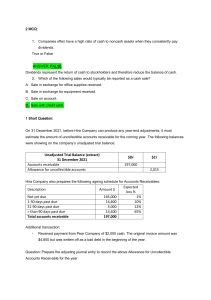

TRADE & OTHER RECEIVABLES LECTURE NOTES: 5. The following are normally included in the line item trade and other receivables’, except a. Advances to officers and employees b. Advances to subsidiaries and affiliates c. Receivables from sale of securities or property other than inventory. d. Dividends and interest receivable. 6. Accounts receivable are normally reported at the: a. Present value of future cash receipts. b. Current value plus accrued interest. c. Expected amount to be received. d. Current value less expected collection costs. 7. New Corp., which has started operations in the current year, has the following data relating to accounts receivable for the year ended December 31, 2016: 1. In accordance with PAS 39, “loans and receivables” are non-derivative financial assets with fixed or determinable payments that are not quoted in an active market other than: a. Those for which the holder may not recover substantially all of its initial investment, other than because of credit deterioration, which shall be classified as available for sale. b. Those that the entity intends to sell immediately or in the near term, which shall be classified as held for trading, and those that the entity upon initial recognition designates as at fair value through profit or loss. c. Those that the entity upon initial recognition designates as available for sale. d. All of the above 2. In accordance with PFRS 9, loans and receivables can be measured at amortized cost if a. The asset is held within a business model whose objective is to hold assets in order to collect contractual cash flows. b. The contractual terms of the financial asset give rise on specified dates to cash flows that are solely payments of principal and interest on the principal amount outstanding. c. Both a and b. d. Either a or b. 3. Which statement is incorrect regarding loans and receivables? a. An entity shall recognize loans and receivables on its statement of financial position when, and only when, the entity becomes a party to the contractual provisions of the instrument. b. Receivables are initially recognized at its fair value plus transaction costs that are directly attributable to the acquisition of the financial assets. c. Loans and receivables are subsequently measured at amortized cost using the effective interest method. d. Loans and receivables are required to be classified as non-current in the statement of financial position. 4. The category "trade receivables" includes a. Advances to officers and employees. b. Income tax refunds receivable. c. Caims against insurance companies for casualties sustained. d. Open accounts resulting from short-term extensions of credit to customers. Cash sales Credit sales Collections on credit sales Sales returns and allowances on credit sales Accounts written off Allowance for doubtful accounts, 12/31 (5% of accounts receivable) Allowance for sales discounts, 12/31 Allowance for sales returns, 12/31 Allowance for freight, 12/31 P1,000,000 5,000,000 3,000,000 100,000 20,000 ? 10,000 15,000 3,000 What is the net realizable value of the accounts receivable on December 31? a. P2,708,000 c. P1,758,000 b. P1,880,000 d. P1,752,000 8. On June 9, Seller Corp. sold merchandise with a list price of P5,000 to Buyer on account. Seller allowed trade discounts of 30% and 20%. Credit terms were 2/15, n/40 and the sale was made FOB shipping point. Seller prepaid P200 of delivery costs for Buyer as an accommodation. On June 25, Seller received from Buyer a remittance in full payment amounting to a. P2,744 c. P2,944 b. P2,940 d. P3,000 LECTURE NOTES: Trade and Cash Discounts Trade Cash Objective Generate sales Encourage prompt payment Accounting Not recorded separately Recorded using either Gross or Net method Gross and Net method of recording Sales Gross Net Cash discounts Deducted from sales when granted Deducted from sales whether granted or not Cash discounts granted Deducted from sales (sales discounts) Not accounted for separately since already deducted from sales Cash discounts not granted Included in sales Reported as other income (forfeited sales discounts) Accounting for Freight Who should pay? Who actually paid? Buyer FOB shipping point Freight collect Seller FOB destination Freight prepaid Deduct from AR FOB destination Freight collect Add to AR FOB shipping point Freight prepaid 9. Trade discounts are a. Not recorded in the accounts; rather they are a means of computing a price. b. Used to avoid frequent changes in catalogues. c. Used to quote different prices for different quantities purchased. d. All of the above. 10. If a company employs the gross method of recording accounts receivable from customers, then sales discounts taken should be reported as a. A deduction from sales in the income statement. b. An item of "other income and expense" in the income statement. c. A deduction from accounts receivable in determining the net realizable value of accounts receivable. d. Sales discounts forfeited in the cost of goods sold section of the income statement. 11. Of the approaches to record cash discounts related to accounts receivable, which is more theoretically correct? a. Net approach. b. Gross approach. c. Allowance approach. d. All three approaches are theoretically correct. 12. The Pacifier Company uses the net price method of accounting for cash discounts. In one of its transactions on December 15, Pacifier sold merchandise with a list price of P500,000 to a client who was given a trade discount of 20% and 15%. Credit terms were 2/10, n/30. The goods were shipped FOB destination, freight collect. On December 20, the client returned damaged goods originally billed at P60,000. Total freight charges paid by the buyer amounted to P7,500. What is the net realizable value of this receivable on December 31? a. P272,500 c. P280,000 b. P274,400 d. P333,200 (P23-Kimwell-RPCPA 10/88) LECTURE NOTES: Traditional Methods of Accounting for Bad Debts Allowance method Profit or loss approach • % of sales FOCUS: Doubtful accounts expense SFP approach • % of accounts receivable • Aging FOCUS: Allowance for doubtful accounts 13. Why is the allowance method preferred over the direct write-off method of accounting for bad debts? a. Allowance method is used for tax purposes. b. Estimates are used. c. Determining worthless accounts under direct writeoff method is difficult to do. d. Improved matching of bad debt expense with revenue. 