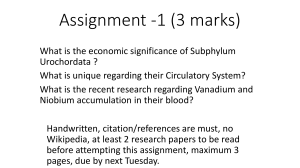

Spent Resid Catalyst UNLOCKING A CIRCULAR ECONOMY BY RECYCLING REFINERY WASTE MATERIALS Mohammed Benchekchou Kevin Jones Martijn Janssen Ferrovanadium ( FeV ) Vanadium pentoxide (V 2 O 5 ) Cautionary Note This document contains proprietary B. V . (The “Company”) and may not or in part, for any purpose, except constitute a violation of applicable information and is being provided solely for information purposes by Shell & AMG Recycling be reproduced in any form or further distributed to any other person or published, in whole with the prior written consent of the Company . Failure to comply with this restriction may securities laws . Shell & AMG Recycling BV, also referred to as “SAR”, is a limited liability company organized under the laws of the Netherlands and owned jointly (50 - 50 ) by Shell Overseas Investment BV and AMG Advanced Metallurgical Group NV . The companies in which SAR directly and indirectly owns investments are separate entities . In this presentation “SAR” or “SAR group” may be used for convenience where references are made to SAR or SAR and any of its subsidiaries in general . Likewise, the words “we”, “us” and “our” are also used to refer to subsidiaries in general or to those who work for them . These expressions are also used where no useful purpose is served by identifying the particular company or companies . ‘‘subsidiaries’’, “SAR subsidiaries” and “SAR companies” as used in this presentation refer to companies over which SAR either directly or indirectly has control . Companies over which SAR has joint control are generally referred to “joint ventures” and companies over which SAR has significant influence but neither control nor joint control are referred to as “associates” . In this presentation, joint ventures and associates may also be referred to as “equity - accounted investments” . The term “SAR interest” is used for convenience to indicate the direct and/or indirect (ownership interest held by SAR in a venture, partnership or company, after exclusion of all third - party interest . This presentation may contain forward - looking statements concerning the financial condition, results of operations and businesses of SAR . All statements other than statements of historical fact are, or may be deemed to be, forward - looking statements . Forward - looking statements are statements of future expectations that are based on management’s current expectations and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in these statements . Forward - looking statements include, among other things, statements concerning the potential exposure of SAR to market risks and statements expressing management’s expectations, beliefs, estimates, forecasts, projections and assumptions . These forward looking statements are identified by their use of terms and phrases such as ‘‘anticipate’’, ‘‘believe’’, ‘‘could’’, ‘‘estimate’’, ‘‘expect’’, ‘‘goals’’, ‘‘intend’’, ‘‘may’’, ‘‘objectives’’, ‘‘outlook’’, ‘‘plan’’, ‘‘probably’’, ‘‘project’’, ‘‘risks’’, “schedule”, ‘‘seek’’, ‘‘should’’, ‘‘target’’, ‘‘will’’ and similar terms and phrases . There are a number of factors that could affect the future operations of SAR and could cause those results to differ materially from those expressed in the forward - looking statements included in this presentation, including (without limitation) : (a) price fluctuations in feedstock materials that are used by SAR ; (b) changes in demand for SAR’s products and services ; (c) currency fluctuations ; (d) loss of market share and industry competition ; (e) environmental and physical risks ; (f) risks associated with the identification of suitable potential acquisition properties and targets, and successful negotiation and completion of such transactions ; (g) the risk of doing business in developing countries and countries subject to international sanctions ; (h) legislative, fiscal and regulatory developments including regulatory measures addressing climate change ; (i) economic and financial market conditions in