank considered the loan impaired and projected the cash flow from the loan on December 31, 2015. The bank accrued the interest on December 31, 2015, but did not continue to accrue interest for 2016 due to impairment of the loan. The projected cash flows are: Date of cash flow Amount projected on Dec. 31, 2016 December 31, 2017 500,000 December 31, 2018 1,000,000 December 31, 2019 2,000,000 December 31, 2020 4,000,000 The PV of 1 at 11% is 0.90 for one period, 0.81 for two periods, 0.73 for three periods, and 0.66 for four periods. What is the loan impairment loss on December 31, 2016? (Problem 25-1, Practical Accounting 1, Valix, 2016) 3. On December 31, 2016, Macedon Bank has 5 year loan receivable with a face value of ₱ 5,000,000 dated January 1, 2015 that is due on every December 31, 2019. Interest on the loan is payable at 9% every December 31. The borrower paid interest that was due on December 31, 2015 but informed the bank that interest accrued in 2016 will be paid at maturity date. There is high probability that the remaining interest payment will not be paid because of financial difficulty. The prevailing market rate of interest on December 31, 2016 is 10%. The PV of 1 for three periods is 0.772 at 9% and 0.751 at 10%. This study source was downloaded by 100000828756128 from CourseHero.com on 09-24-2022 22:49:08 GMT -05:00 https://www.coursehero.com/file/86590317/Audit-problem-11docx/ What is the loan impairment loss to be recognized on December 31, 2016? (Problem 25-4, Practical Accounting 1, Valix, 2016) DIFFICULT 1. On December 31, 2016, Oregon Bank recorded an investment of ₱5,000,000 in a loan granted to a client. The loan has a 10% effective interest rate payable annually every December 31. The principal is due in full maturity on December 31, 2019. Unfortunately, the borrower is experiencing significant difficulty and will have difficult time in making full payment. The bank projected that the entire principal will be paid at maturity date and 4% interest of ₱200,000 will be paid annually on December 31 of the next three years. There is no accrued interest on December 31, 2016. The present value of 1 at 10% for three periods is 0.75 and the present value of an ordinary annuity of 1 at 10% for the three periods is 2.49. a. What is the loan impairment loss for 2016? b. What is the interest income for 2017? c. What is the carrying amount of the loan receivable on December 31, 2017? (Problem 25-6, Practical Accounting 1, Valix, 2016) 2. An aging of Maligaya Campany’s accounts receivable on December 31, 2012, reveals the following information: Time Outstanding Amount of Account Receivables Under 30 days ₱ 80,000 30-60 days 16,000 61-120 days 12,000 This study source was downloaded by 100000828756128 from CourseHero.com on 09-24-2022 22:49:08 GMT -05:00 https://www.coursehero.com/file/86590317/Audit-problem-11docx/ 121-180 days 8,000 Over 180 days Total ₱ 4,000 120,000 Based on past experience, the company believes that the following uncollectible percentages are appropriate: under 30 days, 1.5%; 30-60 days, 3%; 61-120 days, 15%; 121-180 days, 30%; Over 180 days, 60%. Instructions: Using the aging of accounts receivable variation of the balance sheet approach, prepare the adjusting entry on December 31, 2012 to record estimated bad debts, assuming that the balance in the Allowance for Doubtful Accounts before adjustments is: a. 440 Cr b. 560 Dr (VI – 13, Auditing Problems, Cabrera, 2012-2013) 3. Harding Corp. operates in an industry that has a high rate of bad debts. On December 31, 2012, before any year-end adjustments, Harding’s Accounts receivable balance was ₱600,000 and its Allowance for doubtful accounts balance was ₱25,000. The year-end balance reported in the statement of financial position for the Allowance for doubtful accounts will be based on the aging schedule shown as follows: Time Outstanding Amount of A/R Probability of Collection Under 15 days ₱ 300,000 0.98 16-30 days 200,000 0.90 31-45 days 50,000 0.80 46-60 days 50,000 0.70 61-75 days 10,000 0.65 Over 75 days 10,000 0.00 Instructions: This study source was downloaded by 100000828756128 from CourseHero.com on 09-24-2022 22:49:08 GMT -05:00 