14. When the allowance method of recognizing uncollectible accounts is used, the entry to record the write-off of a specific account a. Decreases both accounts receivable and the allowance for uncollectible accounts. b. Decreases accounts receivable and increases the allowance for uncollectible accounts. c. Increases the allowance for uncollectible accounts and decreases net income. d. Decreases both accounts receivable and net income. 15. A company uses the allowance method to recognize uncollectible accounts expense. What is the effect at the time of the collection of an account previously written off on each of the following accounts? Allowance for uncollectible accounts a. No effect b. Increase c. Increase d. No effect Uncollectible accounts expense Decrease Decrease No effect No effect 16. On January 1, 2016, the balance of accounts receivable of Burgos Company was P5,000,000 and the allowance for doubtful accounts on same date was P800,000. The following data were gathered: 2013 2014 2015 2016 Credit sales P10,000,000 14,000,000 16,000,000 25,000,000 Writeoffs P250,000 400,000 650,000 1,100,000 Recoveries P20,000 30,000 50,000 145,000 Doubtful accounts are provided for as percentage of credit sales. The accountant calculates the percentage annually by using the experience of the three years prior to the current year. How much should be reported as 2016 doubtful accounts expense? a. P750,000 c. P330,000 b. P812,500 d. P875,000 17. John Corp. has the following data relating to accounts receivable for the year ended December 31, 2016: Accounts receivable, January 1, 2016 Allowance for doubtful accounts, January 1, 2016 Sales during the year, all on account, terms 2/10, 1/15, n/60 Cash received from customers during the year Accounts written off during the year P480,000 19,200 2,400,000 2,560,000 17,600 An analysis of cash received from customers during the year revealed that P1,411,200 was received from customers availing the 10-day discount period, P792,000 from customers availing the 15-day discount period, P4,800 represented recovery of accounts written-off, and the balance was received from customers paying beyond the discount period. The allowance for doubtful accounts is adjusted so that it represents certain percentage of the outstanding accounts receivable at year end. The required percentage at December 31, 2016 is 125% of the rate used on December 31, 2015. The doubtful accounts expense for the year ended December 31, 2016 is a. P6,880 c. P8,720 b. P7,120 d. P8,960 18. On the December 31, 2016 statement of financial position of Mann Company, the receivables consisted of the following: Trade accounts receivable Allowance for uncollectible accounts Claim against shipper for goods lost in transit last November 2016 Selling price of unsold goods sent by Mann on consignment at 30% of cost (not included in Mann's ending inventory) Security deposit on the lease of a warehouse Total P 93,000 ( 2,000) 3,000 26,000 30,000 P150,000 How much should be reported as trade and other receivables in Mann's December 31, 2016 statement of financial position? a. P94,000 c. P120,000 b. P68,000 d. P150,000 P20 Kimwell/aicpa 11.90 19. When examining the accounts of Medved Company, you ascertain that balances relating to both receivables and payables are included in a single controlling account called receivables control that has a debit balance of P4,850,000. An analysis of the composition of this account revealed the following: Debit Account receivable – customers Accounts receivable – officers Debit balances – creditors Postdated checks from customers P7,800,000 500,000 300,000 400,000 Credit Subscriptions receivable Accounts payable for merchandise Credit balances in customers’ accounts Cash received in advance from customers for goods not yet shipped Expected bad debts Debit 800,000 Credit P4,500,000 200,000 100,000 150,000 After further analysis of the aged accounts receivable, you determined that the allowance for doubtful accounts should be P200,000. What is the correct total of current net receivables? a. P8,950,000 c. P8,600,000 b. P8,800,000 d. P8,850,000 CGAC 20. Tyson, Inc. reported the following balances (after adjustment) at the end of 2016 and 2015. Total accounts receivable Net accounts receivable 12/31/16 P105,000 102,000 12/31/15 P96,000 94,500 During 2016, Tyson wrote off customer accounts totaling P3,200 and collected P800 on accounts written off in previous years. Tyson's doubtful accounts expense for the year ending December 31, 2016 is a. P1,500 c. P3,000 b. P2,400 d. P3,900 21. Cabugao Company began operations on January 1, 2015. On December 31, 2015, Cabugao provided for uncollectible accounts based on 5% of annual credit sales. On January 1, 2016, Cabugao changed its method of determining its allowance for uncollectible accounts to the percentage of accounts receivable. The rate of uncollectible accounts was determined to be 15% of the ending accounts receivable balance. In addition, Cabugao wrote off all accounts receivable that were over 1 year old. The following additional information relates to the years ended December 31, 2015 and 2016. 2016 2015 Credit sales P8,000,000 P6,000,000 Collections (including collections on recovery) 6,950,000 4,500,000 Accounts written off 70,000 None Recovery in accounts previously written off 20,000 None How much is the provision for uncollectible accounts for the year ended December 31, 2016? a. P125,000 c. P400,000 b. P122,000 d. P 72,000