various countries and regions ; (j) political risks, including the risks of expropriation and renegotiation of the terms of contracts with governmental entities, delays or advancements in the approval of projects and delays in the reimbursement for shared costs ; and (k) changes in trading conditions . All forward - looking statements contained in this presentation are expressly qualified in their entirety by the cautionary statements contained or referred to in this section . Readers should not place undue reliance on forward - looking statements . Each forward - looking statement speaks only as of the date of this presentation 30 August 2022 . Neither SAR nor any of its subsidiaries undertake any obligation to publicly update or revise any forward - looking statement as a result of new information, future events or other information . In light of these risks, results could differ materially from those stated, implied or inferred from the forward - looking statements contained in this presentation . 2 Agenda 1 Shell & AMG Recycling introduction 2 H o w to tu r n w a s te in to v a lu e ? 3 W h a t m a ke s th e b u s in e s s c a s e ? 4 V a n a d iu m m a r ke t a n d p r o d u c t a p p lic a tio n s 5 S u p e r c e n te r p r o je c t – Kin g d o m o f S a u d i A r a b ia 6 Q &A 3 Speakers Presenter Presenter Moderator/presenter Mohammed Benchekchou Vice President Business Development, Shell & AMG Recycling Kevin Jones Managing Director, Shell & AMG Recycling Martijn Janssen Managing Director, Shell & AMG Recycling 4 Do you have sustainable options for managing spent residue - upgrading catalyst and gasification ash? Residue hydrocracking (ebullated Residue hydroprocessing (fixed - bed) - bed) HAZARDOUS How do you SPENT CATALYST manage this AND ASH responsibly? Residue gasification Environmental impact as a result of landfilling Long - term liabilities , reputational and monetary Loss of valuable metals and opportunities to greenhouse - gas emissions lower Today, we will explain how you can turn these threats into an opportunity 5 Who we are – and how we can help you SHELL CATALYSTS & TECHNOLOGIES SHELL & AMG RECYCLING AMG (ADVANCED METALLURGICAL GROUP) – VANADIUM Co - create integrated, customised catalyst and licensing solutions for both Shell and non - Shell refining and petrochemical businesses . Six catalyst manufacturing plants in Belgium, Germany, China and the USA Three research centres in India, the Netherlands and the USA Sales and technical service offices in Canada, China, Dubai, India, the Netherlands Russia, Singapore, the UK and the USA 6 Who we are – and how we can help you SHELL CATALYSTS & TECHNOLOGIES SHELL & AMG RECYCLING AMG (ADVANCED METALLURGICAL GROUP) – VANADIUM Cambridge, Ohio, USA Processing Spent Resid Catalyst since 2002 using Cambridge Ferovan ® Process Zanesville, Ohio, USA Construction began 2019, fully operational in 2022 Nuremburg, Germany Recovery of high - purity vanadium from gasification ash for specialty chemicals and catalyst, aerospace and energy storage 7 Who we are – and how we can help you SHELL CATALYSTS & TECHNOLOGIES Our vision: SHELL & AMG RECYCLING AMG (ADVANCED METALLURGICAL GROUP) – VANADIUM To advance the circular economy while enabling the energy transition. Customer value proposition Provide end - to - end catalyst solutions and support to help customers: g e n e r a te v a lu e fr o m y o u r w a s te s tr e a m s r e d u c e d is p o s a l c o s ts a n d lia b ilitie s a c h ie v e s u s ta in a b ility g o a ls . 