https://www.coursehero.com/file/86590317/Audit-problem-11docx/ a. What is the appropriate balance for Allowance for Doubtful Accounts on December 31, 2012? b. Show how the accounts receivable would be presented on the balance sheet on December 31, 2012. (VI – 14, Auditing Problems, Cabrera, 2012-2013) Auditiing Problems (easy) 1. Ladd Company provided the following information for the current year: Allowance for doubtful accounts- Jan 1 180,000 Sales 9,500,000 Sales return and allowances 800,000 Sales Discounts 200,000 Accounts written off 200,000 The entity provided for doubtful accounts expense at the rate of 3 % of net sales. What is the allowance of doubtful accounts at year-end? 2. Barr company showed the following at year end: Allowance for doubtful accounts 16,000 dr Net Sales 7,100,000 The entity estimated its uncollectible receivables at 2% of net sales. What is the allowance for doubtful accounts at year-end? 3. Effective with the year ended Dec 31, Hall co. adopted a new accounting method for estimating the allowance for doubtful accounts at the amount indicated by the year-end aging of accounts receivable. The following data are available: Allowance for doubtful accounts, Jan. 1 This study source was downloaded by 100000828756128 from CourseHero.com on 09-24-2022 22:49:08 GMT -05:00 https://www.coursehero.com/file/86590317/Audit-problem-11docx/ Provision for doubtful accounts during the current year 250,000 (2% of credit sales of 10,000,000) Accounts written off 200,000 205,000 Estimated uncollectible accounts per aging on Dec. 31 220,000 After year-end adjustment, what is the doubtful account expense for current year? Moderate 4. Roth Co. received from a customer a one year, 500,000 note bearing annual interest of 8%. After holding the note for six months, the entity discounted the note without recourse at 10% What amount of cash was received from the bank? 5. Star Co. assigned 4,000,000 of accounts receivable as collateral for a 2,000,000 6% loan with bank. The entity also paid a finance fee of 5% on the transaction upfront. What amount should be recorded as a gain or loss on the transfer of accounts receivable? 6. Brooked Co. discounted its own 5,000,000 one-year note at a discount rate of 12%, when the prime rate was 10%. In reporting the note prior to maturity. What rate should be used for the recording of interest expense? Difficult 7. Appari Bank granted a loan to a borrower on Jan 1 2013. The interest rate on the loan is 10% payable annually starting Dec 31, 2013. The loan matures in 5 years on Dec 31, 2017. The data related to the loan are: Principal amount 4,000,000 Direct origination cost 61,500 Origination Fee received from a borrower 350,000 The effective interest rate on the loan after considering the direct origination fee received is 12% What is the carrying amount of the loan receivable on Jan 1, 2013 This study source was downloaded by 100000828756128 from CourseHero.com on 09-24-2022 22:49:08 GMT -05:00 https://www.coursehero.com/file/86590317/Audit-problem-11docx/ 8. On Dec 1, 2013, Nicole Co. gave Dawn Co a 200,000, 12% loan. Nicole Co. paid Proceeds of 194,000 after deduction of 6,000 non-refundable loan origination fee. Principal and interest are due in 60 monthly installments of 4,450, Beginning Jan 1 20114. The prepayments yield an effective interest rate of 12% at present of 200,000 and 13.4% at a present value of 194,000. What amount should be reported as accrued interest receivable on Dec 31, 2013? 9. On Dec 31, 2013, Oregon Bank recorded an investment of 5,000,000 in a loan granted to a client. The loan has a 10% effective interest rate payable annually every Dec 31. The principal is due a t maturity on Dec. 31, 2016. Unfortunately, the borrower is experiencing significant financial difficulty in making payments. The projected that the entire principal will be paid at maturity and 4% interest or 200,000 will be paid annually in Dec 31 of the next three years. There is no accrued interest on Dec. 31 2013. What is the impairment loss for 2013? This study source was downloaded by 100000828756128 from CourseHero.com on 09-24-2022 22:49:08 GMT -05:00 https://www.coursehero.com/file/86590317/Audit-problem-11docx/ Powered by TCPDF (www.tcpdf.org)