8 The JV’s offering enables customers to turn waste management risks into opportunities The Risks The Opportunities Ferrovanadium for regional steel industry and export Environmental impact landfilling as a result of Long - term liabilities monetary , reputational and High purity V 2 O 5 for vanadium redox flow batteries Decrease CO 2 footprint Loss of valuable metals and opportunities - gas emissions to lower greenhouse No need for landfill Support local economies 9 Value chain of refinery secondary materials to energy transition materials Gasification ash Oil refining High strength steel Vanadium reclamation Ferrovanadium ( FeV ) Spent catalyst Residue upgrading catalyst Master alloys Energy storage Titanium alloys Vanadium pentoxide (V 2 O 5 ) Fresh catalyst Current AMG or Shell product / process and expertise Vanadium chemicals Vanadium redox flow battery Catalysts and chemicals 10 Vanadium recovery at AMG TAC (GfE) Long - term partners (gasifiers, power plants ) Mainly boiler slags, fly ashes and filtercakes from oil processing Metallurgical products Residue A e r o s p a c e in d u s tr y Shredder M e d ic a l te c h n o lo g y Leaching and filtration and precipitation Smelting furnace Calcination A lu m in o th e r m ic m e ltin g V a c u u m a r c m e ltin g Ele c tr ic a r c m e ltin g Chemical products A u to m o tiv e in d u s tr y S te e l in d u s tr y C a ta ly s ts C o lo r p ig m e n ts Nickel product Vanadium slag Solid residue En e r g y s to r a g e G la s s , c e r a m ic s a n d Water treatment ion exchange ammonia recovery V a n a d iu m o xid e s V a n a d iu m c h e m ic a ls Clean water e na m e l M e d ic a l M e ta llu r g y 11 Smelting, leaching, precipitation, AMV production, calcination 12 AMG Vanadium, Ohio USA Cambridge, Ohio, USA Zanesville, Ohio, USA 13 Cambridge Ferovan ® Process: Hazardous waste to value - added products Oil - burning power plant Oil gasification plant Boiler slag/fly ash Primary furnace ( pre - reduction) Gasification residue/ash Slag transfer Roasted catalyst Spent catalyst Oil refineries (Listed hazardous waste in US) Hazardous waste Ferronickel - molybdenum (FeNiMoly ®) RMSB (storage) Roaster and FGD Secondary furnace ( reduction) Ferrovanadium ( Ferovan ®) Calcium aluminate slag (Revan ™) Calcium sulphate (LimeAdd ™) Value - added products 14 Spent residue - upgrading catalyst in the Middle East Spent residue growth - upgrading catalyst growth in the Middle East + new units under study 1250% + new units under commissioning/construction 800% 650% 650% 650% 570% Residue upgrading operating units + new units under FEED 250% 100% 2020 2021 2022 2023 2024 2025 2026 2027+ Between 2020 and 2023 the spent catalyst volumes have increased 650%, with the potential for 12X growth over the next 6 – 7 years 15 Spent catalyst must be properly managed The goal: Safe, environmentally sound recycling of spent catalyst Reclamation must be performed in a way protective of the environment Listed Hazardous Waste in the USA and in Europe 16 Transboundary movement and classification Controls the transboundary movement of hazardous wastes and aims to restrict and regulate such movement if it can be done in an environmentally sound manner . Spent resid catalyst is classified as hazardous S e lf- h e a tin g te n d e n c ie s o r ig in a te fr o m th e s u lfid e s in th e s p e n t c a ta ly s t Th e o il o n th e s u r fa c e o f th e s p e n t c a ta ly s t h e lp s to p r e v e n t th is r e a c tio n , s o a fte r th e o il is r e m o v e d , s e lf- h e a tin g is m o r e like ly , n o t le s s C o m p le te r o a s tin g , w h ic h r e m o v e s th e s u lp h u r , e lim in a te s th e s e lf- h e a tin g te n d e n c y P a r tia l r e c la m a tio n , s u c h a s th e r m a l d e s o r p tio n , o n ly r e m o v e s th e fr e e o il 17 Industry standards of risk mitigation for spent resid catalyst Ke y c o m p o n e n ts o f s e le c tin g a n d a u d itin g a s p e n t c a ta ly s t r e c y c le r p a r tn e r in c lu d e : Asse ss r is k G e n e r a l fa c ility in fo r m a tio n W a s te h a n d lin g o p e r a tio n s Fa c ility d e s ig n Re g u la to r y c o m p lia n c e En v ir o n m e n ta l e v a lu a tio n Id e n t ify r is k R IS K M A N A G EM EN T P R O CES S Co n t r o l r is k C o m m u n ity r e la tio n s R e v ie w r is k 18 Risky practices observed in the industry Partial processing to avoid shipping and handling requirements Improper storage practices by processors Placement in landfill Not providing evidence of the fate for all spent catalyst constituents including by products and waste streams Improper identification and labeling Substandard occupational health and safety for workers 19 Vanadium and its role in the low Energy storage - carbon economy HSLA steel Specialty alloys Demand for vanadium will increase significantly as global economies evolve to a low - carbon future 20 Vanadium supply Petroleum Waste Recycling 12% Primary Mining 18% BOF Steelmaking Slag 70% USA 3% Other 10% Brazil 6% Vanadium production method South Africa 8% Vanadium producing regions Russia 10% China 63% A structural supply deficit exists due to the difficulty and time requisite to bring new production online and the supply inelasticity of production from steelmaking slags Source: Vanitec 21 Vanadium demand Metric tons vanadium (000’s) China North America Europe ROW 24 23 24 24 22 12 12 13 12 25 15 10 12 13 11 12 13 13 35 40 44 2016 2017 2018 54 2019 66 69 2020 2021 Demand for vanadium will continue to increase rapidly as producers allocate production toward energy transition uses and infrastructure investment globally S o u r c e : V a n ite c 22 Vanadium use sectors Steel , 92.0% Energy storage, 2.5% 2021 Chemicals and catalysts, 3.4% Aerospace alloys, 2.1% Source: Vanitec 23 Vanadium redox flow battery market World Market North America, Western Europe, Middle East 35,000 30,000 25,000 MWh 20,000 15,000 10,000 AMG LIVA Hybrid Power Management System 5,000 - 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 The demand for long duration energy storage is expected to increase dramatically as the shift to green energy gains momentum, with the vanadium redox battery market expected to surpass 30 GWh/y by 2031 Annual Installed Utility and Commercial and Industrial VRFB Deployment Energy Capacity, All Application Segments, World Markets: 2022 - 2031 ( Source: Guidehouse Insights) 24 The Saudi Arabia Supercenter and reference plants Project 3: Fresh catalyst (Shell Catalysts & Technologies Port Allen LA) Project 1: Gasification ash (AMG - TAC Nuremburg, Germany) Project 2: Spent catalyst (AMG Vanadium Cambridge & Zanesville OH) 25 Saudi Arabia Supercenter overview Long - term agreement between SARBV/UCI and Saudi Aramco signed on July 5, 2022 Spent catalyst recycling Install recycling capacity to process regionally generated spent resid upgrading catalyst PROJECT 1 Gasification ash recycling PROJECT 2 PROJECT 3 Electrolyte and demonstration Fresh catalyst manufacturing Install recycling capacity mass energy storage battery Install manufacturing capacity to process 100% of Saudi Install vanadium electrolyte and for fresh residue upgrading Aramco high - high purity vanadium chemicals first LIVA (Lithium - Vanadium) demo battery in KSA catalyst to serve the MENA region and beyond 26 Expected Tangible CO calculations 2 reduction based on initial Project 1 Project 2 Vanadium concentrate from Jazan Gasification Combined Cycle Plant & Vanadium electrolyte production plant S p e n t r e s id u e u p g r a d in g c a ta ly s t m e ta ls r e c la m a tio n 307,000 Mt/y M itig a te d C O 2 e b e n e fit 3,270,000 Mt/y M itig a te d / e n a b le d C O 2 e b e n e fit 27 Key takeaways 1 2 3 A proper management of spent catalysts and gasification ash – hazardous waste – has a positive environmental impact and creates opportunities to lower greenhouse - gas emissions Shell & AMG Recycling’s innovative solutions convert spent catalysts and gasification ash into valuable end products. This helps to unlock value and mitigate potential liabilities in relation to hazardous materials. Th e n e w S a u d i A r a b ia S u p e r c e n te r s e e ks to e n a b le th e d e v e lo p m e n t o f a w o r ld c la s s r e g io n a l fa c ility fo r p r o c e s s in g r e fin e r ie s ’ r e c y c la b le m a te r ia ls in to v a lu a b le p r o d u c ts . It s u p p o r ts o f th e Kin g d o m ’s a m b itio n s to a c c e le r a te e n e r g y tr a n s itio n , a c h ie v e s u s ta in a b ility a s p ir a tio n s a n d d r iv e c ir c u la r in v e s tm e n t in th e Kin g d o m , 28 29